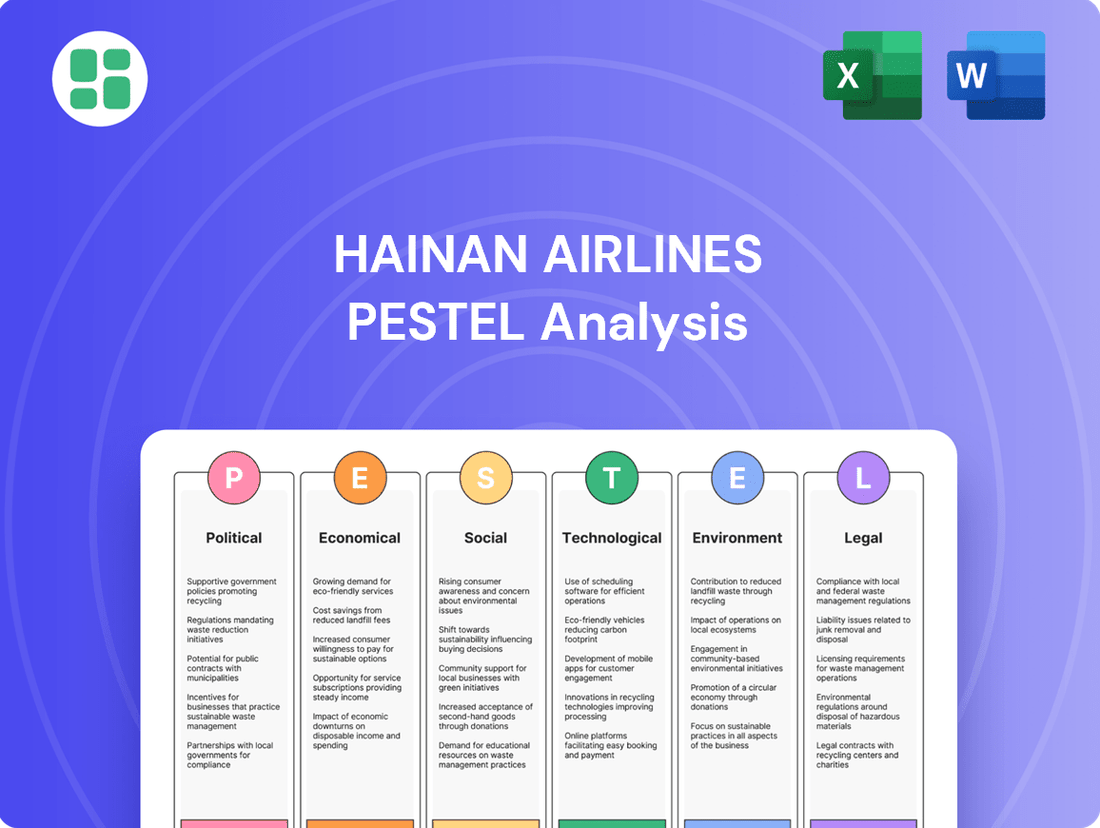

Hainan Airlines PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hainan Airlines Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Hainan Airlines's trajectory. Our meticulously researched PESTLE analysis provides the essential context for understanding the airline's operational landscape and future challenges. Gain a competitive advantage by leveraging these insights to inform your strategic decisions. Download the full PESTLE analysis now for actionable intelligence.

Political factors

The Chinese government, through the Civil Aviation Administration of China (CAAC), actively shapes the aviation landscape with ambitious growth targets. This support is crucial for carriers like Hainan Airlines.

The industry's return to profitability in 2024, after a challenging period, signals a positive trend. Projections for 2025 anticipate a further surge, with an aim to carry 780 million passengers, underscoring a favorable operating environment.

Hainan Airlines, headquartered in Hainan, directly benefits from the province's ambitious Free Trade Port (FTP) initiatives. These policies are actively fostering a more open economic environment, which is crucial for an airline. For instance, the expanded visa-free transit policy, allowing citizens from 59 countries to enter Hainan visa-free for up to 30 days, significantly eases travel for international passengers.

