Hero Motocorp Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hero Motocorp Bundle

Hero Motocorp navigates a competitive landscape shaped by moderate buyer power and intense rivalry, with the threat of new entrants posing a significant challenge. Understanding the influence of suppliers and the availability of substitutes is crucial for their strategic positioning.

The complete report reveals the real forces shaping Hero Motocorp’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Hero MotoCorp sources components from a wide array of suppliers, impacting their bargaining power. If a supplier provides unique, patented parts or specialized technology with no readily available substitutes, their leverage increases significantly. For instance, advanced battery solutions for their burgeoning electric vehicle (EV) line could represent such a scenario, where a limited number of high-quality providers hold considerable sway.

For Hero MotoCorp, the cost and complexity involved in switching suppliers are substantial. This encompasses the expense and time needed for retooling manufacturing lines, the rigorous process of re-qualifying new parts to meet quality standards, and the effort required to establish entirely new logistical chains.

These significant switching costs can effectively lock Hero MotoCorp into relationships with its current suppliers. This dependency, in turn, grants those suppliers increased leverage and bargaining power, as the auto giant faces considerable hurdles in sourcing components from alternative vendors.

The threat of suppliers integrating forward into two-wheeler manufacturing, while generally low for specialized component makers, could increase if large, diversified suppliers possess the capital and market understanding. This potential move would directly challenge Hero MotoCorp's production and market share.

For instance, a major tire supplier or engine component manufacturer with substantial financial backing, perhaps exceeding billions in annual revenue as seen with global automotive suppliers, might consider such a strategic shift if they perceive greater profitability in the finished vehicle market. This would significantly amplify their bargaining power over Hero MotoCorp.

Importance of Supplier's Input to Hero MotoCorp

The bargaining power of suppliers for Hero MotoCorp is significantly influenced by the criticality and uniqueness of their inputs. Suppliers providing essential components that directly impact the quality, performance, and differentiation of Hero's motorcycles wield considerable influence. For example, suppliers of advanced engine technologies or specialized braking systems can command more leverage.

The reliability and quality of these supplier inputs are paramount to Hero MotoCorp's brand reputation. Any compromise in component quality can lead to product defects, recalls, and damage to customer trust. This makes Hero MotoCorp particularly sensitive to disruptions or price increases from suppliers of key components.

- Critical Components: Suppliers of engines, transmissions, and sophisticated electronic control units (ECUs) hold substantial power due to the direct impact on vehicle performance and reliability.

- Technological Differentiation: Providers of advanced features like connected vehicle technology or innovative suspension systems can leverage their unique offerings to increase their bargaining strength.

- Brand Reputation Link: The quality of parts from suppliers like Bosch (for braking systems) or Keihin (for fuel injection systems) directly influences Hero's brand image, giving these suppliers more sway.

- Cost Sensitivity: While Hero MotoCorp aims for cost efficiency, the importance of quality for critical parts means they cannot solely focus on price when dealing with key component suppliers.

Availability of Substitute Inputs

The availability of substitute inputs significantly curtails the bargaining power of suppliers for Hero MotoCorp. When alternative raw materials or components are readily accessible, suppliers find it harder to dictate terms. For instance, if Hero MotoCorp can easily source comparable quality parts from multiple vendors or switch to different materials, the leverage of any single supplier is weakened.

India's automotive component sector is substantial and expanding, providing a degree of choice. This diversification means that even if one supplier faces issues or attempts to increase prices, Hero MotoCorp has other options. This competitive landscape among component providers naturally moderates supplier influence.

- Availability of Substitutes: The presence of alternative materials or components reduces supplier power.

- Sourcing Flexibility: Hero MotoCorp's ability to easily find similar quality parts from different suppliers diminishes individual supplier leverage.

- Market Dynamics: India's large and growing automotive component industry offers numerous alternatives, fostering competition among suppliers.

The bargaining power of suppliers for Hero MotoCorp is moderated by the availability of substitutes and the competitive nature of the Indian automotive component market. With a vast and growing supplier base in India, Hero MotoCorp can often find alternative sources for many parts, limiting the leverage of individual suppliers. This dynamic ensures that no single supplier can unilaterally dictate terms or prices without risking losing business to competitors.

