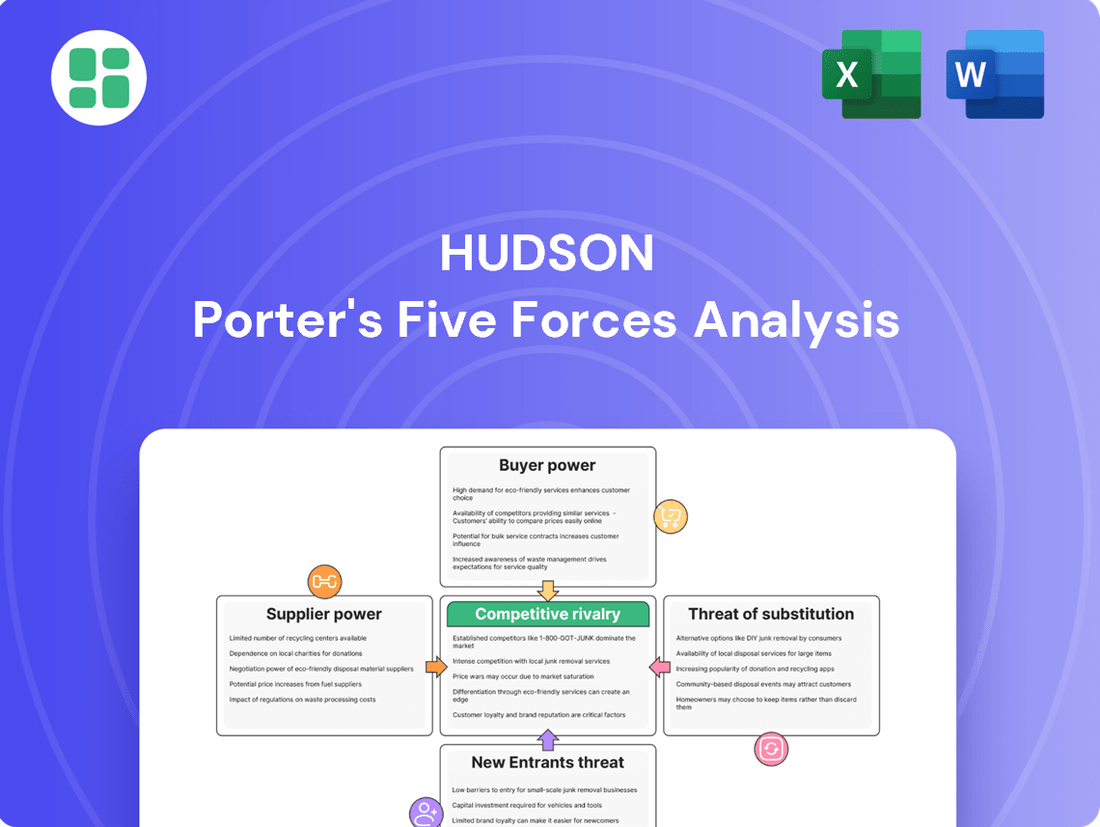

Hudson Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hudson Bundle

Hudson's competitive landscape is shaped by powerful forces, from the bargaining power of its customers to the ever-present threat of new companies entering the market. Understanding these dynamics is crucial for any business aiming to thrive.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Hudson’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Technology and software providers hold moderate bargaining power over Hudson Global. Hudson relies heavily on AI-powered recruiting solutions, applicant tracking systems (ATS), and data analytics, with the global recruitment software market projected to reach $3.7 billion by 2026. The increasing demand for AI in RPO means specialized tech providers offering significant efficiency gains can exert influence.

However, this power is somewhat tempered by the dynamic nature of the recruitment technology landscape. A wide array of vendors compete, offering diverse solutions and fostering a competitive environment that can limit any single supplier's ability to dictate terms. This rapid evolution means Hudson can often find alternative or comparable technologies.

The bargaining power of suppliers in talent sourcing platforms and databases is a key consideration for Hudson Global. Access to a wide range of candidates is essential, and while many platforms exist, specialized talent pools can be concentrated with a few major players, granting them some leverage.

For instance, in 2024, the global recruitment process outsourcing (RPO) market, which heavily relies on these platforms, was valued at approximately $12.5 billion, indicating the significant reliance on such services. Hudson Global's strategy to mitigate this involves building its own extensive networks and employing direct sourcing methods, thereby reducing its dependence on external, potentially costly, database providers.