The overarching goal of transforming Hainan into a premier global trade and tourism destination is a direct driver for increased air travel. This strategic development is projected to substantially boost both inbound and outbound passenger traffic for Hainan Airlines, enhancing its route profitability and network expansion opportunities.

Geopolitical tensions, especially between China and the United States, significantly impact international route expansion for airlines like Hainan Airlines. These relations directly influence the approval process for new international routes, which are often governed by bilateral air service agreements. For instance, in 2024, the US Department of Transportation continued to manage capacity on routes between the US and China, reflecting ongoing diplomatic considerations.

State-led Restructuring and Ownership Changes

The political landscape significantly impacted Hainan Airlines through state-led restructuring. A pivotal event was the transfer of its core aviation business from the HNA Group to Liaoning Fangda Group Industrial Co. This transition, finalized following extensive bankruptcy proceedings, marked a substantial ownership change aimed at revitalizing the airline's financial standing.

This strategic investment by Liaoning Fangda Group is designed to inject stability and improve operational efficiency. By shedding the previous group's financial burdens, Hainan Airlines can now focus on a more streamlined and financially sound operational model. The completion of this restructuring in late 2022 provided a new foundation for the airline's future growth and market position.

- Ownership Transfer: Hainan Airlines' aviation assets moved from HNA Group to Liaoning Fangda Group Industrial Co.

- Restructuring Completion: The significant ownership change was finalized after bankruptcy proceedings, aiming for financial stabilization.

- Strategic Goal: The move is intended to allow Hainan Airlines to operate with reduced financial encumbrances and improved health.

Domestic Competition and Market Regulation

The Chinese aviation sector is experiencing a robust recovery, but this resurgence is marked by heightened domestic competition. Major carriers are vying for market share, creating a dynamic and often challenging environment for airlines like Hainan Airlines. This intensified competition necessitates agile strategies to maintain profitability and market presence.

Government regulations and policy directives play a crucial role in shaping the operational landscape. These include stipulations on capacity allocation, the approval of new routes, and broader market access rules. For Hainan Airlines, understanding and adapting to these regulatory shifts is paramount for its competitive strategy within China's vast domestic market.

For instance, the Civil Aviation Administration of China (CAAC) has been actively managing capacity to ensure stable growth and prevent oversupply. In 2023, while passenger traffic recovered significantly, reaching approximately 90% of 2019 levels, the CAAC's capacity management efforts continue to influence route planning and operational efficiency for all airlines.

- Intensified Competition: Major Chinese airlines are actively competing for passengers and market share as the sector rebounds.

- Regulatory Influence: Government policies on capacity, routes, and market access significantly impact airline operations and strategy.

- Market Recovery Data: Chinese domestic passenger traffic in 2023 neared pre-pandemic levels, indicating a strong but competitive recovery.

- Strategic Adaptation: Hainan Airlines must continually adjust its strategies to navigate the evolving regulatory and competitive pressures within China.

Government policies directly support aviation growth, with China aiming to carry 780 million passengers in 2025. Hainan's Free Trade Port initiatives, including visa-free transit for 59 countries, boost international travel, benefiting Hainan Airlines' route expansion and profitability.

Geopolitical factors, particularly US-China relations, influence international route approvals, as seen with US capacity management on China routes in 2024. The airline also underwent a significant political and financial restructuring, with its core aviation business transferring from HNA Group to Liaoning Fangda Group Industrial Co. in late 2022, aiming for improved financial health and operational efficiency.

What is included in the product

This PESTLE analysis examines the external macro-environmental factors impacting Hainan Airlines across political, economic, social, technological, environmental, and legal dimensions, providing actionable insights for strategic decision-making.

A Hainan Airlines PESTLE analysis, presented in a clear, summarized format, alleviates the pain of sifting through complex data, enabling swift strategic decision-making.

Economic factors

China's civil aviation sector returned to profitability in 2024, a significant turnaround after four consecutive years of losses. This positive momentum is expected to continue, with the industry aiming to transport 780 million passengers in 2025, indicating robust growth targets and a more supportive economic climate for airlines like Hainan Airlines.

