Hainan Airlines Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hainan Airlines Bundle

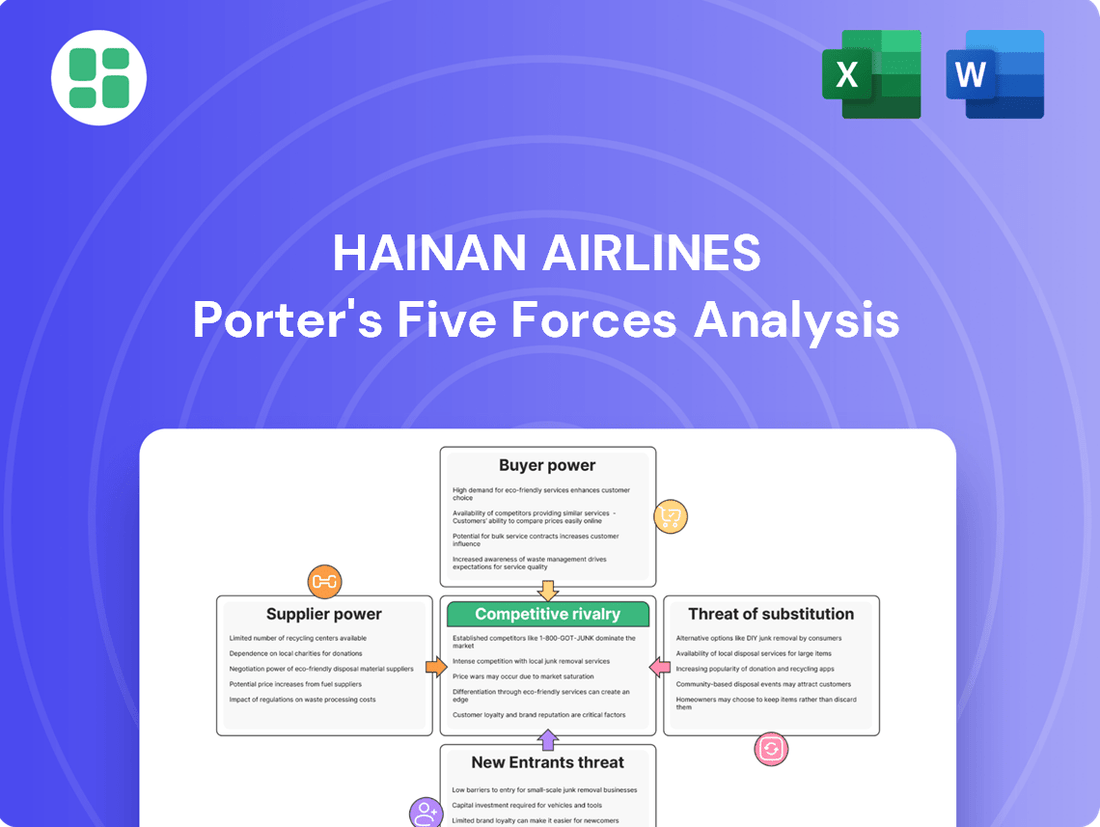

Hainan Airlines faces intense rivalry from established carriers and the constant threat of new low-cost airlines entering the market. Understanding the bargaining power of its suppliers, from aircraft manufacturers to fuel providers, is crucial for its operational efficiency.

The full Porter's Five Forces Analysis reveals the strength and intensity of each market force affecting Hainan Airlines, complete with visuals and summaries for fast, clear interpretation.

Suppliers Bargaining Power

Aircraft manufacturers like Boeing and Airbus hold substantial bargaining power due to the industry's concentrated nature. This duopoly means airlines, including Hainan Airlines, have limited alternatives when sourcing new aircraft and essential spare parts. For instance, in 2024, Hainan Airlines continued its fleet modernization by leasing new generation aircraft, underscoring its dependence on these primary suppliers.

Aircraft lessors wield significant bargaining power over airlines like Hainan Airlines, primarily due to the substantial capital investment required for aircraft acquisition and the ongoing need for fleet modernization. Airlines often lease a significant portion of their fleet to manage capital expenditure and maintain fleet flexibility, making them reliant on lessors.

Major lessors, such as Avolon and Dubai Aerospace Enterprise (DAE), possess considerable leverage. This is amplified by the high global demand for aircraft, especially for newer, more fuel-efficient models. For instance, in 2023, the International Air Transport Association (IATA) reported a strong recovery in air travel, leading to increased demand for new aircraft deliveries, which in turn strengthens the position of lessors.

