Health Catalyst Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Health Catalyst Bundle

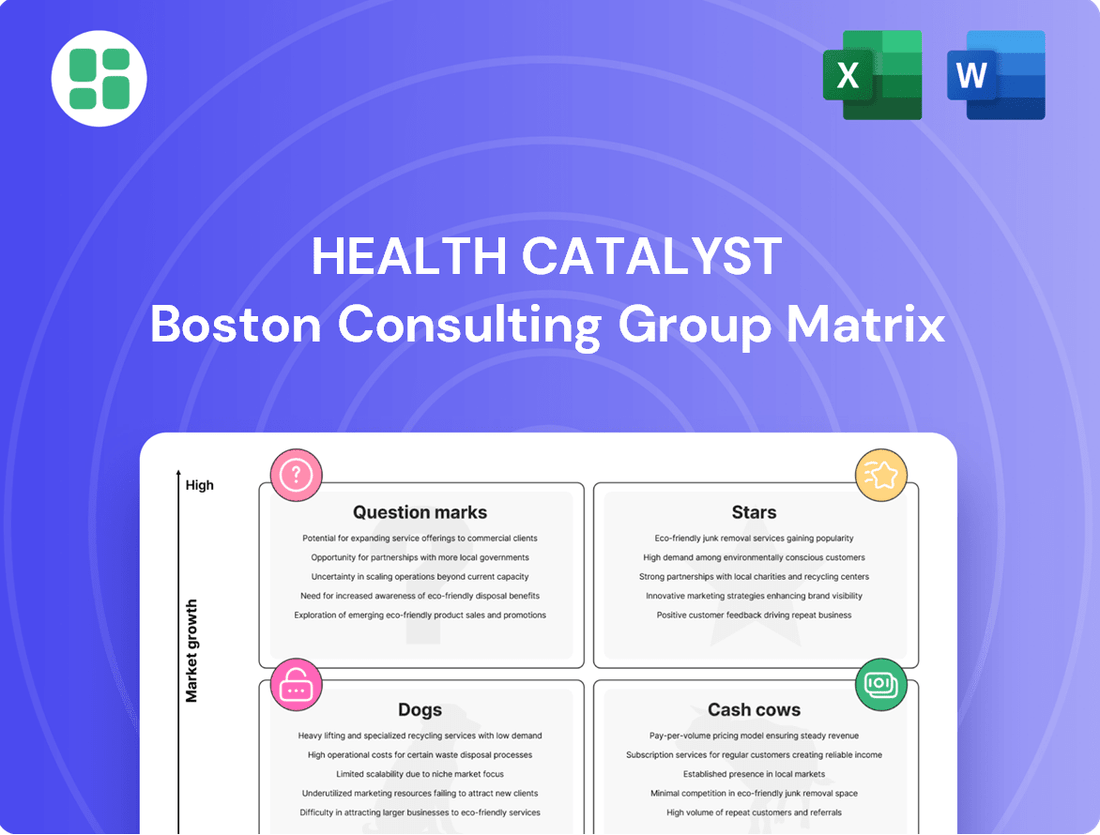

Uncover the strategic positioning of this company's product portfolio with our insightful BCG Matrix preview. See how its offerings stack up as Stars, Cash Cows, Dogs, or Question Marks, and get a glimpse into their market potential.

Ready to transform this understanding into decisive action? Purchase the full BCG Matrix for a comprehensive breakdown, including detailed quadrant analysis and actionable strategies to optimize your investments and product development.

Stars

Health Catalyst's Data Operating System (DOS) is the bedrock of its offerings, a cloud-based ecosystem designed to consolidate and analyze diverse healthcare data. This powerful platform is instrumental in helping healthcare providers turn complex information into practical insights, leading to improvements in patient care, financial performance, and operational efficiency.

DOS's strength lies in its ability to integrate data from a multitude of sources, reportedly over 300. This extensive integration capability gives Health Catalyst a significant competitive edge in the rapidly expanding market for healthcare data integration solutions.

Health Catalyst is heavily investing in AI and machine learning, seeing them as essential for modern healthcare analytics. Their AI-powered tools are built to offer better decision support, streamline administrative work, and improve patient care.

The global healthcare AI market was projected to reach over $100 billion by 2028, with significant growth anticipated. Health Catalyst's focus on these advanced solutions positions them in a rapidly expanding sector, aiming to solidify their leadership.

Health Catalyst's Population Health Management (PHM) solutions are positioned as a star in the Health Catalyst BCG Matrix, reflecting their leadership in this vital healthcare segment. The company was notably recognized as a leader in the Frost Radar™: US Population Health Management, 2024 report, underscoring a significant market share for their PHM suite.

