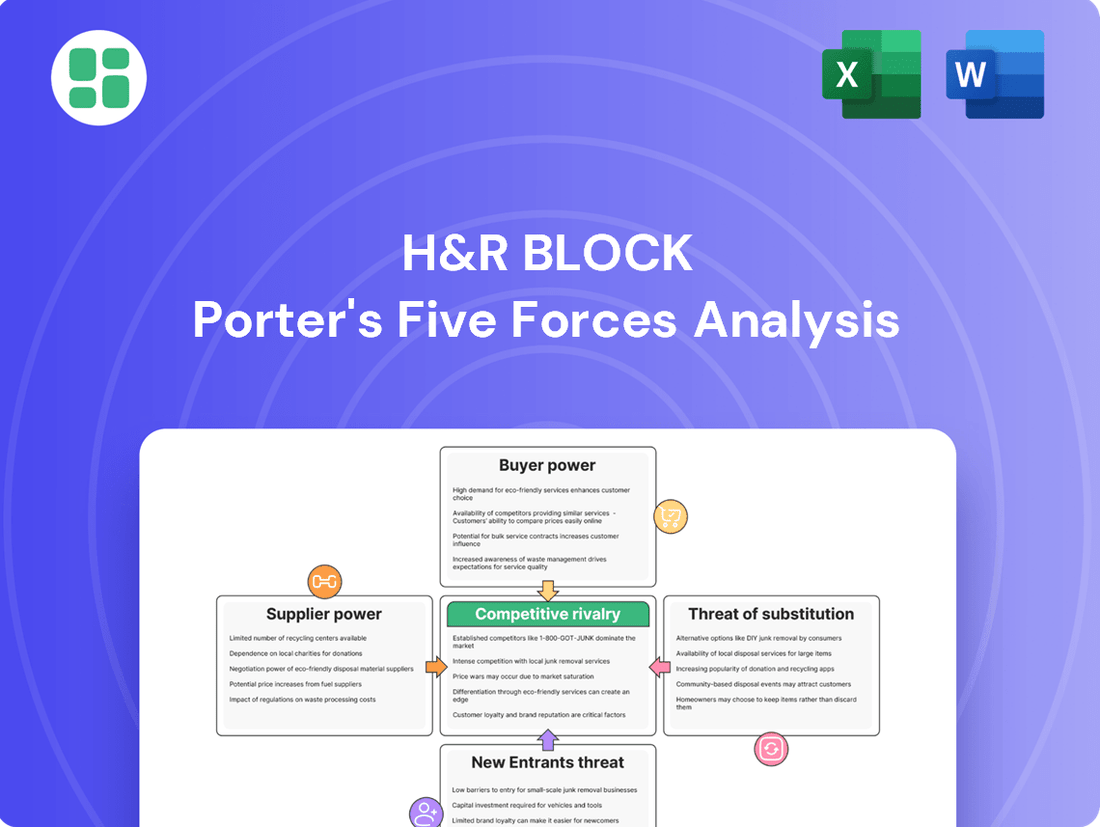

H&R Block Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

H&R Block Bundle

H&R Block navigates a complex landscape shaped by intense rivalry among tax preparation services and the ever-present threat of new digital entrants. Understanding the power of buyers, who can easily switch providers, and the moderate threat of substitutes, like DIY software, is crucial for their success.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore H&R Block’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of specialized human capital, particularly Certified Public Accountants (CPAs) and Enrolled Agents, is a considerable factor for H&R Block. A persistent shortage of talent within the accounting profession amplifies the leverage these highly skilled professionals hold. This scarcity means H&R Block faces increased pressure to offer competitive compensation and benefits to attract and retain these essential employees.

H&R Block's business model, especially its reliance on a vast network of tax preparers for assisted services, makes it particularly susceptible to wage inflation driven by this talent shortage. For instance, industry reports in 2024 indicated rising salaries for accounting professionals, a trend likely to continue as demand outstrips supply.

