Henkell & Co. Sektkellerei KG PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Henkell & Co. Sektkellerei KG Bundle

Understand how evolving consumer preferences and demographic shifts (Social) are impacting Henkell & Co. Sektkellerei KG's sparkling wine market. This analysis also delves into the crucial technological advancements and digital marketing strategies that are reshaping the beverage industry, offering a clear view of competitive pressures.

Gain an edge with our in-depth PESTEL Analysis—crafted specifically for Henkell & Co. Sektkellerei KG. Discover how external forces are shaping the company’s future, and use these insights to strengthen your own market strategy. Download the full version now and get actionable intelligence at your fingertips.

Political factors

Shifts in global trade policies and the implementation of tariffs directly influence Henkell & Co. Sektkellerei KG's import and export expenses. For example, ongoing trade dialogues between significant economic partners like the EU and the United States create market uncertainty, potentially impacting pricing and access for alcoholic beverages.

The recent imposition of a 15% tariff on various EU goods, including wines and spirits, directly raises the cost of European products entering the US market, a key consideration for Henkell's distribution and sales strategies.

Government policies on alcohol production, distribution, and sales are a significant factor for Henkell & Co. Sektkellerei KG. These regulations differ substantially by nation, directly impacting market access and growth potential.

Stricter rules regarding alcohol content, marketing practices, and where alcohol can be sold can indeed stifle expansion. Conversely, a more lenient regulatory environment often presents opportunities for entering new markets or expanding existing ones.

For instance, a notable shift is occurring in Sweden and Finland, with plans to ease their stringent alcohol sales regulations starting in 2025. This liberalization could permit direct sales from producers and allow for higher alcohol content beverages in supermarkets, potentially creating new avenues for companies like Henkell & Co.

Geopolitical stability in Henkell Freixenet's key markets is paramount for its operational continuity and the dependability of its supply chains. Political instability or disruptions can significantly hinder distribution networks, erode consumer confidence, and introduce volatility into market dynamics.

Henkell Freixenet itself acknowledged that geopolitical conditions exerted an influence on its financial performance during fiscal year 2024. Looking ahead to 2025, the company anticipates that ongoing geopolitical tensions will continue to present challenges.

Public Health Initiatives

Government-led public health initiatives aimed at curbing alcohol consumption can significantly impact consumer habits and potentially lead to stricter regulations or higher taxes on alcoholic beverages. These campaigns, often fueled by growing health and wellness awareness, might reduce the demand for conventional alcoholic products. For instance, Latvia's proposed legislation to limit alcohol advertising and enhance health information on product labels exemplifies this evolving regulatory landscape.

Such public health efforts can directly influence the market for companies like Henkell & Co. Sektkellerei KG. For example, a 2024 report by the World Health Organization highlighted a global trend of increasing government interventions in the alcohol sector, with several countries considering or implementing stricter marketing controls and taxation policies to address public health concerns. This suggests a potential headwind for the sparkling wine and spirits industry.

- Increased Regulation: Public health campaigns can trigger stricter government oversight on alcohol marketing and sales.

- Taxation Adjustments: Health-focused policies may result in higher excise duties on alcoholic products, affecting pricing and demand.

- Shifting Consumer Preferences: Growing health consciousness could lead consumers to reduce overall alcohol intake or opt for lower-alcohol alternatives.

Agricultural Subsidies and Policies

Government policies directly influence agricultural inputs for Henkell & Co. Sektkellerei KG. Regulations on grape cultivation, including permissible farming techniques and land use, can alter the availability and price of essential raw materials for sparkling wine production. For instance, in 2024, the European Union's Common Agricultural Policy (CAP) continues to shape vineyard management practices, with ongoing discussions about water allocation and sustainable farming methods that could impact yields.

These agricultural policies have a tangible effect on Henkell's supply chain. Restrictions on water usage due to drought concerns, a growing political issue, can lead to reduced grape harvests, potentially increasing costs for producers. The 2023/2024 season saw significant weather volatility across key European wine regions, prompting policy discussions around drought resilience and support for affected farmers, which directly translates to raw material cost fluctuations for companies like Henkell.

Key considerations for Henkell & Co. Sektkellerei KG regarding agricultural policies include:

- Impact of CAP Reforms: Ongoing adjustments to the EU's Common Agricultural Policy (CAP) could alter subsidy structures for grape growers, affecting vineyard economics and raw material pricing.

- Water Management Regulations: Stricter regulations on water usage in viticulture, driven by climate change concerns, may limit production volumes and increase irrigation costs.

- Climate Change Adaptation Funding: Government initiatives to support climate-resilient agricultural practices, such as drought-resistant grape varietals, could offer opportunities or impose new compliance burdens.