Fuel price volatility continues to be a significant hurdle for airlines, directly impacting operational expenses for carriers like Hainan Airlines. For instance, in 2024, global jet fuel prices have fluctuated, with some reports indicating average prices around $2.50 per gallon, a considerable increase from pre-pandemic levels.

Hainan Airlines' strategic focus on fleet modernization, including the integration of newer, more fuel-efficient aircraft, is a direct response to these escalating costs. By replacing older models with advanced planes, the airline aims to achieve substantial savings in fuel consumption, potentially improving its cost structure by 10-15% per flight hour for newer aircraft compared to older generations.

Hainan Airlines is witnessing a robust rebound in passenger numbers, with both domestic and international travel demand showing substantial growth, especially during high-demand periods like the 2025 Spring Festival.

The air cargo segment in China experienced a significant surge in 2024, with air freight volumes increasing by an estimated 15% year-on-year, bolstering the overall aviation industry's recovery.

Consumer Spending and Travel Demand

Consumer spending on travel is experiencing a significant upswing, with projections indicating that Chinese outbound travel will not only recover but exceed pre-pandemic levels by 2025. This surge directly benefits airlines like Hainan Airlines, as it signals strong demand for air travel services.

The evolving travel landscape, marked by the rise of 'bleisure' (business + leisure) trips and an increase in last-minute bookings, presents further opportunities for Hainan Airlines to capture a larger market share. These trends suggest a more dynamic and potentially higher-spending travel demographic.

- Projected Exceedance: Chinese outbound travel anticipated to surpass 2019 levels by 2025.

- 'Bleisure' Trend: Growing integration of business and leisure travel boosting demand.

- Last-Minute Bookings: Increased flexibility in travel plans leading to more spontaneous reservations.

- Consumer Confidence: Rising disposable incomes and a desire for experiences fuel travel expenditure.

Access to Financing and Investment

Following its restructuring, Hainan Airlines has been actively seeking and securing strategic investment to bolster its financial health. The company's 2024 Annual General Meeting (AGM) approved its financial and financing plans for 2025, signaling a clear commitment to accessing capital for both operational needs and future growth initiatives. This strategic focus on financing is crucial for its ongoing efforts to repay debts and enhance overall financial stability.

The airline's financial strategy for 2025 highlights a determined approach to securing necessary funds. This includes:

- Securing Strategic Investments: Hainan Airlines is actively attracting new capital from strategic partners.

- Debt Repayment Focus: A primary objective is to reduce existing debt burdens and improve its balance sheet.

- Financing Plan Approval: The 2025 financing plan, approved at the 2024 AGM, outlines pathways for capital acquisition.

- Enhancing Financial Stability: The overarching goal is to achieve a more robust and stable financial footing for long-term sustainability.

China's aviation sector is experiencing a strong recovery, with passenger traffic projected to reach 780 million in 2025, up from an estimated 680 million in 2024. This growth is supported by rising consumer confidence and increased disposable incomes, driving demand for both domestic and international travel, including the growing 'bleisure' trend.

Fuel price volatility remains a concern, with average jet fuel prices in 2024 hovering around $2.50 per gallon, impacting operational costs. Hainan Airlines is addressing this through fleet modernization, aiming for fuel efficiency improvements of 10-15% per flight hour with newer aircraft.

Hainan Airlines is actively pursuing strategic investments and has secured approval for its 2025 financing plans to bolster financial health and reduce debt. The air cargo segment also saw a significant 15% year-on-year increase in freight volumes in 2024, contributing to the industry's overall positive trajectory.

| Metric | 2024 (Est.) | 2025 (Proj.) | Impact on Hainan Airlines |

| Passenger Traffic (Millions) | 680 | 780 | Increased revenue potential from higher demand. |

| Jet Fuel Price (Avg. $/Gallon) | 2.50 | Variable | Directly impacts operating expenses; fleet modernization mitigates. |

| Air Cargo Volume Growth (%) | 15% | Growth expected to continue | Diversified revenue stream and operational efficiency. |

| Outbound Travel vs. 2019 Levels | Recovering | Exceeding | Enhanced international route profitability. |

Same Document Delivered

Hainan Airlines PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Hainan Airlines delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the airline's operations and strategic decisions. You'll gain a deep understanding of the external forces shaping its competitive landscape.

