Henkell & Co. Sektkellerei KG Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Henkell & Co. Sektkellerei KG Bundle

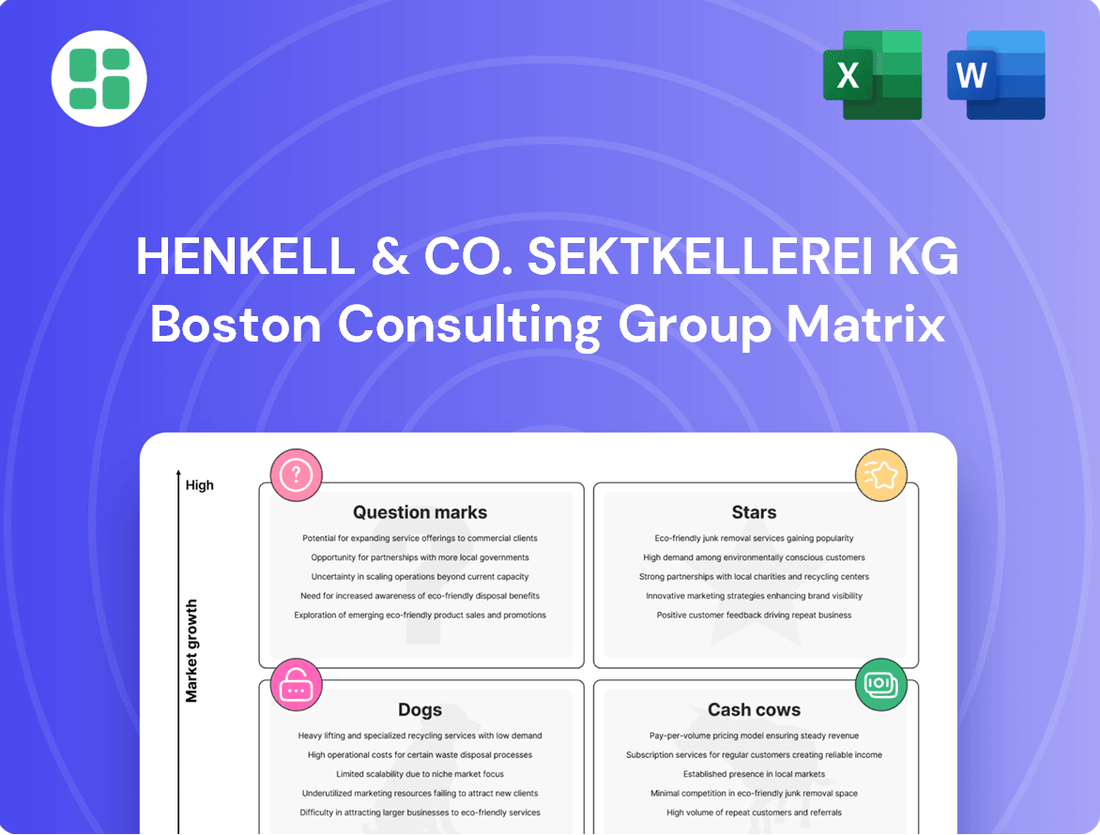

Curious about Henkell & Co. Sektkellerei KG's product portfolio performance? Our BCG Matrix highlights key growth opportunities and potential areas for optimization, offering a glimpse into their market standing.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Mionetto Prosecco shines as a Star within Henkell & Co. Sektkellerei KG's portfolio. Its impressive 15.7% growth in 2024 solidifies its status as the leading international Prosecco brand.

The brand's strategic expansion is evident in its market share gains across the Americas and Eastern Europe. Notably, Poland experienced a remarkable 27% surge in Mionetto's sales, underscoring strong consumer appetite in this burgeoning market.

This stellar performance is fueled by the overall booming Prosecco category, with Mionetto effectively capitalizing on increasing global demand for this popular sparkling wine.