- Trade Agreements and Tariffs: International trade agreements can influence the cost of imported grapes or wine components, as well as the competitiveness of Henkell's exports in global markets.

Government policies on alcohol consumption and public health initiatives, such as those in Latvia and the WHO's 2024 report, are increasingly influencing consumer behavior and regulatory landscapes. These can lead to stricter marketing rules and potential tax hikes, impacting demand for products like Henkell's sparkling wines and spirits.

Agricultural policies, particularly the EU's Common Agricultural Policy (CAP) and water management regulations, directly affect grape cultivation and raw material costs. For instance, drought concerns in 2023/2024 have prompted policy discussions on resilience, potentially increasing production costs for Henkell.

Shifting global trade policies and tariffs, like the 15% EU goods tariff impacting US imports, create market uncertainty and affect Henkell's distribution and pricing strategies. Geopolitical instability, as noted by Henkell Freixenet for fiscal year 2024, also continues to pose challenges to operations and supply chains in 2025.

What is included in the product

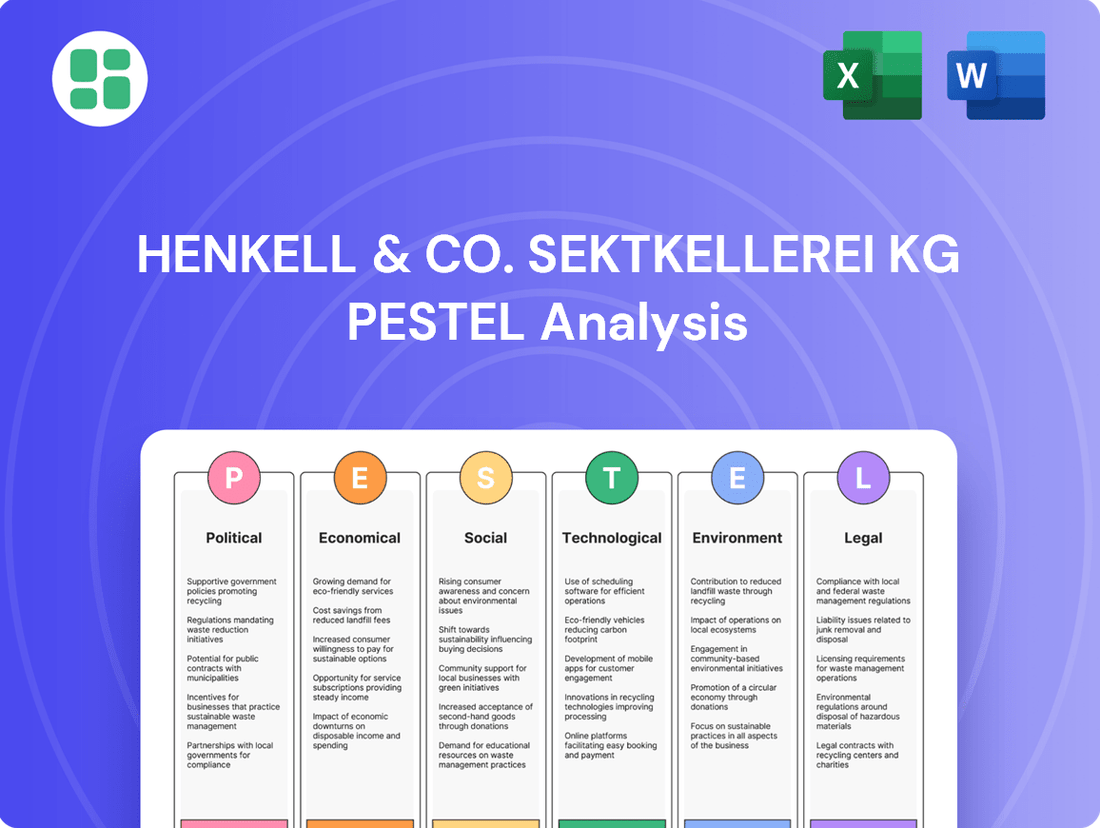

This PESTLE analysis for Henkell & Co. Sektkellerei KG examines how political, economic, social, technological, environmental, and legal factors influence its operations and strategic planning.

It provides a comprehensive understanding of the external landscape, identifying key opportunities and threats for the sparkling wine producer.

A concise PESTLE analysis for Henkell & Co. Sektkellerei KG, highlighting key external factors and their potential impact, serves as a powerful pain point reliever by providing clarity and strategic direction for navigating market complexities.

Economic factors

Persistent inflation globally is a significant factor affecting consumer purchasing power, forcing many to re-evaluate their spending habits and focus on value. This trend means consumers are more likely to seek out affordable options, potentially trading down from premium brands to more budget-friendly alternatives.

