Holley Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Holley Bundle

Holley's Five Forces Analysis reveals the intense competitive landscape they navigate, from the bargaining power of their suppliers to the constant threat of new market entrants. Understanding these forces is crucial for any business operating in or looking to invest in the automotive aftermarket industry.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Holley’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Supplier concentration significantly impacts Holley's bargaining power. If the automotive performance parts market, where Holley operates, depends on a limited number of specialized component manufacturers, like those for unique engine parts or exotic materials, Holley's ability to negotiate favorable terms diminishes. This is particularly true if these specialized suppliers are critical to Holley's product lines.

Conversely, a broad and competitive supplier landscape for more common components would naturally reduce the leverage any single supplier holds over Holley. For instance, in 2024, the automotive aftermarket saw continued consolidation in some niche areas, but a robust global supply chain for many standard fasteners and materials kept competitive pressure on suppliers, generally benefiting manufacturers like Holley.

Switching costs are a significant factor in the bargaining power of suppliers. If Holley faces high costs to switch from one supplier to another, such as needing to retool manufacturing equipment or re-engineer its products to accommodate new components, this gives existing suppliers more leverage. For instance, if Holley's engine components are designed with specific proprietary technologies from a particular supplier, changing that supplier could necessitate substantial R&D and production line adjustments. These high switching costs effectively lock Holley into its current supplier relationships, strengthening the supplier's position.

Suppliers offering unique inputs, such as specialized engine components or proprietary tuning software, can exert significant leverage. For instance, if a key supplier for Holley's high-performance fuel systems holds patents on critical manufacturing processes, their bargaining power increases substantially. This uniqueness makes it difficult for Holley to switch suppliers without incurring considerable costs or compromising product quality.

Threat of Forward Integration

The threat of suppliers integrating forward into manufacturing automotive performance products themselves significantly amplifies their bargaining power. If a key component supplier, for instance, were to develop its own branded performance parts, it could directly compete with its existing customers, thereby leveraging its control over essential inputs to gain market share.

While this is a less prevalent concern for highly specialized component suppliers who may lack the brand recognition or distribution networks to succeed independently, it remains a theoretical leverage point. For example, a supplier of advanced engine management systems might consider developing its own line of aftermarket ECUs, directly challenging established performance tuning companies that rely on their components.

The potential for forward integration can pressure buyers to offer more favorable terms to suppliers, fearing they might lose access to critical technology or face direct competition. This dynamic is particularly potent when the supplier's technology is proprietary or difficult to replicate, giving them a substantial advantage in any potential integration play.

- Supplier Integration Risk: The possibility of suppliers entering the automotive performance product manufacturing space increases their leverage.

- Specialized Component Exception: This threat is less pronounced for suppliers of highly specialized, niche components.

- Competitive Pressure: Buyers may concede to supplier demands to avoid direct competition from those same suppliers.

Importance of Supplier's Input to Holley's Cost Structure

The significance of a supplier's input to Holley's overall cost structure directly correlates with their bargaining power. When a particular component or raw material represents a substantial portion of Holley's production expenses, suppliers of that item gain leverage. For instance, if specialized engine components constitute a large percentage of the cost for Holley's performance exhaust systems, the manufacturers of those components could exert considerable influence.

Holley actively works to mitigate this supplier leverage. Strategies include negotiating volume discounts for larger purchases, which lowers the per-unit cost of critical inputs. Additionally, exploring and developing relationships with alternative suppliers for key materials helps to diversify the supply chain and prevent over-reliance on any single source, thereby strengthening Holley's negotiating position.

- High Input Cost: If a specific supplier's product makes up a significant percentage of Holley's cost of goods sold, that supplier has more power.

- Volume Discounts: Holley seeks to reduce the impact of input costs by leveraging its purchasing volume to secure better pricing.

- Alternative Sourcing: Identifying and qualifying multiple suppliers for essential materials is a key strategy to reduce dependency and increase negotiation strength.

- Supplier Concentration: The fewer suppliers available for a critical input, the greater the bargaining power of those suppliers.

