Oscar Health Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Oscar Health Bundle

Oscar Health's strategic positioning is laid bare in its BCG Matrix, revealing a dynamic portfolio where opportunities and challenges intertwine. Understand which of their offerings are poised for growth and which require careful management to maximize profitability.

This preview offers a glimpse, but the full Oscar Health BCG Matrix unlocks a comprehensive understanding of their product landscape, guiding you toward informed investment and resource allocation decisions.

Don't miss out on the complete strategic blueprint; purchase the full BCG Matrix to gain actionable insights and a clear roadmap for Oscar Health's future success.

Stars

Oscar Health's core individual and family ACA plans are a major growth engine for the company. These plans are performing exceptionally well, attracting a substantial number of new members.

By the first half of 2025, Oscar Health reported over 2 million members enrolled in these ACA plans. This growth significantly outpaced the broader ACA market, highlighting Oscar's competitive advantage and effective market strategy.

The company's strategic expansion into new counties further solidifies these plans' position as market leaders in a rapidly expanding sector.

Oscar's proprietary technology platform, often referred to as +Oscar, is a significant asset, acting as a central nervous system for its operations. This platform seamlessly integrates virtual care services, AI-powered care guides, and personalized member support. It's designed to boost member engagement and streamline operations, which is crucial for managing costs in the competitive health insurance market.

The +Oscar platform is instrumental in delivering a superior member experience while simultaneously driving cost efficiencies. For instance, in 2023, Oscar reported that its technology-enabled virtual primary care services led to a 15% reduction in hospital admissions for members utilizing these services compared to a control group. This technological edge is a core component of Oscar's strategy to gain market share and maintain leadership in the health tech sector.

The Buena Salud Initiative is a strategic move by Oscar Health, designed to capture the burgeoning Hispanic and Latino market within the Affordable Care Act (ACA) landscape. This segment represents a significant portion, nearly one-third, of Oscar's total membership, highlighting its importance to the company's growth strategy.

With a high Net Promoter Score, Buena Salud demonstrates robust market acceptance. Its success is attributed to a culturally sensitive and tailored approach, resonating effectively with its target demographic. This strong reception suggests substantial potential for continued rapid expansion within this currently underserved market segment.

Multi-Condition Chronic Care Plans

Oscar Health has launched multi-condition chronic care plans, specifically targeting members with prevalent conditions like diabetes, pulmonary, and cardiovascular diseases within the Affordable Care Act (ACA) market. This strategic move addresses a significant unmet need by offering integrated care solutions designed to improve health outcomes and manage costs effectively.

These specialized plans are projected to achieve cost reductions of 25% or more. This is accomplished through a focus on integrated care delivery and the removal of financial barriers, such as $0 copays for specialist visits, making comprehensive management more accessible.

- Market Need: Addresses the growing prevalence of chronic conditions within the ACA population.

- Cost Savings: Aims for 25% or greater cost reduction through integrated care models.

- Member Benefits: Includes $0 copays for specialist visits to enhance access to care.

- Growth Potential: Positions Oscar for high growth by offering innovative, comprehensive solutions.

Aggressive Market Footprint Expansion

Oscar Health is making a significant move to expand its market presence, aiming for aggressive growth in the Affordable Care Act (ACA) marketplace. This strategy positions the company as a potential "Star" in the BCG matrix, indicating high market share in a rapidly growing industry.

The company is set to double its market reach, entering over 500 new counties across 18 states for the 2025 plan year. This ambitious expansion is designed to bolster its position in the individual health insurance market.

Oscar Health has a clear objective to increase its ACA market share from the current 13% to a substantial 18% by 2027. This growth is fueled by entering new metropolitan statistical areas, a key indicator of a high-growth strategy.

- Aggressive Geographic Expansion: Oscar Health is entering over 500 new counties across 18 states for the 2025 plan year.

- Market Share Growth Target: The company aims to increase its ACA market share from 13% to 18% by 2027.

- Strategic Metropolitan Area Entry: Expansion into new metropolitan statistical areas signifies a focus on capturing larger market segments.

- High-Growth Potential: This aggressive footprint expansion aligns with a strategy to capitalize on the growing individual health insurance market.

