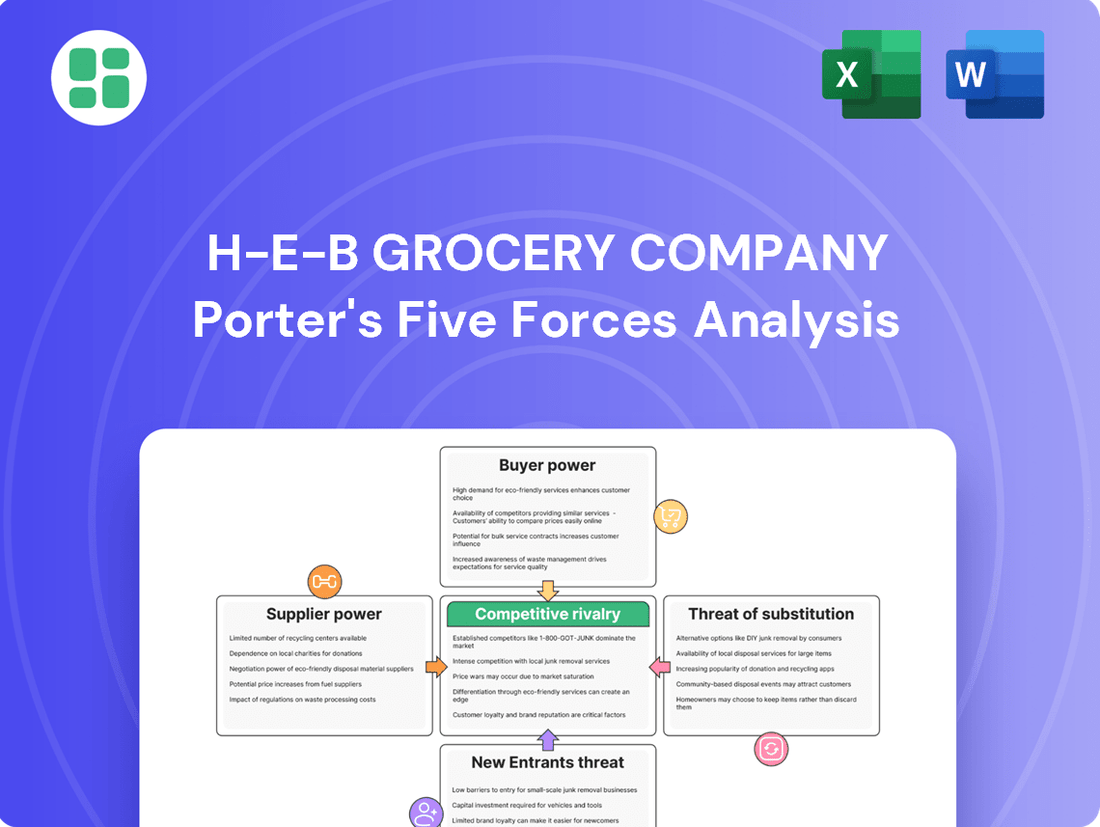

H-E-B Grocery Company Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

H-E-B Grocery Company Bundle

H-E-B Grocery Company navigates a competitive landscape shaped by moderate buyer power and the looming threat of new entrants, particularly in its Texas stronghold. The company's strong brand loyalty and private label offerings help mitigate these forces, but the grocery sector's inherent low switching costs keep competitive pressures high.

The complete report reveals the real forces shaping H-E-B Grocery Company’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

H-E-B's sheer size, operating hundreds of stores across Texas and Mexico, translates into substantial purchasing power. This scale allows them to negotiate favorable pricing and terms with a vast majority of their suppliers, effectively reducing the bargaining power of most individual vendors. For instance, in 2023, H-E-B reported over $40 billion in revenue, indicating the massive volume of goods they procure annually.

However, for certain highly specialized or proprietary products, a concentrated supplier base can shift leverage. If only a few companies produce a critical ingredient or unique item H-E-B needs, those suppliers gain increased bargaining power. H-E-B actively manages this risk by cultivating relationships with a broad spectrum of local and national suppliers, ensuring they aren't overly reliant on any single source for essential goods.

For generic goods, H-E-B's costs to switch suppliers are generally low, allowing for flexibility. However, for proprietary or private-label products, the expense and complexity increase significantly. This can include costs for redesigning packaging, obtaining new certifications, and managing potential disruptions to ensure product availability.

