Heraeus Holding GmbH Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Heraeus Holding GmbH Bundle

Heraeus Holding GmbH navigates a complex landscape shaped by intense rivalry, significant supplier power in specialized materials, and the constant threat of substitutes in its diverse technology sectors. Understanding these forces is crucial for strategic planning.

The complete report reveals the real forces shaping Heraeus Holding GmbH’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Heraeus Holding GmbH's reliance on critical raw materials such as gold, silver, platinum group metals (PGMs), and high-purity quartz significantly shapes its supply chain. The concentration of producers for these specific materials, particularly for rare or highly specialized elements, can be quite limited.

This limited supplier base for essential components grants these producers considerable bargaining power. For instance, the global supply of platinum group metals is dominated by a few key countries, including South Africa and Russia, which can influence pricing and availability for companies like Heraeus.

For Heraeus Holding GmbH, the uniqueness and scarcity of materials significantly influence supplier bargaining power. In highly specialized sectors like electronics, medical technology, and semiconductors, the demand for materials with exceptional purity and specific properties, such as synthetic quartz glass or platinum group metals (PGMs), is paramount. Suppliers who can provide these unique or difficult-to-replicate materials inherently hold greater sway.

For instance, Heraeus itself is a major producer of quartz glass and precious metals, indicating an internal control over some of these critical inputs. However, for raw PGMs, global supply chains are concentrated. In 2023, the global production of platinum was estimated to be around 150-160 metric tons, with South Africa and Russia being the dominant producers. Any disruption or concentration of supply from these regions can amplify the bargaining power of the few suppliers controlling these scarce resources, directly impacting Heraeus's cost of goods sold.

Switching suppliers for Heraeus's high-tech materials and components, such as specialized quartz glass or precious metal compounds, can be a costly endeavor. These costs often include extensive re-qualification processes for new materials, necessitating adjustments in research and development, and potentially leading to significant disruptions in their advanced manufacturing lines. For instance, the integration of a new supplier for critical semiconductor materials might require months of testing and validation to ensure performance and purity standards are met, directly impacting production schedules and introducing unforeseen expenses.

Forward Integration Potential of Suppliers

Suppliers of critical raw materials, such as precious metals and specialized chemicals, possess a degree of forward integration potential. This means they could potentially move into producing finished components or sub-assemblies that Heraeus currently manufactures.

While direct competition through this route might be limited, the mere possibility influences Heraeus's negotiation leverage and pricing strategies with these suppliers. For instance, a major platinum supplier might consider producing catalytic converters if margins become attractive enough.

- Forward Integration Threat: Suppliers of high-purity metals and chemicals could integrate forward into producing components, impacting Heraeus's value chain.

- Pricing Influence: This potential integration can exert upward pressure on raw material costs for Heraeus.

- Strategic Consideration: Heraeus must monitor supplier capabilities and market dynamics to mitigate risks associated with this potential threat.

Recycling and Circular Economy Initiatives

Heraeus's commitment to recycling and circular economy principles, notably through acquisitions like McCol Metals, directly addresses supplier bargaining power. By actively reclaiming precious metals, Heraeus diversifies its raw material inputs, lessening dependence on primary mining operations. This strategy aims to secure a more stable and predictable supply chain for critical materials, thereby exerting greater control over sourcing costs.

This focus on secondary material sourcing is crucial for Heraeus, particularly in volatile precious metal markets. For instance, in 2023, platinum group metals prices experienced significant fluctuations, underscoring the need for robust supply chain management. By integrating recycling capabilities, Heraeus can buffer against these price swings and reduce the leverage of primary material suppliers.

- Diversified Sourcing: Acquisitions like McCol Metals enhance Heraeus's ability to source precious metals from recycled materials, reducing reliance on primary extraction.

- Cost Stabilization: This circular approach helps stabilize the cost of critical raw materials by creating an alternative, often more predictable, supply stream.

- Reduced Supplier Leverage: By offering a viable alternative to primary suppliers, Heraeus diminishes the bargaining power of those who control virgin material extraction.

