Bank of East Asia PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of East Asia Bundle

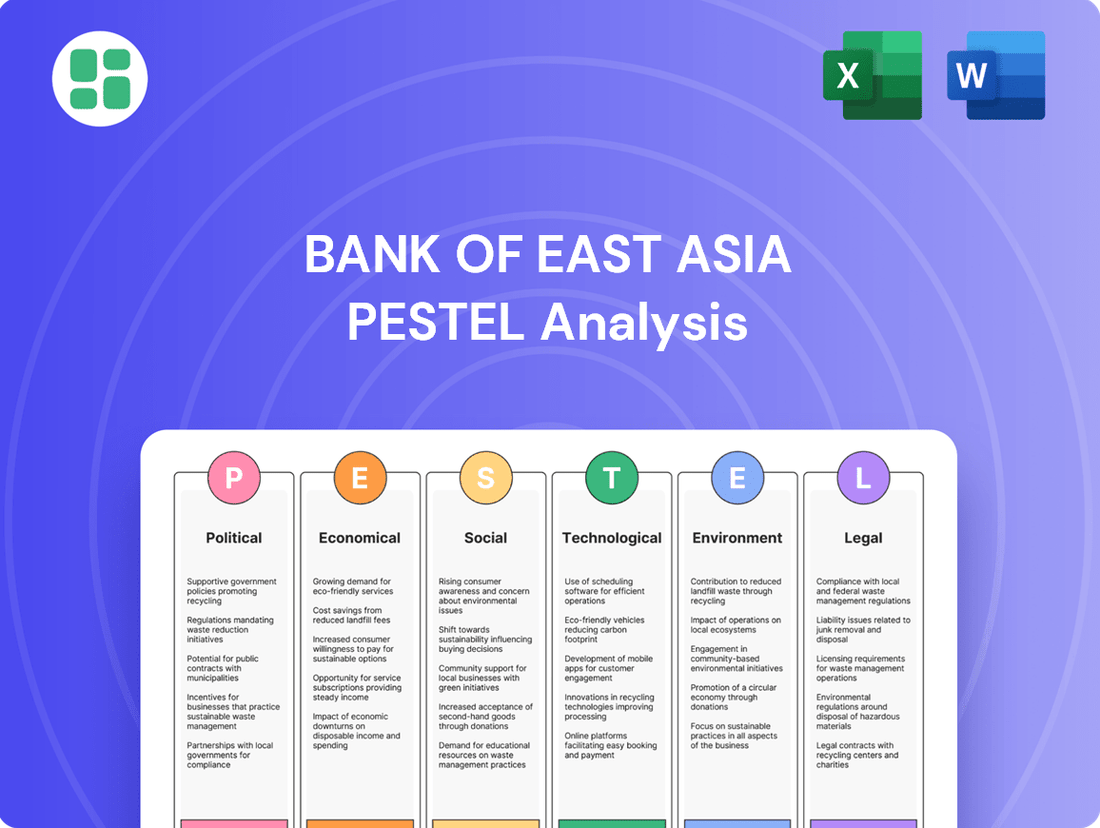

Navigate the complex external forces shaping Bank of East Asia's future. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors impacting its operations and strategic direction. Gain a competitive advantage by understanding these critical trends.

Unlock actionable intelligence with our comprehensive PESTLE analysis of Bank of East Asia. Discover how regulatory changes, economic shifts, and technological advancements present both opportunities and challenges. Equip yourself with the insights needed to make informed decisions.

Don't get left behind in a dynamic market. Our expertly crafted PESTLE analysis for Bank of East Asia provides a clear roadmap of external influences. Understand the landscape to refine your strategy and capitalize on emerging trends. Download the full version now for immediate strategic advantage.

Political factors

Political stability in Hong Kong and mainland China is a cornerstone for Bank of East Asia's operations. Government policies directly impact the regulatory landscape, capital requirements, and market access for banks. Any shifts in these areas can create both opportunities and challenges.

Recent policy pronouncements from Beijing have signaled a commitment to bolstering Hong Kong's position as an international financial center, particularly in its role connecting mainland China with the global economy. This creates a more favorable operating environment for banks like BEA. For instance, the Hong Kong Monetary Authority reported that the total value of Hong Kong's stock market reached HK$37.4 trillion as of May 2024, underscoring the city's financial vitality.

BEA's strategic emphasis on cross-boundary banking services directly leverages these governmental initiatives. By facilitating trade and investment between mainland China and international markets, the bank is well-positioned to benefit from policies aimed at deepening economic integration and strengthening Hong Kong's financial hub status. This alignment is crucial for sustained growth.

Ongoing geopolitical tensions, especially concerning US-China trade policies and the possibility of further tariff increases, create substantial unpredictability for banks in the Asia-Pacific region. These strains can directly disrupt international trade volumes, reduce investor confidence, and consequently influence the earning potential and expansion opportunities for financial institutions with cross-border operations.