H-E-B's strategic investment in its own robust distribution network and advanced supply chain infrastructure is a key factor in mitigating these switching costs. By controlling more of the supply chain, H-E-B can better manage supplier relationships and reduce its reliance on external parties, thereby maintaining greater operational control and reducing the impact of supplier changes.

H-E-B's strong private-label program significantly bolsters its bargaining power with suppliers. By offering a wide array of its own branded products, which represent a substantial portion of its sales, H-E-B decreases its dependence on national brand suppliers. This allows H-E-B to negotiate more favorable terms, as it can readily substitute national brands with its own offerings, effectively reducing the suppliers' leverage.

Threat of Forward Integration by Suppliers

The threat of grocery suppliers integrating forward into retail, essentially becoming competitors, is typically low for large chains like H-E-B. This is because establishing and running a grocery store demands substantial capital and intricate operational know-how, which most suppliers lack. However, niche or specialized food producers might occasionally explore direct-to-consumer sales, bypassing traditional retail channels.

H-E-B's robust brand recognition and vast network of stores present a significant hurdle for any supplier attempting this forward integration. For instance, in 2024, H-E-B reported over 430 stores across Texas, a scale that is incredibly difficult for a single supplier to replicate. This market presence allows H-E-B to negotiate favorable terms and maintain its competitive edge.

- Low Threat of Forward Integration: The high capital and operational demands of grocery retail generally deter suppliers from integrating forward.

- Niche Supplier Ventures: Specialized food producers may explore direct-to-consumer models, but these are typically small-scale.

- H-E-B's Competitive Strength: H-E-B's extensive store footprint (over 430 stores in 2024) and strong brand loyalty create a formidable barrier to entry for integrating suppliers.

- Supplier Dependence: Suppliers often rely on H-E-B's volume and distribution network, making direct competition less appealing.

Importance of H-E-B to Suppliers

H-E-B's significant market share in Texas, often exceeding 40% in key regions, makes it a crucial partner for many suppliers. This substantial sales volume means that securing a contract with H-E-B can represent a significant portion of a supplier's revenue. For instance, H-E-B's commitment to local producers, highlighted by programs like its annual 'Quest for Texas Best' competition, further solidifies its importance to smaller, regional businesses seeking wider distribution.

The sheer scale of H-E-B's operations translates directly into powerful bargaining leverage. Suppliers, particularly those focused on the Texas market, often find their business heavily reliant on the volume and consistent demand H-E-B provides. This dependency can lead to suppliers accepting less favorable terms to maintain their access to H-E-B's extensive customer base, thereby reducing the suppliers' bargaining power.

- H-E-B's Texas Market Dominance: H-E-B consistently holds a leading market share in Texas, providing suppliers with unparalleled access to a vast customer base.

- Local Producer Partnerships: Initiatives like 'Quest for Texas Best' foster strong relationships with local suppliers, making H-E-B a vital sales channel for these businesses.

- Supplier Dependence on Volume: The high sales volume H-E-B generates means many suppliers rely heavily on the grocery chain for a significant portion of their revenue.

- Leverage in Negotiations: This reliance grants H-E-B considerable power to negotiate favorable terms, as suppliers are incentivized to secure and maintain their relationship with the retailer.

H-E-B's immense scale and market dominance, particularly in Texas where it holds over 40% market share in many areas, significantly curtails supplier bargaining power. Suppliers often depend on H-E-B for a substantial portion of their sales, making them amenable to H-E-B's terms. This dynamic is further reinforced by H-E-B's proactive supplier relationship management and its commitment to local producers, as evidenced by programs like 'Quest for Texas Best'.

The bargaining power of suppliers for H-E-B is generally low due to H-E-B's substantial purchasing volume and its significant market share, especially within Texas. In 2024, H-E-B operated over 430 stores, solidifying its position as a critical channel for many suppliers. This reliance on H-E-B for sales volume often leads suppliers to accept less favorable terms to maintain access to its extensive customer base.

While some specialized or proprietary product suppliers might hold more leverage, H-E-B mitigates this by diversifying its supplier base and investing in its own supply chain infrastructure. The low switching costs for generic goods and the high capital requirements for suppliers to integrate forward into retail further diminish supplier influence.

