Helios Technologies Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Helios Technologies Bundle

Helios Technologies operates in a dynamic market, facing moderate threats from new entrants and substitutes, while buyer and supplier power present significant considerations. Understanding these forces is crucial for navigating its competitive landscape.

The complete report reveals the real forces shaping Helios Technologies’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Helios Technologies' reliance on specialized components for its hydraulic and electronic solutions, such as cartridge valves and control systems, can significantly influence supplier bargaining power. If key suppliers offer unique or difficult-to-replicate parts, their leverage increases, especially if Helios has limited alternative sourcing options.

The market for critical components, particularly electrical, electronic, and semiconductor parts, has experienced volatility. For instance, the global semiconductor shortage that extended through much of 2022 and into 2023 demonstrated how supply chain disruptions can empower suppliers, leading to potential price hikes and extended lead times for companies like Helios.

Helios Technologies' global operations expose it to worldwide supply chain disruptions and component shortages, a situation that can significantly boost supplier leverage. For instance, the semiconductor industry, critical for many of Helios's products, faced widespread shortages in 2022 and 2023, with lead times for certain chips extending by over a year, directly impacting pricing and availability for manufacturers like Helios.

While Helios is actively pursuing strategies such as 'in the region, for the region' sourcing to buffer against these global volatility, the intricate nature of procuring highly engineered components globally means suppliers retain considerable influence. The complexity of ensuring consistent quality and availability for specialized electronic components, often sourced from a limited number of specialized manufacturers, inherently grants these suppliers bargaining power.

Original Equipment Manufacturers (OEMs) that rely on Helios Technologies for critical components often impose strict demands for high quality, competitive pricing, and punctual delivery. This pressure on Helios to consistently meet these rigorous standards can, in turn, bolster the leverage of Helios's own key suppliers who reliably fulfill these requirements, as they become indispensable to Helios's ability to satisfy its OEM customers.

Supplier Consolidation Trends

The fluid power industry is seeing a significant trend where manufacturers are aiming to become comprehensive 'one-stop parts shops.' This strategic shift means they offer a wider array of components, potentially consolidating the market.

This consolidation could result in fewer, but larger and more influential suppliers. Such a scenario would naturally increase their bargaining power when dealing with companies like Helios Technologies, as they would represent a more significant portion of the supply chain.

For instance, in 2024, the global fluid power market was valued at approximately $120 billion, with a projected compound annual growth rate (CAGR) of around 4.5% through 2030. This growth underscores the potential for major players to emerge and consolidate their positions, thereby enhancing their supplier leverage.

- Consolidation Strategy: Manufacturers increasingly offer a broad spectrum of fluid power components.

- Increased Supplier Power: Fewer, larger suppliers gain stronger negotiation leverage.

- Market Value: The global fluid power market reached roughly $120 billion in 2024.

- Growth Projection: Expected CAGR of 4.5% through 2030 indicates market expansion and consolidation opportunities.

Technological Advancements in Components

Suppliers leading in advanced materials and smart sensors for hydraulic and electronic systems can leverage their innovation to charge premium prices. Helios Technologies, with its focus on electro-hydraulic solutions, faces this dynamic, needing suppliers who can match its pace in developing cutting-edge technologies.

- Component Innovation: Suppliers at the vanguard of creating sophisticated components, such as advanced materials or intelligent sensors, can dictate higher pricing due to their unique capabilities.

- Helios's Strategic Needs: Helios Technologies' commitment to advancing its electro-hydraulic systems necessitates strong partnerships with suppliers who can provide the specialized components required for these high-tech applications.

- Supplier Leverage: The ability of suppliers to offer proprietary or significantly more efficient components grants them considerable bargaining power, potentially impacting Helios's cost structure.

Suppliers of specialized, difficult-to-source components for Helios Technologies, such as advanced control systems or unique hydraulic valves, wield significant bargaining power. This is particularly true when Helios has limited alternative suppliers, as demonstrated by the global semiconductor shortages experienced in 2022 and 2023, which saw lead times extend by over a year, impacting pricing and availability.

