H&R Block PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

H&R Block Bundle

Navigate the complex external forces impacting H&R Block's tax preparation and financial services. Our PESTLE analysis delves into political shifts, economic volatility, and technological advancements that shape their operational landscape. Gain a competitive edge by understanding these critical factors. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Changes in federal and state tax laws significantly impact H&R Block's business. For instance, the Inflation Reduction Act of 2022, which included provisions affecting energy credits and IRS funding, requires continuous updates to tax preparation software and training for tax professionals. These adjustments to tax brackets, deductions, and credits directly influence the complexity of tax filing and, consequently, the demand for H&R Block's services.

For the upcoming 2025 tax season, anticipated legislative shifts, such as potential adjustments to the Child Tax Credit or changes in reporting thresholds for gig economy workers (like the previously proposed lower 1099-K reporting threshold), necessitate that H&R Block proactively adapt its offerings. These legislative evolutions present both challenges in compliance and opportunities to provide essential guidance to clients navigating new rules.

The IRS's ongoing modernization, including the expansion of its Direct File program to 25 states for the 2025 tax season, presents a significant competitive hurdle for H&R Block. This free, direct filing option directly challenges H&R Block's core DIY and assisted tax preparation services, especially for taxpayers with straightforward returns.

The potential impact is substantial, as a free, government-provided alternative could siphon off a segment of H&R Block's customer base. For instance, if even a small percentage of the estimated 160 million individual tax returns filed annually opt for Direct File, it could represent a notable revenue shift.

To counter this, H&R Block needs to emphasize its unique value proposition, focusing on personalized expert advice, comprehensive financial planning tools, and support for more complex tax situations. Differentiating through enhanced services and client relationships will be crucial for retaining market share and client loyalty in the face of this evolving competitive landscape.

Increased regulatory oversight is a significant political factor impacting H&R Block. The company's late 2024 settlement with the Federal Trade Commission (FTC) highlights this, requiring substantial changes to advertising and customer service for the 2025 and 2026 tax seasons. These changes aim to improve consumer protection by simplifying product downgrades and ensuring clearer disclosures around 'free' filing services.

Compliance with these new FTC mandates is critical for H&R Block to maintain consumer trust and avoid additional legal repercussions. The settlement, which included a $5 million penalty, underscores the government's commitment to protecting taxpayers from deceptive marketing practices. Failure to adapt could lead to further penalties and damage the brand's reputation.

Political Stability and Fiscal Policy

The political climate significantly impacts H&R Block. Debates surrounding long-term fiscal policy and potential comprehensive tax reforms, such as proposals to make the 2017 tax changes permanent, introduce uncertainty for the tax preparation sector. This ongoing political discourse necessitates continuous monitoring by H&R Block to adapt to potential legislative shifts that could redefine its business model and service portfolio.

Key considerations for H&R Block include:

- Anticipating Legislative Changes: Staying ahead of potential alterations in tax laws is crucial for maintaining service relevance.

- Impact of Fiscal Policy: Fluctuations in government spending and taxation policies can directly affect client needs and tax preparation complexity.

- Potential Tax Reforms: Proposals for broad tax reform create both risks and opportunities for the industry.

- Political Stability: A stable political environment generally fosters more predictable economic conditions, which is beneficial for businesses reliant on consistent regulatory frameworks.

International Tax Regulations

H&R Block's international tax services are significantly influenced by evolving global tax regulations. For instance, Canada's recent implementation of new reporting rules for gig economy income directly affects how H&R Block must adapt its services for Canadian clients, impacting compliance and service offerings.

The company must remain agile in navigating the complexities of diverse international tax codes and varying compliance standards. This adaptability is crucial for sustaining its worldwide presence and ensuring continued profitability across its global operations.

- Global Tax Landscape: H&R Block operates in multiple countries, each with unique tax laws and reporting requirements that necessitate continuous monitoring and adaptation.

- Gig Economy Impact: New regulations, such as those in Canada for gig income, directly alter the compliance needs of clients and the services H&R Block must provide.

- Compliance Costs: Adapting to different international tax codes can lead to increased operational costs for H&R Block, requiring investment in updated software and staff training.

- Market Competitiveness: Failure to adapt to international tax changes could put H&R Block at a competitive disadvantage against local tax preparation services in those markets.

