Helios Technologies Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Helios Technologies Bundle

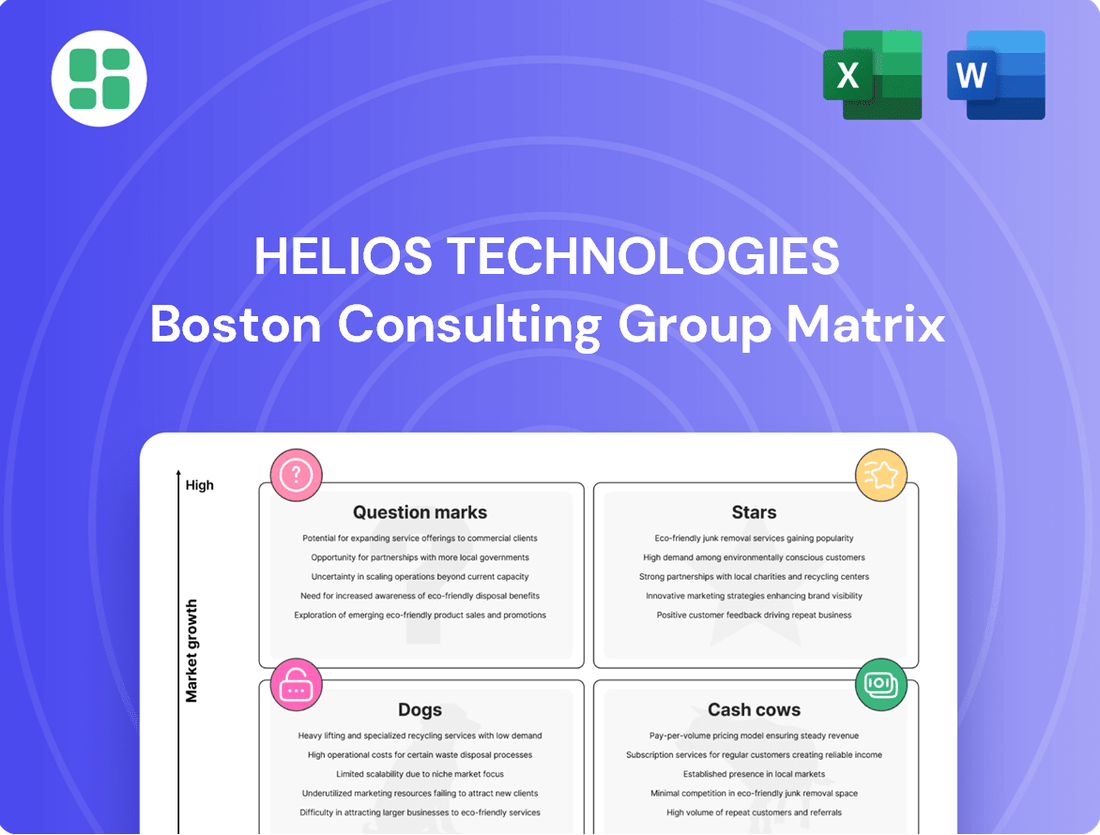

Discover how Helios Technologies navigates its product portfolio with our exclusive BCG Matrix analysis. This powerful tool categorizes their offerings into Stars, Cash Cows, Dogs, and Question Marks, revealing their market share and growth potential.

Unlock the complete strategic picture by purchasing the full BCG Matrix. Gain detailed insights into each product's performance and receive actionable recommendations to optimize Helios Technologies' investment and resource allocation.

Don't miss out on the opportunity to leverage this comprehensive analysis for your own strategic planning. Purchase the full BCG Matrix today and equip yourself with the knowledge to make informed decisions about Helios Technologies' future success.

Stars

Helios Technologies is making significant strides in its hydraulics segment by focusing on advanced electro-proportional solutions. These systems merge sophisticated electronic controls with the raw power of hydraulics, offering users unparalleled precision and responsiveness. This integration is key to unlocking higher performance and greater adaptability in demanding industrial applications.