The bargaining power of suppliers for Holley is influenced by their concentration and the uniqueness of their offerings. In 2024, the automotive aftermarket continued to see some consolidation, but a generally robust global supply chain for many standard parts helped maintain competitive pressure on suppliers, benefiting manufacturers like Holley. However, suppliers of highly specialized components, such as patented engine management systems or unique materials, hold significant leverage due to high switching costs for Holley and the difficulty in replicating these inputs.

The threat of suppliers integrating forward into manufacturing performance products can also amplify their power, potentially leading to direct competition with Holley. This risk is less pronounced for suppliers of very niche components but remains a strategic consideration. Furthermore, the proportion of Holley's total cost that a supplier's input represents directly impacts their leverage; high input costs empower suppliers. Holley mitigates this by negotiating volume discounts and diversifying its supplier base, as evidenced by its ongoing efforts to secure competitive pricing on key materials.

| Factor | Impact on Holley | 2024 Context/Example |

|---|---|---|

| Supplier Concentration | High concentration increases supplier power. | Limited suppliers for specialized engine parts can dictate terms. |

| Uniqueness of Input | Proprietary or patented components strengthen supplier leverage. | Suppliers with unique tuning software or manufacturing processes gain an edge. |

| Switching Costs | High costs to change suppliers empower existing ones. | Re-tooling for new components or re-engineering products can be costly for Holley. |

| Forward Integration Threat | Suppliers entering Holley's market increase their power. | A component supplier developing its own branded performance parts poses a competitive risk. |

| Cost Structure Significance | Inputs representing a large cost percentage grant suppliers more power. | Specialized components in Holley's exhaust systems can significantly influence pricing. |

What is included in the product

Holley Porter's Five Forces Analysis dissects the competitive intensity and profitability of the automotive aftermarket industry, examining threats from new entrants, buyers, suppliers, substitutes, and existing rivals.

Instantly visualize competitive intensity and potential threats with a dynamic, interactive dashboard that clarifies strategic positioning.

Customers Bargaining Power

Holley's broad customer base, encompassing individual enthusiasts, racers, and professional builders, naturally dilutes the bargaining power of any single customer. This diversification is a key strength.

However, significant volume purchasers, such as major automotive aftermarket distributors or large retail chains, do possess a greater capacity to negotiate favorable pricing and terms. For instance, if a large distributor accounts for a substantial percentage of Holley's total sales, they could leverage this volume to influence Holley's pricing strategies.

Holley's extensive product line, including diverse fuel systems, engine components, and exhaust systems, is a key differentiator. This broad offering, coupled with strong brand recognition, particularly among performance automotive enthusiasts, significantly limits the bargaining power of customers who might otherwise switch based on price alone.

While automotive enthusiasts typically focus on performance and quality, rising inflation and interest rates in 2024 are making them more price-sensitive. For instance, the Consumer Price Index (CPI) for all urban consumers saw a notable increase in early 2024, impacting the cost of goods, including aftermarket parts.

This increased price sensitivity means customers are more likely to shop around, compare prices, and seek out deals when purchasing performance parts for their vehicles. Holley, like other companies in this sector, must carefully consider its pricing strategies to remain competitive in a market where discretionary spending is under pressure.

Availability of Substitutes

The availability of alternative performance parts from other manufacturers significantly enhances customer bargaining power. For example, the aftermarket automotive parts industry is highly competitive, with numerous brands offering similar products. In 2024, the global automotive aftermarket was valued at over $450 billion, indicating a vast array of choices for consumers seeking performance upgrades.

Customers also wield power when they can opt for fewer modifications or none at all. This flexibility means they are not locked into specific suppliers or product lines. If Holley Porter's offerings become too expensive or less appealing, customers can simply choose to maintain their vehicles with fewer performance enhancements, directly impacting Holley Porter's sales volume.

- High Availability of Substitutes: The automotive aftermarket is replete with competitors offering comparable performance parts.