The trend toward market consolidation in the fluid power industry, with manufacturers aiming to become comprehensive suppliers, further concentrates power. This means fewer, larger suppliers can command greater leverage, especially given the global fluid power market's substantial value, estimated at around $120 billion in 2024, with a projected growth rate that encourages consolidation.

| Factor | Impact on Helios Technologies | Supplier Leverage |

| Component Specialization | Reliance on unique or proprietary parts | High |

| Alternative Sourcing Options | Limited availability of comparable suppliers | High |

| Supply Chain Disruptions (e.g., 2022-2023) | Extended lead times, increased costs for critical components | High |

| Industry Consolidation | Fewer, larger suppliers dominate the market | Increasing |

| Supplier Innovation (Advanced Materials/Sensors) | Need for cutting-edge components to match Helios's tech | High |

What is included in the product

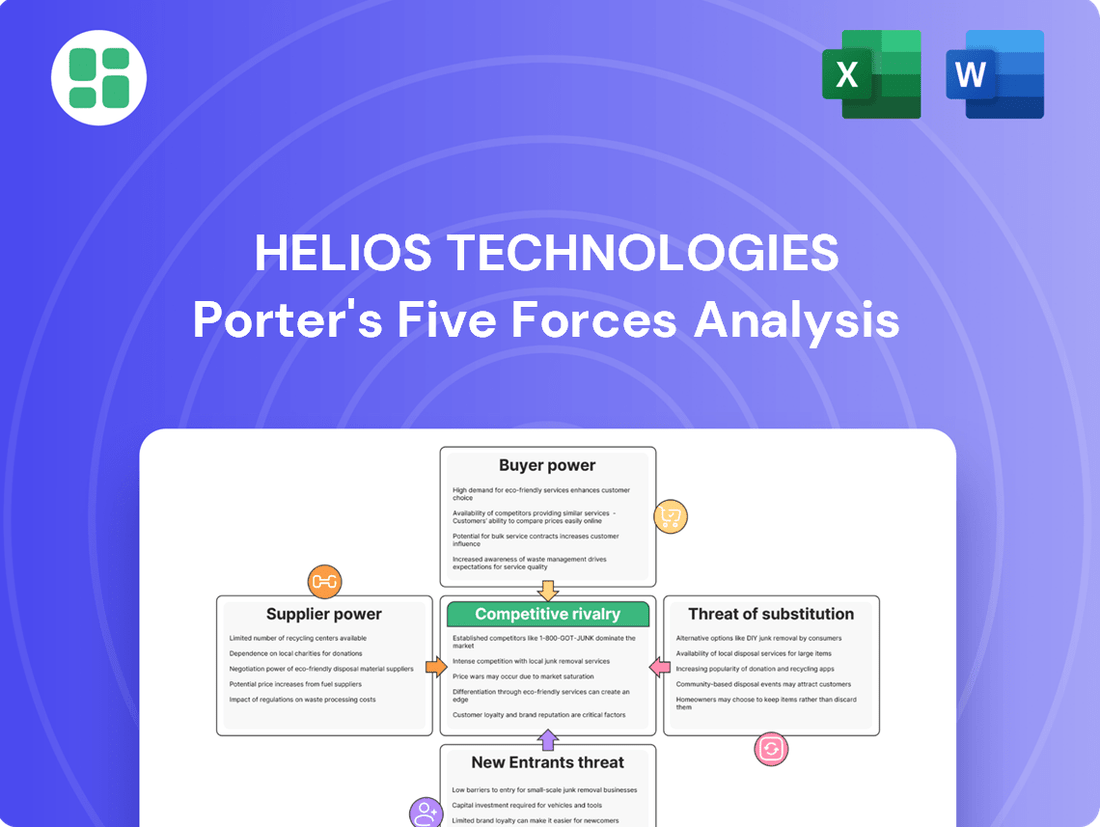

This analysis dissects the competitive forces impacting Helios Technologies, evaluating the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within its markets.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces.

Gain immediate clarity on strategic leverage points, allowing for proactive adjustments to market positioning.

Customers Bargaining Power

Helios Technologies operates across a broad spectrum of specialized industries, including agriculture, construction, material handling, recreational vehicles, marine, health and wellness, and energy. This wide reach means that no single customer segment holds significant sway over the company's pricing or terms.

While certain markets, like agriculture and mobile hydraulics, faced headwinds in 2024, Helios's exposure to growth areas such as health and wellness and the Asia-Pacific region offers a crucial buffer. This diversification inherently limits the bargaining power of any individual customer or customer group.

Helios Technologies' products are fundamental to fluid power and electronic control systems, driving crucial functionality in demanding industrial and mobile sectors. Their integral role means customers often depend on Helios for highly specialized, embedded solutions, which can lead to significant switching costs due to deep integration into existing machinery.