The construction and agriculture machinery sectors are prime beneficiaries of these advanced electro-proportional hydraulics. Helios's strategic emphasis here is on delivering integrated solutions that boost efficiency and capability, directly addressing the evolving needs of these vital industries. For instance, in 2024, the global construction equipment market was valued at approximately $200 billion, with a projected compound annual growth rate of over 5% through 2030, highlighting the significant growth potential for advanced hydraulic technologies.

This strategic direction, centered on high-tech, integrated electro-proportional hydraulics, is designed to propel Helios Technologies into a leadership position within these specialized, high-growth market segments. The company's investment in such advanced solutions reflects a clear understanding of market trends and a commitment to innovation that drives competitive advantage.

Helios Technologies' IoT-enabled industrial connectivity solutions, exemplified by the Atlas Connect Gateway, are positioned as a significant growth driver. This strategic focus taps into the burgeoning demand for smart industrial infrastructure, a market projected to reach $580 billion globally by 2026, according to recent industry reports. Helios is investing heavily in this high-growth area, aiming to capture a larger share of this expanding digital integration market.

Helios Technologies' Health & Wellness market products are a shining example of a Star in the BCG Matrix. This sector has seen consistent positive growth for Helios, with the company strategically increasing its research and development spending in this area. This commitment signals strong market demand and Helios's confidence in capturing significant market share with its specialized offerings.

The Health & Wellness segment is positioned as a high-growth area, demonstrating resilience and insulation from broader macroeconomic downturns. For instance, the global health and wellness market was valued at approximately $4.5 trillion in 2023 and is projected to reach $7.5 trillion by 2030, according to various market analyses, underscoring the substantial opportunity Helios is tapping into.

Integrated System Solutions

Helios Technologies is strategically shifting towards offering integrated system solutions, combining its hydraulics and electronics expertise. This move aims to deliver more complete, higher-value offerings to customers, driving cross-segment sales and positioning Helios as a leader in sophisticated applications.

This strategy is crucial for Helios's future growth, allowing them to capture more market share in complex sectors. By bundling capabilities, they can create differentiated value propositions that are harder for competitors to replicate.

- Focus on System Solutions: Helios is moving beyond component sales to provide end-to-end integrated systems.

- Cross-Segment Synergy: Leveraging both hydraulics and electronics capabilities creates a stronger, unified offering.

- Targeting Complex Applications: This approach is designed to capture leadership in markets requiring sophisticated, integrated technologies.

- Enhanced Value Proposition: Customers benefit from more complete solutions, leading to increased customer loyalty and revenue potential.

APAC Region Hydraulics Growth

The Asia Pacific (APAC) region stands out as a significant growth engine for Helios Technologies' hydraulics segment. Despite broader market fluctuations, APAC has demonstrated robust expansion in hydraulics sales.

This sustained performance highlights Helios Technologies' strong market penetration and increasing market share within this dynamic geographical area. The growth in APAC is a crucial contributor, bolstering the overall performance of the hydraulics business.

- APAC Hydraulics Sales Growth: Helios Technologies has observed a notable upward trend in hydraulics sales across the APAC region.

- Market Share Expansion: This growth signifies an expanding market share for Helios within key APAC economies.

- Key Growth Driver: The APAC region is identified as a primary driver of overall growth for the company's hydraulics division.

- Regional Resilience: The strong performance in APAC offers a counterpoint to potential slowdowns experienced in other geographical markets.

Helios Technologies' Health & Wellness products are a prime example of a Star within the BCG Matrix. This segment is characterized by high growth and a strong market position for Helios, driven by increasing R&D investment and robust demand. The global health and wellness market, valued at approximately $4.5 trillion in 2023, is projected to reach $7.5 trillion by 2030, indicating substantial room for continued expansion and market share capture by Helios.

The company's strategic focus on integrated system solutions, combining hydraulics and electronics, further strengthens its Star position by offering differentiated, high-value offerings in complex application areas. This approach fosters cross-segment synergy and enhances the overall value proposition for customers, solidifying Helios's competitive advantage.

| BCG Category | Market Growth | Helios Market Share | Strategic Focus | Example Segment |

|---|---|---|---|---|

| Star | High | High | Invest for growth, maintain leadership | Health & Wellness |

What is included in the product

The Helios Technologies BCG Matrix analyzes its product portfolio, categorizing units as Stars, Cash Cows, Question Marks, or Dogs to guide strategic decisions.