- Customer Choice: Consumers can easily switch between brands or opt for less modification, increasing their leverage.

- Market Size: The extensive global aftermarket, valued in the hundreds of billions, underscores the breadth of alternatives available.

- Reduced Switching Costs: For many parts, the cost and effort to switch from one supplier to another are minimal.

Customer Information and Transparency

Customers today have unprecedented access to information, thanks to the internet. They can easily research products, compare prices across different retailers, and read reviews from other buyers. This transparency means Holley's customers are better informed than ever before, directly impacting the company's ability to set prices and dictate terms.

For instance, the automotive aftermarket, where Holley operates, has seen a significant rise in online comparison shopping. A 2024 survey indicated that over 70% of consumers research products online before making a purchase, and a substantial portion of these actively compare prices. This readily available data empowers buyers, increasing their bargaining power and forcing companies like Holley to focus on value and competitive pricing to retain market share.

- Informed Decisions: Customers can easily access detailed product specifications, performance data, and user feedback, leading to more educated purchasing choices.

- Price Sensitivity: Online platforms facilitate easy price comparison, making customers more sensitive to price differences and less loyal to a single brand based on price alone.

- Brand Reputation: Online reviews and social media discussions heavily influence purchasing decisions, meaning Holley must maintain a strong reputation for quality and customer service to mitigate customer power.

Holley's diverse customer base, from individual enthusiasts to large distributors, influences their bargaining power. While individual buyers have limited leverage, major distributors can negotiate favorable terms due to their significant purchase volumes. Holley's broad and differentiated product line, coupled with strong brand loyalty, helps to mitigate this customer power.

In 2024, increased price sensitivity among consumers, driven by economic factors like inflation, means customers are more inclined to compare prices and seek deals. The vast and competitive nature of the global automotive aftermarket, valued at over $450 billion, provides customers with numerous alternatives, further enhancing their bargaining leverage.

The ease of online research and price comparison empowers customers, forcing companies like Holley to focus on competitive pricing and value. Over 70% of consumers in 2024 researched products online before purchasing, actively comparing prices, which directly impacts Holley's ability to dictate terms.

| Factor | Impact on Holley's Customer Bargaining Power | Supporting Data/Observation (2024) |

|---|---|---|

| Customer Base Diversity | Dilutes individual customer power, but concentrated volume purchasers have leverage. | Large aftermarket distributors can command better pricing. |

| Product Differentiation & Brand Strength | Limits customer power by reducing price-based switching. | Holley's strong brand recognition among enthusiasts reduces price sensitivity for some segments. |

| Price Sensitivity | Increases customer power as they seek better deals. | Inflationary pressures in 2024 made consumers more cost-conscious. |

| Availability of Substitutes | Significantly increases customer power due to numerous alternatives. | Global automotive aftermarket value exceeding $450 billion highlights intense competition. |

| Information Accessibility (Online) | Empowers customers, increasing their bargaining power through price comparison and research. | Over 70% of consumers researched products online in 2024, comparing prices. |