- Market Resilience: A strong recycling infrastructure bolsters Heraeus's resilience against supply chain disruptions and price volatility in the precious metals market.

Suppliers of Heraeus Holding GmbH's critical raw materials, such as platinum group metals and high-purity quartz, wield significant bargaining power due to limited global production and high switching costs. For example, the global supply of platinum in 2023 was around 150-160 metric tons, with South Africa and Russia being dominant producers, giving these regions considerable influence over pricing and availability for Heraeus.

The concentration of suppliers for specialized materials, like those needed in semiconductors or medical technology, further amplifies their leverage. Companies like Heraeus face substantial expenses, potentially running into months of testing and validation, when qualifying new suppliers for these high-tech components, directly impacting production schedules and introducing unforeseen costs.

The potential for suppliers to integrate forward into producing finished components poses an additional strategic consideration for Heraeus, potentially influencing negotiation leverage and pricing strategies. This threat is underscored by the fact that Heraeus itself is a significant producer of quartz glass and precious metals, indicating the strategic importance of controlling these inputs.

| Material | Key Producing Regions/Factors | Estimated 2023 Global Production (approx.) | Supplier Bargaining Power Factor |

|---|---|---|---|

| Platinum Group Metals (PGMs) | South Africa, Russia (Dominant producers) | Platinum: 150-160 metric tons | High (due to geographic concentration) |

| High-Purity Quartz | Limited specialized producers | N/A (highly specialized market) | High (due to unique properties and few suppliers) |

| Precious Metals (Gold, Silver) | Global mining operations | Gold: ~3,000-3,200 metric tons; Silver: ~25,000-26,000 metric tons | Moderate to High (subject to market volatility and mining concentration) |

