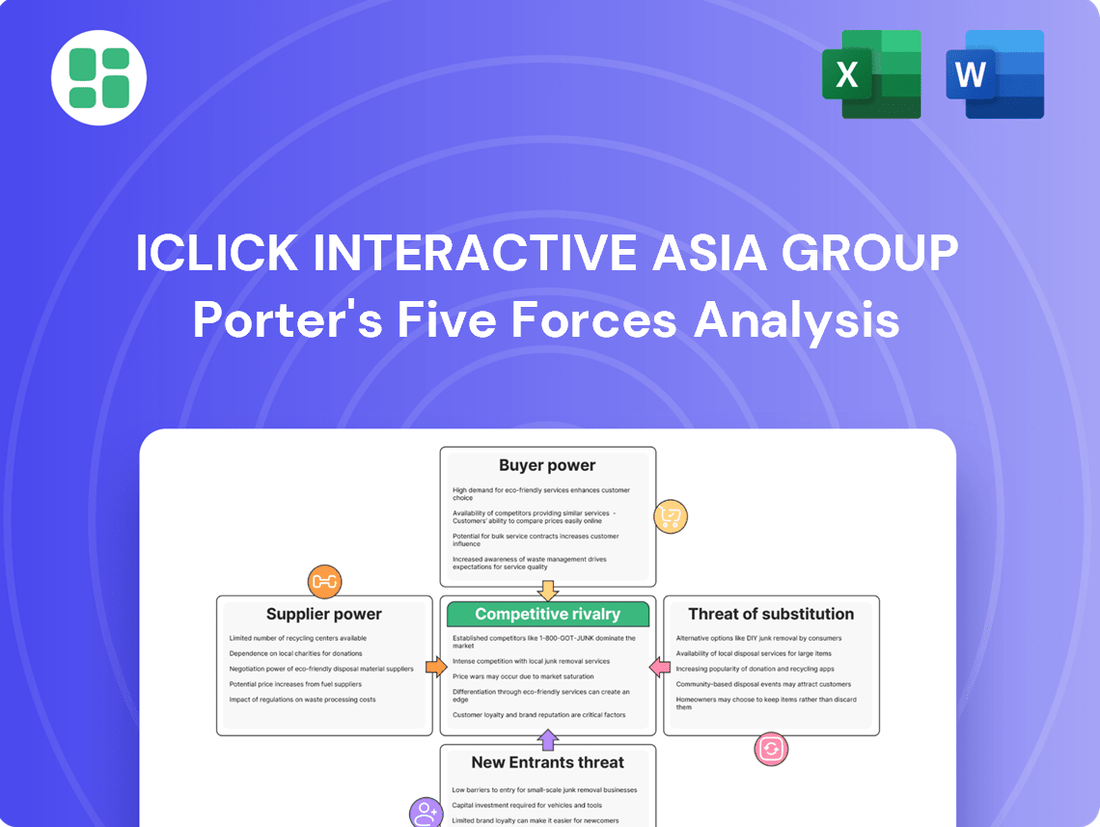

iClick Interactive Asia Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

iClick Interactive Asia Group Bundle

iClick Interactive Asia Group operates in a dynamic digital advertising landscape, facing moderate threats from new entrants and the availability of substitutes. Understanding the bargaining power of both buyers and suppliers is crucial for navigating this competitive environment.

The complete report reveals the real forces shaping iClick Interactive Asia Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

iClick Interactive Asia Group's reliance on a concentrated pool of independent Chinese consumer data and premium cross-channel media resources significantly impacts supplier bargaining power. If a few key providers control unique or high-quality data sets and prime advertising inventory across video, social, mobile, and search, they can leverage this position to negotiate higher prices or dictate less favorable terms for iClick.

The concentration of these essential suppliers means iClick has fewer alternatives for acquiring critical inputs, thereby strengthening the suppliers' ability to exert influence. For instance, if a limited number of platforms offer access to specific, highly sought-after consumer demographics or exclusive media placements, those platforms can demand premium rates, directly affecting iClick's cost structure and profitability.

iClick Interactive Asia Group's reliance on unique technology, particularly its proprietary big data analytics and AI capabilities, significantly influences supplier bargaining power. If these advanced tools are not readily replicable, providers of specialized AI/ML models or cloud infrastructure could command higher prices or more favorable terms.

