Oscar Health Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Oscar Health Bundle

Oscar Health navigates a dynamic healthcare landscape, facing moderate buyer power from consumers and employers, while the threat of new entrants remains significant due to technological advancements. The bargaining power of suppliers, particularly healthcare providers, also presents a notable challenge.

The complete report reveals the real forces shaping Oscar Health’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Oscar Health's reliance on a network of hospitals, doctors, and specialists means these healthcare providers hold considerable bargaining power. This is particularly true in regions where provider options are limited or when Oscar needs access to specialized medical services. For instance, in 2024, the average hospital operating margin in the U.S. hovered around 3-4%, indicating a need for providers to secure favorable reimbursement rates from insurers like Oscar to maintain profitability.

Oscar Health's reliance on its proprietary technology platform, +Oscar, makes technology vendors significant suppliers. These vendors provide essential services like cloud hosting, software development, and data analytics. For instance, in 2024, the healthcare technology market saw continued growth, with cloud adoption remaining a key trend, potentially increasing the leverage of major cloud providers.

While many tech vendors operate in a competitive landscape, those offering highly specialized or unique capabilities could wield considerable bargaining power. If Oscar requires niche AI solutions or specific data integration tools that few providers offer, these vendors can command more favorable terms, impacting Oscar's operational costs and innovation timelines.

Pharmaceutical companies and Pharmacy Benefit Managers (PBMs) hold significant bargaining power as suppliers to health insurers like Oscar Health. Drug costs are a major component of healthcare spending, giving these entities considerable leverage. In 2023, prescription drug spending in the U.S. was estimated to be over $350 billion, highlighting the financial weight of these suppliers.

PBMs, acting as intermediaries, negotiate drug prices on behalf of insurance providers. The increasing consolidation within the PBM industry, with a few major players dominating the market, amplifies their negotiating strength. This concentration allows them to exert considerable influence over drug pricing, directly impacting Oscar Health's medical loss ratio and overall profitability by dictating the cost of prescription benefits.

Data and Analytics Providers

Oscar Health's reliance on data and analytics providers for its core operations means these suppliers can wield significant bargaining power. Their ability to offer unique or proprietary datasets and advanced analytical tools, especially those leveraging AI and machine learning, directly impacts Oscar's competitive edge in member engagement and cost management. For instance, the growing demand for personalized health insights in 2024 means providers with cutting-edge predictive analytics capabilities are highly sought after.

- Specialized Data: Suppliers with exclusive access to specific patient populations or health outcome data can command higher prices.

- AI/ML Capabilities: Providers offering advanced AI algorithms for care navigation and cost optimization are increasingly valuable.

- Integration Costs: Switching costs associated with integrating new data platforms can further empower suppliers.

- Industry Consolidation: As the data analytics sector consolidates, fewer, larger providers may emerge, increasing their leverage.

Regulatory and Compliance Services

The health insurance sector's heavy regulation means companies like Oscar Health must rely on specialized regulatory and compliance services. These suppliers, offering expertise in navigating intricate healthcare laws, licensing, and compliance standards, wield considerable influence. Their services are not optional; they are essential for operational continuity and avoiding substantial penalties.

For instance, the Centers for Medicare & Medicaid Services (CMS) imposes strict rules on health insurers. Non-compliance with these regulations, such as those related to risk adjustment or quality reporting, can result in significant financial repercussions. In 2023, the healthcare industry as a whole faced billions in fines for regulatory violations, underscoring the critical nature of these compliance services.

- Critical Need: Navigating complex healthcare regulations, licensing, and compliance frameworks is non-negotiable for health insurers.

- High Stakes: Non-compliance can lead to severe penalties, operational disruptions, and reputational damage.

- Supplier Power: Expertise in these specialized areas grants suppliers significant bargaining power due to the essential and high-risk nature of their services.