What is included in the product

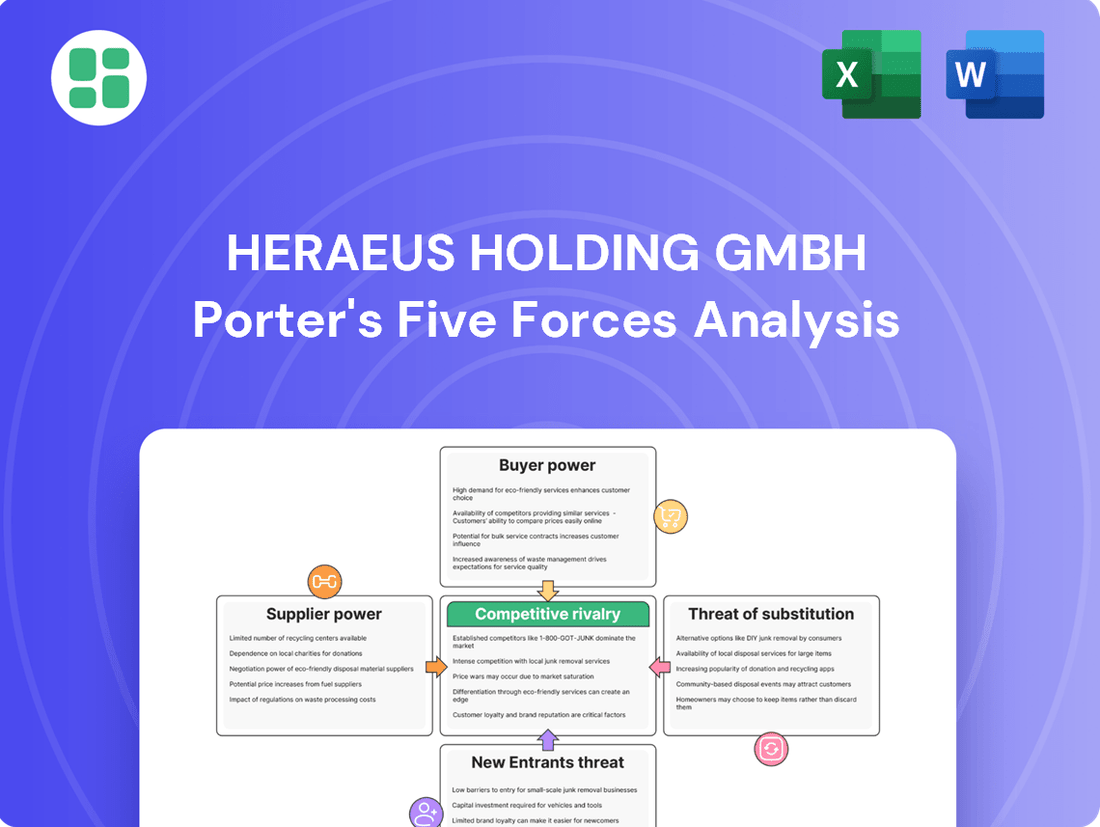

Uncovers the competitive intensity within Heraeus Holding GmbH's diverse markets, assessing the threat of new entrants, the bargaining power of suppliers and buyers, and the impact of substitutes and rival firms.

Instantly understand strategic pressure with a powerful spider/radar chart visualizing Heraeus's competitive landscape.

Customers Bargaining Power

Heraeus Holding GmbH caters to a wide array of sectors, such as electronics, automotive, chemicals, telecommunications, and medical technology, providing advanced products and solutions. This broad industry reach helps to mitigate concentrated customer risk, although the influence of customers differs substantially across these varied markets.

Heraeus's offerings, like specialized precious metal components and high-purity quartz glass, are frequently indispensable for the core operations and quality of their clients' final goods. This inherent necessity can significantly curb a customer's leverage.

For instance, in the semiconductor industry, Heraeus's advanced quartz glass is vital for wafer fabrication processes, where even minute impurities can lead to costly defects. The company reported that its specialty materials segment, which includes many of these critical components, saw robust demand in 2024, underscoring their integral role.

While Heraeus serves a broad range of industries, its presence in specialized, high-tech markets like medical technology and advanced semiconductor manufacturing means it can encounter a more concentrated customer base in these specific niches. These large, key clients, due to their significant purchase volumes and strategic relevance, can wield considerable bargaining power.

Ability of Customers to Backward Integrate

The ability of customers to backward integrate, a key aspect of their bargaining power, is significantly limited for Heraeus Holding GmbH. Given Heraeus's deep specialization in advanced materials science and complex manufacturing techniques, it's exceptionally challenging for most customers to replicate these capabilities in-house. This high technical and capital barrier effectively prevents customers from producing Heraeus's specialized components themselves, thereby reducing their leverage.

Consider these factors:

- High Technical Barriers: Heraeus's proprietary processes for producing high-purity quartz glass, specialty metals, and advanced ceramics require extensive R&D, specialized equipment, and highly skilled personnel, making replication by customers extremely difficult.

- Capital Investment: Establishing the necessary manufacturing infrastructure for Heraeus's product lines would demand substantial capital investment, often exceeding the financial capacity or strategic focus of its diverse customer base.

- Limited Integration Potential: For many of Heraeus's customers, the components it supplies are critical but represent only a small part of their overall value chain, diminishing the economic incentive for them to undertake backward integration.

Price Sensitivity vs. Performance Requirements

In high-tech sectors where Heraeus operates, like semiconductors or advanced materials, customers often place a higher premium on performance, reliability, and tailored solutions rather than just the lowest price. This is particularly true for mission-critical applications where failure is not an option.

While price remains a consideration, the need for cutting-edge, innovative products can significantly lessen customer price sensitivity. For instance, Heraeus's specialized materials for semiconductor manufacturing, which enable higher processing speeds and yields, command a premium due to their critical role in advanced chip production.

- Performance Over Price: In 2024, the global semiconductor market, a key area for Heraeus, saw continued investment in advanced nodes, where material purity and performance are paramount, often outweighing minor cost differences.

- Customization Value: Heraeus's ability to provide customized material solutions for specific client needs in industries like aerospace or medical technology further strengthens its position against pure price competition.

- Reliability Premium: For Heraeus's precious metal products used in catalytic converters, the long-term reliability and efficiency gains for automotive manufacturers often justify a higher initial cost.

Heraeus Holding GmbH's customers generally have moderate bargaining power, largely due to the specialized nature of its products and the high switching costs involved. While some large clients in niche markets can exert influence through volume, the technical barriers to entry for competitors and the critical role of Heraeus's materials in end-product performance limit widespread customer leverage.

