Herc Rentals Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Herc Rentals Bundle

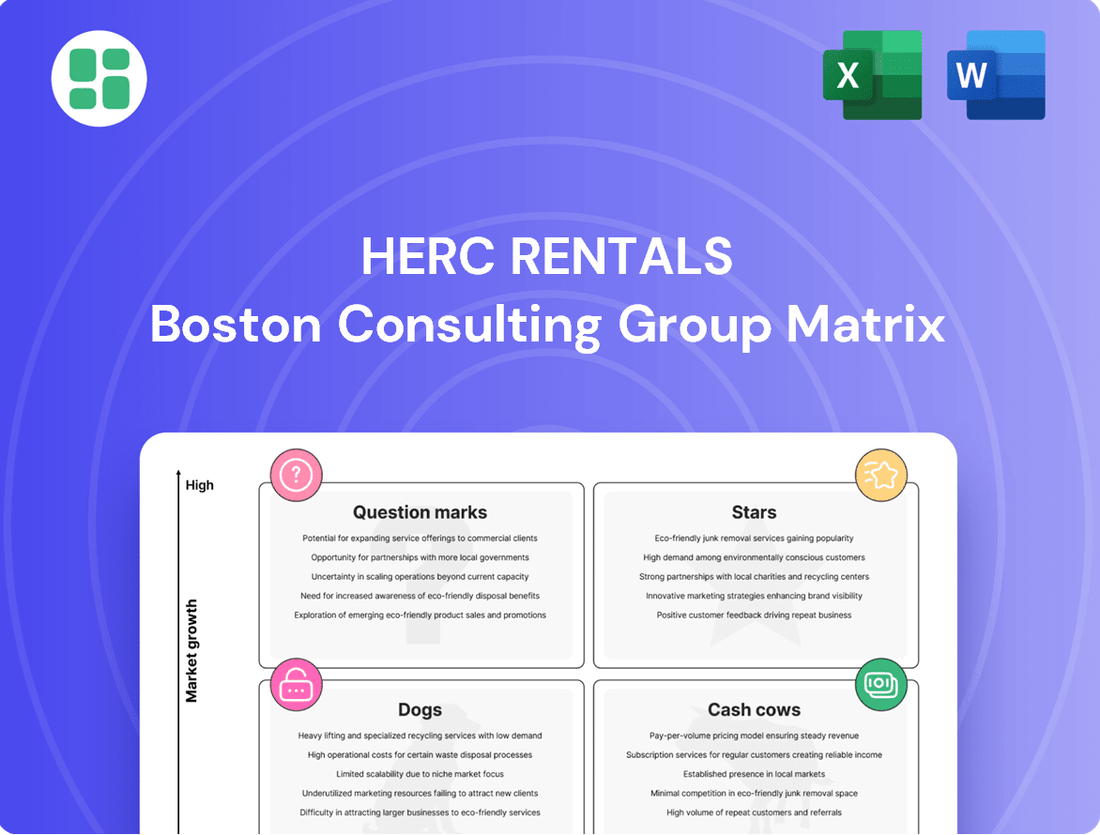

Curious about Herc Rentals' strategic product positioning? Our BCG Matrix preview offers a glimpse into their market performance, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. To truly understand which segments are driving growth and which require careful management, dive deeper into the full report.

Unlock actionable insights by purchasing the complete Herc Rentals BCG Matrix. This comprehensive analysis provides detailed quadrant placements, data-backed recommendations, and a clear roadmap for optimizing your investment and product portfolio. Don't miss out on the strategic clarity you need to thrive.

Stars

Herc Rentals is strategically targeting mega projects, a key component of its BCG Matrix analysis, recognizing the substantial growth in national account business. This segment is fueled by significant federal and private investment in large-scale construction, including data centers, manufacturing reshoring initiatives, and Liquefied Natural Gas (LNG) facilities.

The company is well-positioned to capture a disproportionate share of these mega project opportunities through 2025. This focus enables Herc to deploy vast quantities of specialized equipment, thereby generating robust revenue growth within this rapidly expanding market sector.

