Bank of East Asia Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of East Asia Bundle

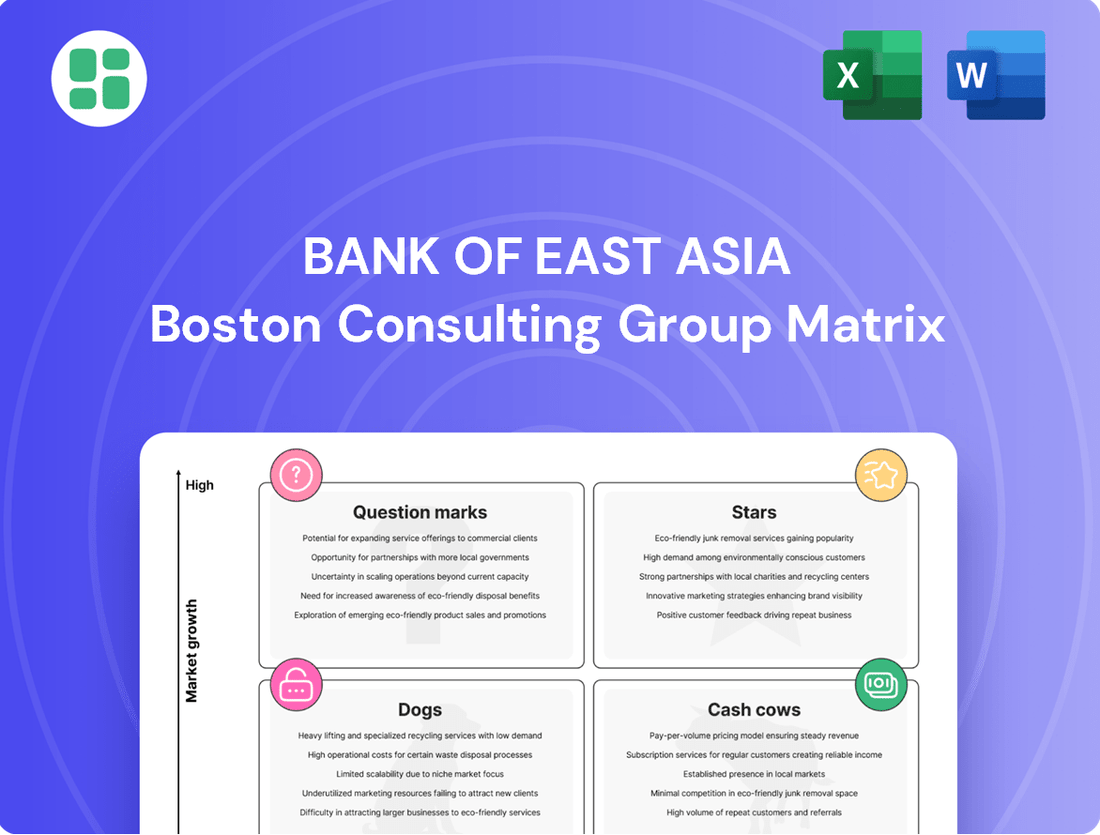

Curious about The Bank of East Asia's strategic positioning? This BCG Matrix preview highlights key product areas, but for a truly actionable understanding of their market share and growth potential, the full report is essential.

Unlock the complete picture of The Bank of East Asia's portfolio by purchasing the full BCG Matrix. Gain detailed insights into which products are Stars, Cash Cows, Dogs, or Question Marks, and receive data-driven recommendations to optimize your investment strategy.

Don't miss out on the critical strategic intelligence contained within The Bank of East Asia's full BCG Matrix. This comprehensive analysis will equip you with the knowledge to make informed decisions and drive future success.

Stars

Bank of East Asia's digital banking services are a clear star in its BCG Matrix. The bank is heavily investing in and promoting these channels, mirroring a broader trend in Hong Kong's banking industry. This focus on mobile and online platforms taps into a high-growth area as consumers increasingly prefer digital solutions for their financial activities.

Cross-border Wealth Management is a key growth driver for Bank of East Asia (BEA), leveraging its robust Hong Kong and mainland China presence. The bank is actively expanding services within the Greater Bay Area, capitalizing on significant wealth flows and supportive policies. This strategic focus aims to capture a leading market share in a rapidly expanding sector.

