Heraeus Holding GmbH SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Heraeus Holding GmbH Bundle

Heraeus Holding GmbH boasts significant strengths in its diversified portfolio and technological leadership, but faces threats from intense competition and evolving market demands.

Want the full story behind Heraeus's market position, potential growth drivers, and strategic challenges? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Heraeus Holding GmbH boasts a highly diversified portfolio, spanning crucial sectors like precious metals, medical technology, quartz glass, and sensors. This broad operational base, as of early 2024, insulates the company from volatility in any single industry, demonstrating a strategic advantage in navigating economic fluctuations. For instance, its precious metals segment often performs counter-cyclically to other industrial sectors.

Heraeus Holding GmbH's core strength is its deep-seated expertise in materials science, which fuels its leadership in innovation. This allows the company to create highly specialized products that meet demanding industry needs.

The company's commitment to research and development is substantial, with a notable focus on integrating AI into manufacturing processes and pioneering new material solutions for rapidly evolving technologies. For instance, Heraeus has been actively exploring AI-driven quality control in its production lines, aiming to enhance efficiency and product consistency.

This dedication to R&D ensures Heraeus stays ahead of the curve in technological advancements. In 2023, the company reported significant investment in future-oriented technologies, underscoring its strategy to maintain a competitive edge through continuous innovation in materials and processes.

Heraeus excels in producing essential high-tech products vital for industries like electronics, automotive, chemicals, and telecommunications. This makes them a fundamental supplier, driving consistent demand for their specialized materials and solutions. For instance, Heraeus's high-purity quartz glass is critical for semiconductor manufacturing, a sector projected for significant growth, with global semiconductor revenue expected to reach $689 billion in 2024 according to SIA data.

Strong Sustainability and ESG Commitments

Heraeus Holding GmbH exhibits robust sustainability and ESG commitments, notably aiming for carbon neutrality in its Precious Metals division by 2025. This forward-looking target underscores a proactive approach to environmental responsibility. The company consistently achieves high ESG ratings, reflecting its dedication to sustainable operations and governance.

Key initiatives, such as advanced precious metals recycling and the development of catalysts for green hydrogen production, highlight Heraeus' tangible efforts in environmental stewardship. These actions not only demonstrate a commitment to a circular economy but also position the company at the forefront of emerging green technologies.

- Carbon Neutrality Target: Heraeus aims for carbon neutrality in its Precious Metals division by 2025, a significant step in environmental responsibility.

- High ESG Ratings: The company consistently receives strong ESG ratings, indicating robust performance in environmental, social, and governance factors.

- Green Initiatives: Heraeus actively pursues environmental stewardship through precious metals recycling and developing catalysts for green hydrogen.

- Reputational Benefits: This strong sustainability focus enhances brand reputation, attracting eco-conscious customers and investors, while potentially mitigating operational risks.

Strategic Partnerships and Collaborations

Heraeus actively cultivates strategic partnerships to bolster its technological edge and expand its market presence, especially in rapidly growing sectors such as hydrogen technologies and silicon carbide power electronics. These alliances are crucial for staying ahead in innovation and reaching new customers.

Collaborations with key industry players, for instance, with Freudenberg e-Power Systems and BASiC Semiconductor, highlight Heraeus's proactive strategy for innovation and market growth. These partnerships are designed to leverage shared knowledge and speed up product development, ultimately leading to wider market adoption.

- Technological Advancement: Partnerships accelerate the development and implementation of cutting-edge technologies in areas like advanced materials and sustainable energy solutions.

- Market Expansion: Collaborations provide access to new markets and customer segments, enhancing Heraeus's global reach and competitive positioning.

- Risk Sharing: Joint ventures and alliances allow for the sharing of research and development costs and risks, making ambitious projects more feasible.

Heraeus Holding GmbH's diversified portfolio, encompassing precious metals, medical technology, quartz glass, and sensors, offers significant resilience against sector-specific downturns. This broad operational scope, as of early 2024, positions the company advantageously in navigating economic uncertainties.