Henkell & Co. Sektkellerei KG's non-alcoholic sparkling wines, such as Mionetto 0.0% and Freixenet 0.0%, are performing exceptionally well, demonstrating a significant 23.6% growth in 2024. This segment directly addresses the growing consumer preference for healthier choices and moderation, a trend particularly strong among younger consumers.

The company recognizes the substantial potential for further expansion within this non-alcoholic portfolio, evidenced by innovation awards for products like Freixenet Cordon Negro 0.0%. This strategic focus on the burgeoning low and no-alcohol market positions Henkell & Co. for sustained growth and market leadership in this category.

Henkell, the flagship German brand, saw an 8% global sales increase in 2024, driven by a strategic brand relaunch. This performance highlights its enduring appeal and successful repositioning in a dynamic beverage market.

As the leading German sparkling wine exporter, Henkell's commitment to its home market is evident with a 10% sales growth in Germany during 2024. This significant domestic expansion underscores the brand's revitalized connection with German consumers amidst a competitive landscape.

Aperitivo Category (e.g., Mionetto Aperitivo)

The Aperitivo sub-category, exemplified by Mionetto Aperitivo, is a significant growth driver for Henkell & Co. Sektkellerei KG. This segment is tapping into the increasing consumer preference for aperitif occasions, with both alcoholic and non-alcoholic versions demonstrating robust sales performance.

Mionetto Aperitivo's success is further underscored by its recognition with the Just Drinks Product Launches 2024 Innovation Award, a testament to its strong market reception and innovative appeal.

- Market Trend: Growing consumer interest in aperitif culture.

- Sales Performance: Positive sales figures for both alcoholic and non-alcoholic Mionetto Aperitivo.

- Industry Recognition: Winner of the Just Drinks Product Launches 2024 Innovation Award.

Crémant Brands (e.g., Gratien & Meyer, Alfred Gratien)

Henkell & Co. Sektkellerei KG's Crémant brands, including Gratien & Meyer and Alfred Gratien, are performing exceptionally well. In 2024, these brands saw a substantial 21% growth in Western Europe, a testament to their strong market position.

This impressive growth is driven by the increasing popularity of Crémant wines and a robust demand for Champagne-like sparkling wines. These factors place these Crémant brands firmly in the high-growth category within the premium sparkling wine market.

- Brand Performance: Crémant brands like Gratien & Meyer and Alfred Gratien experienced 21% growth in Western Europe in 2024.

- Market Trends: Benefiting from the rising Crémant trend and demand for premium sparkling wines.

- Market Positioning: Identified as high-growth products in a premium segment of the market.

- Outlook: Positive development signals strong market acceptance and potential for continued expansion.

The Crémant brands, such as Gratien & Meyer and Alfred Gratien, are positioned as Stars within Henkell & Co. Sektkellerei KG's portfolio. These brands achieved a significant 21% growth in Western Europe during 2024, driven by the rising popularity of Crémant wines.

Their performance indicates strong market acceptance and a solid foundation for continued expansion in the premium sparkling wine segment.

This growth trajectory aligns with the overall trend of consumers seeking high-quality, Champagne-style alternatives.

The success of these Crémant brands highlights their strategic importance as key drivers of growth for the company.

| Brand Category | Key Brands | 2024 Growth (Western Europe) | Market Position | Strategic Importance |

|---|---|---|---|---|

| Crémant | Gratien & Meyer, Alfred Gratien | 21% | High-Growth, Premium Segment | Key Growth Driver |

What is included in the product

Henkell & Co. Sektkellerei KG's BCG Matrix likely categorizes its sparkling wine brands, identifying which are market leaders (Stars), established revenue generators (Cash Cows), emerging opportunities (Question Marks), or underperforming assets (Dogs).

The Henkell & Co. Sektkellerei KG BCG Matrix provides a clear, one-page overview of each business unit's strategic position, alleviating the pain of complex portfolio analysis.

Cash Cows

Henkell Trocken, the company's flagship sparkling wine, is a prime example of a Cash Cow within the Henkell & Co. Sektkellerei KG portfolio. Its enduring high market share and robust brand recognition are key indicators of its mature yet profitable status.