The global surge in environmental, social, and governance (ESG) focus fuels a booming market for sustainable finance products. Bank of East Asia's commitment, evidenced by its status as the first Hong Kong bank in the Net-Zero Banking Alliance, positions it well to capture this growth.

Expanding green and sustainable financing options allows BEA to meet increasing investor demand and solidify its standing in this expanding sector. In 2023, global sustainable debt issuance reached approximately $1.5 trillion, highlighting the significant market opportunity.

Fintech Collaboration Initiatives

Fintech collaboration initiatives, exemplified by Bank of East Asia's (BEA) platform BEAST, are positioned as a high-growth area. This strategic focus on innovation and digital solutions involves partnerships with emerging fintech companies and exploration of advanced technologies such as artificial intelligence and blockchain. The goal is to create novel products and services with significant market potential.

BEA's engagement in the fintech ecosystem is a clear indicator of its commitment to future expansion. These collaborations are designed to accelerate the development of new offerings, aiming to capture leadership positions in evolving digital financial services. For instance, in 2023, BEA announced a strategic partnership with a leading AI firm to enhance its customer service capabilities, a move expected to drive significant user engagement.

- BEAST Platform: BEA's dedicated fintech collaboration platform, fostering innovation and digital solutions.

- Strategic Partnerships: Collaborating with startups and technology providers to co-create new financial products and services.

- Technology Focus: Exploring and integrating cutting-edge technologies like AI and blockchain to drive competitive advantage.

- Market Leadership Aspiration: Aiming to develop market-leading products and services through these collaborative efforts.

Corporate Banking in Emerging Sectors

Bank of East Asia (BEA) is strategically pivoting its corporate banking focus, moving away from mature areas like commercial real estate. The bank is targeting high-growth emerging sectors, including manufacturing, retail trade, and technology, to drive future expansion. This strategic realignment is designed to capture new market opportunities and foster robust growth within its corporate lending book.

By cultivating specialized expertise and tailored financial products for these dynamic industries, BEA aims to secure a more substantial market share. This proactive approach allows the bank to align with evolving economic trends and capitalize on emerging growth engines. In 2024, for instance, global investment in manufacturing technology saw a notable increase, creating fertile ground for banks with focused lending strategies in this area.

- Targeting High-Growth Sectors: BEA is prioritizing lending to manufacturing, retail trade, and technology, sectors identified for significant expansion.

- Developing Specialized Solutions: The bank is creating bespoke financial products and services to meet the unique needs of businesses in these emerging industries.

- Gaining Market Share: This strategic shift is expected to enhance BEA's competitive position and capture a larger portion of the corporate lending market in these growth areas.

- Capitalizing on Economic Drivers: The move aims to leverage new economic trends and ensure sustained, dynamic growth for BEA's corporate banking portfolio.

Bank of East Asia's digital banking services and cross-border wealth management are identified as Stars within its BCG Matrix. The bank's significant investment in digital platforms and expansion within the Greater Bay Area for wealth management tap into high-growth markets. These areas demonstrate strong potential for future revenue generation and market leadership.

Sustainable finance and fintech collaborations also represent Star opportunities for Bank of East Asia. The bank's commitment to ESG, including its Net-Zero Banking Alliance membership, aligns with growing global demand. Furthermore, its fintech initiatives, like the BEAST platform, position it to capitalize on innovation in financial services.

The bank's strategic pivot in corporate banking towards high-growth sectors like manufacturing, retail, and technology also signifies a Star. By shifting focus from mature areas, BEA aims to capture new market share in dynamic industries. This strategic realignment is supported by global trends, such as increased investment in manufacturing technology in 2024.

| Category | BCG Matrix Status | Key Initiatives | Market Trend/Data Point |

|---|---|---|---|

| Digital Banking | Star | Heavy investment in mobile and online platforms | Increasing consumer preference for digital financial solutions |

| Cross-border Wealth Management | Star | Expansion within the Greater Bay Area | Significant wealth flows and supportive policies in the region |

| Sustainable Finance | Star | Commitment to ESG, Net-Zero Banking Alliance membership | Global sustainable debt issuance reached approx. $1.5 trillion in 2023 |

| Fintech Collaborations | Star | BEAST platform, AI and blockchain exploration | Strategic partnership with AI firm in 2023 to enhance customer service |

| Corporate Banking (New Focus) | Star | Targeting manufacturing, retail, technology sectors | Global investment in manufacturing technology saw notable increase in 2024 |

What is included in the product

The Bank of East Asia BCG Matrix offers a strategic overview of its business units, highlighting which to invest in or divest.