For example, in the demanding semiconductor sector, Heraeus’s advanced quartz glass is essential for wafer fabrication, with purity being paramount. The company's 2024 performance in specialty materials highlights the demand for these critical, non-substitutable components. Customers in these high-tech fields prioritize performance and reliability, often accepting higher prices for materials that ensure the quality and efficiency of their own advanced products, thereby reducing price-based bargaining.

| Factor | Impact on Customer Bargaining Power | Heraeus Context |

|---|---|---|

| Switching Costs | High | Customers face significant R&D and qualification costs to switch suppliers for Heraeus's specialized materials. |

| Customer Concentration | Moderate to High (in specific niches) | Large players in sectors like semiconductor manufacturing can have substantial purchasing volume. |

| Product Differentiation | High | Heraeus's proprietary technologies and high-purity materials offer unique performance benefits. |

| Threat of Backward Integration | Low | High technical expertise and capital investment required for Heraeus's production processes deter most customers. |

Preview Before You Purchase

Heraeus Holding GmbH Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Heraeus Holding GmbH's Porter's Five Forces Analysis, covering the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within its diverse markets, offering a comprehensive strategic overview.

Rivalry Among Competitors

Heraeus Holding GmbH faces competitive rivalry across numerous distinct sectors due to its highly diversified business model. Operating globally, the company competes in markets ranging from precious metals and medical technology to quartz glass and specialty light sources. This broad operational scope means rivalry is not concentrated in one area but is instead fragmented across multiple, often specialized, competitive landscapes.

Heraeus Holding GmbH operates in markets characterized by the presence of significant, established global competitors. In the realm of advanced materials and precious metals, companies like Corning, Evonik, Johnson Matthey, and Umicore represent formidable rivals, often possessing extensive R&D capabilities and established market share.

Within the specific segment of quartz glass, Heraeus encounters intense competition from key players such as Pacific Quartz, Shin-Etsu, and Tosoh. This rivalry underscores the need for continuous innovation and cost-efficiency to maintain a competitive edge in these specialized product areas.

Heraeus operates in sectors like semiconductors and medical technology, where rapid innovation is the norm. This means companies must constantly push boundaries to stay ahead, creating a highly competitive landscape.

Heraeus's commitment to R&D, exemplified by initiatives like the Heraeus Awards and the use of AI in medical surgery, fuels this competitive drive. Such investments ensure a continuous stream of new products and processes, putting pressure on rivals to match their pace.

Market Growth Rates Across Segments

Competitive rivalry at Heraeus Holding GmbH is significantly shaped by the varying growth trajectories of its diverse end markets. For example, the quartz glass market, crucial for the semiconductor industry, is experiencing robust expansion. Conversely, certain precious metal segments, such as palladium, are seeing reduced demand in specific applications.

This disparity in market growth creates a dynamic competitive landscape. In rapidly expanding sectors, new entrants may be drawn, intensifying rivalry. Conversely, in stagnating or declining segments, existing players may fight harder for market share, leading to increased price pressures and innovation efforts.

- Semiconductor Market Growth: The global semiconductor market is projected for substantial growth, with some forecasts indicating a compound annual growth rate (CAGR) of over 6% through 2028, benefiting Heraeus's quartz glass business.

- Precious Metals Demand Shifts: Demand for palladium, particularly from the automotive catalytic converter sector, has seen volatility, with some projections suggesting a decline in specific applications due to the shift towards electric vehicles.

- Inter-segment Competition: Intense competition is more likely in segments where growth is slowing or negative, as companies vie for a shrinking customer base.

Differentiation Through Expertise and Customization

Heraeus Holding GmbH differentiates itself through profound materials science expertise and the creation of bespoke, high-technology solutions. This focus on specialized products and robust customer partnerships effectively mitigates intense price-based competition, redirecting the competitive landscape towards innovation and added value.

For instance, in the semiconductor industry, Heraeus's custom quartzware and advanced materials are critical for intricate chip manufacturing processes. The company reported revenue of €6.7 billion in 2023, underscoring the market demand for its specialized offerings.

