Herc Rentals Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Herc Rentals Bundle

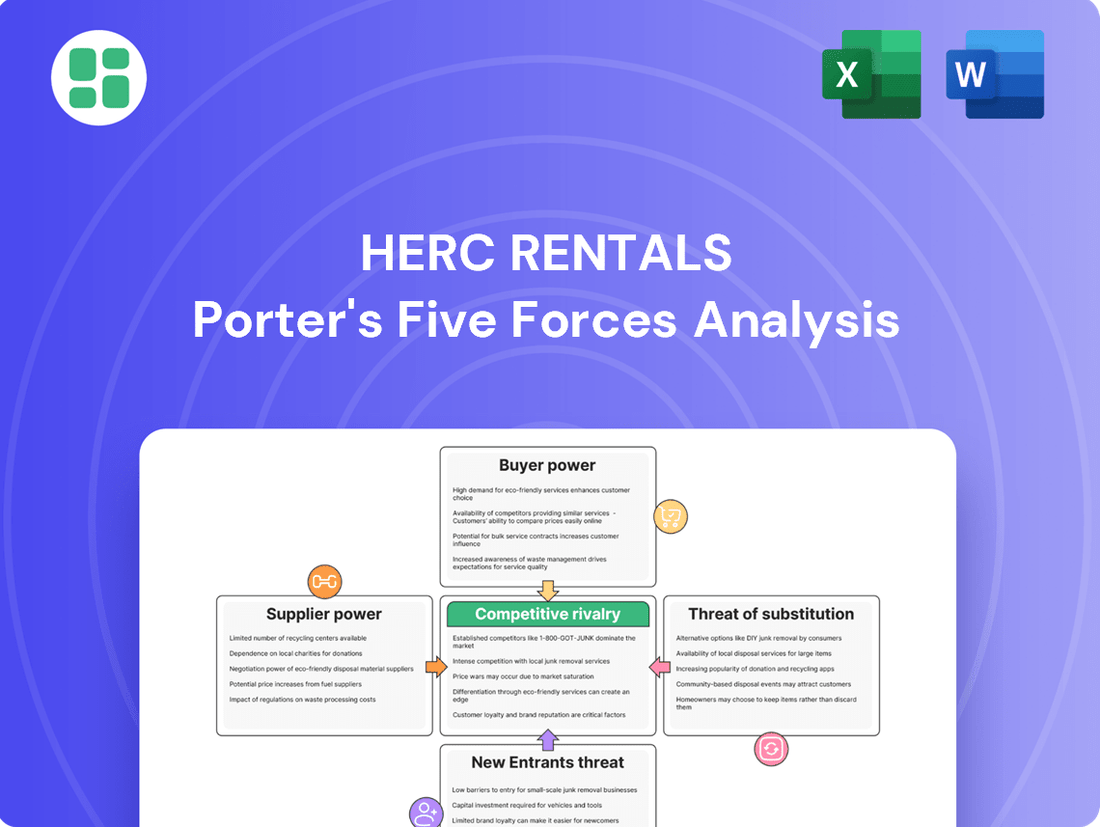

Herc Rentals operates in a dynamic equipment rental market, where understanding the competitive landscape is crucial for success. Our Porter's Five Forces analysis unpacks the intensity of rivalry, the bargaining power of buyers and suppliers, and the threats posed by new entrants and substitutes.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Herc Rentals’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The heavy equipment manufacturing sector is dominated by a handful of major global companies, including Caterpillar, Komatsu, and Volvo. This concentration means Herc Rentals, like other rental firms, has fewer suppliers to choose from, granting these manufacturers considerable bargaining power.

These leading manufacturers hold patents and possess specialized production facilities, limiting Herc's ability to source a wide variety of equipment efficiently. For instance, Caterpillar's revenue in 2023 was approximately $67.1 billion, highlighting its market dominance and influence.

Herc Rentals encounters significant hurdles when looking to switch equipment suppliers, primarily due to high switching costs. The substantial capital already invested in specific brands and models of equipment creates a significant barrier to entry for new suppliers. This financial commitment means Herc is less likely to explore alternative options unless the benefits are overwhelmingly clear.