The switching costs associated with iClick's technology providers are a critical factor. High integration costs, the need for extensive retraining, or potential disruption to ongoing operations if a supplier is changed can give those suppliers considerable leverage. For instance, if iClick has deeply embedded a specific AI algorithm that requires substantial re-engineering to replace, that algorithm's provider gains bargaining power.

The availability of numerous, comparable suppliers for crucial elements like data, ad inventory, or the underlying technology significantly diminishes the bargaining power of any single provider. This diverse supplier ecosystem empowers iClick Interactive Asia Group to negotiate more favorable terms and retain operational flexibility, a key advantage in the dynamic digital advertising landscape.

For instance, in 2023, the digital advertising market saw a proliferation of data providers and ad tech platforms. iClick's ability to source from a broad range of these suppliers, rather than being reliant on a few, allowed them to secure competitive pricing for ad placements and data acquisition, thereby optimizing their campaign costs.

Conversely, if iClick were to encounter a situation where only a limited number of highly specialized suppliers offered essential services, those suppliers would naturally gain a stronger negotiating position. This concentration of power could lead to increased costs and reduced flexibility for iClick.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers for iClick Interactive Asia Group is a key consideration. If major data providers or media platforms could readily develop and launch their own marketing or enterprise solutions, they could effectively bypass iClick and directly engage with advertisers. This would significantly shift bargaining power towards these suppliers.

However, the barrier to entry for such a move is substantial. Developing comprehensive, full-stack marketing platforms demands considerable financial investment, advanced technological expertise, and a deep understanding of the digital advertising ecosystem. For instance, building out the necessary infrastructure and data analytics capabilities could easily run into tens of millions of dollars, a significant hurdle for most data or media suppliers.

- Forward Integration Threat: Suppliers of data or media could potentially launch their own marketing solutions, cutting out iClick.

- Increased Supplier Power: Successful integration by suppliers would enhance their leverage over iClick and its clients.

- Barriers to Entry: Significant capital investment and specialized technical expertise are required to build competing platforms, mitigating this threat.

Importance of iClick to Suppliers

The volume of business iClick Interactive Asia Group provides to its suppliers significantly influences their bargaining power. If iClick represents a substantial portion of a supplier's revenue, that supplier's leverage over iClick is likely reduced because they depend on iClick's continued patronage. For instance, if a key data provider derives 20% of its annual income from iClick, they may be more amenable to iClick's pricing or service demands.

Conversely, if iClick is a minor client for a large supplier, iClick's ability to negotiate favorable terms diminishes. In 2023, iClick's total cost of sales was RMB 1.1 billion, representing a significant expenditure. However, the distribution of this spending across various suppliers determines the individual bargaining power of each. If iClick accounts for less than 1% of a major cloud service provider's total client revenue, that provider holds considerable power.

- Supplier Reliance: iClick's dependence on specific suppliers for critical services like data acquisition and technology infrastructure can shift bargaining power.

- Supplier Market Share: If iClick sources from suppliers who are dominant in their respective markets, those suppliers naturally possess greater leverage.

- iClick's Spend Volume: The sheer scale of iClick's procurement from a particular supplier directly correlates to how much that supplier values the relationship and, consequently, their bargaining power.

The bargaining power of suppliers for iClick Interactive Asia Group is significantly influenced by the availability and concentration of critical resources like independent consumer data and premium cross-channel media. When a few dominant providers control unique data sets or prime advertising inventory, they can dictate higher prices and less favorable terms, directly impacting iClick's operational costs.

iClick's ability to negotiate effectively is also tied to the switching costs associated with its technology providers. High integration expenses or the potential for operational disruption when changing suppliers can grant those providers considerable leverage, as seen with deeply embedded AI algorithms that require substantial re-engineering to replace.

Conversely, a diverse supplier ecosystem, with numerous comparable providers for data, ad inventory, or technology, diminishes individual supplier bargaining power. This was evident in 2023, where iClick's broad sourcing from various data providers and ad tech platforms allowed for competitive pricing and optimized campaign costs.

