Hydrofarm Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hydrofarm Bundle

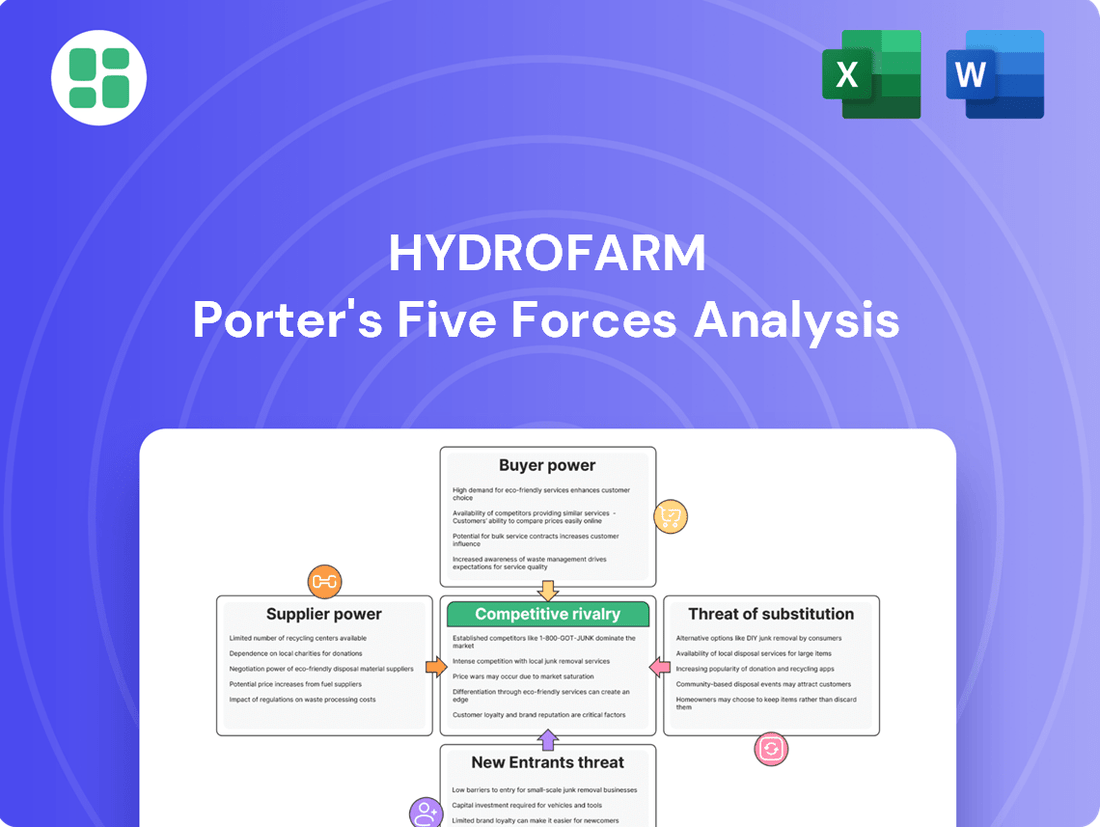

Hydrofarm operates in a dynamic market shaped by several key forces, from the bargaining power of its suppliers to the intense rivalry among existing players. Understanding these pressures is crucial for any business looking to navigate the controlled environment agriculture sector.

The complete report reveals the real forces shaping Hydrofarm’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Hydrofarm's supplier bargaining power is moderate, influenced by the concentration of specialized hydroponics equipment providers. While Hydrofarm produces some of its own brands, it depends on external sources for essential components such as high-intensity grow lights and climate control systems. This reliance on a limited number of specialized suppliers can give them leverage in setting prices and terms.

Switching costs for Hydrofarm's suppliers are a key factor in assessing their bargaining power. For highly specialized equipment, like advanced hydroponic lighting systems or unique nutrient delivery components, changing suppliers can be a complex and expensive undertaking. This often involves significant investment in retooling production lines, obtaining new certifications for safety and efficacy, and renegotiating contracts, all of which can substantially increase the cost and time involved in switching.

Conversely, for more commoditized inputs, such as basic growing media or standard fertilizers, Hydrofarm likely faces lower switching costs. This greater flexibility allows them to more easily source from alternative suppliers if pricing or terms become unfavorable. For instance, in 2024, the global market for horticultural substrates saw increased competition, potentially driving down switching costs for Hydrofarm on these types of inputs.