This strong market presence is driven by Health Catalyst's comprehensive and adaptable PHM product offerings. These solutions are specifically designed to meet diverse client needs, enabling healthcare organizations to effectively manage population health and drive improved patient outcomes.

Solutions for Clinical, Financial, and Operational Improvement

Health Catalyst's solutions are designed to directly impact key areas within healthcare organizations: clinical quality, financial performance, and operational efficiency. These offerings are crucial in today's healthcare landscape, where organizations are constantly seeking ways to improve patient outcomes while managing costs effectively.

The company's focus on reducing waste and optimizing costs aligns perfectly with the financial pressures faced by the healthcare industry. For instance, in 2024, many hospitals are grappling with rising labor costs and reimbursement challenges, making solutions that offer tangible cost savings highly attractive.

By providing quantifiable results, Health Catalyst's applications and services demonstrate clear value. This focus on delivering measurable improvements positions them strongly in a market segment that prioritizes demonstrable return on investment.

- Clinical Quality Enhancement: Improving patient safety and care outcomes.

- Financial Performance Optimization: Reducing operational costs and increasing revenue capture.

- Operational Efficiency Gains: Streamlining workflows and resource utilization.

- Data-Driven Decision Making: Providing insights for better strategic planning.

Strategic Partnerships Enhancing Core Offerings

Health Catalyst's strategic partnership with Microsoft, particularly its integration with Microsoft Azure and Azure AI Foundry, is a key move to boost its core technology. This alliance is designed to speed up the adoption of artificial intelligence within healthcare, enhancing Health Catalyst's existing solutions. By leveraging these advanced AI capabilities, the company is better positioned to offer sophisticated data analytics and insights.

This collaboration also expands Health Catalyst's market presence. Accessing the Azure Marketplace allows their AI-powered solutions to reach a wider audience of healthcare organizations. This strategic move is indicative of a high-growth trajectory, aiming to increase the influence and adoption of their leading products in a competitive landscape.

- Accelerated AI Adoption: The partnership with Microsoft Azure and Azure AI Foundry aims to fast-track the integration and utilization of AI in healthcare data analysis.

- Enhanced Core Offerings: Leveraging Azure's advanced AI capabilities strengthens Health Catalyst's technology stack, enabling more sophisticated solutions.

- Expanded Market Reach: Inclusion in the Azure Marketplace provides a significant channel to introduce Health Catalyst's AI-driven products to a broader customer base.

Health Catalyst's Population Health Management (PHM) solutions are categorized as Stars in the BCG Matrix, signifying their high market share and high growth potential. This positioning is supported by their recognition as a leader in the Frost Radar™: US Population Health Management, 2024 report, indicating strong market acceptance and leadership. The company's PHM suite is designed for adaptability, catering to diverse client needs and driving improved patient outcomes.

These solutions directly address critical healthcare objectives such as enhancing clinical quality, optimizing financial performance, and boosting operational efficiency. In 2024, healthcare providers are particularly focused on cost reduction due to rising labor expenses and reimbursement pressures, making Health Catalyst's ability to demonstrate quantifiable cost savings a significant advantage.

The strategic alliance with Microsoft, integrating with Azure and Azure AI Foundry, further bolsters Health Catalyst's Star status. This partnership accelerates AI adoption in healthcare, enhances their core technology, and expands market reach through the Azure Marketplace, positioning them for continued leadership and growth in the expanding healthcare analytics sector.

What is included in the product

Health Catalyst's BCG Matrix analyzes its product portfolio's market share and growth potential.

It guides strategic decisions on investing, holding, or divesting product units.

Health Catalyst's BCG Matrix offers a clear, visual representation of your portfolio's health, simplifying complex strategic decisions.

Cash Cows

Health Catalyst's professional services, encompassing analytics, implementation, and advisory, are a cornerstone of its business, generating a reliable revenue stream. These services are crucial for ensuring clients maximize the value of Health Catalyst's technology, fostering deep, long-term partnerships.

This segment is characterized by its maturity and high-margin potential, offering a stable counterpoint to the growth-oriented technology division. For instance, in 2023, Health Catalyst reported that its services segment contributed significantly to overall revenue, demonstrating its consistent performance and importance to the company's financial health.

Health Catalyst's mature data integration and warehousing capabilities form the bedrock of its platform, allowing healthcare organizations to consolidate information from various sources. These foundational elements are crucial for clients, ensuring a consistent and reliable data infrastructure.

This segment, while not experiencing rapid growth, holds a significant market share due to its essential nature and widespread adoption by healthcare providers. It functions as a reliable revenue generator, providing the steady cash flow needed to fuel other strategic developments within the company.