Further complicating any potential shift are the specialized training requirements for Herc's maintenance technicians. These technicians are skilled in servicing particular brands and models, and retraining them for different equipment would incur considerable time and expense. Additionally, Herc maintains inventories of parts specific to its current fleet, making a transition disruptive and costly as new parts would need to be sourced and integrated.

In 2023, Herc Rentals reported capital expenditures of $1.6 billion, a significant portion of which was allocated to fleet acquisitions and upgrades. This level of investment underscores the deep financial commitment to their existing equipment base, reinforcing the bargaining power of their current suppliers.

Many equipment manufacturers hold a strong hand due to proprietary technology and innovation. Think about advanced telematics and IoT features built into their machinery; these aren't readily available everywhere. This means Herc Rentals might need specific suppliers for the latest efficiencies or to meet new environmental regulations, giving those suppliers more leverage.

Supplier's Brand Strength

Established equipment manufacturers possess significant brand strength, often recognized for durability, reliability, and performance. Herc Rentals frequently stocks these well-known brands to satisfy customer demand and ensure operational dependability, which bolsters the manufacturers' leverage.

This brand loyalty translates into a powerful influence over customer choices, reinforcing the suppliers' position when negotiating terms with rental companies like Herc Rentals. For instance, in 2024, major equipment manufacturers continued to command premium pricing due to their established reputations, impacting the cost of goods for rental firms.

- Brand Recognition: Leading manufacturers enjoy high visibility and trust among end-users.

- Customer Demand: Herc Rentals must carry popular brands to meet market expectations.

- Supplier Leverage: Brand loyalty strengthens manufacturers' negotiating power over rental companies.

Limited Threat of Forward Integration

Equipment manufacturers typically concentrate on production rather than the short-term rental market, which lessens the direct threat of them entering Herc Rentals' core business. For instance, major equipment producers like Caterpillar or John Deere primarily sell their products through established dealer networks to large end-users, not typically operating rental fleets themselves.

This strategic focus means suppliers are less likely to directly compete by offering rental services, thus limiting their bargaining power through forward integration. While they possess the capability to sell directly to customers, this doesn't translate into a significant competitive pressure within the rental segment itself.

- Limited Forward Integration: Manufacturers focus on production, not short-term rental operations.

- Direct Sales Channels: Suppliers sell to large construction and industrial firms directly.

- Reduced Competitive Threat: This limits suppliers' ability to directly compete in Herc Rentals' rental market.

- Leverage through Sales: Direct sales to end-users still grant suppliers some market influence.

The bargaining power of suppliers for Herc Rentals is considerable, primarily due to the concentrated nature of the heavy equipment manufacturing industry. A few dominant global players, such as Caterpillar and Volvo, control a significant portion of the market. This limited supplier base means Herc Rentals has fewer alternatives when sourcing equipment, allowing these manufacturers to exert substantial influence on pricing and terms.

These leading manufacturers often possess proprietary technology and robust brand recognition, which further strengthens their negotiating position. Herc Rentals, to meet customer demand for reliable and advanced equipment, often finds itself stocking these established brands. For example, in 2024, major equipment manufacturers continued to command premium pricing due to their strong reputations for durability and performance.

High switching costs also play a crucial role in empowering suppliers. Herc Rentals has made substantial capital investments in specific equipment brands, including specialized training for its technicians and maintaining inventories of particular parts. These financial and operational commitments make it difficult and expensive for Herc to transition to different suppliers, reinforcing the existing manufacturers' leverage.

| Supplier Characteristic | Impact on Herc Rentals | Supporting Data (2023/2024) |

|---|---|---|

| Industry Concentration | Limited supplier choice, increased supplier leverage | Caterpillar 2023 Revenue: ~$67.1 billion |

| Proprietary Technology & Brand Strength | Customer demand for specific brands, premium pricing | Major manufacturers maintained premium pricing in 2024 |

| High Switching Costs | Financial and operational barriers to changing suppliers | Herc Rentals 2023 CapEx: ~$1.6 billion (fleet acquisition) |

What is included in the product

This analysis unpacks the competitive landscape for Herc Rentals by examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitute products.

Instantly visualize competitive pressures with a dynamic, interactive dashboard that highlights key threats and opportunities.

Customers Bargaining Power

Herc Rentals' customers often face low switching costs, meaning they can readily move to a different equipment rental provider. This ease of transition is largely due to the standardized nature of many rental items, where a competitor can easily supply a comparable machine. For instance, a standard scissor lift from Herc can often be matched by another supplier, diminishing customer loyalty based on equipment uniqueness.