- Deep Materials Expertise: Heraeus leverages decades of experience in materials science to develop unique products.

- Customization for High-Tech Sectors: The company tailors solutions for demanding industries like semiconductors and healthcare.

- Value-Based Competition: Differentiation shifts focus from price to technological superiority and service.

- Strong Customer Relationships: Long-term partnerships are built on reliability and tailored innovation.

Heraeus Holding GmbH faces substantial competitive rivalry across its diverse business segments, from precious metals to medical technology and quartz glass. Key global players like Johnson Matthey, Umicore, Corning, and Shin-Etsu are formidable competitors, each possessing significant R&D capabilities and established market positions.

The intensity of this rivalry is further amplified by the varying growth rates of Heraeus's end markets, such as the expanding semiconductor sector and the more volatile precious metals market. This dynamic environment necessitates continuous innovation and strategic differentiation to maintain market share and profitability.

Heraeus mitigates direct price competition by focusing on deep materials science expertise and delivering highly customized, high-technology solutions, particularly for demanding sectors like semiconductors and healthcare. This value-based approach, supported by strong customer relationships, allows Heraeus to compete on technological superiority and tailored services rather than just price.

| Competitor | Key Market Segments | Notable Strengths |

|---|---|---|

| Johnson Matthey | Precious Metals, Catalysts | Strong R&D, sustainability focus |

| Umicore | Precious Metals, Recycling, Materials | Circular economy expertise, advanced materials |

| Corning | Specialty Glass, Ceramics | Innovation in optical fiber, advanced glass |

| Shin-Etsu Chemical | Quartz Glass, Silicones, PVC | Dominant market share in silicon wafers, high-quality quartz |

SSubstitutes Threaten

The threat of substitutes for Heraeus Holding GmbH's products is a dynamic factor that shifts depending on the specific market segment. In the solar energy sector, for example, there's a persistent push to substitute silver, a key component in Heraeus's conductive pastes, with more cost-effective metals like copper. While technical hurdles remain in achieving comparable performance, this ongoing research represents a potential substitute threat.

Similarly, for Heraeus's high-purity quartz glass, used in semiconductor manufacturing and lighting, the threat lies in the development of alternative materials possessing similar thermal and optical properties. While currently, few materials can match quartz glass's performance across all critical applications, advancements in ceramics or specialized polymers could present viable substitutes in certain niche areas, impacting demand for Heraeus's quartz products.

Technological advancements are a major force altering industrial processes and creating substitution threats for companies like Heraeus. For instance, the automotive industry's shift towards electric vehicles (EVs) is a prime example. As EVs gain market share, the demand for traditional internal combustion engine components, and consequently the precious metals used in them, like palladium in catalytic converters, is expected to decline.

This trend is already impacting the market. In 2023, global EV sales surpassed 13 million units, a significant increase from previous years, indicating a sustained move away from fossil fuel-powered vehicles. This evolution directly reduces the need for the precious metals that Heraeus might supply for these components, posing a clear substitution risk.

The development of non-precious metal catalysts, such as those based on iron and nickel, poses a significant long-term substitution threat to Heraeus's precious metal catalyst business within the chemical industry. As research progresses, these alternatives could become economically viable and offer comparable performance to platinum group metals (PGMs).

Should these non-precious metal catalysts achieve parity in efficiency and cost-effectiveness, it would likely decrease the demand for Heraeus's PGM-based products. For instance, advancements in base metal catalysis for applications like hydrogenation could directly impact segments where PGMs are traditionally dominant, potentially eroding market share.

Cost-Performance Trade-offs

Customers may switch to substitutes if their cost-performance ratio improves, especially in applications where Heraeus's specialized materials aren't critical or when cost reduction is paramount. This threat is particularly pronounced in less specialized market segments.

For instance, in the semiconductor industry, while Heraeus offers high-purity quartz glass crucial for wafer fabrication, alternative materials are continuously being explored for cost savings in less demanding stages. Companies are evaluating plastics or lower-grade ceramics for certain components, potentially impacting demand for premium materials if the performance gap narrows sufficiently.