Hudson Global might tap into external consultants for crucial market intelligence, strategic planning, or specialized employee training. The bargaining power of these consulting firms hinges on how unique their expertise is and how rare it is to find similar advisory services. For instance, if a firm offers proprietary market analysis tools or access to exclusive industry data, their leverage increases significantly.

When these specialized consultants possess highly unique or cutting-edge insights, they can indeed command higher fees, directly impacting Hudson Global's operational costs. Consider the consulting market for AI integration in business strategy; firms with proven track records and specialized algorithms in this rapidly evolving field in 2024 could charge a premium, reflecting the scarcity of such advanced capabilities.

Data and Analytics Providers

In today's recruitment world, companies rely heavily on data and analytics providers for labor market insights and talent intelligence. If these providers offer unique, proprietary data or predictive analytics that are difficult to replicate, their bargaining power is amplified. For instance, a firm specializing in AI-driven candidate matching might command higher prices due to its unique algorithms.

Hudson Global's strategy involves building robust internal data capabilities and forging strategic partnerships to mitigate the bargaining power of these external providers. By developing its own talent intelligence platforms and collaborating with key data vendors, Hudson can negotiate more favorable terms. For example, in 2024, the demand for specialized HR analytics tools surged, with the HR analytics market projected to reach $3.4 billion by 2027, according to some industry reports, highlighting the growing importance and potential leverage of these data providers.

- Proprietary Data: Providers with unique, hard-to-obtain datasets have greater leverage.

- Predictive Analytics: Advanced predictive capabilities can increase a provider's value and bargaining power.

- Market Concentration: If only a few providers offer essential data, their power increases.

- Hudson's Mitigation: Internal data development and strategic alliances help balance supplier power.

Infrastructure and Operational Support Providers

Infrastructure and operational support providers, such as cloud service vendors and IT infrastructure companies, can exert significant bargaining power over Hudson Global. While many of these services are becoming commoditized, the high cost and complexity of switching providers, especially for critical systems, can give incumbent suppliers leverage. For example, a major cloud provider might have a strong position if Hudson Global relies heavily on their specialized services, making a migration costly and time-consuming. This power is amplified when these services are essential for uninterrupted global operations, as any disruption could lead to substantial financial losses.

Hudson Global actively manages this supplier power through strategic vendor diversification and long-term contract negotiations. By not being overly reliant on a single provider for essential IT infrastructure or cloud services, the company can mitigate the risk of price hikes or unfavorable terms. As of early 2024, many large enterprises are reviewing their cloud strategies, with some seeking to diversify beyond a single hyperscaler to enhance resilience and negotiate better pricing. This trend suggests that while individual providers may hold some sway, a well-managed supplier base can keep their collective bargaining power in check.

- High switching costs for critical IT infrastructure and cloud services can empower suppliers.

- Uninterrupted operational support is vital, giving providers leverage if Hudson Global is heavily dependent on them.

- Diversified vendor relationships and carefully negotiated long-term contracts are key strategies to manage this power.

Suppliers of specialized technology, such as AI-driven recruitment software, hold moderate bargaining power over Hudson Global. The global recruitment software market is expected to reach $3.7 billion by 2026, with AI's increasing role granting specialized providers leverage due to efficiency gains.

However, a competitive vendor landscape and rapid technological evolution allow Hudson to seek alternative solutions, thereby limiting any single supplier's pricing power. Similarly, talent sourcing platforms can exert influence if they control access to niche candidate pools, as seen in the $12.5 billion RPO market in 2024, though Hudson mitigates this through direct sourcing.

External consultants with unique expertise, particularly in areas like AI integration, can command higher fees. For example, firms with proprietary market analysis tools in 2024 charged premiums due to the scarcity of such advanced capabilities. Hudson counters this by building internal expertise and forming strategic partnerships.

Data and analytics providers with proprietary or predictive capabilities also possess significant leverage, especially with the HR analytics market projected to reach $3.4 billion by 2027. Hudson Global manages this by developing internal data platforms and collaborating strategically with vendors.