Despite this general trend, the beverage alcohol market, including sparkling wine and spirits, shows a continued resilience in premiumization within specific segments. Consumers who can still afford it are often willing to pay more for perceived quality, brand prestige, or unique experiences, creating a bifurcated market.

Henkell Freixenet's financial performance in 2024 highlights these pressures, with its reported revenue growth falling short of the Eurozone's average inflation rate. For instance, if Eurozone inflation was around 2.5% in 2024, and Henkell Freixenet's revenue growth was 1.8%, this indicates a real-terms decline in purchasing power impacting their sales volume or pricing strategy.

The price and accessibility of essential inputs like grapes are paramount for Henkell & Co. Sektkellerei KG. Fluctuations in these costs directly impact the company's bottom line and its ability to maintain competitive pricing for its sparkling wine and wine products.

Adverse weather events, such as droughts experienced in key wine-growing regions, can severely limit grape yields. This scarcity drives up the cost of raw materials, creating a direct challenge for production expenses and overall profitability. For instance, Henkell Freixenet specifically pointed to the volatile nature of grape harvests and a shortage of Cava grapes as a major hurdle anticipated for 2025.

As a global beverage company, Henkell & Co. Sektkellerei KG's financial results are significantly influenced by exchange rate volatility. For instance, the Euro's performance against major currencies directly affects the value of international sales and the cost of raw materials or finished goods imported from abroad. In 2024, the Euro experienced fluctuations against the US Dollar and British Pound, impacting companies with substantial international operations.

Favorable currency movements can translate into higher profits when repatriating earnings from foreign markets, as seen when the USD weakened against the EUR in early 2024, potentially increasing the Euro-denominated value of US sales for Henkell. Conversely, an appreciating Euro can make its products more expensive in foreign markets, potentially dampening demand, and simultaneously reduce the cost of imported inputs, offering a mixed impact depending on the company's specific import/export balance.

Economic Growth in Key Markets

The economic health of Henkell Freixenet's core markets is a significant driver of its performance. Robust economic growth translates directly into higher consumer disposable income, which in turn boosts demand for products like sparkling wine and spirits. For instance, in 2024, Henkell Freixenet saw notable growth contributions from the Americas and Eastern Europe, underscoring the impact of positive economic trends in these regions.

This economic expansion fuels consumer confidence and encourages spending on premium and discretionary items, including Henkell Freixenet's portfolio. Markets experiencing strong GDP growth often see a corresponding rise in sales for the company's offerings. This trend was particularly evident in 2024, where these regions acted as key growth engines.

Key economic indicators to monitor for Henkell Freixenet include:

- GDP Growth Rates: Tracking the year-over-year percentage change in Gross Domestic Product for key markets like Germany, France, Spain, the United States, and emerging Eastern European economies.

- Disposable Income Levels: Observing trends in per capita disposable income, which directly correlates with consumer purchasing power for non-essential goods.

- Consumer Confidence Index: Monitoring sentiment surveys that gauge consumer optimism about the economy and their personal financial situation.

- Inflation Rates: While moderate inflation can sometimes accompany growth, excessively high inflation can erode purchasing power and impact demand.

Market Competition and Pricing Strategies

The sparkling wine, wine, and spirits markets are intensely competitive, forcing companies like Henkell Freixenet to adopt sophisticated pricing strategies and continuously innovate. Balancing attractive price points with the perceived value of their core brands is crucial, especially as consumers increasingly seek value and private label alternatives gain traction. For instance, in 2024, the global wine market is projected to reach over $450 billion, with a significant portion driven by competitive pricing pressures.

Henkell Freixenet’s approach involves focusing on its strategic core brands and introducing targeted innovations to solidify its market position. This strategy aims to differentiate its offerings amidst a crowded marketplace. In 2023, the company reported a net sales revenue of €1.3 billion, underscoring the scale of operations and the need for effective market strategies to sustain growth.

- Intense Competition: The global wine and spirits market is highly fragmented, with numerous domestic and international players vying for market share.

- Value Consciousness: Consumers are increasingly price-sensitive, leading to a demand for high-quality products at accessible price points.

- Private Label Growth: The rise of private label brands in retail channels presents a significant competitive challenge, often offering lower-priced alternatives.

- Strategic Brand Focus: Henkell Freixenet prioritizes its key brands and invests in product development and marketing to maintain brand loyalty and attract new customers.

Global economic trends significantly influence Henkell Freixenet's performance, with persistent inflation impacting consumer spending power in 2024. While premium segments show resilience, overall demand for beverages is sensitive to economic downturns. Henkell Freixenet's revenue growth in 2024, reported at 1.8%, lagged behind the Eurozone's average inflation rate, indicating a real-terms sales challenge.