H-E-B's strong private-label program also plays a key role, allowing it to substitute national brands and thus negotiate more effectively with those suppliers. This strategic approach ensures H-E-B maintains considerable control over its supplier relationships and costs.

| Factor | H-E-B's Position | Impact on Supplier Bargaining Power |

| Purchasing Volume | Extremely High (over $40 billion revenue in 2023) | Lowers supplier power |

| Market Share (Texas) | Dominant (often >40%) | Lowers supplier power |

| Supplier Dependence | High for many regional suppliers | Lowers supplier power |

| Private Label Program | Extensive and growing | Lowers supplier power |

| Switching Costs (Generic Goods) | Low | Lowers supplier power |

| Forward Integration Threat | Low (due to capital and operational barriers) | Lowers supplier power |

What is included in the product

This analysis of H-E-B Grocery Company examines the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitutes within the grocery sector.

H-E-B's Porter's Five Forces analysis provides a clear, actionable roadmap for navigating competitive pressures, allowing for strategic adjustments to mitigate threats and capitalize on opportunities.

Customers Bargaining Power

Customer price sensitivity is a significant factor in the grocery sector, particularly with inflation impacting food prices through 2024 and into 2025. Consumers actively seek out deals and lower-cost alternatives, making them highly responsive to pricing strategies.

H-E-B counters this by maintaining competitive pricing and highlighting value, a strategy reinforced by its substantial private-label product selection. For instance, in 2023, private label sales represented a growing share of the U.S. grocery market, often providing a more affordable option for consumers.

Customers in Texas enjoy a wealth of grocery shopping alternatives, ranging from national giants like Walmart and Kroger to budget-friendly options such as Aldi and niche specialty stores. This extensive selection, further amplified by the growing trend of online grocery shopping, grants consumers considerable power to switch between retailers with ease.

Customer switching costs in the grocery sector are typically very low. For consumers, the effort involved in switching from one supermarket to another is minimal, often just a matter of choosing a different location or a store closer to home.

H-E-B actively works to increase these switching costs by fostering deep brand loyalty. They achieve this through exceptional in-store experiences, offering unique private-label products and engaging heavily in local community initiatives, which makes the decision to switch to a competitor less appealing for their established customer base.

Customer Information Availability

Customers today wield significant bargaining power due to readily available information. They can easily compare prices across various retailers online and through competitor flyers, directly influencing their purchasing decisions. This accessibility empowers shoppers to seek the best value, putting pressure on grocery stores like H-E-B to remain competitive on pricing.

H-E-B actively counters this by leveraging its strong digital infrastructure and a deep commitment to transparency. By offering a seamless integration between its online presence and physical stores, H-E-B aims to enhance customer loyalty and reduce price sensitivity. For instance, H-E-B's digital platforms provide detailed product information and personalized offers, making it easier for customers to engage with the brand beyond just price comparisons.

- Increased Price Sensitivity: With easy online access to competitor pricing, customers are more likely to switch for lower prices.

- H-E-B's Digital Advantage: H-E-B's investment in digital tools, like its popular app, provides personalized deals and product information, fostering loyalty.

- Transparency as a Differentiator: H-E-B's commitment to clear pricing and product sourcing builds trust, mitigating some of the customer's price-focused bargaining power.

Customer Concentration

Customer concentration is typically low in the grocery sector, meaning H-E-B doesn't face significant pressure from any single large buyer. This fragmentation means individual customer purchasing power is minimal.

However, the collective bargaining power of customers is substantial. Consumers can readily switch between grocery stores for better prices, quality, or convenience, forcing H-E-B to remain competitive.

- Low Individual Customer Power: No single shopper dictates terms to H-E-B.

- High Collective Customer Power: The ease of switching brands and stores empowers the mass of consumers.

- Price Sensitivity: Customers actively seek deals, impacting H-E-B's pricing strategies.

- Brand Loyalty Factors: While switching is easy, factors like quality, selection, and store experience can foster loyalty, moderating this power.

Customers hold significant bargaining power due to the abundance of grocery options and low switching costs, a trend amplified by increasing price sensitivity observed through 2024 and into 2025. H-E-B counters this by fostering loyalty through superior in-store experiences, unique private-label products, and community engagement, aiming to reduce the appeal of competitors.

The ease with which customers can compare prices online and switch retailers means H-E-B must maintain competitive pricing and offer strong value propositions. H-E-B's investment in digital platforms, such as its mobile app, provides personalized offers and product information, enhancing customer engagement and loyalty beyond simple price comparisons.

