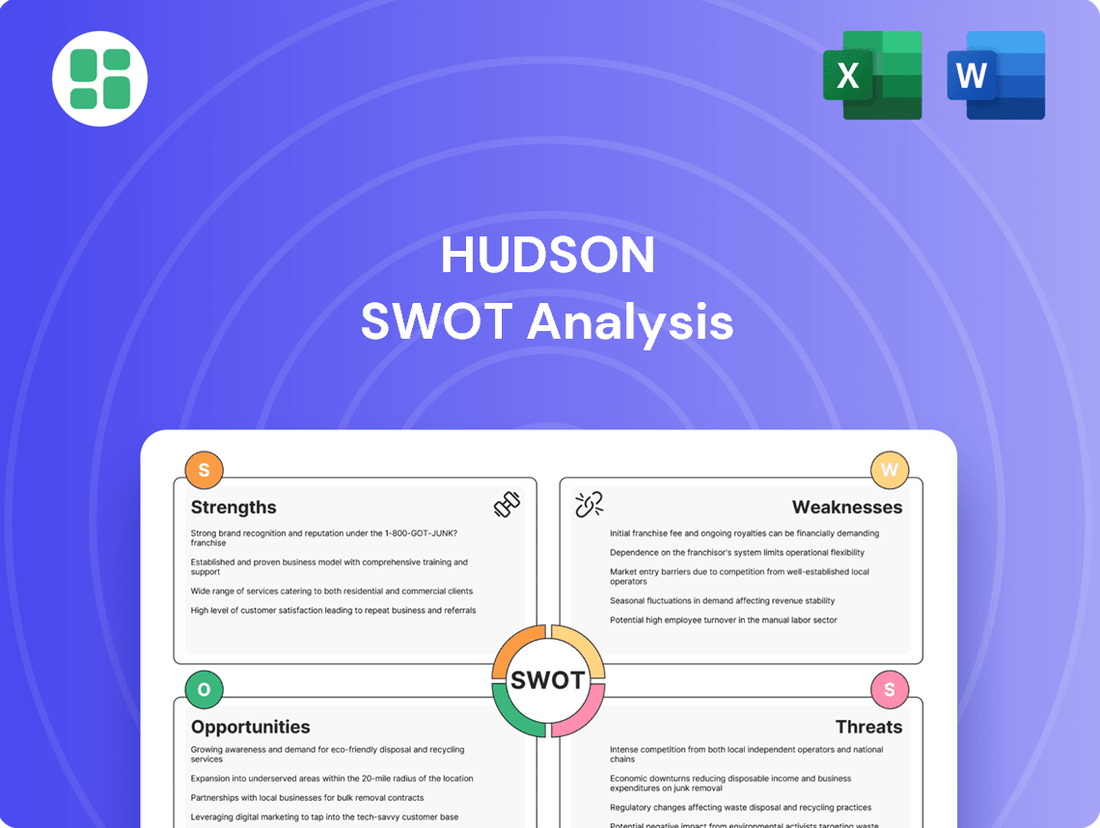

Hudson SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hudson Bundle

Hudson's unique market position is built on strong brand recognition and a loyal customer base, but faces challenges from evolving consumer preferences and intense competition. Understanding these dynamics is crucial for navigating its future success.

Want the full story behind Hudson's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Hudson Global's core strength lies in its specialized Recruitment Process Outsourcing (RPO) expertise. This focused approach allows them to hone in on optimizing talent acquisition, developing efficient processes, and utilizing advanced technologies. Their ability to manage the entire recruitment lifecycle, from initial sourcing to final onboarding, showcases a deep understanding and capability within their niche.

Hudson's client value proposition centers on delivering measurable improvements in talent acquisition. Their services are engineered to boost efficiency, slash recruitment costs, and elevate the caliber of new hires, directly addressing critical business needs.