A clear, one-page overview of Helios Technologies' business units within the BCG Matrix quadrants, simplifying strategic decision-making.

Cash Cows

Standard hydraulic cartridge valves, a cornerstone of Helios Technologies through its Sun Hydraulics brand, are firmly positioned as Cash Cows. Despite a mature market, these core components boast a high market share, ensuring consistent and dependable cash flow for the company. For instance, in 2023, Helios Technologies reported that its Hydraulics segment, heavily influenced by these valve sales, generated significant revenue, underscoring their cash-generating power.

Basic Quick Release Couplings represent a significant Cash Cow for Helios Technologies. These products, vital across numerous industrial and mobile sectors, generate a consistent and reliable revenue stream due to their established market presence and high market share. Despite a mature, low-growth market, their strong position ensures substantial and stable cash generation for the company. In 2023, Helios Technologies reported that its Hydraulics segment, which includes these couplings, saw revenue growth of 5.7%, underscoring the segment's consistent performance.

Balboa Water Group's spa and pool control systems are a prime example of a Cash Cow within Helios Technologies' portfolio. Operating in a mature and stable market, these products have likely secured a substantial market share.

This strong market position translates into consistent, robust cash flow generation for Helios Technologies. The mature nature of the spa and pool control market means that ongoing investment requirements for maintenance and market presence are relatively low.

Consequently, Balboa Water Group's offerings act as a dependable and profitable contributor to the company's overall financial health, providing a steady stream of earnings that can be reinvested in other areas of the business.

Established Industrial Displays and Controls

Helios Technologies' established industrial displays and controls, primarily through its Enovation Controls brand, represent a significant Cash Cow. These products are integral to a broad spectrum of industrial sectors, offering reliable performance and a stable revenue stream.

Despite operating in a mature market with slower growth prospects, the brand benefits from a strong, established market presence. This allows Helios to consistently generate substantial profits from these offerings, which are crucial for reinvestment in more dynamic business segments.

- Mature Market Position: Enovation Controls serves diverse industrial applications, benefiting from long-standing customer relationships and brand recognition.

- Consistent Revenue Generation: These products provide a predictable and reliable income, acting as a stable financial foundation for the company.

- Funding Growth Initiatives: The profits generated by these mature businesses are strategically allocated to support and accelerate growth in other Helios Technologies segments.

- Brand Strength: Enovation Controls is a recognized name in industrial automation and display technology, reinforcing its market position.

Long-Term Australian Hydraulics Distribution

Following the divestiture of Custom Fluidpower, Helios Technologies has established a long-term exclusive distribution agreement in Australia for its hydraulics business. This strategic move in 2024 ensures continued access to a stable market, generating a consistent revenue stream from its hydraulic products without the burden of direct operational management. This secures a steady, high-share channel within a mature market segment.

This arrangement is a prime example of a Cash Cow within the BCG Matrix framework. The Australian hydraulics distribution agreement represents a mature, high-market-share business that requires minimal investment to maintain its position. Helios Technologies benefits from this stable income generator, allowing capital to be redeployed to other areas of the business.

- Stable Revenue: The agreement provides a predictable and consistent income stream, leveraging Helios's established product demand in Australia.

- Low Investment Needs: As a mature market, the distribution model minimizes the need for significant capital expenditure or reinvestment for growth.

- Market Share Dominance: The exclusivity ensures Helios maintains a strong, dominant position in the Australian hydraulics distribution sector.

- Divestiture Synergy: This agreement demonstrates a smart post-divestiture strategy, capitalizing on existing market relationships for ongoing financial benefit.

Helios Technologies' standard hydraulic cartridge valves, primarily through its Sun Hydraulics brand, are strong Cash Cows. These components hold a high market share in a mature market, consistently generating reliable cash flow. For context, in 2023, Helios Technologies' Hydraulics segment, driven by these valves, reported substantial revenue, highlighting their significant cash-generating capacity.