Hainan Airlines' recent lease agreements for multiple aircraft underscore its dependence on these lessors. This reliance can translate into less favorable lease terms for the airline if the lessor holds a dominant market position or if the specific aircraft models are in high demand and short supply, as seen in the tight market for new-generation narrow-body aircraft.

Jet fuel represents a significant expense for airlines, often ranging from 20% to 30% of total operating costs. This substantial portion grants jet fuel suppliers considerable leverage in negotiations.

Global jet fuel prices are highly susceptible to geopolitical events and market dynamics, leading to inherent volatility. For instance, the average price of jet fuel in 2024 has seen fluctuations driven by ongoing global supply chain disruptions and energy market uncertainties.

Hainan Airlines' financial performance is directly tied to these fuel price swings. The airline must either absorb increased fuel costs, impacting its profit margins, or pass these costs onto consumers via higher ticket prices, potentially affecting demand.

Engine Manufacturers

Engine manufacturers hold substantial bargaining power over airlines like Hainan Airlines. This is largely due to the highly specialized nature of aircraft engines and the limited number of dominant global suppliers, such as GE Aviation, Rolls-Royce, and Pratt & Whitney. These few players control a significant portion of the market, making it difficult for airlines to find readily available alternatives.

The selection of an engine for a specific aircraft model has a profound impact on an airline's operational efficiency, fuel consumption, and long-term maintenance expenses. Consequently, these engine makers can leverage this influence to negotiate favorable terms, including pricing and service agreements, directly impacting an airline's profitability.

- Dominant Suppliers: The global aircraft engine market is dominated by a small number of powerful manufacturers.

- High Switching Costs: Airlines face significant costs and operational disruptions when attempting to switch engine suppliers.

- Impact on Operations: Engine choice directly affects fuel efficiency and maintenance, giving manufacturers leverage.

Maintenance, Repair, and Overhaul (MRO) Providers and IT Systems

Maintenance, Repair, and Overhaul (MRO) providers and IT system suppliers wield significant bargaining power over Hainan Airlines. The highly specialized nature of aircraft maintenance, particularly for complex systems, means there are often only a few certified providers globally. This scarcity, coupled with the substantial costs and operational disruptions associated with switching MRO partners, allows these suppliers to command higher prices and favorable terms. For instance, a single engine overhaul for a wide-body aircraft can cost upwards of $2 million, and finding alternative certified facilities can take months.

Similarly, the airline's reliance on sophisticated IT systems for everything from flight scheduling and passenger reservations to cargo logistics and crew management creates a strong position for IT vendors. Developing and maintaining these critical systems requires deep expertise, and the integration of new platforms is both time-consuming and expensive, often involving millions in upfront investment and ongoing licensing fees. In 2024, the global aviation IT market was valued at approximately $25 billion, with a significant portion attributed to core operational systems, highlighting the embedded value and switching costs for airlines.

- Limited Certified MRO Providers: The specialized skills and certifications required for complex aircraft maintenance restrict the pool of qualified MRO suppliers, increasing their leverage.

- High Switching Costs for IT Systems: Migrating critical airline operations software, such as reservation or logistics platforms, involves substantial financial investment and operational risk, making it difficult for airlines to change vendors.

- Dependency on Specialized Expertise: Airlines depend on MRO providers for safety-critical maintenance and IT vendors for operational continuity, creating a power imbalance due to the unique knowledge and capabilities these suppliers possess.

- Significant Investment in IT Infrastructure: The cost of implementing and maintaining advanced IT systems, often running into tens of millions of dollars for a large airline, underscores the deep commitment and potential lock-in with existing suppliers.

The bargaining power of suppliers for Hainan Airlines is considerable, primarily driven by the concentrated nature of key aviation industries. Major aircraft manufacturers like Boeing and Airbus, along with engine makers such as GE Aviation and Rolls-Royce, hold significant sway due to limited alternatives for airlines and the high costs associated with switching. For instance, in 2024, Hainan Airlines' fleet expansion continued to highlight its reliance on these dominant players for new aircraft and critical components.

Aircraft lessors also exert substantial influence, especially given the high capital requirements for fleet acquisition and the ongoing demand for modern, fuel-efficient aircraft. The International Air Transport Association (IATA) reported a strong recovery in air travel in 2023, further bolstering the position of lessors in a competitive market for aircraft. Hainan Airlines' recent lease agreements demonstrate this dependency, potentially leading to less favorable terms if specific aircraft models are in high demand.

