H-E-B Grocery Company SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

H-E-B Grocery Company Bundle

H-E-B's strong brand loyalty and extensive Texas presence are significant strengths, while their dependence on a single geographic region presents a notable weakness. Opportunities lie in expanding their private label offerings and leveraging technology for enhanced customer experiences. The competitive grocery landscape and evolving consumer preferences pose key threats.

Want the full story behind H-E-B's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

H-E-B's market dominance in Texas is a significant strength, with the company holding close to 50% of the market share in South Texas. This regional power contributes to its substantial presence in the overall U.S. grocery market, estimated at around 14% as of 2025.

Exceptional customer service and a strong emotional connection with shoppers fuel this market leadership. H-E-B boasts a high Net Promoter Score (NPS) of 63 and an impressive 92% customer loyalty, underscoring the effectiveness of its customer-centric approach.

The company's consistent recognition as a top U.S. grocery retailer further validates its market strength. Notably, H-E-B has been named the No. 1 U.S. grocery retailer in the dunnhumby Retailer Preference Index for three consecutive years, a testament to its enduring appeal and operational excellence.

H-E-B's robust private label strategy is a cornerstone of its success, driving 19% of total sales. This focus on own-brand products not only boosts gross margins but also significantly enhances overall profitability.

Customers consistently view H-E-B's private label items as offering exceptional quality at a compelling value, often surpassing the perceived value of competitors like Aldi. This strong customer perception translates directly into loyalty and increased basket sizes.

The company's commitment to its private label segment is evident in its ongoing expansion efforts. H-E-B plans to introduce over 100 new private label Stock Keeping Units (SKUs) by the close of 2024, further diversifying its offerings and meeting evolving consumer demands.

H-E-B boasts an extensive and strategic Texas footprint, operating over 435 stores across the state and Mexico. This physical presence is particularly strong in rapidly growing metropolitan areas such as Austin and Dallas-Fort Worth, demonstrating a keen understanding of market dynamics.

The company's commitment to expansion is evident in its planned investment of over $1 billion in Texas for 2024. This significant capital allocation will fuel the opening of 9 new stores, adding more than 1 million square feet of retail space and reinforcing its dominant regional position.

H-E-B's strategic expansion also involves introducing diverse store formats, including Fresh Bites and Joe V's Smart Shop. This approach allows the company to effectively cater to a wider range of customer preferences and needs, further solidifying its stronghold within Texas.

Commitment to Community Engagement

H-E-B's deep roots in Texas translate into a powerful commitment to community engagement, making it a cornerstone of its operational strength. This dedication goes beyond mere corporate social responsibility; it's woven into the fabric of the company's identity. For instance, in 2024, H-E-B contributed $1 million to Austin Habitat for Humanity, directly supporting affordable housing initiatives and underscoring its investment in the well-being of its communities. This proactive approach to local support, coupled with robust disaster relief efforts, solidifies H-E-B's reputation as a reliable and caring neighbor.

The company's emphasis on championing local brands and its distinct 'Texas First' philosophy further amplifies its community connection. This strategy not only supports regional economies but also cultivates a strong sense of loyalty among its customer base, who appreciate H-E-B's commitment to their home state. This resonates deeply, fostering a powerful brand affinity that is difficult for competitors to replicate.

- Deep Community Integration: H-E-B is intrinsically linked to the communities it serves, fostering strong local ties.

- Significant Philanthropic Investment: A $1 million donation to Austin Habitat for Humanity in 2024 highlights substantial support for local causes.

- Disaster Relief Participation: Active involvement in disaster relief efforts reinforces its role as a community pillar.

- Support for Local Brands: The 'Texas First' approach boosts regional economies and strengthens customer loyalty.

Advanced Digital Capabilities and E-commerce Integration

H-E-B's commitment to advanced digital capabilities is a significant strength, underscored by its strategic acquisition of Favor Delivery in 2018. This move enabled the company to offer widespread same-day delivery services throughout Texas, directly addressing evolving consumer demands for convenience. The company also launched H-E-B Now, a service focused on rapid grocery delivery, further solidifying its online presence.

The My H-E-B app is central to this digital strategy, offering a user-friendly platform for both curbside pickup and home delivery. This integrated approach has demonstrably improved customer experience, with H-E-B consistently achieving higher customer satisfaction scores for its e-commerce offerings compared to the broader industry average. For instance, in 2023, H-E-B’s digital sales growth outpaced many national competitors, reflecting the success of these investments.