Preview the Actual Deliverable

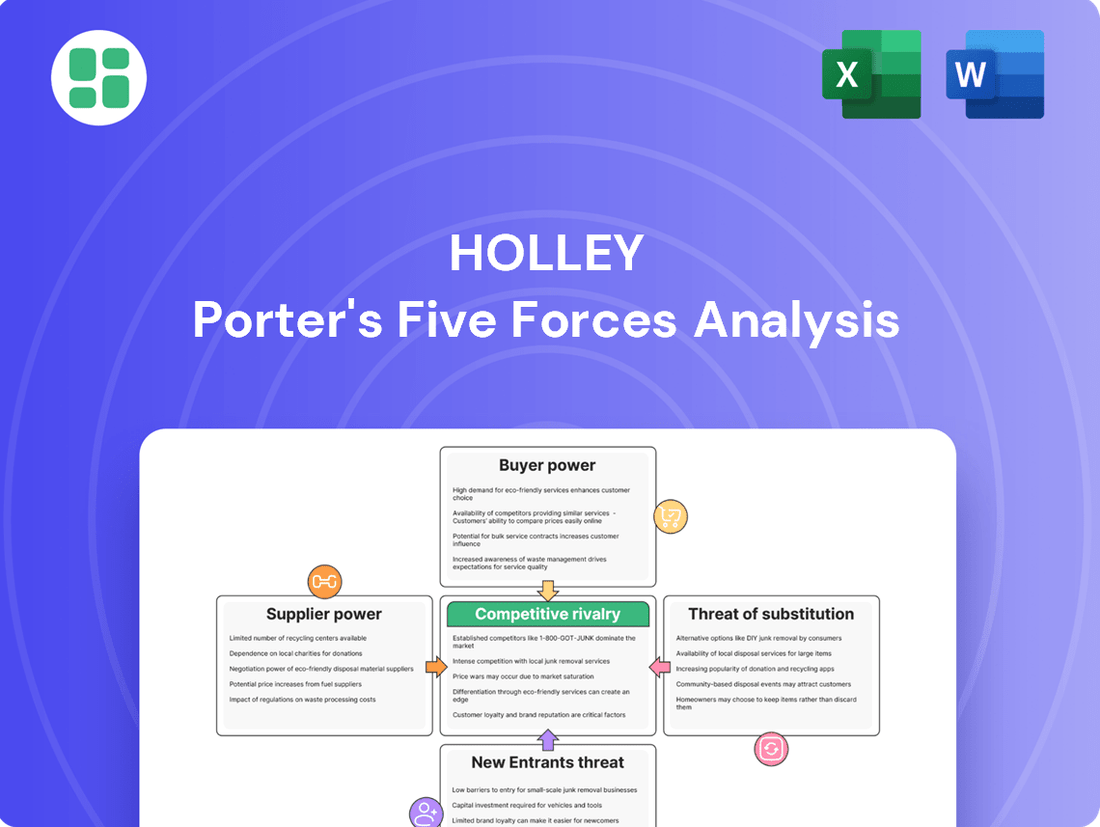

Holley Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Porter's Five Forces, a strategic framework used to analyze industry competition and attractiveness. You'll gain insights into the intensity of rivalry, bargaining power of buyers and suppliers, threat of new entrants, and threat of substitute products, all presented in a ready-to-use format.

Rivalry Among Competitors

The performance automotive aftermarket is a crowded field, featuring a vast number of companies. These range from industry giants with extensive product lines to specialized, smaller firms focusing on specific vehicle types or performance enhancements. This sheer volume and variety of competitors significantly heat up the rivalry.

For instance, in 2024, the global automotive aftermarket sector, which includes performance parts, was valued at over $450 billion. Within this, the performance segment sees intense competition from well-known brands like Edelbrock, COMP Cams, and MagnaFlow, alongside hundreds of smaller, often highly innovative, manufacturers.

This diverse competitive landscape means that companies like Holley must constantly innovate and differentiate their offerings to capture market share. The presence of many players, each with unique strengths and target niches, ensures a dynamic and challenging environment where price, quality, and brand reputation are paramount.

The automotive performance parts market is projected for robust expansion, with analysts anticipating continued growth through 2029. This upward trend is a double-edged sword, as it can soften the intensity of competition by providing ample room for all players to thrive. For instance, the global automotive aftermarket was valued at over $400 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of approximately 5% over the next few years.

However, this very growth acts as a magnet, drawing in new entrants eager to capture a piece of the expanding pie. It also incentivizes established companies to invest more heavily in product development and market penetration, potentially intensifying rivalry as they vie for market share in a growing but increasingly crowded space.

Holley boasts a strong lineup of well-recognized brands, emphasizing innovation to set its products apart in the automotive aftermarket. This differentiation strategy is crucial, as competitors are also actively pursuing unique offerings. For example, in 2024, the automotive aftermarket industry continued to see significant investment in R&D, with companies like Holley introducing new fuel injection systems and engine management technologies.