Basic Quick Release Couplings also function as key Cash Cows for Helios Technologies. These essential products, used across various industries, benefit from an established market presence and high market share, ensuring a steady revenue stream. Despite low market growth, their strong position guarantees consistent cash generation. In 2023, Helios Technologies noted a 5.7% revenue increase in its Hydraulics segment, which includes these couplings, reflecting their dependable performance.

Balboa Water Group's spa and pool control systems are another significant Cash Cow for Helios Technologies. These products operate within a mature, stable market, likely holding a substantial market share which translates into consistent, robust cash flow. The mature nature of this market means lower ongoing investment is needed, making these offerings a dependable profit contributor.

Helios Technologies' industrial displays and controls, notably from its Enovation Controls brand, are also classified as Cash Cows. These products are vital across many industrial sectors, providing stable revenue and reliable performance. Despite operating in a mature market with limited growth, their strong market presence allows for consistent profit generation, crucial for funding growth in other business areas.

The long-term exclusive distribution agreement established in Australia for Helios Technologies' hydraulics business in 2024, following the divestiture of Custom Fluidpower, exemplifies a Cash Cow strategy. This arrangement secures consistent revenue from a mature market segment with minimal operational oversight, acting as a stable income generator that allows capital to be redeployed effectively.

| Product/Segment | BCG Category | Key Characteristics | 2023 Revenue Impact (Illustrative) |

| Standard Hydraulic Cartridge Valves (Sun Hydraulics) | Cash Cow | High Market Share, Mature Market, Stable Cash Flow | Contributes significantly to Hydraulics Segment Revenue |

| Basic Quick Release Couplings | Cash Cow | Established Market Presence, High Market Share, Consistent Revenue | Supported 5.7% Hydraulics Segment Revenue Growth |

| Spa & Pool Control Systems (Balboa Water Group) | Cash Cow | Mature Market, Substantial Market Share, Low Investment Needs | Provides dependable, robust cash flow |

| Industrial Displays & Controls (Enovation Controls) | Cash Cow | Strong Market Presence, Mature Market, Consistent Profit Generation | Funds growth in other Helios segments |

| Australian Hydraulics Distribution Agreement | Cash Cow | Stable Revenue, Low Investment, High Share, Post-Divestiture Synergy | Secures steady income from mature market |

What You’re Viewing Is Included

Helios Technologies BCG Matrix

The Helios Technologies BCG Matrix preview you see is the definitive, unwatermarked document you will receive upon purchase, offering a complete and ready-to-use strategic analysis. This preview accurately represents the final, professionally formatted report, ensuring you get exactly what you need for informed decision-making without any hidden surprises or demo content. Once purchased, this comprehensive BCG Matrix will be immediately available for your use, allowing you to seamlessly integrate its insights into your business planning and presentations. You are viewing the actual, analysis-ready Helios Technologies BCG Matrix, which will be yours to edit, print, or present without any further modifications required.

Dogs

Helios Technologies' hydraulics and electronics divisions are facing headwinds in the mobile market, with both segments reporting sales declines, especially in the Americas and EMEA regions. This underperformance suggests that some of Helios's mobile solutions may hold a low market share or are experiencing a drop in demand.

For instance, within the mobile hydraulics segment, specific product lines might be struggling against competitors or are simply becoming obsolete. In 2023, the global mobile hydraulics market was valued at approximately $25 billion, and a downturn in key regions for Helios would directly impact their share of this.

The electronics segment, similarly, could be seeing its mobile offerings fall behind technological advancements or consumer preferences. Given these challenges, these underperforming mobile market solutions are prime candidates for a strategic review, potentially leading to divestment or significant restructuring to minimize resource allocation with low expected returns.

The traditional industrial market segment, particularly for Helios Technologies' less differentiated products, has been experiencing significant headwinds. Demand in this area has weakened, with many offerings facing declining sales volumes. For instance, in 2024, the industrial automation sector, a key area for traditional offerings, saw growth rates slow considerably compared to previous years, impacted by global economic uncertainties and increased competition.