Jet fuel suppliers represent another powerful force, with fuel costs typically making up 20% to 30% of an airline's operating expenses. Global fuel prices, subject to geopolitical factors and market volatility, directly impact Hainan Airlines' profitability. The average price of jet fuel in 2024 has shown fluctuations due to ongoing supply chain issues and energy market uncertainties, forcing airlines to manage these cost swings.

Furthermore, Maintenance, Repair, and Overhaul (MRO) providers and IT system suppliers command leverage due to the specialized expertise and high switching costs involved. A single engine overhaul can exceed $2 million, and the integration of new IT systems requires millions in investment. The global aviation IT market, valued at around $25 billion in 2024, underscores the embedded value and lock-in with existing vendors for airlines like Hainan Airlines.

What is included in the product

Tailored exclusively for Hainan Airlines, analyzing its position within its competitive landscape by examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes.

Instantly identify strategic vulnerabilities and opportunities within Hainan Airlines' competitive landscape with a clear, one-sheet Porter's Five Forces summary.

Customers Bargaining Power

Individual passengers typically wield limited bargaining power. The air travel market is largely standardized, and switching between airlines is usually straightforward with minimal cost. This ease of comparison, amplified by numerous online travel agencies and aggregators, means passengers can readily find the cheapest options available. For instance, in 2024, the average domestic airfare in China experienced fluctuations, yet the sheer volume of passengers and intense competition among airlines meant that individual price sensitivity remained a significant factor influencing overall pricing.

Large corporations and travel agencies booking significant volumes for business travel or group tours hold considerable bargaining power with Hainan Airlines. This leverage allows them to negotiate favorable rates, specific service level agreements, and adaptable booking conditions, directly impacting Hainan Airlines' revenue streams and operational flexibility.

In 2024, the corporate travel market remained a vital segment for airlines. For example, major global corporations often secure discounts of 5-15% on standard fares for their employees' travel, depending on the volume and commitment. This negotiation power is amplified when these buyers represent numerous travelers or commit to long-term contracts with the airline.

Online Travel Agencies (OTAs) and flight aggregators hold significant bargaining power over airlines like Hainan Airlines. These platforms aggregate a massive amount of travel information and customer demand, creating a consolidated marketplace that airlines must engage with. In 2024, for instance, the global online travel market was valued at hundreds of billions of dollars, demonstrating the sheer scale of these intermediaries.

This concentration of demand allows OTAs to negotiate favorable terms, such as commission rates and placement on their platforms. While they offer increased visibility, potentially driving bookings for Hainan Airlines, they can also dictate pricing and distribution strategies. Airlines often face pressure to offer competitive pricing through these channels, impacting their overall revenue management and profitability.

Cargo Customers

Large logistics companies and major freight forwarders hold significant bargaining power with Hainan Airlines' cargo division. Their ability to consolidate substantial volumes and maintain consistent shipping schedules allows them to negotiate favorable rates and terms. This is particularly relevant as Hainan Airlines' cargo business has been expanding, necessitating a strategic approach to pricing and service to retain these crucial partners.

The bargaining power of these cargo customers is amplified by the availability of alternative carriers. For instance, in 2023, the global air cargo market experienced fluctuations, with capacity tightening at certain points, but the overall competitive landscape means Hainan Airlines must remain attractive. They need to offer competitive pricing, reliable service, and potentially value-added services to secure and maintain long-term contracts with these high-volume clients.

- High-Volume Shipments: Major logistics firms can leverage the sheer quantity of goods they move to demand better pricing.

- Regularity of Demand: Consistent and predictable shipping needs from large clients provide them with leverage.

- Alternative Carrier Options: The presence of other airlines offering cargo services gives customers choices and bargaining power.

- Service Quality Expectations: Beyond price, these customers expect high standards in handling, speed, and reliability.

Price Sensitivity and Demand Elasticity

Customers, particularly those traveling for leisure, exhibit a strong sensitivity to price fluctuations, indicating a high degree of demand elasticity for Hainan Airlines. This means that even small increases in ticket prices can lead to a significant drop in the number of passengers choosing to fly. For instance, data from 2024 indicated that average economy class fares across major Chinese airlines, including those competing with Hainan, saw a notable decrease, putting further pressure on pricing strategies.