However, suppliers of critical, technologically advanced, or highly specialized components still hold significant sway. These are parts that are not easily replicated or substituted, directly impacting Hero MotoCorp's product performance and brand reputation. For instance, suppliers of advanced braking systems or sophisticated engine management units can command greater influence due to the complexity and importance of their offerings.

The high costs associated with switching suppliers—including retooling, re-qualification, and establishing new logistics—further solidify the bargaining power of incumbent suppliers for critical components. This creates a degree of lock-in, making it challenging for Hero MotoCorp to shift away from established, reliable partners even if they seek more favorable terms. For example, in 2023-24, while Hero MotoCorp reported strong sales, the cost of raw materials and key components remained a significant factor in their operational expenses, highlighting supplier influence.

| Component Type | Supplier Bargaining Power Factor | Example | Impact on Hero MotoCorp |

|---|---|---|---|

| Engines & Transmissions | High (Criticality, Complexity) | Suppliers of advanced engine technology | Significant price sensitivity, brand reputation risk |

| Braking Systems | High (Quality, Safety) | Bosch, Brembo | Direct impact on vehicle safety and performance |

| Electronic Control Units (ECUs) | High (Technological Sophistication) | Keihin, Continental | Dependence on specialized technology |

| Tires | Medium (Availability of Substitutes) | MRF, CEAT | Moderate price negotiation possible |

| Raw Materials (Steel, Aluminum) | Medium (Commoditized, Multiple Suppliers) | Various domestic and international producers | Subject to global commodity price fluctuations |

What is included in the product

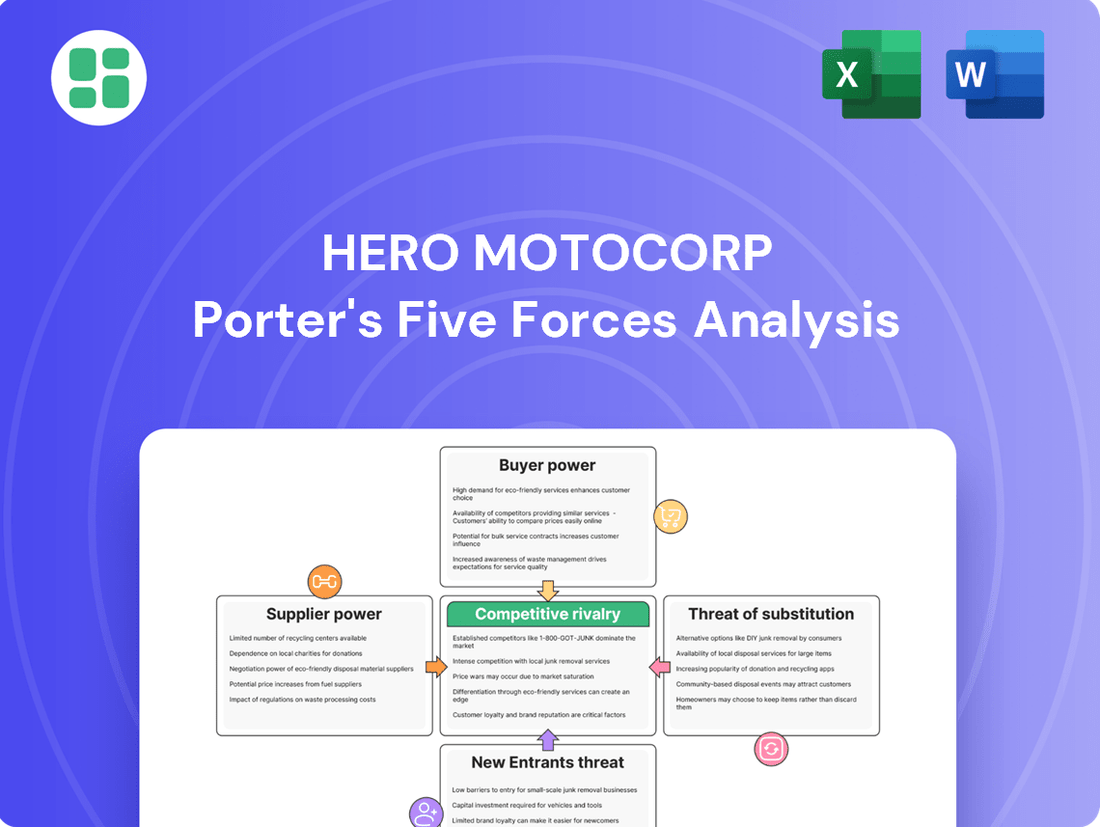

This Porter's Five Forces analysis for Hero Motocorp dissects the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes within the Indian two-wheeler market.