Oscar Health's individual and family ACA plans are positioned as Stars in the BCG matrix due to their strong performance in a high-growth market. The company's aggressive expansion, targeting an increase in ACA market share from 13% to 18% by 2027, underscores this classification. This strategic growth is supported by substantial member enrollment and a commitment to technological innovation.

| Category | Metric | Value | Year | Significance |

|---|---|---|---|---|

| ACA Plans | Member Enrollment | Over 2 million | H1 2025 | Demonstrates strong market adoption and growth engine. |

| Market Share | ACA Market Share Target | 18% | By 2027 | Indicates ambitious growth plans in a growing sector. |

| Geographic Expansion | New Counties Entered | Over 500 | 2025 Plan Year | Aggressive strategy to capture broader market segments. |

| Technology | Virtual Primary Care Impact | 15% reduction in hospital admissions | 2023 | Highlights operational efficiency and member health benefits. |

What is included in the product

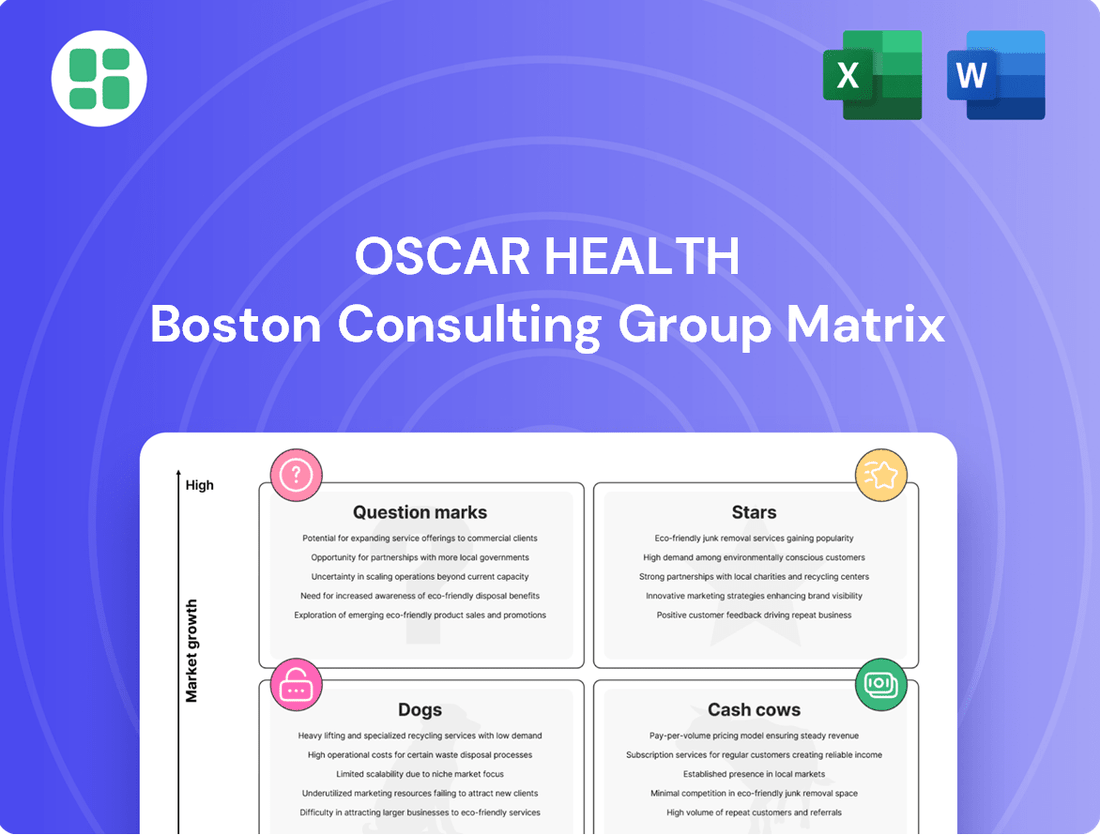

Oscar Health's BCG Matrix provides a strategic overview of its offerings, categorizing them into Stars, Cash Cows, Question Marks, and Dogs.

This analysis guides investment decisions, highlighting which business units to grow, maintain, or divest for optimal portfolio performance.

A clear BCG Matrix visualizes Oscar Health's portfolio, easing strategic decision-making by highlighting growth and market share.

Cash Cows

Oscar Health's established presence in the individual ACA market is its clear Cash Cow. This segment, boasting a substantial and growing membership, generated approximately $6.5 billion in revenue in 2023, forming the bedrock of its premium income. The strategy here centers on maximizing profitability within this large, stable base, ensuring consistent financial performance.

Oscar Health's recurring premium revenue from its member base is a significant cash cow. In 2023, the company reported total revenue of $7.4 billion, primarily driven by premiums. This consistent inflow of funds from a growing membership provides a stable financial foundation, even as the company navigates challenges.