Government initiatives like the IRS's Direct File program, expanded to 25 states for the 2025 tax season, present a direct competitive challenge to H&R Block's core business. This free, government-provided alternative could capture a portion of the market, particularly for simpler tax returns, potentially impacting H&R Block's revenue streams. The company must emphasize its value-added services, such as personalized expert advice and support for complex tax situations, to retain its client base.

What is included in the product

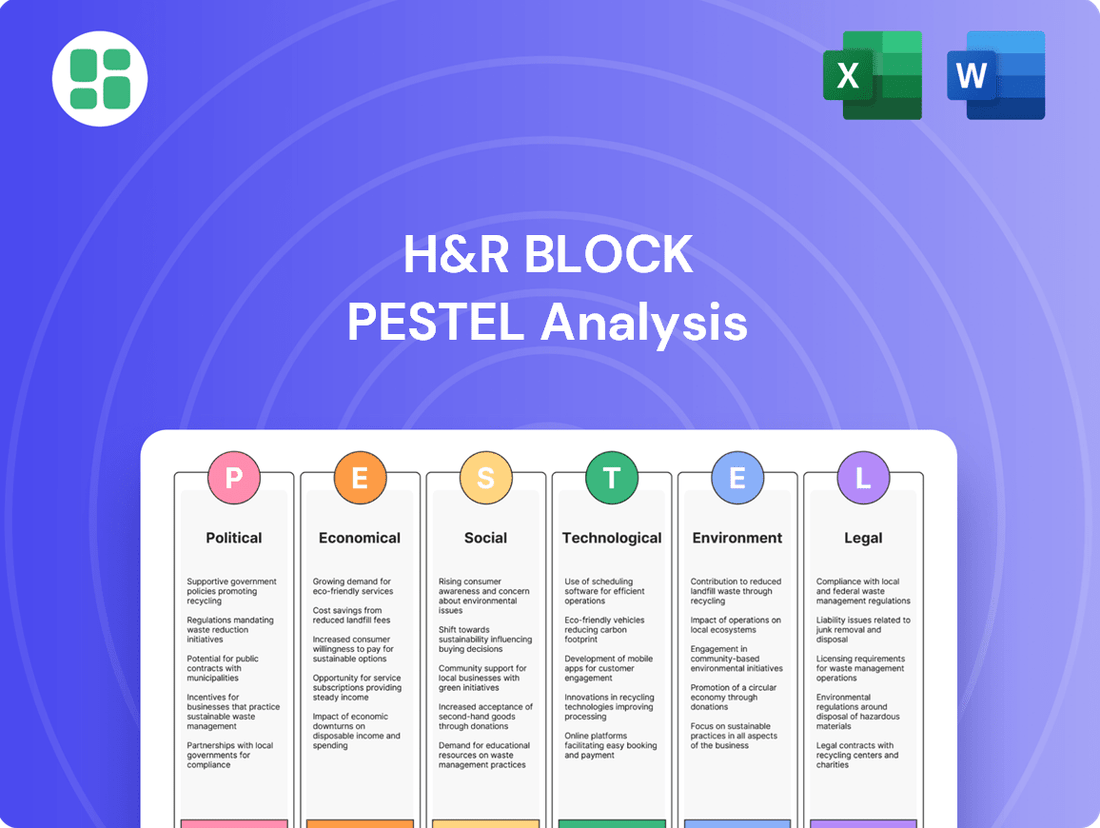

This PESTLE analysis examines the external macro-environmental factors impacting H&R Block across political, economic, social, technological, environmental, and legal dimensions.

It provides a comprehensive understanding of how these forces create opportunities and threats for H&R Block's strategic planning.

Provides a concise version of H&R Block's PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, highlighting key external factors impacting their business.

Economic factors

Economic growth directly impacts H&R Block's business. For instance, the U.S. GDP grew at an annualized rate of 1.3% in the first quarter of 2024, indicating a moderate expansion. This growth generally translates to more individuals earning income, potentially leading to more complex tax filings and a higher demand for tax preparation services.

Unemployment rates are also a key factor. In April 2024, the U.S. unemployment rate stood at 3.9%. Lower unemployment suggests more people are employed and earning taxable income, which can benefit H&R Block. However, a significant portion of the population might still opt for simpler, free filing methods if their financial situations remain straightforward, even with high employment.