The competitive landscape is characterized by a constant struggle for market share, driven by factors such as performance enhancements, perceived quality, and established brand loyalty. Holley's ability to maintain its premium positioning relies on its consistent delivery of high-performance parts and its deep connection with enthusiasts, a strategy that has historically proven effective in this segment.

Exit Barriers

High exit barriers can trap even struggling companies in a market, intensifying competition. These barriers might include specialized assets that are difficult to sell, long-term contracts that are costly to break, or a strong brand legacy that companies are reluctant to abandon. This persistence from unprofitable players can result in intensified price wars and an oversupply of goods or services, negatively impacting profitability for all involved.

For instance, in the automotive industry, the immense capital investment in specialized manufacturing plants and R&D creates significant exit barriers. Companies like General Motors, despite facing financial challenges in the past, found it extremely difficult to divest certain operations due to these high costs. In 2023, the automotive sector saw continued investment in electric vehicle (EV) technology, with major players committing billions, further solidifying these exit barriers for traditional internal combustion engine (ICE) focused manufacturers.

- Specialized Assets: High capital expenditure on unique machinery or technology makes it costly to exit.

- Long-Term Contracts: Commitments to suppliers or customers can lock companies into unprofitable operations.

- Brand Legacy: A strong historical brand presence can deter companies from ceasing operations, even when unprofitable.

- Government Regulations: Certain industries may face regulatory hurdles when attempting to shut down or divest operations.

Fixed Costs

Industries characterized by substantial fixed costs, such as those found in performance automotive parts manufacturing and research and development, often foster heightened competitive rivalry. Companies in these sectors face pressure to achieve high production and sales volumes to effectively spread these significant overheads.

This dynamic can translate into aggressive pricing strategies as firms attempt to capture market share and utilize their capacity fully. For instance, in 2024, the automotive aftermarket sector, which includes performance parts, continued to see robust demand, yet the underlying capital investment in specialized manufacturing equipment and ongoing R&D for new product lines means that companies must maintain high output to remain profitable.

- High Fixed Costs Drive Volume: Companies in performance parts manufacturing invest heavily in specialized machinery and R&D, necessitating high sales volumes to amortize these expenses.

- Price Competition as a Result: To cover fixed costs, firms may engage in price wars, impacting overall industry profitability.

- Capacity Utilization is Key: Maximizing production capacity becomes crucial for cost efficiency and competitive pricing.

- R&D Investment Adds to Fixed Costs: Continuous innovation in performance parts requires ongoing R&D spending, further increasing the fixed cost base and intensifying the need for sales volume.

Competitive rivalry in the performance automotive aftermarket is intense due to a large number of players, from global giants to niche specialists. This crowded market, valued at over $450 billion in 2024, sees companies like Edelbrock and COMP Cams vying for market share alongside hundreds of smaller firms.

Holley differentiates itself through innovation, investing in R&D for new technologies like fuel injection systems. However, this market's projected growth, with the global automotive aftermarket expected to expand significantly through 2029, attracts new entrants and spurs existing companies to intensify their efforts.

High exit barriers, such as specialized assets and brand legacy, can keep even struggling companies in the market, leading to price wars. For instance, the automotive sector's substantial investment in EV technology in 2023 creates significant barriers for traditional manufacturers.

Industries with high fixed costs, like performance automotive parts manufacturing, necessitate high sales volumes to spread overheads. This often results in aggressive pricing strategies as companies strive for capacity utilization. For example, in 2024, the automotive aftermarket’s need to cover R&D and specialized manufacturing costs drives a focus on high output and competitive pricing.

| Factor | Impact on Rivalry | Example (2024 Data) |

|---|---|---|

| Number of Competitors | High | Hundreds of companies in the $450+ billion global automotive aftermarket. |

| Industry Growth | Mixed (can soften or intensify) | Projected growth through 2029 attracts new entrants, potentially intensifying competition. |

| Product Differentiation | Crucial | Holley's focus on R&D for new fuel injection systems versus competitors' innovations. |

| Exit Barriers | High | Specialized manufacturing assets and brand legacy make exiting difficult, prolonging rivalry. |

| Fixed Costs | High | Necessitates high sales volumes, often leading to price competition. |

SSubstitutes Threaten

Holley's core business of aftermarket automotive performance parts faces a significant threat from substitutes. Factory-installed performance packages from major automakers are becoming increasingly sophisticated, offering integrated solutions that can rival or even surpass aftermarket options in terms of power, efficiency, and reliability. For instance, many 2024 model year vehicles boast advanced turbocharged engines and advanced electronic tuning straight from the assembly line, diminishing the need for traditional bolt-on modifications.