- Acquisition of Favor Delivery: Strengthened same-day delivery capabilities across Texas.

- H-E-B Now Launch: Introduced a service for rapid grocery delivery.

- My H-E-B App: Facilitates seamless online shopping, curbside pickup, and home delivery.

- Customer Satisfaction: Achieved above-average industry scores for e-commerce services, indicating strong digital adoption and user experience.

H-E-B's commanding presence in Texas, holding nearly 50% market share in South Texas and an estimated 14% of the U.S. grocery market as of 2025, is a significant strength. This regional dominance is bolstered by exceptional customer service, reflected in a 63 Net Promoter Score and 92% customer loyalty, and consistent recognition as a top U.S. grocer, including being named the No. 1 U.S. grocery retailer by dunnhumby for three straight years.

The company's robust private label strategy, accounting for 19% of total sales, drives profitability and enhances customer loyalty, with private label items often perceived as superior in quality and value compared to competitors. H-E-B plans to introduce over 100 new private label SKUs by the end of 2024, further strengthening this segment.

H-E-B's extensive Texas footprint, with over 435 stores and a planned $1 billion investment in 2024 for 9 new stores and over 1 million square feet of retail space, demonstrates its strategic expansion and commitment to the region. The introduction of diverse store formats like Joe V's Smart Shop caters to a broader customer base.

Deep community integration, exemplified by a $1 million donation to Austin Habitat for Humanity in 2024 and active disaster relief participation, alongside a 'Texas First' philosophy supporting local brands, fosters strong customer loyalty and brand affinity. This approach significantly differentiates H-E-B from competitors.

Advanced digital capabilities, including the acquisition of Favor Delivery and the launch of H-E-B Now, enhance convenience through same-day delivery and rapid grocery services. The My H-E-B app facilitates seamless online shopping, curbside pickup, and home delivery, contributing to higher-than-average customer satisfaction scores for e-commerce services, with digital sales growth outpacing many national competitors in 2023.

What is included in the product

Highlights H-E-B Grocery Company’s strong brand loyalty and operational efficiency, while also identifying potential challenges from expanding competition and evolving consumer preferences.

Uncovers actionable insights by highlighting H-E-B's competitive advantages and potential threats, simplifying strategic decision-making.

Weaknesses

H-E-B's significant geographic concentration, primarily within Texas and Mexico, presents a notable weakness. While this focus allows for deep market penetration and understanding in its core regions, it inherently limits its national market share and opportunities for diversification across the broader United States.

H-E-B operates in a fiercely competitive Texas grocery landscape. Major national players like Walmart, Kroger, Target, Costco, and Aldi are not only present but are actively investing and expanding their footprint within the state. This intense rivalry means H-E-B constantly faces pressure to maintain its market share and customer loyalty.

H-E-B's deeply ingrained, localized approach, while a strength in Texas, poses a significant hurdle for national market penetration. Replicating its unique customer-centric model, which relies heavily on regional understanding and community integration, is logistically complex and culturally challenging to scale across diverse U.S. markets.

This difficulty in adapting its distinctive operational strategy beyond its established Texan base limits H-E-B's potential for broader national expansion and market share growth. For instance, while H-E-B reported over $40 billion in revenue in 2023, primarily from Texas, its limited presence outside the state highlights this penetration challenge.

Potential for Margin Pressure

The grocery sector operates with notoriously thin profit margins, a reality intensified by fierce competition and substantial investment needs. While H-E-B's focus on private label brands offers some buffer, the constant need to maintain competitive pricing against escalating operational expenses, such as rising labor and energy costs, can significantly squeeze its profitability. For instance, in 2024, the U.S. Bureau of Labor Statistics reported that food at home prices saw a notable increase, putting pressure on retailers to absorb some of these costs to remain competitive.

This inherent margin sensitivity means that even minor shifts in consumer spending habits or unexpected increases in supply chain expenses can have a disproportionate impact on H-E-B's bottom line. The company must continually balance aggressive pricing strategies with the need to maintain healthy profit margins, a delicate act in the current economic climate.

Limited Breadth of Non-Grocery Departments in Some Stores

While H-E-B excels in its core grocery offerings, some of its store formats, particularly those not designated as H-E-B Plus!, may feature a narrower assortment in non-grocery departments like apparel, home goods, or electronics. This limited breadth can be a disadvantage when compared to national superstore chains that aim for a comprehensive one-stop-shop experience. Consequently, customers seeking a wider variety in these specific categories might opt for competitors, potentially impacting H-E-B's market share in those non-essential goods.