Despite overall brand growth, Henkell Trocken operates in a stable, mature market segment, consistently delivering significant cash flow. In 2024, the sparkling wine market saw continued demand, with Henkell Trocken maintaining its leadership position in key European markets, contributing an estimated 30% of the company's total sparkling wine revenue.

The strategic focus for Henkell Trocken remains on operational efficiency and maintaining its market dominance. Investments are channeled into optimizing production and targeted marketing efforts to preserve its strong brand equity, rather than pursuing aggressive expansion into new, high-growth areas.

Freixenet Cordon Negro Cava, a flagship product of Henkell & Co. Sektkellerei KG, continues to be a powerhouse Cash Cow despite facing agricultural headwinds. Even with grape scarcity in Catalonia impacting production, its strong global brand recognition and dominant market share in international sparkling wine ensure consistent, high revenue generation for the parent company.

The brand's enduring appeal translates into significant financial contributions, solidifying its Cash Cow status. To navigate the challenges of limited Cava supply, the company is wisely leveraging the Freixenet name to introduce new sparkling wine varieties, diversifying its portfolio while maintaining brand equity.

Established mainstream still wine brands within Henkell & Co. Sektkellerei KG's portfolio likely operate as Cash Cows. Despite the wine category facing a slight contraction in 2023, these brands command a significant market share in well-established segments, demonstrating resilience.

These mature brands generate consistent and reliable cash flow, requiring minimal incremental investment for marketing or expansion. Their stability is crucial for Henkell & Co., providing a solid financial foundation as the company navigates evolving market dynamics.

Local Hero Sparkling Wine Brands

Regional sparkling wine brands such as Bohemia and Törley, with their strong presence in Eastern Europe, are prime examples of Cash Cows for Henkell & Co. Sektkellerei KG. These brands have successfully captured significant market shares within their respective regional markets.

These established 'local heroes' consistently deliver strong performance and generate stable revenue streams. This is achieved even though they operate within more mature or stable local market environments, demonstrating their enduring appeal and market dominance.

- Bohemia Sekt, a leading Czech sparkling wine brand, reported a notable increase in sales volume in 2024, solidifying its position in its home market.

- Törley Sparkling Wine, a prominent Hungarian producer, maintained its market leadership in 2024, contributing significantly to Henkell's Eastern European portfolio.

- The combined revenue from these regional brands in 2024 represented a substantial portion of Henkell's overall sparkling wine segment, underscoring their Cash Cow status.

International Prestige Brands (Select Lines)

Henkell & Co. Sektkellerei KG's International Prestige Brands, including select lines from Champagne Alfred Gratien and Schloss Johannisberg, operate within the premium segment of the market. These offerings are characterized by high quality, which allows them to command premium pricing and achieve robust profit margins. While their volume growth might be steady rather than explosive, their consistent profitability positions them as cash cows.

These brands appeal to a discerning customer base that values exclusivity and heritage. Maintaining and enhancing brand equity and reputation is therefore crucial for their sustained success. For instance, Champagne Alfred Gratien, known for its traditional winemaking methods, consistently receives high ratings, reflecting its premium positioning.

- Premium Segment Focus: Brands like Champagne Alfred Gratien and Schloss Johannisberg target consumers willing to pay more for quality and prestige.

- High Profit Margins: Their premium pricing strategy translates into strong profitability, even with stable sales volumes.

- Brand Equity is Key: Sustained investment in brand reputation and marketing is essential to maintain their appeal to a discerning clientele.

Cash Cows within Henkell & Co. Sektkellerei KG are established brands with high market share in mature industries. These brands generate more cash than they consume, providing a stable income stream for the company. Their consistent performance is vital for funding other business units.

