Holley Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Holley Bundle

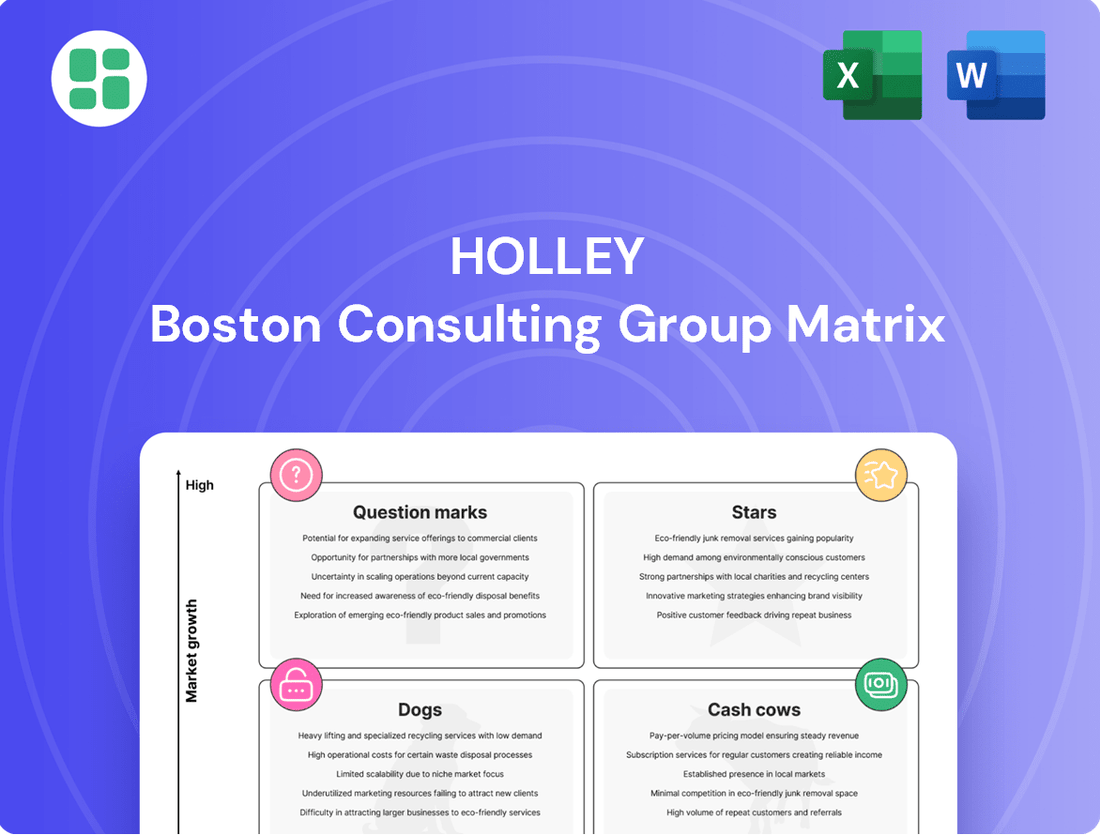

Curious about which products are driving growth and which are lagging? The Holley BCG Matrix provides a foundational understanding of a company's product portfolio, categorizing them into Stars, Cash Cows, Dogs, and Question Marks based on market share and growth rate. This essential framework helps identify areas for investment and divestment.

Unlock the full strategic potential by purchasing the complete Holley BCG Matrix. Gain access to detailed quadrant analysis, actionable insights for each product category, and a clear roadmap for optimizing your business strategy and resource allocation. Don't just understand the basics; master your portfolio.

Stars

Holley's modern EFI systems, like the Sniper EFI and Terminator X, are significant growth drivers, particularly for classic and performance car enthusiasts looking to upgrade. These systems provide substantial performance gains and are known for their user-friendly operation, appealing to a wide range of hobbyists.