Suppliers of essential inputs like nutrient solutions and specialized growing media can wield considerable power in setting prices. For instance, the cost of common hydroponic nutrients has seen notable swings. Hydrofarm's strategic shift towards its own proprietary brands, increasing their sales mix to 56% in 2024 from 35% in 2020, effectively lessens reliance on outside brands and thereby softens supplier leverage.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Hydrofarm's operations, like distribution or manufacturing, is generally quite low. Most suppliers of raw materials or basic components don't possess the established distribution channels, brand loyalty, or the broad range of products that Hydrofarm has built over its extensive history, which spans more than four decades.

While the overall risk is minimal, there's a possibility that a supplier of a highly specialized component could attempt to sell directly to large commercial growers. This would allow them to bypass intermediaries like Hydrofarm. For instance, a manufacturer of advanced LED grow lights might explore direct sales if they believe they can capture more value by cutting out the distribution layer.

- Low Threat: Suppliers generally lack Hydrofarm's extensive distribution and brand recognition.

- Specialized Exception: Highly specialized component makers might consider direct sales to large growers.

- Historical Context: Hydrofarm's 40+ years of operation have built significant barriers to entry for potential integrators.

Importance of Supplier's Input to Hydrofarm's Business

The importance of supplier inputs for Hydrofarm is substantial. The company relies on a steady flow of quality components to manufacture its controlled environment agriculture (CEA) products, essential for meeting customer demand. For instance, in 2023, Hydrofarm's cost of goods sold represented a significant portion of its revenue, highlighting the direct impact of supplier pricing and availability on its financial performance.

Disruptions or escalating costs from critical suppliers can directly affect Hydrofarm's profitability by increasing its cost of goods sold. This was evident when supply chain challenges in early 2024 led to increased lead times for certain electronic components used in their lighting and control systems, impacting production schedules.

To effectively manage this supplier leverage, Hydrofarm prioritizes developing strategic partnerships and diversifying its sourcing. This approach helps mitigate risks associated with single-source dependencies and price volatility.

- High reliance on quality components for CEA product manufacturing.

- Direct impact on Cost of Goods Sold (COGS) from supplier pricing and availability.

- Strategic partnerships and diversified sourcing are key risk mitigation strategies.

Hydrofarm's supplier bargaining power is moderate, influenced by the concentration of specialized hydroponics equipment providers. While Hydrofarm produces some of its own brands, it depends on external sources for essential components such as high-intensity grow lights and climate control systems. This reliance on a limited number of specialized suppliers can give them leverage in setting prices and terms.

Switching costs for Hydrofarm's suppliers are a key factor in assessing their bargaining power. For highly specialized equipment, like advanced hydroponic lighting systems or unique nutrient delivery components, changing suppliers can be a complex and expensive undertaking. This often involves significant investment in retooling production lines, obtaining new certifications for safety and efficacy, and renegotiating contracts, all of which can substantially increase the cost and time involved in switching.

Conversely, for more commoditized inputs, such as basic growing media or standard fertilizers, Hydrofarm likely faces lower switching costs. This greater flexibility allows them to more easily source from alternative suppliers if pricing or terms become unfavorable. For instance, in 2024, the market for horticultural substrates saw increased competition, potentially driving down switching costs for Hydrofarm on these types of inputs.

Suppliers of essential inputs like nutrient solutions and specialized growing media can wield considerable power in setting prices. For instance, the cost of common hydroponic nutrients has seen notable swings. Hydrofarm's strategic shift towards its own proprietary brands, increasing their sales mix to 56% in 2024 from 35% in 2020, effectively lessens reliance on outside brands and thereby softens supplier leverage.

The threat of suppliers integrating forward into Hydrofarm's operations, like distribution or manufacturing, is generally quite low. Most suppliers of raw materials or basic components don't possess the established distribution channels, brand loyalty, or the broad range of products that Hydrofarm has built over its extensive history, which spans more than four decades.

While the overall risk is minimal, there's a possibility that a supplier of a highly specialized component could attempt to sell directly to large commercial growers. This would allow them to bypass intermediaries like Hydrofarm. For instance, a manufacturer of advanced LED grow lights might explore direct sales if they believe they can capture more value by cutting out the distribution layer.