The Bank of East Asia BCG Matrix provides a clear, quadrant-based overview of its business units, simplifying complex portfolio analysis for strategic decision-making.

Cash Cows

Traditional retail deposits form a bedrock of Bank of East Asia's (BEA) funding, offering a reliable and cost-effective source of capital in a well-established market. These deposits, representing a significant portion of BEA's liabilities, are crucial for maintaining stable operations and generating consistent interest income. For instance, as of the first half of 2024, BEA reported substantial growth in its customer deposits, underscoring the continued strength of its traditional deposit base.

The established mortgage lending portfolio in Hong Kong, a mature market, represents a significant Cash Cow for the Bank of East Asia (BEA). BEA likely commands a substantial portion of existing mortgage loans within this segment.

While the pace of new mortgage origination might be measured, this established portfolio consistently yields predictable interest income. The operational costs associated with managing these existing loans are typically lower, contributing to robust profitability.

In 2023, Hong Kong's mortgage market saw continued activity, with banks actively managing their portfolios. BEA's participation in this mature lending space ensures a steady stream of cash flow, bolstering its overall financial stability and ability to fund growth in other areas.

Bank of East Asia's (BEA) long-standing corporate banking relationships in Hong Kong and mainland China represent a significant cash cow. These deeply entrenched connections, built over years of consistent service and trust, translate into a stable and predictable revenue stream.

These relationships are characterized by recurring lending activities and fee-based services, which contribute to a reliable cash flow with relatively low client acquisition costs. For instance, in 2023, BEA reported a net interest income of HKD 16.4 billion, a substantial portion of which is likely driven by these established corporate lending portfolios.

Legacy Insurance Product Portfolio

For Bank of East Asia (BEA), its legacy insurance product portfolio likely represents a stable source of income. These established products, often found in mature markets, benefit from a substantial existing customer base. While new sales growth might be modest, the recurring premiums generate consistent and predictable cash flow. This stability means minimal additional investment is needed for marketing or product development, allowing these products to function as cash cows.

These offerings, characteristic of a cash cow in the BCG matrix, contribute significantly to BEA's overall financial health. For instance, in 2024, the insurance sector generally saw continued demand for traditional life and savings products. While specific BEA figures for legacy products aren't publicly detailed in this context, the broader trend indicates a reliable revenue stream.

- Established Customer Base: These products serve a large, existing clientele, ensuring consistent premium collection.

- Mature Market Presence: Operating in markets with limited new growth, they require less investment for expansion.

- Predictable Revenue Streams: Recurring premiums provide stable and reliable cash flow for the bank.

- Low Investment Requirement: Minimal need for new marketing or product development allows for high cash generation.

ATM and Physical Branch Network

The Bank of East Asia's ATM and physical branch network is a classic Cash Cow. BEA boasts a substantial presence, especially in Hong Kong and mainland China, giving it a significant share of physical touchpoints. While the overall growth in branch transactions might be modest due to digital shifts, this robust infrastructure supports a vast, loyal customer base.

This established network is crucial for providing essential banking services, ensuring consistent operational income. It also plays a vital role in customer retention, even as digital channels gain prominence.

- High Market Share: BEA's extensive physical network in key markets like Hong Kong and mainland China signifies a strong market presence in terms of accessibility.

- Stable Income Generation: Despite lower growth in physical transactions, the network generates reliable income from a large, established customer base.

- Customer Retention: The physical presence acts as a key driver for customer loyalty and retention, facilitating basic banking needs.

- Operational Efficiency: While facing digital competition, the network's mature status allows for efficient operation and continued service delivery.