This low barrier to changing suppliers grants customers considerable bargaining power. They can leverage the availability of alternatives to negotiate more favorable rental rates and contract terms. In 2024, the competitive landscape for equipment rentals, particularly for commonly used machinery, intensified, further empowering customers to seek out the best available pricing and service packages.

Many of Herc Rentals' standard equipment offerings are viewed by customers as commodities. This means that price becomes a primary deciding factor for many, as they simply seek the most affordable option for basic rental needs. For instance, in 2024, the general construction equipment rental market saw intense competition, with average daily rates for common items like scissor lifts remaining relatively stable, reflecting this commoditized nature.

When a service is perceived as a commodity, customers have significant leverage. They can easily switch to a competitor if pricing is not competitive, putting direct pressure on Herc Rentals' profit margins. This forces the company to constantly evaluate its pricing strategies to remain attractive in these segments.

This high price sensitivity directly translates to increased bargaining power for customers. They can effectively demand lower rates, especially for bulk rentals or longer-term contracts, as they know many alternatives exist. This dynamic significantly impacts Herc Rentals' ability to command premium pricing for its more standardized equipment.

Herc Rentals caters to a wide range of customers, including small contractors, large industrial firms, and government agencies undertaking significant infrastructure projects. This broad customer base, while diverse, means that individual customer bargaining power can vary significantly.

Large clients, due to their volume and project scale, often possess greater leverage to negotiate favorable terms and pricing. For instance, a major construction company securing equipment for a multi-year, multi-million dollar project would likely have more sway than a small landscaping business renting a single piece of equipment for a day.

The varied needs of this diverse clientele necessitate Herc Rentals maintaining an extensive and varied equipment fleet. This operational complexity, however, also presents opportunities for upselling specialized equipment or bundled service packages, potentially mitigating some of the direct price pressure from individual large customers.

Threat of Customer Self-Ownership

The threat of customer self-ownership, also known as backward integration, is a significant factor influencing Herc Rentals. Large clients, such as major construction firms or industrial enterprises, might opt to buy their own equipment if they have consistent, long-term needs for specific machinery. This can reduce their dependency on rental services and give them leverage in negotiations. For example, a large infrastructure project requiring specialized earthmoving equipment for several years might find purchasing more economical than renting over that extended period.

Herc Rentals needs to emphasize the advantages of renting to mitigate this threat. These benefits include avoiding the substantial capital expenditure of equipment ownership, the costs associated with maintenance and repairs, and the flexibility to scale their fleet up or down based on project demands. In 2023, Herc Rentals reported total revenue of $2.3 billion, indicating a large customer base, some of whom could potentially shift to ownership if the cost-benefit analysis favors it.

- Self-Ownership Alternative: Large customers might buy equipment for long-term or frequent use, bypassing rental companies.

- Bargaining Power: This potential for backward integration strengthens customer negotiation leverage.

- Herc's Value Proposition: Herc must highlight flexibility, reduced capital outlay, and maintenance services to retain customers.

- Market Context: In 2023, Herc Rentals generated $2.3 billion in revenue, showing the scale of its customer base and the potential impact of self-ownership.

Availability of Multiple Rental Providers

The equipment rental market is highly fragmented, featuring a significant number of national, regional, and local providers. This competitive landscape, which includes giants like United Rentals and Sunbelt Rentals, directly impacts Herc Rentals' pricing power. In 2024, the industry continued to see robust activity, with companies actively managing their fleets to meet diverse customer needs.

Customers benefit from this abundance of choices, as they can readily compare offerings and negotiate favorable terms. This ease of comparison allows them to solicit bids from various suppliers, driving down prices and limiting Herc Rentals' ability to unilaterally set rates. For instance, a construction firm needing specialized equipment can easily obtain quotes from three or more providers, leveraging competition to their advantage.

- Numerous Competitors: The presence of major players like United Rentals and Sunbelt Rentals, alongside many smaller regional and local operators, creates a buyer's market.

- Price Sensitivity: Customers can easily shop around, making pricing a key differentiator and reducing Herc Rentals' leverage in negotiations.