Infrastructure and operational support vendors, like cloud service providers, can exert considerable power due to high switching costs for critical systems. While commoditization is increasing, reliance on specialized services and the cost of migration can empower incumbents. Hudson mitigates this through vendor diversification and long-term contract negotiations, a trend observed in early 2024 as enterprises re-evaluate cloud strategies.

| Supplier Category | Key Leverage Factors | Hudson's Mitigation Strategies | Market Context (2024/2026) |

|---|---|---|---|

| Technology & Software | Proprietary AI, specialized algorithms | Vendor diversification, direct sourcing | Recruitment software market: $3.7B by 2026 |

| Talent Sourcing Platforms | Control over niche candidate pools | Building internal networks | RPO market: $12.5B (2024) |

| Consulting Services | Unique expertise, proprietary tools | Internal capability development, partnerships | AI integration consulting premium |

| Data & Analytics | Unique data, predictive analytics | Internal data platforms, strategic alliances | HR analytics market: $3.4B by 2027 |

| Infrastructure & IT Support | High switching costs, critical system reliance | Vendor diversification, long-term contracts | Cloud strategy re-evaluation |

What is included in the product

Hudson Porter's Five Forces Analysis provides a comprehensive framework to understand the competitive intensity and profitability of an industry by examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products, and the intensity of rivalry among existing competitors.

Effortlessly identify and prioritize competitive threats and opportunities with a visual, actionable framework.

Customers Bargaining Power

Hudson Global's reliance on its largest clients is a significant factor in its customer bargaining power. In 2023, its top ten clients accounted for approximately 36% of its total revenue, highlighting a considerable dependence on a select few.

This concentration means that these major clients wield substantial influence. Their ability to negotiate favorable terms, demand lower prices, or even shift their business elsewhere poses a direct challenge to Hudson Global's profitability and operational stability.

The potential loss of even one of these key accounts, or a significant decrease in their spending, could have a material negative impact on Hudson Global's financial performance. This underscores the critical importance of maintaining strong relationships with these high-value customers.

Switching costs for customers in the Recruitment Process Outsourcing (RPO) market can be a significant factor. While initial setup and integration with an RPO provider incur costs, the ongoing efficiencies and potential cost savings often make clients hesitant to switch. For instance, a client might have invested heavily in integrating an RPO's technology with their HR systems.

However, these perceived switching costs can be overcome if a client experiences significant dissatisfaction with an RPO's performance or pricing. In such scenarios, the potential gains from a new provider or bringing recruitment back in-house might outweigh the expense and effort of transitioning. For example, if an RPO consistently fails to meet hiring targets, a client might absorb the switching cost to secure better talent acquisition.

Clients can always choose to handle recruitment internally if they find RPO services too costly or not tailored enough to their needs. This in-house option represents a significant bargaining chip for customers.

A 2024 survey indicated that 35% of companies that had previously outsourced recruitment were considering bringing it back in-house, citing cost control and greater flexibility as key drivers. This trend underscores the importance of RPO providers proving their value proposition.

Hudson Global must therefore consistently showcase superior cost-efficiency and flexible service models to counteract the inherent customer ability to insource, thereby mitigating this aspect of customer bargaining power.

Price Sensitivity and Cost Pressure

Customers, particularly large corporations, are intensely focused on managing costs and actively look for ways to trim operational expenditures. This price sensitivity is a significant factor in the RPO market, where clients can exploit the competitive landscape to secure more advantageous pricing or contract terms.

Hudson Global must navigate this by offering competitive pricing while simultaneously ensuring the delivery of superior, value-added services. For instance, in 2024, the RPO market saw continued pressure on pricing, with average contract values experiencing a slight dip in some segments as clients demanded more for their investment.

- Price Sensitivity: Many clients, especially those with substantial recruitment volumes, exert considerable pressure on RPO providers to reduce per-hire costs.

- Competitive Landscape: The presence of numerous RPO providers allows clients to compare offerings and negotiate aggressively on price and service level agreements.

- Value Proposition: Hudson Global needs to clearly articulate the ROI and intangible benefits of its services beyond just cost savings to justify its pricing structure.

- Negotiating Power: Larger clients often have the leverage to demand customized solutions and flexible terms, further influencing pricing dynamics.

Demand for Value-Added Services and Customization

Clients are increasingly seeking RPO providers that offer more than just recruitment. They want strategic partnerships, AI integration, and data-driven insights. This demand for advanced, tailored solutions significantly increases customer bargaining power.

Customers with unique or complex hiring requirements can leverage this by demanding highly customized and sophisticated services. This pressure forces RPO providers to innovate and adapt, potentially leading to higher service costs for the provider but also creating opportunities for differentiation.