Sociological factors

Chinese travelers are increasingly embracing spontaneity, with a noticeable trend towards shorter booking lead times. This shift requires airlines like Hainan Airlines to offer greater flexibility in their booking systems and service packages. A recent report indicates that spontaneous travel bookings have seen a significant uptick, particularly in the 2024-2025 period.

The rise of 'bleisure' travel, a blend of business and leisure, is another key sociological factor, especially prominent among younger demographics. This trend presents an opportunity for Hainan Airlines to develop tailored packages that cater to both professional and personal travel needs, potentially increasing ancillary revenue streams.

The desire for international and long-haul journeys is a significant sociological driver for Hainan Airlines. As global travel restrictions continue to ease, Chinese outbound travel is experiencing a strong resurgence, with a noticeable shift towards longer, more distant destinations.

This trend is directly influencing Hainan Airlines' strategic decisions. The airline is actively broadening its international network, aiming to establish connections between a greater number of cities across key continents including Asia, Europe, North America, and Africa to capitalize on this growing demand.

Data from the China Tourism Academy indicated that in 2023, the number of Chinese outbound tourists was projected to reach 100 million, a substantial increase from previous years, with a growing interest in destinations beyond traditional short-haul markets.

China's proactive expansion of visa-free policies, with a notable focus on Hainan province, has demonstrably fueled a surge in international arrivals. This liberalization directly translates to increased passenger demand for airlines like Hainan Airlines, as the island transforms into a more appealing and easily reachable hub for global tourists.

Customer Service Expectations and Brand Perception

Hainan Airlines' standing as a SKYTRAX 5-star airline underscores a commitment to superior cabin and ground services, shaping customer service expectations. Meeting and surpassing these high passenger benchmarks for convenience, comfort, and overall service quality is paramount for maintaining its market position and drawing in new clientele.

In 2024, customer satisfaction scores for airlines globally continued to be a critical differentiator. For instance, J.D. Power's 2024 North America Airline Satisfaction Study indicated that while overall satisfaction improved, service issues remained a key pain point for travelers. Hainan Airlines, by consistently delivering on its 5-star promise, aims to mitigate these common industry challenges.

- Brand Perception: Hainan Airlines' 5-star rating directly influences its brand perception, positioning it as a premium carrier.

- Customer Loyalty: Exceeding service expectations fosters customer loyalty, reducing churn and encouraging repeat business.

- Competitive Advantage: Superior service acts as a significant competitive advantage in the increasingly crowded aviation market.

- Reputation Management: Proactive management of customer service interactions is vital for maintaining its esteemed reputation.

Demographic Shifts and Market Segmentation

Demographic shifts are significantly reshaping travel patterns. The increasing prevalence of family and multigenerational travel, coupled with a growing segment of middle-aged and senior travelers actively seeking cultural immersion and nature-based experiences, opens up new avenues for market segmentation.

Hainan Airlines can strategically leverage these trends by refining its product and service offerings. For instance, specialized routes like the 'Boutique Express' and 'Free Trade Port Express' can be further tailored to meet the distinct preferences of these evolving passenger demographics, enhancing customer engagement and loyalty.

- Growing Senior Travel Market: In 2024, the global senior travel market is projected to continue its robust growth, with a significant portion of this demographic showing increased interest in experiential travel.

- Multigenerational Travel Trends: Data from late 2023 and early 2024 indicates a sustained rise in families traveling together, often with grandparents and grandchildren, seeking shared experiences.

- Tailored Service Opportunities: Hainan Airlines' existing 'Boutique Express' and 'Free Trade Port Express' services can be adapted with specific amenities and itineraries appealing to cultural and nature-focused senior travelers.

The evolving preferences of Chinese travelers, marked by a growing desire for unique experiences and a shift towards more sustainable and responsible tourism, are critical sociological factors. Hainan Airlines needs to align its offerings with these values, potentially through eco-friendly initiatives and culturally rich travel packages.

