Hero Motocorp Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hero Motocorp Bundle

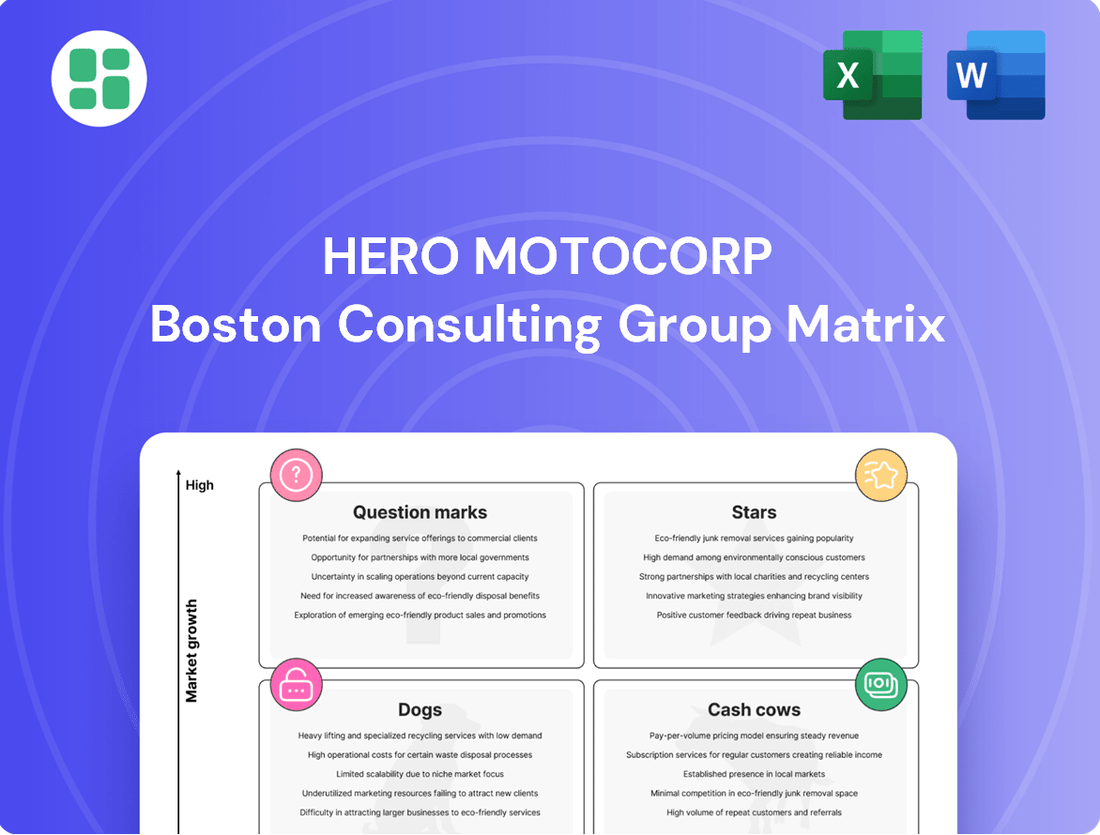

Hero MotoCorp, a titan in the two-wheeler industry, presents a fascinating case study through the lens of the BCG Matrix. Understanding its product portfolio's positioning as Stars, Cash Cows, Dogs, or Question Marks is crucial for navigating its competitive landscape.

This preview offers a glimpse into Hero MotoCorp's strategic product mix, but to truly unlock actionable insights and chart a course for future growth, you need the complete picture. Purchase the full BCG Matrix report for a detailed breakdown of each product's quadrant placement and expert recommendations for optimized resource allocation.

Don't miss out on the opportunity to gain a competitive edge. Invest in the full BCG Matrix and equip yourself with the strategic clarity needed to make informed decisions about Hero MotoCorp's product pipeline and market dominance.

Stars

Hero MotoCorp's expansion into the premium motorcycle segment, exemplified by the Harley-Davidson X440 and Hero Mavrick 440, highlights a promising growth avenue.