Herc Rentals is significantly expanding its specialty equipment fleet, a strategic move reflecting its importance in complex projects. By the close of 2024, this segment represented 23% of Herc's total fleet value, demonstrating a substantial investment.

This focus on specialty equipment is driven by its critical role in large-scale mega projects and its ability to generate cross-selling opportunities. As of the second quarter of 2025, following the H&E acquisition, specialty equipment accounted for 18% of the fleet value, indicating continued strategic allocation of capital.

The company's increased capital expenditure in this area underscores its high-growth potential and Herc's dedication to capturing a larger share of these specialized markets. This expansion is a key component of Herc's broader fleet strategy.

Herc Rentals' acquisition of H&E Equipment Services, finalized on June 2, 2025, is a prime example of a strategic move designed to bolster its position in the industry. This integration significantly broadens Herc's reach across North America, enhancing its market share in crucial areas.

The combined entity boasts impressive scale, with pro forma total revenues estimated at around $5.1 billion for 2024. This merger also results in a much larger operational network, encompassing 613 locations, which is a substantial increase from Herc's previous footprint.

The successful integration of H&E Equipment Services is anticipated to unlock significant revenue growth opportunities and cost efficiencies. These synergies are crucial for solidifying Herc's competitive advantage and driving future profitability in the equipment rental sector.

Advanced Technology and Digital Platforms

Herc Rentals leverages advanced technology to solidify its market position. Proprietary internal applications for pricing, fleet management, logistics, and transportation are key to its competitive edge. These digital tools are vital in an industry that increasingly demands efficiency and data-driven decision-making.

The ProControl account platform is a prime example of Herc Rentals' commitment to customer value. This industry-leading platform simplifies customer operations and boosts overall efficiency. Such digital solutions are critical for retaining a strong market share.

These technology investments are strategically important for Herc Rentals. For instance, in 2024, Herc Rentals reported significant progress in digitizing its operations, aiming to improve customer experience and operational effectiveness. These efforts are designed to keep pace with an evolving rental market that prioritizes seamless digital interactions and insightful data analytics.

- ProControl Platform: Enhances customer experience and operational efficiency.

- Proprietary Applications: Drive improvements in pricing, fleet management, and logistics.

- Digital Transformation: Essential for maintaining market share in a technology-driven industry.

- Data-Driven Insights: Increasingly valued by customers and crucial for strategic planning.

Aggressive Greenfield Branch Development

Herc Rentals is aggressively pursuing a strategy of aggressive greenfield branch development. This involves opening new locations from the ground up, essentially building their presence in new markets. In 2024 alone, Herc Rentals opened 23 new branches, demonstrating a significant commitment to physical expansion. This momentum continued into the first quarter of 2025 with the addition of three more branches.

The primary objective behind this expansion is to build density within the top 100 metropolitan areas across the United States. By concentrating their efforts in these high-growth urban centers, Herc Rentals aims to capture a larger share of the market. These strategically placed new branches are designed to enhance revenue generation and improve operational efficiency, laying the groundwork for them to become future cash cows for the company.

Key aspects of this strategy include:

- Aggressive Branch Expansion: 23 new branches opened in 2024 and 3 in Q1 2025.

- Market Focus: Targeting the top 100 U.S. metropolitan markets for increased density.

- Growth Objective: Capturing market share in high-growth urban areas.

- Financial Impact: Driving increased revenue and operational scale, positioning for future cash flow generation.

Herc Rentals' strategic focus on mega projects and specialty equipment positions these segments as its Stars in the BCG Matrix. The company's investment in specialty equipment, which represented 23% of its fleet value by the end of 2024, highlights its high-growth potential. The acquisition of H&E Equipment Services in June 2025 further solidifies this by expanding Herc's reach and scale, with pro forma 2024 revenues around $5.1 billion.