While individual customer power is minimal due to low customer concentration, the collective power of consumers to switch is substantial, forcing H-E-B to remain highly competitive on price and quality. Factors like store experience and product selection can, however, build loyalty and mitigate this power.

| Factor | Impact on H-E-B | H-E-B's Mitigation Strategy |

|---|---|---|

| Availability of Alternatives | High; many competing grocery stores and online options exist. | Focus on unique product offerings and superior customer experience. |

| Price Sensitivity | High, especially in 2024-2025 due to economic factors. | Competitive pricing, strong private label selection, and value messaging. |

| Switching Costs | Low; minimal effort for customers to change stores. | Building brand loyalty through exceptional service and community ties. |

| Information Availability | High; easy online price comparisons empower consumers. | Leveraging digital platforms for personalized deals and transparency. |

What You See Is What You Get

H-E-B Grocery Company Porter's Five Forces Analysis

This preview showcases the complete H-E-B Grocery Company Porter's Five Forces Analysis, detailing the competitive landscape, including the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. The document you see here is exactly what you’ll be able to download after payment, providing a comprehensive understanding of H-E-B's strategic positioning.

Rivalry Among Competitors

The Texas grocery landscape is a battleground with a multitude of competitors. H-E-B contends with national powerhouses like Walmart, Kroger, and Target, all vying for market share. These giants bring significant resources and broad reach to the table.

Beyond the national players, H-E-B also faces pressure from a diverse array of regional chains and specialized grocers. Discount retailers such as Aldi offer competitive pricing, while specialty stores like Whole Foods Market and Sprouts cater to niche consumer demands, further fragmenting the market.

Texas's robust population growth, with its major metropolitan areas like Dallas-Fort Worth and Austin seeing substantial increases, directly translates into heightened demand for grocery services. This demographic shift is a primary driver of market expansion.

The influx of new residents fuels aggressive expansion plans from established grocers like H-E-B and also serves as a magnet for new competitors seeking to capture market share. This dynamic intensifies the rivalry among all players in the Texas grocery sector.

In 2024, Texas continued its trend as one of the fastest-growing states in the US, further amplifying the competitive pressures within the grocery market. For instance, the state added over 400,000 residents in the year ending July 1, 2023, according to the U.S. Census Bureau, indicating sustained demand and increased competition.

H-E-B cultivates intense customer loyalty through a strategic blend of superior quality, aggressive pricing, and an extensive array of distinctive private-label offerings. This multifaceted approach sets them apart in a crowded grocery landscape where basic product similarity is common.

Their commitment to community involvement further solidifies this bond, creating a powerful emotional connection with their customer base. For instance, H-E-B's Food Bank partnerships and disaster relief efforts in Texas consistently reinforce their image as a community pillar, driving repeat business.

Exit Barriers

Exit barriers in the grocery sector, including for companies like H-E-B, are substantial. These high barriers stem from the massive investments required for physical infrastructure, such as extensive store networks and sophisticated distribution centers. For instance, the capital expenditure for opening a new supermarket can easily run into millions of dollars, making it difficult for companies to simply walk away from their investments.

The need to maintain established supply chains and a trained workforce further solidifies these exit barriers. Companies cannot easily divest these complex operational components. This situation compels existing players to remain active in the market, even during challenging economic periods, leading to a persistent and often intense competition for market share.

Consequently, competitors are incentivized to fight for every customer and every sale, rather than exiting the market. This dynamic directly contributes to sustained and often fierce rivalry within the grocery industry.

- High Fixed Asset Investment: Grocery retailers like H-E-B invest heavily in physical stores, distribution networks, and technology, creating significant sunk costs.

- Supply Chain Interdependence: Maintaining relationships with suppliers and ensuring efficient logistics are critical, making it costly and complex to dismantle these operations.

- Workforce Retention: Specialized knowledge and customer service skills of employees are valuable assets that are difficult and expensive to replace or retrain if a company exits.

- Brand Loyalty and Reputation: Companies build brand equity over time, and exiting a market can mean abandoning years of marketing and customer relationship building.

Strategic Commitments and Aggressiveness of Rivals

The competitive landscape for H-E-B is marked by significant strategic commitments from its rivals. Major players like Walmart and Kroger are not standing still; they are actively investing in expanding their physical footprint through new store openings and bolstering their online presence and delivery services, particularly in regions where H-E-B holds strong market positions.