The threat of forward integration by suppliers, where they might launch their own marketing solutions, is a potential power shift, though substantial capital investment and technical expertise create significant barriers to entry, as building competing platforms can cost tens of millions of dollars.

| Factor | Impact on Supplier Bargaining Power | Example/Data Point (2023/2024) |

|---|---|---|

| Supplier Concentration | High if few providers control critical inputs | Limited availability of specific demographic data or exclusive media placements |

| Switching Costs | High if integration is complex and costly | Deeply embedded AI algorithms requiring extensive re-engineering |

| Supplier Dependence on iClick | Low if iClick is a minor client; High if iClick is a major revenue source | If iClick represents <1% of a cloud provider's revenue, that provider has high power. |

| Forward Integration Threat | Moderate due to high barriers to entry | Building full-stack marketing platforms requires significant capital (tens of millions USD) |

What is included in the product

This Porter's Five Forces analysis for iClick Interactive Asia Group meticulously dissects the competitive intensity within the online marketing and enterprise service sectors, highlighting factors impacting profitability and strategic positioning.

Instantly identify and mitigate competitive threats with a dynamic Porter's Five Forces analysis, providing actionable insights to navigate iClick Interactive Asia Group's market landscape.

Customers Bargaining Power

iClick Interactive Asia Group serves a broad spectrum of advertisers, marketers, and businesses looking for enterprise solutions, indicating a diverse customer base. This fragmentation typically weakens the bargaining power of individual customers, as no single client represents a disproportionately large share of iClick's revenue. For instance, in 2023, the company reported that its largest customer accounted for less than 10% of its total revenue, underscoring this point.

Customers in China's digital marketing and enterprise solutions sectors face a landscape brimming with alternatives. This includes a wide array of other ad tech platforms and a growing number of domestic AI and big data solution providers.

The sheer abundance of choices significantly bolsters customer bargaining power. If iClick Interactive Asia Group's offerings aren't competitive on price or performance, customers can readily shift their business elsewhere.

For instance, in 2024, the Chinese digital advertising market saw continued growth, with numerous players vying for market share, intensifying the competitive pressure and providing customers with ample switching opportunities.

Customers possess significant bargaining power when switching costs are low. If clients can easily move to alternative marketing or enterprise solution providers without incurring substantial expenses or operational disruption, their ability to negotiate better terms or seek out more favorable offerings is amplified.

While iClick Interactive Asia Group strives to foster customer loyalty through its data-driven insights and operational efficiencies, the highly competitive landscape necessitates continuous evaluation by clients. In 2023, the digital advertising market saw numerous new entrants and evolving technologies, intensifying the pressure on existing providers to demonstrate clear value and superior results to retain their customer base.

Customer Price Sensitivity

In China's highly competitive digital advertising and enterprise software markets, customers exhibit significant price sensitivity. This means they are keenly aware of pricing and will actively seek out the best value for their money. For iClick Interactive Asia Group, this translates into a powerful negotiating position for its clients.

The constant pressure to demonstrate a strong return on investment (ROI) for marketing expenditures, coupled with an ongoing drive for operational efficiency, compels businesses to prioritize cost-effective solutions. This fundamental economic reality empowers customers, as they can readily switch to competitors offering more attractive pricing or better value propositions.

- Price Sensitivity in China's Digital Ad Market: Chinese businesses, particularly SMEs, are highly attuned to marketing spend efficiency, impacting their willingness to pay premium prices.

- ROI Focus Drives Bargaining Power: The need to justify every marketing dollar spent gives customers leverage to negotiate lower rates or demand more value-added services.

- Availability of Alternatives: The presence of numerous digital advertising platforms and enterprise software providers in China means customers can easily explore and switch to alternatives if iClick's pricing is not competitive.

Threat of Backward Integration by Customers

Large advertisers, particularly those with significant digital marketing spend, may explore developing their own marketing technology and data analytics platforms. This move towards backward integration, while demanding substantial investment and technical expertise, directly enhances their leverage. For instance, in 2024, major e-commerce players continued to invest heavily in proprietary data solutions to better understand consumer behavior, reducing reliance on third-party analytics providers.

The capability for large clients to build in-house solutions creates a credible threat of disintermediation. This means they can potentially bypass external service providers like iClick Interactive Asia Group, thereby increasing their bargaining power. This pressure can force companies like iClick to offer more competitive pricing or enhanced service offerings to retain these key accounts.

