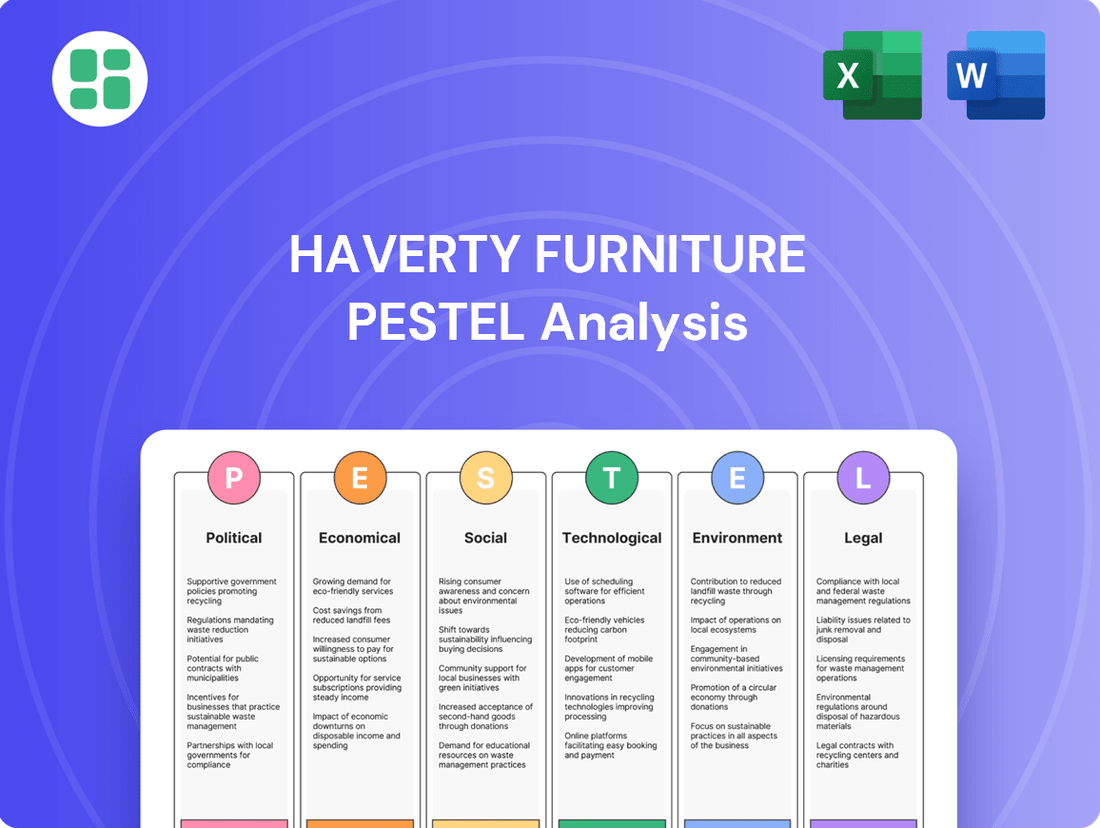

Haverty Furniture PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Haverty Furniture Bundle

Navigate the dynamic furniture market with our comprehensive PESTLE analysis of Haverty Furniture. Uncover how political shifts, economic fluctuations, and technological advancements are reshaping their operational landscape. Equip yourself with critical intelligence to anticipate challenges and seize opportunities. Purchase the full analysis now for actionable insights to inform your strategic decisions.

Political factors

Changes in international trade policies, including tariffs on imported furniture materials or finished goods, can significantly impact Haverty's cost of goods sold and pricing strategies. For instance, if new tariffs are imposed on wood or fabric imports, Haverty's expenses would likely rise, potentially leading to higher prices for consumers or reduced profit margins.

Given that furniture is often imported, tariffs can create headwinds for margins and scalability, requiring companies to explore alternative sourcing options. For example, if tariffs on furniture imported from Vietnam increase, Haverty might need to shift production or sourcing to countries like Mexico or explore domestic manufacturing to mitigate these costs.

Strict consumer protection laws, particularly concerning product safety, warranties, and advertising standards, directly impact Haverty's operational compliance and reputation. For instance, regulations like the Consumer Product Safety Improvement Act (CPSIA) mandate rigorous testing for harmful substances in furniture, a cost that directly affects Haverty's sourcing and manufacturing processes.