The increasing emphasis on personalized travel experiences and the influence of social media on travel choices are also shaping consumer behavior. Travelers are looking for authentic connections and shareable moments, prompting airlines to enhance their digital presence and customer engagement strategies.

The growing awareness of health and wellness among travelers, particularly post-pandemic, means that airlines must prioritize hygiene and passenger well-being. This sociological trend necessitates clear communication about safety protocols and the provision of a comfortable, healthy travel environment.

The demographic shift towards an aging population in China, coupled with increased disposable income among this group, presents a significant opportunity for Hainan Airlines. Catering to the specific needs and preferences of senior travelers, such as comfort, accessibility, and slower-paced itineraries, can unlock a valuable market segment.

| Sociological Factor | Trend Description | Implication for Hainan Airlines |

|---|---|---|

| Traveler Preferences | Growing demand for unique experiences and sustainable tourism. | Develop eco-friendly options and culturally immersive packages. |

| Social Media Influence | Increased reliance on social platforms for travel inspiration and booking. | Enhance digital marketing and customer engagement strategies. |

| Health & Wellness | Heightened focus on hygiene and passenger well-being. | Maintain and communicate stringent safety protocols. |

| Aging Population | Increased disposable income and travel interest among seniors. | Tailor services and itineraries for senior travelers. |

Technological factors

Hainan Airlines is making significant strides in fleet modernization, a crucial technological factor for efficiency and sustainability. By integrating newer aircraft such as the Airbus A321neo and Boeing 737-8, the airline is directly addressing rising fuel costs and environmental concerns.

These advanced aircraft are designed for superior fuel efficiency, with the A320neo family, for example, offering up to 15% fuel burn reduction compared to previous generations. This translates to lower operating expenses and a smaller carbon footprint, vital for competitiveness in the 2024-2025 aviation landscape.

Hainan Airlines is actively digitizing its passenger services to improve the customer journey. This includes the implementation of e-invoices and e-newspapers, alongside ongoing optimization of its online booking platforms. These digital advancements are designed to reduce paper consumption, a key environmental consideration, and provide passengers with a more modern and convenient in-cabin information experience.

Technological advancements in aircraft maintenance and ground handling are crucial for Hainan Airlines' operational efficiency and safety. The airline's engagement in aviation services, including maintenance, indicates a continuous integration of advanced solutions for fleet upkeep. For instance, the adoption of predictive maintenance technologies, utilizing AI and big data analytics, can significantly reduce unscheduled downtime. In 2024, the global aviation maintenance, repair, and overhaul (MRO) market was valued at approximately $85 billion, with advanced technologies driving a significant portion of its growth.

Investment in Aviation Infrastructure

Investment in aviation infrastructure, particularly the development of China's international hub airports and the CAAC's push for a global network, directly enhances air traffic management and operational efficiency. This technological advancement benefits airlines such as Hainan Airlines by improving connectivity and streamlining operations.

By 2025, China aims to significantly expand its airport capacity, with projections indicating over 500 million passengers handled annually by its top 50 airports. This expansion is supported by technological upgrades in air traffic control systems and digital infrastructure.

- Enhanced Connectivity: Upgraded infrastructure facilitates more direct routes and reduces layover times, boosting passenger experience and operational efficiency for Hainan Airlines.

- Improved Air Traffic Management: Investments in advanced air traffic control technology, including AI-driven systems, are projected to increase airspace capacity and reduce flight delays by an estimated 15% by 2025.

- Digitalization of Operations: The adoption of digital technologies for passenger services, baggage handling, and aircraft maintenance across major hubs streamlines operations and reduces costs for all airlines.

Data Analytics and Operational Optimization

Hainan Airlines is increasingly leveraging data analytics to fine-tune its operations. By analyzing vast datasets, the airline can identify opportunities to optimize flight paths, aiming for straighter routes and direct flight approvals. This data-driven strategy directly impacts efficiency.