The Bank of East Asia's (BEA) established wealth management services, particularly in Hong Kong, function as a significant Cash Cow. These services cater to a mature client base seeking stable investment growth and financial planning. The consistent fee-based income generated from managing these assets provides a reliable revenue stream with relatively low incremental investment requirements. For example, in 2023, the wealth management sector saw continued client engagement, with BEA leveraging its existing client relationships to maintain its position.

BEA's strong position in the Hong Kong mortgage market, characterized by a large, existing loan portfolio, represents a key Cash Cow. While new origination growth may be tempered in this mature market, the steady interest income from these established loans is predictable and contributes significantly to profitability. In the first half of 2024, BEA's mortgage portfolio remained a stable contributor to its net interest income, underscoring its Cash Cow status.

| Business Unit | BCG Category | Key Characteristics | 2023/H1 2024 Data Point |

|---|---|---|---|

| Traditional Retail Deposits | Cash Cow | Reliable, cost-effective funding source; stable operations. | Substantial growth in customer deposits reported in H1 2024. |

| Hong Kong Mortgage Portfolio | Cash Cow | Predictable interest income; lower management costs. | Steady contributor to net interest income in 2023 and H1 2024. |

| Legacy Insurance Products | Cash Cow | Recurring premiums; substantial existing customer base. | General sector trend shows continued demand for traditional products in 2024. |

| Corporate Banking Relationships | Cash Cow | Recurring lending and fee income; low client acquisition costs. | Net interest income reached HKD 16.4 billion in 2023. |

| ATM & Branch Network | Cash Cow | Supports loyal customer base; generates consistent operational income. | Maintains significant physical touchpoints in key markets. |

What You’re Viewing Is Included

Bank of East Asia BCG Matrix

The Bank of East Asia BCG Matrix preview you are viewing is the identical, fully formatted report you will receive immediately after purchase. This comprehensive analysis, designed for strategic clarity, contains no watermarks or demo content, ensuring you get a ready-to-use document for your business planning needs.

Dogs

Certain physical branches of the Bank of East Asia, particularly those situated in areas experiencing economic decline or exhibiting consistently low customer traffic, could be categorized as 'Dogs' within the BCG Matrix framework. These locations often represent a significant drain on resources due to ongoing operational expenses such as rent, utilities, and staffing.

These underperforming branches struggle to generate substantial new business or foster meaningful customer engagement, especially as banking increasingly shifts towards digital channels. For instance, in 2024, the bank might observe that a specific branch in a less frequented commercial district, despite its fixed costs, contributes minimally to overall new account openings or loan origination compared to its digital counterparts.

The challenge lies in the fact that these operational costs are high, yet the return on investment is disproportionately low. This situation can be exemplified by a branch whose operational expenditure exceeds its generated revenue or fee income by a considerable margin, thereby consuming capital that could be better allocated to more profitable ventures or digital transformation initiatives.

Niche, outdated investment funds often find themselves in the Dogs quadrant of the BCG Matrix. These are funds that, for various reasons, have simply fallen out of favor with investors. Think of them as old technology that no one uses anymore.

These funds typically suffer from poor past performance, meaning they haven't generated attractive returns for their investors. High management fees can also be a major deterrent, making them uncompetitive. For instance, a specialized emerging market fund launched a decade ago that has consistently underperformed its benchmark might now be considered a Dog, especially if market conditions have shifted significantly.

The consequence of being a Dog is a very low market share. Investors are not putting new money into these funds, and existing capital may even be flowing out. In 2024, many legacy sector-specific funds, like those focused on outdated manufacturing industries, are likely experiencing this decline, attracting minimal new capital and requiring management effort disproportionate to their meager returns.

In the Bank of East Asia's BCG Matrix, highly commoditized trade finance segments often fall into the "Dog" category. These are areas where the bank may lack a significant technological edge or cost advantage in a crowded global marketplace.

These segments, characterized by low margins and substantial manual processing, face fierce competition from larger institutions and nimble fintechs. Consequently, BEA might experience a limited market share and struggle with profitability in these basic trade finance offerings.