The ongoing complexity of tax laws and the anticipation of further legislative changes in 2025 further enhance the bargaining power of these experts. Their ability to navigate intricate tax scenarios and ensure compliance for clients is a valuable service, granting them significant leverage in salary negotiations and employment terms.

The increasing reliance on digital solutions and AI in tax preparation significantly boosts the bargaining power of technology and software providers. H&R Block's strategic investments in AI-driven tools and online platforms create a dependency on these external partners for advanced features and robust infrastructure.

The tax management software market is projected for substantial growth, with some reports indicating a CAGR exceeding 10% through 2028, granting providers of sophisticated automation and AI solutions considerable leverage in pricing and contract negotiations. This means H&R Block must carefully manage these relationships to ensure access to critical technologies without incurring excessive costs.

Data and cybersecurity vendors hold considerable sway over H&R Block. The company's reliance on these suppliers stems from the critical need to safeguard sensitive client financial information. A data breach can result in substantial financial penalties and severe reputational damage, making H&R Block highly dependent on these specialized services.

The cost of cybersecurity solutions is significant, and switching vendors can be complex and disruptive. For instance, the global cost of a data breach averaged $4.35 million in 2022, according to IBM's Cost of a Data Breach Report. This high cost of failure empowers vendors who can guarantee robust protection and compliance with regulations like GDPR and CCPA.

Real Estate and Office Infrastructure

H&R Block's reliance on landlords for its vast network of physical offices, numbering over 3,000 company-owned locations in 2023, grants suppliers of real estate and office infrastructure a degree of bargaining power. This is further amplified by the need for office supplies and utilities across this extensive footprint.

While individual landlords might possess limited sway, the aggregated demand from H&R Block's numerous branches can consolidate leverage for larger real estate management firms, particularly in high-demand urban centers. This collective need translates into a more significant negotiation position for these suppliers.

However, the ongoing shift towards virtual tax preparation and remote work models, a trend accelerated by digital advancements, may gradually diminish the bargaining power of these suppliers. As H&R Block potentially reduces its physical office footprint, the dependency on traditional real estate and office infrastructure providers could lessen.

- Supplier Dependence: H&R Block requires physical office spaces, utilities, and office supplies, creating a dependency on these suppliers.

- Geographic Concentration: The power of real estate suppliers can be higher in regions where H&R Block has a significant concentration of offices.

- Industry Trends: The increasing adoption of remote work and digital service delivery may reduce the long-term bargaining power of traditional office infrastructure suppliers.

Marketing and Advertising Agencies

H&R Block relies on marketing and advertising agencies to stay visible and attract clients in a crowded marketplace. The bargaining power of these agencies is generally moderate, especially for those with proven success in reaching H&R Block's target audiences or excelling in digital advertising strategies.

In 2024, the demand for effective digital marketing services remained high, with many agencies demonstrating strong negotiation leverage due to their specialized skills. For instance, agencies adept at performance marketing and data analytics, crucial for client acquisition and retention, could command higher fees.

- Specialized Expertise: Agencies with unique capabilities in areas like tax season promotions or financial services marketing hold more sway.

- Performance Metrics: Agencies that can demonstrably link their campaigns to client acquisition and revenue growth for H&R Block can negotiate from a stronger position.

- Market Competition: The competitive landscape for advertising services means H&R Block can switch providers, but highly sought-after agencies still possess considerable power.

The bargaining power of H&R Block's suppliers is influenced by the critical need for specialized human capital, particularly CPAs and Enrolled Agents. The persistent shortage of these professionals in 2024, as indicated by industry salary trends, grants them significant leverage in compensation demands.

Technology and software providers also wield considerable power, especially those offering AI-driven tax solutions. H&R Block's investment in these platforms creates a dependency, and the projected growth of the tax management software market through 2028 further strengthens these suppliers' negotiating positions.

Data and cybersecurity vendors are crucial due to the sensitive nature of client information. The high average cost of a data breach, reported at $4.35 million in 2022, empowers these providers who guarantee robust protection and compliance, making H&R Block highly reliant on their services.