Hainan Airlines must therefore meticulously balance its pricing to remain competitive and attract passengers. The challenge lies in setting fares that are appealing enough to stimulate demand while simultaneously ensuring that these prices are sufficient to cover operational costs and generate profit. This delicate act is amplified in a market where consumers can easily compare prices and switch between carriers based on the lowest available fare.

- Price Sensitivity: Leisure travelers are highly responsive to price changes.

- Demand Elasticity: Small price increases can significantly reduce passenger numbers.

- 2024 Fare Trends: Average economy fares in the Chinese market have shown a downward trend, intensifying price competition.

- Strategic Pricing: Hainan Airlines needs to carefully manage fares to attract customers while covering costs.

The bargaining power of customers for Hainan Airlines is generally high, driven by price sensitivity and the availability of numerous alternatives. Leisure travelers, in particular, are highly responsive to price changes, making demand elastic. For instance, in 2024, average domestic airfares in China saw fluctuations, but the intense competition meant individual price sensitivity remained a key factor influencing purchasing decisions.

Large corporate clients and travel agencies booking substantial volumes possess significant leverage, enabling them to negotiate favorable rates and terms. These entities can secure discounts, often in the range of 5-15% for corporate travel in 2024, depending on commitment levels. This ability to negotiate directly impacts Hainan Airlines' revenue management and profitability.

Online Travel Agencies (OTAs) and flight aggregators also wield considerable bargaining power due to their role in consolidating demand. The global online travel market's substantial value, in the hundreds of billions of dollars in 2024, underscores their influence. This allows them to negotiate commission rates and platform placement, potentially dictating pricing strategies for airlines.

| Customer Segment | Bargaining Power Level | Key Factors |

|---|---|---|

| Individual Leisure Travelers | High | Price sensitivity, ease of comparison, numerous alternatives |

| Corporate Travel Buyers (High Volume) | High | Volume discounts (e.g., 5-15% in 2024), long-term contracts, service level agreements |

| Online Travel Agencies (OTAs) | High | Consolidated demand, market reach, negotiation of commissions and placement |

| Large Freight Forwarders | High | Volume of shipments, regularity of demand, availability of alternative carriers |

Full Version Awaits

Hainan Airlines Porter's Five Forces Analysis

This preview shows the exact Hainan Airlines Porter's Five Forces Analysis you'll receive immediately after purchase, offering a comprehensive examination of the competitive landscape. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the airline industry. This document provides actionable intelligence for strategic decision-making, delivered in a professionally formatted and ready-to-use file.

Rivalry Among Competitors

Hainan Airlines operates in a highly competitive environment, primarily challenged by China's dominant state-controlled carriers: Air China, China Southern Airlines, and China Eastern Airlines. These giants often leverage significant government backing and established networks, creating a formidable competitive landscape.

In 2023, the combined passenger traffic of Air China, China Southern, and China Eastern represented a substantial majority of the domestic market. For instance, Air China reported carrying over 100 million passengers in 2023, underscoring its scale. This intense rivalry means Hainan Airlines must constantly innovate and optimize its operations to secure market share and profitability.

The Chinese domestic aviation market is incredibly crowded, with Hainan Airlines facing intense rivalry from carriers like China Southern, China Eastern, and Air China. Despite a strong rebound in passenger numbers, with domestic traffic reaching 95% of 2019 levels by the end of 2024, profitability remains a hurdle due to overcapacity and aggressive price wars.

While China's domestic air travel rebounded strongly in 2023, international route recovery has lagged, though it's now accelerating. This trend presents both opportunities and intensified rivalry as airlines like Hainan Airlines rebuild their global networks.

Hainan Airlines is actively engaged in restoring previously suspended international routes and launching new ones, particularly to popular destinations. For instance, by early 2024, Hainan Airlines had resumed numerous international services, aiming to capture a larger share of this recovering market.

This strategic expansion directly fuels competitive rivalry on lucrative international segments. As more carriers re-establish or grow their international presence, price wars and service differentiation become critical factors for market share in the post-pandemic aviation landscape.

Capacity Growth and Fleet Modernization

Chinese airlines, including Hainan Airlines, are actively expanding and modernizing their fleets. This strategic move aims to meet surging travel demand but simultaneously intensifies competition. Airlines are now in a race to fill these newly added seats, putting pressure on load factors and pricing strategies.