Helios Technologies' customer-centric strategy is a key factor in mitigating the bargaining power of customers. By actively engaging with clients to understand their evolving needs and aligning with their future technology roadmaps, Helios builds strong, collaborative relationships. This proactive approach aims to position Helios as an indispensable partner, offering leading technology solutions that address critical customer challenges, thereby reducing the likelihood of customers leveraging their power to demand lower prices or higher quality than can be profitably supplied.

Market Conditions and Volume Fluctuations

Helios Technologies experienced a notable dip in its hydraulics segment during 2024, primarily due to market softness in key areas like agriculture and industrial sectors. This weakness translates to a temporary increase in customer bargaining power.

When demand slackens and inventory levels rise, customers are in a stronger position to negotiate better terms. This was evident as Helios reported a sales decline in its hydraulics business, giving buyers more leverage.

- Sectoral Weakness: Agriculture and industrial markets faced downturns in 2024, impacting Helios's hydraulics sales.

- Increased Leverage: Reduced demand and potential overstocking by customers amplify their bargaining power.

- Negotiation Advantage: Customers can more effectively negotiate pricing and terms when facing suppliers with declining sales.

Global Reach and Niche Leadership

Helios Technologies' expansive presence across more than 90 countries significantly dilutes individual customer bargaining power. This widespread operation means that no single customer, or even a small group, represents a substantial portion of Helios's overall revenue, making it difficult for them to exert significant pressure on pricing or terms.

By focusing on leadership within specific niche markets, Helios further solidifies its position. The highly specialized and critical nature of its high-performance solutions means that customers often have few, if any, viable alternatives for their advanced application needs. This lack of substitutes directly reduces the bargaining power customers can wield.

- Global Footprint: Operating in over 90 countries limits the concentration of any single customer's influence.

- Niche Market Dominance: Helios's focus on specialized, high-performance solutions creates a barrier to entry for competitors, thereby reducing customer options.

- Limited Alternatives: The critical functionality of Helios's products in advanced applications means customers have fewer readily available substitutes, weakening their negotiating leverage.

Helios Technologies' broad geographical reach, serving over 90 countries, inherently limits the bargaining power of any single customer due to revenue diversification. Furthermore, their focus on niche markets with highly specialized, critical fluid power and electronic control solutions means customers often face significant switching costs and a lack of readily available alternatives, effectively reducing customer leverage.

However, Helios did experience increased customer bargaining power in its hydraulics segment during 2024 due to market softness in agriculture and industrial sectors. This downturn led to a sales decline, giving buyers more negotiation advantage.

Despite this, Helios's customer-centric approach, emphasizing collaborative relationships and technology alignment, aims to mitigate this power by making them an indispensable partner.

| Factor | Helios Technologies' Position | Impact on Customer Bargaining Power |

| Geographic Diversification | Operates in over 90 countries | Lowers power; no single customer dominates revenue |

| Market Specialization | Niche, high-performance solutions | Lowers power; limited substitutes, high switching costs |

| 2024 Market Conditions (Hydraulics) | Weakness in agriculture & industrial sectors | Increased power; sales decline grants negotiation advantage |

| Customer Strategy | Collaborative, technology-aligned partnerships | Lowers power; aims to be indispensable partner |

Preview the Actual Deliverable

Helios Technologies Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Helios Technologies, detailing the competitive landscape and strategic positioning of the company. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, offering actionable insights into industry rivalry, buyer and supplier power, threats of new entrants, and substitute products. Rest assured, there are no placeholders or generic content; you are viewing the complete, ready-to-use analysis that will be yours to download and leverage instantly.

Rivalry Among Competitors

Helios Technologies operates in a highly competitive global arena for motion control and electronic controls technology. Key rivals such as Bosch Rexroth, Parker Hannifin Corp, and Danfoss A/S possess significant market share and extensive product portfolios, directly challenging Helios across various segments. For instance, Parker Hannifin reported revenues of approximately $15.3 billion in 2023, underscoring its substantial global reach and competitive capacity.

The fluid power industry, encompassing hydraulics, faces inherent cyclicality. In 2024, the sector experienced a downturn, often described as a rolling recession, with particular weakness noted in segments like agriculture and mobile equipment. This market contraction naturally fuels competitive rivalry as companies vie more aggressively for a shrinking pool of business.

Competitive rivalry in the hydraulics sector is intense, fueled by a relentless pursuit of innovation. Companies are pouring resources into developing new products and enhancing existing ones, particularly in areas like digitalization, electrification, and smart hydraulics. This constant drive to stay ahead means that staying stagnant is not an option for any player in this market.