The demand for EFI conversions and upgrades continues to be strong, with the aftermarket performance parts industry showing consistent growth. In 2024, the global automotive aftermarket industry was valued at over $500 billion, with performance parts being a substantial contributor.

Holley's strategic focus on components for popular late-model engine platforms like the GM LS and Ford Coyote positions them in a high-growth, high-market-share segment. These engines are incredibly popular for vehicle swaps and performance modifications, creating a robust and consistent demand for Holley's intake manifolds, tuners, and exhaust systems. For instance, the aftermarket for LS engine swaps alone is a multi-billion dollar industry, with Holley capturing a significant portion through its specialized offerings.

The company actively cultivates this market by engaging directly with enthusiasts at major events such as LS Fest, which saw over 10,000 attendees in 2023, showcasing Holley's commitment to and presence within this core customer base. This direct engagement not only drives sales but also provides valuable market feedback for future product development, reinforcing Holley's leadership in this lucrative niche.

The demand for forced induction solutions like superchargers and turbochargers is robust, driven by automotive enthusiasts chasing substantial power enhancements. Holley's comprehensive product line, encompassing intake manifolds and tuning systems, directly addresses this high-growth market, solidifying their strong competitive standing.

Holley's commitment to innovation, exemplified by their new intake manifold designs for popular engines like the Ford Coyote, underscores their leadership in the forced induction segment. This focus on cutting-edge solutions ensures they remain at the forefront of meeting enthusiast needs.

Off-Road and Truck Performance Products

Holley's strategic expansion into the Modern Truck & Off-Road vertical, encompassing brands like Flowmaster, ADS, Superchips, and DiabloSport, is a calculated move to capitalize on a burgeoning market. This segment is experiencing robust demand for performance exhaust systems, suspension upgrades, and vehicle tuners, all crucial components for truck and off-road enthusiasts. Holley's investment in this area highlights its commitment to capturing significant growth opportunities.

The performance aftermarket for trucks and off-road vehicles is a dynamic sector. For instance, in 2024, the global automotive aftermarket, which includes these specialized segments, was projected to continue its upward trajectory. Holley's brands are well-positioned to benefit from this trend, with specific product categories like performance exhaust and engine tuning showing consistent consumer interest.

- Market Growth: The modern truck and off-road segment represents a significant and expanding portion of the automotive aftermarket.

- Brand Synergy: Holley's acquisition and integration of key brands like Flowmaster and Superchips create a powerful portfolio within this niche.

- Product Demand: Performance exhaust systems, suspension components, and electronic tuners are consistently high-demand items for truck and off-road vehicle owners.

- Strategic Focus: This vertical is a critical area for Holley's future growth strategy and market penetration.

Safety & Racing Products (e.g., Simpson, Stilo)

The Safety & Racing Products vertical, featuring brands like Simpson and Stilo, is a strong performer within Holley's portfolio. This segment benefits from a growing market, fueled by the demands of professional racing and a rising interest in safety among enthusiasts. Holley's dedication to innovation in this area keeps its products competitive and at the cutting edge of performance and protection.

This category is characterized by its high market share and consistent growth. For instance, the global motorsports safety equipment market was valued at approximately $1.5 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 5% through 2030. Holley's investment in research and development ensures that brands like Simpson and Stilo continue to lead in this expanding market.

- High Market Share: Simpson and Stilo are recognized leaders in their respective safety and racing product categories.

- Consistent Growth: The segment benefits from ongoing demand from professional racing and a growing enthusiast base prioritizing safety.

- Innovation Focus: Holley actively invests in R&D to maintain product leadership and meet evolving safety standards.

- Event Presence: Holley strategically showcases these product innovations at key industry events such as the Performance Racing Industry (PRI) Show, reinforcing their market position.

Stars in the BCG matrix represent products or business units with high market share in a high-growth market. Holley's modern EFI systems and its strategic focus on popular late-model engine platforms exemplify this category. The company's active engagement with enthusiasts at events further solidifies its leadership in these rapidly expanding segments.