The aggressive branch development strategy, with 23 new branches in 2024 and 3 in Q1 2025, also contributes to its Star status by building density in key metropolitan areas. This expansion is designed to capture market share and drive future revenue growth, positioning these new locations for strong performance.

Herc's investment in technology, including proprietary applications for fleet management and the ProControl platform, enhances operational efficiency and customer value, further supporting the Star quadrant's characteristics of high growth and market leadership.

The company's commitment to these growth areas, backed by substantial capital expenditure and strategic acquisitions, demonstrates a clear strategy to capitalize on high-demand segments of the equipment rental market.

What is included in the product

This BCG Matrix overview provides strategic insights into Herc Rentals' business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

Herc Rentals BCG Matrix: A clear visual roadmap to strategically allocate resources, alleviating the pain of uncertain investment decisions.

Cash Cows

Herc Rentals' core general equipment rentals, featuring aerial lifts, earthmoving machinery, and material handling equipment, represent a significant portion of their business. This segment benefits from a high market share within the equipment rental industry.

Despite a projected moderating growth rate of 4-6% for the overall equipment rental market in 2025, these foundational categories continue to be robust cash generators for Herc. Their consistent performance is crucial for fueling expansion into other strategic areas.

Herc Rentals' extensive North American branch network, bolstered by over 600 locations after the H&E acquisition, positions its equipment rental services firmly as Cash Cows. This mature and widespread presence ensures consistent demand across diverse client segments, driving stable revenue generation.

The sheer scale of this network allows Herc to achieve significant operational efficiencies, directly contributing to strong profit margins. In 2024, Herc Rentals reported a substantial increase in revenue, with its equipment rental segment being a primary driver, underscoring the Cash Cow status of its established network.

Herc Rentals' overall equipment rental revenue stands as a prime example of a cash cow. In 2024, this segment generated a record $3.199 billion, marking an impressive 11% increase. This robust performance underscores a large and stable revenue stream that fuels the company's operations and strategic initiatives.

Looking ahead, Herc Rentals anticipates continued strength, forecasting 4-6% growth for this segment in 2025. Despite potential fluctuations in market demand across different regions, the consistent and substantial revenue generated by equipment rentals provides a solid financial bedrock. This financial stability allows Herc Rentals to confidently invest in growth opportunities and maintain its operational efficiency.

Value-Added Services (Maintenance & Repair)

Herc Rentals’ value-added services, encompassing maintenance, repair, and safety training, function as a significant cash cow within its business model. These offerings are crucial for supporting the primary equipment rental business, ensuring customer satisfaction and operational efficiency.

These services are characterized by their consistent demand and high profitability, contributing steadily to Herc Rentals’ overall revenue. For instance, in 2024, ancillary revenue streams, which include maintenance and repair services, have shown robust performance, with industry analysts projecting continued growth in this segment due to the essential nature of equipment upkeep.

- High Profit Margins: Maintenance and repair services typically command higher profit margins compared to the rental of the equipment itself, as they leverage existing infrastructure and specialized technician expertise.

- Consistent Ancillary Cash Flow: The ongoing need for equipment servicing and operational support creates a predictable and stable stream of revenue, independent of new rental demand fluctuations.

- Customer Retention: Offering comprehensive maintenance and repair solutions enhances customer loyalty by providing a one-stop shop for their equipment needs, thereby reducing churn.

- Operational Efficiency: Proactive maintenance by Herc ensures equipment availability and reliability for rental customers, minimizing downtime and maximizing utilization rates.

Long-Standing Customer Relationships

Herc Rentals benefits significantly from its long-standing customer relationships, particularly within its national account segment. This tenure fosters repeat business and a consistent, reliable revenue stream, a hallmark of a cash cow. In 2024, Herc reported continued growth in this area, underscoring the value of these established partnerships.

These deep-rooted connections provide Herc with a stable and predictable revenue base, reducing market volatility impact. The company's diversified client portfolio, spanning construction, industrial, and government sectors, further solidifies this stability, ensuring that even if one sector experiences a downturn, others can compensate.