These investments reflect an aggressive stance, aiming to capture market share and cater to evolving consumer preferences for omnichannel shopping experiences. For instance, Kroger has been notably expanding its delivery and pickup options, a trend that gained significant momentum in the early 2020s and continues to be a focus.

H-E-B itself is a formidable competitor, demonstrating its own aggressive strategy through substantial investments in expansion and innovative initiatives. This includes not only building new stores but also enhancing its supply chain and digital capabilities to maintain its competitive edge and solidify its market leadership in Texas.

- Rival Investment: Walmart and Kroger are channeling significant capital into new store construction and e-commerce infrastructure development in H-E-B's primary operating areas.

- E-commerce Focus: Competitors are prioritizing the enhancement of online ordering, curbside pickup, and home delivery services to meet growing digital demand.

- H-E-B's Response: H-E-B is counteracting these moves with its own aggressive expansion plans and strategic investments in technology and store modernization.

- Market Share Defense: The intense activity from all major players underscores a fierce battle for market share, driven by a commitment to growth and customer acquisition.

The competitive rivalry within the Texas grocery market is exceptionally intense, driven by a mix of national giants, regional players, and specialized grocers all vying for consumer attention. H-E-B faces formidable opposition from companies like Walmart and Kroger, which are actively investing in expanding their physical and digital footprints, particularly in H-E-B's core Texas markets.

These strategic investments, including enhancements to e-commerce and delivery services, reflect a direct challenge to H-E-B's market dominance, forcing continuous innovation and competitive pricing. H-E-B, in turn, is responding with its own aggressive expansion and technological upgrades to maintain its strong position.

The high fixed asset investment required for grocery operations, coupled with complex supply chains and the need for workforce retention, creates significant barriers to exit. This means existing players are compelled to compete fiercely for market share rather than withdrawing, intensifying the rivalry.

| Competitor | 2023 Revenue (USD Billions) | Texas Market Share (Est.) | Key Strategy |

|---|---|---|---|

| H-E-B | ~ $40.0 (Est.) | ~ 20% | Private label, community focus, expansion |

| Walmart | $648.1 | ~ 15% | Low prices, omnichannel, Supercenters |

| Kroger | $150.0 | ~ 10% | Delivery/pickup expansion, loyalty programs |

| Target | $107.4 | ~ 5% | In-store experience, owned brands, drive-up |

SSubstitutes Threaten

Consumers increasingly explore alternatives to traditional supermarkets like H-E-B. Farmers' markets, specialty food shops, and direct-to-consumer (DTC) services are gaining traction, offering unique product assortments and distinct shopping experiences. For instance, the U.S. farmers' market sector saw significant growth, with the USDA reporting over 8,600 registered markets in recent years, indicating a substantial segment of consumers seeking local and fresh produce.

The threat of substitutes for H-E-B is notably high from the restaurant and fast-food sectors. Consumers often opt for dining out or ordering takeout as an alternative to preparing meals at home, directly impacting grocery sales.

This substitution effect is amplified by economic trends. In 2024, consumer spending on dining out has continued to grow at a faster pace than spending on groceries, indicating a widening gap that favors off-premise food consumption.

The rise of meal kits and prepared foods presents a significant threat of substitutes for traditional grocery retailers like H-E-B. These offerings cater to consumers prioritizing convenience and time savings, directly competing with H-E-B's core grocery business.

While H-E-B has expanded its own prepared foods section, specialized meal kit services, such as HelloFresh and Blue Apron, provide a more curated and often perceived as a higher-value substitute. For instance, the meal kit market experienced substantial growth, with global revenues projected to reach over $20 billion by 2027, indicating a strong consumer preference for these alternatives.

Online Grocery and Delivery Services (Non-Traditional Retailers)

Beyond H-E-B's own digital storefronts, third-party delivery services and online-only grocery platforms pose a significant threat of substitution. Services like Instacart, Shipt, and online behemoths such as Amazon Fresh offer consumers convenient alternatives to traditional brick-and-mortar grocery shopping, directly impacting H-E-B's market share.

The increasing adoption of these digital solutions is a testament to evolving consumer preferences for convenience and accessibility. In 2024, the online grocery market continued its robust expansion, with projections indicating sustained double-digit growth, underscoring the growing appeal of these substitute channels.