For example, the US imposed tariffs on over $300 billion worth of Chinese goods in 2019, and while some tariffs were rolled back, the underlying tensions persist. This volatility impacts global supply chains and investment flows, directly affecting the banking sector’s ability to facilitate trade finance and manage currency risks.

Bank of East Asia (BEA), with its significant presence in both mainland China and Hong Kong, is particularly exposed to these geopolitical shifts. Fluctuations in trade relations can impact BEA's loan demand, deposit growth, and overall asset quality as businesses adjust their strategies in response to changing international economic landscapes.

Regulatory bodies like the Hong Kong Monetary Authority (HKMA) and the China Banking and Insurance Regulatory Commission (CBIRC) exert significant control over banks. In 2025, their priorities are clear: bolstering defenses against cyber fraud, financial crime, and operational disruptions. This means banks, including Bank of East Asia, must consistently upgrade their compliance systems to meet these evolving demands.

Cross-border Integration Initiatives

Hong Kong's role as China's international financial hub is strengthening through initiatives boosting cross-border movement and mainland access to Hong Kong's financial services. For Bank of East Asia (BEA), its 'OneBank strategy' is designed to capitalize on these trends, offering integrated banking across borders. This integration presents significant growth avenues, though it also involves managing intricate regulatory frameworks.

These cross-border integration efforts are directly impacting financial institutions like BEA. For instance, the Hong Kong Monetary Authority (HKMA) has been actively promoting FinTech and cross-boundary payment systems, with initiatives like the Faster Payment System (FPS) facilitating easier transactions. In 2023, the total value of cross-boundary transactions facilitated through various channels saw a notable increase, underscoring the growing connectivity.

- Cross-border Financial Connectivity: Initiatives like the Wealth Management Connect scheme, launched in 2020, allow investors in Hong Kong and the Greater Bay Area (GBA) to invest in each other's markets. By the end of 2023, the cumulative investment under the Wealth Management Connect scheme reached over RMB 100 billion, demonstrating significant uptake.

- Facilitating People Flows: Measures to simplify travel and visa processes between Hong Kong and mainland China, particularly within the GBA, are increasing business and personal interactions. This enhanced mobility directly supports the demand for cross-border banking services.

- Regulatory Harmonization Efforts: While full harmonization is a long-term goal, there are ongoing dialogues and pilot programs aimed at aligning certain financial regulations to ease cross-border operations, a critical factor for banks like BEA.

Policy Support for Economic Growth

Both Hong Kong and mainland Chinese authorities are actively implementing pro-growth policies to stabilize economic recovery and boost confidence. For instance, in 2024, China's government announced a fiscal deficit target of 3% of GDP, signaling continued commitment to stimulus measures. Hong Kong also introduced measures like property tax waivers and consumption voucher schemes to invigorate the economy.

These policies, including targeted fiscal support and initiatives to stimulate consumption, are crucial for driving demand for banking services and supporting overall loan growth. The effectiveness of these measures is evident in the projected GDP growth figures; Hong Kong's economy is forecast to grow by 2.5% to 3.5% in 2024, while mainland China's GDP is expected to expand by around 5% in the same year.

Bank of East Asia (BEA) directly benefits from these broader economic stimulus efforts. The increased economic activity translates into higher demand for loans, mortgages, and other financial products. For example, BEA's net interest income saw an increase in early 2024, partly attributable to a more supportive interest rate environment and increased lending opportunities driven by these policies.

- Pro-Growth Policies: Both Hong Kong and mainland China are actively deploying fiscal and monetary measures to support economic expansion.

- Stimulus Impact: Initiatives like consumption vouchers and tax breaks aim to boost consumer spending and business investment.

- Economic Forecasts: Hong Kong's GDP is projected to grow between 2.5% and 3.5% in 2024, with mainland China targeting around 5% growth.

- BEA's Benefit: The bank stands to gain from increased demand for financial services and loan growth spurred by these government initiatives.

Government policies in Hong Kong and mainland China significantly shape Bank of East Asia's operating environment, influencing everything from capital requirements to market access. Initiatives aimed at strengthening Hong Kong's role as an international financial hub, particularly its connection to mainland China, create favorable conditions. For instance, the Hong Kong Monetary Authority reported a total stock market value of HK$37.4 trillion as of May 2024, highlighting the city's financial dynamism.

| Policy Area | Impact on BEA | Supporting Data (2023-2024) |

|---|---|---|

| Cross-border Financial Connectivity | Enhanced opportunities via schemes like Wealth Management Connect. | Wealth Management Connect cumulative investment exceeded RMB 100 billion by end-2023. |

| Economic Stimulus Measures | Increased demand for banking services and loan growth. | Hong Kong GDP forecast: 2.5%-3.5% growth in 2024; China GDP target: ~5% in 2024. |

| Regulatory Focus (Cybersecurity, Financial Crime) | Need for continuous compliance system upgrades. | HKMA and CBIRC prioritizing defenses against fraud and crime in 2025. |

What is included in the product

This PESTLE analysis of the Bank of East Asia examines the impact of Political, Economic, Social, Technological, Environmental, and Legal forces on its operations and strategic planning.