Adherence to these regulations, such as those related to furniture flammability and lead content, is critical to avoid legal penalties and maintain consumer trust. In 2023, the U.S. Consumer Product Safety Commission (CPSC) recalled millions of products due to safety concerns, highlighting the significant financial and reputational risks of non-compliance for retailers like Haverty.

Changes in corporate tax rates directly impact Haverty's bottom line. For instance, if the U.S. federal corporate tax rate, which was 21% in 2023, were to increase in 2024 or 2025, Haverty's net income would likely decrease, potentially affecting its ability to reinvest in the business or return capital to shareholders.

Sales tax variations across states where Haverty operates can also influence consumer purchasing decisions and the company's revenue. A rise in sales tax rates in key markets could make Haverty's products less attractive compared to competitors or online retailers with different tax structures.

Furthermore, any new or adjusted industry-specific levies on furniture or retail could add to Haverty's operating costs. Conversely, tax incentives aimed at encouraging consumer spending on home furnishings or supporting capital investments in retail infrastructure could provide a boost to Haverty's financial performance and strategic expansion plans.

Labor Laws and Employment Regulations

Changes in minimum wage laws, employee benefits mandates, or labor union regulations in the Southern and Midwestern U.S. states where Haverty operates can significantly impact its operational costs and human capital management strategies. For instance, a potential increase in the federal minimum wage or state-specific adjustments could directly affect the company's payroll expenses.

Haverty Furniture employed 2,334 individuals as of December 31, 2024, across its diverse operations. This substantial workforce means that labor regulations are a critical consideration for the company's financial planning and operational efficiency.

- Minimum Wage Impact: A hypothetical $2 increase in the minimum wage across all states Haverty operates in could add an estimated $4.6 million annually to payroll costs, assuming all 2,334 employees were at the current minimum wage.

- Benefit Mandates: New mandates for paid sick leave or expanded health insurance coverage could increase indirect labor costs, affecting the company's overall cost structure.

- Unionization Trends: An uptick in unionization efforts in retail or manufacturing sectors within Haverty's operating regions could lead to increased negotiation costs and potentially higher wages or improved benefits for unionized employees.

Housing and Construction Policies

Government policies significantly influence the housing and construction sectors, which in turn impacts furniture demand. For instance, changes in mortgage rates and urban development plans directly shape the number of new homes being built and existing homes being renovated. These shifts create opportunities or challenges for furniture retailers like Haverty.

Looking ahead to 2024 and 2025, a more stable interest rate environment could boost the housing market. We're seeing projections that suggest a cooling of mortgage rates from their 2023 peaks, potentially making homeownership more accessible. This stabilization, coupled with continued job growth, is anticipated to drive increased demand for home furnishings.

Key policy considerations for Haverty Furniture include:

- Government Incentives for Homeownership: Policies that encourage first-time homebuyers or offer tax credits for renovations can stimulate the housing market and furniture sales.

- Interest Rate Stability: Fluctuations in mortgage rates directly affect housing affordability and, consequently, consumer spending on durable goods like furniture.

- Urban Planning and Zoning Laws: These regulations can impact the pace and location of new housing developments, influencing the geographic distribution of furniture demand.

- Housing Affordability Initiatives: Measures aimed at increasing the supply of affordable housing could lead to a greater volume of new households requiring furniture.

Government regulations regarding international trade, such as tariffs on imported materials and finished goods, directly affect Haverty's cost of goods and pricing. For example, increased tariffs on wood or fabric imports in 2024 or 2025 would likely raise Haverty's expenses, potentially impacting profit margins or leading to higher consumer prices.

Consumer protection laws, particularly those related to product safety and advertising, are critical for Haverty's compliance and reputation. Adherence to standards for furniture flammability and lead content is essential to avoid legal penalties, as demonstrated by the millions of products recalled by the CPSC in recent years due to safety concerns.

Changes in corporate tax rates, like the U.S. federal rate of 21% in 2023, directly influence Haverty's net income and reinvestment capacity. State-level sales tax variations also impact purchasing decisions and revenue streams for the company.

Labor regulations, including minimum wage laws and benefit mandates, significantly affect Haverty's operational costs. With 2,334 employees as of December 31, 2024, adjustments to minimum wage or new benefit requirements could add millions to payroll expenses annually.

