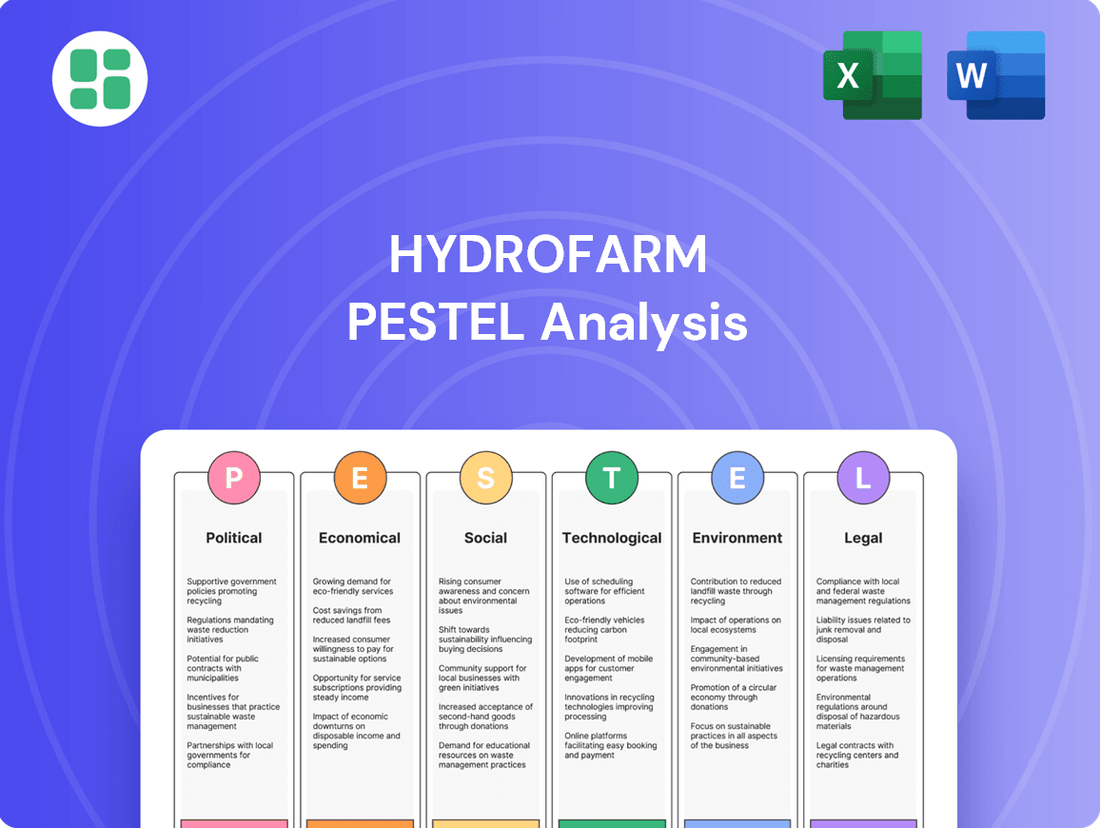

Hydrofarm PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hydrofarm Bundle

Unlock the crucial external factors shaping Hydrofarm's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces at play. Equip yourself with the strategic foresight needed to navigate this dynamic market. Download the full version now for actionable intelligence.

Political factors

The legal framework for cannabis cultivation in North America is a critical political factor influencing Hydrofarm. Evolving regulations at both federal and state levels create both opportunities and challenges. For instance, potential federal descheduling of cannabis in the US, a topic of ongoing discussion in 2024 and projected into 2025, could dramatically reshape the market by lowering tax burdens on legal cannabis businesses and unlocking capital for expansion and innovation.

However, the current regulatory environment has also contributed to issues like oversupply in the cannabis sector. This oversupply, exacerbated by varying state regulations and licensing complexities, has directly impacted Hydrofarm's sales figures and overall financial health in recent reporting periods, demonstrating the sensitivity of the company to these political shifts.

Global trade policies, especially tariffs on imports from nations like China, directly influence Hydrofarm's production expenses. Macroeconomic instability stemming from shifting tariff regulations presents a significant hurdle for the company. For instance, in 2024, ongoing trade tensions could lead to increased costs for essential lighting and equipment components, impacting Hydrofarm's margins and pricing flexibility.

Government support for sustainable agriculture, including hydroponics, is a significant political factor. For instance, the US Department of Agriculture (USDA) offers various grant and loan programs that can indirectly benefit controlled environment agriculture (CEA) by supporting broader agricultural innovation and sustainability. These programs, often updated annually, can provide crucial capital for research, development, and infrastructure improvements in the CEA sector.