- Low Threat: Suppliers generally lack Hydrofarm's extensive distribution and brand recognition.

- Specialized Exception: Highly specialized component makers might consider direct sales to large growers.

- Historical Context: Hydrofarm's 40+ years of operation have built significant barriers to entry for potential integrators.

The importance of supplier inputs for Hydrofarm is substantial. The company relies on a steady flow of quality components to manufacture its controlled environment agriculture (CEA) products, essential for meeting customer demand. For instance, in 2023, Hydrofarm's cost of goods sold represented a significant portion of its revenue, highlighting the direct impact of supplier pricing and availability on its financial performance.

Disruptions or escalating costs from critical suppliers can directly affect Hydrofarm's profitability by increasing its cost of goods sold. This was evident when supply chain challenges in early 2024 led to increased lead times for certain electronic components used in their lighting and control systems, impacting production schedules.

To effectively manage this supplier leverage, Hydrofarm prioritizes developing strategic partnerships and diversifying its sourcing. This approach helps mitigate risks associated with single-source dependencies and price volatility.

- High reliance on quality components for CEA product manufacturing.

- Direct impact on Cost of Goods Sold (COGS) from supplier pricing and availability.

- Strategic partnerships and diversified sourcing are key risk mitigation strategies.

| Supplier Characteristic | Impact on Hydrofarm | 2024 Data/Observation |

|---|---|---|

| Concentration of Specialized Providers | Moderate bargaining power | Key components like advanced lighting systems rely on a few specialized manufacturers. |

| Switching Costs (Specialized) | High leverage for suppliers | Significant investment required for retooling and certifications when changing suppliers for unique components. |

| Switching Costs (Commoditized) | Low leverage for suppliers | Increased competition in horticultural substrates in 2024 lowered switching costs for basic growing media. |

| Proprietary Brand Mix | Reduces supplier dependence | Hydrofarm's proprietary brands comprised 56% of sales in 2024, softening supplier leverage. |

| Supplier Forward Integration Threat | Low | Suppliers generally lack Hydrofarm's distribution network and brand recognition. |

What is included in the product

This analysis unpacks the competitive forces impacting Hydrofarm, detailing supplier and buyer power, threats from new entrants and substitutes, and the intensity of rivalry within the hydroponics market.

Instantly identify and mitigate competitive threats with a visual breakdown of industry power dynamics.

Streamline strategic planning by pinpointing key areas of market pressure and potential vulnerabilities.

Customers Bargaining Power

Hydrofarm's customer base is quite varied, encompassing commercial cultivators, home gardening enthusiasts, and retail partners throughout North America. This wide segmentation inherently lessens the bargaining clout of any single customer group, as no one segment represents an overwhelming portion of the company's revenue. For instance, in 2024, while commercial growers accounted for a significant portion of sales, their individual impact was moderated by the presence of other substantial customer segments.

Nevertheless, substantial commercial growers or major retail chains, due to their considerable purchasing volumes, can indeed wield more influence. These larger entities might negotiate better terms or pricing, leveraging their commitment to significant order quantities. This dynamic means that while overall customer power is diffused, concentrated demand from key accounts remains a factor in Hydrofarm's operational strategy.

Customer price sensitivity is a significant factor for Hydrofarm, especially given the current industry climate. In 2024, the cannabis industry experienced an oversupply, which directly impacted Hydrofarm's net sales and product volume. This oversupply situation means customers have more choices and are actively seeking the most cost-effective options available.

This heightened price sensitivity translates into increased bargaining power for Hydrofarm's customers. They are more inclined to negotiate prices or switch to competitors if they perceive better value. For instance, Hydrofarm's first quarter of 2025 continued to reflect these challenging market dynamics, underscoring the need for competitive pricing strategies.

Customers can easily find alternatives to Hydrofarm, such as other hydroponics suppliers, direct-from-manufacturer purchases, or even traditional soil gardening. This wide array of choices significantly strengthens their negotiating position.

The accessibility of substitutes means customers can readily switch if prices rise or if another supplier offers better terms. For instance, in 2024, the global hydroponics market, while growing, still sees many smaller regional players offering competitive pricing, especially for basic equipment.