The company's profound expertise in materials science is a cornerstone of its innovative capacity, enabling the creation of highly specialized products for demanding industries. This deep knowledge fuels its leadership in developing advanced materials critical for sectors like semiconductors, which saw global revenue projected at $689 billion in 2024.

Heraeus demonstrates a strong commitment to R&D, with strategic investments in AI for manufacturing and novel material solutions. For example, their focus on AI-driven quality control in 2023 aimed to boost production efficiency and consistency.

The company's proactive sustainability agenda, including a 2025 carbon neutrality target for its Precious Metals division and active participation in green hydrogen catalyst development, enhances its reputation and market appeal among environmentally conscious stakeholders.

What is included in the product

Analyzes Heraeus Holding GmbH’s competitive position through key internal and external factors, detailing its strengths in specialty materials and market leadership alongside potential weaknesses in diversification and threats from global economic volatility.

Offers a clear breakdown of Heraeus's competitive landscape, enabling targeted strategies to mitigate weaknesses and capitalize on strengths.

Weaknesses

Heraeus Holding GmbH, as a significant participant in the precious and special metals sector, faces substantial risk from the inherent price volatility of commodities like gold, silver, and platinum group metals. These price swings directly influence the company's profitability and its cost of goods sold, creating an ongoing challenge for margin management.

While Heraeus employs strategies such as trading and recycling to mitigate some of this raw material price exposure, a sudden or prolonged surge in costs could still lead to compressed profit margins, impacting overall financial performance.

Heraeus's commitment to staying ahead in high-tech products and materials demands significant, ongoing investment in research and development. This is a crucial weakness because the substantial costs for R&D in areas like advanced materials and medical tech can put a strain on the company's finances.

For instance, in 2023, Heraeus reported R&D expenses that, while driving innovation, also represent a considerable outlay. Successfully bringing these cutting-edge developments to market is essential to justify these expenditures and ensure a return on investment.

Heraeus operates in sectors like automotive and electronics, which are known for their sensitivity to economic cycles. For instance, the global automotive production forecast for 2024 suggests a modest 3% growth, but this is highly dependent on stable economic conditions, with potential for significant downward revisions if recessions occur. A downturn in these core industries directly translates to reduced demand for Heraeus's specialized materials and technologies, potentially impacting revenue streams.

Intense Competition in Specialized Markets

While Heraeus commands strong positions in many specialized sectors, these niche markets are characterized by fierce rivalry. Global technology conglomerates and agile niche competitors frequently challenge Heraeus's standing. For instance, in the precious metals sector, companies like Johnson Matthey and Umicore are significant rivals, often employing aggressive pricing strategies and rapid product development cycles. This intense competition necessitates continuous investment in research and development to maintain market leadership and profitability.

The pressure from competitors, who may introduce disruptive technologies or undercut pricing, directly impacts Heraeus's market share and profit margins. For example, advancements in alternative materials or more efficient processing techniques by rivals can quickly erode established advantages. Heraeus's ability to stay ahead hinges on its commitment to innovation and maintaining high operational efficiency across its diverse business units.

- Intense Rivalry: Heraeus faces strong competition from global technology groups and specialized niche players in its core markets.

- Innovation Pressure: Competitors' rapid innovation and aggressive pricing strategies can threaten Heraeus's market share and profitability.

- Need for Constant Advancement: Maintaining a competitive edge requires ongoing investment in R&D and operational excellence.

- Market Dynamics: The specialized nature of Heraeus's markets means that even small shifts in technology or pricing by competitors can have a significant impact.

Regulatory and Compliance Complexities

Heraeus operates in highly regulated sectors like medical technology and chemicals, facing a constantly shifting global regulatory environment. For instance, compliance with medical device standards, such as the EU's Medical Device Regulation (MDR), which saw significant updates in 2021 and 2023, demands substantial investment in documentation and testing.

The chemical industry, too, is subject to stringent environmental and safety regulations, like REACH in Europe, which requires extensive data submission for chemical substances. Adherence to these diverse international mandates can be a significant drain on resources, both in terms of time and financial outlay.