Food Security Policies

Growing global concerns about food security are prompting governments to increase their focus and funding for alternative farming techniques, including hydroponics. Many nations are launching programs to guarantee consistent year-round access to fresh produce and to shorten supply chains, thereby reducing transportation emissions.

This heightened emphasis on food security directly fuels the growth of the hydroponics sector, a market where Hydrofarm operates. For instance, the United States Department of Agriculture (USDA) has been investing in research and development for controlled environment agriculture, including hydroponics, to bolster domestic food production capabilities. In 2024, several countries announced new agricultural technology grants, with a significant portion earmarked for vertical farming and hydroponic systems to enhance resilience against climate change impacts on traditional agriculture.

- Governmental Support: Increased policy backing and financial incentives for controlled environment agriculture, including hydroponics, driven by food security imperatives.

- Market Expansion: Direct correlation between national food security strategies and the growth potential for hydroponic solutions providers like Hydrofarm.

- Investment Trends: Rising public and private investment in ag-tech, with a notable allocation towards hydroponic innovations to ensure stable food supplies.

Urban Agriculture Initiatives

Governmental support for urban agriculture, including hydroponics, is expanding market access for companies like Hydrofarm. Cities worldwide are prioritizing local food production, recognizing its benefits for food security and sustainability. For instance, by 2024, many cities are expected to have dedicated urban farming zones, increasing demand for hydroponic systems and supplies.

Vertical farming, a core element of urban agriculture, allows for efficient food production within city limits, reducing transportation costs and environmental impact. Initiatives promoting community hydroponic projects and educational labs are fostering greater adoption and awareness. The global vertical farming market, a significant driver for hydroponic suppliers, was projected to reach over $20 billion by 2025, with urban centers being key growth areas.

- Increased Demand: Urban agriculture policies directly boost the market for hydroponic equipment and services.

- Reduced Supply Chains: Localized food production through hydroponics minimizes logistical complexities and costs for consumers and producers.

- Technological Advancement: Government-backed research and development in urban farming technologies, including hydroponics, spurs innovation.

- Policy Support: Favorable zoning laws and subsidies for urban farms encourage investment in hydroponic infrastructure.

Governmental support for controlled environment agriculture, including hydroponics, is a significant driver for Hydrofarm, fueled by increasing global food security concerns. For instance, in 2024, several countries launched new agricultural technology grants, with a notable portion allocated to hydroponic systems to enhance resilience against climate change. This trend is projected to continue into 2025, bolstering market growth.

The evolving legal landscape for cannabis cultivation in North America presents both opportunities and challenges for Hydrofarm. Potential federal descheduling of cannabis in the US, a topic of significant discussion in 2024 and anticipated into 2025, could reshape the market by reducing tax burdens and unlocking capital for expansion.

Governmental support for urban agriculture, including hydroponics, is expanding market access for companies like Hydrofarm. Cities are prioritizing local food production, and by 2024, many are expected to have dedicated urban farming zones, increasing demand for hydroponic systems and supplies, with the global vertical farming market projected to exceed $20 billion by 2025.

| Political Factor | Impact on Hydrofarm | 2024-2025 Data/Projections |

|---|---|---|

| Cannabis Legalization | Market expansion, potential for increased demand for cultivation equipment. | Ongoing federal discussions in the US in 2024-2025; state-level variations continue. |

| Food Security Initiatives | Increased investment in hydroponics as a solution for stable food supplies. | Global governments launching ag-tech grants for hydroponics; projected market growth. |

| Urban Agriculture Policies | Growth in demand for hydroponic systems within city limits. | Projected increase in urban farming zones by 2024; vertical farming market to exceed $20B by 2025. |

What is included in the product

Hydrofarm's PESTLE analysis examines the influence of external macro-environmental factors—Political, Economic, Social, Technological, Environmental, and Legal—on its operations and strategic positioning.

Hydrofarm's PESTLE analysis offers a clear and concise summary of external factors, relieving the pain point of wading through complex data during strategic planning.

Economic factors

A major economic hurdle for Hydrofarm has been the significant oversupply plaguing the cannabis industry. This surplus has driven down prices for finished cannabis goods, directly impacting Hydrofarm's revenue streams.

For instance, Hydrofarm's financial reports for 2024 and the first quarter of 2025 illustrate this economic pressure. The company experienced a noticeable drop in net sales and a widening net loss, a direct consequence of the prevailing market conditions.