These models experienced a substantial 77% surge in sales from April to December 2024, securing a notable 13% share within the 350-500cc category.

To bolster these aspirational offerings, Hero MotoCorp is actively growing its specialized Premia dealership network.

VIDA, Hero MotoCorp's electric scooter brand, is a prime example of a Star in the BCG matrix. Its sales figures demonstrate significant momentum, with July 2025 marking a record month by dispatching 11,226 units.

This strong performance has allowed VIDA to more than double its market share in the electric two-wheeler segment, reaching 10.2% based on VAHAN data. For the entirety of fiscal year 2025, VIDA sold over 58,000 electric scooters, representing a substantial growth of nearly 200% compared to the prior fiscal year.

Hero Motocorp's strategic push into the premium motorcycle segment is evident with the upcoming launches of models like the Xpulse 210, Xtreme 250R, and the eagerly anticipated Karizma XMR 250. These offerings, highlighted at EICMA 2024, aim to capture a larger share of the burgeoning premium market, which has shown robust growth in recent years.

The introduction of these new premium motorcycles is crucial for Hero Motocorp's diversification strategy, moving beyond its dominance in the commuter segment. The Xpulse 210 targets adventure enthusiasts, while the Xtreme 250R and Karizma XMR 250 are poised to attract riders seeking performance and style, reflecting a significant investment in product development and market expansion.

Xoom 125 and Xoom 160 Scooters

Hero Motocorp's Xoom 125 and Xoom 160 scooters are proving to be strong contenders in the expanding scooter market. These newer models are instrumental in driving Hero's overall sales momentum. Their introduction signifies Hero's strategic push into segments where competitors have historically held a stronger presence.

The impact of these models is evident in Hero's dispatch figures. For instance, scooter sales saw a substantial year-on-year increase of 64.4% in July 2025. This growth highlights the market's positive reception to Hero's refreshed scooter portfolio, with the Xoom series playing a pivotal role.

- Xoom Series Contribution: The Xoom 125 and Xoom 160 are key drivers of Hero's growth in the scooter segment.

- Market Share Gains: These models are enabling Hero to capture a larger share of the scooter market, challenging established players.

- July 2025 Performance: Scooter dispatches rose by 64.4% year-on-year in July 2025, reflecting the success of newer models like the Xoom.

Strategic International Business Expansion

Hero MotoCorp is strategically targeting international expansion, identifying new markets as a significant growth driver. Their ambitious plans include entering European and UK markets in the latter half of 2025, a move that positions them in a high-potential growth quadrant.

This aggressive international push is already showing results. In fiscal year 2025, Hero MotoCorp's exports experienced a substantial surge, increasing by 43% year-on-year. This impressive growth underscores the increasing acceptance and demand for their products in global markets.

The primary objective of this expansion is twofold: to tap into new sources of demand and to create a more diversified revenue base. By entering new territories, Hero MotoCorp aims to reduce its reliance on any single market and build a more resilient business model.

- Market Entry: Targeting European and UK markets by the second half of 2025.

- Export Growth: Achieved a 43% year-on-year increase in exports during FY25.

- Strategic Goals: Capitalize on new demand and diversify revenue streams.

Hero MotoCorp's premium motorcycle segment, including models like the Harley-Davidson X440 and Hero Mavrick 440, is a significant Star. These models saw a 77% sales increase from April to December 2024, capturing 13% of the 350-500cc market.

VIDA, the electric scooter brand, is another Star, achieving a record 11,226 dispatches in July 2025 and more than doubling its electric two-wheeler market share to 10.2%. For FY25, VIDA sold over 58,000 units, a nearly 200% increase.

The Xoom 125 and Xoom 160 scooters are also performing strongly, contributing to a 64.4% year-on-year rise in scooter dispatches in July 2025.