While Oscar Health has faced headwinds with medical costs impacting recent profitability, the sheer volume of premium revenue remains its core financial engine. The company is actively implementing strategies to manage these costs, aiming to transform this substantial revenue into reliable, long-term cash flow. This focus on operational efficiency is crucial for solidifying its position.

Oscar Health has made significant strides in improving its Selling, General & Administrative (SG&A) expense ratio. This efficiency gain, partly driven by technology and AI adoption, shows better control over administrative costs and increased leverage of fixed expenses. For instance, in Q1 2024, Oscar reported an adjusted SG&A expense ratio of 22.4%, an improvement from 25.1% in Q1 2023, demonstrating their commitment to operational streamlining.

This enhanced SG&A efficiency is vital for boosting profit margins on their current revenue streams. By reducing the cost of doing business, Oscar can generate more cash from its core operations. Continued success in managing these expenses will directly contribute to stronger cash flow, a key characteristic of a Cash Cow in the BCG matrix.

Strategic Focus on Core Market Profitability

Oscar Health's strategic focus on its individual market offerings clearly positions these as its Cash Cows within the BCG Matrix. The company's leadership has publicly stated a goal to achieve overall profitability by 2026, with a significant portion of this turnaround expected from stabilizing and optimizing its largest revenue-generating segment. This means the individual market is being managed to consistently generate cash for the company.

Key initiatives driving this Cash Cow status include rigorous repricing strategies and enhanced risk adjustment processes. These measures are designed to improve the profitability of each member acquired in the individual market. For instance, in the first quarter of 2024, Oscar Health reported a substantial improvement in its medical loss ratio (MLR) for its individual and family plans, a direct result of these focused efforts.

- Individual Market Dominance: This segment represents Oscar's largest revenue stream, making its profitability crucial for overall financial health.

- Path to Profitability: The explicit 2026 profitability target hinges on stabilizing and optimizing the individual market.

- Repricing and Risk Adjustment: These are the core operational levers being pulled to ensure consistent cash generation from this segment.

- Q1 2024 MLR Improvement: Early 2024 data indicates positive traction in improving the financial performance of the individual market plans.

Leveraging Data-Driven Care Management

Oscar Health's emphasis on data-driven care management positions its existing, profitable member base as a potential cash cow within the BCG matrix. By leveraging its technology platform, Oscar aims to refine care navigation and proactively manage member health, directly impacting its medical loss ratio (MLR).

This strategic focus on clinical efficiency is designed to transform current revenue streams into more stable and predictable cash flow. For instance, Oscar reported a medical loss ratio of 84.1% in the first quarter of 2024, an improvement from previous periods, indicating progress in cost management.

- Data-Driven Navigation: Oscar's platform guides members to high-value care providers, optimizing treatment pathways and reducing unnecessary expenses.

- Cost Management Focus: Proactive health management and cost containment efforts are key to enhancing the profitability of its established customer relationships.

- MLR Improvement: The company's efforts to lower its medical loss ratio, a key indicator of profitability in health insurance, directly contribute to its cash generation potential.

- Sustainable Cash Flow: By improving the efficiency of care delivery for its current members, Oscar seeks to create a more sustainable and robust cash flow from its established operations.

Oscar Health's established individual ACA market serves as its primary Cash Cow. This segment, representing its largest revenue source, is being optimized for consistent cash generation, crucial for achieving its 2026 profitability goal. Initiatives like repricing and improved risk adjustment are directly enhancing the profitability of this core business.

The company's focus on operational efficiencies, particularly in its Selling, General & Administrative (SG&A) expenses, further strengthens its Cash Cow status. For example, Oscar reported an adjusted SG&A expense ratio of 22.4% in Q1 2024, down from 25.1% in Q1 2023, indicating better cost control and increased cash generation potential from its existing revenue.

Furthermore, Oscar's data-driven care management strategies are designed to improve its medical loss ratio (MLR), directly boosting cash flow from its member base. The Q1 2024 MLR for individual and family plans showed improvement, reflecting progress in managing healthcare costs and solidifying the individual market as a reliable cash generator.

| Metric | Q1 2023 | Q1 2024 | Change |

| Total Revenue | $1.9 billion | $2.3 billion | +21.1% |

| Adjusted SG&A Ratio | 25.1% | 22.4% | -2.7 pp |

| Individual Market MLR | (Not specified) | Improved | Positive |

Full Transparency, Always

Oscar Health BCG Matrix

The Oscar Health BCG Matrix preview you're examining is the identical, fully unlocked document you'll receive immediately after purchase. This means no watermarks, no placeholder text, and no hidden surprises – just a professionally formatted and strategically insightful analysis ready for your immediate use. You can trust that the comprehensive breakdown of Oscar Health's portfolio, categorized into Stars, Cash Cows, Question Marks, and Dogs, is exactly what you'll be working with. This direct transfer ensures you get the complete, actionable insights without any need for further editing or reformatting, empowering swift strategic decision-making.