This downturn is further reflected in Hydrofarm's sales performance, which has seen a decline in both the volume of products sold and the average selling prices, underscoring the broad economic challenges posed by industry oversupply.

High inflation and rising interest rates, exemplified by the Federal Reserve's continued rate hikes through mid-2024 to combat persistent inflation, directly impact Hydrofarm's operational costs. Increased borrowing costs for capital-intensive projects like building new controlled environment agriculture facilities can deter investment. For instance, a 2024 survey indicated that over 60% of construction firms cited higher interest rates as a significant challenge.

These economic headwinds also influence consumer spending patterns, potentially reducing demand for premium produce often associated with hydroponic farming. As disposable income tightens, consumers may opt for more budget-friendly alternatives. This cautious economic climate encourages a shift in capital expenditure, favoring upgrades and efficiencies in existing operations over new, large-scale developments for companies like Hydrofarm.

Consumer spending habits and disposable income are crucial for Hydrofarm, directly impacting demand for its hydroponics systems and supplies, especially among home gardening enthusiasts. As disposable incomes rise, consumers are more likely to invest in these systems, seeking convenience and control over their food production.

The increasing consumer focus on health and wellness, alongside a strong preference for fresh, locally sourced, and pesticide-free produce, is a significant tailwind. This trend is particularly evident in 2024 and projected into 2025, with surveys indicating a growing willingness among consumers with higher disposable incomes to spend more on products that align with these values.

E-commerce Growth and Revenue Diversification

Hydrofarm is strategically expanding its e-commerce presence and diversifying revenue streams to navigate industry volatility. In 2024, the company saw a significant 25% surge in e-commerce sales, demonstrating a successful pivot towards online channels.

This growth is complemented by a deliberate effort to broaden its customer base beyond the cannabis sector and expand internationally. By increasing sales to non-cannabis related end markets and non-U.S./Canada customers, Hydrofarm aims to create more resilient and stable revenue streams, mitigating the impact of sector-specific downturns.

- E-commerce Sales Growth: 25% increase in 2024.

- Market Diversification: Targeting non-cannabis end markets.

- Geographic Expansion: Increasing sales to non-U.S./Canada customers.

- Risk Mitigation: Stabilizing revenue through diversification.

Industry Growth Projections for Hydroponics and CEA

Despite current challenges, the hydroponics and controlled environment agriculture (CEA) sectors are poised for substantial expansion. The global hydroponics market is anticipated to reach significant valuations between 2030 and 2034, fueled by increasing urban populations and corporate commitments to sustainability. This trajectory suggests a robust long-term economic outlook for businesses operating within these spheres.

Key growth drivers are expected to propel this expansion:

- Urbanization: As more people move to cities, the demand for locally grown, fresh produce will rise, making CEA solutions increasingly vital.

- Sustainability Initiatives: Corporate and governmental sustainability mandates are encouraging the adoption of resource-efficient farming methods like hydroponics.

- Technological Advancements: Innovations in automation, LED lighting, and data analytics are improving efficiency and reducing operational costs within CEA systems.

- Food Security Concerns: Growing awareness of global food security issues is driving investment and interest in resilient, controlled growing environments.

Economic factors present a mixed landscape for Hydrofarm, with industry oversupply driving down cannabis prices and impacting revenue. This is evident in Hydrofarm's 2024 and Q1 2025 financial reports, which show declining net sales and widening net losses due to lower sales volumes and average selling prices.

Rising inflation and interest rates, as seen with the Federal Reserve's actions through mid-2024, increase Hydrofarm's operational costs and borrowing expenses, potentially slowing capital-intensive projects. Furthermore, these economic conditions can curb consumer spending on premium hydroponic produce, pushing consumers toward more budget-friendly alternatives.

Despite these challenges, the hydroponics and controlled environment agriculture (CEA) sectors are projected for significant growth, driven by urbanization, sustainability mandates, technological advancements, and food security concerns. Hydrofarm's strategic expansion into e-commerce, with a 25% sales surge in 2024, and diversification into non-cannabis markets and international sales are key to navigating these economic volatilities and capitalizing on future growth.

| Economic Factor | Impact on Hydrofarm | Supporting Data/Trend |

|---|---|---|

| Cannabis Industry Oversupply | Reduced revenue and profitability due to lower product prices. | Hydrofarm's 2024/Q1 2025 financial reports show declining net sales and widening net losses. |

| Inflation & Interest Rates | Increased operational costs and borrowing expenses; potential slowdown in capital investment. | Federal Reserve rate hikes through mid-2024; 60%+ of construction firms citing higher interest rates as a challenge in 2024. |

| Consumer Spending & Disposable Income | Potential decrease in demand for premium hydroponic produce; shift to budget-friendly alternatives. | Consumer focus on value amid economic uncertainty. |

| Hydroponics/CEA Market Growth | Long-term growth opportunity driven by urbanization, sustainability, and technology. | Global hydroponics market projected for significant valuation between 2030-2034. |

What You See Is What You Get

Hydrofarm PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Hydrofarm PESTLE Analysis breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company, providing valuable strategic insights.