Non-Strategic International Ventures with Limited Scale

Non-Strategic International Ventures with Limited Scale, often referred to as Dogs in the Bank of East Asia BCG Matrix, represent smaller, non-core international operations that haven't achieved substantial market presence. These ventures might be characterized by their limited scale and a failure to gain significant traction in their target regions.

Such operations can become a drain on resources, consuming valuable capital and management bandwidth without yielding proportionate returns or aligning with the bank's overarching strategic goals. For instance, a regional banking subsidiary in a less developed market that consistently reports low profitability and minimal growth could fall into this category.

- Limited Market Share: These ventures typically hold a small percentage of their local market, often struggling against established competitors.

- Low Profitability: Consistently weak financial performance, with revenues barely covering operational costs, is a hallmark.

- Resource Drain: They can tie up management attention and capital that could be better allocated to more promising areas.

- Strategic Misfit: Often, these operations do not align with the bank's core competencies or long-term strategic direction.

High-Risk Commercial Real Estate Lending (Mainland China)

Bank of East Asia's (BEA) significant exposure to commercial real estate (CRE) lending in mainland China has become a notable concern. This sector is characterized by its low growth prospects and elevated risk profile.

The bank has experienced increased impairment losses stemming from its CRE portfolio. For instance, as of the first half of 2024, BEA reported a notable increase in its impairment allowances, partly attributed to its exposure in the Chinese property market.

- Low Growth, High Risk: Mainland China's CRE sector faces ongoing weakness, limiting growth potential while presenting substantial risks.

- Impairment Losses: BEA has seen a rise in impairment provisions linked to its commercial real estate loans in China, impacting profitability.

- Strategic Divestment: The bank is actively working to reduce its exposure to this segment, indicating a strategic move away from a capital-intensive, low-return area.

- Capital Consumption: This 'Dog' category has consumed capital without delivering commensurate returns, underscoring the need for BEA to reallocate resources.

Certain physical branches of the Bank of East Asia, particularly those situated in areas experiencing economic decline or exhibiting consistently low customer traffic, could be categorized as 'Dogs' within the BCG Matrix framework. These locations often represent a significant drain on resources due to ongoing operational expenses such as rent, utilities, and staffing.

These underperforming branches struggle to generate substantial new business or foster meaningful customer engagement, especially as banking increasingly shifts towards digital channels. For instance, in 2024, the bank might observe that a specific branch in a less frequented commercial district, despite its fixed costs, contributes minimally to overall new account openings or loan origination compared to its digital counterparts.

The challenge lies in the fact that these operational costs are high, yet the return on investment is disproportionately low. This situation can be exemplified by a branch whose operational expenditure exceeds its generated revenue or fee income by a considerable margin, thereby consuming capital that could be better allocated to more profitable ventures or digital transformation initiatives.

Bank of East Asia's (BEA) significant exposure to commercial real estate (CRE) lending in mainland China has become a notable concern. This sector is characterized by its low growth prospects and elevated risk profile. The bank has experienced increased impairment losses stemming from its CRE portfolio. For instance, as of the first half of 2024, BEA reported a notable increase in its impairment allowances, partly attributed to its exposure in the Chinese property market.

| BEA Business Segment | BCG Category | Market Share | Market Growth | Profitability Concern |

|---|---|---|---|---|

| Underperforming Physical Branches | Dog | Low | Declining/Low | High operational costs vs. low revenue |

| Niche, Outdated Investment Funds | Dog | Low | Low | Poor performance, high fees |

| Comitized Trade Finance | Dog | Limited | Low | Low margins, high competition |

| Non-Strategic International Ventures | Dog | Limited | Low | Low profitability, resource drain |

| Mainland China CRE Lending | Dog | Varies (but facing headwinds) | Low | Increased impairment losses, strategic divestment |

Question Marks

Bank of East Asia (BEA) is actively investigating stablecoins and digital asset applications, collaborating with fintech firms in this dynamic sector. This area presents substantial growth opportunities, but BEA's current footprint in implemented solutions is probably minimal, positioning it as a Question Mark.

The digital asset market's potential is vast, with global digital asset market capitalization reaching approximately $2.5 trillion in early 2024, according to various industry reports. BEA's investment in this nascent field is crucial for it to gain traction and potentially evolve into a market leader.