- Tenured customer relationships drive consistent revenue in Herc's national accounts.

- Repeat business from these established relationships creates a predictable income stream.

- Diversification across construction, industrial, and government sectors enhances stability.

Herc Rentals' core general equipment rental segment, including aerial lifts and earthmoving machinery, is a prime example of a cash cow. This segment generated a notable $3.199 billion in revenue in 2024, an 11% increase, demonstrating its substantial and stable income generation capabilities.

The company's extensive network of over 600 locations, enhanced by acquisitions, ensures consistent demand and operational efficiencies that contribute to strong profit margins. This widespread presence solidifies the equipment rental business as a reliable financial bedrock for Herc Rentals.

Value-added services like maintenance and repair also function as cash cows, offering high profit margins and consistent ancillary cash flow. These services are vital for customer retention and operational efficiency, further strengthening Herc's revenue streams.

Long-standing customer relationships, particularly within national accounts, provide a predictable and stable revenue base, mitigating market volatility. The diversification across sectors like construction, industrial, and government reinforces this stability, ensuring consistent performance.

| Segment | 2024 Revenue (Billions USD) | YoY Growth | BCG Status |

|---|---|---|---|

| General Equipment Rentals | 3.199 | 11% | Cash Cow |

| Value-Added Services (Ancillary) | N/A (Included in overall) | Strong Performance | Cash Cow |

| National Accounts | N/A (Contributing factor) | Continued Growth | Cash Cow |

What You See Is What You Get

Herc Rentals BCG Matrix

The preview you are seeing is the exact Herc Rentals BCG Matrix report you will receive upon purchase, ensuring complete transparency and no hidden surprises. This comprehensive document, meticulously prepared by industry experts, is ready for immediate application in your strategic planning and decision-making processes. You can confidently expect the same high-quality, fully formatted analysis that is presented here, without any watermarks or demo content. This means you'll gain immediate access to a professional tool designed to provide actionable insights into Herc Rentals' business units and their market positions.

Dogs

Herc Rentals is strategically divesting its Cinelease studio entertainment and lighting and grip equipment rental business, with the sale anticipated to finalize in 2025. This move signals that Cinelease is viewed as a non-core asset within Herc's broader operations.

The divestiture suggests Cinelease likely possesses low growth potential and a comparatively small market share within Herc's portfolio. By selling Cinelease, Herc aims to free up capital and focus resources on its more promising and high-growth segments.

Local market projects highly sensitive to interest rates are currently experiencing a slowdown. Herc Rentals' CEO highlighted that these projects remain on hold, which directly impacts the growth of their local accounts. This segment is characterized by low growth due to broader economic pressures, resulting in reduced demand and equipment utilization for Herc.

Aging or underutilized general fleet assets in Herc Rentals' portfolio can be classified as 'dogs' within the BCG matrix. These are typically older pieces of equipment that are not in high demand, leading to lower dollar utilization. For instance, in Q1 2025, Herc saw dollar utilization for some general equipment dip to 37.6%, a clear indicator of underperformance.

These 'dog' assets represent a drain on capital, as they tie up resources without generating significant returns. Their low market share in their specific utility or within declining equipment sub-segments means they are unlikely to see substantial growth. Herc actively manages this by disposing of used equipment, often recouping around 44% of the original cost, which signifies a strategic move to exit less productive assets.

Highly Commoditized Basic Tool Rentals

In the highly competitive and commoditized basic tool rental market, Herc Rentals might find certain segments classified as 'dogs' within its BCG Matrix. These are areas where differentiation is minimal, and pricing power is scarce. For instance, the rental of very common, everyday tools like basic hand tools or simple power tools often faces intense competition from numerous smaller players, leading to thinner profit margins.

The market for these basic tools is characterized by low barriers to entry. This means new competitors can emerge relatively easily, further fragmenting the market and intensifying price wars. Herc Rentals, despite its broad offerings, may not hold a dominant market share in these specific, highly commoditized niches, making significant growth challenging.