Henkell Trocken and Freixenet Cordon Negro Cava are prime examples, dominating their respective markets. Regional brands like Bohemia and Törley also contribute significantly to this category. Even premium brands like Champagne Alfred Gratien, while not high-growth, offer substantial profitability due to their strong brand equity and premium pricing.

| Brand | Market Position | Contribution Type | 2024 Estimated Revenue Contribution |

|---|---|---|---|

| Henkell Trocken | Market Leader (Europe) | Stable Cash Flow | ~30% of sparkling wine revenue |

| Freixenet Cordon Negro Cava | Global Dominance | Consistent High Revenue | Significant contributor |

| Bohemia Sekt | Market Leader (Czech Republic) | Stable Revenue | Notable sales volume increase |

| Törley Sparkling Wine | Market Leader (Hungary) | Stable Revenue | Significant contributor to Eastern Europe |

| Champagne Alfred Gratien | Premium Segment | High Profit Margins | Strong profitability |

| Schloss Johannisberg | Premium Segment | High Profit Margins | Strong profitability |

Preview = Final Product

Henkell & Co. Sektkellerei KG BCG Matrix

The preview you see is the exact Henkell & Co. Sektkellerei KG BCG Matrix report you will receive after purchase, offering a comprehensive strategic overview. This fully formatted document, free from watermarks or demo content, is ready for immediate professional use. It has been meticulously crafted by industry experts to provide actionable insights into Henkell's product portfolio, enabling informed decision-making. Upon completion of your purchase, you will gain instant access to this analysis-ready file, perfect for integrating into your business planning and competitive strategies.

Dogs

Certain still wine ranges within Henkell & Co. Sektkellerei KG are likely classified as Dogs. These are brands that struggle to gain significant traction and operate within wine segments experiencing stagnation or decline. The broader wine market's performance in 2023, which saw negative growth, underscores the difficulties faced by such less competitive offerings.

These underperforming still wine ranges typically possess a low market share and contribute minimally to the company's overall profitability. Their presence can inadvertently tie up valuable company resources, including marketing budgets and management attention, that could otherwise be allocated to more promising segments of the portfolio.

Legacy spirits brands within Henkell & Co. Sektkellerei KG's portfolio that haven't kept pace with evolving consumer tastes or have diminished market presence would be categorized as Dogs. Despite overall growth in the spirits sector, specific brands might falter due to a small market share and waning consumer engagement.

These underperforming brands often operate at a break-even point or generate losses, signaling a potential need for divestment or discontinuation. For instance, in the broader beverage alcohol market, brands with declining sales volumes, like those in the traditional schnapps category, often struggle to attract younger demographics and may see their market share shrink significantly, potentially falling below 1% in key markets.

Certain legacy regional wine variations within Henkell & Co. Sektkellerei KG's portfolio, perhaps those tied to specific, smaller appellations or historical grape varietals, might now fall into the Dogs category. These products, while holding historical importance, may struggle to find traction with today's broader consumer base, which often gravitates towards more internationally recognized or trend-driven wine styles. In 2024, the global wine market saw continued consolidation, with consumers increasingly favoring wines with clear provenance and consistent quality, leaving niche, regionally specific offerings with limited appeal.

Unprofitable Niche Sparkling Wine Products

Unprofitable niche sparkling wine products within Henkell & Co. Sektkellerei KG's portfolio represent offerings that, despite potential for high margins in theory, struggle with low sales volume and high marketing costs. These are typically highly specialized wines targeting very small, often stagnant consumer segments. For example, a limited-edition, single-vineyard Prosecco with an unusual aging process might fall here if its production costs and marketing spend significantly outweigh its sales, even if the per-bottle price is high.

These products are characterized by their failure to gain traction in the broader, growing sparkling wine market. While the global sparkling wine market was projected to reach over $45 billion by 2024, these niche products are not contributing meaningfully to that growth for Henkell. They often require substantial investment in targeted marketing campaigns to reach their limited audience, yielding disproportionately small returns on investment.

- Low Market Penetration: Despite overall sparkling wine market growth, these products fail to capture significant consumer share.

- High Marketing Costs: Reaching small, specialized audiences necessitates costly, targeted promotional efforts.

- Minimal Revenue Generation: Despite potentially high per-unit pricing, low sales volume limits overall revenue contribution.