The ongoing capacity growth directly fuels competitive rivalry. As more aircraft enter service, airlines must work harder to attract passengers, leading to more aggressive marketing and potentially lower fares. This dynamic is a key characteristic of the Chinese aviation market.

- Fleet Expansion: China's civil aviation industry saw its fleet grow to over 4,000 aircraft by the end of 2023.

- Capacity Increase: This expansion translates to a significant increase in available seat kilometers (ASKs), intensifying the need to fill capacity.

- Rivalry Impact: Increased capacity forces airlines to compete more fiercely on routes, impacting profitability and market share.

Service Differentiation and Ancillary Revenues

Competitive rivalry in the airline industry extends beyond mere ticket prices and flight paths. Airlines increasingly differentiate themselves through superior service quality, cultivating a strong brand reputation, and offering a variety of ancillary services. Hainan Airlines actively pursues this strategy by positioning itself as a '5-star Chinese carrier'.

This commitment to service excellence is further bolstered by strategic alliances. For instance, Hainan Airlines' partnership with IHG Hotels & Resorts allows for integrated customer experiences, offering benefits that transcend the flight itself. Such collaborations are crucial for building loyalty and capturing additional revenue streams in a market characterized by intense competition.

- Service Quality Focus: Hainan Airlines aims for a '5-star' rating, differentiating itself through premium onboard services and customer care.

- Brand Reputation: Building a strong brand image is a key competitive weapon, influencing passenger choice beyond price.

- Ancillary Revenue Streams: Partnerships like the one with IHG Hotels & Resorts enable the airline to offer integrated travel solutions and generate revenue beyond ticket sales.

- Customer Experience Enhancement: These differentiation strategies are designed to improve the overall passenger journey, fostering repeat business.

The competitive rivalry for Hainan Airlines is fierce, dominated by China's major state-controlled carriers like Air China, China Southern, and China Eastern. These giants, backed by significant government support and extensive networks, set a high bar. The sheer scale of their operations, with Air China alone carrying over 100 million passengers in 2023, means Hainan Airlines faces constant pressure on pricing and market share.

The Chinese domestic aviation market, while recovering strongly, remains oversupplied, leading to aggressive price wars. This intense competition extends to international routes as well, with airlines like Hainan Airlines actively rebuilding and expanding their global networks post-pandemic. Fleet modernization and expansion across the industry, with China's civil aviation fleet exceeding 4,000 aircraft by the end of 2023, further intensifies this rivalry, pushing airlines to fill increased capacity.

Beyond price, differentiation through service quality and brand reputation is crucial. Hainan Airlines' pursuit of a '5-star' rating and strategic alliances, such as its partnership with IHG Hotels & Resorts, are key strategies to build customer loyalty and capture ancillary revenue in this highly competitive environment.

| Competitor | 2023 Passenger Traffic (Approx.) | Fleet Size (Approx.) | Key Differentiation Strategy |

|---|---|---|---|

| Air China | 100+ million | 700+ | Extensive domestic and international network, government backing |

| China Southern Airlines | 110+ million | 650+ | Largest fleet in China, strong domestic presence |

| China Eastern Airlines | 100+ million | 600+ | Focus on hub development, expanding international routes |

| Hainan Airlines | ~50 million (Domestic + International) | ~200 | Service quality focus ('5-star'), strategic partnerships |

SSubstitutes Threaten

China's impressive high-speed rail network presents a substantial threat to Hainan Airlines. By the end of 2023, China had over 45,000 kilometers of high-speed rail lines in operation, connecting major cities efficiently. This extensive network offers a compelling alternative for domestic travel, especially on routes under 1,000 kilometers, directly impacting Hainan Airlines' passenger numbers.

The convenience and frequency of high-speed rail, coupled with often competitive pricing, directly challenge Hainan Airlines' domestic market share. For instance, a journey between Beijing and Shanghai, a key route for airlines, can be completed by high-speed train in around 4.5 hours, often with city-center to city-center convenience that air travel struggles to match, especially when factoring in airport transit and security times.

For very short distances or within specific regions, intercity bus services and personal vehicle travel present lower-cost alternatives to flying. These options, while slower, appeal to budget-conscious travelers or those with unique logistical requirements, siphoning off a portion of potential air passengers.

In 2024, the average cost of a long-distance bus ticket in China remained significantly lower than a domestic flight, often by 50% or more for comparable distances, making it a compelling substitute for price-sensitive consumers. For instance, a typical 500-kilometer route might cost around $20 by bus versus $40-$60 by air.