Consider the landscape for basic concrete mixers or standard scaffolding. These are essential but widely available items. In 2024, the rental equipment industry, while robust, sees significant price sensitivity in these fundamental categories. For example, reports from industry analysis firms indicate that average daily rental rates for basic equipment can fluctuate significantly based on local competition, often seeing single-digit percentage differences between providers, impacting overall profitability.

- Low Market Share: Herc may not be a dominant player in every single basic tool rental sub-segment.

- Intense Competition: Numerous smaller, localized rental companies often compete aggressively on price for basic tools.

- Limited Pricing Power: Commoditization means customers are highly price-sensitive, restricting Herc's ability to command premium rates.

- Low Growth Potential: Mature markets for basic tools often experience slower growth compared to specialized or technologically advanced equipment.

Underperforming Legacy Branch Locations

Certain Herc Rentals legacy branch locations might be classified as Dogs in the BCG Matrix. These are typically branches situated in mature or declining local markets, or those that haven't adapted to Herc's strategic focus on urban market expansion. Their performance, characterized by low growth and market share, often lags behind the company's overall network achievements.

For instance, if a legacy branch in a region experiencing population decline and limited industrial activity generates significantly lower revenue compared to newer, strategically placed urban branches, it would likely fit the 'dog' profile. Such locations may require a re-evaluation of their operational efficiency and market relevance.

- Underperforming Legacy Branches: Locations in stagnant or economically challenged local markets.

- Strategic Misalignment: Branches not fitting Herc's urban market growth strategy.

- Low Growth and Market Share: Consistent underperformance relative to the broader network.

- Potential for Divestment or Restructuring: Dogs often represent candidates for closure or significant operational changes.

Herc Rentals' 'dogs' are assets with low market share and low growth potential, often representing aging or underutilized general fleet equipment. In Q1 2025, some general equipment saw dollar utilization dip to 37.6%, highlighting this underperformance. These assets tie up capital without significant returns, and Herc manages them by disposing of used equipment, recouping about 44% of original cost.

The highly competitive basic tool rental market also contains 'dog' segments for Herc, where differentiation is minimal and pricing power is scarce. Common tools like basic hand tools or simple power tools face intense competition, leading to thinner profit margins and slow growth, with rental rates for basic equipment in 2024 showing single-digit percentage differences between providers.

Legacy branch locations in mature or declining markets, or those not aligned with Herc's urban expansion strategy, can also be classified as 'dogs'. These underperforming branches, characterized by low growth and market share, may be candidates for closure or restructuring to improve overall network efficiency.

| Category | Characteristics | Example | 2024/2025 Data Point |

| Underutilized Fleet | Low market share, low growth, low dollar utilization | Aging general equipment | Q1 2025 dollar utilization: 37.6% for some general equipment |

| Commoditized Tools | Intense competition, limited pricing power, low growth | Basic hand tools, concrete mixers | 2024 average daily rates: single-digit % differences between providers |

| Legacy Branches | Low growth, low market share, strategic misalignment | Branches in declining local markets | Revenue lags behind strategically placed urban branches |

Question Marks

New greenfield market entries for Herc Rentals are positioned as Stars or Question Marks within the BCG Matrix, reflecting their high-growth potential and the significant investment required. Herc's strategy involves opening new locations in targeted urban markets, aiming to build market share from scratch in areas with promising growth prospects.

These ventures demand substantial upfront capital for establishment, creating an element of uncertainty regarding their future success. For instance, during 2024, Herc continued its expansion, with new branches contributing to revenue growth, though the return on these specific investments is still being realized.

The equipment rental market is experiencing a significant shift towards sustainability, with a rising demand for eco-friendly machinery. Herc Rentals' focus on adopting the latest technology and fuel-efficient options indicates a strategic move into this burgeoning sector. This includes exploring and potentially piloting new electric and sustainable equipment, a segment poised for substantial growth.