The demand for performance upgrades in classic and modern vehicles continues to surge, driving growth in these areas. Holley's innovative product lines, such as the Sniper EFI, cater directly to this demand, ensuring strong sales and market presence.

The aftermarket for performance parts, particularly for engines like the GM LS, is a multi-billion dollar industry where Holley holds a significant position. This strong market share in a growing sector clearly places these offerings in the Star quadrant.

Holley's brands like Flowmaster and Superchips, within the Modern Truck & Off-Road vertical, also exhibit characteristics of Stars. The robust demand for performance exhaust and tuning for trucks, coupled with Holley's strong brand portfolio, positions this segment for continued high growth and market leadership.

What is included in the product

The Holley BCG Matrix analyzes products/business units based on market share and growth, guiding investment and divestment decisions.

Visualize strategic positioning, simplifying complex portfolio decisions.

Cash Cows

Traditional Holley carburetors, despite the prevalence of electronic fuel injection (EFI), continue to be a significant revenue generator for Holley. This segment is particularly strong in the vintage vehicle restoration and drag racing communities, where these iconic pieces are highly sought after. Holley's dominant market share in this mature segment ensures consistent cash flow with minimal need for extensive new product development.

Classic exhaust systems from brands like Flowmaster and Hooker Blackheart are prime examples of Cash Cows for Holley. These well-established product lines hold a dominant market share, particularly within the enthusiast segment for popular domestic muscle cars.

The market for these systems is mature, characterized by consistent demand from restorers and hobbyists. This stability translates into predictable revenue streams and healthy profit margins, often requiring minimal investment in marketing or product development.

In 2024, the aftermarket exhaust segment, which includes these classic systems, continued to show resilience. While specific Holley data isn't publicly broken down by individual product lines, the broader automotive aftermarket industry saw continued growth, with reports indicating a compound annual growth rate (CAGR) of around 3-4% for the performance and accessories segment leading up to 2025.

MSD Ignition Systems, a cornerstone of Holley's portfolio, represents a classic Cash Cow. Its ignition components are vital for a vast array of performance vehicles, and the brand's enduring reputation guarantees steady demand.

The mature technology behind MSD's products, coupled with its extensive market penetration, translates into a predictable and robust revenue stream for Holley. This consistent performance solidifies its position as a reliable cash generator within the company's diverse offerings.

Common Fuel Pumps and Filters

Common fuel pumps and filters, encompassing both standard replacements and performance upgrades for a wide array of vehicles, fall into the Cash Cows category within Holley's BCG Matrix. This segment is characterized by high sales volume but limited growth potential, reflecting a mature market for essential automotive components. Holley's strong distribution network ensures consistent demand and reliable cash flow from these products.

These components are vital for vehicle maintenance and performance enhancement, creating a stable revenue stream. For instance, the aftermarket automotive parts industry, which includes fuel pumps and filters, was projected to reach over $400 billion globally by 2024, demonstrating the sheer scale of this market. Holley's established presence in this sector allows them to capitalize on this consistent demand.

- High Volume, Low Growth: The market for standard replacement and upgrade fuel pumps and filters is substantial but not rapidly expanding.

- Steady Cash Flow: Consistent demand due to the necessity of these parts provides a predictable and reliable income for Holley.

- Established Distribution: Holley's extensive network facilitates efficient sales and delivery, reinforcing its market position.

- Market Size: The global aftermarket automotive parts industry, a key indicator for this segment, is valued in the hundreds of billions of dollars, underscoring the significant revenue potential.

Basic Engine Dress-Up and Accessory Lines

Holley's basic engine dress-up and accessory lines, such as valve covers and air cleaners, represent a classic cash cow in the BCG matrix. These products, while not experiencing rapid market growth, consistently generate reliable sales. This stability stems from their enduring appeal to vehicle owners looking to customize and personalize their engines, a segment that remains active. Holley's strong brand presence and comprehensive product offerings in this category solidify its position as a dependable income source.