Oscar Health's bargaining power with suppliers is influenced by several factors, including the concentration of suppliers in key areas and the essential nature of their services. For example, in 2024, the significant consolidation among Pharmacy Benefit Managers (PBMs) has amplified their leverage over drug pricing, directly impacting Oscar's costs. Similarly, specialized technology and data providers, especially those with AI capabilities, can command higher prices due to the critical role their services play in Oscar's operational efficiency and competitive strategy.

| Supplier Category | Key Factors Influencing Bargaining Power | Example Data/Trend (2023-2024) |

|---|---|---|

| Healthcare Providers (Hospitals, Doctors) | Provider availability, specialization, reimbursement needs | U.S. hospital operating margins ~3-4% (2024), indicating pressure for favorable rates. |

| Technology Vendors (+Oscar Platform) | Specialization of services, cloud adoption trends | Healthcare tech market growth, with cloud services remaining a key trend (2024). |

| Pharmaceutical Companies & PBMs | Drug costs, PBM industry consolidation | U.S. prescription drug spending >$350 billion (2023); PBM market concentration is high. |

| Data & Analytics Providers | Uniqueness of data, AI/ML capabilities, integration costs | Growing demand for personalized health insights (2024) favors advanced analytics providers. |

| Regulatory & Compliance Services | Critical need for expertise, high stakes of non-compliance | Billions in healthcare industry fines for violations (2023) highlight essential nature of compliance services. |

What is included in the product

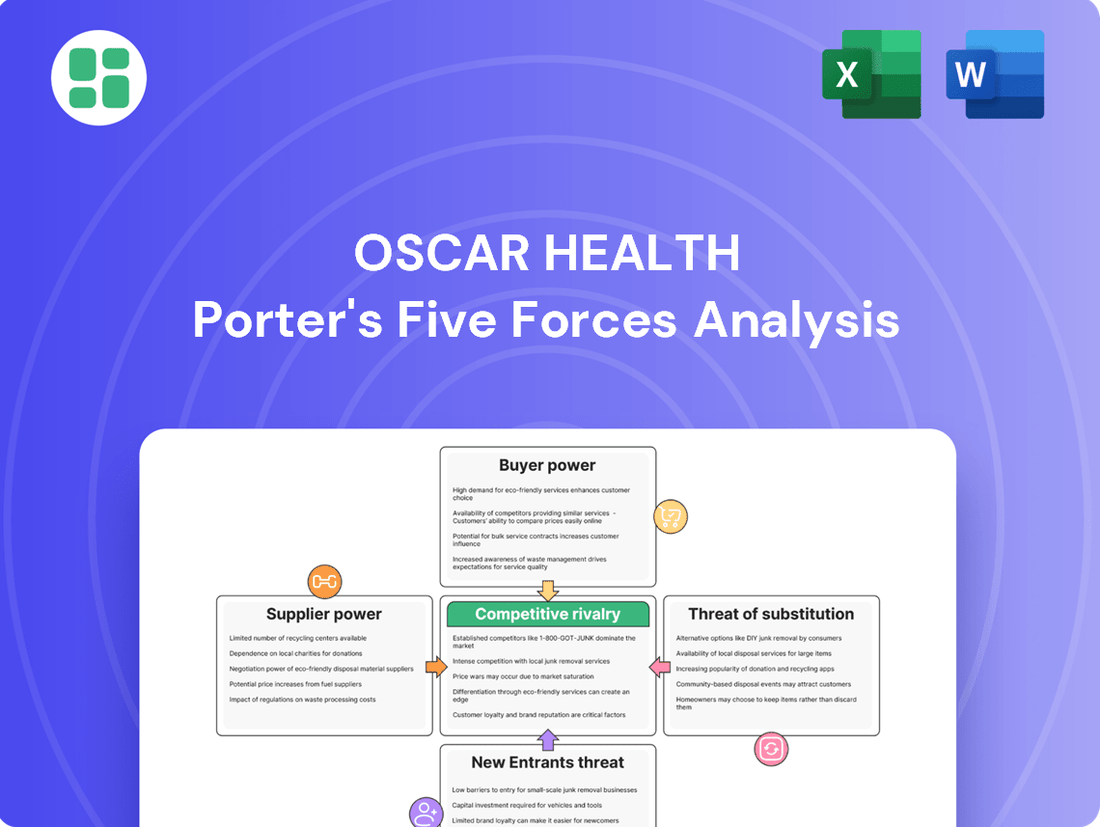

This Porter's Five Forces analysis for Oscar Health dissects the intensity of rivalry, buyer and supplier power, threat of new entrants, and the influence of substitutes within the health insurance market.

Instantly visualize the competitive landscape of the health insurance market, highlighting Oscar Health's strategic positioning against rivals and potential disruptors.