H&R Block's extensive network of over 3,000 physical offices in 2023 gives real estate and office infrastructure suppliers some leverage, particularly larger firms in competitive urban markets. However, the trend towards virtual services may gradually lessen this power.

| Supplier Category | Key Factor Influencing Power | Impact on H&R Block | 2024/2025 Trend |

|---|---|---|---|

| Specialized Human Capital (CPAs, EAs) | Talent Shortage, Tax Law Complexity | Increased wage pressure, retention challenges | Rising salaries, high demand |

| Technology & Software Providers | AI Capabilities, Market Growth | Dependency on advanced tools, potential for higher costs | Strong growth in tax software market (CAGR >10% projected) |

| Data & Cybersecurity Vendors | Data Sensitivity, Breach Costs | High reliance on security, vendor lock-in potential | Significant cost of breaches ($4.35M avg. in 2022) |

| Real Estate & Office Infrastructure | Number of Physical Locations, Geographic Demand | Rental costs, operational expenses | Potential decrease in power due to remote work trends |

What is included in the product

Tailored exclusively for H&R Block, this analysis dissects the competitive forces shaping the tax preparation industry, highlighting the intensity of rivalry, buyer and supplier power, and the threat of new entrants and substitutes.

Empower strategic clarity by visualizing H&R Block's competitive landscape; understand and mitigate threats with an intuitive Porter's Five Forces framework.

Customers Bargaining Power

Customers using H&R Block's do-it-yourself (DIY) tax software and online services generally have low switching costs. Many competing tax preparation services, such as TurboTax, TaxAct, and TaxSlayer, offer comparable digital platforms. This ease of migration means customers can readily move their financial data to a different provider if they find a better price, more appealing features, or a superior user experience. For instance, in 2023, the DIY tax software market was valued at approximately $3.5 billion, indicating a highly competitive landscape where customer retention is key.

The ability for customers to easily transfer their basic financial information between different tax software platforms significantly empowers them. This technical capability allows them to shop around and compare offerings without substantial hurdles. Consequently, they can make decisions primarily based on factors like price, the range of features available, or the overall ease of use. H&R Block actively addresses this by offering free federal filing for simple tax returns and implementing price-matching strategies to retain its customer base in this competitive segment.

The tax preparation market is indeed crowded, offering consumers a wide array of choices. This means clients can easily compare services and prices, significantly boosting their bargaining power. For instance, alongside H&R Block's primary competitors, there are budget-friendly options like FreeTaxUSA and even government-backed free filing services, all vying for taxpayer attention.

This abundance of alternatives directly impacts H&R Block. Customers can readily switch to a provider offering a lower price or a perceived better value. In 2023, the DIY tax software market alone was estimated to be worth billions, highlighting the competitive landscape where price sensitivity is a major factor for many filers.

To counter this, H&R Block focuses on its assisted services and the comprehensive support it provides. This strategy aims to build client loyalty and justify its pricing by offering a more personalized and secure experience compared to purely online, self-service platforms. The company's ability to retain clients hinges on demonstrating value beyond just the cost of filing.

Many individual taxpayers, especially those with simple returns, are very aware of price and often choose the most affordable or even free tax filing options. This is a significant factor influencing H&R Block's strategy.

The Federal Trade Commission's (FTC) scrutiny of H&R Block's advertising, particularly concerning 'free' filing and how customers are sometimes moved to paid services, highlights just how much customers care about clear pricing. In 2023, the FTC ordered H&R Block to pay $5.2 million to settle claims it misled customers about its free tax filing services.

Consequently, H&R Block must maintain competitive pricing across its various service levels and frequently uses promotional discounts to attract and retain these price-conscious customers.

Increased Demand for Expertise for Complex Filers

For individuals with straightforward tax situations, price is a major concern, giving them significant bargaining power. However, the landscape shifts dramatically for those facing complex filings, such as self-employment income, multi-state tax obligations, or intricate deduction scenarios.