The financial performance of these accessory lines is characterized by steady revenue generation with relatively low overhead. For instance, in 2024, Holley reported that its engine dress-up and accessory segments contributed significantly to overall profitability, demonstrating a mature market segment that continues to provide substantial returns. Minimal investment in research and development for these established products allows for a high-margin contribution to the company's bottom line.

- Consistent Revenue: Engine dress-up items offer predictable sales, appealing to a dedicated customization market.

- Brand Loyalty: Holley's established reputation ensures continued demand for these accessories.

- Low R&D Costs: Mature product lines require minimal investment, maximizing profit margins.

- Profitability Driver: These accessories are key contributors to Holley's overall financial health in 2024.

Holley's established carburetor lines, particularly for classic and performance applications, continue to be significant revenue generators. These products benefit from a loyal customer base in the restoration and racing communities, ensuring consistent demand. The mature nature of this market means that while growth is limited, the cash flow generated is substantial and predictable for Holley.

Holley's classic exhaust systems, including brands like Flowmaster, represent stable income sources. The demand from enthusiasts for these well-known performance upgrades remains strong, particularly for popular vehicle platforms. This segment benefits from Holley's dominant market share, translating into reliable cash flow with minimal need for extensive reinvestment.

MSD Ignition Systems are a prime example of a cash cow for Holley. The brand's strong reputation and the essential nature of its ignition components for a wide range of performance vehicles guarantee steady sales. This mature product category, with its established technology and broad market penetration, consistently contributes to Holley's profitability.

Holley's fuel pumps and filters, essential for both maintenance and performance upgrades, are solid cash cows. This segment operates in a mature market with high sales volume but limited growth potential. Holley's extensive distribution network ensures consistent demand, providing a reliable stream of income. The global aftermarket automotive parts industry, which includes these components, was projected to exceed $400 billion in 2024, highlighting the scale of this market.

Basic engine dress-up items and accessories from Holley, such as valve covers and air cleaners, are also considered cash cows. These products cater to a consistent demand for vehicle customization and personalization. In 2024, these segments demonstrated their ability to generate steady revenue with low overhead, contributing significantly to Holley's overall financial health due to minimal R&D requirements.

| Product Category | BCG Status | Key Characteristics | 2024 Market Insight | Holley's Position |

|---|---|---|---|---|

| Classic Carburetors | Cash Cow | Mature market, loyal customer base, consistent demand. | Strong in restoration and racing segments. | Dominant market share, reliable cash flow. |

| Classic Exhaust Systems | Cash Cow | Established brands, consistent demand from enthusiasts. | Resilient aftermarket segment, continued demand. | Market leader, predictable revenue. |

| MSD Ignition Systems | Cash Cow | Enduring reputation, vital for performance vehicles. | Steady demand due to essential function. | Reliable cash generator, broad market penetration. |

| Fuel Pumps & Filters | Cash Cow | High volume, low growth, essential components. | Aftermarket projected over $400 billion globally in 2024. | Strong distribution, consistent demand. |

| Engine Dress-Up & Accessories | Cash Cow | Steady revenue, low R&D, customization appeal. | Significant profitability contributor in 2024. | Dependable income source, strong brand. |

What You See Is What You Get

Holley BCG Matrix

The preview you are currently viewing is the exact Holley BCG Matrix document you will receive upon purchase. This comprehensive report, meticulously crafted for strategic insight, will be delivered to you in its final, unwatermarked form, ready for immediate application in your business planning. You can be confident that the detailed analysis and professional formatting you see here are precisely what you will download, enabling you to effectively categorize and strategize for your product portfolio.

Dogs

Discontinued or low-demand Stock Keeping Units (SKUs) represent Holley's "Dogs" in the Boston Consulting Group (BCG) matrix. These are products with low market share and low growth potential. Holley has strategically streamlined its offerings by removing around 12,000 such SKUs, a move designed to improve operational efficiency and focus resources on more profitable areas.