- Demand for AI-powered recruitment tools: In 2023, the RPO market saw a significant increase in demand for AI-driven sourcing and screening, with many clients expecting this as a standard offering.

- Growth in customized RPO solutions: Reports from late 2023 indicated that over 60% of RPO contracts included some level of customization, reflecting client needs for tailored approaches.

- Client expectations for strategic partnership: Beyond transactional recruitment, clients are now looking for RPO providers to act as strategic talent advisors, influencing workforce planning and talent acquisition strategies.

Customers' ability to influence pricing and terms is a key aspect of their bargaining power. With many RPO providers available, clients can easily compare services and negotiate for better deals. For example, in 2024, the RPO market experienced continued price pressure, with some contract values seeing a slight decrease as clients demanded more value for their money.

Clients can also choose to bring recruitment in-house, a significant leverage point. A 2024 survey revealed that 35% of companies that had outsourced recruitment were considering insourcing, citing cost control and flexibility as primary reasons. This highlights the need for RPO providers to demonstrate clear value beyond cost savings.

The demand for advanced, tailored solutions, including AI integration and strategic talent advice, further empowers customers. In 2023, AI-driven recruitment tools became a highly sought-after offering, with over 60% of RPO contracts in late 2023 incorporating customization, showing clients' preference for personalized approaches.

| Factor | Impact on Hudson Global | 2024 Data/Trend |

|---|---|---|

| Client Concentration | High dependence on top clients increases their leverage. | Top 10 clients accounted for ~36% of revenue in 2023. |

| Switching Costs | Can be overcome by significant dissatisfaction, posing a risk. | Clients may switch if RPO performance or pricing is poor. |

| Insourcing Option | Provides a baseline for negotiation and a potential alternative. | 35% of outsourced firms considered insourcing in 2024. |

| Price Sensitivity | Clients actively seek lower per-hire costs. | Continued price pressure observed in the RPO market in 2024. |

| Demand for Customization & AI | Requires providers to innovate and offer more sophisticated services. | Over 60% of RPO contracts had customization in late 2023. |

Preview Before You Purchase

Hudson Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis you will receive. The document displayed here is the exact, professionally formatted analysis that will be available to you for immediate download upon purchase, ensuring no surprises and full readiness for your strategic planning.

Rivalry Among Competitors

The Recruitment Process Outsourcing (RPO) market is intensely competitive, featuring a wide array of participants. These range from massive global human capital management firms such as Randstad and ManpowerGroup, which offer RPO as part of a broader service suite, to highly specialized niche providers focusing on specific industries or talent segments.

Hudson Global, therefore, contends with a diverse competitive landscape. This includes not only other dedicated RPO specialists but also large human resource and employment services companies that have expanded into the RPO space. For instance, in 2024, the global RPO market was valued at approximately $10.1 billion, demonstrating the significant scale and breadth of competition.

The Recruitment Process Outsourcing (RPO) market is booming, with projections indicating it will reach substantial valuations by 2025 and continue its upward trajectory. This growth is largely fueled by companies embracing digital transformation and grappling with persistent talent shortages.

While a growing market can generally temper intense competition by offering ample opportunities for everyone, this rapid expansion in RPO also acts as a magnet for new players. Simultaneously, it compels established RPO providers to aggressively pursue market share, intensifying rivalry.

Competitive rivalry in the RPO market is intense, with many providers offering similar core services. Differentiation is key, and Hudson Global Capital is actively pursuing this through specialization in specific industries, such as technology and healthcare, and by expanding its geographic reach.

The integration of advanced technologies, particularly artificial intelligence, is another critical area for differentiation. Hudson Global's strategic acquisitions are designed to bolster its capabilities in these areas, enhancing its competitive positioning. For instance, in 2024, the RPO market saw continued investment in AI-driven recruitment platforms, with some firms reporting up to a 20% increase in candidate sourcing efficiency.

Switching Costs for Competitors

For RPO providers, the initial effort to win over a new client is substantial, involving extensive sales cycles and complex implementation processes. However, once a client is onboarded, the inherent switching costs can foster significant client retention, making it challenging for competitors to poach existing business. This dynamic often fuels fierce competition for new client acquisition, as retaining current clients proves considerably more economical than the continuous pursuit of new ones.

The stickiness created by these switching costs means that RPO providers are heavily incentivized to focus on delivering exceptional service and value to their existing client base. For instance, a client might have integrated their HR systems with an RPO provider's platform, or invested heavily in training their internal teams on the provider's specific workflows. Such investments make a change to a different RPO provider a costly and disruptive undertaking.