- Information Accessibility: Online platforms and industry networks facilitate easy access to competitive pricing and service information for potential renters.

Herc Rentals' customers, particularly those requiring standard equipment, often face low switching costs. This ease of movement to competitors, driven by commoditized offerings, significantly amplizes their bargaining power. In 2024, the rental market's competitive intensity meant customers could readily leverage alternatives to negotiate better pricing and terms.

The perception of many rental items as commodities means price is a primary driver for customers. This forces Herc Rentals to remain competitive on rates, especially for bulk or long-term rentals, as customers can easily find comparable equipment elsewhere. The fragmented nature of the industry, with numerous national and local players, further empowers buyers to solicit multiple bids and secure favorable deals.

Large clients possess even greater leverage due to their volume and potential for backward integration, i.e., purchasing their own equipment for long-term needs. Herc Rentals must therefore emphasize the value of rental flexibility and avoidance of capital expenditure to retain these significant customer segments. In 2023, Herc Rentals' $2.3 billion in revenue highlights the scale of its customer base, underscoring the importance of managing customer bargaining power.

| Factor | Impact on Herc Rentals | Customer Leverage | 2024 Market Insight |

|---|---|---|---|

| Low Switching Costs | Reduced customer loyalty, price pressure | High | Standard equipment easily sourced from competitors |

| Commoditization | Price becomes primary differentiator | High | Intense competition on rates for common machinery |

| Backward Integration | Potential loss of rental revenue | High for large clients | Large firms may buy for consistent, long-term needs |

| Fragmented Market | Limits pricing power, increases competition | High | Numerous providers enable easy comparison and negotiation |

Preview Before You Purchase

Herc Rentals Porter's Five Forces Analysis

This preview showcases the complete Herc Rentals Porter's Five Forces Analysis, detailing competitive rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. The document you see here is precisely the same professionally written and formatted analysis you'll receive immediately after purchase, ready for your strategic review.

Rivalry Among Competitors

The North American equipment rental landscape is highly concentrated, with Herc Rentals facing off against giants like United Rentals and Sunbelt Rentals. This oligopolistic structure fuels a fierce competitive environment where these major players constantly vie for market dominance.

Competition is particularly intense across several key areas: pricing strategies, the breadth and availability of rental fleets, the extent of their geographic coverage, and the overall quality of customer service provided. These factors are critical battlegrounds for market share.

In 2023, the top three players in the North American equipment rental market, including Herc Rentals, collectively held a significant portion of the industry's revenue, underscoring the concentrated nature of the competition and the ongoing struggle for dominance.

Herc Rentals operates in an industry with substantial fixed costs, particularly in acquiring and maintaining its extensive equipment fleet and supporting a wide network of branches. For instance, in 2023, Herc Rentals reported capital expenditures of $1.1 billion, reflecting significant ongoing investment in its assets.

These high upfront investments create considerable exit barriers. Companies are less likely to leave the market when they have so much capital tied up, which naturally intensifies competition as players are incentivized to stay and fight for market share, even when economic conditions are challenging.

Much of the equipment Herc Rentals offers is standardized, meaning competitors can easily offer similar items. This makes it tough for Herc to stand out based on the equipment alone. For instance, a standard excavator or scissor lift from Herc might be very similar to one from United Rentals or Sunbelt Rentals.

Because the products are so similar, competition naturally heats up in other areas. Companies like Herc Rentals often find themselves competing more intensely on price, how quickly they can get equipment to customers, and the overall quality of their customer service. This shift towards non-product factors intensifies the rivalry.

This commoditization of equipment means that many rental companies are vying for the same customers by offering competitive pricing and reliable service. In 2023, the equipment rental industry in North America, a key market for Herc, was valued at approximately $80 billion. This large market size, coupled with the standardized nature of offerings, underscores the intense competitive rivalry.

Geographic Market Overlap and Expansion

Major rental companies, including Herc Rentals, are actively expanding their physical footprint. In 2024, Herc Rentals continued its growth strategy, aiming to increase its presence in key markets. This expansion, often through acquisitions and new branch openings, directly intensifies competition by creating greater geographic overlap.

This expansion means that companies like Herc Rentals, United Rentals, and Sunbelt Rentals are increasingly vying for the same customer base in overlapping territories across North America. For instance, a new Herc branch might open in a region where United Rentals already has a significant presence, leading to more direct competition for equipment rentals.