The cost and availability of key inputs like grapes are critical economic factors for Henkell & Co. Sektkellerei KG. Adverse weather events in 2024, such as droughts in wine-growing regions, led to grape shortages, particularly for Cava, driving up raw material costs and impacting production expenses for 2025.

Currency exchange rate volatility also plays a crucial role for Henkell Freixenet. Fluctuations in the Euro against major currencies, like the US Dollar and British Pound in 2024, directly affect the value of international sales and the cost of imported goods, creating both opportunities and challenges for the company's global operations.

Henkell Freixenet's sales performance is closely tied to the economic health of its key markets. Positive economic growth in regions like the Americas and Eastern Europe in 2024 contributed significantly to the company's sales, demonstrating a direct correlation between economic expansion and increased consumer demand for its products.

Preview the Actual Deliverable

Henkell & Co. Sektkellerei KG PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of Henkell & Co. Sektkellerei KG. This detailed report covers all crucial political, economic, social, technological, legal, and environmental factors impacting the company's operations and strategic decisions. You can trust that the insights and structure you see are what you will be working with immediately after your purchase.

Sociological factors

Consumers are increasingly seeking out beverages with lower alcohol content or no alcohol at all. This growing preference is largely fueled by a heightened awareness of health and wellness, prompting a desire for more mindful consumption. This trend is a significant sociological shift influencing the beverage industry.

Henkell Freixenet has recognized and responded to this evolving consumer preference by strategically expanding its range of non-alcoholic products. This focus proved to be a key driver of growth for the company in 2024, demonstrating the commercial viability of catering to this demand. The company's proactive approach highlights its adaptation to changing societal habits.

Consumers are increasingly drawn to premium and craft alcoholic beverages, signaling a significant shift towards quality and unique experiences over sheer volume. This premiumization trend, evident in the growing demand for artisanal spirits and wines, is projected to persist through 2025.

This movement emphasizes factors like the origin of ingredients, meticulous production processes, and the overall consumer experience, with buyers showing a greater willingness to invest in ethically produced and high-quality products. For instance, the global premium spirits market alone was valued at over $110 billion in 2023 and is expected to see continued growth.

The growing societal focus on health and wellness is significantly shaping consumer preferences, including those related to alcoholic beverages. This trend is directly impacting the beverage industry, pushing for products that align with healthier lifestyles.

Consumers are increasingly seeking out 'better for you' options, which translates to a higher demand for natural, organic, and additive-free products. In 2024, the global market for organic beverages, including alcoholic ones, is projected to see continued robust growth, reflecting this consumer shift.

In response, companies like Henkell & Co. are adapting by enhancing product transparency through clearer labeling and actively promoting healthier consumption habits. This strategic pivot aims to meet evolving consumer expectations and capitalize on the expanding market for wellness-conscious beverage choices.

Demographic Shifts (Millennials and Gen Z)

Millennials and Gen Z, now comprising a significant portion of the legal drinking age population, are reshaping the beverage market. These demographics prioritize authenticity, sustainability, and novel experiences, influencing their choices in alcoholic beverages. For instance, a 2024 report indicated that over 60% of Gen Z consumers are interested in exploring low-alcohol or no-alcohol options, a trend Henkell & Co. must acknowledge.

Their purchasing decisions are heavily influenced by digital channels and social media trends, making online engagement critical for brand building. This generation's openness to craft beverages and diverse categories, including ready-to-drink cocktails and artisanal spirits, presents both a challenge and an opportunity for established players. By 2025, it's projected that these younger consumers will drive a substantial portion of new product adoption in the wine and spirits sector.

- Preference for Authenticity: Younger consumers seek brands with transparent sourcing and production stories.

- Sustainability Focus: Environmental impact is a key consideration in purchasing decisions.

- Digital Influence: Social media and online reviews significantly shape brand perception and product discovery.

- Exploration of New Categories: Growing interest in non-alcoholic, low-alcohol, and craft beverage segments.

Cultural and Lifestyle Trends

The ongoing trend of consumers favoring at-home social gatherings significantly impacts beverage preferences for Henkell & Co. Sektkellerei KG. This shift drives demand for premium products suitable for home enjoyment and convenient ready-to-drink (RTD) formats. For instance, the global RTD market was valued at approximately $1.1 trillion in 2023 and is projected to grow, indicating a strong consumer appetite for convenience.

Fandom culture and major sporting events present valuable opportunities for brand engagement and activations. In 2024, events like the UEFA European Championship and the Olympic Games offer platforms for beverage brands to connect with large, engaged audiences. These occasions allow for targeted marketing and product placements that resonate with specific consumer interests.