AI-powered personalized financial advisory is a significant growth opportunity for Bank of East Asia (BEA), fitting into the Stars category of the BCG Matrix. While BEA is developing AI for compliance, extending this to customer advisory is a new venture with limited current market presence but immense future potential. This strategic move requires considerable investment to build out capabilities and capture market share in this burgeoning sector, aiming to offer hyper-personalized solutions.

Developing entirely new digital-only banking products or targeting specific underserved, digitally-native customer segments fits the 'Question Mark' category for the Bank of East Asia. These ventures operate in a high-growth digital banking market but typically begin with a nascent market share, requiring substantial investment in marketing and product development to gain traction.

For instance, a new digital savings account with a competitive interest rate, or a specialized lending platform for small businesses that are heavily reliant on digital channels, could be considered. These initiatives need to quickly build customer adoption to avoid falling into the 'Dog' quadrant, especially as the digital banking sector continues to expand rapidly. In 2024, the global digital banking market was projected to reach over $25 trillion, highlighting the immense growth potential.

Expansion into Untapped Niche International Markets

Expansion into untapped niche international markets for Bank of East Asia (BEA) would likely be categorized as a Question Mark in the BCG Matrix. These markets, while potentially offering high future growth, currently have low market share for BEA, demanding significant investment to establish a foothold.

For instance, consider BEA's potential expansion into specific fintech-focused segments within emerging Southeast Asian economies. While the overall digital banking market in these regions is growing rapidly, BEA's current penetration in these highly specialized niches is minimal. This necessitates substantial capital allocation for localized product development, regulatory navigation, and targeted marketing campaigns to build brand awareness and customer acquisition from a low base.

- High Growth Potential: Niche markets often exhibit faster growth rates than mature markets, driven by unmet customer needs or emerging technological trends.

- Low Market Share: BEA's existing presence in these specific niches is limited, meaning they are starting from a relatively small customer base and revenue stream.

- Substantial Investment Required: To succeed, BEA must invest heavily in understanding local consumer behavior, adapting services, and building brand recognition, similar to how many international banks navigated the early stages of digital transformation in developing economies.

- Uncertain Future Success: The outcome of these investments is not guaranteed, as competition can be fierce and market dynamics unpredictable, placing these ventures firmly in the Question Mark category.

Blockchain-based Trade Finance Solutions

Blockchain-based trade finance solutions, like those explored by Bank of East Asia (BEA) involving stablecoin transfers through digital currency wallets, are positioned in a high-growth technological sector. This initiative by BEA signifies an early-stage venture with currently limited market adoption but substantial potential to transform conventional trade finance processes.

The global trade finance market is vast, with estimates suggesting it facilitates trillions of dollars in international commerce annually. For instance, the International Chamber of Commerce (ICC) has highlighted that SMEs alone face a significant trade finance gap, estimated to be around $1.5 trillion in 2023, a figure that blockchain solutions aim to address by improving efficiency and accessibility.

- High Growth Potential: The adoption of distributed ledger technology in trade finance is anticipated to grow significantly, with projections indicating a market size of over $10 billion by 2027, driven by increased efficiency and reduced costs.

- Early-Stage Initiative: BEA's engagement in testing stablecoin transfers for trade finance represents an investment in innovation, aiming to capture future market share by establishing a first-mover advantage in a nascent but promising field.

- Revolutionary Impact: Blockchain technology promises to streamline complex trade finance workflows, enhance transparency, and reduce the risk of fraud, potentially lowering transaction costs by an estimated 15-30% for participants.

These are ventures with high growth potential but currently low market share for Bank of East Asia. They require significant investment to develop and gain traction, with an uncertain future outcome.

Examples include new digital-only banking products targeting specific segments or expansion into niche international markets.

Success hinges on rapid customer adoption and effective marketing to compete in rapidly expanding sectors like digital banking, which saw global market projections exceeding $25 trillion in 2024.

These initiatives are critical for BEA to capture future market opportunities and avoid becoming obsolete.

BCG Matrix Data Sources

Our Bank of East Asia BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.