Customers Bargaining Power

Oscar Health's customers, including individuals, families, and small businesses, exhibit significant price sensitivity. Healthcare premiums represent a substantial portion of household budgets, making affordability a critical factor in their purchasing decisions. This is particularly true within the Affordable Care Act (ACA) marketplace, where Oscar actively competes by offering a range of cost-effective plans.

Oscar Health customers wield significant bargaining power due to the ease with which they can switch plans, particularly during annual open enrollment periods. This annual window allows individuals and employers to re-evaluate and select new coverage, directly impacting Oscar's customer retention.

The proliferation of online comparison tools and readily accessible information about plan benefits and costs, a feature Oscar actively promotes, further amplifies customer leverage. For instance, in 2024, the average consumer had access to dozens of health insurance plans on state and federal marketplaces, enabling informed choices based on price, network, and coverage details.

Oscar Health's focus on a personalized and user-friendly digital experience, including its mobile app and virtual care, directly addresses a growing customer desire for convenience. In 2023, Oscar reported that 88% of its members used its digital tools, highlighting the importance of these features in attracting and retaining customers.

However, this very appeal can empower customers. If Oscar's digital offerings, like its app or virtual care, fail to meet the high expectations set for seamless and personalized healthcare, or if competitors offer comparable or superior digital solutions, customers gain leverage. This increased leverage translates into a stronger bargaining power, allowing them to demand better services or switch to providers that better meet their needs.

Demand for Value-Based Care and Cost Management

Customers are increasingly demanding health plans that deliver tangible value, focusing on preventative services and effective cost management, particularly for chronic conditions. Oscar Health's strategic approach includes multi-condition plans designed to reduce expenses significantly, aiming for reductions of 25% or more for prevalent diseases such as diabetes, pulmonary, and cardiovascular issues.

- Value Proposition: Patients seek health insurance that demonstrably lowers out-of-pocket expenses and provides comprehensive care for long-term health needs.

- Cost Reduction Focus: Oscar's initiatives target chronic disease management, a key area where patients experience substantial and ongoing healthcare costs.

- Market Trend: The shift towards value-based care signifies a growing customer power, compelling insurers to innovate in service delivery and pricing structures.

- Competitive Advantage: By offering plans that promise significant cost savings for managing chronic conditions, Oscar aims to capture a segment of the market prioritizing affordability and efficacy.

Access to Diverse Networks and Services

Customers' ability to negotiate with Oscar Health is significantly shaped by their need for access to particular doctors, hospitals, or specialized medical services. Oscar's strategy of building robust networks offering various avenues to quality care aims to mitigate this, but if these networks are perceived as less comprehensive than those of established competitors, customers retain the power to seek broader healthcare options elsewhere.

For instance, in 2024, the average number of physicians per 1,000 people in the US was approximately 2.6. If Oscar's network offerings fall below this benchmark in specific regions, or lack key specialists, customers might feel compelled to switch to insurers with more extensive provider lists. This directly translates to increased bargaining power for those customers who value provider choice above all else.

- Provider Network Breadth: The number and specialization of in-network providers directly impact customer choice and thus their bargaining power.

- Geographic Accessibility: Limited geographic reach of Oscar's network can empower customers in underserved areas to demand better terms or seek alternatives.

- Specialty Care Access: Customers requiring specific specialists (e.g., oncologists, pediatric specialists) will exert more power if Oscar's network is perceived as deficient in these areas.

- Competitor Network Comparison: Direct comparisons of network size and quality with major competitors like UnitedHealthcare or Anthem in 2024 highlight potential areas where Oscar's customer bargaining power might be higher if its networks are seen as more restrictive.

Oscar Health's customers possess considerable bargaining power, driven by their ability to easily switch plans, especially during open enrollment periods. This ease of switching, amplified by readily available online comparison tools, allows consumers to actively seek the best value, a trend evident in 2024 where numerous plans were accessible on marketplaces. Furthermore, customers demand tangible value, pushing insurers like Oscar to innovate in cost management, particularly for chronic conditions, where Oscar aims for significant expense reductions. This focus on affordability and comprehensive care empowers customers to negotiate for better terms and services.