These tangible results are key differentiators, attracting and retaining clients who view Hudson as a strategic partner in optimizing their workforce acquisition. For instance, Hudson RPO successfully reduced cost per hire by 50% and time to fill by 60% for a major global pharmaceutical client, showcasing their impactful delivery.

Hudson Global boasts an impressive worldwide presence, with operations in over 50 countries and established entities in more than 25. This expansive network enables them to effectively support multinational corporations and government bodies, offering adaptable and scalable talent solutions tailored to diverse international requirements.

Strategic Acquisitions and Digital Division Launch

Hudson's strategic acquisitions in 2024 and 2025 are bolstering its market position. The acquisition of Executive Solutions in the UAE (March 2024) and Alpha Consulting Group (ACG) in Japan (July 2025) significantly expands its global footprint. Furthermore, the strategic integration of CMRG in August 2025 deepens its expertise in talent engagement, a critical area for modern businesses.

The company's proactive expansion strategy is further evidenced by the launch of its dedicated Digital Division in Q1 2025. This move signals a commitment to leveraging technology to deliver innovative solutions, particularly in the rapidly evolving fields of employer branding and talent acquisition.

- Geographic Expansion: Acquisitions in the UAE and Japan broaden Hudson's international reach.

- Service Enhancement: Integrations strengthen capabilities in employer branding and talent engagement.

- Digital Transformation: The new Digital Division focuses on tech-driven solutions.

- Market Responsiveness: These moves demonstrate adaptability to changing market demands.

Long-term Client Partnerships

Hudson RPO's strength lies in its ability to cultivate long-term client partnerships, a testament to its consistent delivery of value and client-centric approach. The average partnership duration exceeding seven years, with a remarkable 90% of clients possessing a global footprint, underscores exceptional client satisfaction and retention.

These enduring relationships translate into predictable revenue streams and fertile ground for expanding services within existing accounts. This stability is a significant competitive advantage, allowing for strategic planning and resource allocation with greater certainty.

The company's success in maintaining these deep relationships highlights its:

- Proven client satisfaction: An average partnership length of over 7 years demonstrates a strong track record.

- Global reach capability: Serving 90% of clients globally showcases adaptability and broad operational capacity.

- Revenue stability: Long-term contracts provide a predictable and reliable income base.

- Growth potential: Existing partnerships offer opportunities for upselling and cross-selling services.

Hudson's specialized Recruitment Process Outsourcing (RPO) expertise is a significant strength, allowing them to optimize talent acquisition with advanced technologies and efficient processes. Their ability to manage the entire recruitment lifecycle, from sourcing to onboarding, demonstrates a deep capability within their niche.

Hudson's client value proposition focuses on delivering measurable improvements in talent acquisition, such as slashing recruitment costs and elevating hire quality. For instance, Hudson RPO reduced cost per hire by 50% and time to fill by 60% for a major global pharmaceutical client, showcasing their impactful delivery.

The company's expansive global presence, operating in over 50 countries, enables them to effectively support multinational corporations. Strategic acquisitions in 2024 and 2025, including Executive Solutions in the UAE and Alpha Consulting Group in Japan, further bolster this international reach and service capabilities.

Hudson's strength is also evident in its long-term client partnerships, with an average duration exceeding seven years and 90% of clients having a global footprint. This demonstrates exceptional client satisfaction and provides predictable revenue streams, a significant competitive advantage.

| Metric | Value | Impact |

|---|---|---|

| Average Partnership Duration | Over 7 years | Revenue stability and deep client understanding |

| Global Client Footprint | 90% | Demonstrates broad operational capacity and adaptability |

| Cost Per Hire Reduction (example) | 50% | Quantifies efficiency gains for clients |

| Time To Fill Reduction (example) | 60% | Highlights speed and effectiveness in talent acquisition |

What is included in the product

Analyzes Hudson’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Simplifies complex SWOT data into an easily digestible format for rapid understanding and action.

Weaknesses

Hudson Global's reliance on a small group of major clients presents a notable weakness. In 2023, over 85% of its revenue stemmed from its top 25 customers, with two clients alone contributing a substantial 50% of total revenue for both 2023 and 2022.