Sociological factors

A significant societal shift towards prioritizing health and wellness is directly boosting demand for fresh, nutrient-dense, and pesticide-free foods. This growing awareness means consumers are actively seeking out produce that aligns with healthier lifestyles.

Hydroponically grown produce, often marketed as a safer and healthier alternative due to its controlled cultivation methods and reduced reliance on pesticides, is a direct beneficiary of this trend. For instance, the global hydroponics market was valued at approximately $10.5 billion in 2023 and is projected to reach $22.1 billion by 2030, indicating strong consumer acceptance.

This heightened consumer consciousness fuels the market for companies like Hydrofarm, as individuals increasingly look for dependable sources of high-quality, clean food. The perception of hydroponics as a superior method for producing healthier options resonates strongly with this health-focused demographic.

The relentless march of urbanization, with an estimated 68% of the world's population projected to live in urban areas by 2050 according to UN data, directly fuels the need for innovative farming solutions. This trend significantly reduces available arable land, pushing agricultural practices towards more compact and efficient methods.

Societal shifts towards local food sourcing and a desire for fresher produce in urban centers are creating a burgeoning market for hydroponic and vertical farming systems. This growing consumer demand translates into increased opportunities for companies like Hydrofarm, as urban dwellers and businesses seek to overcome space limitations and cultivate food within city limits.

Consumers are increasingly drawn to locally sourced food, valuing freshness and a smaller environmental footprint. This trend is amplified by a desire to support local economies and agricultural communities. For instance, a 2024 survey indicated that 65% of consumers are willing to pay a premium for locally grown produce.

Hydroponic operations, often located within or adjacent to urban areas, are perfectly positioned to capitalize on this demand. By offering year-round access to fresh vegetables, these farms directly address the societal shift towards supporting local food systems and community-supported agriculture initiatives.

DIY and Home Gardening Trends

The enduring popularity of home gardening and do-it-yourself cultivation projects directly benefits Hydrofarm, especially with its accessible equipment. This trend is fueled by a growing interest in personal food security and the recreational aspect of growing one's own produce, driving demand for hydroponic solutions.

Individuals are increasingly turning to home gardening for both cost savings and a sense of self-sufficiency. This societal shift encourages investment in hydroponic systems, as they offer efficient and controlled environments for growing food year-round, even in urban settings.

Recent data highlights this surge:

- The global hydroponics market size was valued at USD 11.01 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 11.5% from 2023 to 2030.

- Surveys indicate that over 35% of households in developed nations engage in some form of home gardening, with a significant portion exploring advanced methods like hydroponics.

- The DIY home improvement sector saw substantial growth in 2023, with gardening supplies being a key contributor, indicating strong consumer interest in undertaking such projects.

Food Safety Concerns and Traceability

Societal concerns about foodborne illnesses are driving a greater demand for transparency in food origins. Consumers are increasingly worried about the safety of their produce, pushing for clearer information about where their food comes from and how it's grown.

Hydroponic systems, particularly those in controlled environments, inherently offer a significant advantage by drastically reducing the risk of contamination from pathogens like E. coli and Salmonella. Furthermore, these systems typically eliminate the need for chemical pesticides, directly addressing consumer anxieties about chemical residues on their food. This makes hydroponically grown produce a compelling choice for health-conscious individuals.

The growing emphasis on food safety directly fuels the demand for transparent supply chains. Consumers want to know the journey of their food from seed to shelf, and hydroponics, with its contained and monitored growing processes, is well-positioned to provide this traceability. For instance, in 2024, surveys indicated that over 70% of consumers are willing to pay a premium for produce with verifiable safety certifications.

- Increased Consumer Vigilance: Growing awareness of foodborne illnesses prompts demand for safer food production methods.

- Reduced Contamination Risk: Controlled environment hydroponics minimize exposure to pathogens and eliminate pesticide use.

- Demand for Transparency: Consumers seek traceable supply chains, a strength of many hydroponic operations.

- Market Appeal: The focus on safety and reduced chemicals makes hydroponic produce attractive to a significant market segment.