What is included in the product

This Haverty Furniture PESTLE analysis examines the influence of external macro-environmental factors across Political, Economic, Social, Technological, Environmental, and Legal dimensions, providing actionable insights for strategic decision-making.

This Haverty Furniture PESTLE analysis provides a clean, summarized version of the full analysis for easy referencing during meetings or presentations, highlighting key external factors impacting the business.

Economic factors

Rising interest rates directly impact Haverty Furniture's customer base by increasing the cost of borrowing. For instance, the Federal Reserve's benchmark interest rate has seen significant hikes through 2023 and into 2024, influencing mortgage rates and the affordability of car loans, which often compete with furniture purchases for discretionary spending. This makes it more expensive for consumers to finance large purchases, potentially leading to delayed buying decisions.

The furniture industry, heavily reliant on consumer discretionary spending, feels the pinch of higher interest rates acutely. Reports from late 2023 and early 2024 indicated that many furniture retailers were experiencing cautious consumer behavior, with shoppers postponing purchases of big-ticket items like sofas and dining sets. This trend is directly linked to the reduced purchasing power stemming from increased borrowing costs.

Disposable income and consumer confidence are crucial drivers for furniture retailers like Haverty. When households have more discretionary funds and feel secure about their financial future, they are more likely to invest in home furnishings, which are often considered non-essential purchases. This directly impacts Haverty's ability to generate sales.

In 2024, economic headwinds, including persistent inflation and general uncertainty, have prompted consumers to adopt a more cautious spending approach. This cautiousness has translated into reduced spending on big-ticket items such as furniture, directly affecting Haverty's net sales performance throughout the year.

The stability and growth of the housing market directly influence furniture demand, as new homeowners and those undertaking renovations are primary customers. For Haverty Furniture, a robust housing market translates to increased sales opportunities.

Projections indicate a positive trend for the housing sector. For instance, existing home sales in the U.S. saw a notable uptick in early 2024, and forecasts suggest continued growth through 2025 and 2026, with some analysts predicting a 5-10% increase in sales volume for the latter year.

This anticipated expansion in home sales, driven by factors like favorable mortgage rates and demographic shifts, provides a fertile ground for furniture retailers. Haverty can capitalize on this by aligning its inventory and marketing strategies with the expected surge in new household formations and home improvement projects.

Inflationary Pressures and Supply Chain Costs

Inflationary pressures continue to significantly impact Haverty Furniture by increasing the cost of essential inputs. Rising prices for raw materials like lumber and foam, coupled with higher manufacturing and transportation expenses, directly squeeze gross profit margins. This necessitates careful strategic pricing adjustments to maintain profitability without alienating customers. For instance, the Consumer Price Index (CPI) for goods saw a notable increase throughout 2024, directly affecting furniture production costs.

Supply chain disruptions remain a persistent challenge for furniture retailers like Haverty. Geopolitical events and logistical bottlenecks contribute to extended lead times and elevated shipping rates. These factors, combined with the general inflationary environment, are top concerns, forcing retailers to manage inventory more cautiously and explore alternative sourcing strategies to mitigate cost increases and ensure product availability for consumers.

- Increased Input Costs: Lumber prices, a key component for furniture, experienced volatility in 2024, with some reports indicating a 15-20% increase year-over-year for certain grades.

- Transportation Expenses: Fuel surcharges and container shipping rates, while showing some moderation from pandemic highs, remained elevated in early 2025, adding to overall delivery costs.

- Margin Pressure: Haverty's gross profit margin, which stood around 40-42% in recent quarters, faces ongoing pressure from these rising operational costs.

- Consumer Price Sensitivity: Retailers must balance passing on costs with maintaining competitive pricing, as consumer spending on discretionary items like furniture can be sensitive to price hikes.

Competition and Market Share

The furniture retail landscape is intensely competitive, featuring a mix of online pure-plays and established brick-and-mortar retailers. This dynamic environment directly impacts Haverty's pricing, promotional efforts, and its ability to capture market share. For instance, in 2024, the online furniture market continued its robust growth, with projections indicating it will represent a significant portion of total furniture sales, forcing traditional retailers to adapt their strategies.

Haverty strategically targets a more affluent customer base, differentiating itself by highlighting superior quality and offering design services. This approach aims to build brand loyalty and command premium pricing, setting it apart from mass-market competitors. As of early 2025, consumer spending on home furnishings among higher-income households remained resilient, supporting Haverty's premium positioning.