Helios Technologies positions itself as a leader through its deeply ingrained culture of innovation. The company boasts hundreds of active patents, a testament to its ongoing research and development efforts. Recent product introductions, such as the high-capacity electro-proportional flow control valves and the SenderCAN Plus, highlight Helios' commitment to delivering cutting-edge solutions to meet evolving market demands.

Operational Efficiency and Cost Control

In the face of a demanding market, intense competitive rivalry is increasingly centered on enhancing operational efficiency and meticulously managing costs. Helios Technologies has actively pursued these objectives, implementing strategies to drive efficiencies, control expenditures, and reduce its debt burden, all of which contribute to a more robust competitive standing.

Helios's commitment to these areas is reflected in its financial performance. For instance, in the first quarter of 2024, the company reported an adjusted gross profit margin of 38.5%, a testament to its cost control measures and operational streamlining. This focus allows them to better navigate pricing pressures and maintain profitability.

- Operational Efficiency Focus: Helios has prioritized streamlining its operations to reduce waste and improve throughput, directly impacting its ability to compete on price and service.

- Cost Management Initiatives: The company has implemented targeted cost reduction programs across various departments, aiming to lower the overall cost of goods sold and operating expenses.

- Margin Improvement: By controlling costs and optimizing operations, Helios is working to improve its gross and operating margins, providing greater financial flexibility and resilience.

- Debt Reduction Strategy: A key component of strengthening its competitive position involves actively reducing outstanding debt, which lowers interest expenses and enhances the company's financial stability.

Strategic Acquisitions and Market Diversification

Helios Technologies actively pursues strategic acquisitions to bolster its market position and broaden its offerings. This approach allows the company to integrate new technologies, gain access to diverse customer segments, and enter previously untapped markets, thereby enhancing its competitive resilience.

In 2024, Helios continued this strategy, focusing on niche markets where it aims for leadership through both organic innovation and targeted acquisitions. For instance, the company's expansion into advanced automation solutions through recent acquisitions in late 2023 and early 2024 demonstrates a clear effort to diversify its revenue streams and mitigate dependence on any single industry segment.

- Acquisition Focus: Helios targets companies that enhance its capabilities in high-growth niche markets.

- Diversification Strategy: Acquisitions aim to broaden the customer base and reduce exposure to market cyclicality.

- Market Entry: Strategic purchases facilitate entry into new and adjacent end markets.

- Competitive Impact: This aggressive acquisition strategy intensifies rivalry by consolidating market share and technological expertise.

The competitive rivalry within the motion control and electronic controls sector is fierce, with established players like Bosch Rexroth, Parker Hannifin, and Danfoss posing significant challenges to Helios Technologies. These competitors boast substantial market presence and comprehensive product lines, directly impacting Helios's market share across various segments. For example, Parker Hannifin's 2023 revenue of approximately $15.3 billion highlights its considerable global reach and competitive strength, intensifying the pressure on Helios to innovate and maintain efficiency.

The intensity of competition is further amplified by the inherent cyclicality of the fluid power industry. In 2024, the sector experienced a notable downturn, often characterized as a rolling recession, with particular softness observed in agricultural and mobile equipment markets. This contraction naturally escalates competitive rivalry as companies fight more aggressively for a reduced volume of available business.

| Competitor | Approximate 2023 Revenue (USD Billions) | Key Areas of Competition |

|---|---|---|

| Bosch Rexroth | Not publicly disclosed as a standalone entity for 2023, but parent Bosch Group reported €91.6 billion in 2023. | Hydraulics, Electric Drives & Controls, Automation |

| Parker Hannifin Corp | $15.3 | Hydraulic and Pneumatic Systems, Filtration, Instrumentation |

| Danfoss A/S | €10.1 (approx. $10.9 billion based on average 2023 exchange rates) | Variable Frequency Drives, Compressors, Hydraulic Systems |

SSubstitutes Threaten

The electrification of fluid power systems poses a threat of substitution, especially in mobile machinery and off-highway vehicles. While complete replacement of traditional hydraulics isn't imminent for high-power needs, electro-hydraulic systems offer a compelling alternative, blending power density with improved efficiency. This trend suggests that components solely reliant on traditional hydraulics might face reduced demand as electrified solutions become more prevalent and cost-effective.