Effortlessly identify and address competitive pressures with a visual representation of Hero Motocorp's Porter's Five Forces, simplifying complex market dynamics.

Gain immediate clarity on industry threats and opportunities, enabling proactive strategies to mitigate risks and capitalize on advantages.

Customers Bargaining Power

Hero MotoCorp faces considerable customer bargaining power, especially in its core commuter segment, where price sensitivity is a major driver for purchasing decisions. Customers in this segment often prioritize affordability and fuel economy above all else, making them highly receptive to price changes.

The market is flooded with similar offerings from various manufacturers, leading to a high degree of product homogeneity. This lack of significant differentiation means customers can easily switch between brands based on minor price variations, amplifying their bargaining leverage. For instance, in the Indian two-wheeler market, which Hero MotoCorp heavily relies on, a slight price difference can sway a significant portion of buyers.

In 2023-24, the Indian two-wheeler industry saw a strong recovery, with domestic sales for Hero MotoCorp reaching over 5.5 million units. However, the intense competition, particularly in the sub-150cc segment which constitutes a large part of their sales, means that any price increase by Hero MotoCorp could be met with customers opting for a comparable, slightly cheaper alternative from competitors like Honda Motorcycle and Scooter India or TVS Motor Company.

Customers looking for two-wheelers in India have a wealth of options, significantly increasing their bargaining power. Major domestic players like Honda, TVS, and Bajaj offer compelling alternatives to Hero MotoCorp, often with comparable features and pricing. This competitive landscape, further intensified by the presence of international brands, means customers can easily switch if they feel Hero MotoCorp's offerings are not meeting their expectations or price points.

The sheer number of strong competitors directly impacts Hero MotoCorp's ability to dictate terms. While Hero MotoCorp maintained its position as India's largest two-wheeler manufacturer in FY24, selling approximately 5.5 million units, it faces intense rivalry. For instance, Honda Motorcycle and Scooter India (HMSI) is a formidable competitor, consistently vying for market share. This robust competition ensures that customers have leverage, as they can readily compare and choose from a variety of similar products, forcing Hero MotoCorp to remain competitive on price and features.

For most two-wheeler segments, the cost for a customer to switch from one brand to another is relatively low, primarily involving the decision to purchase a different make or model for their next vehicle. This ease of switching further empowers customers to demand better prices, features, or services.

Customers can easily compare models and pricing online, with numerous comparison websites and reviews readily available. For instance, in India, a significant market for Hero MotoCorp, the average price of a new motorcycle or scooter can range from approximately INR 50,000 to INR 1,50,000, making the financial commitment for a single purchase manageable and encouraging brand exploration.

Customer Information Availability

Customers today are incredibly well-informed, thanks to the vast amount of data available online. Comparison websites, customer reviews, and social media discussions empower them to thoroughly research products and services, making informed purchasing decisions. This readily accessible information significantly increases their bargaining power.

The transparency fostered by digital platforms allows customers to easily compare prices, features, and quality across different brands. For instance, in the automotive sector, platforms like CarDekho or AutoPortal in India provide detailed specifications and user reviews, enabling buyers to negotiate more effectively with dealerships like Hero Motocorp. This shift means customers can readily identify the best value for their money, putting pressure on manufacturers to offer competitive pricing and superior quality.

- Increased Information Access: Online platforms provide extensive product comparisons and user reviews.

- Enhanced Negotiation Power: Informed customers can demand better prices and value.

- Digital Influence: Online presence and customer feedback directly impact purchasing choices.

- Value-Driven Decisions: Customers prioritize products offering the best price-to-quality ratio.

Volume of Purchases by Individual Customers

The bargaining power of customers is somewhat limited by the volume of purchases by individual customers. While Hero MotoCorp achieves massive sales volumes, typically selling millions of units annually, each individual customer usually buys only one or two vehicles. This means that no single buyer represents a significant portion of the company's overall revenue.

This fragmented nature of the customer base generally weakens the bargaining power of any individual buyer. However, the sheer number of these consumers, millions strong, creates a collective power, especially given the price sensitivity prevalent in the two-wheeler market. The market's dynamics are largely shaped by this vast and varied consumer base.