Health Catalyst's established client base, exceeding 1,000 organizations globally, positions it favorably within the Cash Cows quadrant. This extensive adoption signifies market penetration and a strong foundation for sustained revenue.

The company's impressive dollar-based retention rate of 102% for platform clients in 2024 is a key indicator of its Cash Cow status. This metric demonstrates that existing clients are not only staying but also increasing their spending, underscoring customer loyalty and predictable revenue streams.

This high retention rate translates into a reliable and consistent cash flow, a hallmark of Cash Cows. It allows Health Catalyst to fund other strategic initiatives, such as investments in new technologies or market expansion, without relying heavily on external financing.

Financial Analytics Suite

Health Catalyst's Financial Analytics Suite acts as a cash cow within its BCG Matrix portfolio. This suite offers clients robust tools for financial and quality benchmarking, crucial for navigating the intricate landscape of healthcare reimbursement and escalating cost pressures. Its value proposition directly impacts a client's profitability, ensuring a consistent demand and high profit margins.

The suite addresses a fundamental, stable need within the healthcare industry, making it a reliable revenue generator. For instance, in 2023, Health Catalyst reported total revenue of $282.1 million, with its data and analytics offerings, which include the financial suite, forming a significant portion of this. This segment requires relatively low investment for continued operation and growth, allowing it to contribute substantially to the company's overall cash flow.

- Financial Benchmarking: Enables healthcare organizations to compare their financial performance against industry peers.

- Quality Benchmarking: Facilitates the assessment of clinical quality metrics alongside financial outcomes.

- Reimbursement Navigation: Provides insights to optimize revenue cycle management amidst complex payment models.

- Cost Pressure Management: Offers tools to identify and address cost inefficiencies within operations.

Support and Maintenance Services for Core Platform

The ongoing support and maintenance services for Health Catalyst's Data Operating System (DOS) and its associated applications represent a significant cash cow. This segment generates a predictable and stable revenue stream, as clients depend on continuous support to ensure their critical data infrastructure functions optimally and remains secure.

This area operates within a mature, low-growth market. However, its essential nature provides a reliable cash flow with minimal need for substantial promotional investment, making it a foundational element of Health Catalyst's financial stability.

- Revenue Stability: Health Catalyst's support and maintenance services offer a consistent revenue base, crucial for predictable financial planning.

- Client Dependency: Customers rely heavily on these services for the continuous operation and security of their vital data systems.

- Mature Market: While growth is limited, the established demand in this segment ensures a steady income.

- Low Investment: The cash cow status is reinforced by the minimal marketing and development expenditure required to maintain its revenue generation.

Health Catalyst's professional services, such as analytics and implementation, are mature offerings that generate consistent, high-margin revenue. These services are vital for clients to derive maximum value from Health Catalyst's technology, solidifying long-term relationships and providing a stable financial base.

The company's established data integration and warehousing capabilities are essential for healthcare organizations, ensuring a reliable data infrastructure. This segment, while not experiencing rapid growth, holds a significant market share due to its fundamental importance, providing a steady cash flow that supports other company initiatives.

Health Catalyst’s strong client retention, evidenced by a 102% dollar-based retention rate in 2024, highlights its Cash Cow status. This metric confirms existing clients are increasing their spending, underscoring loyalty and predictable revenue streams that fund strategic investments.

The Financial Analytics Suite, enabling financial and quality benchmarking, is a key cash cow. It addresses a stable need in healthcare for optimizing reimbursement and managing costs, ensuring consistent demand and strong profit margins.

| Business Unit | BCG Quadrant | Revenue Contribution (2023 Est.) | Growth Rate (Est.) | Investment Needs |

|---|---|---|---|---|

| Professional Services | Cash Cow | Significant | Low | Low |

| Data Integration & Warehousing | Cash Cow | High | Low | Low |

| Financial Analytics Suite | Cash Cow | Moderate | Low | Low |

| DOS Support & Maintenance | Cash Cow | High | Low | Very Low |

Preview = Final Product

Health Catalyst BCG Matrix

The preview of the Health Catalyst BCG Matrix you are currently viewing is the identical, fully formatted document you will receive upon purchase. This means no watermarks, no altered content, and no surprises – just a professionally designed, analysis-ready strategic tool for your business.

Dogs

Health Catalyst is exiting its Ambulatory Operations Tech-Enabled Managed Services (TEMS) business by mid-2025. This strategic move will eliminate approximately $9 million in annual revenue.

This divestiture suggests the TEMS segment was likely a lower-margin or underperforming area for Health Catalyst, potentially lacking strong growth prospects or strategic fit within the company's broader objectives. Companies often shed non-core or less profitable assets to focus resources on more promising ventures.