Dogs

The Cigna+Oscar partnership has seen a dramatic drop in membership, plummeting from over 61,000 in Q1 2024 to a mere 10,000 by Q2 2025. This sharp decline clearly signals a low and shrinking market share, with very little hope for future growth.

Oscar Health is essentially exiting this segment, classifying the Cigna+Oscar partnership as a 'Dog' within its business portfolio. This strategic move reflects the segment's poor performance and limited potential for recovery or expansion.

Oscar Health's decision to exit the small group health insurance market after December 2024, shifting focus to Individual Coverage Health Reimbursement Arrangements (ICHRAs), clearly positions its small group offerings as a 'Dog' in the BCG matrix. This strategic pivot indicates the segment likely struggled with low market share and insufficient profitability, not aligning with the company's future growth ambitions.

In Oscar Health's portfolio, underperforming legacy geographic markets represent areas where the company's expansion efforts have not translated into substantial membership growth or market share. These regions, while perhaps historically significant, are now consuming valuable resources without delivering the expected returns. For instance, if Oscar Health reported in its 2024 filings that certain established markets in the Midwest saw less than a 2% membership increase year-over-year, these would be prime examples of such underperforming segments.

Inefficient Operational Overheads

Inefficient operational overheads represent areas within Oscar Health where expenses are disproportionately high relative to the value they create. These are essentially drains on resources that don't bolster the company's competitive position or drive revenue growth.

For instance, while Oscar Health has focused on improving its Selling, General, and Administrative (SG&A) expenses, any lingering pockets of inefficiency, such as redundant administrative functions or underutilized technology, would fall into this category. Such overheads tie up capital that could be reinvested in core growth areas or innovation.

In 2024, the healthcare industry continued to grapple with rising administrative costs. Companies are under pressure to streamline operations to maintain profitability amidst evolving regulatory landscapes and competitive pressures. Oscar Health's success hinges on identifying and rectifying these inefficient overheads.

- Areas of disproportionate cost: Inefficient administrative processes, redundant back-office functions, or underperforming technology investments.

- Impact on competitive advantage: These costs divert resources from areas that could build a stronger market position, such as product development or customer acquisition.

- Need for optimization: A strategic review is necessary to identify opportunities for cost reduction, automation, or elimination of non-value-adding activities.

High-Cost, Low-Engagement Member Segments

High-cost, low-engagement member segments in Oscar Health's portfolio can be likened to cash traps within the BCG matrix framework. These are individuals or groups who consistently utilize a high volume of medical services, leading to significant expenses. For instance, reports from 2024 indicate that certain chronic condition management programs, while necessary, can strain profitability if not meticulously managed.

These segments often don't demonstrate high levels of interaction with Oscar's digital tools or proactive health management initiatives. This lack of engagement means that while their medical costs are elevated, their overall lifetime value to the company is diminished. This creates a scenario where substantial resources are allocated without a corresponding return in loyalty or reduced per-member-per-month (PMPM) costs through preventative care.

Effectively managing these "cash trap" segments requires targeted strategies. Oscar Health can focus on:

- Enhanced Care Navigation: Guiding members toward more cost-effective treatment options and providers.

- Preventative Care Initiatives: Proactively addressing potential health issues before they escalate into high-cost episodes.

- Personalized Engagement Programs: Tailoring communication and support to encourage healthier behaviors and utilization of Oscar's resources.

- Data Analytics for Risk Stratification: Identifying these high-cost, low-engagement members early to implement specific interventions.

Oscar Health's Cigna+Oscar partnership is a clear 'Dog' in its portfolio, experiencing a severe membership decline from over 61,000 in Q1 2024 to just 10,000 by Q2 2025, indicating a shrinking market share with minimal growth prospects.

The company's decision to exit the small group health insurance market after December 2024, shifting focus to ICHRAs, further solidifies its small group offerings as a 'Dog' due to poor performance and limited future potential.

Underperforming legacy geographic markets and inefficient operational overheads also represent 'Dog' segments for Oscar Health, consuming resources without generating adequate returns or strengthening its competitive position.