- Cost-Performance Sensitivity: Customers actively seek substitutes when the price difference between Heraeus's offerings and alternatives becomes significant, provided the substitute meets a minimum performance threshold.

- Innovation in Substitutes: Advances in material science can lead to new, lower-cost substitutes that challenge Heraeus's market position, especially in high-volume applications.

- Market Segmentation: The threat is more acute in segments where product differentiation is less pronounced and price is a primary purchasing driver.

Innovation as a Countermeasure

Heraeus actively combats the threat of substitutes through relentless innovation in materials science. For instance, their development of specialized quartz glass compositions for semiconductor manufacturing provides unique performance characteristics that are challenging for alternative materials to replicate. This focus on high-performance, proprietary solutions directly reduces the attractiveness of substitute products.

The company's investment in advanced materials, such as novel medical-grade polymers and ceramics, further solidifies its position against substitutes. By offering materials with enhanced biocompatibility, durability, or specific functional properties, Heraeus creates a higher barrier to entry for less advanced or less specialized alternatives. This strategy ensures their offerings remain competitive and differentiated.

A key aspect of Heraeus's countermeasure is its continuous application development. By identifying and addressing emerging market needs with tailored material solutions, they preemptively neutralize potential substitute threats. For example, their work on advanced catalysts for cleaner industrial processes offers a distinct advantage over less efficient or environmentally impactful alternatives.

- Heraeus's R&D spending in 2023 reached €350 million, a testament to their commitment to innovation.

- The company holds over 10,000 patents globally, protecting its proprietary material technologies.

- In 2024, Heraeus launched a new line of high-purity quartz glass for extreme ultraviolet (EUV) lithography, a market where substitutes are scarce due to extreme technical demands.

The threat of substitutes for Heraeus Holding GmbH is significant, particularly in areas where cost-effectiveness or technological advancements allow for alternative materials. For instance, the push to replace silver with copper in solar pastes highlights this vulnerability. Similarly, in the semiconductor sector, while Heraeus's high-purity quartz glass is critical, ongoing research into advanced ceramics and polymers could offer substitutes for less demanding applications.

The automotive industry's shift to electric vehicles is a prime example, directly impacting demand for precious metals used in traditional components. Global EV sales exceeding 13 million units in 2023 underscore this trend, reducing the need for metals like palladium in catalytic converters. Furthermore, the development of non-precious metal catalysts, such as iron and nickel-based alternatives, poses a long-term threat to Heraeus's precious metal catalyst business.

| Industry Segment | Heraeus Product | Potential Substitute | Key Driver for Substitution | 2023/2024 Trend Relevance |

|---|---|---|---|---|

| Solar Energy | Silver Pastes | Copper Pastes | Cost Reduction | Ongoing R&D for copper performance parity |

| Semiconductors | High-Purity Quartz Glass | Advanced Ceramics, Polymers | Cost Savings in non-critical applications | Continuous material science innovation |

| Automotive Catalysts | Platinum Group Metals (PGMs) | Base Metal Catalysts (e.g., Iron, Nickel) | EV adoption, Environmental Regulations | EV sales over 13 million in 2023 |

Entrants Threaten

The high-tech materials and manufacturing sectors where Heraeus operates demand enormous capital for state-of-the-art production plants and ongoing, significant research and development. For example, Heraeus's precious metals processing often involves specialized refining equipment costing millions. These substantial initial expenditures create a formidable hurdle for any new company looking to enter the market, effectively deterring many potential competitors.

Heraeus Holding GmbH benefits from its profound materials expertise and technological know-how, cultivated over many years. This deep specialization allows Heraeus to create highly innovative and often proprietary products. For instance, their work in precious metals processing and advanced ceramics requires a level of scientific understanding and manufacturing precision that is not easily replicated.

The significant investment in research and development, coupled with a strong portfolio of patents, creates a substantial barrier for potential new entrants. Developing comparable technological capabilities and intellectual property would demand considerable time, capital, and specialized talent, making it difficult for newcomers to compete effectively.