These customers actively seek out specialized knowledge and are less swayed by minor price differences. H&R Block's strategic focus on attracting these complex filers indicates a recognition that this segment prioritizes the value of expert guidance over pure cost savings, thereby tempering their price sensitivity.

- Customer Segment Shift: H&R Block's increasing focus on complex filers, a segment less sensitive to price, demonstrates a strategic move to capture higher-value clients.

- Value over Price: Customers with intricate tax needs (e.g., self-employed, multi-state income) prioritize expert assistance, reducing their bargaining power based solely on cost.

- Expertise as a Differentiator: The demand for specialized knowledge in complex tax situations allows H&R Block to command better pricing, as clients are willing to pay for accuracy and peace of mind.

Access to Information and Digital Tools

Customers today are incredibly well-informed, thanks to the vast amount of information available online. They can easily access tax law updates, compare services, and read reviews, all of which significantly boosts their ability to make informed choices. For instance, a quick search can reveal average tax preparation fees, allowing clients to gauge if H&R Block's pricing is competitive.

The proliferation of AI-powered tax assistance tools further empowers individuals. These tools can answer basic tax questions and help users understand their tax obligations, lessening the need to solely rely on a tax professional for fundamental knowledge. This increased self-sufficiency directly translates to greater bargaining power for the customer.

- Informed Decisions: Customers can easily research tax laws and service provider reviews, leading to more educated choices.

- AI Empowerment: AI tools offer accessible answers to tax queries, reducing dependence on single service providers for basic information.

- Transparency Advantage: Greater access to information about tax services and pricing levels the playing field, increasing customer leverage.

Customers of H&R Block, particularly those using DIY tax software, face minimal switching costs, enabling them to easily move to competitors like TurboTax or TaxAct. This ease of transition, fueled by the ability to transfer financial data, allows them to prioritize price and features, a significant factor in the multi-billion dollar DIY tax software market. H&R Block's response includes offering free federal filing for simple returns and employing price matching to retain these price-sensitive customers.

For individuals with straightforward tax situations, price is a primary driver, granting them considerable bargaining power. However, for those with complex tax needs, such as self-employment or multi-state income, the emphasis shifts from cost to the value of expert guidance, thereby reducing their price sensitivity. H&R Block's strategic focus on these complex filers acknowledges their prioritization of accuracy and peace of mind over minor cost savings.

The digital age has equipped customers with extensive information, from tax law updates to competitor reviews, enhancing their ability to make informed decisions and compare services. Furthermore, the rise of AI-powered tax tools empowers individuals with basic tax knowledge, lessening their reliance on tax professionals and increasing their overall bargaining leverage.

| Factor | Impact on H&R Block | Supporting Data/Example |

|---|---|---|

| Switching Costs | Low for DIY users | Customers can easily transfer data between platforms. |

| Price Sensitivity | High for simple filers | FTC order for H&R Block to pay $5.2 million in 2023 for misleading 'free' filing ads indicates customer focus on clear pricing. |

| Information Availability | High customer knowledge | Online access to tax law, competitor fees, and reviews empowers comparisons. |

| AI Assistance | Reduced reliance on professionals for basic queries | AI tools can answer fundamental tax questions, increasing customer self-sufficiency. |

Same Document Delivered

H&R Block Porter's Five Forces Analysis

This preview showcases the complete H&R Block Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the tax preparation industry. The document you see here is precisely the same professionally formatted and insightful analysis you will receive immediately after purchase, ensuring you get the full, ready-to-use content without any alterations.

Rivalry Among Competitors

The tax preparation landscape is a battleground, with giants like H&R Block and Intuit's TurboTax holding significant sway. This dominance, coupled with a crowded field of smaller competitors and independent professionals, fuels a fierce competition for every client. For instance, in the fiscal year ending April 30, 2023, H&R Block served approximately 24 million tax returns, highlighting the scale of operations for major players.

Competitive rivalry in the tax preparation industry is intense, driven by both price and features. Companies frequently engage in aggressive pricing, offering free services for basic tax returns and competitive rates for more intricate filings. This dynamic forces players to constantly innovate their offerings to attract and retain customers.