- Increased Branch Networks: Major rental players are consistently adding new locations, leading to more direct competition in specific geographic areas.

- Acquisition-Driven Growth: Companies often acquire smaller, regional players, which can instantly increase their market share and competitive intensity in those acquired territories.

- Greenfield Expansion: Opening new branches from scratch in underserved or high-demand areas also contributes to greater market saturation and rivalry.

- Customer Base Overlap: As networks expand, companies find themselves competing for the same customer segments in more and more markets.

Service Differentiation and Value-Added Offerings

While the core equipment in the rental industry can be quite similar, companies like Herc Rentals actively work to stand out by offering extra services. This includes things like advanced tracking technology for equipment, specialized upkeep, safety training for customers, and even complete packages to manage entire projects. These value-added offerings are crucial for winning business.

The competition isn't just about having the right machine; it's about how well that machine is supported and how easily it integrates into a customer's workflow. Herc Rentals, for instance, emphasizes its ability to provide superior service and customized solutions, making the overall customer experience a significant differentiator in the market. This focus on tailored support is a key area where rental companies battle for an edge.

- Telematics and Equipment Management: Herc Rentals offers advanced telematics, providing real-time data on equipment location, usage, and maintenance needs. This allows for better fleet management and operational efficiency for their clients.

- Specialized Maintenance and Support: Beyond standard repairs, Herc provides specialized maintenance programs and on-site support, minimizing downtime and ensuring equipment reliability for critical projects.

- Safety Training and Compliance: Offering comprehensive safety training programs helps customers operate rented equipment correctly and safely, reducing risks and potential liabilities.

- Project-Specific Solutions: Herc Rentals aims to be more than just a rental provider by offering integrated project solutions, which can include equipment packages, logistics, and on-site management, simplifying complex operations for clients.

Competitive rivalry within the equipment rental sector, where Herc Rentals operates, is characterized by intense competition among a few dominant players and a fragmented base of smaller firms. This dynamic is fueled by high fixed costs and relatively standardized equipment, pushing companies to compete fiercely on price, service, and fleet availability.

The market is dominated by a few large companies, including Herc Rentals, United Rentals, and Sunbelt Rentals, which collectively hold a substantial market share. In 2023, these top players demonstrated this concentration, engaging in aggressive strategies to capture market share.

Herc Rentals, like its peers, invests heavily in its fleet and branch network. For example, Herc Rentals reported capital expenditures of $1.1 billion in 2023, a clear indicator of the significant investment required to maintain and expand its competitive offering in this high-stakes environment.

| Competitor | 2023 Revenue (Approx. USD Billions) | Key Competitive Factors |

|---|---|---|

| United Rentals | 14.7 | Extensive fleet, broad geographic reach, strong customer service |

| Sunbelt Rentals | 10.1 | Diverse fleet specialization, growing market presence, customer relationships |

| Herc Rentals | 2.3 | Fleet modernization, geographic expansion, value-added services |

SSubstitutes Threaten

The most significant substitute for Herc Rentals' equipment is customers choosing to buy their own equipment. This is particularly true for large-scale, frequently utilized, or long-duration projects where the total cost of ownership can become more attractive than renting, especially if borrowing costs, like interest rates, decrease. For instance, if interest rates dropped significantly in 2024, the appeal of purchasing equipment would likely increase for many businesses.

Herc Rentals counters this threat by emphasizing the advantages of rental, such as offering flexibility, eliminating the need for substantial upfront capital investment, and handling all maintenance and repair responsibilities. However, the fundamental threat of customers opting for ownership persists, especially for specific customer segments or project types where the long-term cost savings of purchasing outweigh the benefits of renting.

Customers can choose long-term equipment leasing from financial institutions or dealers, offering access to necessary equipment without the burden of immediate purchase. This alternative financial arrangement can be particularly attractive for businesses prioritizing capital preservation over extended periods, making it a viable substitute for outright ownership or even short-term rentals for prolonged projects.

While Herc Rentals primarily deals with heavy machinery, the threat of manual labor or simpler alternative methods exists for smaller tasks or in niche applications. For instance, a small landscaping job might opt for hand tools and human effort rather than renting a compact excavator. This is a minor concern, as Herc Rentals' core value proposition lies in providing efficiencies for larger-scale projects.