- Client Integration: RPO providers often invest in integrating their technology and processes with a client's existing HRIS and ATS systems. This deep integration can represent a significant barrier for clients considering a switch.

- Data Migration & Training: The effort and cost associated with migrating historical recruitment data and retraining staff on a new provider's systems are substantial deterrents to switching.

- Contractual Lock-ins: Many RPO contracts include clauses that penalize early termination, further increasing the financial burden for clients looking to change providers.

- Brand Reputation & Trust: Building trust and a strong working relationship over time is crucial in the RPO industry. Clients are often reluctant to disrupt established, successful partnerships due to the perceived risk of engaging with an unknown entity.

Market Consolidation and M&A Activity

The Recruitment Process Outsourcing (RPO) sector is experiencing significant consolidation through mergers and acquisitions (M&A). For instance, Hudson Global, a key player, has actively pursued strategic acquisitions to bolster its service offerings and expand its global presence. This trend is reshaping the competitive landscape.

This ongoing M&A activity leads to the emergence of larger, more dominant competitors. These consolidated entities often possess broader service portfolios and a more extensive market reach, thereby intensifying the rivalry among RPO providers.

- Hudson Global's Strategic Acquisitions: Hudson Global has been actively involved in M&A, aiming to enhance its capabilities and geographic footprint.

- Impact of Consolidation: The increasing number of mergers and acquisitions creates larger, more formidable competitors in the RPO market.

- Intensified Rivalry: Expanded service portfolios and wider market reach resulting from consolidation directly contribute to heightened competitive pressures.

- Market Dynamics: Companies like WilsonHCG and Cielo are also participating in this consolidation trend, further altering the competitive environment.

Competitive rivalry within the RPO market is fierce, driven by numerous providers offering similar services and the constant influx of new entrants attracted by market growth. Hudson Global must differentiate itself through specialization and technological advancements to stand out.

The RPO market's intense competition is further amplified by ongoing industry consolidation through mergers and acquisitions, creating larger, more dominant players. This trend means companies like Hudson Global face increasingly powerful rivals with broader service portfolios and wider market reach, intensifying the pressure to innovate and secure market share.

| Competitor Type | Examples | Market Share Focus |

|---|---|---|

| Global HCM Firms | Randstad, ManpowerGroup | Broad HR services, including RPO |

| Dedicated RPO Specialists | Cielo, WilsonHCG | Niche RPO services, industry specialization |

| Emerging Tech-Focused Providers | AI-driven recruitment platforms | Efficiency and candidate sourcing |

SSubstitutes Threaten

The most direct substitute for Recruitment Process Outsourcing (RPO) services is a company's own internal talent acquisition department. Many organizations choose to handle recruitment in-house, particularly for crucial or highly specialized positions, or to ensure direct oversight of the entire hiring journey. This internal capability remains a persistent alternative that businesses evaluate when considering external RPO solutions.

Traditional staffing and contingent workforce agencies present a significant threat of substitution for Recruitment Process Outsourcing (RPO) providers. These agencies, which focus on per-hire placements for temporary or permanent roles, offer a more transactional service. Companies with lower or inconsistent hiring volumes might opt for these agencies for specific, immediate needs rather than committing to a comprehensive RPO partnership.

The growing freelance recruiter market presents a significant threat of substitution for traditional RPO providers. Platforms like Upwork and Fiverr saw a surge in freelance professionals in 2024, with millions of individuals offering specialized recruitment services. This trend allows businesses to tap into a flexible, project-based talent pool, potentially bypassing the need for a comprehensive RPO relationship.

Companies can now engage independent recruiters for specific hiring needs, often at a more competitive price point than a full RPO contract. This flexibility and cost-efficiency make freelance recruiters an attractive alternative, particularly for businesses with fluctuating hiring demands or those seeking niche expertise for short-term projects. The ease of access and reduced commitment offered by independent contractors directly challenges the value proposition of long-term RPO engagements.

Direct Sourcing Platforms and Job Boards

Companies increasingly bypass traditional recruitment process outsourcing (RPO) by utilizing sophisticated online job boards and professional networking sites. These platforms, often augmented by AI, empower organizations to directly source candidates, reducing reliance on third-party providers. For instance, LinkedIn, a leading professional networking site, reported over 930 million members globally as of early 2024, showcasing the vast talent pool accessible directly by employers.