High-cost, low-engagement member segments, particularly those with chronic conditions that strain profitability without demonstrating loyalty, are also categorized as 'Dogs' requiring strategic intervention to improve their value proposition.

| Segment | Market Share | Growth Potential | Profitability | BCG Classification |

|---|---|---|---|---|

| Cigna+Oscar Partnership | Low and Shrinking | Very Low | Low | Dog |

| Small Group Health Insurance (Legacy) | Low | Limited | Low | Dog |

| Underperforming Geographic Markets | Low | Low | Low | Dog |

| High-Cost, Low-Engagement Members | N/A | Low (without intervention) | Low | Dog |

Question Marks

Oscar Health is strategically positioning itself to capitalize on the burgeoning Individual Coverage Health Reimbursement Arrangement (ICHRA) market. With new ICHRA products slated for launch in 2025 and a scaling plan through 2027, Oscar is targeting a significant addressable market, including the gig economy and employers looking for flexible health benefit solutions.

This represents a nascent yet high-growth segment for Oscar. While their current market share in ICHRAs is low, the company is making substantial investments to secure a strong future position. The ICHRA market is projected to grow significantly, with estimates suggesting it could cover millions of individuals in the coming years, offering a substantial opportunity for Oscar.

Oscar Health's 2025 strategy involves entering new metropolitan statistical areas and counties, a move that positions these new markets as potential Stars within its BCG Matrix. These new ventures are characterized by high growth potential, mirroring the rapid expansion of the health insurance market in underserved regions.

However, these nascent markets currently hold a low market share for Oscar, demanding substantial investment to establish brand recognition and customer acquisition. For instance, Oscar's 2024 expansion focused on adding approximately 100,000 members in new markets, highlighting the capital-intensive nature of these entries.

Oscar Health's Guided Care HMO plans, introduced for the 2025 plan year, are positioned as a Question Mark in the BCG Matrix. These plans are designed to attract members looking for a more guided healthcare experience alongside potentially lower premiums.

The success of these new HMO offerings is still being determined, as their market adoption and profitability are yet to be fully established. Until Oscar Health can demonstrate significant market share growth and a clear path to profitability for Guided Care HMOs, they remain in the Question Mark category, requiring careful monitoring and strategic investment.

AI Initiatives for Medical Cost Optimization

Oscar Health is strategically investing in advanced AI initiatives to drive medical cost optimization. A key objective is to achieve $60 million in administrative cost savings by 2026 through these AI-powered operational improvements.

These AI initiatives represent high-potential, yet unproven, bets for future profitability and efficiency gains. Their full impact and return on investment are still being assessed, reflecting their classification as question marks within the BCG matrix.

- AI for claims processing automation

- Predictive analytics for fraud detection

- Personalized member engagement platforms

- AI-driven care management tools

Expansion into the Gig Economy

Oscar Health is strategically focusing on the substantial U.S. gig economy, a market segment that includes roughly 58 million independent workers. This represents a key growth area where Oscar is actively investing to build its market share.

This expansion into the gig economy is positioned as a strategic Question Mark within the BCG Matrix. The success of this venture hinges on Oscar's ability to effectively penetrate this market and convert it into a high-growth Star.

- Target Market Size: Approximately 58 million independent workers in the U.S.

- Strategic Focus: Oscar executives have identified this as a significant growth opportunity.

- BCG Matrix Classification: Currently categorized as a Question Mark due to its high potential and ongoing development.

- Growth Potential: Successful penetration could transform this segment into a Star performer for Oscar Health.

Oscar Health's expansion into new metropolitan areas and counties for 2025 are classified as Question Marks. These are areas with high growth potential, but Oscar currently has a low market share, requiring significant investment to gain traction.

The Guided Care HMO plans, introduced for the 2025 plan year, also fall into the Question Mark category. Their success is contingent on market adoption and demonstrating a clear path to profitability, which is still being evaluated.

Oscar's strategic investments in AI initiatives, aimed at achieving $60 million in administrative cost savings by 2026, are also considered Question Marks. The full impact and ROI of these advanced technologies are still under assessment.

The gig economy represents another significant Question Mark for Oscar Health. While the market is large, with approximately 58 million independent workers, Oscar's ability to penetrate and convert this segment into a high-growth Star is still developing.

| Business Unit | Market Growth | Relative Market Share | BCG Classification |

| New Metro/County Expansion (2025) | High | Low | Question Mark |

| Guided Care HMO Plans (2025) | High | Low | Question Mark |

| AI Initiatives for Cost Savings | High (potential) | Low (unproven) | Question Mark |

| Gig Economy Market Entry | High | Low | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from Oscar Health's financial disclosures, internal performance metrics, and market research reports to provide a clear strategic overview.