Societal trends emphasizing health and wellness are significantly boosting demand for fresh, nutrient-dense, and pesticide-free foods, directly benefiting hydroponic systems. This consumer preference for cleaner eating, coupled with urbanization, drives the need for localized, efficient food production. For example, the global hydroponics market was valued at approximately $10.5 billion in 2023 and is projected to grow substantially, reflecting this demand.

The increasing desire for local sourcing and food transparency further amplifies opportunities for hydroponic operations. Consumers are willing to pay more for produce with verifiable safety and a reduced environmental footprint, a demand that controlled-environment agriculture is well-positioned to meet. A 2024 survey found that 65% of consumers would pay more for locally grown produce.

The growing popularity of home gardening and DIY projects also contributes to Hydrofarm's market, as individuals seek self-sufficiency and recreational cultivation. This trend is supported by the accessibility of hydroponic equipment for home use, making it easier for consumers to grow their own food year-round.

Concerns about foodborne illnesses are driving demand for safer, traceable food sources, a niche where hydroponics excels. By minimizing contamination risks and eliminating pesticide use, hydroponic produce appeals to a market segment prioritizing food safety. In 2024, over 70% of consumers expressed willingness to pay a premium for produce with verifiable safety certifications.

| Sociological Factor | Impact on Hydroponics | Supporting Data (2023-2025) |

|---|---|---|

| Health & Wellness Trend | Increased demand for clean, pesticide-free produce. | Global hydroponics market valued at $10.5 billion (2023), projected growth. |

| Urbanization | Need for localized, space-efficient farming solutions. | 68% of world population projected urban by 2050 (UN). |

| Local Sourcing Preference | Demand for fresh, community-supported agriculture. | 65% of consumers willing to pay premium for local produce (2024 survey). |

| Food Safety Concerns | Preference for transparent, low-risk food production. | 70%+ consumers willing to pay for verifiable safety certifications (2024). |

Technological factors

Ongoing innovations in LED grow light technology are significantly impacting controlled environment agriculture (CEA). These advancements focus on boosting energy efficiency and fine-tuning light spectrums to promote optimal plant growth. For instance, by 2024, the global LED grow light market was projected to reach over $4.5 billion, demonstrating substantial growth driven by these technological leaps.

Hydrofarm, a key player in distributing and manufacturing high-intensity grow lights, directly benefits from these advancements. Improved LED technology translates to enhanced performance and greater sustainability for CEA operations, making them more attractive and cost-effective for growers. This allows Hydrofarm to offer solutions that reduce electricity consumption, a critical factor for growers aiming for profitability.

The agricultural sector is witnessing a significant shift towards smart farming, with automation, AI, and IoT becoming increasingly prevalent in hydroponic systems. This technological wave allows for granular control over crucial environmental variables such as nutrient delivery, pH levels, temperature, and humidity, directly impacting crop health and output. For instance, by 2024, the global smart farming market was projected to reach over $22.5 billion, with hydroponics being a key beneficiary of these advancements.

These sophisticated systems translate to tangible benefits: higher crop yields and a notable reduction in labor expenses. By automating tasks like nutrient monitoring and environmental adjustments, growers can optimize resource allocation and minimize human intervention. This trend positions companies like Hydrofarm to develop and offer more advanced, integrated solutions that cater to this evolving demand for precision agriculture.

Technological advancements in HVAC and environmental monitoring are crucial for indoor farming, ensuring precise control over temperature, humidity, and CO2. These systems directly impact plant health and yield in controlled environments. For instance, the global indoor farming market, including the controlled environment agriculture (CEA) segment, was valued at approximately USD 50 billion in 2023 and is projected to grow significantly, driven by the need for efficient climate management.

Innovations in Growing Media and Nutrient Formulations

Continuous research and development are significantly boosting the efficiency and effectiveness of hydroponic systems. Innovations in growing media, such as advanced coco coir blends and rockwool alternatives, alongside precision nutrient formulations, are key drivers. These advancements allow for more tailored plant nutrition, directly impacting growth rates and overall yield.

Hydrofarm, with its extensive product range, benefits directly from these technological leaps. The company’s portfolio includes a wide array of growing media and nutrient solutions, catering to diverse hydroponic needs. For instance, the development of slow-release nutrient technologies and bio-stimulants can improve nutrient uptake and plant resilience, offering customers enhanced performance.

The impact of these innovations is quantifiable. For example, studies in 2024 indicated that optimized nutrient solutions in hydroponic lettuce cultivation could increase yields by up to 15% compared to standard formulations. Similarly, advancements in substrate technology have shown to improve water retention and aeration, reducing the frequency of nutrient solution replenishment.