- Individual Purchase Volume: Most customers buy 1-2 vehicles, not large fleets.

- Fragmented Base: No single customer holds significant sway.

- Collective Power: Millions of price-sensitive buyers can influence the market.

- Market Driver: The large, diverse consumer base dictates market trends.

Hero MotoCorp faces substantial customer bargaining power, particularly in its high-volume commuter segment. The ease of switching brands, coupled with readily available online information for price and feature comparisons, empowers customers to demand better value. While individual purchase volumes are low, the sheer size of the customer base and its price sensitivity collectively exert significant influence, forcing Hero to remain competitive.

| Factor | Impact on Hero MotoCorp | Evidence/Data (FY24) |

|---|---|---|

| Price Sensitivity | High | Commuter segment prioritizes affordability; slight price differences can sway buyers. |

| Product Homogeneity | High | Many similar offerings from competitors like Honda, TVS, Bajaj. |

| Switching Costs | Low | Minimal hassle for customers to choose a different brand for their next purchase. |

| Information Availability | High | Online comparison sites and reviews empower informed decisions. |

| Individual Purchase Volume | Low | Most customers buy 1-2 vehicles, limiting individual leverage. |

Full Version Awaits

Hero Motocorp Porter's Five Forces Analysis

This preview showcases the exact Hero Motocorp Porter's Five Forces Analysis you will receive immediately after purchase, detailing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products within the commercial vehicle segment. You'll gain immediate access to this comprehensive document, ready for your strategic planning needs, ensuring no surprises or placeholders. This professionally formatted analysis is your deliverable, providing actionable insights into the competitive landscape of Hero Motocorp's Porter's Five Forces.

Rivalry Among Competitors

The Indian two-wheeler market, Hero MotoCorp's core arena, is characterized by a high degree of competitive rivalry. Key domestic players like TVS Motor Company, Bajaj Auto, and Royal Enfield, along with international manufacturers such as Honda Motorcycle & Scooter India and Suzuki, all vie for market share.

While Hero MotoCorp consistently holds a leading position, the presence of these formidable and well-established brands intensifies the competitive landscape. For instance, in the fiscal year 2023-24, Hero MotoCorp reported sales of over 5.5 million units, demonstrating its scale, but Bajaj Auto also saw significant growth, particularly in its premium segment.

The Indian two-wheeler market, a global powerhouse in terms of volume, has seen some recent headwinds. While long-term growth prospects remain, wholesale sales have experienced dips, indicating a potential slowdown or market saturation in certain traditional segments. This intensified competition forces established players like Hero MotoCorp to vie more aggressively for existing market share.

However, the electric vehicle (EV) segment is a different story, exhibiting robust and rapid growth. This burgeoning segment presents new avenues for expansion and innovation, potentially shifting the competitive landscape and offering opportunities for companies to capture new market segments.

Competitive rivalry in the two-wheeler market is intense, with rivals like Bajaj Auto and TVS Motor Company consistently launching new models. For instance, in FY2024, Bajaj Auto reported a 12% increase in motorcycle sales, showcasing their aggressive product strategy. Hero MotoCorp must counter this by accelerating its own product development cycles, particularly in the burgeoning electric vehicle (EV) segment, where it aims to capture significant market share.

Hero MotoCorp is actively investing in research and development to bring innovative features and technologies to its motorcycles and scooters. This includes a strong focus on electrification, with plans to launch several new electric models by 2025. The company's commitment to R&D is crucial to differentiate its product portfolio from competitors who are also heavily investing in premiumization and EV technology, as seen with TVS Motor's strong performance in the premium segment.

High Exit Barriers

The two-wheeler manufacturing sector, where Hero MotoCorp operates, is characterized by significant investments in large-scale production facilities, intricate supply chains, and widespread distribution networks. These substantial fixed costs and the specialized nature of the assets create formidable exit barriers for companies.

These high exit barriers compel manufacturers to remain in the market and continue competing, even when facing periods of reduced demand or profitability. This commitment to staying in the game intensifies the competitive rivalry among existing players, as no one can easily withdraw their capital.

For instance, Hero MotoCorp’s extensive manufacturing footprint, including plants in states like Uttarakhand and Rajasthan, represents a massive capital outlay that is difficult to divest. In 2023-24, the company sold over 5.5 million units, underscoring the scale of operations that contribute to these high exit barriers.