These optimizations translate into tangible benefits. For instance, shortening flight distances through better route planning can lead to significant reductions in fuel consumption. In 2023, the aviation industry saw fuel costs represent a substantial portion of operating expenses, making such efficiencies critical. Airlines are actively seeking ways to mitigate these costs, with data analytics at the forefront of these efforts.

The environmental implications are also noteworthy. Reduced fuel burn directly correlates with lower carbon emissions, aligning with Hainan Airlines' commitment to sustainability. This focus on environmental performance is becoming a key differentiator in the competitive airline market, as passengers and regulators alike place greater emphasis on eco-friendly travel solutions.

- Route Optimization: Data analytics enables the identification of more direct flight paths, reducing flight time and distance.

- Fuel Efficiency: Streamlined routes directly contribute to lower fuel consumption, a major cost driver for airlines.

- Environmental Impact: Reduced fuel burn leads to a decrease in carbon emissions, supporting sustainability goals.

- Operational Adjustments: Continuous data analysis allows for agile adjustments to schedules and operational procedures for maximum efficiency.

Hainan Airlines is embracing advanced technologies to enhance operational efficiency and passenger experience. The airline's fleet modernization, incorporating fuel-efficient aircraft like the Airbus A321neo, directly addresses rising fuel costs and environmental concerns, with the A320neo family offering up to a 15% fuel burn reduction. Digitalization efforts, such as e-invoices and optimized online booking, streamline services and reduce paper consumption. Furthermore, the adoption of predictive maintenance, leveraging AI and big data, is set to minimize aircraft downtime, a critical factor in the global aviation MRO market valued at approximately $85 billion in 2024.

| Technology Area | Impact on Hainan Airlines | Relevant Data/Projections (2024-2025) |

|---|---|---|

| Fleet Modernization | Improved fuel efficiency, reduced emissions | A320neo family offers up to 15% fuel burn reduction |

| Digitalization of Services | Enhanced customer experience, operational streamlining | Increased use of e-invoices, e-newspapers, and online platforms |

| Predictive Maintenance | Reduced unscheduled downtime, increased safety | AI and big data analytics for proactive maintenance |

| Data Analytics for Route Optimization | Fuel savings, reduced flight times | Aims for straighter routes and direct flight approvals |

Legal factors

Hainan Airlines, like all carriers, navigates a complex web of civil aviation security regulations. This includes strict adherence to national and regional laws governing air transport, encompassing passenger and baggage handling rules. The Civil Aviation Administration of China (CAAC) is known for its dynamic approach, often adjusting operational standards. For instance, changes to check-in deadlines require swift implementation by airlines to ensure compliance.

Hainan Airlines' international reach is shaped by bilateral air transport agreements, like the one between the United States and China. These pacts directly influence which routes the airline can fly and how often, a critical factor for its global strategy. For instance, the existing framework allows for a certain number of flights between the two nations, impacting capacity and market access.

Navigating these international treaties is paramount for Hainan Airlines' growth. Compliance ensures continued access to key international markets and facilitates the expansion of its route network. The airline must stay abreast of any amendments or renegotiations of these agreements, as they can significantly alter operational capabilities and competitive positioning in the global aviation landscape.

Hainan Airlines, like any major employer, must navigate a complex web of labor laws. These govern everything from hiring and compensation to working conditions and employee rights, ensuring fair treatment across its vast workforce. For instance, in 2023, China's Ministry of Human Resources and Social Security continued to emphasize stricter enforcement of labor contracts and overtime regulations, impacting operational costs and scheduling.

Managing a diverse workforce, including pilots, cabin crew, and ground staff, necessitates compliance with sector-specific regulations, which can vary significantly. Adherence to these legal frameworks is crucial for maintaining operational continuity and avoiding costly disputes, as demonstrated by the ongoing focus on worker protections in the aviation sector.

Data Privacy and Consumer Protection Laws

Hainan Airlines, like all airlines, faces stringent data privacy and consumer protection regulations as it digitalizes services and collects vast amounts of passenger data. Compliance with laws such as China's Personal Information Protection Law (PIPL) is crucial. Failure to protect passenger information can lead to significant fines and reputational damage, impacting customer trust and loyalty. For instance, PIPL, effective November 1, 2021, mandates strict consent requirements for data processing and grants individuals rights over their personal information.