Beyond price, the battleground extends to the sophistication of software, user experience, and the availability of expert assistance. H&R Block, for instance, has responded to this pressure with initiatives like price matching and the introduction of AI Tax Assist, aiming to differentiate itself and capture market share through enhanced value and technological advancement.

H&R Block’s hybrid service model, combining DIY digital solutions with in-person professional assistance, directly challenges competitors like TurboTax. This strategy aims to cater to a broad client base, from those comfortable with self-service to individuals needing expert guidance for intricate tax situations. In 2023, H&R Block reported a 5% increase in revenue from its DIY segment, highlighting the growing demand for digital options, while its assisted services segment also saw steady growth.

Technological Advancements and AI Integration

The competitive landscape for tax preparation services is increasingly shaped by rapid technological advancements, especially in artificial intelligence and automation. Companies are pouring resources into AI-powered client portals, sophisticated predictive analytics, and automated workflows. This drive for efficiency and improved client experience fuels intense rivalry, compelling firms to innovate constantly or risk losing market share.

For instance, in 2024, H&R Block continued to emphasize its digital offerings, aiming to streamline the tax filing process for its clients. Competitors like Intuit TurboTax are also heavily invested in AI, using it to personalize tax advice and identify potential deductions more effectively.

- AI-driven client portals enhance user experience and data accessibility.

- Predictive analytics help anticipate client needs and tax law changes.

- Streamlined workflows through automation reduce processing times and errors.

- Continuous innovation is crucial to maintain a competitive edge in the digital tax preparation market.

Regulatory and Legislative Changes

Changes in tax laws, like the anticipated expiration of key Tax Cuts and Jobs Act (TCJA) provisions at the end of 2025, significantly intensify competitive rivalry in the tax preparation industry. This dynamic environment necessitates constant adaptation.

Companies that can swiftly update their software and training programs to reflect these evolving regulations, while clearly communicating the impact to their clients, will secure a distinct competitive advantage. This agility is paramount for success.

H&R Block, like its competitors, must invest in continuous monitoring of legislative developments and maintain agile development cycles to remain competitive. For instance, the complexity introduced by potential changes to tax brackets or deductions directly impacts software functionality and client advisory services.

- Anticipated TCJA Expiration: Key provisions set to expire at the end of 2025 create uncertainty and opportunity for tax preparers.

- Software and Training Adaptation: The ability to quickly update systems and educate staff on new tax laws is a critical differentiator.

- Client Communication: Effectively informing clients about how regulatory changes affect their tax situations builds trust and loyalty.

- Agile Development: A commitment to continuous monitoring and rapid software adjustments is essential in this evolving landscape.

The tax preparation sector is characterized by intense rivalry, with H&R Block facing strong competition from both large players like Intuit's TurboTax and a multitude of smaller firms and independent professionals. This competition is driven by a focus on pricing, with aggressive strategies like free basic filing and competitive rates for complex returns being common. The fight for market share also hinges on technological innovation, user experience, and the quality of expert assistance offered.

H&R Block actively combats this rivalry by enhancing its hybrid model, blending DIY digital solutions with in-person support, and investing in AI-driven tools like AI Tax Assist. For fiscal year 2024, H&R Block reported continued growth in its DIY segment, indicating success in its digital strategy, while also maintaining a strong presence in assisted services. This multi-faceted approach is crucial for retaining and attracting clients in a dynamic market.

| Competitor | Primary Offering | Key Differentiator |

|---|---|---|

| H&R Block | Hybrid (DIY & Assisted) | Extensive physical office network, AI Tax Assist |

| Intuit TurboTax | Primarily DIY Digital | Strong brand recognition, AI-powered personalization |

| Jackson Hewitt | Assisted Tax Preparation | Focus on in-person service and customer support |

SSubstitutes Threaten

The most significant threat of substitution for H&R Block's assisted tax services comes from readily available DIY software and online platforms. Competitors like TurboTax and FreeTaxUSA offer accessible solutions, and in 2024, the market for tax preparation software continued to grow, with many taxpayers opting for these lower-cost or free alternatives for simpler returns.