| Factor | Impact on Oscar's Customer Bargaining Power | Supporting Data/Trend (2024) |

|---|---|---|

| Ease of Switching | High | Annual open enrollment periods provide regular opportunities for customers to change plans. |

| Price Sensitivity | High | Healthcare premiums are a significant household expense, making cost a primary decision driver. |

| Information Availability | High | Online comparison tools and plan details empower informed choices, increasing leverage. |

| Demand for Value & Cost Reduction | High | Customers seek plans that demonstrably lower out-of-pocket costs and manage chronic conditions effectively. Oscar's multi-condition plans aim for 25%+ reductions for prevalent diseases. |

| Provider Network Access | Moderate to High | Customers may switch if Oscar's network lacks desired physicians or specialists compared to competitors. The US average is ~2.6 physicians per 1,000 people. |

Preview Before You Purchase

Oscar Health Porter's Five Forces Analysis

This preview shows the exact Oscar Health Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. It delves into the competitive landscape of the health insurance industry, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing players. This comprehensive analysis will equip you with a deep understanding of the strategic forces shaping Oscar Health's market position and future opportunities.

Rivalry Among Competitors

Oscar Health contends with deeply entrenched, large-scale insurers such as UnitedHealthcare, Anthem, Aetna, and Cigna. These established players command substantial financial might, expansive provider relationships, and widespread brand loyalty, giving them a significant advantage in market penetration and customer acquisition.

In 2024, the health insurance industry continues to be dominated by these giants. For instance, UnitedHealth Group reported revenues exceeding $370 billion in 2023, showcasing the immense scale these competitors operate at, a stark contrast to newer entrants like Oscar Health.

Oscar Health's competitive edge hinges on its technology-driven approach, aiming to deliver a seamless member experience through its full-stack platform and AI. This focus on user-friendliness, virtual care, and personalized assistance sets it apart in a crowded market.

The intensity of competition directly correlates with Oscar's ability to sustain this technological differentiation. If rivals can rapidly replicate or surpass Oscar's tech innovations, the advantage may diminish, intensifying rivalry.

In 2024, Oscar's commitment to technology was evident in its continued investment, aiming to streamline administrative processes and enhance member engagement, a critical factor in retaining customers amidst aggressive competition from established insurers.

The health insurance market is largely mature, with growth concentrated in specific areas like the Affordable Care Act (ACA) marketplace. Oscar Health's strategic move into new counties and states within the ACA marketplace for 2025 signals a clear intent to capitalize on this segment's expansion. However, the overall industry's heavy reliance on government regulations means that shifts in policy can significantly alter the competitive landscape and impact profitability.

Cost Management and Profitability Challenges

Oscar Health's competitive rivalry is significantly shaped by the intense pressure to manage costs and achieve profitability. The company has been actively working to improve its Selling, General, and Administrative (SG&A) expense ratio and its medical loss ratio (MLR). This focus is essential for survival and growth in a market where rivals are also striving for efficiency.

The company's financial performance reflects these challenges. Oscar reported positive net income in the first quarter of 2025, a promising sign. However, this was followed by losses in the second quarter of 2025, largely attributed to higher-than-expected market morbidity, which directly impacts medical costs.

Effectively managing these medical costs is paramount. It directly influences Oscar's ability to compete on price and service with established players and newer entrants. Sustained financial health hinges on mastering this delicate balance.

- SG&A Expense Ratio Focus: Oscar aims to reduce its SG&A expenses as a percentage of revenue to enhance profitability.

- Medical Loss Ratio (MLR) Improvement: A lower MLR, meaning more premium dollars are spent on actual healthcare costs rather than administrative overhead, is a key target.

- Q1 2025 Net Income: Oscar achieved positive net income in the first quarter of 2025, demonstrating progress in cost control.

- Q2 2025 Losses: Higher market morbidity in the second quarter of 2025 led to a return to net losses, highlighting the ongoing volatility of medical costs.

Strategic Partnerships and Niche Market Focus

Oscar Health is actively working to differentiate itself in the competitive health insurance landscape by forging strategic partnerships and concentrating on niche market segments. This approach aims to build a loyal customer base and reduce direct head-to-head competition with larger, more established players.

The company's focus on tailored solutions, such as Buena Salud designed for Hispanic and Latino members, and multi-condition plans, allows Oscar to address specific healthcare needs more effectively. For instance, in 2023, Oscar reported a 12% increase in its Medicare Advantage membership, partly driven by its targeted plan offerings and partnerships, indicating a growing acceptance of its specialized strategies.