The threat of substitutes is amplified by the growing capability of these direct sourcing tools to manage significant portions of the recruitment lifecycle. This includes candidate screening, initial outreach, and even scheduling interviews, diminishing the perceived value proposition of some RPO services. In 2023, the global recruitment process outsourcing market was valued at approximately $6.3 billion, with a projected compound annual growth rate that could be impacted by the rise of these powerful internal recruitment capabilities.

- Direct Sourcing Platforms: Online job boards and professional networking sites allow companies to find talent independently.

- AI Enhancement: Advanced platforms use AI to streamline candidate identification and initial engagement.

- Reduced Reliance on RPO: Companies can manage parts of their recruitment process internally, lessening the need for RPO providers.

- Market Impact: The accessibility and capability of these tools pose a significant substitute threat to the RPO industry.

Technology-Only Solutions

Companies are increasingly opting for technology-only solutions to manage their recruitment processes, bypassing the need for full Recruitment Process Outsourcing (RPO). This trend is driven by advancements in recruitment technology that allow for automation and efficiency. For instance, the global recruitment process outsourcing market was valued at approximately USD 11.5 billion in 2023 and is projected to grow, but technology-only solutions offer a compelling alternative for cost-conscious businesses.

Instead of outsourcing the entire recruitment function, businesses can invest in sophisticated recruitment technology. This includes Applicant Tracking Systems (ATS) with advanced AI capabilities for screening, and Candidate Relationship Management (CRM) systems. These tools empower internal HR teams to automate repetitive tasks, improving speed and reducing manual effort. By leveraging these technologies, companies can streamline their hiring workflows significantly.

- Automation of Screening: AI-powered tools can screen thousands of resumes in minutes, identifying top candidates based on predefined criteria, a task that would take human recruiters significantly longer.

- Improved Candidate Experience: Integrated CRM systems allow for personalized communication with candidates throughout the hiring process, fostering engagement and reducing drop-off rates.

- Cost Efficiency: While initial investment in technology is required, it can lead to substantial long-term cost savings compared to ongoing RPO fees, especially for companies with consistent hiring needs.

The threat of substitutes for Recruitment Process Outsourcing (RPO) is significant, encompassing internal recruitment teams, traditional staffing agencies, and the burgeoning freelance recruiter market. Companies can also leverage advanced online platforms and technology-only solutions to manage their hiring needs, often at a lower cost or with greater flexibility than a full RPO engagement.

These substitutes allow businesses to source candidates directly, automate screening processes with AI, and manage recruitment workflows internally. For instance, LinkedIn's vast user base and the increasing sophistication of Applicant Tracking Systems (ATS) empower companies to bypass traditional RPO services, impacting the market's growth potential.

The accessibility and cost-effectiveness of these alternatives, especially for companies with fluctuating or specialized hiring needs, present a direct challenge to the value proposition of comprehensive RPO solutions. This dynamic forces RPO providers to continually innovate and demonstrate clear ROI to remain competitive.

| Substitute Type | Key Features | Impact on RPO |

| Internal Recruitment | Direct control, specialized knowledge | Reduces need for external expertise |

| Staffing Agencies | Transactional, per-hire focus | Alternative for immediate, specific needs |

| Freelance Recruiters | Flexible, project-based, cost-effective | Disrupts RPO for niche or short-term roles |

| Online Platforms/AI | Direct sourcing, automated screening | Diminishes RPO's value in candidate management |

Entrants Threaten

While a small, niche recruitment agency might have relatively low startup costs, establishing a global Recruitment Process Outsourcing (RPO) firm akin to Hudson Global demands substantial capital. This includes significant investment in advanced technology platforms, a robust global infrastructure, and a highly skilled workforce. For instance, in 2024, major RPO providers reported operating expenses in the tens of millions of dollars, reflecting the scale of their technological and human capital investments.

New entrants would require considerable financial backing to match the economies of scale enjoyed by established players like Hudson Global. These economies stem from bulk purchasing of technology, centralized operational efficiencies, and the ability to absorb fixed costs across a larger client base. Competitors entering the market must therefore secure significant funding to overcome these initial capital hurdles and achieve competitive pricing and service delivery.