- Potential for In-house Development: Large enterprises with substantial data assets and marketing budgets may develop proprietary marketing technology and analytics capabilities.

- Increased Customer Leverage: The credible threat of backward integration empowers customers by providing them with an alternative to relying solely on external providers.

- Impact on Pricing and Services: This bargaining power can lead to pressure on service providers to offer more competitive pricing and value-added services to retain large clients.

The bargaining power of customers for iClick Interactive Asia Group is significant, driven by a fragmented client base where no single customer dominates revenue. This fragmentation, evidenced by the largest customer representing less than 10% of revenue in 2023, dilutes individual customer influence. However, the sheer volume of alternative digital marketing and enterprise solution providers in China, a market that saw continued growth and intense competition in 2024, provides customers with ample opportunities to switch, thereby amplifying their negotiating leverage.

Low switching costs further empower iClick's customers. The ease with which clients can transition to competing platforms without incurring substantial financial or operational penalties means they can readily demand better pricing or superior service. This is underscored by the 2023 digital advertising market's trend of new entrants and evolving technologies, forcing providers to continuously demonstrate value to retain clients.

Customers, especially in China's digital ad market, exhibit high price sensitivity and a strong focus on ROI, pushing them to seek cost-effective solutions. For instance, SMEs are particularly attuned to marketing spend efficiency. This economic reality allows clients to negotiate aggressively, as they can easily opt for competitors offering more attractive value propositions. Furthermore, large advertisers may develop in-house solutions, a trend seen in 2024 with major e-commerce players investing in proprietary data analytics, which creates a credible threat of disintermediation and enhances their bargaining power.

| Factor | Description | Impact on iClick |

| Customer Fragmentation | Largest customer < 10% revenue (2023). | Weakens individual customer power. |

| Availability of Alternatives | Numerous digital ad platforms & enterprise solutions in China. | Increases customer switching potential. |

| Low Switching Costs | Ease of moving to competitors without significant expense. | Amplifies customer negotiation leverage. |

| Price Sensitivity & ROI Focus | Customers prioritize cost-efficiency and demonstrable returns. | Pressures iClick on pricing and value. |

| Potential for In-house Solutions | Large clients may develop proprietary tech (e.g., e-commerce in 2024). | Threatens disintermediation, boosting customer power. |

Preview the Actual Deliverable

iClick Interactive Asia Group Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The comprehensive Porter's Five Forces Analysis for iClick Interactive Asia Group details the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the digital advertising and marketing sector. This professionally written analysis is ready for your immediate use.

Rivalry Among Competitors

The competitive rivalry in China's digital markets is incredibly intense, a dynamic iClick Interactive Asia Group navigates daily. This sector is constantly evolving, driven by rapid innovation and the sheer scale of the market.

iClick faces formidable competition from established tech behemoths such as Baidu, Alibaba, and Tencent. These giants command massive user bases and possess extensive first-party consumer data, giving them a significant advantage in targeting and personalization within the digital advertising space.

For instance, in 2023, China's digital advertising market was estimated to be worth over $100 billion, with these major players capturing a substantial share. iClick must continuously innovate its offerings to differentiate itself and secure market share against these deeply entrenched competitors.

The digital marketing landscape in China is booming, and the enterprise software sector is right behind it, with projections showing a healthy 13.4% compound annual growth rate between 2025 and 2030. This rapid expansion, while generally a positive sign, can paradoxically intensify rivalry.

As markets grow, they become more attractive, inevitably drawing in new competitors eager to stake their claim. Existing players, sensing opportunity, often ramp up their competitive efforts, employing more aggressive tactics to secure a larger piece of the expanding pie.

iClick Interactive Asia Group stands out by leveraging proprietary data-driven insights, advanced AI capabilities, and comprehensive full-stack consumer lifecycle solutions to differentiate its offerings.

However, the competitive landscape is dynamic, with emerging technologies like AI-generated content and immersive experiences constantly redefining market expectations.

For instance, in 2024, the digital advertising market saw significant investment in AI technologies, with projections indicating continued growth in AI-powered personalization and content creation tools, intensifying the need for clear differentiation.

Therefore, iClick's ability to continuously innovate and maintain a distinct product offering is paramount to effectively navigating and mitigating the pressures of intense rivalry within the sector.