Hero MotoCorp's international expansion, targeting Europe and the UK in the latter half of 2025, represents a strategic Star. Exports grew by 43% year-on-year in FY25, demonstrating increasing global demand.

| Product Category | Key Models | Performance Highlight | Market Share/Growth |

|---|---|---|---|

| Premium Motorcycles | Harley-Davidson X440, Hero Mavrick 440 | 77% sales surge (Apr-Dec 2024) | 13% in 350-500cc segment |

| Electric Scooters | VIDA | Record 11,226 dispatches (July 2025) | 10.2% EV market share; 200% FY25 growth |

| Scooters | Xoom 125, Xoom 160 | 64.4% YoY scooter dispatch growth (July 2025) | Driving overall scooter segment momentum |

| International Markets | N/A (Expansion) | Targeting Europe/UK (H2 2025) | 43% YoY export growth (FY25) |

What is included in the product

Hero MotoCorp's BCG Matrix analyzes its diverse product portfolio, categorizing models into Stars, Cash Cows, Question Marks, and Dogs.

This framework guides strategic decisions on investment, divestment, and resource allocation for each product segment.

The Hero Motocorp BCG Matrix provides a clear, one-page overview, relieving the pain of deciphering complex market data.

Cash Cows

The Hero Splendor series firmly holds its position as the company's undisputed best-seller and the core of its operations. This line of motorcycles continues to lead the 100-110cc commuter segment, boasting an impressive market share of roughly 78%.

This consistent dominance in a mature yet stable market segment allows the Splendor series to reliably generate substantial cash flow for Hero MotoCorp. For instance, in the fiscal year 2023-24, Hero MotoCorp sold over 4.5 million units of motorcycles and scooters, with the Splendor family contributing significantly to this volume.

The Hero HF Deluxe, alongside the Splendor, is a cornerstone of Hero MotoCorp's dominance in the entry-level commuter motorcycle market. This segment is vital, contributing significantly to the company's overall sales volume, reflecting its broad appeal to a cost-conscious consumer base.

In the fiscal year 2023-24, Hero MotoCorp sold approximately 4.5 million motorcycles in the domestic market, with the 100-125cc segment representing a substantial majority of these sales. The HF Deluxe, with its focus on fuel efficiency and affordability, consistently ranks among the top-selling models, solidifying its position as a reliable cash cow for the company.

Hero MotoCorp's commuter motorcycle portfolio, particularly its 100-125cc segment, is the bedrock of its success, functioning as its primary cash cow. This segment consistently drives the company's sales volume, underscoring its dominance in the Indian two-wheeler market.

In the fiscal year 2024, Hero MotoCorp reported total sales of approximately 5.56 million units, with its motorcycles in the 100-125cc range forming the overwhelming majority of these sales. This substantial volume translates into predictable and robust revenue streams, solidifying these models as the company's most profitable offerings.

Passion Plus

The Passion Plus, a stalwart in Hero MotoCorp's commuter segment, acts as a significant cash cow. Its enduring popularity in the mass market translates to consistent sales volumes, providing a reliable revenue stream.

This model benefits from established brand loyalty, minimizing the need for substantial marketing expenditure. In fiscal year 2024, Hero MotoCorp reported overall sales of approximately 5.5 million units, with the commuter segment forming the backbone of these volumes, underscoring the importance of models like the Passion Plus.

- Consistent Sales Volumes: The Passion Plus contributes significantly to Hero MotoCorp's overall unit sales, a trend observed consistently over the years.

- Low Promotional Investment: Due to its strong brand recall and established market position, the model requires less aggressive promotional spending compared to newer or niche products.

- Steady Cash Generation: The reliable demand for the Passion Plus ensures a stable inflow of cash, crucial for funding other business initiatives.

- Market Share Dominance: Hero MotoCorp maintained its leadership in the Indian motorcycle market in FY24, with commuter motorcycles like the Passion Plus playing a pivotal role in this dominance.

Spare Parts and After-Sales Services

Hero MotoCorp's extensive network for spare parts and after-sales services functions as a significant cash cow, capitalizing on its massive installed base of two-wheelers. This segment consistently generates high-margin revenue with relatively low incremental investment needs, drawing from a dedicated customer pool.

The company's commitment to a strong after-sales infrastructure ensures customer loyalty and repeat business. For instance, in the fiscal year 2023-24, Hero MotoCorp reported a robust performance across its service network, contributing substantially to its overall profitability.