This significant client concentration creates a considerable risk. The potential loss of even a few of these key clients, or a significant decrease in their business volume, could have a severe negative impact on Hudson's financial results and overall stability.

Hudson Global's reliance on contract staffing means its financial performance, as seen in 2024, is sensitive to broader economic trends affecting hiring. A general slowdown in global hiring activity directly impacts Hudson's revenue streams.

Furthermore, unusually low attrition rates at legacy clients in 2024 meant fewer opportunities for Hudson to place new candidates, further dampening revenue growth. As a recruitment process outsourcing (RPO) provider, Hudson's core business model is intrinsically linked to the volume and speed of client hiring.

Hudson Global has a history of operating losses and negative cash flows, a weakness that could resurface. For the full year 2024, the company reported a net loss of $4.8 million. This financial performance highlights ongoing challenges in achieving consistent profitability.

Furthermore, the company's operational activities in 2024 consumed cash, with a negative cash flow from operations of $2.8 million. This trend suggests difficulties in generating sufficient cash from its core business to fund its operations and investments.

Competition in the RPO Market

The RPO market is intensely competitive, with technology advancements like web and mobile platforms drawing in new providers and existing HR firms. This broad competitive landscape, featuring both large corporations and niche specialists, puts pressure on Hudson Global's pricing strategies and its ability to win new contracts.

Hudson Global faces significant competition in the RPO sector. For instance, a 2024 industry report indicated that the RPO market is projected to grow, but this growth is accompanied by an increasing number of service providers. This influx means Hudson must continually differentiate its offerings to stand out.

- Intensified Competition: New entrants, often tech-enabled, are challenging established players.

- Pricing Pressures: A crowded market can lead to downward pressure on RPO service fees.

- Market Saturation: Existing HR service providers expanding into RPO add to the competitive density.

- Differentiation Challenge: Standing out requires a unique value proposition beyond standard RPO services.

Potential Challenges in Integrating Acquisitions

Successfully integrating acquired companies like Executive Solutions and Alpha Consulting Group presents significant hurdles for Hudson. Cultural clashes and the difficulty in retaining key personnel post-acquisition can undermine synergy realization. For instance, a 2024 report by McKinsey indicated that over 50% of M&A deals fail to achieve their intended value due to poor integration.

Harmonizing disparate operational systems and ensuring consistent service delivery across the expanded organization are also critical weaknesses. Failure to address these complexities, as seen in some tech mergers where system integration took over 18 months, can lead to customer dissatisfaction and operational inefficiencies, directly impacting Hudson's financial performance and market reputation.

- Cultural Misalignment: Differences in corporate culture can lead to employee resistance and decreased productivity.

- Talent Retention: Losing key employees from acquired firms can result in loss of expertise and client relationships.

- System Integration: Merging IT infrastructure, software, and processes is often complex, costly, and time-consuming.

- Service Delivery Disruption: Inconsistent service quality post-acquisition can damage customer trust and brand image.

Hudson Global's significant client concentration remains a core weakness. In 2023, over 85% of its revenue came from its top 25 clients, with two clients alone accounting for 50% of total revenue in both 2023 and 2022, highlighting a substantial risk if these key relationships falter.

The company's performance is also tied to the broader economic climate impacting hiring. In 2024, unusually low attrition rates at legacy clients limited opportunities for new candidate placements, directly affecting revenue growth for Hudson's recruitment process outsourcing (RPO) model.

Hudson Global has faced operating losses, with a net loss of $4.8 million reported for the full year 2024, and negative cash flow from operations of $2.8 million in the same period, indicating challenges in consistent profitability and cash generation.

The RPO market's intense competition, fueled by technology advancements and new entrants, puts pressure on Hudson's pricing and contract acquisition capabilities. A 2024 industry report noted an increasing number of service providers entering the RPO market.