High Exit Barriers

High exit barriers significantly shape competitive rivalry in the digital advertising sector. Companies like iClick Interactive Asia Group invest heavily in technology infrastructure, data acquisition, and specialized talent. These substantial fixed costs make it difficult and expensive to exit the market, even when facing low profitability.

This situation often results in established players remaining active, intensifying competition as they strive to maintain market share or simply survive. For instance, the ongoing need for continuous platform upgrades and data analytics capabilities in 2024 means that exiting the market without recouping these investments is often not a viable option.

- Substantial upfront investments in proprietary technology platforms and data infrastructure create significant sunk costs.

- The specialized nature of talent required for data science and ad tech development means retraining or redeploying personnel is challenging and costly.

- Companies may continue to operate at reduced profitability to avoid the financial penalties or complete loss of investment associated with early termination of long-term contracts or leases.

Strategic Shifts and Divestitures

iClick Interactive Asia Group’s strategic divestiture of its lower-margin demand-side marketing solutions and mainland China enterprise solutions in 2023 highlights the fierce competition and difficult economic climate within these sectors. This move is a clear indicator of intensified rivalry, forcing companies to re-evaluate their market positioning and profitability drivers.

By shedding these business units, iClick aims to concentrate on higher-margin services, a common strategy to navigate intense competition and improve overall financial health. This realignment could alter the competitive landscape for its remaining operations and any future ventures, as resources are redirected towards more lucrative areas.

- Divestiture Rationale: iClick sold its demand-side marketing solutions and mainland China enterprise solutions businesses, citing intense competition and challenging macroeconomic conditions.

- Strategic Focus: The company is shifting its focus towards higher-margin services, indicating a strategic response to competitive pressures.

- Impact on Rivalry: This realignment may intensify competition in the remaining business segments as iClick reallocates resources and potentially alters its market approach.

The intense competition within China's digital advertising sector, where iClick Interactive Asia Group operates, is a significant factor. Giants like Baidu, Alibaba, and Tencent leverage vast user data and resources, making differentiation crucial for iClick. The market's growth, projected to expand significantly, attracts new entrants and intensifies existing rivalries, compelling companies to constantly innovate.

High exit barriers, stemming from substantial investments in technology and talent, mean that even underperforming companies often remain in the market, exacerbating competitive pressures. iClick's 2023 divestiture of certain business units underscores this reality, as it strategically shifts focus to higher-margin services amidst a challenging environment.

| Competitor | Market Share (Estimated 2023) | Key Strengths |

|---|---|---|

| Baidu | Significant share in search advertising | Dominant search engine, extensive user data |

| Alibaba | Leading e-commerce advertising | Vast e-commerce ecosystem, strong consumer insights |

| Tencent | Dominant in social media and gaming ads | Massive social media user base (WeChat), gaming integration |

SSubstitutes Threaten

While digital marketing dominates, traditional advertising channels like TV, print, and outdoor media remain as substitutes. These channels can still be relevant for specific demographics or brand awareness campaigns. However, their effectiveness as direct substitutes for iClick's data-driven digital solutions in China is diminishing, especially as digital penetration continues to soar.

The threat of substitutes for iClick Interactive Asia Group is heightened by the increasing trend of large enterprises and brands developing their own in-house marketing and data solutions. Companies with significant financial resources, such as major consumer goods brands or large e-commerce players, are increasingly investing in building internal digital marketing teams and proprietary data analytics capabilities. This allows them to gain greater control over their data, tailor solutions to specific needs, and potentially reduce costs associated with outsourcing.

For instance, a major global technology company might invest millions in developing its own AI-driven customer segmentation tools, bypassing the need for third-party providers like iClick for these specific functions. This in-house development directly substitutes the services iClick offers, particularly for clients who prioritize data security and have unique analytical requirements that off-the-shelf solutions may not fully address. The ability to customize and retain full ownership of data and algorithms makes this a compelling alternative for resource-rich organizations.

The growing trend of social commerce and direct-to-consumer (DTC) sales on platforms like Xiaohongshu and Douyin presents a significant threat of substitution for iClick Interactive Asia Group. These platforms enable brands to connect and transact directly with their customer base, effectively sidestepping the need for traditional advertising technology intermediaries.