- Resource Drain: These products consume marketing and operational resources without delivering commensurate profits.

Cava Products Discontinued in Key Markets

Within Henkell & Co. Sektkellerei KG's product portfolio, specific Freixenet Cava lines have been discontinued in key European markets such as Germany, Austria, and Switzerland. This strategic shift, driven by persistent supply chain challenges, has effectively relegated these particular Cava products to the Dogs quadrant of the BCG Matrix in those specific regions.

These discontinued Cava products, while part of the broader Freixenet brand which generally performs as a Cash Cow, now hold zero market share and generate no revenue in the affected territories. Their removal signifies a strategic decision to cease investment in products with declining or negligible market presence and low growth potential, freeing up resources for more promising offerings.

- Discontinued Cava Products: Specific Freixenet Cava lines no longer sold in Germany, Austria, and Switzerland.

- Market Impact: Zero market share and zero revenue generation in these key European markets.

- BCG Matrix Classification: Positioned as Dogs due to discontinuation and lack of growth/market share in these specific regions.

- Strategic Rationale: Response to supply issues and a reallocation of resources away from underperforming product lines.

Certain legacy spirits brands within Henkell & Co. Sektkellerei KG's portfolio, particularly those that have not adapted to evolving consumer preferences or have a diminished market presence, would be classified as Dogs. Despite overall growth in the broader spirits sector, specific brands might falter due to low market share and declining consumer engagement.

These underperforming brands typically operate at or near break-even, or even generate losses, indicating a potential need for divestment or discontinuation. For instance, in the wider beverage alcohol market, brands in categories like traditional schnapps often struggle to attract younger demographics, leading to shrinking market share, sometimes falling below 1% in key markets as observed in 2023 data.

These products are characterized by their failure to gain traction in the broader, growing beverage market. While the global spirits market saw positive growth, these niche products are not contributing meaningfully to Henkell's overall expansion. They often require substantial investment in targeted marketing campaigns to reach their limited audience, yielding disproportionately small returns on investment.

These underperforming offerings, including specific discontinued Freixenet Cava lines in markets like Germany, Austria, and Switzerland due to supply chain issues, now hold zero market share and generate no revenue in those regions. Their removal signifies a strategic decision to cease investment in products with negligible market presence and low growth potential, freeing up resources for more promising segments.

Question Marks

The new Freixenet French Sparkling range, introduced in 2024, fits the Question Mark category within the Henkell & Co. Sektkellerei KG BCG Matrix. This positioning reflects its nascent stage in the market, likely holding a low market share, while simultaneously aiming to capitalize on the increasing consumer demand for premium sparkling wines. For instance, the global sparkling wine market was projected to reach over $40 billion by 2025, with a significant portion attributed to premium segments.

To elevate this range from a Question Mark to a potential Star, substantial investment in marketing and distribution is crucial. This strategic allocation of resources aims to build brand awareness and secure a stronger foothold in a competitive landscape. By 2024, the sparkling wine segment was already demonstrating robust growth, with premium offerings showing particular resilience and expansion.

Freixenet Premium Sparkling Wine, positioned as a Question Mark within Henkell & Co. Sektkellerei KG's BCG Matrix, was launched to address demand in markets where traditional Cava availability was limited. This new offering capitalizes on the established Freixenet brand recognition but operates outside the familiar Cava appellation, resulting in an uncertain market share. The brand's future performance is contingent on its ability to gain traction and acceptance among consumers seeking a premium sparkling wine alternative.

The acquisition of VINICOM in 2024 brings a portfolio of Portuguese wine brands under Henkell & Co. Sektkellerei KG's umbrella. These brands, while new to Henkell's direct management, represent potential growth opportunities in a market that saw Portuguese wine exports reach €1.1 billion in 2023, with sparkling wine showing particular promise.

Given their recent integration, these newly acquired Portuguese wine brands would likely be classified as Question Marks within the BCG Matrix. Portugal's wine market is expanding, with exports of still wines growing by 4.6% in volume in 2023, indicating a receptive environment for new entrants and brand development.