A PESTLE analysis for The Bank of East Asia offers a clear, summarized version of external factors, relieving the pain point of navigating complex market dynamics during strategic planning.

Economic factors

The Bank of East Asia (BEA) is navigating a landscape of anticipated moderate economic expansion. For 2025, mainland China's growth is forecast to be approximately 4.8%, while Hong Kong's economy is expected to grow by around 2.5%.

This outlook suggests a stable, yet not explosive, environment for banking activities. While these projections point to a continued recovery, it's important to acknowledge that persistent challenges will likely accompany this growth.

The Bank of East Asia's interest rate environment is heavily influenced by the Hong Kong Monetary Authority's (HKMA) base rate, which closely tracks the US Federal Reserve's policy due to the Hong Kong dollar's peg to the US dollar. This direct link means that changes in US interest rates immediately impact Hong Kong's borrowing costs and deposit rates.

Looking ahead to 2025, analysts are predicting that a more measured approach to US rate cuts, rather than aggressive reductions, could provide a supportive backdrop for bank net interest margins. This means banks like Bank of East Asia might see their profitability bolstered as the gap between what they earn on loans and pay on deposits remains favorable.

Hong Kong's property market has seen persistent weakness, a significant factor for banks like Bank of East Asia (BEA). This downturn, coupled with exposure to struggling mainland developers, continues to pose challenges.

BEA has been actively managing its credit risk. A key strategy has been reducing its exposure to commercial real estate in mainland China, a move that reflects the sector's volatility.

The overall performance of the property market remains a critical determinant for the banking sector's asset quality and the demand for new loans. For instance, in early 2024, Hong Kong's residential property prices continued to face downward pressure, impacting the value of collateral and potentially increasing non-performing loans.

Inflationary Pressures

While global inflationary pressures have eased from their peaks, inflation remains a key consideration for monetary policy. Hong Kong's Consumer Price Index (CPI) saw a modest increase, with the Composite CPI rising by 2.1% in April 2024 year-on-year, a slight uptick from the previous month's 1.7%. This persistent inflation impacts consumer purchasing power and influences the demand for credit, directly affecting banks like Bank of East Asia.

Banks must closely monitor these inflationary trends as they directly affect the cost of funds and the overall profitability of lending operations. Fluctuations in inflation can also sway business and consumer confidence, leading to shifts in investment and spending patterns. For instance, higher inflation can erode the real value of savings, potentially dampening consumer sentiment and slowing economic activity.

- Inflationary Impact: Persistent inflation affects consumer spending and the demand for loans.

- Monetary Policy Influence: Inflation rates guide central bank interest rate decisions, impacting funding costs for banks.

- Economic Confidence: Fluctuations in inflation can create uncertainty, influencing business and consumer sentiment.

- Hong Kong CPI: The Composite CPI in Hong Kong recorded a 2.1% year-on-year increase in April 2024.

Consumer and Business Confidence

Consumer and business confidence in Hong Kong are showing signs of improvement, largely due to increased policy support from mainland China. This support is expected to create positive spillover effects, injecting new momentum into Hong Kong's economy and its asset markets. For instance, the Hong Kong Purchasing Managers' Index (PMI) for manufacturing, a key indicator of business sentiment, rose to 50.9 in April 2024, indicating a slight expansion after several months of contraction.

This anticipated uplift in confidence is crucial as it can directly stimulate consumer spending and encourage businesses to increase investment. Higher confidence levels often translate into greater willingness to spend on goods and services, and for businesses, it means a more favorable environment for expansion and capital expenditure. This, in turn, drives demand for a wide array of banking and financial services, benefiting institutions like the Bank of East Asia (BEA).

BEA's financial performance is intrinsically linked to these sentiment indicators. When confidence is high, consumers are more likely to take out loans for purchases, and businesses are more inclined to seek financing for growth. Conversely, low confidence can lead to reduced spending and investment, impacting loan demand and overall profitability for banks. The recent positive trends in economic sentiment suggest a potentially more robust operating environment for BEA in the near future.

- Hong Kong PMI Manufacturing: 50.9 in April 2024, signaling a return to expansion.

- Mainland China Policy Support: Expected to boost Hong Kong's economy and asset markets.

- Consumer Spending Impact: Improved confidence can lead to increased retail sales and service consumption.

- Business Investment: Positive sentiment encourages capital expenditure and job creation.

Economic growth in mainland China is projected at 4.8% for 2025, with Hong Kong's economy expected to expand by 2.5%. This moderate growth environment influences credit demand and the banking sector's overall health.

Interest rates, tied to the US Federal Reserve's policy via the Hong Kong dollar peg, are anticipated to offer a supportive net interest margin environment for banks in 2025, assuming measured rate cuts.

Persistent weakness in Hong Kong's property market, including exposure to mainland developers, continues to be a key risk factor for banks like BEA, impacting asset quality and loan demand.