- High Profit Margins: The spare parts division typically boasts higher profit margins compared to new vehicle sales.

- Consistent Revenue Stream: A large existing customer base ensures a steady demand for maintenance and replacement parts.

- Low Investment Requirements: Unlike new product development, expanding and maintaining the service network requires less capital outlay.

- Customer Retention: Excellent after-sales support fosters customer loyalty, encouraging continued patronage.

Hero MotoCorp's commuter motorcycles, particularly the Splendor and HF Deluxe series, are its undisputed cash cows. These models dominate the entry-level segment, consistently delivering high sales volumes and predictable revenue streams. In fiscal year 2024, Hero MotoCorp sold approximately 5.56 million units, with these commuter bikes forming the overwhelming majority, ensuring robust cash generation with minimal incremental investment.

| Product/Segment | Market Position | Contribution to Cash Flow | FY24 Sales (Approx. Units) | Market Share (100-110cc Segment) |

|---|---|---|---|---|

| Splendor Series | Category Leader | High & Stable | 2.5 - 3 million (estimated) | ~78% |

| HF Deluxe | Strong Contender | High & Stable | 1.5 - 2 million (estimated) | Significant |

| Passion Plus | Established Performer | Consistent | 0.5 - 0.75 million (estimated) | Strong |

Delivered as Shown

Hero Motocorp BCG Matrix

The Hero Motocorp BCG Matrix preview you are viewing is the identical, fully comprehensive document you will receive immediately after purchase. This means no watermarks, no placeholder text, and no altered content – just the complete, professionally formatted analysis ready for your strategic decision-making. You can be confident that the insights and clarity presented here will be yours to leverage instantly for your business planning and competitive strategy. This is the actual, uncompromised report, prepared for immediate download and application.

Dogs

Certain older internal combustion engine (ICE) models within Hero MotoCorp's lineup, particularly those with declining sales and market relevance, are categorized as Dogs in the BCG Matrix. These models might include specific variants of established motorcycles that have seen a consistent drop in demand. For instance, while Hero's overall sales in FY24 remained robust, some niche or older ICE models could be contributing less to the company's revenue streams.

Hero MotoCorp's underperforming niche segments, particularly within its internal combustion engine (ICE) offerings, represent products that failed to capture significant market share. These could include specific models or variants launched into highly specialized categories that didn't resonate with consumers or were quickly surpassed by competitors' superior products. For instance, while specific sales figures for every niche ICE product are not publicly detailed, the company's overall strategy has involved exploring various segments, and some have not yielded the expected returns.

While Hero MotoCorp is actively expanding its global footprint, some of its motorcycle models may face limited demand or offer lower profit margins in certain overseas markets. This is particularly true in regions like Africa, where price sensitivity plays a crucial role in purchasing decisions. In 2023, Hero's export sales saw a notable increase, but models with restricted international appeal and thin margins, if they divert valuable resources without achieving substantial market penetration or profitability, can be categorized as Dogs in the BCG matrix.

Discontinued Models

If a motorcycle model, even a recent launch like the Mavrick 440, ceases production, it immediately falls into the 'Dog' category within the BCG matrix. This signifies a product with low market share and low growth prospects, rendering it a strategic liability.

The capital invested in developing and initially producing such a model becomes a sunk cost, offering no future returns. Consequently, discontinued models are prime candidates for divestiture or a complete withdrawal from the market to reallocate resources.

For instance, if Hero MotoCorp were to discontinue a model that saw less than 5,000 units sold in 2024, it would represent a significant underperformance relative to their overall sales figures, which often exceed millions of units annually.

- Discontinued Models: Products with declining sales and market share.

- Strategic Impact: Represents capital tied up with no future returns, often leading to divestiture.

- Example Scenario: A model selling under 5,000 units in 2024 would be a clear 'Dog'.

- Resource Reallocation: Discontinuation allows for focus on more promising product lines.