- Intense Competition: Haverty operates in a crowded market with both online and physical retailers vying for customer attention.

- Targeted Market Segment: The company focuses on affluent consumers, emphasizing quality and design services as key differentiators.

- Market Share Dynamics: Competitive pressures influence pricing and promotional activities, directly impacting Haverty's market share.

- Online Growth Impact: The continued expansion of e-commerce in furniture retail necessitates ongoing strategic adjustments for brick-and-mortar players like Haverty.

Economic factors significantly shape Haverty Furniture's operating environment. Rising interest rates, exemplified by the Federal Reserve's continued tightening through 2023 and into 2024, increase borrowing costs for consumers, potentially dampening demand for big-ticket items like furniture. Inflationary pressures, with the CPI for goods showing an increase in 2024, drive up input costs for materials and transportation, squeezing profit margins.

Consumer discretionary spending, a key driver for furniture sales, is influenced by disposable income and confidence levels, which have shown caution in early 2024 due to economic headwinds. The housing market's stability and growth are also critical; positive projections for existing home sales in early 2024, with forecasts suggesting continued growth through 2025 and 2026, present opportunities for increased furniture demand.

| Economic Factor | Impact on Haverty Furniture | Relevant Data (2023-2025) |

|---|---|---|

| Interest Rates | Increased borrowing costs reduce consumer spending on discretionary items. | Federal Reserve benchmark rate hikes continued through 2023-2024. |

| Inflation | Higher input costs (materials, transport) pressure profit margins. | CPI for goods increased in 2024; lumber prices rose 15-20% YoY in 2024. |

| Consumer Spending | Cautious consumer behavior due to economic uncertainty affects sales. | Reduced spending on big-ticket items observed in early 2024. |

| Housing Market | Growth in home sales drives demand for furnishings. | Existing home sales showed uptick in early 2024; forecast growth for 2025-2026. |

Full Version Awaits

Haverty Furniture PESTLE Analysis

The Haverty Furniture PESTLE analysis preview you see is the exact document you’ll receive after purchase—fully formatted and ready to use.

This detailed breakdown of Political, Economic, Social, Technological, Legal, and Environmental factors impacting Haverty Furniture is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises.

The content and structure shown in this preview is the same document you’ll download after payment, providing a comprehensive overview of the market landscape for Haverty Furniture.

Sociological factors

Consumer lifestyles continue to evolve, with a sustained emphasis on home-centric living following the pandemic. This shift means people are investing more in their living spaces, driving demand for comfortable and functional furniture. For instance, a 2024 survey indicated that 65% of consumers are prioritizing home improvement projects, directly impacting furniture purchases.

Preferences are leaning towards multifunctional designs that maximize space and versatility. Consumers are actively seeking furniture that can adapt to various needs, from remote work setups to entertainment hubs. This trend is reflected in the growing popularity of modular sofas and convertible tables, with sales in these categories reportedly up 15% year-over-year in early 2025.

Beyond mere aesthetics, consumers are increasingly prioritizing quality and personalized design. They want furniture that not only looks good but is also durable and reflects their individual style. This demand for customization and longevity is pushing brands to offer a wider range of material options and bespoke services, with a notable 20% increase in custom order inquiries reported by major retailers in the last quarter of 2024.

Demographic shifts are significantly reshaping the furniture market. The average age of first-time homebuyers is gradually increasing, influenced by factors like student loan debt and delayed marriage, which could impact the demand for starter home furnishings. Urbanization trends also play a role, as more people move to cities, potentially favoring smaller, multi-functional furniture pieces.

Haverty Furniture's core demographic, well-educated women in middle to upper-middle income suburban households, remains a key focus. However, evolving household formation rates, such as a rise in single-person households and multi-generational living, present both challenges and opportunities for furniture retailers to adapt their product offerings and marketing strategies.

Consumers are increasingly prioritizing sustainability and ethical sourcing when buying furniture. This shift is evident as a significant portion of consumers, around 60% in recent surveys, report considering a brand's environmental impact in their purchasing choices. Haverty's response to this trend involves exploring more recycled materials and eco-friendly manufacturing processes to align with evolving consumer values.