- Enhanced Yields: Optimized nutrient formulations can lead to significant increases in crop yields, with some studies showing gains of 10-20% in 2024.

- Improved Resource Efficiency: New growing media and nutrient delivery systems reduce water and fertilizer usage, contributing to sustainability.

- Customized Plant Nutrition: Tailored nutrient mixes address specific plant needs at different growth stages, maximizing health and productivity.

- Substrate Innovation: Development of advanced substrates like aerated concrete and biochar-infused media improves root zone conditions.

Vertical Farming System Evolution

Vertical farming systems, which stack hydroponic setups to maximize space utilization, are a key technological advancement. These systems are becoming more efficient and accessible, especially for urban agriculture initiatives. The global vertical farming market was valued at approximately $5.5 billion in 2023 and is projected to reach over $20 billion by 2030, showcasing rapid growth.

Hydrofarm's equipment plays a crucial role in supporting this expanding sector, allowing for increased food production within limited urban footprints. The ongoing innovation in LED lighting, automation, and environmental control within these systems further enhances their viability and scalability.

- Increased Efficiency: Modern vertical farms can yield up to 300 times more produce per acre than traditional farming.

- Reduced Resource Use: Hydroponic systems often use 90% less water than conventional agriculture.

- Technological Integration: Advancements in AI and IoT are optimizing nutrient delivery and climate control in these farms.

- Market Growth: The controlled environment agriculture (CEA) sector, including vertical farming, is expected to see significant investment in 2024 and 2025.

Technological advancements are revolutionizing controlled environment agriculture (CEA), with innovations in LED lighting and automation driving efficiency. By 2024, the global LED grow light market exceeded $4.5 billion, reflecting substantial growth in this area. Hydrofarm, as a distributor and manufacturer, directly benefits from these trends by offering more energy-efficient and sustainable lighting solutions to growers.

Smart farming technologies, including AI and IoT, are increasingly integrated into hydroponic systems, enabling precise control over environmental factors and nutrient delivery. This trend is projected to continue, with the global smart farming market reaching over $22.5 billion by 2024. Such advancements lead to higher crop yields and reduced labor costs, areas where Hydrofarm can provide enhanced solutions.

Innovations in growing media and nutrient formulations are also critical, allowing for tailored plant nutrition and improved resource efficiency. For example, optimized nutrient solutions in hydroponic lettuce cultivation showed yield increases of up to 15% in 2024. Hydrofarm's product range, including growing media and nutrient solutions, is well-positioned to capitalize on these developments.

Vertical farming, a key technological advancement in CEA, is experiencing rapid growth, with the market valued at approximately $5.5 billion in 2023 and projected to surpass $20 billion by 2030. Hydrofarm's equipment supports this sector by facilitating increased food production in urban areas, leveraging innovations in lighting, automation, and environmental control.

| Key Technological Factor | Impact on CEA | Hydrofarm Relevance | Market Data (2024/2025 Projections) |

| LED Grow Lights | Increased energy efficiency, optimized light spectrums | Core product offering, enhances crop performance | Global LED grow light market projected to exceed $4.5 billion |

| Smart Farming (AI/IoT) | Automation, precise environmental control, data analytics | Enables integrated system solutions, precision agriculture | Global smart farming market projected to exceed $22.5 billion |

| Growing Media & Nutrients | Improved resource efficiency, tailored plant nutrition | Extensive product range, supports diverse hydroponic needs | Optimized nutrients can increase yields by up to 15% |

| Vertical Farming Systems | Maximized space utilization, urban agriculture enablement | Supports growth in a key CEA segment | Vertical farming market projected to reach over $20 billion by 2030 |

Legal factors

The patchwork of cannabis laws across North America directly affects Hydrofarm. For instance, in 2024, the US federal government continued to debate descheduling, which could streamline interstate commerce and potentially benefit companies like Hydrofarm. However, state-specific regulations, like differing licensing requirements and potency limits in states such as California and Colorado, create operational complexities and can contribute to market imbalances.

Hydrofarm operates within a landscape of rigorous product safety and quality standards, particularly for its hydroponics equipment and supplies. For instance, the U.S. Environmental Protection Agency (EPA) sets guidelines for nutrient solutions, impacting Hydrofarm's product formulations. Failure to meet these standards, such as those related to heavy metal content in fertilizers, could lead to product recalls and significant financial penalties, as seen with past instances in the broader agricultural supply sector.