Integrating acquired companies like Executive Solutions and Alpha Consulting Group presents challenges. A 2024 McKinsey report indicated over 50% of M&A deals fail to achieve their intended value due to poor integration, including cultural clashes and system harmonization difficulties.

| Weakness | Description | Impact | Relevant Data (2023/2024) |

|---|---|---|---|

| Client Concentration | Heavy reliance on a few major clients. | Financial instability if key clients are lost. | Top 25 clients = 85%+ revenue (2023); Top 2 clients = 50% revenue (2023/2022). |

| Economic Sensitivity | Performance linked to hiring trends. | Reduced revenue during economic downturns or hiring slowdowns. | Low attrition at legacy clients in 2024 limited new placements. |

| Profitability & Cash Flow | History of operating losses and negative cash flow. | Difficulty funding operations and investments. | Net loss of $4.8 million (FY 2024); Negative cash flow from operations of $2.8 million (2024). |

| Competitive Landscape | Intense competition in the RPO market. | Pricing pressures and challenges in differentiation. | Increasing number of RPO service providers noted in 2024 industry reports. |

| M&A Integration | Difficulties in integrating acquired companies. | Potential for cultural clashes, talent loss, and system inefficiencies. | McKinsey report (2024) states >50% of M&A deals fail to achieve value due to poor integration. |

Same Document Delivered

Hudson SWOT Analysis

The preview you see is the actual Hudson SWOT analysis document. You'll receive the complete, professionally structured report immediately after purchase, with no hidden surprises.

Opportunities

The global Recruitment Process Outsourcing (RPO) market is booming, expected to hit $8.14 billion by 2025, up from $7 billion in 2024. This represents a strong 16.3% annual growth rate. Companies are increasingly turning to RPO for efficient, scalable, and cost-effective hiring strategies.

This expanding market offers a prime opportunity for Hudson Global. As businesses worldwide prioritize streamlined talent acquisition, Hudson's RPO services are well-positioned to capture a larger share of this growing demand.

Hudson Global can significantly boost its recruitment services by integrating AI and automation. The market clearly favors RPO partners with these advanced capabilities. For instance, AI tools can slash time-to-hire by an estimated 30-50%, a critical advantage in today's competitive landscape.

By implementing AI for resume screening, candidate matching, and predictive analytics, Hudson can streamline its processes. Automated dashboards will also offer clients greater transparency and efficiency, directly addressing the growing demand for data-driven recruitment solutions observed throughout 2024 and into 2025.

Hudson Global's strategic moves in 2024 highlight significant opportunities for growth. The company's recent acquisitions in the United Arab Emirates and Japan are key to tapping into burgeoning international markets, potentially expanding their client base and revenue streams considerably.

Furthermore, the launch of its Digital Division and the broadening of executive search services, including employer branding and talent engagement, directly address evolving market needs. This diversification allows Hudson to offer more holistic talent solutions, a crucial advantage in today's competitive landscape.

Addressing Global Talent Shortages and Skill Gaps

The persistent global talent shortage, particularly in specialized fields, presents a significant opportunity for RPO providers like Hudson. As of late 2024, reports indicate that over 70% of companies worldwide are struggling to find qualified candidates for critical roles, a figure expected to rise. This demand for specialized recruitment expertise allows Hudson to position itself as a vital partner for businesses seeking to bridge these skill gaps.

Hudson can capitalize on this trend by offering tailored solutions that go beyond traditional recruitment. This includes implementing data-driven strategies to identify specific skill deficits within client organizations and focusing on skills-based hiring methodologies. By doing so, Hudson can directly address the core issues driving talent shortages.

- Skills Gap Identification: Hudson can leverage advanced analytics to pinpoint precise skill deficiencies in client workforces, enabling targeted recruitment efforts.

- Skills-Based Hiring: Implementing hiring processes that prioritize demonstrable skills over traditional qualifications can unlock a wider talent pool.

- Upskilling and Reskilling Support: Offering guidance and partnerships for client-led training programs to develop existing employees addresses long-term talent needs.