Rising inflation, a persistent economic challenge, directly influences H&R Block's operating expenses and consumer spending habits. As the cost of living escalates, individuals are increasingly looking for ways to supplement their income, potentially boosting demand for tax services catering to gig economy workers. For instance, the U.S. Consumer Price Index (CPI) saw a significant increase, with annual inflation rates hovering around 3.1% to 3.4% in late 2023 and early 2024, impacting everyday expenses.

This economic climate can also foster a greater price sensitivity among consumers when it comes to tax preparation services. As household budgets tighten, individuals may be more inclined to seek out cost-effective solutions, presenting both a challenge and an opportunity for H&R Block to highlight its value proposition and potentially offer tiered service options.

Consumer spending habits are a significant driver for H&R Block. In 2023, U.S. consumer spending saw a notable increase, with retail sales growing by 3.8% year-over-year, indicating a generally healthy demand for services. However, the availability of disposable income directly influences whether consumers opt for professional tax preparation like H&R Block's services or lean towards more budget-friendly DIY software.

Should economic conditions tighten, leading to reduced disposable income, consumers may shift towards lower-cost or free tax preparation options. This could impact H&R Block's revenue streams, potentially altering the mix between its assisted services and its do-it-yourself products. For instance, if inflation continues to put pressure on household budgets, the appeal of DIY solutions might rise.

H&R Block's financial products, such as its Spruce mobile app, are designed to help consumers manage their finances, which can indirectly influence their ability to afford tax services. As of early 2024, a significant portion of Americans still live paycheck to paycheck, highlighting the sensitivity of consumer spending decisions to changes in disposable income.

Competitive Pricing and Market Share

The tax preparation landscape is intensely competitive, featuring established firms, user-friendly DIY software, and even government-backed options like the IRS Direct File program. H&R Block's ability to attract and retain clients hinges significantly on its pricing strategies. For instance, their 50% off price matching and free federal filing for straightforward tax situations are key tactics to vie for market share against rivals such as TurboTax and entirely free filing services.

H&R Block's market share is directly influenced by its competitive pricing. In the 2023 tax season, the company reported serving 23.1 million tax returns, a slight increase from the previous year. This growth underscores the effectiveness of their pricing initiatives in a market where cost is a significant decision factor for many taxpayers.

- Market Competition: H&R Block faces intense competition from TurboTax, FreeTaxUSA, and the IRS's Direct File program.

- H&R Block's Pricing: Offers like 50% off price matching and free federal filing for simple returns are crucial for customer acquisition.

- Market Share Data: H&R Block processed 23.1 million tax returns in the 2023 tax season, indicating continued client engagement.

- Customer Value: Aggressive pricing helps H&R Block maintain its position by offering perceived value against both paid and free alternatives.

Gig Economy Growth and Income Reporting

The gig economy's continued expansion is a significant economic driver, with millions of individuals leveraging platforms for supplemental or primary income. This trend directly benefits H&R Block by increasing the pool of potential clients needing tax preparation services.

The IRS has introduced changes to 1099-K reporting thresholds, impacting how gig workers receive and report income. For instance, the American Rescue Plan initially lowered the threshold to $600 for third-party payment networks, though implementation has been delayed, creating a dynamic tax landscape that requires expert navigation.

- Gig Economy Expansion: The U.S. gig economy workforce is projected to grow, with estimates suggesting a significant portion of the labor force participates in some form of gig work.

- Complex Tax Needs: Gig workers often have variable income streams and deductible business expenses, necessitating specialized tax knowledge.

- Platform Reporting Changes: Evolving reporting requirements for payment platforms like PayPal, Venmo, and Uber create compliance challenges for freelancers.

- H&R Block Opportunity: H&R Block can capitalize on this by offering tailored tax solutions and educational resources for self-employed individuals.

Economic factors significantly shape H&R Block's operating environment, influencing both consumer behavior and the demand for tax services. Fluctuations in GDP, unemployment rates, and inflation directly impact individuals' financial capacity and their need for tax assistance.

The ongoing growth of the gig economy presents a substantial opportunity for H&R Block, as these workers often have more complex tax situations requiring specialized expertise. Evolving reporting requirements for payment platforms further underscore the need for professional guidance.