Hydrofarm's legal strategy heavily emphasizes protecting its intellectual property, encompassing unique product designs, efficient manufacturing methods, and established brand names. This focus is crucial for maintaining its edge in the competitive horticulture market.

The company's commitment to proprietary branded products means that robust intellectual property protection is not just a preference but a necessity. This shields against infringement and preserves Hydrofarm's market differentiation.

Environmental Regulations for Agriculture

Hydrofarm's agricultural product distribution and operational activities are directly impacted by a complex web of environmental laws. These regulations govern critical areas such as waste disposal, the quality of water discharged from facilities, and the responsible use of chemicals, including pesticides and fertilizers. For instance, the United States Environmental Protection Agency (EPA) sets standards for agricultural runoff, with reports in late 2024 indicating increased scrutiny on nutrient management plans across major agricultural regions.

Adherence to these environmental mandates is not merely a legal obligation but a cornerstone of sustainable business. Failure to comply can result in significant financial penalties, operational disruptions, and damage to Hydrofarm's reputation. As public and governmental focus on environmental stewardship intensifies, particularly concerning water quality and biodiversity, maintaining robust compliance strategies is paramount for long-term viability.

- Waste Management: Compliance with EPA regulations like the Resource Conservation and Recovery Act (RCRA) for hazardous waste disposal.

- Water Discharge: Adherence to Clean Water Act permits for any wastewater discharged, ensuring it meets established quality standards.

- Chemical Usage: Following regulations set by the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA) regarding the sale and distribution of agricultural chemicals.

- Sustainability Initiatives: Proactive engagement in sustainable practices, potentially aligning with emerging state-level initiatives like California's focus on reducing agricultural water use by 20% by 2030, as reported in early 2025.

Trade Compliance and Import/Export Laws

Hydrofarm, as a distributor with operations spanning North America, must meticulously adhere to intricate international trade compliance and import/export regulations. These legal frameworks dictate the flow of goods across borders and are subject to frequent revisions.

Shifts in tariffs or the renegotiation of trade agreements, such as the United States-Mexico-Canada Agreement (USMCA), can significantly influence the cost and accessibility of products imported from other countries. For instance, potential tariff increases on agricultural equipment or components could directly affect Hydrofarm's cost of goods sold and necessitate adjustments to its pricing models.

- USMCA Impact: The USMCA, which replaced NAFTA, has specific rules of origin that can affect duties on imported goods, requiring careful tracking of component sourcing.

- Tariff Volatility: Changes in tariffs, often driven by geopolitical factors, can introduce unpredictable cost fluctuations for imported horticultural supplies.

- Customs Compliance: Strict adherence to customs declarations and documentation is crucial to avoid delays, fines, and reputational damage.

Hydrofarm navigates a complex legal environment, particularly concerning cannabis cultivation regulations across different states and countries. For example, by mid-2025, the ongoing federal debate in the US regarding cannabis descheduling could significantly alter interstate commerce for hydroponic equipment. State-specific rules, such as varying licensing fees and product testing requirements in key markets like Illinois and Massachusetts, continue to shape operational strategies and market access.

Environmental factors

Hydroponic systems, like those offered by Hydrofarm, are remarkably water-efficient, utilizing up to 90% less water than conventional farming by recirculating nutrient solutions. This is a critical advantage given that global freshwater availability is a growing concern, with projections indicating that by 2025, over two-thirds of the world's population could face water shortages.

This inherent efficiency positions Hydrofarm's technology as a key solution for sustainable agriculture, directly addressing global water scarcity issues. The company's products enable growers to produce more with less, a vital strategy as water stress intensifies in many agricultural regions worldwide.

Controlled environment agriculture (CEA) is inherently energy-intensive, primarily due to the significant power demands of lighting and climate control systems. These operations can consume substantial amounts of electricity, contributing to a larger carbon footprint for indoor growing. For instance, a typical indoor farm might use 100,000 kWh per acre annually for lighting alone, depending on crop and technology.

Hydrofarm directly tackles this environmental challenge by developing and promoting energy-efficient technologies. Their portfolio includes advanced LED grow lights, which can reduce energy consumption by up to 50% compared to traditional high-pressure sodium (HPS) lamps. Furthermore, their climate control solutions are designed for optimal energy usage, minimizing waste and further lowering the environmental impact of CEA operations.

Hydroponic systems inherently reduce waste by eliminating soil erosion and the need for extensive land clearing. Hydrofarm's role in supplying growing media and nutrient solutions supports a shift towards circular economy principles in agriculture. For instance, the global market for sustainable agriculture is projected to reach $24.8 billion by 2025, indicating a strong trend towards practices that minimize environmental impact.