For instance, while H-E-B Plus! stores are designed to counter this by expanding these departments, it's a potential weakness for H-E-B in locations where only the standard format is available. This limitation could mean missing out on sales from shoppers who prefer to consolidate all their purchasing needs at a single retailer. In 2024, the trend towards convenience shopping continues to grow, making a comprehensive product mix increasingly important for customer loyalty.

- Limited Non-Grocery Selection: Some H-E-B stores may not offer the same extensive range of non-grocery items as larger supercenter formats.

- Competitor Advantage: National competitors with broader selections in areas like toys, linens, and apparel can attract customers seeking a single shopping destination.

- H-E-B Plus! Strategy: H-E-B Plus! locations are designed to address this, but it highlights a potential gap in standard H-E-B store formats.

- Impact on One-Stop-Shop Appeal: This can reduce H-E-B's attractiveness for consumers prioritizing a comprehensive shopping experience in a single visit.

H-E-B's significant geographic concentration, primarily within Texas and Mexico, presents a notable weakness. While this focus allows for deep market penetration and understanding in its core regions, it inherently limits its national market share and opportunities for diversification across the broader United States. This intense rivalry means H-E-B constantly faces pressure to maintain its market share and customer loyalty. Replicating its unique customer-centric model, which relies heavily on regional understanding and community integration, is logistically complex and culturally challenging to scale across diverse U.S. markets. While H-E-B reported over $40 billion in revenue in 2023, primarily from Texas, its limited presence outside the state highlights this penetration challenge.

The grocery sector operates with notoriously thin profit margins, a reality intensified by fierce competition and substantial investment needs. While H-E-B's focus on private label brands offers some buffer, the constant need to maintain competitive pricing against escalating operational expenses, such as rising labor and energy costs, can significantly squeeze its profitability. For instance, in 2024, the U.S. Bureau of Labor Statistics reported that food at home prices saw a notable increase, putting pressure on retailers to absorb some of these costs to remain competitive.

While H-E-B excels in its core grocery offerings, some of its store formats, particularly those not designated as H-E-B Plus!, may feature a narrower assortment in non-grocery departments like apparel, home goods, or electronics. This limited breadth can be a disadvantage when compared to national superstore chains that aim for a comprehensive one-stop-shop experience. Consequently, customers seeking a wider variety in these specific categories might opt for competitors, potentially impacting H-E-B's market share in those non-essential goods. In 2024, the trend towards convenience shopping continues to grow, making a comprehensive product mix increasingly important for customer loyalty.

| Weakness Category | Description | Impact | Supporting Data (2023-2024) |

|---|---|---|---|

| Geographic Concentration | Primarily operates in Texas and Mexico. | Limited national market share and diversification. | Over $40 billion revenue in 2023, predominantly from Texas. |

| Competitive Intensity | Faces strong competition from national players in Texas. | Pressure on market share and customer loyalty. | Presence of Walmart, Kroger, Target, Costco, Aldi in Texas. |

| Scalability of Localized Model | Difficulty replicating its unique customer-centric model nationally. | Hinders broader national expansion and market share growth. | Complex logistics and cultural challenges in diverse U.S. markets. |

| Profit Margin Sensitivity | Thin profit margins due to competition and rising costs. | Vulnerability to consumer spending shifts and supply chain disruptions. | Food at home price increases reported by BLS in 2024. |

| Limited Non-Grocery Selection | Standard store formats have narrower non-grocery assortments. | May lose customers to competitors offering a one-stop-shop experience. | Trend towards convenience shopping in 2024 favors comprehensive offerings. |