- Strategic Partnerships: Oscar collaborates with providers and other health-related entities to offer integrated care solutions, enhancing member value and reducing churn.

- Niche Market Focus: By developing plans like Buena Salud, Oscar targets underserved or specific demographic groups, aiming for higher engagement and satisfaction.

- Competitive Differentiation: These niche strategies are crucial for Oscar to stand out in a market dominated by giants like UnitedHealth Group and Anthem (now Elevance Health), which have vast scale and diversified offerings.

- Navigating Competition: The success of these focused initiatives will be a key determinant in Oscar's ability to manage competitive pressures and achieve sustainable growth.

Oscar Health faces intense rivalry from established health insurers with significant financial resources and extensive provider networks. These incumbents leverage scale and brand recognition, making it challenging for Oscar to gain market share. For example, in 2023, UnitedHealth Group's revenue surpassed $370 billion, dwarfing Oscar's operational scale.

Oscar's strategy to counter this involves a strong emphasis on technology and a superior member experience, aiming to differentiate itself. However, the market remains largely mature, with growth primarily in segments like the ACA marketplace. Oscar's expansion into new counties for 2025 targets this growth area, but the intense competition necessitates constant innovation and cost management.

The company's ability to manage its medical loss ratio and SG&A expenses is critical for profitability and competitive positioning. While Oscar reported positive net income in Q1 2025, higher market morbidity in Q2 2025 led to losses, underscoring the volatility and competitive pressures related to medical cost management.

| Competitor | 2023 Revenue (Approx.) | Key Competitive Advantage |

|---|---|---|

| UnitedHealth Group | $370+ Billion | Scale, Financial Might, Provider Network |

| Elevance Health (Anthem) | $170+ Billion | Market Penetration, Brand Loyalty |

| CVS Health (Aetna) | $220+ Billion | Integrated Healthcare Services, Pharmacy Network |

| Cigna Group | $190+ Billion | Global Reach, Diverse Product Offerings |

SSubstitutes Threaten

Government-sponsored healthcare programs like Medicare and Medicaid present a significant threat of substitution for private health insurance. These public options directly cater to specific demographics, offering alternative coverage that can reduce the demand for private plans. For instance, by mid-2024, Medicare enrollment continued its steady growth, with projections indicating further expansion, directly impacting the pool of potential customers for private insurers targeting seniors.

Larger employers increasingly opt for self-insurance, directly managing their employees' healthcare costs instead of buying plans from insurers like Oscar Health. This trend represents a significant substitute, especially for Oscar's business targeting smaller employers who may not have the scale to self-insure effectively. In 2023, a substantial portion of the employer-sponsored health insurance market, estimated to be over 60%, was self-insured, highlighting the competitive pressure from this alternative.

The rise of Direct Primary Care (DPC) and concierge medicine presents a threat of substitutes for traditional health insurance models like Oscar Health. These models allow patients to pay a recurring fee directly to a physician, often in conjunction with a high-deductible health plan, thereby reducing their reliance on comprehensive insurance for routine medical needs. This shift can divert a portion of the market away from insurers.

Wellness Programs and Preventative Health Services

The rise of standalone wellness programs and preventative health services presents a significant threat of substitutes for traditional health insurance. As individuals increasingly adopt digital health apps and focus on proactive health management outside of insurance plans, the perceived necessity of comprehensive coverage may lessen. For instance, the global digital health market was valued at approximately $200 billion in 2023 and is projected to grow substantially, indicating a strong shift towards these alternative health solutions.

These substitutes can directly address consumer needs for health maintenance and early intervention, potentially fragmenting the market for health insurers like Oscar Health. If individuals believe they can effectively manage their well-being and mitigate health risks through these accessible and often more affordable alternatives, their reliance on traditional insurance plans could diminish.

- Growing Digital Health Adoption: The increasing availability and user-friendliness of digital health platforms offer convenient alternatives for managing personal health.

- Focus on Preventative Care: A cultural shift towards proactive health management empowers individuals to seek preventative services independently, reducing the perceived need for insurance to cover these aspects.

- Cost-Effectiveness of Substitutes: Many standalone wellness programs and digital health tools are perceived as more cost-effective than comprehensive insurance premiums, especially for younger, healthier demographics.

- Personalized Health Management: The ability to tailor health and wellness routines through these substitutes appeals to individuals seeking personalized approaches to their well-being.