Inflation remains a consideration, with Hong Kong's Composite CPI at 2.1% year-on-year in April 2024, influencing consumer spending power and the cost of funds for banks.

| Economic Indicator | Value | Period | Implication for BEA |

|---|---|---|---|

| Mainland China GDP Growth Forecast | 4.8% | 2025 | Stable credit demand |

| Hong Kong GDP Growth Forecast | 2.5% | 2025 | Moderate expansion in financial services |

| Hong Kong Composite CPI | 2.1% | April 2024 | Impacts consumer spending and cost of funds |

| Hong Kong PMI Manufacturing | 50.9 | April 2024 | Indicates improving business sentiment |

Preview Before You Purchase

Bank of East Asia PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the Bank of East Asia delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. Gain immediate access to this detailed report to understand the strategic landscape for the Bank of East Asia.

Sociological factors

Customer preferences in Hong Kong are rapidly shifting towards digital and personalized banking. A significant portion of Hong Kong’s population, particularly younger demographics, now prefers mobile banking for everyday transactions. For instance, by the end of 2023, over 70% of retail banking transactions were conducted digitally.

Banks like Bank of East Asia (BEA) are responding by investing heavily in their digital infrastructure. This includes enhancing mobile app functionality and developing AI-driven tools for personalized financial advice. BEA’s commitment to digital transformation aims to meet the demand for convenient, tailored banking solutions, recognizing that customer loyalty hinges on these evolving expectations.

Significant demographic shifts, like an aging population and evolving intergenerational wealth transfer patterns, are directly impacting the demand for specialized financial services. This translates to a heightened need for wealth management, retirement planning, and estate planning solutions. For instance, in Hong Kong, the proportion of the population aged 65 and over is projected to reach 27% by 2030, underscoring the growing market for retirement-focused products.

Bank of East Asia (BEA) is strategically positioned to address these evolving needs. With its robust wealth management capabilities, the bank can effectively cater to diverse age groups seeking tailored financial advice and products. This includes offering comprehensive investment strategies for accumulating wealth and providing secure options for wealth preservation and distribution across generations.

Financial literacy is paramount as banking services migrate online. In 2024, approximately 70% of global internet users engaged in online banking, highlighting the need for accessible digital platforms. Bank of East Asia must ensure its digital offerings are user-friendly and accompanied by educational resources to prevent digital exclusion, especially among older demographics or those with limited tech experience.

Trust in Financial Institutions

Public trust in financial institutions is a cornerstone for banks like the Bank of East Asia, particularly as financial crime and cyber threats become more prevalent. Maintaining this trust requires a proactive approach to security and transparency. For instance, in 2024, reports indicated a significant increase in reported cyberattacks targeting financial services globally, highlighting the critical need for robust defense mechanisms.

Banks must actively showcase their commitment to safeguarding customer assets and data. This involves clear communication about security protocols and the implementation of effective customer protection measures. A strong reputation is not just beneficial; it's a vital asset in the competitive banking landscape, directly influencing customer loyalty and market share.

- 2024 Global Financial Crime Report: Saw a notable rise in phishing and ransomware attacks against banks.

- Customer Confidence Surveys: Often cite data security and transparent communication as key drivers of trust.

- Bank of East Asia's 2024 Annual Report: May detail investments in cybersecurity and fraud prevention initiatives.

- Regulatory Scrutiny: Increased focus on data privacy and consumer protection by financial regulators in 2024/2025.

Cross-border Customer Base

Bank of East Asia's customer base is geographically diverse, encompassing Hong Kong, mainland China, and other international locations. This means the bank must cater to a wide array of cultural norms, spending patterns, and financial requirements. For instance, in 2024, mainland China's digital payment adoption continued to surge, with mobile payment transactions projected to reach over $75 trillion, a stark contrast to the more traditional banking preferences still prevalent in some segments of Hong Kong's market.

Effectively serving this varied clientele requires tailored financial products and services. Understanding regional economic conditions and consumer confidence is paramount; for example, while Hong Kong's GDP growth was estimated at 2.5% for 2024, mainland China's growth was around 5.0%, influencing disposable income and investment appetite differently across these markets.

- Cultural Nuances: Adapting communication styles and product offerings to align with local cultural expectations in each market is crucial for building trust and loyalty.

- Consumption Habits: Recognizing differences in spending, saving, and investment behaviors, such as the higher propensity for wealth management products among affluent customers in mainland China compared to Hong Kong, informs product development.

- Banking Needs: Addressing specific demands, like the growing need for cross-border wealth management solutions for Chinese expatriates or the demand for convenient digital banking for younger demographics in both regions, is key to customer retention.

Societal attitudes towards financial institutions are evolving, with a growing emphasis on corporate social responsibility and ethical banking practices. Customers increasingly expect banks to demonstrate a commitment to sustainability and community well-being. For example, a 2024 survey indicated that 65% of consumers consider a bank's social impact when making financial decisions.