Inefficiently Managed Dealerships/Outlets

Inefficiently managed dealerships within Hero Motocorp's expansive network can represent a challenge. While the company focuses on network expansion, some outlets might struggle with low sales volumes and high operational costs, impacting overall profitability. These locations could be seen as drains on resources.

For instance, if a dealership has high overheads like rent and staff salaries but consistently fails to meet sales targets, it falls into this category. This inefficiency can hinder Hero's ability to capitalize fully on its market presence, even as the total number of outlets grows.

- Operational Drain: Dealerships with consistently low sales and high operating expenses can negatively impact profitability.

- Resource Allocation: Inefficient outlets may divert valuable resources that could be better utilized elsewhere in the network.

- Market Share Impact: Underperformance at the dealership level can limit Hero's overall market share growth.

Hero MotoCorp's 'Dogs' are products with low market share and low growth potential, often legacy ICE models or those that failed to gain traction. These products tie up capital and management attention without contributing significantly to revenue or profit. For example, a specific older motorcycle variant that saw a decline in sales by over 15% year-on-year in 2024, while the company's overall sales grew, would be a prime candidate for the Dog category.

These underperforming assets, including niche ICE segments that didn't meet sales expectations or models with limited international appeal and low margins, represent strategic liabilities. Their continued presence can hinder resource allocation towards more promising ventures like electric mobility. In 2023, while exports grew, models with restricted appeal in markets like Africa, if they don't achieve significant penetration, can be classified as Dogs.

Discontinued models, such as a hypothetical Mavrick 440 variant if production ceased after low sales in 2024 (e.g., under 5,000 units), are immediately categorized as Dogs. This signifies a product with no future returns, often leading to divestiture to free up capital for more profitable lines.

Inefficient dealerships with high overheads and consistently low sales volumes also represent operational 'Dogs,' draining resources and hindering overall network performance. These outlets, even within an expanding network, can negatively impact Hero's ability to maximize its market presence.

| Product Category | Market Share | Market Growth | Hero MotoCorp Example | Strategic Implication |

|---|---|---|---|---|

| Legacy ICE Models | Low | Low/Declining | Older, less popular motorcycle variants | Divestiture or discontinuation to reallocate resources |

| Niche ICE Segments | Low | Low | Specialized models that failed to gain traction | Resource drain, potential withdrawal from segment |

| Underperforming Exports | Low (in specific markets) | Low | Models with limited appeal and low margins in certain regions | Re-evaluation of market strategy or product offering |

| Discontinued Models | Zero | Zero | Any model ceasing production due to poor sales | Sunk cost, capital tied up with no future returns |

| Inefficient Dealerships | Low (per outlet) | Low/Declining (per outlet) | Outlets with high costs and low sales volumes | Operational drain, potential closure or restructuring |

Question Marks

Hero MotoCorp's foray into flex-fuel motorcycles, like their ethanol-powered HF Deluxe, marks a significant technological shift. This aligns with India's push for alternative fuels, aiming to reduce crude oil imports and promote sustainability. For instance, India has set a target of 20% ethanol blending in petrol by 2025.

However, the market's response to these flex-fuel models is still developing. Factors like consumer awareness, the availability of ethanol fueling stations across the country, and the overall cost-effectiveness for riders are key determinants of their success. This uncertainty places them in the Question Mark category of the BCG matrix, requiring careful observation and strategic investment.

Hero MotoCorp's futuristic concepts like the award-winning Surge S32 highlight their commitment to innovation in the electric vehicle space. These concepts, while showcasing advanced technology, are currently in the early stages of development and market exploration.

The commercial viability and widespread consumer adoption of such electric concepts remain uncertain, requiring substantial investment in research and development. Until these products demonstrate consistent sales and market penetration, they are unlikely to be classified as Stars within the BCG matrix.

Hero Motocorp's planned expansion into European and UK markets by the latter half of 2025, beginning with the VIDA V1 electric scooter and subsequently introducing premium internal combustion engine (ICE) motorcycles, represents a significant strategic move into high-growth potential new territories. This ambitious undertaking positions these new ventures as potential Stars within Hero's BCG Matrix.