Consumers are increasingly evolving from passive recipients to active curators of their drinking experiences. This means they are more interested in the story behind a brand, the ingredients used, and the ritual of consumption. This trend supports Henkell's focus on quality and heritage, allowing for storytelling around their sparkling wine and spirits portfolios.

- At-Home Consumption: Increased preference for premium beverages and RTDs for social occasions at home.

- Event-Driven Opportunities: Leveraging fandom and sporting events for brand visibility and activations.

- Consumer Empowerment: Consumers are actively shaping their drinking experiences, valuing authenticity and narrative.

- Market Growth: The RTD market's continued expansion highlights a strong consumer demand for convenience and evolving beverage formats.

Societal shifts toward health and wellness continue to drive demand for lower-alcohol and non-alcoholic options, a trend Henkell & Co. has actively addressed by expanding its product lines, which saw significant growth in 2024.

Younger demographics, particularly Millennials and Gen Z, are influencing the market with their preference for authenticity, sustainability, and novel experiences, leading to increased interest in craft beverages and diverse categories, with Gen Z showing a strong inclination towards low- and no-alcohol choices as of 2024.

The preference for at-home social gatherings is boosting the demand for premium and ready-to-drink (RTD) beverages, with the global RTD market projected for continued expansion, underscoring a consumer appetite for convenience and quality for home enjoyment.

Fandom culture and major events like the UEFA European Championship in 2024 provide significant opportunities for beverage brands to engage with large audiences, facilitating targeted marketing and product placement.

| Sociological Factor | Impact on Henkell & Co. | Supporting Data/Trend |

| Health & Wellness Focus | Increased demand for non-alcoholic and low-alcohol products. | Growth in non-alcoholic product lines in 2024. |

| Demographic Shifts (Millennials/Gen Z) | Demand for authenticity, sustainability, and new beverage experiences. | Gen Z interest in low/no-alcohol options (over 60% in 2024); growth in craft segments. |

| At-Home Consumption | Preference for premium and RTD beverages for social gatherings. | Global RTD market valued at ~$1.1 trillion in 2023, with ongoing growth. |

| Event-Driven Engagement | Opportunities for brand activation during major sporting and cultural events. | UEFA European Championship 2024 as a key activation platform. |

Technological factors

Technological innovations are significantly reshaping Henkell & Co.'s production and winemaking processes. Automation, for instance, is being increasingly integrated into bottling and packaging lines, leading to greater speed and reduced labor costs. The application of artificial intelligence in winemaking is also gaining traction, with AI algorithms analyzing vast datasets to optimize fermentation temperatures and predict optimal harvest times, thereby enhancing product consistency and quality.

These advancements directly impact operational efficiency and cost reduction. For example, automated sorting systems for grapes can improve selection accuracy, minimizing waste and ensuring only the highest quality fruit enters the winemaking process. This focus on precision, driven by technology, allows for better resource allocation and a more predictable output, ultimately contributing to improved profitability.

Emerging technologies like vineyard robots present a significant opportunity for market growth and competitive advantage. These robots can perform tasks such as precision spraying, targeted irrigation, and even harvesting, especially in challenging terrains. By adopting such innovations, Henkell & Co. can potentially achieve higher yields, improve grape quality, and reduce the environmental impact of its vineyard operations, positioning itself as a leader in sustainable and technologically advanced winemaking.

The digitalization of Henkell & Co.'s distribution and supply chain is a significant technological factor. The adoption of digital tools for order management, inventory tracking, and delivery optimization is transforming how the company operates. For instance, many beverage companies are seeing efficiency gains of up to 15-20% through better inventory management and route optimization software, directly impacting cost reduction and faster delivery times.

Mobile applications are playing a crucial role by providing real-time data tracking and enhancing communication across the supply chain. This allows for improved visibility and control, enabling Henkell & Co. to respond more effectively to market demands and potential disruptions. The ability to track shipments and inventory in real-time, a trend increasingly adopted across the logistics sector, minimizes errors and boosts overall customer service satisfaction.

The rise of e-commerce and direct-to-consumer (DTC) sales is fundamentally reshaping the beverage alcohol industry. Platforms like Drizly and ReserveBar, alongside brand-specific websites, offer consumers unparalleled convenience and access to a vast selection of products. This trend allows companies like Henkell & Co. to cultivate direct relationships with their customer base, bypassing traditional intermediaries.

This shift toward DTC channels not only broadens market reach but also presents opportunities for enhanced profit margins by reducing wholesale markups. In 2024, the online alcohol market continues its upward trajectory, with projections indicating sustained growth as regulatory landscapes adapt and consumer preferences solidify around digital purchasing convenience.