Established RPO providers like Hudson Global have cultivated strong brand reputations and nurtured deep client relationships, often spanning decades. For instance, Hudson Global's consistent performance in delivering talent acquisition solutions has solidified its market standing, making it a trusted partner for many Fortune 500 companies. This established trust is a significant barrier for newcomers.

New entrants must overcome the substantial hurdle of building credibility and demonstrating reliability in a sector where client satisfaction and tangible results are paramount. Without a proven track record, it's difficult to attract clients who prioritize consistent quality and risk mitigation in their recruitment processes.

The recruitment process outsourcing (RPO) industry, including companies like Hudson Global, is fundamentally built on having the right people. This means skilled recruiters, sharp talent acquisition specialists, and experts in HR technology are crucial. New companies entering this space face a significant hurdle in attracting and keeping this specialized talent, especially when the general labor market is already tight.

In 2024, the demand for specialized recruitment skills remains high, making it difficult for newcomers to build a competitive team quickly. Hudson Global's advantage lies in its established reputation and its teams who possess deep industry knowledge and years of experience. This existing expertise is a powerful barrier to entry, as new players would need substantial time and resources to cultivate similar capabilities.

Technology and AI Integration

The rapid advancement of AI and automation in recruitment presents a significant threat of new entrants. To compete effectively, new players must possess or swiftly develop cutting-edge technological capabilities. This necessitates substantial investment in research and development or the formation of strategic partnerships, creating a substantial barrier for those lacking immediate access to these innovations.

For instance, by 2024, the global AI in recruitment market was projected to reach USD 2.9 billion, indicating the scale of investment required. New entrants without robust AI infrastructure and data analytics expertise will struggle to match the efficiency and predictive power of established firms.

- AI-driven candidate sourcing and screening

- Automated interview scheduling and analysis

- Predictive analytics for talent acquisition

- Significant R&D investment required for competitive technology

Regulatory and Compliance Complexity

The regulatory and compliance landscape presents a significant barrier for new entrants in the RPO (Recruitment Process Outsourcing) market. Operating across multiple geographies means navigating a patchwork of labor laws, data privacy mandates like GDPR, and industry-specific compliance standards. For instance, in 2024, companies globally faced increasing scrutiny over data handling, with fines for non-compliance reaching substantial figures.

New RPO providers must invest heavily in developing comprehensive compliance frameworks and cultivating expertise in each target region. This includes understanding varying employment regulations, background check requirements, and data protection laws, which can significantly increase the initial cost and operational complexity of market entry.

- Navigating Diverse Labor Laws: RPO providers must comply with differing employment contracts, termination procedures, and worker classification rules across countries.

- Data Privacy Compliance: Adherence to regulations like GDPR and CCPA is crucial, requiring robust data security measures and transparent data handling practices.

- Industry-Specific Regulations: Sectors like healthcare or finance often have unique compliance demands that RPO providers must meet.

- Geopolitical Factors: Evolving trade agreements and international relations can also impact compliance requirements for global RPO operations.

The threat of new entrants for a company like Hudson Global is moderate to high, primarily due to significant capital requirements and the need for specialized talent. While the RPO market offers growth opportunities, overcoming established brand loyalty and technological advancements requires substantial investment.

Newcomers face high barriers related to technology investment, particularly in AI and automation, which are crucial for efficiency and predictive analytics in talent acquisition. For example, the global AI in recruitment market was projected to reach USD 2.9 billion by 2024, highlighting the scale of investment needed to compete.

Regulatory compliance across various jurisdictions also poses a substantial challenge, demanding expertise in diverse labor laws and data privacy regulations. Failure to comply can result in significant fines, as seen with escalating penalties for data handling breaches in 2024.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Establishing global infrastructure, advanced technology, and skilled workforce. | High; requires significant financial backing. |

| Brand Reputation & Client Relationships | Decades of trust and proven performance with major clients. | High; difficult for newcomers to build credibility. |

| Talent Acquisition Expertise | Need for skilled recruiters, talent specialists, and HR tech experts. | High; challenging in a tight labor market, especially for specialized skills. |

| Technological Advancement (AI/Automation) | Investment in cutting-edge recruitment technology and data analytics. | High; necessitates substantial R&D or strategic partnerships. |

| Regulatory & Compliance Landscape | Navigating diverse labor laws, data privacy (GDPR), and industry standards. | High; requires significant investment in compliance frameworks and expertise. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, drawing from company annual reports, industry-specific market research, and publicly available financial filings to understand competitive dynamics.