Hydrofarm's strategy to counter this involves developing its own brands. By offering unique, proprietary products, the company aims to create a stronger connection with its customer base, making it harder for them to switch to a competitor offering a generic alternative.

Customer Information and Transparency

The bargaining power of customers is significantly amplified by the widespread availability of information online. Consumers can easily compare product features, pricing, and identify alternative suppliers, creating a more informed marketplace. This transparency directly impacts Hydrofarm by necessitating competitive pricing and a strong value proposition to retain customers.

Commercial growers and retailers, a key customer segment for Hydrofarm, are particularly adept at leveraging this readily accessible data. They actively seek cost-effective and scalable hydroponic systems, which empowers them to negotiate more favorable terms with suppliers. For instance, in 2024, the average price per square foot for commercial grow space continued to be a critical factor in purchasing decisions, pushing suppliers to optimize their cost structures.

- Informed Purchasing Decisions: Customers can readily access detailed product reviews, performance data, and pricing information across various hydroponic system providers.

- Price Sensitivity: The ability to compare prices easily makes customers more sensitive to price differences, pressuring Hydrofarm to maintain competitive pricing.

- Demand for Value: Beyond price, customers are looking for integrated solutions and excellent customer support, demanding greater value from their suppliers.

- Market Competition: The ease of switching suppliers due to readily available information intensifies competition, forcing Hydrofarm to continuously innovate and offer superior products and services.

Threat of Backward Integration by Customers

The threat of customers integrating backward into hydroponics supply manufacturing or distribution is generally low across Hydrofarm's diverse customer base.

While large commercial growers, a key segment, might explore in-house sourcing for specific high-volume inputs, the substantial capital outlay and technical know-how required for manufacturing or even sophisticated distribution typically deter widespread backward integration. For instance, establishing a dedicated facility to produce nutrient solutions or lighting systems involves significant R&D and operational costs, making it an unfeasible option for most.

This low threat is further evidenced by the continued reliance on specialized suppliers like Hydrofarm, which offers a broad portfolio of products and logistical efficiencies that are difficult for individual growers to replicate. The complexity of sourcing raw materials, maintaining quality control, and managing distribution networks presents a considerable barrier to entry for most customers seeking to produce their own supplies.

In 2024, the hydroponics market, valued at over $10 billion globally and projected to grow substantially, still relies on specialized manufacturers and distributors to meet the varied needs of growers, from hobbyists to large-scale agricultural operations.

- Low Threat of Backward Integration: Most Hydrofarm customers lack the capital and expertise to manufacture their own hydroponics supplies.

- High Barriers to Entry: Establishing in-house manufacturing requires significant investment in R&D, facilities, and specialized knowledge.

- Continued Reliance on Specialists: The complexity of the hydroponics supply chain reinforces customer dependence on established distributors and manufacturers.

- Market Dynamics: The global hydroponics market's continued growth in 2024 highlights the ongoing demand for specialized suppliers.

Hydrofarm's customer bargaining power is moderate, influenced by price sensitivity and the availability of substitutes. While a diverse customer base dilutes individual power, large commercial growers and retailers can negotiate better terms due to volume purchases. The oversupply in the cannabis market during 2024 heightened customer price sensitivity, as they actively sought cost-effective solutions, pressuring Hydrofarm to maintain competitive pricing.

Customers can easily source alternatives from numerous hydroponics suppliers and even traditional gardening methods, increasing their leverage. This ease of switching, particularly for basic equipment where regional players in 2024 offered competitive pricing, necessitates Hydrofarm's focus on proprietary product development and strong customer relationships to mitigate this power.