Virtual communication technologies present a significant threat to Hainan Airlines, particularly for business travel. Platforms like Zoom and Microsoft Teams have become deeply ingrained, allowing companies to conduct meetings and collaborations remotely. This reduces the inherent need for employees to travel physically for such purposes.

The impact is tangible. For instance, a significant portion of business travel, which is a key revenue driver for airlines, can be replaced by virtual alternatives. While business travel has seen a resurgence in 2024, the long-term structural shift towards virtual interaction could cap its growth potential, directly affecting airlines like Hainan.

Other Modes of Cargo Transport

For cargo services, alternatives such as rail, road, and sea freight can substitute air cargo, especially for goods that are not time-sensitive or are bulky. Hainan Airlines' cargo operations face competition from these modes, which often offer lower costs despite longer transit times. For instance, in 2024, the global maritime shipping industry handled an estimated 11 billion tonnes of goods, showcasing its significant capacity for bulk and less time-critical cargo compared to air freight.

These alternative transport modes present a considerable threat because they can undercut air cargo prices significantly. While air cargo is prized for speed, its premium cost makes it unsuitable for many types of shipments. For example, the cost per kilogram for ocean freight can be as low as 10% of air freight, making it a highly attractive substitute for many businesses.

- Rail Freight: Offers cost-effectiveness for long-distance, heavy, or bulk shipments within continents, often with lower emissions than air transport.

- Road Freight: Provides flexibility and door-to-door delivery, ideal for shorter distances and less-than-truckload (LTL) shipments, though capacity can be limited for very large volumes.

- Sea Freight: The most economical option for large volumes and non-perishable goods, despite significantly longer transit times, handling the vast majority of international trade by volume.

Alternative International Travel Options

While not a direct replacement, alternative international travel methods like cruise ships or extensive overland journeys can serve as substitutes, particularly for leisure travelers. These options offer distinct experiences and price points, potentially diverting some demand from traditional air travel. For instance, the global cruise industry saw a significant recovery in 2023, with passenger numbers approaching pre-pandemic levels, indicating a robust alternative for vacationers.

These substitutes appeal to travelers seeking different types of journeys, from relaxed sea voyages to adventurous land expeditions. For example, the European rail network continues to expand and improve, offering a compelling alternative for shorter international trips, potentially impacting demand for short-haul flights within the continent.

- Cruise Industry Growth: The cruise sector reported strong bookings in late 2023 and early 2024, signaling a continued appeal for alternative international leisure travel.

- Overland Travel Appeal: Investments in high-speed rail and improved cross-border infrastructure in regions like Europe and Asia present growing overland travel options.

- Niche Market Impact: While not affecting business travel, these substitutes can capture a portion of the leisure market seeking unique or slower-paced international experiences.

China's extensive high-speed rail network is a formidable substitute for Hainan Airlines, particularly for domestic routes under 1,000 kilometers. By the end of 2023, over 45,000 kilometers of high-speed rail were operational, offering efficient and often more convenient city-center to city-center travel than air. This directly impacts Hainan Airlines' passenger volumes, as rail journeys like Beijing to Shanghai take approximately 4.5 hours, a competitive timeframe when factoring in airport transit and security.

Virtual communication technologies also pose a significant threat, especially to business travel, a key revenue source for airlines. Platforms like Zoom and Microsoft Teams have reduced the necessity for physical meetings. While business travel saw a rebound in 2024, the long-term structural shift towards remote collaboration could limit its growth potential for carriers like Hainan.

For cargo, alternatives like rail, road, and sea freight offer lower costs for non-time-sensitive goods. Sea freight, for instance, can be as much as 90% cheaper per kilogram than air cargo, making it a strong substitute for bulk shipments. In 2024, global maritime shipping handled an estimated 11 billion tonnes, highlighting its capacity for large volumes.

| Substitute | Key Advantage | Impact on Hainan Airlines | 2024 Data/Context |

|---|---|---|---|

| High-Speed Rail | Speed, Convenience (city-center to city-center) | Reduces domestic passenger demand | 45,000+ km operational by end of 2023 |

| Virtual Meetings | Cost savings, Time efficiency | Decreases business travel demand | Continued widespread adoption post-pandemic |

| Sea/Road/Rail Freight | Lower cost for bulk/non-urgent goods | Threatens air cargo market share | Sea freight ~10% cost of air freight per kg |

Entrants Threaten

The aviation industry, including carriers like Hainan Airlines, presents a formidable barrier to entry due to exceptionally high capital requirements. Acquiring a modern aircraft fleet, whether through purchase or lease, represents a multi-million dollar investment per plane. For instance, a new Boeing 787 Dreamliner can cost upwards of $300 million. Beyond aircraft, establishing and maintaining the necessary operational infrastructure, such as maintenance facilities and ground support equipment, demands substantial ongoing capital, making it incredibly difficult for new airlines to compete.