- Increased compliance costs: For example, the ongoing implementation of stricter environmental standards globally could add millions to operational expenditures annually.

- Risk of penalties: Non-compliance with regulations, such as those pertaining to data privacy in its digital services or product safety in its medical divisions, can lead to substantial fines and legal challenges.

- Operational disruptions: Changes in trade policies or product approval processes in key markets could necessitate costly redesigns or halt production lines.

Heraeus faces significant challenges due to the inherent volatility of precious metals prices, directly impacting its cost of goods sold and profitability. Despite mitigation strategies like trading and recycling, sharp price increases can still compress margins, as seen in the fluctuating precious metals markets throughout 2024.

The company's dedication to innovation necessitates substantial and continuous investment in research and development, particularly in advanced materials and medical technologies. For instance, R&D spending in 2023, while crucial for future growth, represents a considerable financial commitment that requires successful market translation to ensure a return on investment.

Operating in economically sensitive sectors like automotive and electronics exposes Heraeus to demand fluctuations. With modest global automotive production growth forecasts for 2024, any economic slowdown could significantly reduce demand for Heraeus's specialized products.

Heraeus operates in highly regulated sectors, such as medical technology and chemicals, where compliance with evolving global standards, like the EU's Medical Device Regulation (MDR) and chemical regulations like REACH, incurs substantial costs and demands significant resources for documentation and testing.

Preview the Actual Deliverable

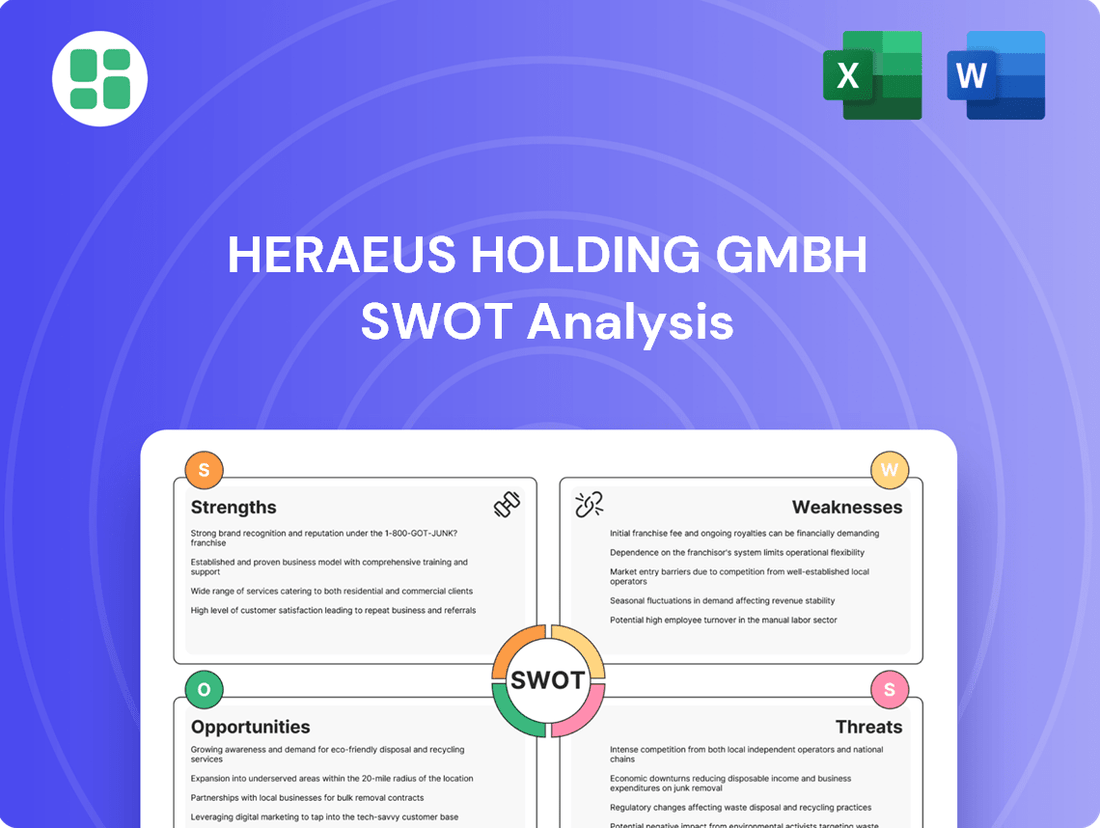

Heraeus Holding GmbH SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. It offers a concise overview of Heraeus Holding GmbH's Strengths, Weaknesses, Opportunities, and Threats. Upon purchase, you'll gain access to the full, in-depth analysis, providing comprehensive insights for strategic decision-making.