This trend means that individuals with uncomplicated tax situations can easily prepare and file their taxes independently, bypassing the need for professional assistance. Even H&R Block’s own DIY offerings, while a part of their business, directly substitute for their higher-margin assisted services, highlighting the pervasive nature of this threat.

For individuals and small businesses facing intricate tax matters, independent Certified Public Accountants (CPAs) and tax attorneys represent a significant threat of substitutes. These professionals offer a level of personalized guidance and strategic tax planning that H&R Block's more standardized offerings may not match, particularly concerning complex audits or specialized financial situations.

The demand for specialized human expertise in navigating nuanced tax laws remains robust, as evidenced by the continued growth in the accounting services sector. For instance, the U.S. Bureau of Labor Statistics projected employment of accountants and auditors to grow 6 percent from 2022 to 2032, faster than the average for all occupations, indicating a persistent need for skilled professionals.

Taxpayers can still opt for manual paper filing or use free online tools directly from the IRS. While these methods are less convenient and offer no personalized guidance, they remain a zero-cost alternative. For instance, in the 2023 tax season, the IRS saw millions of paper returns filed, demonstrating that this option, though declining, still exists.

Emerging AI-Driven Tax Advisory Platforms

The rise of AI-driven tax advisory platforms presents a growing threat of substitutes for traditional tax preparation services. These platforms leverage artificial intelligence and machine learning to automate complex tax planning and compliance tasks, potentially offering a more efficient and cost-effective alternative for certain client segments. While still in development, their increasing sophistication could erode demand for some of H&R Block's higher-value advisory offerings.

For instance, by 2024, the global AI in accounting market was projected to reach significant figures, indicating substantial investment and development in this area. This trend suggests that AI solutions are becoming more capable of handling tasks previously requiring human expertise.

- AI Automation: AI can automate data entry, form completion, and even identify potential deductions, reducing the need for manual intervention.

- Cost Efficiency: AI-powered platforms often operate at lower overheads, allowing them to offer services at competitive price points.

- Scalability: These digital solutions can scale rapidly to meet fluctuating demand without the same staffing constraints as traditional firms.

- Evolving Capabilities: As AI technology advances, its ability to provide nuanced tax advice and planning will likely increase, posing a more direct challenge to established players.

Financial Advisors Offering Tax Planning

The threat of substitutes for traditional tax preparation services is growing as financial advisors increasingly incorporate tax planning into their broader wealth management offerings. For affluent individuals and those with complex financial situations, this integrated approach can serve as a viable alternative to engaging separate tax professionals. This trend is particularly noticeable as firms aim to provide a more comprehensive client experience.

For instance, many wealth management firms now offer tax-efficient investment strategies and retirement planning that inherently involve tax considerations. In 2024, a significant portion of high-net-worth individuals (HNWIs), often defined as those with investable assets of $1 million or more, are seeking integrated financial solutions. A survey indicated that over 60% of HNWIs prefer a single point of contact for all their financial needs, including tax advice.

- Integrated Services: Financial advisory firms are bundling tax planning with investment management, estate planning, and retirement services.

- Client Preference: A growing number of affluent clients prefer a holistic financial approach, reducing the need for standalone tax preparation.

- Industry Evolution: This trend pressures traditional tax preparers, like H&R Block, to enhance their advisory capabilities or risk losing clients seeking comprehensive solutions.

The threat of substitutes for H&R Block's services is multifaceted, ranging from readily available DIY software to specialized professional advice. The increasing sophistication and affordability of tax preparation software, like TurboTax and H&R Block's own digital offerings, provide a significant substitute for those with simpler tax returns. For instance, in 2024, the continued growth in the tax software market indicates a strong preference for these accessible, lower-cost alternatives.