- Growing Online Grocery Market: The U.S. online grocery market is expected to reach over $200 billion by the end of 2024, a substantial increase from previous years.

- Third-Party Delivery Dominance: Services like Instacart reported significant user growth and order volumes throughout 2023 and into 2024, highlighting their competitive edge.

- Consumer Behavior Shift: Studies in 2024 show a persistent preference among a growing segment of consumers for the convenience offered by online grocery ordering and delivery, making these substitutes highly attractive.

Price and Performance of Substitutes

The price and perceived performance of substitutes significantly shape consumer decisions. For instance, the convenience of dining out can be weighed against the cost of purchasing groceries. As of late 2024, persistent inflation has made this comparison particularly salient, with some consumers finding prepared meals or restaurant options more budget-friendly than assembling meals from scratch.

This shift is evident in consumer spending patterns. Reports from early 2024 indicated a noticeable uptick in spending at fast-casual restaurants and for meal delivery services, suggesting that the perceived value proposition of these substitutes is strengthening, especially when grocery bills continue to climb.

- Inflation Impact: Higher grocery prices in 2024 have made dining out and prepared meals more competitive on a cost-per-meal basis for some households.

- Convenience Factor: The time-saving aspect of ready-to-eat options remains a strong draw, particularly for busy consumers.

- Value Perception: Consumers are actively re-evaluating the overall value, considering not just price but also quality, convenience, and time saved.

- Market Response: Grocery retailers are responding with more prepared food offerings and loyalty programs to retain price-sensitive customers.

The threat of substitutes for H-E-B is significant, encompassing a wide range of alternatives from direct grocery competitors to entirely different food consumption methods. Consumers are increasingly turning to farmers' markets, specialty food stores, and direct-to-consumer (DTC) models for unique offerings and experiences, reflecting a growing demand for curated and local options. In 2024, the continued rise of online grocery platforms and third-party delivery services like Instacart further intensifies this threat, offering unparalleled convenience that directly challenges traditional brick-and-mortar grocery shopping. The U.S. online grocery market alone is projected to exceed $200 billion by the end of 2024, underscoring the substantial shift in consumer behavior towards digital channels.

| Substitute Category | Examples | Key Drivers | 2024 Market Trend/Data Point |

|---|---|---|---|

| Local & Specialty | Farmers' Markets, Specialty Food Shops | Unique products, freshness, community focus | USDA reports over 8,600 registered farmers' markets, indicating sustained consumer interest. |

| Convenience Foods | Meal Kits (HelloFresh), Prepared Foods | Time-saving, convenience, curated experience | Meal kit market globally projected to exceed $20 billion by 2027; H-E-B expanding its own prepared foods. |

| Off-Premise Dining | Restaurants, Fast Food, Takeout | Convenience, social experience, immediate consumption | Consumer spending on dining out growing faster than groceries in 2024; inflation makes prepared meals competitive. |

| Online Grocery | Amazon Fresh, Instacart, Shipt | Convenience, accessibility, broad selection | Online grocery market expected to grow double-digits in 2024; Instacart showing significant user growth. |

Entrants Threaten

The grocery retail sector, particularly for established players like H-E-B with extensive physical store networks, demands significant upfront capital. Newcomers face the daunting task of funding land purchases, building modern retail spaces, stocking diverse inventories, and establishing robust supply chains. For instance, the average cost to build a new supermarket can range from $10 million to $50 million or more, depending on size and location.

Established players like H-E-B leverage significant economies of scale in purchasing and distribution. In 2023, H-E-B's reported revenue exceeded $14 billion, a testament to their operational efficiency and purchasing power, which allows them to negotiate better terms with suppliers. This scale creates a substantial cost advantage that new entrants would find incredibly difficult to match, impacting their ability to compete on price.

The experience curve further solidifies the advantage for incumbents. As H-E-B has grown, they have refined their processes, reducing per-unit costs through accumulated knowledge and operational improvements. For instance, their sophisticated supply chain management, developed over decades, minimizes waste and optimizes delivery routes, contributing to lower operating expenses compared to a newcomer still building these capabilities.

H-E-B has cultivated deep brand loyalty within Texas, a testament to its long-standing community involvement, commitment to quality, and a consistently customer-focused experience. This loyalty acts as a significant barrier for new grocery stores entering the market.