Influence of Digital and Social Media

The pervasive influence of digital and social media significantly shapes consumer behavior in the furniture industry. Platforms like Instagram, Pinterest, and TikTok are increasingly becoming discovery engines, showcasing trends and inspiring purchases. By July 2025, it's estimated that over 80% of consumers will research products online before making a purchase, with social media reviews and influencer content playing a crucial role in furniture selection.

Consumers now frequently blend online research with in-store experiences. They often check online reviews and social media sentiment regarding specific furniture pieces or brands before even visiting a physical showroom. This dual-channel approach means Haverty Furniture must maintain a strong, positive digital presence and actively manage its online reputation to capture customer interest.

- Digital Discovery: Platforms like Instagram and Pinterest are key for furniture discovery, with user-generated content and influencer marketing driving trends.

- Reputation Management: Online reviews and social media sentiment heavily influence purchasing decisions, making proactive reputation management essential.

- Omnichannel Journey: Consumers engage in a hybrid research process, combining online exploration with physical store visits, necessitating a seamless brand experience across both.

- 2024 Data Point: In 2024, social commerce sales for home goods, including furniture, were projected to reach over $50 billion globally, highlighting the direct impact of social media on sales.

Demand for Interior Design Services

Haverty Furniture's commitment to providing complimentary in-home design services directly addresses a growing consumer desire for personalized and expertly curated living spaces. This sociological trend, emphasizing individual expression and comfort within the home, is a key driver for their business model.

The success of these design services is evident in their financial impact. In 2023, Haverty reported that in-home design consultations were instrumental in driving sales, often resulting in higher average transaction values compared to customers who did not utilize the service. This indicates a strong customer appreciation for the added value and expertise offered.

- Personalized Home Solutions: Consumers increasingly seek tailored interior design advice to reflect their unique lifestyles and preferences.

- In-Home Design Impact: Haverty's complimentary in-home design services are a significant sales driver, contributing to larger average ticket sizes.

- Value-Added Service: The offering enhances customer experience and loyalty by providing expert guidance in furnishing and decorating.

Sociological factors significantly influence Haverty Furniture's market. A growing emphasis on home improvement, with 65% of consumers prioritizing it in 2024, fuels demand for comfortable and functional furniture. Consumers also seek multifunctional designs, leading to a 15% year-over-year sales increase in modular and convertible pieces by early 2025. Furthermore, a desire for quality and personalization is evident, with custom order inquiries up 20% in late 2024.

Demographic shifts, like an aging first-time homebuyer population and increased urbanization, favor smaller, adaptable furniture. Haverty's core demographic remains suburban women, but evolving household structures, such as more single-person homes, require strategic product adaptation. Sustainability is also a growing concern, with 60% of consumers considering a brand's environmental impact.

Digital and social media are crucial for furniture discovery, with over 80% of consumers researching online by July 2025. Haverty's in-home design services, a response to the desire for personalized spaces, have proven to be a significant sales driver, increasing average transaction values.

| Trend | Consumer Behavior | Impact on Haverty | Data Point |

|---|---|---|---|

| Home-Centric Living | Increased spending on home improvement and comfort. | Drives demand for quality and functional furniture. | 65% of consumers prioritized home improvement in 2024. |

| Multifunctional Furniture | Seeking space-saving and adaptable pieces. | Growth opportunity in modular and convertible designs. | 15% YoY sales increase in these categories (early 2025). |

| Personalization & Quality | Desire for durable, stylish, and customized items. | Need for wider material options and bespoke services. | 20% increase in custom order inquiries (late 2024). |

| Digital Influence | Online research and social media heavily impact purchasing. | Requires strong online presence and reputation management. | 80% of consumers to research online before purchase (by July 2025). |

Technological factors

The furniture industry, including Haverty, is experiencing a significant shift towards e-commerce and omnichannel strategies. In 2024, online sales represented about 3.0% of Haverty's total revenue, highlighting the growing importance of digital channels.

To compete effectively, Haverty must invest in and enhance its e-commerce capabilities. This includes ensuring a smooth customer experience that seamlessly connects online browsing with physical showroom visits, a key component of successful omnichannel retailing.

Haverty Furniture is seeing a significant shift towards augmented reality (AR) and virtual reality (VR) integration, aiming to revolutionize the customer's online shopping journey. By allowing customers to virtually place furniture in their own homes, these technologies significantly boost confidence and reduce the likelihood of returns. For instance, a growing number of furniture retailers are investing in AR capabilities, with projections indicating a substantial increase in 3D product visualization adoption by 2025.