For instance, in 2023, GMV (Gross Merchandise Volume) on Douyin's e-commerce platform reportedly reached hundreds of billions of yuan, showcasing the immense scale of direct sales. This direct engagement capability allows brands to build relationships and control the customer journey entirely within these ecosystems, reducing reliance on third-party marketing solutions like those offered by iClick.

Generic Software Tools and Manual Processes

Businesses might choose readily available, less sophisticated software or even revert to manual methods rather than investing in iClick's advanced big data and AI solutions. This can be particularly true for smaller enterprises or those with less complex analytical needs, where the cost of specialized platforms outweighs the perceived benefits.

The decision hinges on a careful cost-benefit assessment. For instance, while a company might see a 20% improvement in campaign efficiency with iClick, the upfront investment could be substantial. If a generic CRM tool offers a 5% improvement at a fraction of the cost, it becomes a viable substitute for some.

- Cost of Specialized Solutions: iClick's AI-driven analytics, while powerful, come with a premium price tag that might deter budget-conscious businesses.

- Availability of Generic Alternatives: Off-the-shelf software, though less tailored, provides basic functionalities at a significantly lower cost, acting as a direct substitute for less demanding tasks.

- Efficiency Trade-offs: Businesses must weigh the efficiency gains from advanced analytics against the operational costs and complexity of implementing and maintaining such systems, especially when compared to simpler, manual workflows.

- Market Trends in 2024: The demand for cost-effective digital marketing tools remains high in 2024, with many SMEs prioritizing affordability and ease of use in their software selections.

Emergence of New Technologies and Business Models

The rapid pace of technological change presents a significant threat of substitutes for iClick Interactive Asia Group. Emerging technologies like advanced AI, the metaverse, and novel e-commerce platforms are constantly creating new ways for businesses to reach customers and deliver value. For instance, the global AI market was valued at approximately $150.65 billion in 2023 and is projected to grow substantially, indicating a strong trend toward AI-driven solutions that could bypass traditional digital marketing channels.

These new technologies can offer alternative marketing and enterprise solutions that directly compete with or even replace iClick's current services. Consider the rise of decentralized advertising platforms or immersive virtual experiences that could offer advertisers new avenues to engage consumers, potentially reducing reliance on iClick's established network. The adaptability and integration of these new technological paradigms are therefore critical for iClick to maintain its competitive edge and mitigate the threat of substitutes.

- AI-Powered Marketing Automation: Advanced AI can automate campaign management, personalization, and analytics, offering a more efficient alternative to some of iClick's current services.

- Metaverse Advertising: Virtual worlds offer new, immersive advertising opportunities that could divert marketing spend from traditional digital channels.

- Decentralized Ad Networks: Blockchain-based advertising platforms promise greater transparency and user control, potentially disrupting existing models.

- Evolving E-commerce Solutions: New direct-to-consumer models and social commerce platforms can offer alternative customer acquisition strategies.

The threat of substitutes for iClick Interactive Asia Group is multifaceted, encompassing traditional advertising, in-house solutions, and emerging digital platforms. Brands can opt for established channels like TV or print, though their relevance is waning against digital's reach. Furthermore, large enterprises are increasingly building their own data and marketing capabilities, directly replacing the need for third-party providers like iClick.

The rise of social commerce and direct-to-consumer (DTC) models on platforms such as Douyin and Xiaohongshu presents a significant substitution threat. These platforms allow brands to engage and transact directly with customers, reducing reliance on intermediary marketing solutions. For example, Douyin's e-commerce GMV reached hundreds of billions of yuan in 2023, highlighting the scale of these direct sales channels.

Businesses also consider cost-effectiveness, sometimes opting for simpler, generic software or even manual processes over iClick's advanced big data and AI solutions. While iClick's AI can boost efficiency by an estimated 20%, the cost of its specialized platforms might lead budget-conscious firms to choose alternatives offering a more modest 5% improvement at a lower price point.

Emerging technologies like advanced AI and the metaverse also pose a substitution threat by offering new customer engagement avenues. The global AI market was valued at over $150 billion in 2023, indicating a strong shift towards AI-driven solutions that could bypass traditional digital marketing. Decentralized ad networks and virtual experiences are also creating new competitive landscapes.