The airline must ensure secure handling of sensitive passenger data, including booking details, payment information, and travel history. Transparent policies regarding data collection, usage, and storage are paramount for maintaining customer confidence and adhering to legal frameworks. As of 2024, the global trend is towards even stricter data protection, with many jurisdictions updating or introducing new regulations that could affect international carriers like Hainan Airlines.

- Data Minimization: Collecting only necessary passenger data for operational and service delivery purposes.

- Consent Management: Obtaining explicit consent for data processing, especially for marketing or secondary uses.

- Security Measures: Implementing robust cybersecurity protocols to safeguard passenger data against breaches.

- Transparency: Clearly communicating data handling practices through accessible privacy policies.

Post-Restructuring Legal Obligations

Following the HNA Group's extensive restructuring, Hainan Airlines operates under significant legal obligations. These include strict adherence to debt repayment schedules and the operational terms agreed upon with its new strategic investor, Liaoning Fangda Group. For instance, as of early 2024, the restructuring plan mandates specific financial performance benchmarks that the airline must meet to ensure continued support and stability.

The legal framework established during this period profoundly impacts Hainan Airlines' decision-making, particularly concerning its financial health and operational scope. These post-restructuring legal requirements dictate how the company manages its capital, enters into new contracts, and potentially expands its routes or fleet. The ongoing oversight by regulatory bodies ensures compliance with the court-approved restructuring agreement.

Key legal factors influencing Hainan Airlines in 2024-2025 include:

- Debt Servicing Compliance: Adherence to the repayment schedules for billions of yuan in restructured debt.

- Investor Agreement Terms: Meeting performance and governance clauses stipulated by Liaoning Fangda Group.

- Regulatory Oversight: Continued compliance with aviation and financial regulations specific to restructuring entities.

- Contractual Obligations: Managing existing and future contracts within the legal parameters of the restructuring.

Hainan Airlines must strictly adhere to China's Civil Aviation Law and related security regulations, which are frequently updated by the CAAC. For example, in 2023, the CAAC introduced new guidelines for passenger screening, requiring airlines to adapt their ground operations. These legal mandates directly affect operational efficiency and safety protocols.

International operations are governed by bilateral air service agreements, influencing route rights and flight frequencies. The existing agreements between China and countries like the US dictate market access, impacting Hainan Airlines' global network strategy. Navigating these treaties is crucial for continued international expansion and competitive positioning.

Labor laws in China, particularly those enforced by the Ministry of Human Resources and Social Security, impact employee relations and operational costs. Stricter enforcement of labor contracts and overtime regulations, as emphasized in 2023, necessitates careful management of workforce scheduling and compensation.

Data privacy laws, such as China's Personal Information Protection Law (PIPL), are critical for handling passenger data. PIPL, effective since November 2021, imposes strict consent requirements and data security measures, with potential fines for non-compliance. As of 2024, the global trend is towards more stringent data protection, affecting international carriers.

Environmental factors

Hainan Airlines is actively pursuing carbon emissions reduction through a multi-pronged approach. Key strategies include optimizing flight paths for fuel efficiency, streamlining ground operations to conserve energy, and implementing onboard weight reduction programs.

These initiatives are crucial for mitigating the airline's environmental impact. For instance, by focusing on fuel-saving operations, Hainan Airlines aims to directly lower its carbon dioxide output, aligning with global sustainability goals and increasing industry pressure for greener aviation practices.

China's aviation industry is actively encouraging the use of Sustainable Aviation Fuel (SAF) to achieve its environmental targets, a trend that will inevitably impact major carriers like Hainan Airlines. While specific SAF adoption rates for Hainan Airlines aren't publicly detailed, the national push suggests increasing regulatory or market-driven incentives for its implementation. For instance, by 2025, China aims to have SAF constitute a significant portion of its aviation fuel supply, with projections indicating a substantial increase in SAF production capacity in the coming years, driven by government support and international commitments.