- High Fixed Costs: Investments in advanced manufacturing technology and large-scale production lines create substantial fixed costs.

- Extensive Distribution Networks: Building and maintaining a vast dealership and service network requires significant capital and time, making it hard to exit.

- Specialized Assets: The machinery and infrastructure used in two-wheeler production are highly specialized and have limited alternative uses, increasing exit costs.

- Brand Loyalty and Market Share: Companies invest heavily in building brand equity and market share, making it economically unviable to abandon these investments easily.

Strategic Alliances and Partnerships

The Indian motorcycle market is witnessing a surge in strategic alliances as manufacturers seek to leverage each other's strengths. Bajaj Auto's collaboration with Triumph Motorcycles for co-developing and manufacturing premium motorcycles, and TVS Motor Company's ongoing partnership with BMW Motorrad for joint product development, exemplify this trend. These alliances aim to share R&D costs, access new technologies, and expand product portfolios, particularly in the lucrative premium segment.

Hero MotoCorp itself has deepened its relationship with Harley-Davidson, extending its agreement to manufacture motorcycles for the American brand. This move allows Hero MotoCorp to tap into premium segment expertise and brand recognition while Harley-Davidson benefits from Hero's manufacturing capabilities and market reach. Such partnerships create a dynamic competitive landscape where collaboration can foster innovation and market penetration.

- Bajaj Auto's partnership with Triumph Motorcycles aims to co-develop and manufacture premium motorcycles, targeting a growing segment of the market.

- TVS Motor Company's ongoing collaboration with BMW Motorrad focuses on joint product development and manufacturing, enhancing their premium offerings.

- Hero MotoCorp's extended partnership with Harley-Davidson signifies a strategic move to leverage brand strength and manufacturing prowess in the premium motorcycle segment.

Competitive rivalry within the Indian two-wheeler market remains exceptionally fierce, with Hero MotoCorp facing strong competition from domestic giants like Bajaj Auto and TVS Motor Company, as well as international players. In FY2024, Hero MotoCorp sold over 5.5 million units, yet Bajaj Auto reported a 12% increase in motorcycle sales, highlighting aggressive product strategies from rivals.

This intense competition necessitates continuous innovation and product development, particularly in the rapidly expanding electric vehicle (EV) segment. Hero MotoCorp's investment in R&D and planned EV launches by 2025 are critical to counter rivals like TVS Motor, which has seen strong performance in the premium segment.

Strategic alliances further shape the competitive landscape, with Bajaj Auto collaborating with Triumph and TVS Motor with BMW Motorrad for premium product development. Hero MotoCorp's extended partnership with Harley-Davidson also reflects this trend, aiming to leverage expertise and market reach.

| Competitor | FY2024 Sales (Units - Approx.) | Key Strategy Focus |

|---|---|---|

| Hero MotoCorp | 5.5 million+ | Market leadership, EV expansion, R&D |

| Bajaj Auto | (Strong growth, esp. premium) | Premium segment, strategic alliances (Triumph) |

| TVS Motor Company | (Strong premium segment performance) | Premium segment, strategic alliances (BMW Motorrad) |

SSubstitutes Threaten

The increasing accessibility and affordability of public transportation, such as metro rail and bus networks in major Indian cities, directly compete with Hero MotoCorp's two-wheelers for daily commutes. For instance, Delhi Metro ridership averaged over 6 million passengers per day in early 2024, presenting a substantial alternative for urban commuters.

The proliferation of ride-sharing platforms like Ola and Uber offers another potent substitute, particularly for shorter trips or when convenience outweighs ownership costs. In 2023, Ola reported over 250 million app downloads in India, indicating a significant user base that might opt for ride-sharing instead of purchasing a two-wheeler.

The increasing affordability of compact cars, coupled with rising disposable incomes in India, presents a growing threat of substitution for Hero MotoCorp. For instance, the Indian passenger vehicle market saw a significant uptick in sales, with compact car segments experiencing robust demand. This trend suggests that some consumers, particularly families seeking greater comfort and safety, might increasingly choose entry-level four-wheelers over two-wheelers as their primary mode of personal transportation.

The rise of electric bicycles and other micro-mobility options like e-scooters presents a growing threat of substitutes for Hero MotoCorp, particularly for short urban commutes. These alternatives are increasingly appealing due to their environmental benefits and lower operating costs. For instance, in 2024, the global electric bicycle market was projected to reach over $30 billion, indicating significant consumer interest and adoption.