Technological Advancements Reducing Equipment Needs

Emerging technologies are a significant threat of substitutes for equipment rental companies like Herc Rentals. For instance, advancements in construction automation and robotics, coupled with innovative building techniques such as modular construction, could lessen the reliance on traditional rental equipment. The widespread adoption of these technologies might reduce the demand for specific machinery, posing a long-term substitute challenge.

Consider the impact of 3D printing in construction, which can fabricate building components on-site, potentially bypassing the need for heavy machinery rentals. Furthermore, the increasing efficiency and decreasing cost of electric and autonomous construction equipment could also serve as substitutes for current rental fleets. By 2024, the global construction robotics market was projected to reach billions, indicating a growing trend towards automation that could displace traditional equipment needs.

- Automation in Construction: Increased use of robotic excavators and automated assembly systems can reduce the need for human-operated heavy machinery rentals.

- Modular and Prefabricated Construction: These methods shift significant building processes off-site, potentially decreasing on-site equipment requirements.

- 3D Printing in Construction: On-site additive manufacturing can create structures with less reliance on traditional heavy equipment for assembly and material handling.

- Advanced Materials: Lighter, stronger building materials might require less robust or specialized rental equipment for installation.

Shared Equipment Programs or Cooperatives

The threat of substitutes for Herc Rentals, particularly concerning shared equipment programs or cooperatives, is a nuanced consideration. While not a direct substitute for large-scale commercial rental needs, these arrangements can impact smaller, local operations. Businesses might choose to pool resources, collectively owning and utilizing equipment instead of renting from a third party, thereby reducing their reliance on commercial rental providers.

This trend is more likely to affect smaller, regional rental companies rather than major players like Herc Rentals, which cater to a broader market with diverse equipment needs. For instance, a group of local construction firms might form a cooperative to share ownership of specialized machinery, decreasing their individual need for short-term rentals. This strategy can be cost-effective for participants, especially for equipment used infrequently.

- Impact on Local Markets: Shared equipment programs primarily pose a threat to smaller, local rental businesses by offering an alternative to commercial renting.

- Resource Pooling: Businesses can collectively own and utilize equipment, reducing their dependence on third-party rental companies for certain assets.

- Cost-Effectiveness: For companies with infrequent equipment needs, cooperative ownership can be a more economical choice than continuous rental.

- Limited Scope: This substitute is less likely to significantly impact large-scale rental providers like Herc Rentals, which serve a wider range of customer needs and project sizes.

The threat of substitutes for Herc Rentals is multifaceted, encompassing ownership, leasing, alternative labor, and technological advancements. While direct ownership is a primary substitute, especially when interest rates are low, as seen in potential 2024 trends, leasing arrangements also offer an alternative for capital-conscious businesses. Emerging technologies like construction robotics and 3D printing present a more significant long-term challenge by potentially reducing the need for traditional rental equipment.

| Substitute Type | Description | Impact on Herc Rentals | Example/Trend |

|---|---|---|---|

| Equipment Ownership | Customers buying their own equipment. | Moderate to High, especially for frequent or long-term use. | Increased appeal if interest rates fall in 2024, making financing cheaper. |

| Equipment Leasing | Long-term leasing from financial institutions or dealers. | Moderate, offers capital preservation benefits. | Attractive for businesses prioritizing liquidity over ownership. |

| Alternative Technologies | Automation, robotics, modular construction, 3D printing. | Low to Moderate currently, but High potential long-term. | Global construction robotics market projected to reach billions by 2024, indicating growing automation. |

| Shared Ownership/Cooperatives | Businesses pooling resources to own equipment. | Low, primarily affects smaller regional players. | Local construction firms sharing specialized machinery to reduce rental needs. |

Entrants Threaten

The equipment rental sector demands significant upfront investment. Acquiring a comprehensive fleet of machinery, from heavy construction equipment to specialized tools, along with establishing and maintaining a widespread branch network, necessitates substantial capital. This high financial barrier effectively deters many potential new entrants from challenging established players like Herc Rentals.

Established players like Herc Rentals leverage substantial economies of scale in equipment procurement, maintenance, and distribution networks. This allows them to secure more favorable pricing from manufacturers and streamline operations across their extensive service areas. For instance, Herc Rentals' substantial fleet size enables them to spread fixed costs over a larger asset base, reducing per-unit operating expenses.