New airlines confront a formidable array of national and international aviation regulations, demanding extensive licensing and stringent safety certifications. For instance, in 2024, the International Civil Aviation Organization (ICAO) continued to emphasize enhanced safety oversight, requiring new entrants to demonstrate robust compliance with evolving standards. This intricate and costly process of establishing a compliant operational framework presents a significant barrier, deterring many potential competitors.

The threat of new entrants is significantly constrained by limited airport slot availability, especially at major, congested hubs. Acquiring desirable slots often demands substantial capital investment or considerable political leverage, acting as a formidable barrier for newcomers aiming to establish a presence. For Hainan Airlines, the ability to secure and retain prime operating slots at critical airports such as Beijing Capital International Airport (PEK) and Guangzhou Baiyun International Airport (CAN) is paramount to its network's efficiency and reach, thereby presenting a substantial hurdle for potential competitors seeking to enter the market.

Established Brand Loyalty and Network Effects

Established brand loyalty and network effects pose a significant barrier for new airlines entering the market. Major carriers like Hainan Airlines have cultivated strong customer recognition, comprehensive route systems, and attractive frequent flyer programs, often bolstered by strategic alliances. For instance, in 2024, major Chinese airlines continued to see robust domestic travel recovery, with Hainan Airlines Group reporting a significant increase in passenger volume compared to pre-pandemic levels, demonstrating the stickiness of their existing customer base.

New entrants would face immense challenges in replicating this established loyalty and network breadth, which are critical for passenger and cargo acquisition. Building a comparable customer base and operational network requires substantial investment and time, making it difficult for newcomers to compete effectively against incumbents who already benefit from these ingrained advantages.

- Brand Recognition: Hainan Airlines, as a major player, benefits from years of brand building and customer trust.

- Network Breadth: Extensive domestic and international routes are a key differentiator, offering convenience that new airlines struggle to match.

- Frequent Flyer Programs: Loyalty programs incentivize repeat business, creating a strong retention mechanism.

- Strategic Partnerships: Alliances with other airlines and travel providers further enhance the value proposition for existing customers.

Access to Talent and Infrastructure

The aviation industry demands a specialized and extensively trained workforce, encompassing pilots, flight attendants, and maintenance technicians. New airlines entering the market would grapple with the significant challenge of attracting and onboarding this crucial talent pool. For instance, in 2024, the global shortage of qualified pilots continued to be a pressing issue, with some regions experiencing a deficit of over 10,000 pilots.

Beyond human capital, establishing the necessary operational infrastructure presents another substantial hurdle. This includes securing airport slots, developing robust ground handling capabilities, and building complex logistical networks. The capital expenditure required for these elements is immense, making it difficult for new entrants to compete with established carriers that already possess these advantages.

- Talent Acquisition: Difficulty in recruiting and retaining skilled aviation professionals like pilots and engineers.

- Training Costs: High expenses associated with training new personnel to meet stringent aviation safety standards.

- Infrastructure Development: Significant investment needed for ground operations, maintenance facilities, and securing desirable airport slots.

- Regulatory Compliance: Navigating complex and costly regulatory approvals for new airlines and their operations.

The threat of new entrants for Hainan Airlines is considerably low due to the immense capital required to start an airline. Purchasing or leasing a single modern aircraft can cost hundreds of millions of dollars, with a Boeing 787 Dreamliner alone exceeding $300 million in 2024. This financial barrier extends to essential infrastructure like maintenance facilities, making it exceptionally difficult for newcomers to establish a competitive presence.

Porter's Five Forces Analysis Data Sources

Our Hainan Airlines Porter's Five Forces analysis is built upon a robust foundation of data, including official company filings, aviation industry reports from organizations like IATA, and financial databases such as Bloomberg. We also incorporate insights from market research firms specializing in the travel sector and news from credible aviation trade publications.