Opportunities

The burgeoning demand for advanced materials is a significant tailwind, fueled by transformative megatrends like the rollout of 5G networks, the accelerating adoption of electric vehicles (EVs), and the development of smart cities globally. Heraeus, with its established proficiency in specialized composites, high-performance alloys, and robust metals, is strategically positioned to leverage this expanding market. Analysts project the advanced materials sector to experience robust growth in the coming years, presenting substantial opportunities for Heraeus to broaden its market reach and product offerings.

The medical technology sector is booming, driven by an aging global population and the rise of personalized medicine. Heraeus can capitalize on this by innovating in AI-powered diagnostics and advanced surgical materials. The digital health market, projected to reach over $600 billion by 2026, offers significant avenues for growth through remote monitoring solutions.

The accelerating global transition to a hydrogen economy presents a significant growth avenue for Heraeus, especially in the burgeoning green hydrogen production and fuel cell sectors. Heraeus's deep-seated expertise in precious metal catalysts positions it favorably to capitalize on this trend.

Heraeus has proactively established a dedicated Business Line for Hydrogen Systems, underscoring its commitment to this emerging market. Furthermore, the company is actively developing innovative low-iridium catalysts, a crucial advancement for cost-effective fuel cell technology.

The International Energy Agency (IEA) projects that hydrogen demand could surge significantly by 2030, driven by decarbonization efforts across industries. This expanding market offers substantial long-term growth potential for Heraeus's specialized materials and solutions, particularly in catalyst development and manufacturing.

Increased Focus on Circular Economy and Recycling

The increasing global push towards a circular economy presents a significant opportunity for Heraeus to bolster its precious metals recycling operations. By expanding these services, Heraeus can capitalize on growing environmental consciousness and regulatory pressures that favor resource efficiency.

As a leading player in precious metals recycling, Heraeus is well-positioned to offer solutions that not only minimize environmental impact but also ensure a stable, in-house supply of critical raw materials. This strategic alignment with sustainability goals resonates strongly with an increasing customer base seeking eco-friendly product life cycles.

- Expanded Recycling Services: Heraeus can leverage its expertise to offer more comprehensive precious metals recycling solutions, catering to diverse industries.

- Secured Raw Material Supply: A stronger recycling focus directly contributes to a more secure and predictable supply chain for precious metals, mitigating geopolitical risks.

- Alignment with Regulations: The company's recycling efforts align with evolving environmental regulations, such as those promoting extended producer responsibility and waste reduction.

- Market Demand for Sustainability: Growing consumer and business demand for sustainable products and practices creates a favorable market for Heraeus's circular economy initiatives. For instance, the global precious metals recycling market was valued at approximately USD 20 billion in 2023 and is projected to grow significantly, driven by these trends.

Digitalization and AI Integration Across Operations

Heraeus is actively pursuing the integration of artificial intelligence and digitalization throughout its operations, from manufacturing to product development. This strategic push aims to significantly boost efficiency, elevate product quality, and foster greater innovation across the company. For instance, Heraeus is already piloting AI applications in specialized areas like quartz glass production and the development of minimally invasive surgical tools.

The company's commitment to adopting these advanced digital technologies is expected to yield substantial operational cost savings. Furthermore, it is anticipated to result in improved product performance and the creation of entirely new business models, positioning Heraeus for sustained growth and competitive advantage in the evolving market landscape.

- Enhanced Efficiency: AI-driven process optimization in manufacturing and supply chain management.

- Improved Quality: Predictive maintenance and real-time quality control powered by AI.