Consumer spending habits, particularly disposable income levels, dictate the preference between professional tax preparation and DIY solutions. H&R Block's competitive pricing strategies are crucial for attracting and retaining clients in this dynamic market.

| Economic Factor | Data Point (2023-2024) | Impact on H&R Block |

|---|---|---|

| U.S. GDP Growth | 1.3% (Q1 2024 annualized) | Moderate growth suggests increased taxable income, potentially boosting demand. |

| U.S. Unemployment Rate | 3.9% (April 2024) | Lower unemployment generally means more employed individuals, but simple filings may still opt for DIY. |

| U.S. Inflation (CPI) | 3.1%-3.4% (late 2023/early 2024) | Increases operating costs and consumer price sensitivity; may drive demand for income-boosting tax strategies. |

| U.S. Consumer Spending | 3.8% retail sales growth (2023) | Healthy spending can support demand for services, but disposable income dictates choice between professional and DIY. |

| Gig Economy Workforce | Growing segment | Increased demand for specialized tax services due to variable income and deductions. |

What You See Is What You Get

H&R Block PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This H&R Block PESTLE analysis provides a comprehensive overview of the political, economic, social, technological, legal, and environmental factors impacting the company. It’s a valuable tool for understanding H&R Block's strategic landscape.

Sociological factors

Demographic shifts, particularly the growing financial independence of Gen Z and their participation in the gig economy, are reshaping tax service needs. This younger demographic often requires specialized guidance for freelance income and diverse revenue streams.

H&R Block must adapt its services, focusing on digital platforms and accessible educational content to cater to varying financial literacy levels and tax preparation preferences across generations. For instance, in 2024, the IRS reported a significant increase in self-employment tax filings, highlighting the need for tailored solutions.

Consumers increasingly favor digital and online methods for tax preparation, with a significant shift towards e-filing. In 2024, an estimated 90% of individual tax returns were filed electronically in the US, a figure projected to climb further.

H&R Block must prioritize the continuous improvement of its digital offerings, including online platforms, mobile apps, and self-service tools. This adaptation is crucial to meet the demands of clients who prefer convenient, accessible, and often hybrid approaches to managing their tax obligations.

While tax software has become more accessible, many individuals still seek the assurance of professional guidance. A substantial number of taxpayers, particularly those with more intricate financial scenarios, prefer the confidence that comes from human expertise. This preference highlights a persistent need for trusted advisors in tax preparation.

H&R Block strategically addresses this by offering a hybrid approach, seamlessly integrating advanced digital tools with the option for in-person or remote assistance from tax professionals. This dual offering allows them to serve both the do-it-yourself (DIY) segment and those who prioritize expert support, setting them apart from purely software-driven competitors.

Rise of the Gig Economy Workforce

The ongoing expansion of the gig economy presents a significant opportunity for H&R Block. A substantial portion of the workforce now engages in freelance or contract work, often juggling multiple income sources. This trend is projected to continue, with estimates suggesting that by 2027, approximately 60% of the U.S. workforce could be participating in the gig economy in some capacity.

Gig workers typically face more complex tax situations than traditional employees. They need to navigate self-employment taxes, track business expenses for deductions, and often make quarterly estimated tax payments. For instance, in 2023, the IRS reported a notable increase in self-employment tax filings.

- Gig Economy Growth: Projections indicate continued expansion, with a significant majority of the US workforce potentially involved by 2027.

- Complex Tax Needs: Gig workers require specialized assistance with self-employment taxes, expense deductions, and estimated tax payments.

- Market Opportunity: H&R Block's tailored services and products, like Self-Employed Online, directly address the evolving needs of this growing demographic.

Demand for Financial Advisory Services

Beyond just filing taxes, consumers increasingly seek comprehensive financial advice. This trend is evident in the growing interest in wealth management and personalized financial planning, suggesting a shift from transactional tax services to ongoing advisory relationships. For instance, a 2024 survey indicated that over 60% of individuals earning between $50,000 and $150,000 are interested in seeking financial advice beyond tax preparation.

H&R Block's strategic moves into mobile banking with Spruce and small business support through Block Advisors and Wave directly address this evolving demand. These expansions allow the company to engage with clients throughout the year, not just during tax season, fostering loyalty and creating new revenue opportunities. This diversification is crucial as the financial services landscape becomes more integrated.