Bank of East Asia (BEA) must align its operations with these societal expectations. This involves transparent reporting on environmental, social, and governance (ESG) initiatives and actively engaging in community development programs. Demonstrating genuine commitment to these areas can enhance brand reputation and foster stronger customer relationships.

The increasing demand for personalized and accessible financial education is a significant societal trend. As digital banking becomes more prevalent, there's a greater need to equip consumers with the knowledge to navigate online platforms and understand complex financial products. In 2024, financial literacy rates remained a concern, with a significant portion of the population reporting low confidence in managing their finances.

BEA can play a crucial role by offering educational resources and workshops, both online and offline, to improve financial literacy across its customer base. This proactive approach not only empowers customers but also builds trust and positions BEA as a responsible financial partner.

Technological factors

Hong Kong's banking sector is in the midst of a significant digital transformation, with a notable portion of financial institutions, over one-third, actively incorporating generative AI into their operational frameworks. This rapid adoption underscores a broader trend of technological advancement within the industry.

Bank of East Asia needs to maintain robust investment in and adoption of cutting-edge digital solutions. This strategic imperative is crucial for optimizing internal processes, elevating customer service experiences, and crucially, preserving a competitive advantage in this dynamic and fast-changing market landscape.

Embracing cloud technologies and modernizing digital infrastructure are key components of this digital evolution. These advancements enable greater agility, scalability, and efficiency, which are vital for navigating the complexities of the contemporary financial services environment.

The Hong Kong Monetary Authority's (HKMA) Fintech 2025 strategy is a significant driver for technological advancement in banking. This initiative actively champions the integration of technologies like artificial intelligence (AI) and distributed ledger technology (DLT) across sectors such as wealthtech and insurtech.

This proactive regulatory stance fosters an environment where banks, including the Bank of East Asia, are encouraged to adopt innovative fintech solutions. Such adoption is crucial for enhancing operational efficiency and elevating customer service experiences in the competitive financial landscape.

The banking sector, including institutions like Bank of East Asia, is grappling with a surge in sophisticated cyber threats such as phishing and malware. This escalating risk landscape elevates cybersecurity from a technical concern to a fundamental strategic imperative for maintaining operational integrity and customer confidence.

A critical technological challenge involves managing the cybersecurity risks inherent in partnerships with third-party service providers, including cloud infrastructure and fintech collaborators. Robust governance frameworks and diligent oversight are crucial to mitigate these external vulnerabilities, ensuring data protection across the extended digital ecosystem.

In 2023, the global financial services sector experienced a significant increase in cyber incidents, with reports indicating a substantial rise in ransomware attacks targeting banks. For instance, IBM's 2023 Cyber Security Report highlighted that the financial sector faced an average cost of $5.90 million per data breach, underscoring the financial and reputational stakes involved in maintaining strong data protection measures.

AI and Data Analytics Integration

Banks are increasingly leveraging Artificial Intelligence (AI) and advanced data analytics for enhanced customer service, improved operational efficiency, and more precise risk identification. For instance, in 2024, many financial institutions reported significant cost savings and revenue growth through AI-driven fraud detection systems, with some seeing reductions in fraudulent transactions by up to 20%.

The Hong Kong Monetary Authority (HKMA) actively supports AI adoption through initiatives like its Generative AI Sandbox, launched in late 2024, which allows banks to test AI applications in a controlled environment. This, coupled with a data-driven supervisory framework, encourages responsible innovation. This integration allows for predictive analysis and personalized financial advice, with early adopters reporting a 15% increase in customer engagement through tailored product recommendations.

- Enhanced Customer Service: AI-powered chatbots and personalized recommendations improve customer experience, with a 2024 survey indicating a 25% rise in customer satisfaction for banks utilizing these technologies.

- Operational Efficiency: Automation of routine tasks through AI leads to significant cost reductions, with projections for 2025 suggesting a 10-15% decrease in operational expenses for early adopters.

- Risk Management: Advanced analytics enable more accurate credit scoring and fraud detection, with AI models in 2024 demonstrating a 30% improvement in identifying high-risk loan applications.

- Regulatory Support: Initiatives like the HKMA's Generative AI Sandbox foster a conducive environment for technological advancement within the banking sector.

Blockchain and DLT Exploration

The Hong Kong Monetary Authority (HKMA) is actively pushing for the adoption of Distributed Ledger Technology (DLT). This includes exploring tokenized deposits and cross-border Central Bank Digital Currencies (CBDCs), as seen in initiatives like Project mBridge and Project Ensemble. For Bank of East Asia (BEA), understanding and potentially integrating these advancements is crucial for capitalizing on opportunities in digital assets and improving interbank settlement efficiency.

BEA should consider how DLT can streamline its operations. For instance, tokenized deposits could offer new avenues for liquidity management and product innovation. The bank's strategic planning must account for the evolving regulatory landscape surrounding these technologies, ensuring compliance while seeking competitive advantages.