Outdated electronic accessories, like standalone analog gauges, often find themselves in the Dogs category of the BCG Matrix. These products, once popular, have been largely replaced by integrated digital systems, leading to a declining market share and low growth prospects. For instance, the market for aftermarket automotive analog gauges, while still existing, has seen a significant shift towards digital displays and integrated vehicle information systems.

Niche products catering to extremely specialized or rare vehicle applications often fall into the 'dog' category of the BCG matrix. These items serve a minuscule market that isn't expanding, making them financially challenging to sustain.

The costs associated with managing inventory and production for such limited-demand products typically exceed the meager revenue they generate. For example, a manufacturer might produce a specific carburetor for a classic car model with only a few thousand units remaining globally, leading to high per-unit costs and low sales volume.

Commoditized Basic Maintenance Chemicals (Pre-Cataclean)

Before the strategic licensing agreement for Cataclean, Holley's commoditized basic maintenance chemicals, like generic engine cleaners or fuel additives, would have fallen into the 'dog' category of the BCG Matrix. These products faced intense price competition and offered little differentiation, leading to low margins and minimal market share gains.

These types of chemicals typically operate in highly saturated markets where brand loyalty is low and purchasing decisions are primarily driven by price. For instance, the global automotive aftermarket chemicals market, while substantial, is characterized by numerous players offering similar products, making it difficult for any single generic item to stand out.

- Low Market Share: These chemicals likely held a small percentage of the overall maintenance chemical market.

- Low Market Growth: The market for generic, undifferentiated maintenance chemicals generally experiences slow growth.

- Low Profitability: Intense competition drove down prices, resulting in thin profit margins for these products.

- Lack of Competitive Advantage: Holley possessed no unique selling proposition for these basic chemical offerings.

Underperforming Acquired Brands/Product Lines

Holley's acquisition strategy, while generally robust, can sometimes lead to underperforming assets. These acquired brands or specific product lines might not capture the expected market share or exhibit desired growth, effectively becoming cash traps within the portfolio.

For instance, if an acquired company's key product line consistently misses sales targets, it could drain resources without generating sufficient returns. This situation demands careful evaluation.

- Underperforming Acquired Brands: These are brands brought into Holley through mergers or acquisitions that fail to meet initial growth and market share projections.

- Cash Trap Identification: A brand becomes a cash trap when its ongoing operational costs and investment needs outweigh the revenue and profit it generates.

- Divestiture or Restructuring: Consistently underperforming assets are prime candidates for divestiture, selling them off to another entity, or undergoing significant restructuring to improve their viability.

- Strategic Portfolio Management: Holley must continually assess its acquired assets to ensure they align with overall strategic goals and contribute positively to the company's performance.

Holley's "Dogs" represent products with low market share and minimal growth potential, often stemming from discontinued SKUs or outdated technologies. The company has actively managed this by shedding approximately 12,000 such items to enhance efficiency and redirect capital toward more promising ventures.

For example, standalone analog gauges, once a staple, now fall into this category due to the industry's shift towards integrated digital systems, diminishing their market relevance and growth prospects.

Niche products for very specific or rare vehicle applications also become "Dogs" due to their limited customer base and lack of expansion opportunities, often resulting in high per-unit costs that outweigh sales revenue.

Holley's strategic pruning of these underperforming assets, including certain commoditized chemicals before their licensing, aims to streamline operations and improve overall portfolio health.

| Category | Description | Examples | Market Share | Growth Potential | Profitability |

|---|---|---|---|---|---|

| Dogs | Low market share, low growth potential products | Discontinued SKUs, outdated analog gauges, niche parts, underperforming acquired brands | Low | Low | Low |

Question Marks

As the electric vehicle (EV) market accelerates, Holley's exploration into EV performance components positions them in a high-growth, yet potentially low-market-share, segment. This area demands substantial investment in research and development, alongside robust marketing efforts, to cultivate future market leaders.