Heraeus Holding GmbH benefits significantly from its deeply entrenched customer relationships, particularly within demanding sectors like global industry and medicine. These relationships are not easily replicated, often requiring extensive qualification processes and the integration of Heraeus into complex, long-term supply chains. New market entrants would face substantial hurdles in establishing similar levels of trust and reliability, especially when supplying critical components where performance and consistency are paramount.

Regulatory Hurdles and Quality Standards

The threat of new entrants for Heraeus Holding GmbH is significantly mitigated by substantial regulatory hurdles and demanding quality standards, particularly in its specialized sectors like medical technology and high-purity materials for semiconductors.

New companies must navigate complex approval processes, which often involve extensive testing, validation, and certification to meet stringent industry requirements. For instance, medical device manufacturers must comply with regulations like those from the FDA in the US or the MDR in Europe, a process that can take years and substantial investment. Similarly, materials used in semiconductor fabrication demand exceptionally high purity levels and consistent quality, requiring advanced manufacturing capabilities and rigorous quality control systems that are difficult and costly for newcomers to replicate.

- Regulatory Compliance Costs: New entrants face significant upfront costs and long lead times for regulatory approvals in sectors like medical devices, where compliance with standards such as ISO 13485 is mandatory.

- High Quality Standards: Industries like advanced materials for electronics demand extreme purity and consistency, requiring specialized manufacturing processes and capital investment that deter many potential competitors.

- Proven Track Record: Established players like Heraeus benefit from a reputation built on years of reliable supply and adherence to quality, a factor that new entrants struggle to quickly establish.

Market Fragmentation and Niche Opportunities

While Heraeus Holding GmbH operates in markets with generally high entry barriers, certain segments present opportunities for new entrants, particularly those focusing on niche applications or leveraging technological advancements.

Emerging startups, especially from China, are increasingly entering the quartz market, driven by national objectives for self-sufficiency. This trend highlights localized threats where specific market demands are being addressed by new players, potentially impacting established supply chains and market share.

These new entrants often target specific applications within the broader quartz market, such as specialized semiconductor components or advanced optical materials. Their agility and focus on particular niches can allow them to bypass some of the broader market barriers faced by larger, more diversified companies.

- Niche Market Entry: Startups can gain traction by focusing on specialized segments within the quartz industry, such as high-purity materials for advanced electronics or specific optical coatings.

- Technological Disruption: New entrants may leverage innovative manufacturing processes or material science breakthroughs to offer cost-effective or performance-enhanced alternatives to existing products.

- Geopolitical Influence: National self-sufficiency goals, as seen with Chinese quartz startups, can create localized competitive pressures and alter global supply dynamics.

The threat of new entrants for Heraeus Holding GmbH is generally low due to substantial capital requirements and specialized knowledge. For instance, developing advanced materials for semiconductor manufacturing demands billions in investment for cleanroom facilities and R&D. This high barrier, coupled with stringent quality standards and lengthy qualification processes, makes it difficult for newcomers to compete effectively.

However, niche markets and geopolitical factors can present localized threats. For example, Chinese startups targeting specific quartz applications, driven by national self-sufficiency goals, are emerging. These agile players can disrupt specific segments by focusing on innovative processes or cost advantages, as observed in the growing competition within the quartz glass market for semiconductor applications.

| Factor | Impact on Heraeus | Example Data (Illustrative) |

|---|---|---|

| Capital Intensity | High Barrier | Semiconductor material production facilities can cost upwards of $1 billion. |

| Technological Expertise | High Barrier | Heraeus's deep knowledge in precious metals refining is a result of decades of R&D, estimated at hundreds of millions annually. |

| Regulatory Hurdles | High Barrier | Medical device material approvals (e.g., FDA) can take 2-7 years and cost millions. |

| Niche Market Entry | Moderate Threat | Emergence of specialized quartz glass manufacturers in China, aiming for self-sufficiency in semiconductor components. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Heraeus Holding GmbH is built upon a foundation of verified data, including the company's annual reports, industry-specific market research from firms like Statista and IBISWorld, and global economic indicators from sources such as Bloomberg.