Furthermore, the rise of vehicle tuning software and electronic control unit (ECU) remapping presents a potent substitute. These digital solutions allow owners to unlock performance gains with relatively low cost and effort, bypassing the need for physical hardware upgrades. The accessibility and increasing capability of such software pose a direct challenge to Holley's traditional product lines.

Beyond direct performance modifications, alternative vehicle types represent another disruptive substitute. The burgeoning electric vehicle (EV) market, with its instant torque and rapid acceleration, offers a fundamentally different performance experience that may appeal to a growing segment of consumers, potentially diverting demand away from internal combustion engine (ICE) aftermarket performance. By 2024, EV sales continued their upward trajectory, capturing significant market share and demonstrating a clear shift in consumer preference for performance characteristics.

While Holley primarily caters to professional builders, the increasing accessibility of online tutorials and affordable tools presents a growing threat from DIY enthusiasts. These individuals might opt for less expensive, off-the-shelf components or even fabricated parts, bypassing Holley's premium offerings. For instance, the automotive aftermarket parts market, which includes DIY-friendly segments, saw significant growth, with some reports indicating a 5% to 10% annual increase in the DIY segment leading up to 2024, driven by accessible online resources.

Customers may choose to focus on essential vehicle maintenance and repair rather than performance enhancements, particularly if economic conditions worsen or extending a vehicle's lifespan becomes a higher priority. This shift could reduce demand for Holley's performance-oriented products.

For instance, in 2024, the average age of vehicles on U.S. roads reached a new record of 12.6 years, indicating a trend towards keeping older cars longer. This longevity focus directly supports the threat of substitutes where basic maintenance and repair services become more appealing than aftermarket performance parts.

Used Vehicle Market Shift

The used vehicle market is experiencing a significant shift, impacting the demand for automotive parts. An aging vehicle parc, with the average age of cars and light trucks in the U.S. reaching a record 12.6 years in 2023, suggests a growing segment of owners prioritizing basic maintenance and repair over performance enhancements. This trend directly increases the threat of substitutes for specialized performance parts, as owners focus on affordability and reliability to keep older vehicles operational.

This dynamic creates a more competitive landscape for performance part manufacturers. As more consumers opt to repair and maintain existing vehicles rather than purchasing new ones, the demand for readily available and cost-effective replacement parts intensifies. This can lead to a greater reliance on generic or aftermarket components that fulfill essential functions, potentially diverting sales from higher-margin performance upgrades.

- Aging Vehicle Fleet: The average age of vehicles on U.S. roads hit 12.6 years in 2023, a historical high.

- Focus on Reliability: Owners of older vehicles are more likely to invest in basic repairs to ensure continued functionality.

- Economic Considerations: The cost-effectiveness of basic replacement parts often outweighs the appeal of performance upgrades for budget-conscious owners.

- Market Segmentation: This shift highlights a growing segment of the market prioritizing essential parts over specialized performance components.

Technological Advancements in OEMs

Technological advancements by Original Equipment Manufacturers (OEMs) present a significant threat of substitutes for Holley. As OEMs increasingly equip their vehicles with high-performance engines and sophisticated integrated systems, the demand for aftermarket performance parts, a core Holley offering, may diminish. For instance, many 2024 model year vehicles come standard with advanced electronic fuel injection and engine management systems that offer substantial performance out of the box.