- Growing Demand for Holistic Financial Guidance: Consumers are actively looking for services that go beyond simple tax filing, encompassing budgeting, savings, and investment advice.

- H&R Block's Diversification Strategy: The company's investments in Spruce (mobile banking) and its small business offerings (Block Advisors, Wave) are designed to capture this broader market need.

- Year-Round Client Engagement: By offering a wider suite of financial tools and services, H&R Block aims to build deeper, more consistent relationships with its customer base, moving beyond seasonal interactions.

- Revenue Stream Diversification: Expanding into advisory and banking services helps H&R Block reduce its reliance on the highly seasonal tax preparation business, leading to more stable income.

Societal expectations regarding financial literacy and transparency are increasing, influencing how individuals approach tax preparation and financial management. Consumers are demanding more accessible information and clearer explanations of tax laws and financial products.

H&R Block's focus on educational content and user-friendly digital tools directly addresses this societal shift. By providing resources that demystify complex tax concepts, the company aims to empower a broader segment of the population to manage their finances effectively. This aligns with a growing public emphasis on financial empowerment.

The increasing acceptance of remote work and digital interactions has fundamentally altered consumer preferences for service delivery. Many individuals now expect the convenience of accessing professional services, including tax assistance, through online platforms and mobile applications.

H&R Block's investment in its digital infrastructure, including its online platform and mobile app, positions it to meet these evolving consumer expectations. This adaptation is crucial for remaining competitive in a market where digital convenience is paramount. In 2024, over 90% of US tax returns were filed electronically, underscoring this trend.

Technological factors

The tax and accounting landscape is rapidly evolving due to advancements in Artificial Intelligence (AI) and generative AI (GenAI), promising substantial gains in efficiency, accuracy, and client satisfaction. These technologies are poised to automate repetitive tasks, improve data analysis, and offer more personalized client interactions.

H&R Block is strategically integrating AI, exemplified by its AI Tax Assist tool for DIY Online clients. This innovation aims to simplify data input, automate the creation of tax documents, and deliver up-to-the-minute tax law changes, thereby strengthening its market position.

As tax preparation shifts further online, strong cybersecurity is crucial for safeguarding sensitive client financial information. This digital transformation necessitates continuous investment in advanced security measures to prevent unauthorized access and data breaches.

A significant data breach experienced by H&R Block in 2024 underscored the critical importance of robust data protection. This event emphasizes the ongoing need for vigilance and investment in security protocols to maintain client confidence and adhere to increasingly stringent data privacy regulations.

The ongoing migration to digital channels means H&R Block must consistently invest in making its mobile and online tax filing platforms intuitive and packed with useful features. This commitment is vital for attracting and retaining clients who increasingly expect a smooth, accessible digital experience.

H&R Block's strategic emphasis on its MyBlock app, along with improvements to data import and the overall online user journey, directly addresses these evolving consumer demands. This focus is particularly important for engaging younger demographics who are digital natives and prioritize convenience.

By the end of fiscal year 2024, H&R Block reported that approximately 70% of its tax filings were completed digitally, showcasing the significant reliance on its online and mobile platforms. This trend is expected to continue, with projections indicating further growth in digital adoption for tax preparation services in 2025.

Automation of Tax Preparation Processes

Technological advancements are significantly automating tax preparation. This includes everything from initial data input and form completion to pinpointing eligible tax breaks and flagging potential audit issues. For H&R Block, this means their tax professionals can dedicate more time to offering expert advice and handling intricate client needs, rather than getting bogged down in routine tasks.

The efficiency gains are substantial. For instance, tax software increasingly uses AI to scan documents and extract relevant information, a process that previously required considerable manual effort. By 2024, it's estimated that over 70% of individual tax returns are filed electronically, a trend driven by the increasing sophistication and user-friendliness of automated preparation tools.

- Increased Efficiency: Automation reduces the time spent on repetitive tasks, allowing for faster return processing.

- Enhanced Accuracy: Software algorithms can minimize human error in calculations and form completion.

- Shift to Advisory Services: Professionals can focus on strategic tax planning and client consultation, adding more value.