The global push towards digital currencies and DLT is significant. By mid-2024, several central banks were in advanced stages of CBDC research and pilot programs, with many exploring DLT for wholesale payments. BEA's engagement with these developments positions it to leverage potential benefits such as reduced transaction costs and enhanced transparency in financial dealings.

BEA's strategic response to these technological factors could involve:

- Assessing DLT's impact on traditional banking services and identifying areas for innovation.

- Participating in pilot programs for tokenized deposits and cross-border CBDC initiatives.

- Developing internal expertise and infrastructure to support DLT-based solutions.

- Monitoring regulatory developments and adapting strategies accordingly.

Technological advancements are fundamentally reshaping the banking sector, with generative AI adoption exceeding one-third of financial institutions in Hong Kong, according to recent data. Bank of East Asia must prioritize investments in digital solutions and cloud technologies to maintain agility and enhance customer experiences in this rapidly evolving market. The HKMA's Fintech 2025 strategy actively promotes AI and DLT integration, encouraging banks to innovate.

Cybersecurity remains a critical technological challenge, with a notable increase in sophisticated threats like ransomware impacting financial services globally. IBM's 2023 report indicated an average data breach cost of $5.90 million for the financial sector, highlighting the imperative for robust data protection measures and diligent oversight of third-party providers.

AI and advanced analytics are driving significant improvements in customer service and risk management, with early adopters reporting up to a 20% reduction in fraudulent transactions in 2024. The HKMA's Generative AI Sandbox, launched in late 2024, further supports responsible AI innovation, with banks seeing a 15% increase in customer engagement through personalized recommendations.

Distributed Ledger Technology (DLT) is gaining traction, with explorations into tokenized deposits and cross-border CBDCs like Project mBridge. By mid-2024, numerous central banks were piloting DLT for wholesale payments, offering BEA opportunities to reduce transaction costs and enhance transparency.

| Technology Area | Impact on Banking | Key Initiatives/Trends (2024-2025) | Potential Benefit for BEA | Associated Risk |

|---|---|---|---|---|

| Generative AI | Enhanced customer service, operational efficiency, risk identification | Over 1/3 HK banks adopting AI; HKMA Generative AI Sandbox | Improved customer engagement (15% increase reported); Cost savings via AI-driven fraud detection (up to 20% reduction) | Cybersecurity threats, data privacy concerns |

| Cloud Computing | Increased agility, scalability, and efficiency | Modernization of digital infrastructure | Optimized internal processes, greater operational flexibility | Third-party vendor risk, data security |

| Distributed Ledger Technology (DLT) | Streamlined operations, new product innovation, improved settlement efficiency | HKMA exploring tokenized deposits, CBDCs (Project mBridge) | Reduced transaction costs, enhanced transparency in financial dealings | Regulatory uncertainty, integration complexity |

| Cybersecurity | Maintaining operational integrity and customer confidence | Increase in ransomware and phishing attacks; Avg. data breach cost $5.90M (IBM 2023) | Protecting sensitive customer data and financial assets | Sophisticated cyber threats, third-party vulnerabilities |

Legal factors

The Hong Kong Monetary Authority (HKMA) consistently refines banking regulations to bolster the financial system's stability. For instance, recent updates in 2024 have emphasized enhanced requirements for operational resilience and cybersecurity measures, directly impacting how banks manage risk and invest in technology.

Banks like the Bank of East Asia (BEA) must actively adapt their compliance frameworks and internal policies to meet these evolving standards. Failure to do so can lead to significant penalties and operational disruptions, underscoring the importance of proactive regulatory engagement.

Hong Kong's commitment to combating financial crime is evident in the AML/CFT (Amendment) Ordinance 2024, which tightens regulations for digital payment platforms and virtual assets. This legislative update mandates enhanced due diligence and reporting for financial institutions.

Financial institutions like the Bank of East Asia are increasingly adopting advanced technologies, such as AI and Machine Learning, to bolster their transaction monitoring capabilities. These tools are crucial for identifying and reporting suspicious activities more effectively, aiming to reduce the risk of financial crime.

Ensuring robust compliance with these evolving AML/CTF regulations represents a substantial and continuous operational challenge. The cost of compliance for financial institutions globally was estimated to be in the tens of billions of dollars annually, a figure expected to rise with stricter enforcement and technological advancements.

As Bank of East Asia (BEA) grows its digital offerings, it must strictly follow data privacy laws. This includes Hong Kong's Personal Data (Privacy) Ordinance, which mandates protecting sensitive customer information. Recent data breaches in the financial sector, like the 2023 incident affecting millions of customers globally, underscore the severe penalties for non-compliance, ranging from hefty fines to significant damage to brand reputation.

Consumer Protection Frameworks

Regulators are significantly stepping up efforts to combat financial scams and bolster fraud prevention across the banking industry. The Hong Kong Monetary Authority (HKMA), for instance, has issued enhanced fraud management guidelines, signaling a stricter approach to safeguarding consumers. This includes fostering collaborative initiatives with banks to tackle scams within the digital ecosystem.