The threat of customers backward integrating is generally low. The significant capital, R&D, and operational expertise required to manufacture hydroponics supplies deter most customers, reinforcing their reliance on specialized suppliers like Hydrofarm, which offers a broad product portfolio and logistical efficiencies. The global hydroponics market, valued at over $10 billion in 2024, continues to demonstrate this reliance on specialized manufacturers.

| Factor | Impact on Hydrofarm | Supporting Data (2024/2025) |

|---|---|---|

| Customer Segmentation | Moderates individual customer power. | Diverse base including commercial, home, and retail clients. |

| Purchasing Volume | Concentrated demand from large buyers grants leverage. | Key accounts can negotiate terms based on significant order quantities. |

| Price Sensitivity | High due to market oversupply. | Cannabis industry oversupply in 2024 impacted Hydrofarm's net sales and volume. |

| Availability of Substitutes | High, increasing customer options. | Numerous hydroponics suppliers and traditional gardening alternatives exist. |

| Information Accessibility | Empowers customers to compare and negotiate. | Online resources facilitate easy comparison of pricing and performance. |

| Backward Integration Threat | Low due to high barriers to entry. | Significant capital and expertise needed for in-house manufacturing. |

Preview Before You Purchase

Hydrofarm Porter's Five Forces Analysis

This preview showcases the complete Hydrofarm Porter's Five Forces Analysis, offering a thorough examination of the competitive landscape within the hydroponics industry. The document you see here is precisely the same professionally formatted and ready-to-use analysis that will be available to you instantly after purchase, ensuring no surprises and immediate utility for your strategic planning needs.

Rivalry Among Competitors

The hydroponics market presents a landscape of moderate to high competitive rivalry, with Hydrofarm navigating a crowded field of numerous players. As a prominent independent manufacturer and distributor, Hydrofarm encounters competition from established giants like The Scotts Miracle-Gro Company, which significantly impacts market share dynamics.

Furthermore, specialized hydroponics suppliers and rapidly growing entities such as GrowGeneration Corp. contribute to the diverse competitive environment. This broad spectrum of competitors, ranging from large corporations to niche providers, intensifies the pressure on pricing and innovation within the industry.

While the broader hydroponics market is poised for robust expansion, with North America alone projected to see a compound annual growth rate of 12.79% between 2025 and 2033, Hydrofarm has navigated a more turbulent landscape recently. The company has explicitly cited challenging industry conditions, largely attributed to an oversupply within the cannabis sector.

This oversupply has directly impacted Hydrofarm's financial performance, leading to a decline in net sales. Consequently, competitive rivalry has intensified as businesses compete more aggressively for a reduced immediate market share, putting pressure on pricing and profitability.

Hydrofarm actively combats competitive rivalry by emphasizing product differentiation, notably through its expanding collection of innovative, proprietary branded products. This strategic focus is yielding tangible results, with proprietary brand sales making up 56% of the company's mix in 2024.

This shift towards proprietary brands not only strengthens Hydrofarm's market position but also directly contributes to improved gross profit margins. By offering unique, value-added products, Hydrofarm creates a distinct competitive advantage over generic offerings, effectively mitigating price-based competition.

Exit Barriers for Competitors

Exit barriers for competitors in the hydroponics sector can be moderately high. This is often due to the need for specialized manufacturing equipment and the investment in building robust distribution networks. For instance, a company heavily invested in custom-molded plastic components for grow systems faces significant costs if it decides to exit, making it difficult to recoup its initial investment.

These elevated exit barriers mean that companies might continue to operate even in less profitable periods, which can intensify competitive rivalry. Established players often have long-term contracts with suppliers or distributors, further locking them into the market. This can lead to a prolonged period of intense competition as firms strive to maintain market share.

- Specialized Assets: High upfront costs for manufacturing machinery specific to hydroponic systems.

- Distribution Networks: Significant investment in establishing and maintaining relationships with retailers and end-users.

- Long-Term Contracts: Commitments with suppliers or major clients that are costly to break.

- Brand Reputation: The time and resources invested in building brand loyalty can be a deterrent to exiting.

Cost Structure and Strategic Focus

Hydrofarm's commitment to cost management is evident in its strategic focus on operational efficiency. By actively reducing its manufacturing footprint, the company has achieved substantial savings in Selling, General, and Administrative (SG&A) expenses. For instance, in the fiscal year ending December 31, 2023, Hydrofarm reported SG&A expenses of $108.5 million, a decrease from $122.1 million in 2022, showcasing their proactive approach to cost control.

This deliberate strategy directly impacts competitive rivalry by enhancing Hydrofarm's ability to absorb price pressures from competitors. Improved profitability stemming from these cost reductions allows Hydrofarm to maintain a more competitive pricing structure, even when facing aggressive tactics from rivals in the horticultural supply market. This financial resilience is crucial for navigating industry headwinds and preserving market share.