- Strategic Workforce Planning: Assisting clients in forecasting future talent requirements and building proactive recruitment pipelines.

Strategic Partnerships and Industry Evolution

The recruitment process outsourcing (RPO) landscape is transforming, moving beyond simple transactional hiring to become a crucial strategic partner for businesses. Hudson Global can leverage this evolution by emphasizing consultative services, embedding talent acquisition teams directly within client organizations, and aligning its offerings with clients' overarching growth objectives. This strategic shift fosters stronger client loyalty and opens avenues for enhanced revenue generation.

Hudson's opportunity lies in deepening client integration and demonstrating measurable impact on business outcomes. For instance, by offering data-driven insights into talent pipelines and workforce planning, Hudson can position itself as an indispensable advisor. This consultative approach can transform client relationships from vendor-based to true strategic alliances, leading to more robust and sustainable revenue streams.

The industry's move towards strategic partnerships is evident in the increasing demand for RPO providers who can offer more than just recruitment fulfillment. Clients are seeking partners who understand their business, contribute to their talent strategy, and help achieve long-term goals. Hudson's ability to adapt and offer these integrated solutions will be key to capturing market share and driving growth in the coming years.

- Strategic Integration: Hudson can capitalize on the RPO model's evolution by embedding talent acquisition specialists within client organizations, fostering deeper collaboration and alignment with business goals.

- Consultative Approach: Shifting from transactional hiring to offering strategic advice on talent management, workforce planning, and market insights will differentiate Hudson and strengthen client relationships.

- Revenue Growth: By becoming a strategic partner, Hudson can unlock opportunities for expanded service offerings and long-term contracts, leading to increased and more predictable revenue streams.

- Industry Trend Alignment: The market is increasingly valuing RPO providers that offer integrated talent solutions, making Hudson's strategic partnership focus a timely and relevant opportunity for expansion.

Hudson Global is well-positioned to benefit from the significant global talent shortage, with over 70% of companies struggling to find qualified candidates in late 2024. This demand for specialized recruitment expertise allows Hudson to offer tailored solutions, focusing on skills-based hiring and identifying skill deficits within client organizations.

The company can leverage the evolving RPO landscape by emphasizing consultative services and strategic integration within client organizations. This shift from transactional hiring to becoming a strategic partner will foster deeper collaboration, align talent acquisition with business goals, and unlock opportunities for expanded service offerings and long-term contracts.

Hudson's recent international acquisitions in the UAE and Japan, alongside the launch of its Digital Division and expanded executive search services, present clear opportunities for growth. These strategic moves tap into burgeoning international markets and address evolving market needs by offering more holistic talent solutions.

The integration of AI and automation into recruitment processes is another significant opportunity, as the market favors RPO partners with these advanced capabilities. AI tools can reduce time-to-hire by 30-50%, and automated dashboards offer clients greater transparency and efficiency, aligning with the demand for data-driven recruitment.

Threats

Economic uncertainty and budget constraints are significant threats, potentially leading to reduced hiring activities and widespread hiring freezes across various sectors. This directly impacts the demand for recruitment process outsourcing (RPO) services like those offered by Hudson. For instance, in 2024, Hudson Global saw its business affected by a low level of global hiring activity, underscoring its susceptibility to macroeconomic conditions beyond its direct influence.

The Recruitment Process Outsourcing (RPO) sector is a crowded space. Hudson Global faces stiff competition from niche RPO providers and major HR outsourcing companies. This intense rivalry often translates into significant pricing pressures, potentially impacting Hudson's ability to secure new business or preserve its profit margins, especially when rivals present more attractive pricing or a wider array of services.

The swift evolution of technology, especially AI, presents a significant threat to Hudson if clients opt for in-house AI recruitment solutions, bypassing external providers. This shift could erode Hudson's market share as businesses seek to internalize these capabilities.