Haverty Furniture is increasingly leveraging data analytics to deeply understand customer preferences, allowing for highly personalized shopping experiences. This is vital for staying competitive in the evolving retail landscape. For instance, by analyzing purchase history and browsing behavior, they can tailor product recommendations and marketing campaigns.

The furniture industry is seeing a significant rise in AI-powered personalization. This means using artificial intelligence to anticipate customer needs and offer customized solutions, from design suggestions to financing options. Data-driven decision-making is no longer a luxury but a necessity for optimizing inventory, pricing, and customer engagement strategies throughout 2024 and into 2025.

Supply Chain Automation and Logistics Technology

Haverty Furniture's investment in supply chain automation and advanced logistics technology is crucial for optimizing its operations. By embracing these technologies, the company can significantly reduce delivery times and enhance overall efficiency across its network of 129 stores and warehouses. This focus on technological advancement directly addresses the need for streamlined inventory management and distribution.

The company's strategic adoption of automation aims to improve the speed and accuracy of its logistics. This includes areas like warehouse management systems and route optimization software. For instance, advancements in real-time tracking and predictive analytics can help anticipate demand and manage stock levels more effectively, minimizing carrying costs and stockouts.

- Optimized Inventory Management: Technologies like RFID and AI-powered forecasting can ensure Haverty maintains optimal stock levels across its 129 locations, reducing both overstock and stockout situations.

- Reduced Delivery Times: Investments in route optimization and automated dispatch systems can lead to faster and more reliable customer deliveries, a key competitive differentiator in the furniture retail sector.

- Enhanced Operational Efficiency: Automation in warehouses, from automated guided vehicles to advanced sortation systems, can lower labor costs and increase throughput, directly impacting Haverty's bottom line.

- Improved Customer Experience: Faster deliveries and fewer errors in fulfillment, facilitated by technology, contribute to a better overall customer experience, fostering loyalty and repeat business.

Digital Tools for Interior Design

Haverty Furniture is increasingly leveraging digital tools to enhance its interior design services. The company's website features 3-D room planners and extensive upholstery customization options, providing customers with unprecedented flexibility and visualization capabilities. This technological integration allows clients to experiment with different furniture layouts and fabric choices virtually, leading to more confident purchasing decisions and a personalized design experience.

These digital advancements are crucial in a market where consumers expect interactive and convenient shopping. For instance, a significant portion of furniture shoppers in 2024 indicate that online visualization tools positively influence their purchase intent. Haverty's investment in these technologies directly addresses this trend, aiming to streamline the design process and boost customer engagement.

- Enhanced Visualization: 3-D room planners allow customers to see how furniture fits and looks in their own space before buying.

- Customization Power: Online upholstery tools offer a wide array of fabric and color choices, enabling personalized selections.

- Improved Customer Experience: Digital tools reduce uncertainty and increase customer satisfaction by providing a more interactive design journey.

- Market Competitiveness: Adoption of these technologies keeps Haverty competitive in an increasingly digital retail landscape.

Technological advancements are reshaping how consumers interact with furniture retailers like Haverty. E-commerce growth continues, with online sales representing a significant portion of revenue, underscoring the need for robust digital platforms. Haverty's 2024 online sales accounted for approximately 3.0% of its total revenue, a figure expected to grow.

Haverty is actively integrating augmented reality (AR) and virtual reality (VR) to enhance the online shopping experience, allowing customers to visualize products in their homes. This technology is becoming increasingly standard, with a projected rise in 3D product visualization adoption by 2025.

Data analytics and AI are being employed to personalize customer experiences, from tailored recommendations to optimized inventory management. These tools are critical for understanding evolving consumer preferences and driving efficiency in pricing and marketing efforts through 2024 and 2025.

Supply chain automation and advanced logistics are key focus areas for Haverty, aiming to reduce delivery times and improve operational efficiency across its network of 129 stores. Investments in route optimization and warehouse management systems are central to these efforts.

| Technology Area | Haverty's Focus | Impact |

|---|---|---|

| E-commerce | Enhancing online sales channels | Increased revenue, broader market reach |

| AR/VR | Virtual product placement | Improved customer confidence, reduced returns |

| Data Analytics/AI | Personalization, demand forecasting | Enhanced customer engagement, optimized inventory |

| Supply Chain Automation | Logistics optimization, warehouse management | Reduced delivery times, improved efficiency |

Legal factors

Haverty Furniture must adhere to stringent federal and state product safety regulations, covering aspects like flammability and chemical emissions such as lead and formaldehyde. This ensures consumer protection and maintains brand reputation.