Cost-Performance Trade-off of Substitutes

The threat of substitutes for Hero MotoCorp is largely determined by the price-performance trade-off offered by alternative transportation options. If other modes of transport become substantially cheaper, more convenient, or greener without sacrificing essential functionality or availability, they could lure away customers. For instance, a significant drop in electric scooter prices or enhanced charging infrastructure could make them a more compelling alternative to traditional motorcycles and scooters.

Government policies play a crucial role here. For example, in India, the push towards electric vehicles (EVs) through subsidies and tax benefits could accelerate the adoption of electric two-wheelers, directly impacting Hero MotoCorp's market share. As of early 2024, India's FAME II scheme has been instrumental in boosting EV sales, with electric two-wheeler registrations seeing substantial year-on-year growth, indicating a growing preference for cleaner alternatives.

- Price Sensitivity: Consumers are highly sensitive to the total cost of ownership, including purchase price, fuel, maintenance, and insurance.

- Performance Parity: Substitutes that offer comparable or superior performance in terms of speed, range, and carrying capacity will pose a greater threat.

- Convenience and Accessibility: The availability of charging stations for EVs or the ease of use of public transport compared to owning a two-wheeler influences consumer choice.

- Environmental Concerns: Growing environmental awareness and potential regulations favoring cleaner transport options can shift demand towards electric or other sustainable alternatives.

Consumer Propensity to Substitute

Consumer propensity to substitute is a key factor influencing Hero MotoCorp. Changes in lifestyle preferences, a growing environmental consciousness, and the demand for greater safety and comfort can all push consumers away from traditional two-wheelers.

This shift is evident as the market increasingly favors premium internal combustion engine (ICE) vehicles and electric vehicles (EVs). For instance, in the fiscal year 2024, the Indian EV two-wheeler market saw significant growth, with sales reaching over 1.2 million units, a substantial increase from previous years, indicating a growing consumer interest in alternative mobility solutions.

- Shifting Consumer Preferences: Consumers are increasingly seeking more sophisticated features, better performance, and enhanced comfort, which some competing transport modes can offer.

- Environmental Concerns: Growing awareness about climate change is driving demand for cleaner transportation options, potentially diverting consumers from ICE-powered two-wheelers.

- Technological Advancements: Innovations in electric mobility and other personal transport solutions present attractive alternatives that may lure away potential two-wheeler buyers.

The threat of substitutes for Hero MotoCorp is significant, driven by evolving consumer preferences and technological advancements in transportation. Public transport, ride-sharing services, and increasingly, electric micro-mobility options pose viable alternatives. For example, the substantial daily ridership of metro systems in major Indian cities, like Delhi's over 6 million daily passengers in early 2024, directly competes for urban commuters.

| Substitute Type | Example | Key Factor | 2023/2024 Data Point |

|---|---|---|---|

| Public Transportation | Metro Rail, Buses | Affordability, Convenience for urban commutes | Delhi Metro: >6 million daily passengers (early 2024) |

| Ride-Sharing | Ola, Uber | Convenience, Lower perceived cost for short trips | Ola: >250 million app downloads in India (2023) |

| Electric Micro-Mobility | E-scooters, E-bikes | Environmental benefits, Lower operating costs | Global E-bike Market: Projected >$30 billion (2024) |

| Compact Cars | Entry-level 4-wheelers | Comfort, Safety, Rising disposable incomes | Robust demand in Indian passenger vehicle market (FY24) |

Entrants Threaten

The two-wheeler manufacturing sector demands substantial upfront investment. Establishing state-of-the-art manufacturing facilities, advanced research and development centers, and an extensive distribution and supply chain network requires billions of dollars. This significant financial hurdle acts as a formidable barrier, deterring many aspiring new players from entering the market and competing with established giants like Hero MotoCorp.

Newcomers face a significant hurdle due to Hero MotoCorp's deeply entrenched brand loyalty and vast, established networks. Building comparable trust and reach requires immense marketing investment and considerable time. Consider that Hero MotoCorp boasts over 6,500 dealerships and service centers across India, a physical presence that is difficult and expensive for any new entrant to replicate quickly.