Banks are legally obligated to establish and maintain robust internal control systems and implement proactive measures to shield customers from financial crime. This legal mandate underscores the critical importance of consumer protection in the banking sector, requiring institutions like the Bank of East Asia to invest heavily in security and compliance.

- HKMA's Enhanced Fraud Management Guidelines: These directives aim to strengthen banks' defenses against increasingly sophisticated financial scams.

- Collaborative Initiatives with Banks: The HKMA is actively partnering with financial institutions to identify and disrupt digital fraud networks.

- Legal Requirement for Robust Internal Controls: Banks must demonstrate effective systems for preventing and detecting financial crime to protect consumers.

- Proactive Consumer Protection Measures: This includes educating customers about potential risks and implementing advanced security protocols.

Cross-border Regulatory Cooperation

Bank of East Asia (BEA) operates across numerous jurisdictions, including mainland China and other international financial centers. This necessitates a deep understanding and adherence to a complex web of cross-border legal and regulatory frameworks. Ensuring compliance with varying capital requirements, anti-money laundering (AML) directives, and data privacy laws across these regions presents a significant operational challenge.

The bank's extensive network means it must navigate differing legal interpretations and enforcement practices. For instance, as of late 2024, regulatory bodies like the European Banking Authority (EBA) and the Monetary Authority of Singapore (MAS) continue to refine their AML and Know Your Customer (KYC) standards, requiring constant adaptation from institutions like BEA.

Harmonization efforts between national and international regulatory bodies are vital for streamlining operations and reducing compliance burdens. Initiatives such as the Basel Accords, which aim to standardize capital adequacy ratios globally, directly impact BEA's risk management and strategic planning. Continued cooperation is essential for facilitating seamless international banking services and mitigating potential legal disputes.

- Cross-border Compliance Burden: BEA must manage adherence to diverse legal systems, including those in China, Hong Kong, and other key markets.

- Evolving AML/KYC Standards: Regulatory bodies globally, such as the EBA and MAS, are continually updating AML and KYC requirements, demanding ongoing vigilance.

- Impact of Regulatory Harmonization: International agreements like the Basel Accords influence BEA's capital requirements and risk management strategies.

- Mitigation of Legal Risks: Effective navigation of differing legal frameworks is critical to preventing penalties and maintaining operational integrity.

The Bank of East Asia (BEA) must navigate a complex and evolving legal landscape, particularly concerning anti-money laundering (AML) and counter-terrorist financing (CTF) regulations. Hong Kong's AML/CFT Ordinance, updated in 2024, imposes stricter due diligence and reporting obligations, impacting how BEA handles transactions and customer onboarding. Global regulatory bodies, like the European Banking Authority (EBA) and the Monetary Authority of Singapore (MAS), are also continuously refining their AML/KYC standards, demanding ongoing vigilance and adaptation from BEA's operations across multiple jurisdictions.

Furthermore, the HKMA's enhanced fraud management guidelines and emphasis on operational resilience and cybersecurity, particularly highlighted in 2024 updates, legally obligate banks like BEA to invest in robust internal control systems and advanced technologies. This includes protecting sensitive customer data under Hong Kong's Personal Data (Privacy) Ordinance, with significant penalties for non-compliance, as evidenced by past data breaches in the financial sector.

| Regulatory Focus Area | Key Legal Development (2024/2025) | Impact on BEA | Example Data/Stat |

|---|---|---|---|

| AML/CTF | Updated AML/CFT Ordinance (Hong Kong) | Stricter due diligence and reporting requirements | Global AML compliance costs estimated in tens of billions annually, expected to rise. |

| Operational Resilience | HKMA enhanced requirements | Increased investment in cybersecurity and technology | Cybersecurity spending by global banks projected to exceed $100 billion annually by 2025. |

| Data Privacy | Personal Data (Privacy) Ordinance enforcement | Mandatory protection of sensitive customer information | Fines for data breaches can reach millions of dollars, plus reputational damage. |

| Cross-border Compliance | Evolving EBA/MAS AML/KYC standards | Need for continuous adaptation across jurisdictions | BEA operates in multiple financial centers, each with unique regulatory nuances. |

Environmental factors

The financial sector, including institutions like the Bank of East Asia, is experiencing a pronounced shift towards integrating Environmental, Social, and Governance (ESG) principles. The Hong Kong Monetary Authority (HKMA) is particularly focused on solidifying Hong Kong's status as a premier hub for sustainable finance, a trend that directly impacts how banks operate. This push signifies a move beyond traditional financial metrics to encompass broader societal and environmental impacts.

Bank of East Asia is therefore anticipated to embed ESG considerations deeply within its strategic planning and day-to-day operations. This integration is not merely about compliance but about aligning with evolving industry expectations and investor demands for responsible business practices. For instance, by 2024, many global financial institutions have reported increased allocation of capital towards ESG-focused funds, demonstrating a tangible market shift.

Bank of East Asia, like other financial institutions, is navigating heightened scrutiny regarding climate change risks. These risks are twofold: physical, stemming from events like typhoons impacting Hong Kong's infrastructure, and transitional, arising from shifts to a low-carbon economy that could affect borrowers' business models.