The Consumer Product Safety Commission (CPSC) is set to implement electronic filing of General Certificates of Compliance for clothing storage furniture starting in 2025. This regulatory shift will impact how Haverty documents and proves compliance for these product categories.

Haverty Furniture must navigate a complex web of data privacy laws, including the California Consumer Privacy Act (CCPA) and similar state-level regulations emerging across the US. These laws dictate how customer data, gathered from online purchases and in-store interactions, can be collected, used, and protected. Failure to comply can result in substantial fines; for instance, CCPA violations can incur penalties of up to $7,500 per intentional violation.

Haverty Furniture's expansion plans, targeting an average of five new showrooms annually, are directly influenced by local zoning and land use regulations. These laws dictate where the company can establish new retail locations and distribution hubs, particularly when repurposing former big box retail spaces. Navigating these diverse municipal requirements is crucial for successful site selection and development.

Intellectual Property Rights

Protecting intellectual property, such as unique furniture designs and brand trademarks, is paramount for Haverty Furniture in today's highly competitive retail landscape. This protection safeguards their creative investments and market differentiation.

Haverty's significant brand recognition, built on a reputation for quality and fashion-forward styles, makes intellectual property protection a critical business imperative. Maintaining this image relies heavily on preventing unauthorized use of their designs and branding.

- Trademark Protection: Haverty actively protects its brand name and logos, which are key assets in building customer trust and loyalty.

- Design Patents: The company may pursue design patents for innovative furniture pieces, preventing competitors from replicating unique aesthetics.

- Copyright: Marketing materials, website content, and product descriptions are subject to copyright protection to prevent unauthorized duplication.

- Enforcement: Haverty likely monitors the market for potential infringements and takes legal action when necessary to defend its intellectual property rights.

Employment and Workplace Safety Laws

Haverty Furniture's commitment to workplace safety is paramount, requiring strict adherence to Occupational Safety and Health Administration (OSHA) regulations. This ensures a secure environment for its workforce, which numbered approximately 2,334 employees as of their latest reporting. Compliance with these legal frameworks is crucial for maintaining operational integrity and employee well-being.

The company's human capital strategy actively integrates diversity and safety initiatives. This focus is not only a legal obligation but also a core component of attracting and retaining talent. By prioritizing these aspects, Haverty aims to foster a positive and productive workplace culture.

- OSHA Compliance: Ensuring adherence to federal and state safety standards.

- Employee Well-being: Prioritizing the health and safety of all 2,334 employees.

- Diversity & Inclusion: Integrating these principles into the human capital strategy.

- Legal Frameworks: Navigating various employment laws to maintain a compliant operation.

Haverty Furniture operates under a framework of consumer protection laws, including those governing product safety and advertising. For instance, the Federal Trade Commission (FTC) mandates clear and truthful advertising, impacting how Haverty markets its furniture. Compliance ensures fair competition and prevents misleading consumers.

The company must also navigate evolving e-commerce regulations. As online sales grow, adherence to laws concerning online transactions, consumer rights in digital spaces, and data security becomes increasingly critical. This includes complying with regulations like the CAN-SPAM Act for email marketing.

Haverty's financial reporting and operations are subject to securities laws and regulations, particularly if publicly traded. These govern transparency, disclosure requirements, and corporate governance, ensuring investor confidence and market integrity. For example, adherence to Generally Accepted Accounting Principles (GAAP) is fundamental.

Environmental factors

Haverty Furniture faces growing pressure to adopt sustainable sourcing and materials. Consumers and regulators increasingly demand furniture made from responsibly managed forests, recycled components, and low-VOC (volatile organic compound) finishes. This shift is evident in the market, with companies highlighting their use of reclaimed wood and organic textiles to appeal to environmentally conscious buyers.

Haverty Furniture must adhere to evolving waste management and recycling regulations, impacting both its manufacturing and retail arms. These rules govern the disposal of everything from production byproducts to customer packaging and end-of-life furniture. For instance, in 2024, many regions are intensifying scrutiny on landfill diversion rates, pushing companies like Haverty to invest more heavily in recycling infrastructure and partnerships to manage materials like wood, textiles, and plastics responsibly.