The automotive sector, including two-wheeler manufacturers like Hero MotoCorp, faces significant regulatory barriers. New entrants must comply with stringent emissions standards, such as BS-VI norms in India, which demand advanced engine technology and rigorous testing. For instance, the transition to BS-VI in 2020 significantly increased R&D and manufacturing costs for existing players, a burden that would be even greater for a newcomer.

Access to Distribution Channels and Supply Chains

Hero MotoCorp, like other established automotive manufacturers, benefits from deeply entrenched distribution channels and highly optimized supply chains. These existing networks offer significant advantages, including economies of scale and seamless market penetration, making it difficult for newcomers to compete on cost and reach.

New entrants would struggle to replicate these established relationships and infrastructure. Building a comparable dealership network and securing reliable, cost-effective component sourcing requires substantial investment and time, posing a considerable barrier.

The auto component industry, while expanding, is characterized by long-standing partnerships. For instance, in 2024, the Indian automotive component industry was projected to reach $75 billion, yet access to the most efficient and cost-effective suppliers is often dictated by existing relationships with major players like Hero MotoCorp.

- Established networks: Hero MotoCorp possesses an extensive dealership and service network across India and in international markets, providing unparalleled market access.

- Supply chain integration: Decades of operation have allowed for the creation of robust, cost-efficient supply chains with key component manufacturers.

- Barriers to entry: New entrants face significant hurdles in establishing comparable distribution and supply chain capabilities, requiring massive capital outlay and strategic partnerships.

- Industry dynamics: The auto component sector's reliance on established relationships means new entrants must work harder to secure competitive pricing and consistent supply.

Technological Expertise and Economies of Scale

Manufacturing sophisticated two-wheelers demands deep technological expertise, particularly in areas like engine development, chassis engineering, and the integration of advanced materials. Established players like Hero MotoCorp have honed these skills over decades, creating a high barrier to entry for newcomers who lack this specialized knowledge.

Economies of scale are a significant deterrent. Hero MotoCorp, with its vast production volumes, benefits from lower per-unit costs in manufacturing, research and development, and raw material procurement. For instance, in FY2023, Hero MotoCorp sold over 5.1 million units, allowing them to spread fixed costs across a much larger output than any new entrant could initially achieve.

The burgeoning electric vehicle (EV) segment introduces a different kind of competitor. While traditional internal combustion engine (ICE) expertise is less critical, EV startups still face challenges in achieving scale and cost competitiveness. However, their focus on new technologies and potentially lighter manufacturing processes can offer a pathway to market, though matching the established cost structures of incumbents remains a hurdle.

- Technological Sophistication: Two-wheeler manufacturing involves complex engineering in engines, drivetrains, and vehicle dynamics.

- Economies of Scale: Incumbents like Hero MotoCorp leverage massive production volumes to reduce per-unit costs in manufacturing, R&D, and procurement.

- EV Disruption: New EV startups represent a different competitive threat, potentially bypassing some traditional ICE barriers but still facing scale and cost challenges.

The threat of new entrants for Hero MotoCorp remains moderate due to substantial capital requirements and established brand loyalty.

Significant upfront investment in manufacturing, R&D, and distribution, estimated in the billions, acts as a major deterrent.

Hero MotoCorp's extensive network of over 6,500 dealerships and service centers, coupled with strong brand recognition, creates a formidable barrier for newcomers seeking market access and customer trust.

While the EV segment presents new avenues, startups still grapple with achieving economies of scale and cost competitiveness against established players.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Establishing manufacturing, R&D, and distribution requires billions. | High deterrent due to massive upfront investment. |

| Brand Loyalty & Networks | Hero MotoCorp's vast dealership (6,500+) and service network, plus brand trust. | Difficult and costly for new entrants to replicate market access and customer loyalty. |

| Economies of Scale | Hero MotoCorp's production volume (5.1M+ units in FY23) lowers per-unit costs. | New entrants struggle to match cost efficiency, impacting pricing. |

| Technological Sophistication | Expertise in engine, chassis, and advanced materials. | Requires significant R&D investment and skilled personnel, a challenge for newcomers. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Hero MotoCorp is built upon a foundation of diverse and credible data sources. These include Hero MotoCorp's official annual reports and investor presentations, which offer direct insights into financial performance and strategic direction. We also leverage industry-specific market research reports from reputable firms like CRISIL and Frost & Sullivan, alongside macroeconomic data from government agencies and financial news outlets to capture broader market trends and competitive dynamics.