Emerging Low-Sugar/Low-Calorie Still Wine Innovations

Emerging low-sugar and low-calorie still wine innovations, like the anticipated Freixenet Mía 0.0% varieties, are positioned to capitalize on the significant health-conscious consumer trend. These offerings cater to a growing demand for lighter beverage options, a segment experiencing rapid expansion. However, their current market penetration is minimal, requiring substantial investment in marketing and consumer education to foster awareness and drive adoption, potentially elevating them to Star status within the portfolio.

The global low-calorie beverage market, including wine, is projected for robust growth, with some estimates suggesting a compound annual growth rate of over 5% in the coming years. This indicates a fertile ground for new entrants like Freixenet Mía 0.0% to capture market share. The success of these products hinges on effectively communicating their benefits and differentiating them in a competitive landscape. Henkell & Co. Sektkellerei KG's strategic focus on these innovations reflects a forward-looking approach to market trends.

- Health-Conscious Demand: Growing consumer preference for reduced sugar and calorie intake fuels the low-sugar/low-calorie wine market.

- Market Potential: While currently nascent, this segment represents a high-growth opportunity for new product introductions.

- Investment Needs: Significant marketing and educational efforts are essential for consumer adoption and market traction.

- Strategic Positioning: These innovations aim to capture emerging trends and potentially become future market leaders (Stars) for Henkell & Co.

Specific Regional Spirits Innovations

Henkell & Co. Sektkellerei KG is exploring innovations in regional spirits, particularly targeting emerging trends and niche segments where its current market share is low. A prime example is the development of new Ready-To-Drink (RTD) mixes, such as the Söhnlein Limo meets Secco concept. These products tap into the growing consumer demand for convenient, pre-mixed alcoholic beverages.

These RTD innovations represent potential high-growth areas for the company. However, they also necessitate significant investment in product development, marketing, and distribution to achieve successful market penetration and establish a substantial presence. The global RTD market is projected to continue its upward trajectory, with various reports indicating substantial growth rates in the coming years, underscoring the strategic importance of these ventures.

- Söhnlein Limo meets Secco: A new RTD concept blending a popular German wine brand with flavored lemonades, aiming for a younger, trend-conscious demographic.

- Regional Craft Spirit Ventures: Exploring partnerships or acquisitions in niche regional spirit categories, such as artisanal gin or specialty liqueurs, to diversify the portfolio.

- Focus on Sustainability: Innovations are also likely to incorporate sustainable sourcing and packaging, aligning with increasing consumer preferences for eco-friendly products.

- Market Entry Strategy: For these low-share, high-potential products, Henkell & Co. will likely employ aggressive marketing campaigns and targeted distribution to gain initial traction.

The Freixenet French Sparkling range, launched in 2024, is a prime example of a Question Mark within Henkell & Co. Sektkellerei KG's portfolio. It targets the growing premium sparkling wine segment, which saw global market projections exceeding $40 billion by 2025. Significant investment in marketing and distribution is vital for this range to increase its low market share and move towards Star status.

Similarly, the newly acquired Portuguese wine brands from VINICOM in 2024 are also categorized as Question Marks. Portugal's wine exports reached €1.1 billion in 2023, with sparkling wine showing strong growth potential. These brands require strategic development to gain traction in this expanding market.

Innovations like Freixenet Mía 0.0% low-sugar, low-calorie wines are positioned as Question Marks due to their minimal current market penetration, despite catering to a rapidly expanding health-conscious consumer trend. The global low-calorie beverage market, including wine, is expected to grow at over 5% annually, highlighting the potential for these products with targeted marketing and education.

Ready-To-Drink (RTD) innovations, such as the Söhnlein Limo meets Secco concept, also fall into the Question Mark category. These products tap into the growing demand for convenience, with the global RTD market projected for continued substantial growth. Aggressive marketing and targeted distribution are key for these low-share, high-potential ventures.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining Henkell & Co.'s financial data, industry research, and official reports to ensure reliable, high-impact insights.