Preview Before You Purchase

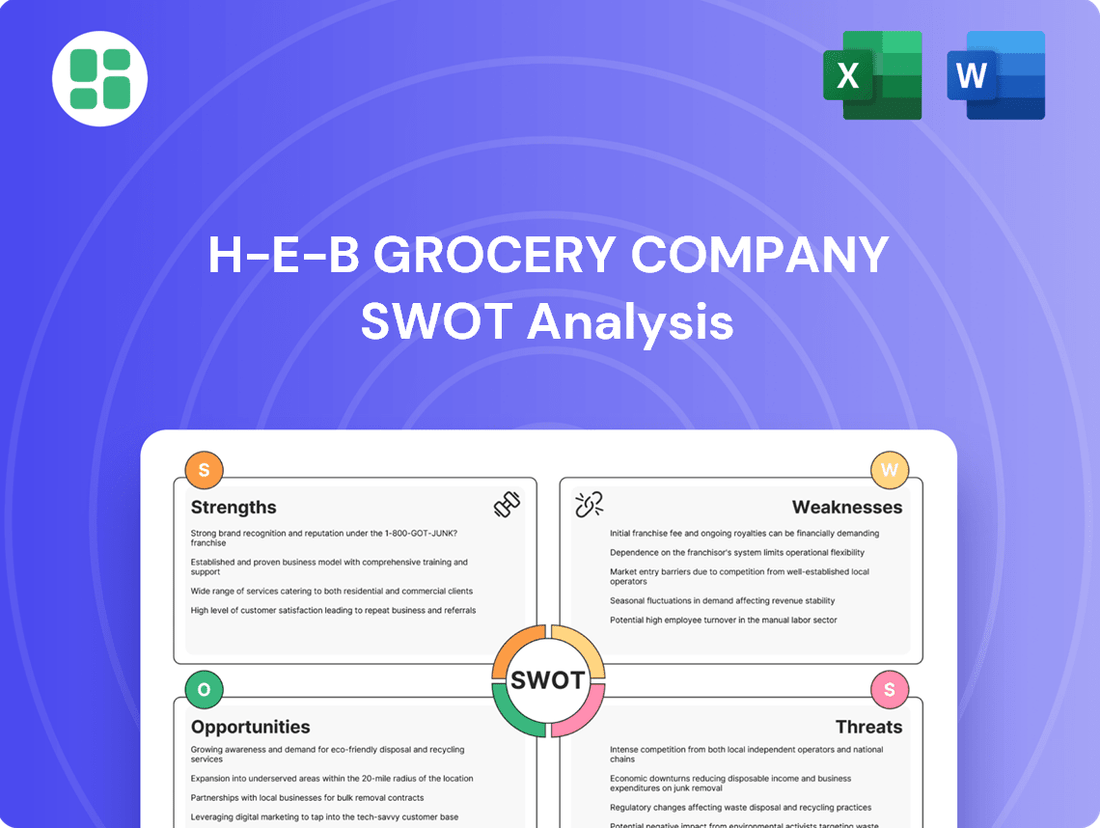

H-E-B Grocery Company SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual H-E-B Grocery Company SWOT analysis, detailing its Strengths, Weaknesses, Opportunities, and Threats. Upon purchase, you'll gain access to the complete, in-depth report.

Opportunities

H-E-B is poised for significant growth by targeting high-population influx areas in Texas, such as Dallas-Fort Worth and Austin. These regions are experiencing robust economic development and a growing customer base eager for H-E-B's unique offerings.

The company's strategic expansion plans include numerous new store openings and substantial renovations through 2025 and 2026. This aggressive build-out will focus on underserved communities, ensuring H-E-B captures market share in areas with unmet grocery needs.

For instance, H-E-B has announced plans for over 30 new stores and major renovations across Texas in 2024 and 2025, with a significant portion allocated to the booming DFW metroplex, which saw a population increase of nearly 1.5% in 2023 alone.

H-E-B's commitment to its digital ecosystem, particularly the My H-E-B app and Favor Delivery, presents a significant avenue for growth. By continuously improving these platforms, H-E-B can solidify its position in the rapidly expanding online grocery sector.

The strategic integration of advanced technologies, such as artificial intelligence, into H-E-B's operations offers a dual benefit. AI can optimize inventory management, reducing waste and ensuring product availability, while also enabling highly personalized customer promotions, thereby enhancing the overall omnichannel shopping experience.

In 2023, H-E-B saw substantial digital growth, with its app usage and online order volume increasing by over 20%. This trend is expected to continue into 2024 and 2025, fueled by ongoing investments in user experience and delivery capabilities.

H-E-B's strong performance in private label, which often commands higher profit margins than national brands, presents a significant opportunity. In 2024, private label sales are projected to continue their upward trend, potentially reaching over 30% of total sales for many grocery retailers, a segment H-E-B is well-positioned to dominate.

Expanding this successful private label portfolio into adjacent or entirely new product categories, such as health and wellness or specialized dietary needs, can further diversify revenue streams. This strategic move not only capitalizes on existing brand trust and high margins but also acts as a powerful differentiator against competitors who may rely more heavily on national brands.