Beyond software, independent CPAs and tax attorneys offer a more personalized and strategic approach, particularly for complex tax situations or audits. The U.S. Bureau of Labor Statistics projected a 6 percent growth for accountants and auditors from 2022 to 2032, underscoring the persistent demand for human expertise in this field. Even free IRS resources remain a zero-cost substitute, though less convenient.

Emerging AI-driven tax advisory platforms also pose a growing threat, promising efficiency and cost-effectiveness. The significant investment in the global AI in accounting market by 2024 highlights its potential to automate tasks traditionally handled by human professionals. Furthermore, wealth management firms are integrating tax planning into their services, appealing to affluent clients who prefer a single point of contact for comprehensive financial needs, with over 60% of HNWIs seeking such integrated solutions in 2024.

| Substitute Category | Key Competitors/Examples | Key Characteristics | Impact on H&R Block |

|---|---|---|---|

| DIY Tax Software | TurboTax, FreeTaxUSA, H&R Block DIY | Affordability, accessibility, ease of use for simple returns | Directly substitutes for assisted services, especially for less complex returns. |

| Independent Professionals | CPAs, Tax Attorneys | Personalized advice, strategic planning, expertise in complex situations | Threatens higher-margin advisory services; addresses needs not fully met by standardized offerings. |

| Free/Government Resources | IRS Free File, Paper Filing | Zero cost, direct government access | A minimal but existing alternative for cost-sensitive taxpayers. |

| Integrated Financial Services | Wealth Management Firms | Bundled tax planning with investment, retirement, and estate planning | Appeals to affluent clients seeking holistic financial solutions, potentially diverting clients from standalone tax services. |

| AI-Driven Platforms | Emerging AI Tax Solutions | Automation, potential cost efficiency, evolving advisory capabilities | Future threat to advisory services, offering potentially more efficient alternatives. |

Entrants Threaten

Entering the tax preparation industry involves significant regulatory and licensing hurdles. Individuals preparing tax returns for compensation must obtain a Preparer Tax Identification Number (PTIN) and comply with IRS standards, a requirement impacting over 700,000 PTIN holders in 2024.

For firms offering assisted tax services, professional credentials such as Enrolled Agent (EA) or Certified Public Accountant (CPA) are often mandatory, creating a substantial barrier for new entrants. These licensing requirements, alongside ongoing compliance, ensure a baseline of expertise but effectively limit the ease with which new competitors can enter the market.

The threat of new entrants for H&R Block is significantly mitigated by the high capital investment required in technology and infrastructure. Establishing a competitive presence, particularly for large-scale operations, demands substantial capital for robust tax software, secure IT systems, and potentially a network of physical locations. For instance, developing advanced AI tax preparation tools and ensuring stringent data security measures involves considerable upfront and recurring expenses, creating a substantial barrier for smaller, newly formed competitors aiming to match H&R Block's operational scale and technological sophistication.

Established players like H&R Block have cultivated strong brand recognition over many years, fostering customer trust that acts as a significant hurdle for newcomers. For instance, H&R Block's brand has been a household name in tax preparation for decades, built on consistent service and reliability.

The tax preparation industry handles highly sensitive personal financial data, leading consumers to gravitate towards brands they perceive as secure and reputable. This inherent need for trust means new entrants must invest heavily to overcome customer hesitation.

Developing the kind of brand loyalty and trust that H&R Block enjoys requires substantial and sustained investment in marketing and customer service, a long-term commitment that new competitors must be prepared to undertake.

Economies of Scale and Experience Curve

Existing large players in the tax preparation industry, like H&R Block, benefit significantly from economies of scale. This means they can spread costs like marketing, technology, and nationwide branch operations over a larger base, leading to lower per-unit costs. For instance, H&R Block's extensive network of physical locations and robust digital platform represent substantial upfront investments that new entrants would struggle to replicate. In 2023, H&R Block reported $3.5 billion in revenue, demonstrating the scale of operations they manage.

The experience curve also plays a crucial role. Years of dealing with evolving tax laws, client needs, and operational challenges have honed the processes of established firms. This accumulated expertise translates into greater efficiency and a deeper understanding of customer service requirements, which are difficult for newcomers to quickly acquire. This ingrained knowledge allows them to anticipate changes and adapt more effectively than a nascent competitor.