Data Analytics and AI for Consumer Insights

Henkell & Co. Sektkellerei KG leverages AI-powered data analytics to gain granular insights into consumer preferences and market dynamics. This technology allows for sophisticated analysis of purchasing patterns and emerging trends, informing strategic decisions. For instance, by analyzing millions of customer interactions, companies in the beverage sector can identify unmet needs and preferences for specific flavor profiles or product formats.

The application of AI extends to optimizing product development and marketing efforts. By understanding which marketing messages resonate most effectively with different consumer segments, Henkell can refine its campaigns for maximum impact. In 2024, the global market for AI in marketing was projected to reach over $50 billion, highlighting the significant investment and reliance on these technologies for competitive advantage.

Furthermore, personalized consumer experiences are becoming a key differentiator. AI-driven applications, such as virtual sommelier services or personalized recipe generators that suggest drink pairings, enhance engagement and loyalty. These tools not only provide value to the consumer but also generate valuable data for further refinement of offerings.

- AI-driven market trend analysis identifies shifts in consumer tastes, enabling proactive portfolio adjustments.

- Personalized marketing campaigns, informed by AI, achieve higher conversion rates by targeting specific consumer segments.

- Data analytics optimize pricing strategies, ensuring competitiveness while maximizing revenue.

- AI-powered recommendation engines enhance customer experience, driving repeat purchases and brand loyalty.

Innovative Packaging and Product Development

Technological advancements are key drivers for Henkell & Co. Sektkellerei KG, particularly in creating novel product formats and sustainable packaging. This focus directly addresses growing consumer preferences for environmentally responsible choices and distinctive product experiences. For instance, the development of alcohol-free sparkling wines and ready-to-drink (RTD) cocktails caters to evolving market demands.

Innovations in packaging aim to reduce waste, with refillable options gaining traction. Henkell Freixenet, a significant part of the group, has actively pursued product innovation, including the introduction of new non-alcoholic sparkling wine lines. This strategic direction is supported by technological capabilities that enable efficient production of these specialized products.

- Sustainable Packaging: Investment in technologies for biodegradable or recyclable materials, reducing the environmental footprint of their products.

- Alcohol-Free Innovation: Development of advanced fermentation and de-alcoholization techniques to produce high-quality non-alcoholic beverages.

- Ready-to-Drink (RTD) Formats: Utilizing advanced bottling and preservation technologies to offer convenient, pre-mixed cocktail options.

- Digital Integration: Employing technology in packaging design and production for enhanced consumer engagement and traceability.

Technological advancements are central to Henkell & Co.'s operational efficiency and market competitiveness. Automation in bottling and packaging, alongside AI for winemaking optimization, are key areas. For example, AI can predict optimal fermentation temperatures, improving product consistency.

The digitalization of distribution and supply chains, including real-time tracking and route optimization software, is enhancing efficiency. Many beverage companies report efficiency gains of up to 15-20% from these digital tools, leading to cost reductions and faster deliveries.

Emerging technologies like vineyard robots offer opportunities for higher yields and reduced environmental impact, supporting sustainable winemaking. The e-commerce and DTC sales trend, which saw significant growth in 2024, allows for direct consumer relationships and potentially higher profit margins.

AI-driven data analytics provide granular insights into consumer preferences, informing product development and marketing. The global market for AI in marketing was projected to exceed $50 billion in 2024, underscoring its importance.

| Technology Area | Impact on Henkell & Co. | Example/Data Point |

|---|---|---|

| Automation | Increased production speed, reduced labor costs | Automated bottling lines enhance throughput. |

| AI in Winemaking | Optimized fermentation, improved product consistency | AI algorithms analyze data to predict optimal harvest times. |

| Digital Supply Chain | Enhanced efficiency, faster delivery | Route optimization software can yield 15-20% efficiency gains. |

| E-commerce/DTC | Broader market reach, improved profit margins | Online alcohol sales continue to grow significantly. |

| AI in Marketing | Personalized campaigns, better consumer insights | AI in marketing market projected over $50 billion in 2024. |

Legal factors

Laws governing alcohol advertising and marketing are a critical legal factor for Henkell & Co. Sektkellerei KG. These regulations differ substantially across various markets, and their dynamic nature necessitates continuous adaptation of promotional strategies. For instance, proposals in Latvia during 2024 to further restrict alcohol advertising underscore the need for vigilance and flexibility.

Mandatory labeling for alcoholic beverages is tightening globally, with the EU leading the charge. This includes detailed nutritional information, ingredient lists, and crucial health warnings. These regulations are designed to give consumers a more transparent view of what's in their drinks.