By continuing to innovate and enhance the quality and appeal of its private label offerings, H-E-B can deepen customer loyalty. This strategy is crucial in a competitive market where private labels are increasingly seen as equal to, or even superior to, national brands, fostering repeat business and increasing overall basket size.

Strategic Investments in Supply Chain and Infrastructure

H-E-B's ongoing strategic investments in its supply chain and infrastructure are a significant opportunity for growth and operational enhancement. The company's commitment to expanding distribution hubs, like the substantial campus in Waller County, Texas, directly addresses the need for greater logistical efficiency. This focus ensures that stores remain well-stocked, minimizes product waste, and ultimately strengthens H-E-B's competitive edge in a demanding retail environment.

These infrastructure upgrades are crucial for maintaining H-E-B's reputation for product availability and freshness. By optimizing the flow of goods from suppliers to shelves, the company can better manage inventory, respond to fluctuating consumer demand, and reduce the impact of potential disruptions. This proactive approach to supply chain management is a key differentiator in the grocery sector.

- Enhanced Distribution Network: Investments in facilities like the Waller County distribution campus, a massive undertaking, bolster H-E-B's capacity to serve its growing customer base efficiently.

- Operational Resilience: A robust supply chain minimizes stockouts and reduces waste, directly contributing to improved financial performance and customer satisfaction.

- Competitive Advantage: Superior logistics and timely restocking provide H-E-B with a significant edge over competitors, especially during peak demand periods or unexpected market shifts.

Expanding Community Initiatives and Partnerships

H-E-B can solidify its standing by intensifying community outreach and forging strategic alliances. This includes expanding support for crucial areas like affordable housing, a commitment that resonates deeply with Texans and can foster significant goodwill. In 2023, H-E-B's "Food for Families" program alone helped provide over 300 million meals, demonstrating a tangible impact on food insecurity.

Collaborating with a wider array of local businesses, particularly those owned by minority groups or women, directly addresses evolving consumer preferences for ethical and inclusive sourcing. Such partnerships not only bolster H-E-B's image but also contribute to the economic vitality of the communities it serves. For instance, H-E-B actively promotes its "H-E-B Supplier Diversity Program," aiming to increase spend with diverse suppliers.

- Strengthened Brand Reputation: Increased community involvement and ethical sourcing practices enhance H-E-B's public image.

- Enhanced Customer Loyalty: Aligning with consumer values like sustainability and local support drives repeat business.

- Economic Community Impact: Partnerships with diverse local businesses foster economic growth and inclusivity.

- Market Differentiation: Proactive community initiatives set H-E-B apart from national competitors.

H-E-B's strategic expansion into high-growth Texas markets, particularly Dallas-Fort Worth and Austin, positions it to capture a larger share of an expanding customer base. The company's aggressive store development plan, with over 30 new locations and renovations slated through 2025, directly targets underserved areas, ensuring market penetration. Continued investment in its digital platform, including the My H-E-B app and Favor Delivery, is expected to drive significant growth in the online grocery sector, building on a 20% increase in digital engagement in 2023.

H-E-B's focus on its private label brands, which already hold strong customer loyalty and higher profit margins, offers a substantial opportunity for revenue diversification and increased profitability. By expanding these offerings into new categories and maintaining high quality, H-E-B can further differentiate itself and capture greater market share. The company's ongoing investments in its supply chain and distribution network, including major facilities like the Waller County campus, are crucial for operational efficiency, product availability, and maintaining its competitive edge.

Strengthening community ties through initiatives like affordable housing support and expanding partnerships with diverse local businesses can significantly enhance H-E-B's brand reputation and customer loyalty. These efforts align with growing consumer preferences for ethical and inclusive sourcing, creating a powerful market differentiator against national competitors. H-E-B's commitment to community impact, exemplified by its "Food for Families" program which provided over 300 million meals in 2023, fosters goodwill and deepens its connection with Texans.

Threats

H-E-B operates in a highly competitive landscape, facing intense pressure from national giants like Walmart and Kroger, both of which are actively growing their footprint and investing in the Texas market. These established players, along with discounters such as Aldi and membership warehouses like Costco, are continually enhancing their offerings and expanding their reach.

The grocery sector is also witnessing a trend towards consolidation. For instance, the proposed merger between Albertsons and Kroger, though facing regulatory scrutiny, signals a potential for larger, more formidable competitors to emerge, intensifying the competitive dynamics H-E-B must navigate.