Healthcare Sharing Ministries and Alternative Coverage Models

Healthcare sharing ministries (HCSMs) present a notable threat to traditional health insurers like Oscar Health. These ministries operate on a principle of voluntary cost-sharing among members with shared beliefs, offering a less regulated and often lower-cost alternative to conventional health insurance plans. For individuals prioritizing affordability or seeking coverage aligned with specific religious or ethical values, HCSMs can serve as a direct substitute.

The growth of these alternative models can siphon off a segment of the potential membership pool that would otherwise opt for regulated health insurance. This diversion of members impacts the risk pool diversification for traditional insurers, potentially leading to higher premiums for remaining members. For instance, while specific 2024 data on HCSM market share relative to traditional insurance is still emerging, reports from prior years indicated significant growth, with some estimates suggesting millions of Americans participate in such arrangements.

- Alternative Models Impact: Healthcare sharing ministries and similar alternative coverage models can draw away potential members from the traditional health insurance market.

- Cost and Belief Alignment: These ministries appeal to individuals seeking lower-cost options or coverage that aligns with specific religious or ethical beliefs.

- Regulatory Differences: HCSMs operate under different regulatory frameworks than traditional health insurance, allowing for greater flexibility but also fewer consumer protections.

- Market Share Erosion: The increasing popularity of these alternatives poses a threat by potentially reducing the customer base and risk pool for established insurers.

The threat of substitutes for Oscar Health is multifaceted, encompassing government programs, employer self-insurance, direct primary care, wellness programs, and healthcare sharing ministries. These alternatives offer varying levels of cost, convenience, and alignment with individual needs, potentially diverting members from traditional insurance. The increasing adoption of digital health and preventative care further fragments the market, as individuals seek more personalized and cost-effective health management solutions. This trend challenges insurers to adapt their offerings to remain competitive.

Government programs like Medicare and Medicaid are significant substitutes, especially for specific demographics. By mid-2024, Medicare enrollment continued its upward trajectory, directly impacting the pool of potential customers for private insurers targeting seniors. Similarly, the trend of large employers self-insuring, a practice covering over 60% of the employer-sponsored health insurance market in 2023, represents a substantial substitute that bypasses traditional insurance providers.

| Substitute Type | Description | Impact on Oscar Health | Relevant Data/Trend |

|---|---|---|---|

| Government Programs | Medicare, Medicaid | Reduces demand for private plans among eligible demographics. | Steady Medicare enrollment growth through mid-2024. |

| Employer Self-Insurance | Employers manage healthcare costs directly. | Bypasses insurers for larger companies. | Over 60% of employer-sponsored market self-insured in 2023. |

| Direct Primary Care (DPC) | Recurring fees to physicians for primary care. | Decreases reliance on comprehensive insurance for routine needs. | Growing adoption alongside high-deductible plans. |

| Digital Health & Wellness | Apps, preventative services outside insurance. | Lowers perceived need for traditional insurance. | Global digital health market valued at ~$200 billion in 2023. |

| Healthcare Sharing Ministries | Voluntary cost-sharing among members. | Offers lower-cost, belief-aligned alternatives. | Millions of Americans participate; prior years showed significant growth. |

Entrants Threaten

The health insurance sector demands significant upfront capital, estimated in the hundreds of millions of dollars, to cover operational costs, maintain adequate claims reserves, and invest in essential technology infrastructure. For instance, in 2024, established insurers often hold billions in reserves to meet their obligations.

Furthermore, new companies must surmount formidable regulatory barriers. This includes securing licenses in each state they wish to operate, a process that can take years and involve extensive documentation and financial scrutiny. Compliance with intricate healthcare legislation, such as the Affordable Care Act (ACA) and its ongoing modifications, adds another layer of complexity and cost, deterring many potential entrants.

Establishing extensive provider networks is a significant hurdle for new entrants in the health insurance market. This requires substantial capital and time to negotiate with hospitals, doctors, and specialists across various regions.

Oscar Health, for instance, operates in 18 states for its 2025 offerings, showcasing the scale of network development needed. This existing infrastructure and established relationships represent a formidable barrier, making it difficult for newcomers to quickly build comparable coverage and attract members.

Oscar Health, like other established health insurers, benefits from significant brand recognition and a foundation of member trust built over years of operation. Newcomers face a steep climb, needing substantial marketing investment to even begin challenging this ingrained trust.