New competitors must invest heavily in marketing and promotions to even begin chipping away at H-E-B's established customer base. The relatively low cost for consumers to switch between grocery stores means that any new entrant needs a compelling value proposition to attract shoppers away from their trusted H-E-B.

Access to Distribution Channels

H-E-B boasts a robust and extensive distribution network throughout Texas and into Mexico. This established infrastructure is a significant barrier for potential new entrants. Building a comparable network requires substantial capital investment and time, making it difficult for newcomers to compete on logistics and reach.

Securing access to suitable distribution channels is a major hurdle. New grocery retailers would need to either invest heavily in developing their own logistics or negotiate agreements with existing providers, which can be challenging given H-E-B's strong relationships and existing capacity utilization. For instance, in 2024, the grocery industry continued to see consolidation, making it harder for smaller players to secure favorable distribution terms.

- Established Logistics: H-E-B's efficient supply chain minimizes costs and ensures product availability, a feat difficult for new entrants to replicate quickly.

- Capital Intensive: Developing a comparable distribution network can cost hundreds of millions of dollars, a prohibitive expense for many startups.

- Negotiation Power: H-E-B's scale gives it significant leverage with suppliers and logistics partners, further disadvantaging new, smaller competitors.

- Market Penetration: Access to prime retail locations is also tied to distribution, meaning a lack of strong logistics directly limits market penetration potential.

Regulatory Hurdles and Government Policy

While the grocery sector generally faces fewer direct regulatory obstacles compared to highly specialized industries, specific governmental requirements can still act as deterrents for new entrants. Zoning laws, which dictate where businesses can operate, and stringent food safety regulations, such as those enforced by the FDA, demand significant compliance efforts and investment. For instance, in 2024, navigating the complexities of state-specific food handling permits and federal labeling standards requires dedicated resources that smaller startups may struggle to allocate.

Government policies can further influence the competitive landscape. Initiatives encouraging local sourcing, as seen in various state-level programs aiming to support regional agriculture, can inadvertently favor established grocery chains with existing supplier relationships. Similarly, evolving health standards or sustainability mandates, if not proactively addressed, can present compliance challenges and increased operational costs for newcomers. HEB, with its deep roots in Texas and established relationships with local producers, is well-positioned to adapt to such policies.

- Zoning Laws: Local ordinances can restrict where grocery stores can be built, adding complexity and cost to site selection for new competitors.

- Food Safety Regulations: Compliance with FDA and state-level food safety standards requires investment in infrastructure, training, and ongoing monitoring.

- Governmental Support for Local Sourcing: Policies promoting local produce can benefit established retailers with existing networks, creating a barrier for new entrants without these connections.

- Evolving Health and Sustainability Standards: New regulations concerning nutrition labeling or environmental practices can necessitate costly adjustments for businesses entering the market.

The threat of new entrants for H-E-B is relatively low due to substantial capital requirements for establishing a physical presence and robust supply chains. Significant investment is needed for real estate, store build-outs, and inventory, with new supermarket construction costs often ranging from $10 million to $50 million. Furthermore, H-E-B's established economies of scale, evident in its 2023 revenue exceeding $14 billion, allow for superior purchasing power and cost efficiencies that are difficult for newcomers to match.

Brand loyalty, cultivated through decades of community engagement, acts as a powerful barrier, making it challenging for new competitors to attract H-E-B's established customer base. The company's extensive and efficient distribution network, a result of significant investment and operational refinement, further solidifies its competitive position, requiring new entrants to either replicate this costly infrastructure or secure difficult-to-obtain distribution agreements.

| Barrier Type | Description | Example for H-E-B |

|---|---|---|

| Capital Requirements | High upfront investment for store construction and inventory. | Supermarket construction costs: $10M - $50M+ |

| Economies of Scale | Cost advantages due to large-scale operations. | 2023 Revenue: >$14 Billion, enabling better supplier terms. |

| Brand Loyalty | Strong customer preference for established brands. | Deeply ingrained customer trust and preference in Texas. |

| Distribution Network | Established infrastructure for logistics and supply chain. | Extensive network across Texas and into Mexico. |

Porter's Five Forces Analysis Data Sources

Our H-E-B Porter's Five Forces analysis is built upon a foundation of publicly available financial reports, industry-specific market research from firms like IBISWorld, and news articles detailing competitor strategies and consumer trends.