- Scalability: Automated processes allow firms like H&R Block to handle a larger volume of clients more effectively.

Integration of Financial Technology (FinTech)

H&R Block is actively integrating financial technology (FinTech) to broaden its appeal and client engagement. The company's Spruce mobile banking platform exemplifies this, moving beyond seasonal tax services to offer year-round financial management tools. This strategic move aims to foster deeper client relationships and enhance financial literacy among its user base.

The expansion into FinTech allows H&R Block to create a more comprehensive financial ecosystem for its clients. By offering services like mobile banking and financial planning, the company can better support users in managing their finances throughout the year. This also streamlines data collection for tax preparation, making the process more efficient and user-friendly.

- FinTech Integration: H&R Block's Spruce platform offers mobile banking, budgeting tools, and early direct deposit, enhancing year-round client engagement.

- Holistic Financial Management: By extending services beyond tax preparation, H&R Block aims to become a central hub for clients' financial lives.

- Data Flow for Taxes: Integrated platforms facilitate seamless data transfer, simplifying tax filing and improving accuracy for clients.

- Financial Literacy: The company leverages FinTech to provide educational resources, empowering clients to make better financial decisions.

Technological advancements, particularly in AI and automation, are reshaping the tax preparation industry. H&R Block is actively leveraging these tools, as seen with its AI Tax Assist, to streamline processes and improve client experience. The increasing reliance on digital platforms, with approximately 70% of H&R Block's filings being digital by fiscal year 2024, highlights the critical need for robust cybersecurity and user-friendly online services.

The company's expansion into FinTech, notably with the Spruce mobile banking platform, demonstrates a strategy to offer year-round financial management, fostering deeper client relationships and enhancing financial literacy. This integration aims to create a comprehensive financial ecosystem, simplifying data collection for tax preparation and improving overall client financial well-being.

| Technology Area | H&R Block Initiative | Impact/Benefit | Data Point (2024/2025) |

|---|---|---|---|

| Artificial Intelligence (AI) | AI Tax Assist | Automates data input, tax document creation, and tax law updates | Enhances efficiency and accuracy in DIY online filings |

| Digital Platforms | MyBlock App, Online Filing | Improves user experience, accessibility, and client retention | ~70% of filings were digital in FY2024; expected continued growth in 2025 |

| Cybersecurity | Investment in Advanced Security Measures | Protects sensitive client financial information, maintains trust | Critical following 2024 data breach incident |

| FinTech | Spruce Mobile Banking | Offers year-round financial management, budgeting, early direct deposit | Expands client engagement beyond seasonal tax services |

Legal factors

H&R Block navigates a complex web of tax laws, with continuous shifts in federal, state, and local regulations directly affecting its service offerings. Staying current with these changes is paramount for the company to ensure both its software and its tax professionals accurately guide clients through compliance, avoiding potential penalties.

For instance, the evolving landscape of reporting requirements, such as the 1099-K threshold adjustments and new mandates for digital asset reporting, necessitates ongoing updates to H&R Block's systems and training. These legal factors underscore the critical need for agility and robust compliance mechanisms within the organization.

The Federal Trade Commission's (FTC) late 2024 action against H&R Block, citing deceptive 'free' filing claims and restrictive downgrading, highlights the critical role of consumer protection laws. This settlement mandates substantial alterations to H&R Block's advertising and customer service, directly influencing its operational and marketing approaches for the 2025 and 2026 tax filing periods.

H&R Block’s handling of sensitive client financial data makes compliance with data privacy laws, including state-specific breach notification rules and potential federal privacy legislation, absolutely crucial. Failure to protect this information carries significant legal weight.

A notable 2024 data breach faced by H&R Block resulted in class action litigation, underscoring the persistent legal risks associated with data security. This event emphasizes the critical need for strong security protocols and transparent client data practices to reduce legal liabilities and preserve customer confidence.

Intellectual Property and Software Licensing

H&R Block's reliance on proprietary tax software means intellectual property protection is paramount. In 2024, the company continued to invest in its digital platforms, making its software patents and copyrights a key asset. Legal disputes over software, such as patent infringement claims, could disrupt product updates and affect its market standing, as seen in past tech industry litigation.