Entrants Threaten

Entering the competitive online marketing and enterprise solutions sector, particularly for platforms leveraging data-driven and AI technologies like iClick Interactive Asia Group, demands significant upfront capital. This includes substantial investment in robust technology infrastructure, acquiring and processing vast datasets, and developing sophisticated analytical tools.

These high capital and technology requirements act as a considerable barrier, effectively deterring many potential new competitors from entering the market. For instance, the global digital advertising market, a key area for iClick, was projected to reach over $600 billion in 2024, highlighting the scale of investment needed to compete effectively.

China's Technology, Media, and Telecommunications (TMT) sector faces a dynamic regulatory landscape, with recent reforms in AI governance and data privacy creating significant entry barriers. For instance, the Cybersecurity Review Measures, updated in 2023, impose stringent requirements on data handling and cross-border transfers.

Navigating these intricate local regulations and securing the necessary operational licenses is a substantial challenge for nascent companies aiming to penetrate the Chinese market. This complexity inherently favors established entities like iClick Interactive Asia Group, which possess robust, pre-existing compliance frameworks and a deeper understanding of the regulatory environment.

The threat of new entrants for iClick Interactive Asia Group is significantly mitigated by the immense need for extensive data access and deep local market insights, particularly within China's complex digital landscape. New players would face a steep uphill battle trying to replicate iClick's established, independent Chinese consumer data set, which is crucial for effective campaign targeting and performance. Gaining the nuanced understanding of local consumer behavior and digital trends that iClick possesses would take considerable time and investment, creating a substantial barrier to entry.

Brand Loyalty and Established Relationships

Brand loyalty and established relationships present a significant barrier for new entrants targeting the online marketing sector where iClick Interactive Asia Group operates. Companies like iClick have cultivated strong, long-term partnerships with numerous advertisers and businesses, built on a consistent history of delivering measurable results and effective campaign management.

Newcomers face the considerable challenge of not only competing on price or features but also overcoming the inertia of existing brand loyalty. Building trust and demonstrating a comparable level of reliability and performance to established players like iClick requires substantial investment in marketing, sales, and proving value, a process that can be lengthy and costly in this dynamic market.

- Established Trust: iClick's track record fosters advertiser confidence, making it harder for new entrants to gain initial traction.

- High Switching Costs: Advertisers may incur costs or disruptions when switching to a new platform, reinforcing loyalty to incumbents.

- Network Effects: As iClick grows its user base and advertiser network, it becomes more valuable to all participants, creating a virtuous cycle that new entrants struggle to break.

Talent Acquisition and Expertise

The development and upkeep of advanced big data analytics and AI platforms necessitate a deep pool of specialized talent. This includes data scientists, AI engineers, and digital marketing strategists, whose skills are in high demand globally.

The scarcity of such expertise within China presents a substantial hurdle for new companies looking to establish a competitive edge. For instance, by the end of 2023, the demand for AI professionals in China was estimated to be over 300,000, with supply lagging significantly behind.

- High Demand for Specialized Skills: Companies require professionals skilled in machine learning, natural language processing, and data visualization.

- Talent Scarcity in China: A limited supply of qualified data scientists and AI engineers makes it challenging for new entrants to build robust teams.

- Cost of Talent Acquisition: The competitive landscape for tech talent drives up recruitment costs, impacting the operational budget of new companies.

- Retention Challenges: Even when talent is found, retaining it amidst aggressive headhunting by established players is a constant struggle for emerging firms.

The threat of new entrants for iClick Interactive Asia Group is considerably low due to high capital requirements and the need for extensive data infrastructure. The massive investment needed for technology, data acquisition, and sophisticated analytics, coupled with stringent Chinese data regulations updated in 2023, creates substantial barriers.

Established brand loyalty and deep local market insights further deter new players, as they struggle to replicate iClick's trusted relationships with advertisers and nuanced understanding of Chinese consumer behavior. The scarcity of specialized AI and data science talent in China, with demand outstripping supply by over 300,000 professionals by late 2023, also presents a significant challenge for emerging firms.

These combined factors—high initial investment, regulatory complexity, established trust, and talent scarcity—effectively shield iClick Interactive Asia Group from significant new competitive pressures.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for iClick Interactive Asia Group leverages data from company annual reports, investor presentations, and regulatory filings. We also incorporate insights from industry research reports and market intelligence platforms to assess competitive dynamics.