The increasing integration of digital technologies like IoT sensors and advanced data analytics into hydraulic systems presents a significant threat of substitution. These smart technologies allow for real-time monitoring and predictive maintenance, offering enhanced efficiency and control that basic hydraulic components may lack. For instance, in the industrial automation sector, which heavily relies on hydraulics, the adoption of Industry 4.0 principles means that older, less connected hydraulic systems are increasingly being replaced by newer, digitally enabled ones. This shift is driven by the promise of reduced downtime and optimized performance, making traditional hydraulics a less attractive option for new investments.

While fluid power is Helios Technologies' core, alternative motion control technologies like purely mechanical or electric actuation systems do exist. These can substitute for fluid power in some scenarios, offering different benefits like precision or energy efficiency. However, Helios often targets demanding, critical applications where its engineered fluid power solutions provide superior force, speed, and durability that simpler alternatives struggle to match.

Sustainability-Driven Alternatives

The growing focus on sustainability and stricter environmental regulations are significantly boosting the demand for energy-efficient hydraulic systems and eco-friendly hydraulic fluids. This trend directly encourages the creation and use of alternative materials and system designs that reduce environmental harm, posing a threat to less sustainable hydraulic solutions.

For instance, the global market for bio-based hydraulic fluids, a key sustainability-driven alternative, was valued at approximately $1.5 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 6% through 2030. This indicates a clear shift towards greener options that could displace traditional petroleum-based fluids. Helios Technologies, like other players in the industry, faces pressure to innovate in this area to remain competitive.

- Growing Demand for Energy Efficiency: Increased regulatory pressure and corporate sustainability goals are driving the adoption of hydraulic systems designed for lower energy consumption, potentially substituting older, less efficient models.

- Rise of Bio-based Hydraulic Fluids: The market for environmentally friendly hydraulic fluids is expanding, offering alternatives to conventional mineral oil-based products due to concerns about biodegradability and toxicity.

- Innovation in System Design: Manufacturers are exploring novel hydraulic system architectures and materials that minimize leakage and waste, presenting substitutes for traditional, less optimized designs.

- Circular Economy Initiatives: Efforts to implement circular economy principles in manufacturing could lead to the development of reusable or recyclable hydraulic components, offering an alternative to single-use or difficult-to-recycle parts.

Cross-Industry Technological Convergence

Cross-industry technological convergence, especially with Industry 4.0, presents a significant threat of substitutes for Helios Technologies. As sectors increasingly adopt automation and digital integration, solutions from disparate fields are emerging to fulfill similar functions. For instance, advanced robotics and sophisticated integrated control systems can now offer alternatives to traditional hydraulic or electronic components, directly impacting Helios's core offerings.

This convergence means that a problem Helios solves with one type of technology might soon be addressed by a combination of technologies from entirely different industries. For example, the demand for precise motion control in manufacturing, a key area for Helios, could increasingly be met by novel electro-mechanical actuators or advanced pneumatic systems that bypass traditional hydraulic solutions. The global robotics market alone was valued at approximately $50 billion in 2023 and is projected to grow significantly, indicating a substantial shift in available alternatives.

- Cross-Industry Convergence: Technologies from diverse sectors like robotics, AI, and IoT are merging to create new solutions.

- Indirect Substitution: Advanced robotics and integrated control systems can now perform tasks traditionally handled by Helios's hydraulic or electronic components.

- Market Impact: The growing robotics market, valued at around $50 billion in 2023, highlights the increasing availability of alternative technologies.

The threat of substitutes for Helios Technologies' fluid power solutions is multifaceted, encompassing electrification, digital integration, and alternative motion control technologies. Electrification, particularly in mobile machinery, offers a pathway to reduced reliance on traditional hydraulics, while smart technologies enhance efficiency and control, making basic hydraulic components less appealing. Furthermore, cross-industry convergence, driven by Industry 4.0, introduces advanced robotics and integrated control systems as viable alternatives for tasks previously dominated by hydraulics.

| Technology Area | Key Substitute Trend | Market Impact/Data Point (2023/2024) | Implication for Helios |

|---|---|---|---|

| Electrification | Electro-hydraulic systems, battery-powered actuation | Global electric vehicle market share expected to reach ~20% by end of 2024. | Potential reduction in demand for pure hydraulic components in mobile applications. |

| Digital Integration | IoT sensors, predictive maintenance, AI-driven control | Industrial IoT market projected to exceed $100 billion in 2024. | Need for Helios to integrate smart capabilities to remain competitive against digitally native solutions. |

| Alternative Motion Control | Advanced robotics, electro-mechanical actuators | Global robotics market valued at approximately $50 billion in 2023. | Direct competition for precise motion control applications. |

| Sustainability | Bio-based hydraulic fluids, energy-efficient designs | Bio-based hydraulic fluid market ~$1.5 billion in 2023, growing at ~6% CAGR. | Pressure to innovate with eco-friendly and energy-saving solutions. |