Legacy or Non-Strategic Product Lines in Health Catalyst's BCG Matrix represent older offerings that may not align with the company's current emphasis on AI-driven solutions and core platform expansion. These could include products with declining market relevance or those requiring significant resources for maintenance without substantial strategic benefit.

For instance, if Health Catalyst had a legacy data warehousing solution that has been superseded by more advanced cloud-based platforms, it might fall into this category. Such products often exhibit low growth rates and a small market share, demanding ongoing investment that could be better allocated to more promising areas.

The company’s stated objective to streamline its technology portfolio underscores a potential divestment or sunsetting of these non-strategic assets. This strategic pruning aims to sharpen focus and resource allocation towards areas with higher growth potential and greater alignment with future market demands, such as their AI-powered clinical decision support tools.

Certain analytics applications within Health Catalyst's portfolio, while technically sound, may be experiencing low client adoption. These products, which could include niche data visualization tools or specific disease management modules, represent the 'Dogs' in the BCG matrix. For instance, if a particular predictive analytics module designed for a rare condition saw only a handful of implementations by mid-2024, it would fit this category.

These 'Dog' products consume valuable development and support resources, yet they generate minimal new revenue and fail to expand Health Catalyst's market share. Imagine a scenario where a legacy reporting tool, still maintained but rarely utilized by new clients in 2024, occupies engineering bandwidth that could be allocated to more promising innovations.

The continued investment in these underperforming areas might be more of a legacy burden than a strategic asset, hindering the company's ability to focus on high-growth opportunities. By late 2024, Health Catalyst might have identified several such modules, perhaps those with less than 5% of its client base actively using them, prompting a review of their future.

Services with Unsustainable Profitability

Certain professional services or specialized consulting projects can fall into the category of having unsustainable profitability. These are engagements that, despite being offered, consistently yield low profit margins or demand significant resources without generating commensurate value or future growth opportunities.

Health Catalyst's strategic emphasis on enhancing efficiency and boosting overall profitability naturally leads to a critical examination of these less lucrative service lines. The company aims to identify and potentially phase out offerings that act as cash traps, immobilizing capital with meager returns.

- Niche Consulting Engagements: Projects requiring highly specialized knowledge but with limited scalability or pricing power.

- Low-Margin Implementation Services: Standardized service packages that, due to competitive pressures, cannot command higher fees.

- Support Services with High Overhead: Ongoing client support that, while necessary, may not contribute significantly to the bottom line.

- Services with Declining Demand: Offerings in areas where market interest is waning, making it difficult to justify continued investment.

Underperforming Acquired Technologies

Health Catalyst's growth strategy has involved acquiring companies like Medicity, Twistle, and Lumeon. However, some of these acquired technologies may not have met expectations regarding market penetration or revenue generation. For instance, if an acquired platform struggles to integrate with Health Catalyst's core offerings or fails to capture a significant user base, it could be classified as a dog. This situation necessitates a thorough review to determine if continued investment is warranted or if divesting the underperforming asset is a more prudent financial decision.

These underperforming acquired technologies represent a challenge within the BCG matrix framework. They are essentially investments that have not delivered the anticipated return on investment in a dynamic and competitive healthcare technology landscape. Health Catalyst must carefully assess the strategic fit and future potential of these assets. For example, if an acquired solution's market share remains stagnant, it might be a candidate for restructuring or sale to free up capital for more promising ventures.

- Underperforming Acquired Technologies: Certain acquired technologies may not achieve desired market share or growth.

- Integration Challenges: Seamless integration into the core platform is crucial for success.

- Financial Implications: These can represent investments that did not yield expected returns.

- Strategic Re-evaluation: Requires careful evaluation for divestiture or significant restructuring.

Products classified as 'Dogs' in Health Catalyst's portfolio are those with low market share and low growth potential. These offerings consume resources without generating significant returns. For example, a niche analytics tool with minimal client adoption by mid-2024 would fit this description.

These 'Dogs' represent a drain on development and support teams, diverting attention from more promising innovations. By late 2024, Health Catalyst likely identified modules used by less than 5% of its client base, prompting a strategic review.

The company's divestiture of its Ambulatory Operations TEMS business for $9 million in annual revenue by mid-2025 signals a move away from such underperforming segments. This strategic pruning aims to sharpen focus on high-growth areas like AI-powered solutions.

Similarly, certain acquired technologies that have failed to gain traction or integrate effectively could also be categorized as 'Dogs'. These require careful assessment for potential restructuring or divestiture to optimize capital allocation.