Navigating software licensing agreements is also a critical legal factor. H&R Block must ensure compliance with terms for any third-party software integrated into its services. Failure to adhere to these licenses can lead to costly penalties and operational disruptions. For instance, in 2023, several major tech firms faced significant fines for licensing violations, highlighting the risks involved.

- Intellectual Property Protection: H&R Block's core business relies on its unique tax preparation software, making the safeguarding of patents and copyrights essential for competitive advantage.

- Software Licensing Compliance: Adherence to agreements for all software, whether developed in-house or licensed from third parties, is crucial to avoid legal repercussions and service interruptions.

- Risk of Infringement Claims: Potential legal challenges related to software patents or copyright infringement could negatively impact H&R Block's innovation pipeline and market position.

Employment and Labor Laws

H&R Block navigates a landscape shaped by employment and labor laws, a critical factor given its substantial workforce, which includes many tax professionals and seasonal staff. Compliance with regulations concerning wages, hours, worker classification, and anti-discrimination is paramount. For instance, in 2023, the U.S. Department of Labor continued to enforce wage and hour laws, with a significant focus on ensuring correct overtime pay and preventing misclassification of employees as independent contractors.

Changes in legislation, especially those affecting contract or seasonal employment, can directly impact H&R Block's operational expenses and how it structures its staffing. The ongoing debate and potential regulatory shifts around the gig economy, for example, could necessitate adjustments to how H&R Block engages its seasonal tax preparers.

- Wage and Hour Compliance: Adherence to federal and state minimum wage laws, overtime provisions, and record-keeping requirements is essential for H&R Block's large, often seasonal workforce.

- Worker Classification: Proper classification of employees versus independent contractors is crucial to avoid penalties and ensure compliance with tax and labor regulations.

- Non-Discrimination Policies: Implementing and enforcing policies that prevent discrimination based on race, gender, age, or other protected characteristics is a legal imperative.

- Impact of Gig Economy Regulations: Evolving laws concerning independent contractors could influence H&R Block's staffing models and associated costs for its seasonal tax professionals.

H&R Block's operations are heavily influenced by consumer protection laws, as evidenced by the FTC's late 2024 settlement regarding deceptive 'free' filing claims. This action mandates significant changes to advertising and customer service, impacting marketing strategies for the 2025 and 2026 tax seasons. The company's handling of sensitive client data also necessitates strict adherence to data privacy regulations, including state-specific breach notification rules and potential federal legislation.

The legal ramifications of a 2024 data breach, which led to class action litigation, underscore the critical need for robust data security protocols and transparent practices to mitigate liabilities and maintain customer trust. Furthermore, intellectual property protection is vital, with ongoing investments in proprietary software making patents and copyrights key assets, vulnerable to infringement claims that could disrupt product development and market standing.

Compliance with software licensing agreements for both in-house and third-party software is essential to prevent costly penalties and operational disruptions, a risk highlighted by significant fines levied against tech firms in 2023 for similar violations. Employment and labor laws are also critical due to H&R Block's large workforce, requiring compliance with wage, hour, worker classification, and anti-discrimination regulations, with the Department of Labor actively enforcing these standards.

Potential shifts in regulations concerning the gig economy could necessitate adjustments to how H&R Block engages its seasonal tax professionals, impacting staffing models and operational costs. The company must ensure proper classification of employees versus independent contractors to avoid penalties and maintain compliance with tax and labor laws.

Environmental factors

Stakeholders and investors increasingly scrutinize companies on Environmental, Social, and Governance (ESG) factors, creating pressure for firms like H&R Block to showcase robust corporate responsibility. This growing emphasis means that how a company operates beyond just profits is becoming a key performance indicator.

H&R Block actively addresses this by publishing an annual ESG report. For instance, their 2023 ESG report highlighted a 22% reduction in Scope 1 and 2 greenhouse gas emissions compared to their 2019 baseline. Such disclosures are crucial for building trust and attracting socially conscious investors and clients, potentially boosting brand loyalty and market valuation.

H&R Block, while a service provider, still consumes resources, notably paper, due to its vast network of physical offices. The company actively pursues waste reduction, as evidenced by its 'Path to Print Less' initiative. This program successfully cut down printed pages by 36% in fiscal year 2024, highlighting a tangible effort to minimize its environmental impact.