New entrants face a steep climb to match these advantages. They often lack the brand recognition and established customer loyalty that come with years of service. Furthermore, the capital required to build a comparable infrastructure, invest in sophisticated tax software, and launch widespread marketing campaigns presents a formidable barrier. For example, while digital-only tax services have emerged, they still face the challenge of building trust and scale against established brands.

- Economies of Scale: Large firms can spread marketing, technology, and operational costs across a wider customer base, enabling competitive pricing and innovation.

- Experience Curve: Accumulated knowledge in tax law and client service provides an efficiency and adaptability edge for established companies.

- Barriers for New Entrants: Newcomers must overcome significant capital requirements for infrastructure, technology, and marketing to compete with established players.

- Brand and Trust: Established firms benefit from brand recognition and customer trust built over years, a difficult asset for new entrants to quickly develop.

Access to Talent and Distribution Channels

The threat of new entrants in the tax preparation industry is significantly impacted by the difficulty in accessing crucial talent and established distribution channels. Recruiting and retaining a large pool of qualified tax professionals presents a considerable hurdle, exacerbated by industry-wide talent shortages. For instance, in 2023, the U.S. Bureau of Labor Statistics projected a 5% growth for accountants and auditors, a category encompassing many tax preparers, but the specialized nature of tax law creates a more concentrated demand.

Furthermore, building widespread distribution channels, whether through physical office networks or effective online marketing strategies, demands substantial capital investment and considerable time. New players often find it challenging to replicate the extensive reach and brand recognition that established firms like H&R Block have cultivated over decades.

- Talent Acquisition: Competition for skilled tax professionals is high, with many seeking specialized roles or higher compensation, making it difficult for new entrants to build a competent workforce.

- Distribution Network: Establishing a physical presence or a robust digital platform to serve a broad customer base requires significant upfront investment in real estate, technology, and marketing.

- Brand Loyalty: Existing customers often exhibit loyalty to established brands like H&R Block due to familiarity and trust, creating a barrier for new entrants seeking market share.

The threat of new entrants for H&R Block is considerably low due to several formidable barriers. High capital requirements for technology, infrastructure, and marketing, coupled with stringent regulatory and licensing demands for tax preparers, deter many potential competitors. Established brands like H&R Block benefit from decades of cultivated customer trust and loyalty, making it difficult for newcomers to gain market share without substantial investment in building a similar reputation.

Economies of scale enjoyed by H&R Block, which allow for lower per-unit costs in areas like marketing and technology, further disadvantage new entrants. The experience curve, representing years of accumulated expertise in navigating complex tax laws and client service, also provides a significant competitive edge that is challenging to replicate quickly. For instance, H&R Block's 2023 revenue of $3.5 billion underscores the scale of operations new entrants would need to match.

| Barrier Type | Description | Impact on New Entrants | Example for H&R Block |

|---|---|---|---|

| Capital Requirements | Significant investment needed for advanced tax software, IT security, and potentially physical locations. | High barrier, requiring substantial upfront funding. | Developing AI-driven tax preparation tools and ensuring robust data security. |

| Regulatory & Licensing | Mandatory PTIN for preparers, and often EA or CPA credentials for firms. | Limits the pool of qualified individuals and increases compliance costs. | Over 700,000 PTIN holders in 2024 must meet IRS standards. |

| Brand Recognition & Trust | Established reputation built over decades fosters customer loyalty. | New entrants struggle to gain trust and attract customers away from familiar brands. | H&R Block's long-standing presence as a household name in tax preparation. |

| Economies of Scale | Spreading fixed costs like marketing and technology over a larger customer base. | Allows for competitive pricing and greater investment capacity. | H&R Block's extensive network of physical offices and digital platform. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for H&R Block is built upon a foundation of publicly available financial reports, industry-specific market research from firms like IBISWorld, and government regulatory filings. This ensures a comprehensive understanding of the competitive landscape.