Entrants Threaten

The motion control and electronic controls technology sector, where Helios Technologies operates, demands considerable upfront capital. Newcomers must invest heavily in cutting-edge research and development to innovate, establish sophisticated manufacturing plants, and acquire specialized, often custom-built, machinery. For instance, the development cycle for advanced servo drives or complex control systems can easily run into millions of dollars before a single unit is produced.

The intricate fusion of hydraulics and electronics in advanced systems like those developed by Helios Technologies creates a significant barrier to entry. Newcomers must possess not only specialized knowledge but also substantial investment in research and development to replicate such sophisticated designs.

Helios's proprietary cartridge valve technology, for instance, exemplifies this hurdle. Its unique design platform and the complex machining required to produce it demand a high level of engineering acumen and manufacturing precision that is difficult and costly for new companies to acquire, especially in a market where innovation is key.

Helios Technologies benefits from a formidable shield of intellectual property, including hundreds of active and recently filed patents and trademarks. This extensive IP portfolio, along with protected trade secrets, makes it exceptionally challenging for potential competitors to enter the market by replicating Helios's established products or technologies without facing legal infringement issues.

Established Customer Relationships and Distribution Channels

Helios Technologies benefits from deeply entrenched customer relationships, particularly with original equipment manufacturers (OEMs) across various sectors. New entrants face a significant hurdle in replicating this trust and the extensive global sales infrastructure Helios has cultivated over years of operation. It takes substantial time and capital investment to build comparable distribution networks and achieve the level of market penetration Helios enjoys.

For instance, Helios's reach extends to over 90 countries, underscoring the global complexity new competitors must navigate. Establishing the necessary market presence and securing OEM partnerships is a formidable barrier.

- Global Reach: Helios operates in over 90 countries, demonstrating a significant global distribution and service network.

- OEM Relationships: Long-standing partnerships with OEMs across diverse end markets are a key competitive advantage.

- High Entry Costs: Building comparable trust, distribution networks, and global sales infrastructure is both time-consuming and capital-intensive for new entrants.

Economies of Scale and Cost Advantages of Incumbents

Existing players in the industrial technology sector, such as Helios Technologies, often possess significant economies of scale. This advantage translates into lower per-unit costs across manufacturing, procurement of raw materials, and research and development investments. For instance, in 2024, the industrial automation market saw continued price pressures due to a slight softening in demand, making it even harder for newcomers to match the cost efficiencies of established firms.

These cost advantages create a substantial barrier for new entrants. A new company would need to invest heavily to achieve comparable production volumes and efficiency levels, a feat that is particularly daunting when facing incumbents that can leverage their scale to offer more competitive pricing. This dynamic limits the threat of new entrants by making it economically unviable for them to enter and compete effectively from day one.

- Economies of Scale: Helios benefits from reduced per-unit costs in production and R&D.

- Cost Advantages: Incumbents can offer lower prices, challenging new entrants.

- 2024 Market Conditions: A softer market in 2024 amplified these cost-based barriers.

The threat of new entrants for Helios Technologies is considerably low due to substantial capital requirements, the need for specialized expertise, and the protection offered by intellectual property. Building the necessary R&D capabilities and manufacturing infrastructure to compete in motion control and electronic controls technology demands millions in upfront investment.

Helios's proprietary technologies and extensive patent portfolio create a significant hurdle for newcomers looking to replicate their product offerings. Furthermore, established OEM relationships and a global distribution network, spanning over 90 countries, are difficult and costly to replicate, reinforcing Helios's market position.

Economies of scale enjoyed by Helios also present a cost barrier, particularly in the competitive industrial automation market of 2024, where price efficiencies are critical. New entrants struggle to match the per-unit cost advantages that established players like Helios leverage.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Helios Technologies is built upon a foundation of comprehensive data, including Helios's annual reports, investor presentations, and SEC filings. We also leverage industry-specific market research reports and data from reputable financial information providers to ensure a robust understanding of the competitive landscape.