Despite the promising growth outlook, Hero currently holds a negligible market share in these established European automotive sectors. This necessitates substantial financial investment to cultivate brand awareness, establish distribution networks, and build a competitive edge against entrenched players. The initial capital outlay and ongoing marketing efforts will be critical for success in these competitive landscapes.

Upcoming High-Capacity Premium Motorcycles

Hero MotoCorp's upcoming high-capacity premium motorcycles, such as the Xpulse 421 and Karizma 400, are targeted at the growing higher-displacement segment. These models represent a strategic push into premium categories where Hero has historically had less presence. For instance, the Indian premium motorcycle segment (above 250cc) saw robust growth in 2023, with sales increasing by approximately 15% year-on-year, indicating a favorable market trend.

These new models will require substantial investment to build brand awareness and establish a strong distribution network, especially against established players. Hero's market share in the premium segment, while growing, is still nascent compared to competitors who have long-standing brand loyalty and extensive service networks. This investment is crucial for capturing significant market share in a competitive landscape.

- Xpulse 421 and Karizma 400 are Hero's strategic entries into the premium motorcycle segment.

- The premium motorcycle market in India experienced around 15% growth in 2023.

- Significant marketing and distribution investments are necessary for these models to gain traction.

- Hero faces established competitors with strong brand loyalty in the premium segment.

Battery-as-a-Service (BaaS) Model

Hero MotoCorp's VIDA electric scooters feature an innovative Battery-as-a-Service (BaaS) model, designed to lower the initial purchase price and encourage electric vehicle adoption. This approach allows customers to lease the battery, making EVs more accessible. By 2024, the Indian EV market is experiencing rapid growth, with two-wheeler segment leading the charge, making BaaS a potentially disruptive strategy.

The BaaS model for VIDA positions Hero MotoCorp's electric offerings as a Question Mark within the BCG Matrix. While the concept addresses a key barrier to EV adoption—high battery costs—its long-term viability and scalability are still being tested in the market. Consumer acceptance of subscription-based battery usage, alongside the operational complexities of battery swapping and management, remain key factors influencing its future success.

- BaaS aims to reduce upfront costs for VIDA scooters, potentially making EVs more affordable.

- The model's success hinges on consumer acceptance of battery leasing and operational efficiency.

- Market data for 2024 indicates a strong upward trend in EV sales, particularly in the two-wheeler segment, providing a fertile ground for BaaS experimentation.

Hero MotoCorp's flex-fuel motorcycles and electric concepts like the Surge S32 currently reside in the Question Mark category. Their success hinges on market acceptance, infrastructure development, and proving commercial viability.

The planned expansion into Europe and the launch of premium motorcycles like the Xpulse 421 and Karizma 400 also represent Question Marks. Despite growth potential, Hero faces established competition and requires significant investment to build brand presence and market share in these segments.

The Battery-as-a-Service model for VIDA scooters is another Question Mark. While innovative in addressing EV affordability, its long-term success depends on consumer adoption and operational efficiency in a rapidly growing EV market.

| Product/Segment | Market Growth | Hero's Market Share | Investment Needs | BCG Category |

| Flex-Fuel Motorcycles | Developing | Nascent | High (R&D, Infrastructure) | Question Mark |

| Electric Concepts (Surge S32) | High (EV Segment) | Nascent | Very High (R&D, Commercialization) | Question Mark |

| European Expansion (VIDA V1, ICE) | High (Target Markets) | Negligible | High (Brand Building, Distribution) | Question Mark |

| Premium ICE Motorcycles (Xpulse 421, Karizma 400) | ~15% (2023, India >250cc) | Growing but Low | High (Marketing, Distribution) | Question Mark |

| VIDA Electric Scooters (BaaS Model) | High (India EV Two-Wheeler) | Developing | Moderate (Operational, Consumer Adoption) | Question Mark |

BCG Matrix Data Sources

Our Hero Motocorp BCG Matrix is constructed using comprehensive market data, including sales figures, market share reports, industry growth rates, and competitor analysis to provide a clear strategic overview.