Newcomers would find it challenging to replicate these cost efficiencies, making it difficult to compete on price and service quality. Entering the market without a comparable scale would necessitate higher per-unit costs, a significant barrier to entry. In 2023, Herc Rentals reported total rental revenue of $2.5 billion, illustrating the scale of operations that new entrants would need to approach to achieve comparable cost advantages.

Herc Rentals' extensive distribution and service network acts as a significant barrier to new entrants. As of June 2025, the company boasts 622 branches across North America, offering unparalleled geographic reach and localized support.

Establishing a comparable network requires immense capital investment and considerable time, making it a daunting challenge for any new player aiming to compete effectively in the equipment rental market.

Brand Recognition and Customer Relationships

Existing rental companies, such as Herc Rentals, have cultivated significant brand recognition and robust customer relationships over many years. This deep-seated trust and loyalty present a substantial barrier for any new company attempting to enter the market.

Newcomers must invest heavily in marketing and service to even begin chipping away at the established reputations of incumbents. For instance, Herc Rentals reported approximately $2.6 billion in revenue for 2023, a testament to its market presence built on these very relationships.

- Brand Loyalty: Customers often stick with familiar, reliable providers for essential equipment needs, making it difficult for new entrants to secure initial business.

- Reputation: Years of consistent service and quality build a reputation that new companies struggle to replicate quickly.

- Customer Relationships: Long-term partnerships and understanding of specific client needs are hard-won advantages.

Regulatory and Environmental Compliance

The equipment rental sector faces stringent regulatory and environmental compliance hurdles. For instance, in 2024, adhering to evolving emissions standards for construction machinery, such as those mandated by the EPA in the United States, necessitates substantial upfront investment in newer, compliant fleets. This complexity acts as a significant deterrent for potential new entrants who may not possess the capital or the specialized knowledge to navigate these requirements effectively.

New companies must also contend with varying transportation regulations and safety standards across different jurisdictions. Herc Rentals, like other established players, has invested in robust compliance programs and experienced personnel. In 2024, the ongoing focus on safety in the industry, underscored by initiatives like the American Rental Association's Safety First campaign, means that newcomers must demonstrate a clear commitment and capability in these areas from day one. Failure to do so can lead to fines and operational disruptions, further raising the barrier to entry.

- Regulatory Complexity: Navigating safety, environmental, and transportation rules requires significant expertise.

- Capital Investment: Acquiring compliant fleets, especially with tightening emissions standards in 2024, is costly.

- Operational Experience: Established firms have proven track records in compliance, a difficult hurdle for startups.

- Industry Standards: Adherence to safety initiatives, like those promoted by the ARA, demands immediate attention and resources.

The threat of new entrants in the equipment rental market, particularly for a company like Herc Rentals, is generally considered moderate. Significant capital investment is required to build a comparable fleet and branch network, acting as a substantial barrier.

Economies of scale enjoyed by incumbents, coupled with established brand loyalty and customer relationships, further deter new competition. For instance, Herc Rentals' 2023 revenue of $2.5 billion highlights the scale needed to compete effectively.

Navigating complex regulatory and environmental compliance, especially with evolving emissions standards in 2024, also presents a considerable challenge for newcomers. This necessitates upfront investment and specialized knowledge that startups may lack.

| Barrier to Entry | Description | Impact on New Entrants |

| Capital Requirements | High cost of acquiring equipment fleets and establishing branch networks. | Significant deterrent due to substantial upfront investment. |

| Economies of Scale | Established players benefit from lower per-unit costs in procurement and operations. | New entrants struggle to match pricing and efficiency. |

| Brand Loyalty & Relationships | Years of trust and established client partnerships. | Difficult for new companies to attract initial customers. |

| Regulatory Compliance | Adherence to safety, environmental (e.g., 2024 emissions standards), and transportation regulations. | Requires capital, expertise, and can lead to penalties if not met. |

Porter's Five Forces Analysis Data Sources

Our Herc Rentals Porter's Five Forces analysis is built upon a foundation of robust data, including industry-specific market research reports, company financial statements, and public filings from regulatory bodies. We also leverage insights from trade publications and economic databases to capture a comprehensive view of the competitive landscape.