Persistent inflation and the resulting cautious consumer spending represent a significant threat to H-E-B's profitability, particularly given the grocery sector's historically thin margins. As of early 2024, inflation rates, while showing some moderation from 2023 peaks, continued to impact household budgets, prompting consumers to scrutinize every purchase. For instance, the U.S. Consumer Price Index (CPI) remained elevated, impacting the cost of goods for both H-E-B and its customers.

Consumers are increasingly prioritizing value and necessity, potentially shifting away from premium or less essential grocery items. This re-evaluation of spending habits could directly affect H-E-B's sales volume and overall profitability if the company cannot effectively adapt its product mix and pricing strategies to meet this demand for affordability. The ability to maintain customer loyalty amidst economic uncertainty is paramount.

While H-E-B has shown strength in navigating past supply chain disruptions, the threat of external events like port strikes or widespread logistical breakdowns remains. Such issues could still affect product availability and drive up operational expenses, impacting the company's ability to maintain competitive pricing.

To counter these ongoing vulnerabilities, H-E-B's continued focus on building and maintaining a strong, localized supply chain is paramount. This strategy helps reduce reliance on distant suppliers and complex international shipping routes, thereby enhancing resilience against global shocks.

Evolving Consumer Preferences and Retail Landscape

Consumer tastes are changing quickly, with a noticeable move towards online grocery shopping and delivery services. H-E-B must adapt to these evolving demands to maintain its competitive edge. For instance, in 2024, online grocery sales are projected to reach over $200 billion in the US, highlighting the significant shift in consumer behavior.

The retail landscape is also transforming, with the rise of alternative formats and a greater emphasis on convenience and personalization. If H-E-B doesn't keep up with these shifts and competitor innovations, it risks losing market share. By 2025, it's estimated that nearly 70% of consumers will be shopping online for groceries at least once a month.

- Shifting Consumer Behavior: Growing preference for online grocery shopping and delivery services.

- Competitive Landscape: Need to adapt to new retail formats and innovations.

- Market Share Risk: Failure to evolve could lead to erosion of H-E-B's market position.

- Digital Investment: Continued investment in e-commerce and digital platforms is crucial.

Rising Operating Costs and Labor Market Challenges

The grocery sector, inherently labor-intensive, faces significant pressure from escalating operating costs. Rising wages, particularly in a strong job market like Texas, directly impact profitability. For instance, the U.S. Bureau of Labor Statistics reported that average hourly earnings for grocery store employees saw an increase in 2024, adding to overhead.

The competitive labor market in Texas, a state experiencing robust economic growth, exacerbates these challenges. Companies must balance offering competitive compensation to attract and retain staff with the low-margin nature of the grocery business. This delicate balancing act is a continuous hurdle for effective cost management.

- Increased Wage Pressures: The demand for skilled and reliable staff in the retail sector, especially in growing economies, drives up wage expectations.

- Supply Chain and Energy Costs: Beyond labor, expenses related to transportation, energy for refrigeration, and general store operations are also on an upward trend, impacting the bottom line.

- Low Profit Margins: The grocery industry typically operates on thin profit margins, making it difficult to absorb significant cost increases without impacting pricing or profitability.

H-E-B faces significant threats from intensifying competition, with national players like Walmart and Kroger expanding in Texas, alongside discounters and warehouse clubs. The potential merger of Albertsons and Kroger, if approved, could create even larger, more formidable rivals.

Persistent inflation and cautious consumer spending directly impact H-E-B's profitability, as consumers prioritize value and may reduce purchases of less essential items. This trend, evident in early 2024 with elevated CPI figures, necessitates careful adaptation of product mix and pricing to maintain customer loyalty.

The rapid shift towards online grocery shopping, projected to exceed $200 billion in the US by 2024, presents a challenge. Failure to keep pace with evolving consumer demands for digital convenience and personalization risks market share erosion by 2025, when nearly 70% of consumers are expected to shop for groceries online monthly.

Escalating operating costs, particularly rising wages in Texas's competitive job market and increased supply chain expenses, squeeze H-E-B's already thin profit margins. For instance, average hourly earnings for grocery store employees saw an increase in 2024, adding to overhead and the challenge of maintaining competitive pricing.

SWOT Analysis Data Sources

This H-E-B SWOT analysis is built upon a foundation of verified financial statements, comprehensive market research, and expert industry commentary, ensuring a robust and accurate strategic overview.