- Innovation Acceleration: AI assisting in R&D for new materials and product designs.

- Cost Reduction: Streamlined operations leading to lower manufacturing and logistical expenses.

The growing demand for advanced materials, driven by trends like 5G, EVs, and smart cities, presents a significant opportunity for Heraeus to expand its market presence with its expertise in specialized composites and high-performance alloys. The medical technology sector's expansion, fueled by an aging population and personalized medicine, offers avenues for Heraeus to innovate in AI-powered diagnostics and advanced surgical materials, tapping into a digital health market projected to exceed $600 billion by 2026.

Heraeus's strategic focus on the hydrogen economy, particularly green hydrogen production and fuel cells, is well-timed given the accelerating global transition. The company's established position in precious metal catalysts, coupled with its dedicated Hydrogen Systems Business Line and development of low-iridium catalysts, positions it to benefit from the projected surge in hydrogen demand by 2030, as indicated by the IEA.

The increasing emphasis on a circular economy provides Heraeus with a prime opportunity to enhance its precious metals recycling operations, aligning with environmental consciousness and regulatory pressures favoring resource efficiency. This expansion not only minimizes environmental impact but also secures a stable, in-house supply of critical raw materials, appealing to a growing customer base prioritizing sustainable product life cycles. The global precious metals recycling market, valued at approximately USD 20 billion in 2023, is expected to see substantial growth driven by these sustainability trends.

Heraeus's proactive integration of artificial intelligence and digitalization across its operations is poised to drive significant improvements in efficiency, product quality, and innovation. This digital transformation is expected to yield substantial operational cost savings and enhance product performance, creating new business models and securing a competitive edge. For example, AI is being piloted in areas like quartz glass production, aiming for process optimization and enhanced quality control.

| Opportunity Area | Key Drivers | Heraeus's Position | Market Outlook (2024-2025) |

|---|---|---|---|

| Advanced Materials | 5G, EVs, Smart Cities | Expertise in composites, alloys, metals | Robust sector growth expected |

| Medical Technology | Aging population, personalized medicine | AI diagnostics, surgical materials innovation | Digital health market >$600B by 2026 |

| Hydrogen Economy | Decarbonization, green hydrogen | Precious metal catalysts, Hydrogen Systems BL | IEA projects significant demand surge by 2030 |

| Circular Economy (Recycling) | Sustainability, resource efficiency | Precious metals recycling leadership | Global recycling market ~$20B (2023), growing |

| Digitalization & AI | Operational efficiency, innovation | AI pilots in production, R&D | Cost savings, improved product performance |

Threats

Heraeus Holding GmbH faces ongoing threats from volatile precious metal prices, a factor external management strategies can only partially mitigate. Geopolitical events and economic uncertainty in 2024 and early 2025 have continued to drive significant price swings for gold, platinum, and palladium, impacting Heraeus's raw material costs and the valuation of its inventory.

Supply chain disruptions remain a critical concern. Events in 2024, such as regional conflicts and trade disputes, have underscored the fragility of global logistics. This could lead to shortages or increased costs for essential materials, directly affecting Heraeus's production capabilities and overall profitability in the coming year.

A persistent global economic slowdown poses a significant threat to Heraeus. Reduced industrial activity in key sectors like automotive, electronics, and chemicals, which are crucial for Heraeus's material sales, would directly impact revenue. For instance, the automotive sector, a major consumer of specialty materials, faced production challenges in 2023 due to supply chain issues and fluctuating demand, a trend that could continue if economic headwinds persist.

Heraeus operates in high-stakes, technology-driven sectors where competition is fierce. Established players are continually innovating, while nimble startups pose a significant threat with disruptive technologies, potentially impacting Heraeus's market position.

The pace of technological change is a constant challenge; a rival's breakthrough in new materials or advanced manufacturing processes could quickly diminish the value of Heraeus's existing product lines. For instance, advancements in additive manufacturing could challenge traditional methods in sectors Heraeus serves.