In the healthcare sector, where individuals entrust their well-being and finances, this trust is a powerful barrier. For instance, in 2024, major incumbent health insurers continued to leverage their long-standing reputations, making it challenging for newer players to rapidly acquire a significant customer base.

Economies of Scale and Data Advantages

Existing health insurers possess significant advantages due to economies of scale. They can spread fixed costs like claims processing and administrative overhead across a larger member base, leading to lower per-member costs. This makes it challenging for new entrants to compete on price from the outset.

Oscar Health, with its approximately 2 million members as of the first quarter of 2025, has built a technology-first platform that allows for efficient operations and sophisticated data analytics. This data advantage, derived from years of member interactions, enables better risk assessment and personalized member experiences, creating a barrier for newcomers lacking similar data accumulation and analytical capabilities.

- Economies of Scale: Incumbent insurers' ability to spread fixed costs across a large membership base reduces per-member operational expenses.

- Data Analytics Advantage: Oscar's technological infrastructure allows for advanced data analysis, improving efficiency and member targeting, a capability difficult for new entrants to quickly match.

- Operational Efficiency: Streamlined claims processing and administrative functions, driven by technology, provide a cost advantage that new, smaller players struggle to replicate.

Complexity of Healthcare Technology Integration

The threat of new entrants into the health insurance market, particularly those aiming to replicate Oscar Health's technology-driven model, is significantly tempered by the sheer complexity and cost of integrating healthcare technology. Building a comprehensive tech platform that seamlessly connects virtual care, personalized member support, and advanced data analytics from the ground up is a monumental undertaking. This requires substantial investment in specialized software development, cybersecurity, and data infrastructure, making it a high barrier for newcomers.

New players would need to either develop or acquire highly sophisticated technological capabilities to even begin to compete with Oscar's established digital ecosystem. For instance, acquiring a robust electronic health record (EHR) integration or developing proprietary AI for personalized care pathways demands considerable time and capital. In 2024, the continued evolution and increasing sophistication of health tech, including generative AI applications in patient engagement and administrative efficiency, further elevate this entry barrier.

- High Capital Investment: Developing a full-stack health tech platform can cost hundreds of millions of dollars, encompassing software development, data warehousing, and AI integration.

- Regulatory Hurdles: Navigating healthcare regulations like HIPAA for data privacy and security adds significant complexity and cost to technology development and deployment.

- Talent Acquisition: Securing specialized talent in health informatics, AI engineering, and cybersecurity is crucial but challenging, further increasing operational costs for new entrants.

The threat of new entrants in the health insurance sector, particularly for a company like Oscar Health, is considerably low due to several significant barriers. These include the massive capital requirements for operations and reserves, which can run into hundreds of millions of dollars, as seen with established insurers holding billions in reserves in 2024. Furthermore, navigating complex state-by-state licensing and adhering to stringent healthcare regulations like the ACA presents formidable challenges. Building a competitive provider network also demands substantial investment and time, a hurdle Oscar Health, operating in 18 states for 2025, has already overcome.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Hundreds of millions needed for operations and reserves. Established players hold billions in reserves (2024). | High barrier, requiring significant funding. |

| Regulatory Compliance | State licensing, ACA adherence, and data privacy (HIPAA) are complex and costly. | Time-consuming and expensive to navigate. |

| Provider Network Development | Establishing relationships with healthcare providers across regions is crucial and resource-intensive. | Requires extensive time, capital, and negotiation expertise. |

| Brand Recognition & Trust | Incumbents leverage long-standing reputations, making it hard for newcomers to gain member trust. | Requires substantial marketing investment to overcome. |

| Economies of Scale | Larger insurers spread fixed costs, leading to lower per-member expenses. | New entrants struggle to compete on price initially. |

| Technology & Data Advantage | Oscar's tech platform and data analytics capabilities offer efficiency and better risk assessment. | Difficult for new players to replicate sophisticated tech infrastructure and data accumulation. |

Porter's Five Forces Analysis Data Sources

Our Oscar Health Porter's Five Forces analysis is built upon a foundation of comprehensive data, including publicly available financial reports, industry-specific market research, and government health insurance filings.

We leverage insights from health insurance industry trade publications, competitor earnings calls, and regulatory databases to thoroughly assess the competitive landscape.