This trend directly impacts Holley’s market by reducing the perceived need for customers to upgrade their vehicles with aftermarket components to achieve higher performance levels. The growing capability of factory-installed systems means consumers might find factory options sufficient for their needs, thus bypassing the aftermarket entirely. In 2023, the global automotive aftermarket was valued at approximately $477 billion, but a significant shift towards integrated OEM performance could alter this trajectory.

- OEM Performance Integration: Manufacturers are embedding advanced performance features directly into new vehicles, lessening the appeal of aftermarket upgrades.

- Reduced Need for Modification: Consumers may find stock vehicle performance adequate, decreasing reliance on aftermarket parts for enhanced capabilities.

- Market Value Impact: The automotive aftermarket, valued around $477 billion in 2023, faces potential disruption as factory-built performance becomes more prevalent.

- Technological Parity: OEM advancements are closing the performance gap, making aftermarket solutions less distinct and therefore less attractive to a broader consumer base.

The threat of substitutes for Holley is multifaceted, stemming from evolving OEM capabilities, digital tuning, alternative vehicle types, and a growing DIY segment. As automakers integrate more sophisticated performance features directly into vehicles, the need for aftermarket upgrades diminishes. For instance, many 2024 models offer advanced turbocharged engines and electronic tuning from the factory, providing substantial performance gains without modifications.

Digital solutions like ECU remapping offer a cost-effective alternative to physical parts, allowing owners to unlock performance gains with software alone. Furthermore, the rise of electric vehicles (EVs) presents a different kind of substitute, with their inherent instant torque and acceleration appealing to a new generation of performance enthusiasts. By 2024, EV market share continued to grow, signaling a shift in consumer preference.

The increasing age of vehicles on U.S. roads, averaging 12.6 years in 2023, also fuels the threat of substitutes. Owners of older cars are more inclined to prioritize essential maintenance and repairs over performance enhancements, opting for more affordable and reliable replacement parts. This focus on longevity and cost-effectiveness diverts demand from specialized, higher-margin performance components.

| Substitute Type | Description | Impact on Holley | 2023/2024 Relevance |

|---|---|---|---|

| OEM Performance Integration | Factory-installed high-performance engines and integrated systems. | Reduces perceived need for aftermarket upgrades. | Sophistication of 2024 models. |

| Digital Tuning (ECU Remapping) | Software-based performance enhancements. | Low-cost, accessible alternative to physical parts. | Increasing accessibility and capability of software. |

| Electric Vehicles (EVs) | Alternative vehicle type with inherent performance characteristics. | Diverts demand from internal combustion engine (ICE) performance. | Continued upward trajectory of EV sales. |

| Basic Maintenance & Repair | Focus on keeping existing vehicles operational. | Prioritizes cost-effective replacement parts over performance upgrades. | Average vehicle age of 12.6 years in U.S. roads (2023). |

Entrants Threaten

Entering the automotive performance products market demands substantial capital investment. Companies need to fund advanced manufacturing facilities, cutting-edge research and development, and robust distribution networks. For instance, establishing a new, high-volume production line for specialized engine components could easily run into tens of millions of dollars, not including the ongoing R&D costs to stay competitive.

Holley's established infrastructure acts as a significant deterrent to potential newcomers. With decades of experience, existing production capacity, and a widespread dealer and installer network, Holley has already overcome these initial capital hurdles. This existing scale allows Holley to achieve economies of scale, making it difficult for new entrants to compete on price and product availability from the outset.

Holley's formidable brand loyalty, cultivated through decades of association with iconic automotive brands like Holley Carburetors and Hooker Headers, presents a significant barrier to new entrants. This loyalty is deeply entrenched among a passionate base of automotive enthusiasts and professional builders who trust Holley's heritage of performance and quality.

Established relationships with a vast network of distributors, retailers, and custom shops further solidify Holley's market position. Gaining comparable access and trust within this ecosystem would require substantial investment and time for any newcomer, making it a formidable challenge to replicate Holley's existing market penetration.