Climate Change and Resilient Food Systems

Climate change, marked by increasingly frequent extreme weather events and widespread land degradation, highlights a critical need for robust and adaptable food production systems. The agricultural sector globally faced significant disruptions in 2023 due to droughts, floods, and unseasonal temperatures, impacting yields and supply chains.

Hydrofarm's product offerings, which facilitate controlled environment agriculture (CEA), present a vital solution. CEA allows for consistent, year-round crop cultivation irrespective of external climatic vagaries. For example, indoor farming operations utilizing hydroponic systems, a core area for Hydrofarm, can achieve up to 90% water savings compared to traditional agriculture, enhancing water security in vulnerable regions.

- Extreme Weather Impacts: Global crop losses due to weather-related disasters reached an estimated $30 billion in 2023, underscoring the vulnerability of conventional farming.

- CEA's Role: Controlled environments minimize climate risks, enabling predictable yields and contributing to food security, especially in areas prone to climate shocks.

- Resource Efficiency: Hydroponic systems, supported by Hydrofarm, can reduce water usage by up to 95% and eliminate the need for pesticides, promoting environmental sustainability.

- Market Growth: The global CEA market is projected to reach $70.6 billion by 2027, driven by the demand for resilient and sustainable food production methods.

Sustainable Sourcing and Eco-Friendly Products

Hydrofarm’s dedication to distributing high-quality, eco-friendly products like organic fertilizers and sustainable growing media directly addresses the growing consumer and grower demand for environmentally responsible options. This strategic alignment with sustainability trends is crucial in the current market landscape.

The company's emphasis on sustainable sourcing and product development resonates strongly with an increasingly eco-conscious customer base. This focus can be a significant differentiator, attracting growers who prioritize reduced environmental impact in their operations.

For instance, the global market for organic fertilizers was projected to reach approximately $10.5 billion by 2025, indicating a substantial and growing demand for such products. Hydrofarm’s offerings position it to capture a share of this expanding market.

- Growing Demand: Increased consumer awareness drives demand for organic and sustainable horticultural products.

- Market Opportunity: The organic fertilizer market alone is a multi-billion dollar sector with continued growth.

- Brand Appeal: Offering eco-friendly solutions enhances Hydrofarm's brand image and customer loyalty among environmentally conscious growers.

Hydroponic systems, a core offering of Hydrofarm, significantly reduce water usage by up to 90% compared to traditional farming, a crucial advantage as global freshwater scarcity looms, with projections suggesting over two-thirds of the world's population could face shortages by 2025.

Controlled environment agriculture (CEA), facilitated by Hydrofarm's products, is inherently energy-intensive, with lighting alone potentially consuming 100,000 kWh per acre annually. Hydrofarm addresses this by promoting energy-efficient LED grow lights, which can cut energy use by up to 50% over older technologies.

Hydroponics inherently minimizes waste, eliminating soil erosion and the need for land clearing. Hydrofarm's role in supplying growing media and nutrients supports a circular economy, aligning with a global sustainable agriculture market projected to reach $24.8 billion by 2025.

Climate change, evidenced by extreme weather events that caused an estimated $30 billion in global crop losses in 2023, necessitates resilient food production. Hydrofarm's CEA solutions offer predictability, with hydroponic systems alone capable of 90% water savings, bolstering food security.

| Environmental Factor | Impact on Hydrofarm | Hydrofarm's Response/Opportunity | Relevant Data (2024/2025 Projections) |

| Water Scarcity | Increased demand for water-efficient solutions. | Hydroponic systems offer up to 90% water savings. | Global water shortages projected for over 2/3 of population by 2025. |

| Energy Consumption | High operational costs for CEA; need for efficiency. | Distribution of energy-saving LED grow lights (up to 50% reduction). | CEA lighting can consume 100,000 kWh/acre/year. |

| Waste Reduction | Growing consumer demand for sustainable practices. | Hydroponics eliminates soil erosion; focus on circular economy. | Sustainable agriculture market projected at $24.8 billion by 2025. |

| Climate Change & Extreme Weather | Vulnerability of traditional agriculture; need for resilience. | CEA provides climate-independent cultivation. | Weather-related crop losses estimated at $30 billion in 2023. |

PESTLE Analysis Data Sources

Our Hydrofarm PESTLE Analysis is meticulously constructed using data from leading agricultural research institutions, government agricultural departments, and reputable market intelligence firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the hydroponic farming sector.