A significant change impacting companies like Henkell & Co. Sektkellerei KG is the EU's new mandate for wines bottled after December 2023. These wines must now include QR codes or web addresses on their labels, directing consumers to online sources for ingredient and nutritional data.

Government taxation policies on alcoholic beverages, including sparkling wine, wine, and spirits, directly affect Henkell & Co.'s product pricing and consumer demand. For instance, in 2024, the UK's alcohol duty system, which taxes based on alcohol by volume, continues to influence the cost of imported goods.

Fluctuations in excise duties and sales taxes, such as potential increases in Value Added Tax (VAT) in certain markets, can significantly impact profitability and market share.

Furthermore, ongoing trade discussions and potential tariffs, like the historical 15% tariff on EU goods impacting alcohol imports into the US, represent a form of taxation that can disrupt supply chains and alter cost structures for companies like Henkell & Co.

Import and Export Regulations

Navigating the intricate web of international import and export regulations is a significant challenge for Henkell & Co. Sektkellerei KG's global reach. These regulations, encompassing quotas, tariffs, and complex customs procedures, directly impact the efficiency and cost-effectiveness of cross-border trade for their diverse portfolio of sparkling wines and spirits.

Ensuring strict compliance with these varied legal frameworks is paramount for maintaining smooth international distribution channels. For instance, the ongoing discussions around trade agreements between major economic blocs highlight the dynamic nature of these regulations. The 'Toasts Not Tariffs' coalition actively campaigns for permanent tariff-free trade in wines and spirits between the US and EU, a move that could significantly alter operational costs and market access for companies like Henkell.

- Tariff Impact: Tariffs can add substantial costs to imported goods, affecting Henkell's pricing strategies and competitiveness in foreign markets. For example, in 2023, tariffs on certain alcoholic beverages between the EU and the UK remained a point of negotiation following Brexit.

- Quota Restrictions: Import quotas limit the volume of specific goods that can be brought into a country, potentially restricting Henkell's market penetration and sales volumes in certain regions.

- Customs Compliance: The complexity of customs documentation and procedures requires dedicated resources and expertise to avoid delays and penalties, impacting supply chain reliability.

- Trade Agreements: Changes in trade agreements, such as those being discussed between the US and EU, can either open up new opportunities or introduce new barriers for Henkell's export activities.

Direct-to-Consumer (DTC) Sales Laws

The legal framework surrounding direct-to-consumer (DTC) alcohol sales continues its dynamic evolution. While some jurisdictions are easing prior restrictions, others maintain rigorous regulations, necessitating careful navigation by companies like Henkell & Co. Sektkellerei KG.

Key considerations for DTC expansion include compliance with state and country-specific laws, particularly concerning age verification technologies and the often complex licensing procedures. These legal nuances directly impact the feasibility and cost of establishing robust online sales channels.

The recent legislative shift in New York, permitting direct-to-consumer spirits shipments, exemplifies a broader trend towards increased acceptance of DTC alcohol sales. This development, effective as of late 2023, signals potential opportunities for businesses prepared to adapt to these changing legal landscapes.

- Evolving DTC Alcohol Laws: Regulations are shifting, with some regions becoming more permissive for direct shipments.

- Compliance Challenges: Companies must adhere to varied state/country laws, including age verification and licensing.

- New York's Trendsetting Move: The state's 2023 law allowing direct spirits shipping highlights a growing acceptance of DTC models.

Henkell & Co. Sektkellerei KG must navigate evolving alcohol advertising laws, with Latvia proposing stricter rules in 2024. Mandatory EU labeling, including QR codes for wine ingredients implemented from late 2023, increases transparency but adds compliance costs. Taxation policies, such as the UK's alcohol duty system based on ABV, directly impact pricing and demand.

Environmental factors

Climate change is a major concern for grape cultivation, bringing unpredictable weather, droughts, and extreme temperatures that directly impact harvests and quality. This volatility in grape supply and rising raw material costs present a significant challenge for wine and sparkling wine producers like Henkell & Co. Sektkellerei KG.

The ongoing drought in Spain's Penedès region, a key area for Cava production, has already severely impacted Henkell Freixenet's operations. For instance, reports from late 2023 indicated that some Spanish wine regions experienced yield reductions of up to 30% due to the persistent lack of rainfall, directly affecting the availability and price of grapes for producers.

Growing water scarcity in key wine-producing areas like parts of Germany and France presents a significant challenge for Henkell & Co. Sektkellerei KG. For instance, the Rhine River, crucial for many agricultural regions, experienced historically low water levels in 2022 and 2023, impacting irrigation and transportation, which could affect vineyard yields and supply chain logistics.