- Reduced SG&A Expenses: Hydrofarm's SG&A expenses decreased by 11.1% in 2023 compared to 2022, highlighting successful cost-saving initiatives.

- Manufacturing Footprint Optimization: The company has strategically consolidated its manufacturing operations to drive efficiency and lower production costs.

- Profitability Enhancement: These cost-management efforts are designed to bolster profitability, enabling Hydrofarm to better compete on price.

- Competitive Resilience: By controlling costs, Hydrofarm strengthens its position to withstand pricing pressures from competitors in the horticultural sector.

Competitive rivalry within the hydroponics sector is intense, with Hydrofarm facing numerous competitors, including large players like Scotts Miracle-Gro and specialized firms such as GrowGeneration. This crowded market necessitates constant innovation and competitive pricing, a challenge amplified by recent industry oversupply, particularly within the cannabis sector, which has impacted Hydrofarm's sales.

Hydrofarm is actively addressing this rivalry by focusing on proprietary brands, which constituted 56% of its sales mix in 2024, thereby improving gross profit margins and differentiating itself from generic offerings. Furthermore, the company's strategic cost management, including an 11.1% reduction in SG&A expenses in 2023 to $108.5 million, enhances its ability to withstand pricing pressures and maintain competitiveness.

Exit barriers in hydroponics, such as specialized equipment and distribution networks, can keep less profitable competitors in the market, thus sustaining rivalry. Hydrofarm's efforts to optimize its manufacturing footprint and control costs are crucial for navigating these competitive dynamics and preserving market share.

| Competitor | Market Position | 2024 Sales Focus |

|---|---|---|

| Scotts Miracle-Gro | Established Giant | Broad horticultural products |

| GrowGeneration Corp. | Rapidly Growing Specialty Retailer | Hydroponic and gardening supplies |

| Hydrofarm Holdings, Inc. | Independent Manufacturer & Distributor | Proprietary brands (56% of sales mix in 2024) |

SSubstitutes Threaten

Traditional soil-based farming continues to be a significant substitute for hydroponic systems, particularly in large-scale outdoor operations where upfront investment is often less prohibitive. Despite hydroponics' water-saving and yield-boosting benefits, conventional agriculture's widespread accessibility and established infrastructure present a formidable competitive force.

Within the expansive Controlled Environment Agriculture (CEA) sector, alternative cultivation techniques like aquaponics and aeroponics present viable substitutes to traditional hydroponics. Aquaponics, which ingeniously integrates aquaculture (fish farming) with hydroponics, creates a symbiotic system that significantly reduces waste, a key selling point for sustainability-focused agricultural operations.

These alternative CEA methods can exert considerable pressure on pure hydroponic systems. For instance, the global aquaponics market was valued at approximately USD 780 million in 2023 and is projected to grow substantially. This growth indicates a rising adoption rate, meaning more potential customers for CEA might opt for these substitute technologies, potentially limiting the market share and pricing power of purely hydroponic operations.

The availability of conventional produce from supermarkets, often at lower prices, poses a significant threat. For example, in 2022, the average price per pound for fresh produce in U.S. supermarkets was notably less than that of specialty hydroponic greens. This price difference can sway consumer decisions, especially among those prioritizing cost savings.

Technological Advancements in Substitutes

Innovations in traditional farming or other controlled environment agriculture (CEA) methods can significantly impact the appeal of hydroponics. For instance, breakthroughs in drought-resistant crop varieties or highly efficient precision irrigation for soil-based farming could diminish the perceived advantage of hydroponics regarding water conservation.

The threat of substitutes is amplified by ongoing technological progress across the agricultural spectrum. As of early 2024, investments in agricultural technology (AgTech) continue to surge, with a notable focus on improving traditional farming efficiency. Companies are pouring billions into developing solutions that enhance soil health and water management, directly challenging hydroponics' core benefits.

- Technological advancements in soil-based farming: Innovations like CRISPR gene editing for drought resistance and AI-powered precision irrigation systems are making traditional methods more competitive in resource efficiency.

- Emergence of alternative CEA: Aeroponics and aquaponics, while related, offer different operational models and resource inputs that could serve as substitutes depending on specific crop types and market demands.