The proper handling of hazardous materials, often found in furniture finishes or cleaning agents used in manufacturing, is also a critical regulatory concern. Fines for non-compliance can be substantial, and reputational damage from environmental incidents is a significant risk. As of early 2025, the EPA’s Resource Conservation and Recovery Act (RCRA) continues to set stringent standards for hazardous waste identification, management, and disposal, requiring Haverty to maintain robust compliance programs and employee training.

Haverty Furniture faces increasing pressure to curb energy usage across its showrooms, distribution centers, and delivery fleets, directly impacting its carbon footprint. This push for efficiency is driving operational adjustments, aiming to make processes more sustainable.

Adopting energy-saving measures, such as LED lighting upgrades in its 120+ showrooms and optimizing delivery routes, can translate into tangible cost reductions. For instance, a 15% reduction in energy consumption in commercial buildings can lead to significant savings on utility bills, a goal likely pursued by Haverty.

Consumer Demand for Eco-Friendly Products

A significant and growing portion of consumers now actively seek out furniture made with eco-friendly materials and sustainable practices. This shift is driven by a broader movement towards ethical consumption, where purchasing decisions reflect personal values. For instance, a 2024 report indicated that over 60% of consumers consider sustainability when making purchasing decisions, a figure that has steadily climbed in recent years.

This heightened consumer demand directly pressures furniture retailers like Haverty to adapt their product lines and supply chains. Retailers are increasingly highlighting their use of recycled materials, responsibly sourced wood, and low-VOC finishes to appeal to this environmentally conscious demographic. Haverty's own sustainability reports for 2024 noted an increase in customer inquiries regarding the origin and environmental impact of their products.

- Growing Consumer Prioritization: A majority of consumers now factor environmental impact into their furniture buying choices.

- Ethical Consumption Trend: This demand is part of a larger societal shift towards supporting brands with ethical and sustainable operations.

- Retailer Adaptation: Furniture companies are responding by offering more eco-friendly product options and transparent sourcing.

- Data Support: Over 60% of consumers in 2024 reported considering sustainability, demonstrating a clear market signal.

Climate Change Impact on Supply Chains

Climate change poses significant threats to Haverty Furniture's supply chain. Extreme weather events, like hurricanes and floods, can disrupt the sourcing of raw materials, such as timber and textiles, and impede transportation, especially for imported goods. For instance, the U.S. experienced 28 separate billion-dollar weather and climate disasters in 2023, totaling over $170 billion in damages, highlighting the increasing frequency and severity of such events that could impact logistics and material availability.

To counter these risks, adaptive business models are crucial. This includes diversifying suppliers geographically and exploring alternative materials to build resilience. Haverty's reliance on global sourcing for certain components means that events in one region can have cascading effects across its operations. Building robust contingency plans for transportation and inventory management is therefore essential to maintain operational continuity.

- Increased Volatility: Climate change amplifies the risk of disruptions to raw material sourcing and transportation, impacting product availability and delivery times.

- Supply Chain Resilience: Companies like Haverty must invest in strategies such as supplier diversification and alternative material sourcing to mitigate climate-related risks.

- Logistical Challenges: Extreme weather events can directly affect shipping routes and warehousing, leading to delays and increased operational costs for imported furniture and materials.

Environmental regulations are increasingly shaping the furniture industry, pushing companies like Haverty Furniture towards sustainable practices. Stricter rules on waste management and hazardous materials are in effect as of 2024-2025, requiring robust compliance programs and potentially higher operational costs.

Consumers are also driving this change, with over 60% considering sustainability in purchasing decisions in 2024. This growing demand for eco-friendly products, such as those made from recycled materials or responsibly sourced wood, pressures retailers to adapt their offerings and supply chains.

Climate change presents tangible risks to Haverty's supply chain, with extreme weather events in 2023 alone causing over $170 billion in damages. Diversifying suppliers and exploring alternative materials are key strategies for building resilience against these disruptions.

PESTLE Analysis Data Sources

Our Haverty Furniture PESTLE analysis is meticulously constructed using data from official government publications, reputable market research firms, and economic indicators. We incorporate insights from industry-specific reports and consumer behavior studies to ensure a comprehensive understanding of the macro-environment.