H&R Block's extensive network of physical offices and critical data centers naturally require significant energy, directly contributing to its overall carbon footprint. The company's commitment to expanding its Greenhouse Gas (GHG) emissions inventory, which now includes Scope 3 calculations, demonstrates a proactive approach to quantifying and managing this environmental impact. This enhanced visibility is crucial for identifying areas where energy consumption can be optimized.

Sustainable Office Practices

H&R Block's commitment to environmental stewardship extends beyond simple print reduction. They are actively implementing broader sustainable office practices, including comprehensive recycling programs and associate-led composting initiatives at their corporate headquarters. These efforts not only contribute to operational efficiency but also resonate deeply with the values of both their employees and their customer base, fostering a positive brand image.

These sustainable practices are not merely symbolic; they represent a tangible effort to reduce waste and resource consumption. For instance, by championing recycling and composting, H&R Block can potentially see a reduction in landfill waste. While specific figures for H&R Block's waste diversion rates for 2024 or early 2025 are not publicly detailed, the trend across the corporate sector shows a growing emphasis on these programs. Many companies are reporting significant reductions in their environmental footprint through such initiatives.

- Waste Reduction: Implementing robust recycling and composting programs directly tackles landfill waste, a key environmental concern.

- Operational Efficiency: Sustainable practices can lead to cost savings through reduced material usage and waste disposal fees.

- Employee Engagement: Associate-led initiatives foster a sense of purpose and environmental responsibility among staff.

- Customer Alignment: Demonstrating environmental commitment aligns with the increasing consumer preference for eco-conscious businesses.

Climate Change Impact (Indirect)

While H&R Block isn't directly in the business of producing goods susceptible to climate shifts, the increasing prevalence of extreme weather events can create new tax complexities. For instance, government responses to natural disasters often involve special tax credits or deductions, requiring H&R Block to adapt its services to guide clients through these new provisions. The IRS has provided disaster relief provisions in recent years, allowing taxpayers in affected areas to claim casualty losses.

These events can also disrupt regional operations. An office in an area prone to flooding or wildfires might face temporary closures, impacting service delivery and client access. In 2024, the US experienced numerous billion-dollar weather and climate disasters, underscoring the potential for such disruptions to affect businesses nationwide.

- Increased Demand for Disaster-Related Tax Filings: Natural disasters often trigger specific tax relief measures, creating a surge in demand for tax preparation services to navigate these provisions.

- Potential for Regional Office Disruptions: Extreme weather can lead to temporary closures of physical H&R Block locations, affecting client access and service continuity in affected areas.

- Adaptation to New Tax Legislation: Government responses to climate-related events may introduce new tax laws and credits, requiring H&R Block to update its software and train its preparers.

H&R Block's environmental strategy focuses on reducing its operational footprint and adapting to climate-related tax implications. The company reported a 22% reduction in Scope 1 and 2 greenhouse gas emissions by fiscal year 2023, compared to a 2019 baseline, and a 36% decrease in printed pages in fiscal year 2024 through its 'Path to Print Less' initiative. These efforts highlight a commitment to sustainability that resonates with environmentally conscious stakeholders and clients.

Extreme weather events, increasingly common in the US, present both challenges and opportunities for H&R Block. The 2024 year saw numerous billion-dollar weather and climate disasters, necessitating adaptation to new tax relief provisions for affected taxpayers. This can lead to increased demand for specialized tax preparation services, while also posing risks of temporary office closures due to regional disruptions.

| Environmental Factor | H&R Block's Action/Impact | Data Point/Example |

|---|---|---|

| Greenhouse Gas Emissions | Reducing Scope 1 & 2 emissions | 22% reduction by FY2023 (vs. FY2019 baseline) |

| Waste Reduction | Minimizing paper consumption | 36% reduction in printed pages in FY2024 |

| Climate Change Impact | Adapting to disaster-related tax laws | Increased demand for casualty loss filings following 2024 weather events |

| Operational Resilience | Addressing potential office disruptions | Risk of temporary closures in areas affected by extreme weather |

PESTLE Analysis Data Sources

Our H&R Block PESTLE Analysis is grounded in data from official government tax agencies, economic indicators from reputable financial institutions, and reports on regulatory changes impacting the financial services sector. This ensures a comprehensive understanding of the external forces shaping the company's operations.