To address this, Henkell & Co. must prioritize investment in water-efficient technologies, such as drip irrigation systems and soil moisture monitoring, to reduce water consumption in its vineyards. This proactive approach is vital for mitigating operational risks and ensuring the long-term viability of its grape sourcing and production, especially as climate change intensifies water stress.

Growing consumer and regulatory pressure is significantly influencing the beverage industry, pushing companies like Henkell & Co. Sektkellerei KG towards more sustainable packaging. This demand is evident in the increasing market share of products featuring recyclable, biodegradable, or refillable materials, reflecting a broader shift in consumer preference towards environmentally conscious choices.

Brands are responding by adopting less packaging and optimizing designs for reuse. For instance, by 2024, the global sustainable packaging market is projected to reach $400 billion, a clear indicator of this trend's momentum and the opportunities it presents for innovation in materials and product lifecycle management.

Waste Management and Circular Economy

The beverage industry, including Henkell & Co. Sektkellerei KG, faces growing pressure concerning waste from production and packaging. For instance, the EU aims to reduce packaging waste by 15% per capita by 2035, impacting companies like Henkell. Embracing circular economy principles is vital for both regulatory adherence and maintaining a positive brand image.

Adopting circularity, such as repurposing by-products and minimizing waste, is becoming a strategic imperative. This shift is driven by increasing consumer demand for sustainable practices and stricter environmental regulations. Companies are exploring innovative solutions to manage their environmental footprint effectively.

Some forward-thinking brands are now producing alcohol from recycled ingredients to combat food waste. This innovative approach not only addresses environmental concerns but also creates new revenue streams. For example, certain distilleries are using surplus bread or fruit pulp, demonstrating a tangible commitment to reducing waste and promoting resource efficiency.

- EU Packaging Waste Reduction Target: 15% per capita reduction by 2035.

- Circular Economy Benefits: Enhanced environmental compliance and improved brand reputation.

- Innovation in Waste Reduction: Production of alcohol from recycled food by-products.

Carbon Footprint Reduction

Henkell & Co. Sektkellerei KG faces increasing pressure to shrink its carbon footprint throughout its operations. This includes vineyard management, production processes, and the entire supply chain, from grape sourcing to final delivery to consumers.

The company is actively exploring and implementing strategies to achieve this reduction. Investments in renewable energy, such as solar power for wineries and bottling plants, are becoming crucial. For instance, many German wineries are adopting solar energy; in 2023, the renewable energy share in Germany's gross electricity consumption reached 55%.

Optimizing logistics and distribution networks is another key area. This could involve shifting to more fuel-efficient transport methods or consolidating shipments to reduce mileage. Energy-efficient practices in production, like upgrading machinery and improving insulation in storage facilities, also contribute significantly to lowering overall energy consumption and emissions.

- Vineyard Operations: Implementing sustainable farming practices to reduce the need for energy-intensive inputs.

- Renewable Energy Adoption: Investing in solar or wind power for production facilities and administrative buildings.

- Logistics Optimization: Streamlining transportation routes and exploring lower-emission delivery options.

- Energy Efficiency: Upgrading equipment and infrastructure to minimize energy waste in production and storage.

Environmental factors significantly impact Henkell & Co. Sektkellerei KG, particularly climate change affecting grape harvests and water availability in key regions like Spain and Germany. For example, the Rhine River's low water levels in 2022 and 2023 disrupted agricultural operations. Additionally, increasing consumer and regulatory pressure for sustainable packaging, with the global market projected to reach $400 billion by 2024, necessitates innovation in materials and waste reduction strategies, aligning with the EU's target of a 15% per capita packaging waste reduction by 2035.

| Environmental Factor | Impact on Henkell & Co. | Key Data/Trend |

|---|---|---|

| Climate Change & Water Scarcity | Unpredictable harvests, rising raw material costs, operational disruptions. | 30% yield reduction in some Spanish regions (late 2023) due to drought. Rhine River historically low water levels (2022-2023). |

| Sustainable Packaging Demand | Need for recyclable, biodegradable, or refillable materials; reduced packaging. | Global sustainable packaging market projected to reach $400 billion by 2024. |

| Waste Reduction & Circularity | Pressure to minimize production and packaging waste; adoption of circular economy principles. | EU target: 15% per capita packaging waste reduction by 2035. Innovation in producing alcohol from recycled food by-products. |

| Carbon Footprint Reduction | Need to lower emissions in vineyard management, production, and logistics. | Renewable energy adoption crucial; Germany's renewable energy share reached 55% of gross electricity consumption in 2023. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Henkell & Co. Sektkellerei KG is grounded in data from reputable market research firms, official government statistics on consumer spending and trade, and industry-specific publications detailing beverage sector trends. These sources provide a comprehensive view of the political, economic, social, technological, legal, and environmental factors impacting the company.