- Cost-competitiveness of substitutes: As traditional farming becomes more efficient, the cost premium often associated with hydroponic produce may decrease, making substitutes more attractive to consumers and businesses.

Consumer Awareness and Willingness to Switch

Consumer awareness of hydroponics' advantages, such as higher yields and reduced water usage compared to traditional farming, is growing, yet it remains inconsistent across different markets. While a significant portion of consumers, particularly those prioritizing organic and locally sourced produce, are increasingly interested, their understanding of hydroponics' specific benefits versus other sustainable methods can vary. This gap in awareness directly impacts their willingness to seek out and pay a premium for hydroponically grown products.

The decision for commercial and home growers to adopt hydroponics hinges on a clear perception of tangible benefits. Factors like increased crop yield, improved quality, and potential cost savings over time are critical. For instance, studies indicate hydroponic systems can yield up to 30% more produce than soil-based farming in the same space, and some systems can reduce water consumption by as much as 90%. However, the initial investment cost and the learning curve associated with new technologies can be deterrents, influencing the pace of adoption.

The threat of substitutes is further shaped by the accessibility and cost-effectiveness of alternative growing methods. Traditional agriculture, while often less resource-efficient, benefits from established infrastructure and lower upfront costs. Other controlled environment agriculture (CEA) techniques, like aquaponics or aeroponics, also present alternatives, each with its own set of advantages and disadvantages that growers weigh. The competitive landscape is dynamic, with ongoing innovation in all agricultural sectors impacting the perceived attractiveness of hydroponics.

- Consumer Awareness: While interest in sustainable food is high, specific knowledge of hydroponics' benefits compared to other methods is mixed.

- Willingness to Switch: Growers consider yield increases (potentially up to 30% higher than soil), quality improvements, and cost-effectiveness when deciding to adopt hydroponics.

- Adoption Barriers: Initial setup costs and the need for new skills can slow the adoption rate for both commercial and home growers.

- Alternative Methods: Traditional farming and other CEA techniques like aquaponics and aeroponics serve as direct substitutes, influencing market dynamics.

Traditional soil-based farming remains a potent substitute, especially for large-scale operations where its lower initial investment is a key advantage. Despite hydroponics' efficiency gains, the established infrastructure of conventional agriculture presents a significant challenge. Furthermore, alternative controlled environment agriculture (CEA) methods like aquaponics and aeroponics are gaining traction, with the global aquaponics market valued around USD 780 million in 2023, indicating a growing preference for these related technologies.

The cost-effectiveness of conventional produce also acts as a substitute threat; for instance, in 2022, supermarket produce prices were often lower than specialty hydroponic greens, influencing consumer choices. Technological advancements in both soil-based and other CEA methods continue to erode hydroponics' unique selling propositions. Investments in AgTech, exceeding billions as of early 2024, are enhancing traditional farming efficiency and water management, directly competing with hydroponics' core benefits.

| Substitute Type | Key Advantage | Market Data/Impact |

|---|---|---|

| Traditional Soil Farming | Lower upfront investment, established infrastructure | Widespread accessibility, significant market share |

| Aquaponics | Waste reduction, sustainability | Market valued at ~USD 780 million in 2023, growing adoption |

| Aeroponics | Water efficiency, nutrient delivery | Emerging CEA alternative, potential market disruption |

| Conventional Produce | Lower consumer price point | Price difference can sway purchasing decisions |

Entrants Threaten

Capital requirements in the hydroponics technologies market present moderate barriers to entry. Establishing advanced commercial hydroponic systems demands significant upfront investment, often ranging from $50,000 to over $500,000 for larger operations, covering sophisticated lighting, climate control, and nutrient delivery infrastructure. This high initial outlay, coupled with the need for specialized R&D and technical expertise, deters many potential new players, thereby limiting the immediate threat of new entrants.

Established players like Hydrofarm leverage significant economies of scale in production, procurement, and distribution. For instance, their large-scale purchasing power in 2024 allowed them to secure raw materials at a lower cost per unit compared to any newcomer. This cost advantage makes it challenging for new entrants to match pricing, as they would need substantial initial investment to achieve comparable efficiencies.