To counter this, Heraeus must commit to substantial and ongoing R&D investment. Companies in similar advanced materials sectors, like those in semiconductor manufacturing equipment, often allocate 5-10% of revenue to R&D to stay ahead of the curve, a benchmark Heraeus likely needs to meet or exceed.

Increasing Regulatory Burdens and Environmental Compliance Costs

Heraeus, like many global industrial companies, faces mounting pressure from increasingly stringent environmental regulations. For instance, the European Union's Green Deal initiatives, which aim for climate neutrality by 2050, are driving stricter rules on emissions, waste management, and the use of hazardous substances. This could translate into higher operational expenses for Heraeus as they invest in cleaner technologies and potentially face fines for non-compliance. The company's 2023 sustainability report indicated ongoing efforts to reduce its carbon footprint, a trend that will likely accelerate with new mandates.

Furthermore, evolving regulations within specialized sectors where Heraeus operates, such as medical technology, present unique compliance hurdles. These regulations often demand significant investment in research and development to ensure products meet new safety and efficacy standards. For example, the Medical Device Regulation (MDR) in Europe has already increased compliance costs for many manufacturers. Heraeus’s ability to adapt swiftly to these changing requirements will be crucial for maintaining market access and competitiveness in these sensitive areas.

- Stricter environmental regulations, particularly concerning emissions and waste management, are increasing operational costs globally.

- The European Union's Green Deal aims for climate neutrality by 2050, impacting industrial processes and material usage.

- Evolving regulations in medical technology, such as the EU's MDR, require substantial investments in compliance and can affect market access.

- Heraeus’s 2023 sustainability report highlights ongoing investments in reducing its environmental impact, a trend expected to intensify with new regulations.

Geopolitical Instability and Trade Barriers

Geopolitical instability, including ongoing global tensions and trade disputes, presents a significant threat to Heraeus Holding GmbH. For instance, the International Monetary Fund (IMF) projected in April 2024 that global growth would slow to 3.2% in both 2024 and 2025, partly due to these persistent geopolitical risks and their impact on trade. Protectionist policies and tariffs can directly disrupt Heraeus's intricate international supply chains, potentially leading to increased costs and restricted access to key markets for its specialized products.

Heraeus's diversified global operations mean it is exposed to a wide array of political risks. The World Bank's 2024 "Global Economic Prospects" report highlighted that trade fragmentation, driven by geopolitical factors, could reduce global GDP by as much as 2-7%. This exposure can complicate operational management and introduce unforeseen expenses, making strategic planning more challenging.

- Trade Tensions: Escalating trade wars could impose tariffs on raw materials or finished goods, impacting Heraeus's cost structure and competitiveness.

- Supply Chain Disruptions: Geopolitical conflicts can sever critical supply routes, affecting the availability of essential components for Heraeus's high-tech materials.

- Market Access Restrictions: Protectionist measures in key regions might limit Heraeus's ability to sell its products, hindering revenue growth.

Intensifying competition from both established players and agile startups poses a significant threat, as rivals continually innovate with disruptive technologies. Heraeus must maintain substantial R&D investment, potentially mirroring the 5-10% of revenue allocated by leaders in advanced materials sectors like semiconductor equipment manufacturing, to stay ahead.

The rapid pace of technological advancement means a competitor's breakthrough in new materials or manufacturing processes could quickly devalue Heraeus's existing product lines. For instance, advancements in additive manufacturing could disrupt traditional methods in sectors Heraeus serves, necessitating continuous adaptation and innovation.

Heraeus faces increasing pressure from stringent environmental regulations, such as the EU's Green Deal, which could raise operational costs through investments in cleaner technologies and potential non-compliance fines. The company's 2023 sustainability report indicated ongoing efforts to reduce its carbon footprint, a trend that will likely accelerate with new mandates.

Evolving regulations in specialized sectors like medical technology, exemplified by Europe's Medical Device Regulation (MDR), demand significant R&D investment for compliance, potentially impacting market access and increasing costs for manufacturers.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of robust data, drawing from Heraeus Holding GmbH's official financial statements, comprehensive market research reports, and expert industry analyses to provide a thorough and insightful evaluation.