Question Marks

Health Catalyst's recent launch of 10 AI-integrated data toolkits on the Databricks Marketplace in July 2025 positions them within the burgeoning AI in healthcare sector. This market is experiencing rapid expansion, with some projections indicating it could reach over $100 billion by 2028, driven by advancements in diagnostics and personalized medicine.

As new entrants, these toolkits likely possess a low initial market share, as potential customers are still navigating the discovery phase for such advanced solutions. The healthcare AI market is highly competitive, with established players and numerous startups vying for attention, making early adoption a key challenge.

These toolkits represent a substantial investment with considerable growth potential, akin to a Question Mark in the BCG matrix. Significant marketing and sales efforts will be crucial to drive adoption and transition these offerings into potential Stars, requiring a strategic focus on demonstrating tangible value and ROI to healthcare providers.

Health Catalyst leaders anticipate 2025 will mark a turning point for AI in healthcare, moving beyond hype to focus on practical applications. Think of AI assisting doctors with diagnoses or handling routine paperwork, freeing up valuable time for patient care. These areas are poised for significant growth, though they represent a small fraction of the market currently.

Achieving widespread adoption for these specific AI tools requires substantial investment and a concerted effort to educate healthcare providers on their tangible benefits. For instance, AI-powered clinical decision support systems are projected to grow, but their market share remains low, necessitating robust proof-of-value demonstrations.

Health Catalyst is actively developing innovative solutions for emerging healthcare needs, including robust cybersecurity measures and sophisticated strategies to close care gaps. These specialized areas represent significant growth potential as the industry grapples with increasing digital threats and inequities in patient access. For instance, the global healthcare cybersecurity market was projected to reach $54.2 billion by 2027, highlighting the urgency and scale of these challenges.

However, new solutions addressing these niche or nascent challenges, like advanced telehealth platforms for remote patient monitoring or AI-driven tools for early disease detection in underserved populations, may initially exhibit low market share. This is typical for products in their early stages, requiring substantial investment to refine, validate, and establish market presence against established competitors or alternative approaches. Companies must demonstrate clear value and return on investment to overcome initial adoption hurdles.

Experimental Analytics or Pilot Programs

Experimental analytics and pilot programs represent the nascent stages of innovation within the Health Catalyst BCG Matrix. These ventures are characterized by their exploration of novel data science and AI applications, often in areas with significant growth potential but as yet unproven market traction. For instance, a healthcare provider might pilot an AI-driven predictive analytics tool for early sepsis detection, a field with projected market growth exceeding 20% annually through 2028.

These initiatives typically consume substantial resources due to their experimental nature, mirroring the high cash consumption of Question Marks. Their success is not guaranteed, and they begin with a minimal market share. The critical factor is their ability to demonstrate a compelling value proposition and achieve early adoption. For example, a successful pilot could lead to a 15% reduction in hospital-acquired infections, justifying further investment.

- High Uncertainty: These projects are inherently risky, with a significant chance of failure.

- Resource Intensive: They require substantial investment in technology, talent, and time.

- Potential for High Growth: Successful pilots can unlock entirely new revenue streams or operational efficiencies.

- Strategic Importance: They are crucial for staying ahead of the curve in a rapidly evolving healthcare landscape.

Expansion into New Geographies or Market Segments

Expansion into new geographies or market segments for Health Catalyst, while not introducing entirely new products, would position their existing solutions as new offerings in those specific areas. These ventures would likely target high-growth regions or healthcare niches with low initial market penetration, aiming to capture emerging demand.

- Geographic Expansion: Entering markets like Southeast Asia or Latin America, where digital health adoption is accelerating, could be considered a new offering within those territories. For instance, the digital health market in Southeast Asia was projected to reach $10 billion by 2025, offering significant untapped potential.

- Market Segment Penetration: Targeting underserved segments such as rural healthcare providers or specific chronic disease management areas within existing geographies would also represent new market entries. In 2024, the US rural health market still faces significant challenges in adopting advanced analytics, presenting an opportunity.

- Strategic Rationale: Such expansions are driven by the potential for high growth and the opportunity to establish early market leadership in areas where competition is less intense. This aligns with Health Catalyst's strategy of leveraging its data and analytics platform across diverse healthcare settings.

Question Marks represent Health Catalyst's newer initiatives, like their AI-integrated data toolkits launched in July 2025. These products are in markets with high growth potential, such as AI in healthcare, which is expected to exceed $100 billion by 2028. However, they currently hold a low market share due to their novelty and the competitive landscape. Significant investment is needed to build market presence and potentially turn them into Stars.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from financial statements, market research reports, and competitive intelligence to provide a clear strategic overview.