Hydrofarm's extensive experience curve, built over years of operation, translates into optimized manufacturing processes and reduced waste. This accumulated knowledge allows for greater efficiency and lower per-unit production costs, a hurdle new entrants must overcome. By 2024, their refined operational procedures likely contributed to a noticeable margin advantage.

Hydrofarm's established and extensive distribution network across North America presents a substantial barrier for new entrants. This network serves both commercial and home growers, as well as a wide range of retailers, making it difficult for newcomers to gain comparable reach.

Building a similar distribution infrastructure would require significant upfront investment and time, potentially costing millions of dollars in logistics, warehousing, and sales force development. Securing shelf space in retail stores or achieving visibility on popular online platforms is also a major hurdle, as existing players like Hydrofarm already hold strong relationships and preferred placement.

Brand Loyalty and Product Differentiation

Hydrofarm's extensive 40-year history and its development of innovative, proprietary branded products have cultivated significant brand recognition and fostered strong customer loyalty within the hydroponics market. This deep-rooted brand equity presents a considerable barrier for new entrants aiming to establish a foothold.

To effectively compete, new companies would require substantial investments in marketing and advertising to build awareness and trust, mirroring Hydrofarm's established presence. Furthermore, they would need to introduce highly differentiated products that offer unique value propositions to sway customers away from existing, trusted brands.

- Brand Loyalty: Hydrofarm’s long operating history and proprietary product lines have built a loyal customer base.

- Differentiation Challenge: New entrants must offer distinct products to overcome established brand preferences.

- Marketing Investment: Significant capital is needed for marketing to compete with Hydrofarm's brand recognition.

- Market Share Acquisition: Capturing market share necessitates overcoming existing customer loyalty and perceived product superiority.

Regulatory and Technical Hurdles

While the hydroponics sector isn't as heavily regulated as some industries, compliance with product quality, safety, and environmental standards presents a hurdle. For instance, in 2024, the USDA continued to emphasize food safety regulations that impact controlled environment agriculture, requiring new entrants to invest in compliant systems and processes.

Furthermore, the need for substantial technical expertise in controlled environment agriculture acts as a significant barrier to entry. Developing efficient and competitive hydroponic systems demands specialized knowledge in plant science, nutrient management, and automation, making it challenging for newcomers without this background to establish a foothold.

- Regulatory Compliance: Adherence to food safety and environmental standards, such as those evolving from USDA guidelines, requires upfront investment and ongoing management.

- Technical Expertise: Proficiency in plant physiology, nutrient solutions, and controlled environment technologies is crucial for operational success and product development.

- Capital Investment: Setting up advanced hydroponic systems, including climate control and automation, often necessitates considerable initial capital, impacting the threat of new entrants.

The threat of new entrants in the hydroponics market, particularly concerning Hydrofarm, is generally moderate. While the market offers attractive growth potential, significant capital requirements for advanced systems, estimated between $50,000 and over $500,000 for commercial setups in 2024, alongside the need for specialized technical expertise, act as considerable deterrents. Established players benefit from economies of scale and extensive distribution networks, making it difficult for newcomers to compete on price and reach.

Hydrofarm's established brand loyalty, built over 40 years with proprietary products, further solidifies its market position. New entrants must invest heavily in marketing and product differentiation to gain traction. Regulatory compliance, such as USDA food safety standards, adds another layer of complexity and cost for potential new competitors.

| Barrier to Entry | Impact on New Entrants | Hydrofarm's Advantage |

|---|---|---|

| Capital Requirements | High initial investment for advanced systems | Economies of scale in procurement and production |

| Technical Expertise | Need for specialized knowledge in plant science and automation | Accumulated operational experience and optimized processes |

| Distribution Network | Challenging to replicate extensive reach and retailer relationships | Established nationwide presence serving diverse customer segments |

| Brand Recognition & Loyalty | Requires significant marketing investment and product differentiation | Strong customer trust and preference for proprietary brands |

| Regulatory Compliance | Investment in compliant systems and processes necessary | Existing infrastructure and knowledge of industry standards |

Porter's Five Forces Analysis Data Sources

Our Hydrofarm Porter's Five Forces analysis leverages data from industry-specific market research reports, financial statements of key players, and trade association publications to understand competitive dynamics.

We also incorporate insights from government agricultural statistics and consumer trend surveys to assess buyer power and the threat of new entrants.