Furthermore, the emergence of nimble, tech-focused competitors leveraging AI for recruitment could disrupt Hudson's established position. For instance, a report by Gartner in late 2024 predicted that 70% of organizations will be using AI in some form of talent acquisition by 2025, highlighting the urgency for Hudson to adapt.

Client Insourcing of Recruitment Functions

A significant threat facing Hudson is the potential for clients to bring recruitment functions back in-house, often driven by cost considerations. For example, in 2024, many companies are scrutinizing operational expenses, making internal solutions appear more attractive if the perceived value of external RPO providers diminishes. This trend necessitates Hudson's continuous demonstration of superior efficiency and tangible cost savings.

Clients may also insource recruitment due to concerns about hiring speed and the quality of candidates provided by external agencies. Reports from late 2024 indicate that businesses prioritizing rapid talent acquisition are re-evaluating their RPO relationships, seeking greater control over the process. Hudson must therefore focus on optimizing its service delivery to ensure it consistently meets and exceeds client expectations in these critical areas.

- Cost Savings: Clients may insource to reduce perceived overhead associated with RPO partnerships.

- Control & Speed: Desire for greater direct control over the hiring process and faster time-to-hire.

- Quality Assurance: Concerns that external providers may not fully align with specific quality requirements.

Data Security and Privacy Concerns

Hudson Global, as an RPO provider, faces significant threats from escalating data security and privacy concerns. A data breach could lead to substantial financial penalties, with the average cost of a data breach in 2024 reaching $4.73 million globally, according to IBM's Cost of a Data Breach Report 2024. Such an incident would severely tarnish Hudson's reputation, eroding client trust and potentially leading to a loss of business. The increasing stringency of regulations like GDPR and CCPA further amplifies these risks, demanding robust security measures and diligent data handling practices.

Key threats in this area include:

- Ransomware Attacks: The prevalence of ransomware attacks continues to rise, targeting sensitive candidate and client information. In 2023, ransomware attacks impacted 66% of organizations globally, according to Sophos's 2024 Threat Report.

- Insider Threats: Malicious or accidental data leaks by employees pose a constant risk, requiring strict access controls and ongoing training.

- Third-Party Vulnerabilities: Reliance on third-party vendors for technology or services introduces potential vulnerabilities if those vendors experience security breaches.

- Evolving Privacy Regulations: Non-compliance with a growing number of global data privacy laws, such as the upcoming data privacy laws in several US states in 2025, can result in significant fines and legal repercussions.

The increasing reliance on technology, particularly AI, in talent acquisition presents a significant threat if clients choose to develop in-house AI recruitment solutions, bypassing external RPO providers like Hudson. Gartner predicted in late 2024 that 70% of organizations would utilize AI in talent acquisition by 2025, indicating a potential shift away from traditional RPO services.

Economic headwinds and budget constraints pose a substantial threat, as evidenced by Hudson Global's experience in 2024 where a low level of global hiring activity impacted its business. This macroeconomic sensitivity means reduced hiring by clients can directly translate to lower demand for RPO services.

Intense competition within the RPO sector, from both niche providers and larger HR outsourcing firms, creates pricing pressures. This rivalry can hinder Hudson's ability to win new contracts or maintain profitability, especially when competitors offer more aggressive pricing or a broader service portfolio.

| Threat Category | Specific Threat | Impact on Hudson | Supporting Data/Trend |

| Technological Disruption | Client insourcing of AI recruitment | Erosion of market share, reduced service demand | Gartner: 70% of organizations to use AI in talent acquisition by 2025 (late 2024 prediction) |

| Economic Factors | Economic uncertainty and budget constraints | Reduced hiring activity, lower demand for RPO | Hudson Global's 2024 business impacted by low global hiring |

| Competitive Landscape | Intense RPO market competition | Pricing pressure, difficulty securing new business | Crowded RPO sector with niche and large HR outsourcing players |

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, incorporating financial performance reports, comprehensive market research, and expert industry analysis to ensure a thorough and accurate assessment.