Hainan Airlines' 'Green Tour – Carbon Offsetting' program encourages passengers to contribute to environmental protection, such as tree planting, by voluntarily offsetting their flight emissions. This initiative directly addresses growing environmental concerns among travelers and aligns with global sustainability trends, influencing consumer choices in the aviation sector.

As of early 2024, the aviation industry globally is under increasing pressure to reduce its carbon footprint, with initiatives like Hainan Airlines' program reflecting a proactive response. While specific 2024-2025 donation figures for this particular program are not publicly available, the broader trend shows a rising willingness among consumers to support eco-friendly travel options.

Fleet Modernization for Environmental Performance

Hainan Airlines is actively modernizing its fleet to enhance environmental performance. The airline's strategy includes acquiring newer aircraft models known for their superior fuel efficiency and lower emissions. For instance, the introduction of the Airbus A320neo and Boeing 737-8 represents a significant step in this direction.

These new generation aircraft are designed to meet stringent environmental regulations and contribute to sustainability. The Boeing 737 MAX, for example, boasts up to 20% reduction in CO2 emissions compared to previous models, directly supporting Hainan Airlines' commitment to reducing its carbon footprint.

- Fleet Expansion: Acquisition of fuel-efficient aircraft like the Airbus A320neo and Boeing 737-8.

- Emission Reduction: New aircraft models offer significantly lower CO2 emissions.

- Sustainability Goals: Aligns with Hainan Airlines' broader objectives for environmental responsibility.

- Operational Efficiency: Improved fuel burn translates to cost savings and reduced environmental impact.

Hainan Province's 'Zero Carbon Island' Initiative

Hainan Province is actively working towards becoming a 'Zero Carbon Island,' with ambitious targets set for peak carbon emissions by 2030 and achieving carbon neutrality by 2060. This significant environmental undertaking positions Hainan as a leader in China's green development strategy.

Hainan Airlines, as a prominent player within the province, is intrinsically linked to this 'Zero Carbon Island' initiative. The airline's environmental strategies are designed to complement and actively support these overarching provincial sustainability goals, fostering a synergistic approach to ecological responsibility.

This alignment is crucial for Hainan Airlines, as it can leverage provincial support and incentives for green aviation practices. For instance, the province's focus on renewable energy infrastructure could benefit airline operations, and investments in sustainable aviation fuels (SAFs) are likely to be encouraged.

- Provincial Target: Peak carbon emissions by 2030, carbon neutrality by 2060.

- Airline Alignment: Hainan Airlines' strategies directly support these provincial goals.

- Opportunity: Potential for incentives and infrastructure support for green aviation.

- SAF Focus: Increased likelihood of investment and development in sustainable aviation fuels.

Hainan Airlines is aligning with China's national push for Sustainable Aviation Fuel (SAF), with projections indicating substantial growth in SAF production capacity by 2025. The airline's fleet modernization, including the introduction of fuel-efficient aircraft like the Boeing 737 MAX, aims to reduce CO2 emissions by up to 20% compared to older models.

The airline's 'Green Tour – Carbon Offsetting' program encourages passenger contributions to environmental projects, reflecting a growing consumer demand for eco-friendly travel options. This initiative supports Hainan Province's ambitious 'Zero Carbon Island' strategy, targeting carbon neutrality by 2060.

| Environmental Initiative | Target/Status | Impact |

|---|---|---|

| SAF Adoption | National push for increased production capacity by 2025 | Reduced reliance on fossil fuels, lower emissions |

| Fleet Modernization | Introduction of Boeing 737 MAX, Airbus A320neo | Up to 20% CO2 reduction per flight (737 MAX) |

| Carbon Offsetting Program | Passenger voluntary contributions | Increased environmental awareness, funding for projects |

| Hainan Province Goals | Carbon neutrality by 2060 | Synergistic opportunities for green aviation, potential incentives |

PESTLE Analysis Data Sources

Our Hainan Airlines PESTLE Analysis is grounded in comprehensive data from official Chinese government publications, international aviation industry reports, and reputable economic and financial data providers. This ensures a thorough understanding of the political, economic, social, technological, legal, and environmental factors influencing the airline's operations.