The Hong Kong Monetary Authority (HKMA) is actively engaging banks on this front. In 2024, the HKMA continued its thematic examinations focusing on how banks identify, assess, and manage climate-related risks, with a particular emphasis on integrating these considerations into their broader risk management frameworks.

Furthermore, the HKMA is incorporating climate risk stress testing into its supervisory approach. This means institutions like Bank of East Asia will be assessed on their resilience to various climate scenarios, ensuring they are prepared for potential financial impacts of climate change, a crucial element for long-term stability.

The Hong Kong government is significantly boosting its Government Sustainable Bond Programme, extending its reach to include social projects alongside environmental ones. This expansion is a key driver for the growth of the local sustainable finance market.

For banks like Bank of East Asia (BEA), this presents a substantial opportunity to engage in and lead green and social financing initiatives. The program's evolution aims to foster a more robust and diverse sustainable bond ecosystem.

In 2023, Hong Kong issued HK$30 billion in green bonds, with the government actively seeking to broaden the scope of eligible projects within its sustainable bond framework, signaling a commitment to deeper market development.

Net-Zero Commitments

Bank of East Asia, like other financial institutions in Hong Kong, is guided by the Hong Kong Monetary Authority's (HKMA) Sustainable Finance Action Agenda. This agenda sets a clear path for banks to achieve net-zero emissions within their own operations by 2030 and, more significantly, for their financed emissions by 2050.

Meeting these net-zero commitments necessitates the development of comprehensive transition plans. These plans involve setting concrete decarbonization targets and significantly improving the transparency around climate-related risks and the opportunities that arise from this transition.

- 2030 Target: Net-zero emissions for own operations.

- 2050 Target: Net-zero emissions for financed emissions.

- Key Actions: Develop transition plans, set decarbonization targets, enhance climate risk transparency.

Corporate Social Responsibility (CSR)

Beyond simply following rules, there's a growing demand for banks like Bank of East Asia to actively contribute to society and their local communities. This societal expectation goes beyond basic regulatory compliance, pushing financial institutions to demonstrate a genuine commitment to positive impact.

Bank of East Asia aims to be a force for good by weaving social, environmental, and ethical considerations directly into its core business practices and daily operations. This proactive approach is crucial for building trust and strengthening connections with all stakeholders.

This dedication to corporate social responsibility not only bolsters the bank's public image but also cultivates stronger, more resilient relationships with customers, employees, and the wider community. For instance, in 2023, Bank of East Asia reported a significant increase in its community investment programs, focusing on financial literacy and environmental sustainability initiatives.

- Community Investment: Bank of East Asia's commitment to CSR is reflected in its 2023 community investment figures, which saw a notable rise in funding for financial education and green projects.

- Reputation Enhancement: Strong CSR practices directly contribute to a more favorable public perception and improved brand loyalty among customers.

- Stakeholder Engagement: By integrating social and environmental concerns, the bank fosters deeper engagement and trust with its diverse stakeholder base.

- Sustainable Operations: The bank's strategy emphasizes embedding ethical considerations, leading to more sustainable and responsible business conduct.

Environmental factors are increasingly shaping the banking landscape, with regulators like the Hong Kong Monetary Authority (HKMA) driving a strong push for sustainable finance. This includes a focus on climate risk management, with the HKMA conducting thematic examinations and climate risk stress tests on institutions like Bank of East Asia. The HKMA's Sustainable Finance Action Agenda sets clear net-zero targets for banks, aiming for operational net-zero by 2030 and financed emissions net-zero by 2050.

The Bank of East Asia is actively responding to these environmental pressures by integrating ESG principles into its strategy and operations. This involves developing transition plans and enhancing transparency around climate-related risks and opportunities. The growth of Hong Kong's sustainable bond market, supported by the government's expanded Sustainable Bond Programme, presents significant opportunities for BEA to participate in green and social financing.

In 2023, Hong Kong's green bond issuance reached HK$30 billion, reflecting a growing market for environmentally conscious investments. BEA's commitment to corporate social responsibility, including increased community investment in financial literacy and environmental initiatives in 2023, further aligns with these environmental expectations and strengthens stakeholder relationships.

| Area of Focus | HKMA Target/Initiative | BEA's Response/Action |

|---|---|---|

| Climate Risk Management | Thematic examinations, climate risk stress testing (2024) | Integrating climate risk into risk management frameworks |

| Net-Zero Emissions | Operational net-zero by 2030, financed emissions by 2050 | Developing transition plans, setting decarbonization targets |

| Sustainable Finance Market | Expanding Government Sustainable Bond Programme | Engaging in green and social financing initiatives |

| ESG Integration | Emphasis on ESG principles in operations | Embedding ESG into core business practices and daily operations |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Bank of East Asia is built on a robust foundation of data from official government publications, reputable financial news outlets, and reports from international economic organizations. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors influencing the bank.