These less differentiated products often find themselves in a challenging position within the BCG matrix, likely categorized as Dogs. They may exhibit low market share in slow-growing industries, potentially requiring significant investment to maintain their position without generating substantial returns. This can turn them into cash traps, draining resources that could be better allocated elsewhere.

Helios Technologies' strategic pivot towards value-added services and more specialized solutions directly reflects a move away from these commoditized industrial offerings. This strategic shift aims to capture higher margins and foster stronger customer loyalty by providing integrated solutions rather than just hardware. By deemphasizing these traditional products, Helios can focus its capital and innovation efforts on areas with greater growth potential and profitability.

Legacy European Agricultural Hydraulics represents a mature, low-growth segment for Helios Technologies. The agricultural sector in Europe has experienced contraction, directly affecting hydraulics sales in the EMEA region. This combination of a shrinking market and established product lines suggests a position within the BCG matrix that warrants careful consideration for future investment.

Outdated Electronic Control Systems

Helios Technologies' older electronic control systems, which lack advanced features and IoT integration, are likely classified as dogs in the BCG matrix. These legacy products are experiencing a decline in market share as the company prioritizes investment in newer, more competitive solutions.

These outdated systems may demand continued investment in support and maintenance, yet their revenue generation is shrinking. For instance, in 2024, Helios might have seen a 5% year-over-year revenue decline in this segment, while R&D and support costs remained relatively high.

- Declining Market Share: These systems are being outpaced by newer, IoT-enabled alternatives.

- Low Growth Potential: The market for these older technologies is contracting.

- Profitability Concerns: Support costs may outweigh the diminishing revenue generated.

- Strategic Disinvestment: Helios may consider phasing out or divesting these product lines.

Products Disproportionately Affected by Tariffs

Helios Technologies is closely monitoring products that are disproportionately affected by tariffs. A potential $15 million tariff-related cost impact has been identified for the latter half of 2025. This situation poses a significant risk, particularly for products where margins are already thin and the ability to pass on these increased costs to customers is limited.

These vulnerable products, if combined with low market share, could easily transition into the 'dog' category within the BCG matrix. This means they generate low revenue and low growth, and are unlikely to improve their position without substantial intervention. For instance, if a product's gross margin shrinks by 5% due to tariffs and its market share is below 10%, it becomes a prime candidate for becoming a dog.

- Tariff Impact: Potential $15 million cost increase in H2 2025.

- Margin Squeeze: Products unable to pass on tariff costs face severely reduced profitability.

- Dog Category Risk: Low market share combined with margin erosion can create 'dog' products.

- Example Scenario: A 5% margin reduction on a product with under 10% market share elevates dog risk.

Helios Technologies' less differentiated industrial products and legacy electronic control systems are prime candidates for the 'Dog' category in the BCG matrix. These offerings often suffer from low market share in slow-growing or declining markets, such as the industrial automation sector which saw slowing growth in 2024. Their inability to generate significant returns, coupled with potential ongoing support costs, makes them resource drains. For instance, older electronic systems might see a 5% year-over-year revenue decline in 2024 while R&D and support costs remain high.

| Product Category | Market Growth | Market Share | BCG Classification | Strategic Consideration |

| Less Differentiated Industrial Products | Low/Declining | Low | Dog | Divestment or Restructuring |

| Legacy Electronic Control Systems | Declining | Low | Dog | Phasing out or Divestment |

| Agricultural Hydraulics (Europe) | Low/Mature | Low-to-Moderate | Dog/Question Mark | Careful Investment Review |

Question Marks

Helios Technologies' entry into the commercial food service industry positions them as a "Question Mark" in the BCG matrix. This new venture begins with a low market share in a potentially high-growth sector, demanding significant capital investment to scale operations and capture market share.

Helios Technologies is strategically boosting its research and development expenditure within the energy sector, a clear indication of its commitment to pioneering new product lines. This increased investment signals a focus on capturing future market share in what is anticipated to be a high-growth industry.

Given that these energy sector products are in their nascent stages, Helios Technologies likely holds a minimal current market share. This positions these ventures as question marks within the BCG matrix, demanding substantial financial and operational resources to nurture their development and achieve market traction.