Given Herc Rentals' current fleet composition, their share in the emerging sustainable and electric equipment category is likely modest. This makes these innovative offerings prime candidates for the question mark quadrant in the BCG matrix. Significant investment will be necessary to gauge market acceptance and establish profitability for these new technologies.

Herc Rentals' ProSolutions division, encompassing specialized services like power generation, climate control, and environmental remediation, could see certain segments emerge as question marks within the BCG matrix. This classification arises when these niche offerings are expanded into new, high-growth sectors or geographical regions where Herc's market presence is currently minimal. For instance, a push into renewable energy infrastructure support or advanced data center climate control in emerging markets would represent such a move.

These ventures are characterized by their significant growth potential, mirroring the overall trend in specialized industrial services. However, they also demand substantial, focused investment to build market share and establish leadership. Consider the projected growth in the green energy sector, where demand for specialized temporary power solutions is expected to surge. Herc's strategic investment in these areas, while promising, carries the inherent uncertainty of question marks, requiring careful management and capital allocation.

Advanced Telematics and IoT Integration

Herc Rentals is actively integrating advanced telematics and Internet of Things (IoT) solutions to optimize fleet utilization and logistics. This focus on cutting-edge digital features targets a high-growth market segment. While Herc has a foundation in fleet management technology, its market share in these advanced, rapidly evolving IoT solutions may currently be modest, necessitating continued investment to capture a larger competitive advantage.

- Fleet Utilization: Advanced telematics can provide real-time data on equipment usage, idle times, and operational efficiency, aiming to boost utilization rates.

- Logistics Management: IoT integration can enhance route optimization, predictive maintenance scheduling, and asset tracking, leading to more efficient operations.

- Market Growth: The global telematics market was valued at approximately $31.8 billion in 2023 and is projected to grow significantly, indicating substantial potential for companies investing in these technologies.

- Investment Needs: To establish a stronger competitive position in this dynamic market, Herc will likely need to allocate further capital towards developing and scaling these advanced digital capabilities.

New End Market Penetration via Specialty Fleet

Herc Rentals is actively pursuing new end markets, like the booming renewable energy sector, by strategically expanding its specialty equipment fleet. This move targets high-growth opportunities beyond traditional construction.

While these emerging segments present significant potential, Herc's current market penetration is likely nascent. Successfully converting these into Stars will necessitate substantial investment and a sharp strategic focus on understanding and meeting the unique demands of these new customer bases.

- Specialty Fleet Expansion: Herc's investment in specialized equipment, such as those for wind turbine maintenance or solar farm construction, directly addresses the needs of new end markets.

- New End Market Focus: The company is targeting sectors like renewable energy, data centers, and advanced manufacturing, which are experiencing robust growth.

- Growth Potential vs. Current Share: These new markets offer substantial growth prospects, but Herc's initial market share is expected to be low, requiring dedicated efforts to gain traction.

- Investment and Strategy: Penetrating these markets effectively will demand significant capital allocation and tailored strategies to build brand awareness and customer relationships.

Herc Rentals' investments in nascent, high-growth areas, such as specialized equipment for the renewable energy sector or advanced telematics, are prime examples of Question Marks. These ventures, while holding significant future potential, currently have a low market share and require substantial capital to build brand recognition and operational scale.

The company's strategic expansion into these new end markets, like renewable energy infrastructure, exemplifies this. While the potential for growth is high, Herc's current penetration is limited, necessitating significant investment to establish a strong foothold and convert these into future Stars.

For instance, the global telematics market, a key area for Herc's digital investments, was valued around $31.8 billion in 2023 and is projected for strong growth, underscoring the opportunity and the investment needed to capture market share.

These Question Marks represent strategic bets on future market trends, where success hinges on effective execution and substantial capital deployment to overcome initial low market share and achieve competitive advantage.

BCG Matrix Data Sources

Our Herc Rentals BCG Matrix leverages robust data from financial reports, industry growth forecasts, and internal performance metrics to accurately assess market position and potential.