The automotive aftermarket is experiencing a notable surge in demand for EV-specific services and modifications. By 2024, the global EV aftermarket was estimated to be worth over $20 billion, with projections indicating continued strong growth driven by increasing EV adoption and the desire for personalized performance.

Integrating Advanced Driver-Assistance Systems (ADAS) into aftermarket performance vehicles presents a potential "Question Mark" opportunity for Holley. While the automotive aftermarket is increasingly adopting these technologies, Holley's current market share in ADAS integration is likely minimal, necessitating significant R&D and marketing investment to gain traction.

The global ADAS market was valued at approximately $30 billion in 2023 and is projected to grow substantially, reaching over $100 billion by 2030, indicating a strong growth trajectory. For Holley, this represents a chance to expand its performance electronics portfolio into a rapidly evolving segment, though establishing a competitive position will require overcoming established players and demonstrating superior integration capabilities for performance applications.

Holley's strategic push towards digital modernization and enhanced B2B sales capabilities aligns with the broader industry trend of manufacturers embracing direct-to-consumer (DTC) channels. This suggests a potential for new direct sales initiatives, which, while offering high growth potential, will likely demand substantial investment to gain market traction against established distribution networks. This emerging strategy is gaining traction across the automotive aftermarket sector.

International Market Expansion (e.g., Mexico, Euro & Import)

Holley's international market expansion, particularly into Mexico and the Euro & Import segment, positions these ventures as potential Stars within the BCG matrix. These markets offer substantial growth prospects, but Holley's current market share is relatively modest, necessitating strategic investment. For instance, in 2024, the global automotive aftermarket was projected to reach over $500 billion, with emerging markets like Mexico showing significant upward trends in vehicle parc and aftermarket spending.

- Mexico's growing automotive sector: Mexico's vehicle production and sales have shown resilience, creating a fertile ground for aftermarket parts.

- Euro & Import segment potential: The demand for specialized parts for European and other imported vehicles in North America presents a distinct growth avenue.

- Investment requirements: Success hinges on substantial investment in localized distribution networks, targeted marketing campaigns, and product adaptation to meet regional preferences and regulations.

- Market share growth: The objective is to leverage these investments to capture a larger share of these high-growth international markets, transforming them into future Cash Cows.

Next-Generation Engine Management and Sensor Technologies

Next-generation engine management and sensor technologies, incorporating AI and machine learning, are positioned as a high-growth area within Holley's portfolio. These innovations promise real-time optimization for enhanced performance and efficiency. For instance, the automotive semiconductor market, which underpins these advancements, was projected to reach over $70 billion in 2024, indicating substantial investment and potential.

While the future prospects are bright, these cutting-edge solutions may currently occupy a smaller market share. This is often due to the early stages of adoption and the significant research and development costs associated with such advanced technologies. The complexity of integrating AI into existing vehicle architectures also presents a hurdle for widespread, immediate implementation.

- High Growth Potential: AI and machine learning integration in ECUs and sensors offer advanced real-time optimization capabilities.

- Early Adoption Phase: Current market penetration might be limited due to the novelty and ongoing development of these technologies.

- Development Costs: Significant R&D investment is required, potentially impacting initial profitability and market share.

- Technological Advancement: The automotive semiconductor market, a key enabler, is experiencing robust growth, supporting these next-generation systems.

Holley's foray into EV performance components and ADAS integration for aftermarket vehicles represent classic "Question Mark" scenarios. These areas are characterized by high growth potential but currently low market share for Holley, demanding significant investment in R&D and marketing to capture future market leadership.

The global EV aftermarket is projected to exceed $20 billion in 2024, highlighting the substantial opportunity. Similarly, the ADAS market, valued around $30 billion in 2023, is expected to surge past $100 billion by 2030, underscoring the need for strategic entry and development.

These segments require Holley to carefully allocate resources to build brand recognition and technological expertise, transforming nascent opportunities into future market strengths.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from financial reports, market research, and industry trend analyses to accurately position business units.