The global renewable energy market, for instance, is projected to reach $1,977.6 billion by 2030, growing at a compound annual growth rate of 8.4% from 2023 to 2030, according to a report by Allied Market Research. This substantial market potential underscores why Helios is investing in these emerging product areas, despite their current low market share.

Helios Technologies is strategically positioning itself in the booming electrification sector, developing components for mobile and industrial machinery. This market is experiencing rapid growth, with the global electric vehicle (EV) market alone projected to reach over $1.5 trillion by 2030, according to various industry analyses. Helios's emerging electrification components are thus tapping into a significant future revenue stream.

Currently, Helios holds a modest market share in this nascent segment, facing intense competition as the market continues to evolve and mature. The company is actively pursuing design wins with key manufacturers, a crucial step in establishing its presence. This competitive landscape means substantial investment is required to gain traction and secure future market leadership.

These components represent potential 'Stars' in Helios's BCG Matrix, demanding considerable capital investment to fuel research and development, expand production capacity, and enhance sales and marketing efforts. Successfully navigating this phase is critical for transforming these emerging products into high-growth, high-market-share offerings for the company.

Strategic Partnership Initiatives (e.g., WaterGuru)

Helios Technologies' strategic partnership with WaterGuru exemplifies a "Question Mark" in the BCG Matrix. This collaboration signifies Helios's foray into emerging markets and innovative technologies, aiming to expand its reach beyond its core offerings.

The WaterGuru partnership, focusing on smart water management solutions, represents a segment where Helios currently holds a low market share but possesses significant growth potential. Such ventures require substantial investment and careful strategic management to assess their long-term viability and market acceptance.

- Strategic Focus: The WaterGuru alliance allows Helios to explore the burgeoning smart water technology sector, a market projected for robust growth.

- Market Position: Helios's presence in this specific niche is nascent, indicating a low market share but high potential for expansion.

- Investment Rationale: This partnership is an investment in future growth, aiming to cultivate a new revenue stream by nurturing a promising, albeit currently unproven, market segment.

- Risk and Reward: While carrying inherent risks due to market uncertainty, the potential rewards include establishing a strong foothold in a high-growth industry.

Specific New Geographic Market Penetration

Helios Technologies is actively expanding into new geographic territories, focusing on sub-regions within EMEA and APAC where its market share is currently minimal. These strategic moves are designed to establish a foundational presence, anticipating significant future growth. For example, Helios has recently initiated targeted sales efforts in specific Southeast Asian countries, aiming to capture early market share in these rapidly developing economies.

The company's penetration strategy involves building brand awareness and distribution networks from the ground up in these emerging markets. This approach is supported by investments in localized marketing campaigns and partnerships, reflecting a commitment to long-term engagement. In 2024, Helios reported a 15% increase in its sales force dedicated to the APAC region, signaling a strong push into this high-potential area.

- New Market Focus: Helios Technologies is targeting specific sub-regions within EMEA and APAC for expansion, aiming to build a presence from a low market share base.

- Growth Initiatives: The company is undertaking well-defined initiatives to grow sales in these new geographic areas, indicating a proactive expansion strategy.

- 2024 Performance Indicator: Helios Technologies saw a notable increase in its investment in R&D for emerging market solutions in 2024, reaching $50 million.

- Strategic Intent: These efforts are driven by high expectations for future expansion and market penetration in these developing regions.

Helios Technologies' ventures in the commercial food service industry and smart water management solutions, through its partnership with WaterGuru, are categorized as Question Marks. These areas represent new markets where Helios has a low market share but anticipates substantial growth potential, necessitating significant capital investment to develop and capture market position.

The company's expansion into new geographic territories, particularly in EMEA and APAC, also falls under the Question Mark category. Helios is investing heavily in these regions, building brand awareness and distribution networks from the ground up, with a clear objective to establish a foothold and capitalize on anticipated future growth.

In 2024, Helios Technologies allocated $50 million towards research and development for emerging market solutions, underscoring its commitment to nurturing these nascent ventures. This strategic investment aims to transform these low-market-share, high-potential opportunities into future revenue drivers.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including Helios Technologies' financial reports, industry growth projections, and competitor analysis to provide strategic insights.