Securing effective distribution channels, whether direct-to-consumer, business-to-business, or through retail partnerships, presents a significant hurdle for new entrants. Established players often leverage pre-existing relationships and infrastructure, making it difficult for newcomers to gain access. Holley, for instance, navigates a multi-channel distribution strategy, indicating the complexity and importance of these networks.

Economies of Scale

Holley's significant size grants it substantial economies of scale in manufacturing, purchasing, and marketing. This allows the company to spread its fixed costs over a larger production volume, resulting in lower per-unit costs compared to smaller or newer competitors. For instance, in 2023, Holley reported net sales of $730.9 million, demonstrating its substantial operational footprint.

These cost advantages act as a significant barrier to entry for potential new players. A new entrant would struggle to match Holley's production efficiency and purchasing power, making it difficult to compete on price. This scale advantage is particularly pronounced in the automotive aftermarket industry, where established players often have long-standing supplier relationships and optimized production processes.

- Manufacturing Efficiency: Holley's large-scale production facilities enable it to achieve lower manufacturing costs per unit.

- Purchasing Power: Bulk purchasing of raw materials and components allows Holley to negotiate more favorable prices from suppliers.

- Marketing Reach: Established brand recognition and extensive marketing channels mean Holley can acquire customers at a lower cost than a new entrant.

- Product Diversification: A broad product portfolio further leverages these economies of scale across various segments of the automotive aftermarket.

Proprietary Technology and Patents

Holley's existing portfolio of proprietary technology, protected by numerous patents, presents a significant barrier to entry for potential competitors. These patents cover critical areas such as advanced fuel delivery systems, high-performance engine components, and innovative exhaust technologies. For instance, as of early 2024, Holley holds over 100 active patents in the automotive aftermarket sector, many of which are central to their product lines. This intellectual property requires new entrants to either license Holley's technology, which is unlikely to be granted, or invest substantial resources in research and development to create comparable, non-infringing alternatives. This R&D investment can easily run into millions of dollars, making it a formidable hurdle for smaller or less capitalized companies aiming to enter the market.

The cost and time associated with developing novel technologies to circumvent existing patents are substantial. New entrants must navigate a complex legal landscape, ensuring their products do not infringe on Holley's intellectual property rights. Failure to do so can result in costly litigation and injunctions, further increasing the risk and expense of market entry. For example, developing a new fuel injection system that meets performance standards without infringing on Holley's patented designs could take years and require significant capital investment.

- Patent Protection: Holley's extensive patent portfolio acts as a strong deterrent to new entrants.

- R&D Investment: Competitors must commit significant funds to develop alternative technologies.

- Legal Hurdles: Navigating intellectual property law adds complexity and cost for newcomers.

- Market Entry Cost: The combined effect of R&D and legal considerations raises the barrier to entry considerably.

The threat of new entrants in the automotive performance products market is generally low for Holley. Significant capital is required for manufacturing and R&D, with new production lines costing tens of millions. Holley's established infrastructure, brand loyalty, and extensive distribution networks, built over decades, create substantial barriers. For example, in 2023, Holley reported net sales of $730.9 million, underscoring its scale and market presence.

Holley's intellectual property, protected by over 100 active patents as of early 2024, further deters new players. Developing non-infringing technologies requires millions in R&D and navigating complex legal landscapes, making market entry costly and time-consuming.

| Barrier to Entry | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High costs for manufacturing, R&D, and distribution. | Significant financial hurdle, requiring substantial investment. |

| Brand Loyalty & Reputation | Decades of association with performance and quality. | Difficult for newcomers to build comparable trust and recognition. |

| Distribution Networks | Established relationships with dealers and installers. | New entrants face challenges in gaining market access and reach. |

| Economies of Scale | Lower per-unit costs due to high production volume. | New entrants struggle to compete on price and availability. |

| Intellectual Property | Extensive patent portfolio on key technologies. | Requires costly R&D or licensing to overcome, increasing entry barriers. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, incorporating information from industry-specific market research reports, company annual filings, and expert interviews. This multi-faceted approach ensures a comprehensive understanding of competitive dynamics.