Haverty Furniture Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Haverty Furniture Bundle

Haverty Furniture navigates a competitive landscape shaped by intense rivalry, significant buyer bargaining power, and the ever-present threat of substitutes. Understanding these dynamics is crucial for any stakeholder.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Haverty Furniture’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The concentration of suppliers in the furniture industry directly affects Haverty's ability to negotiate favorable terms. When a few large manufacturers dominate the supply of key components, such as specialized wood or upholstery materials, they gain significant leverage. For example, in 2024, the global furniture market experienced supply chain pressures, with some raw material costs increasing by as much as 15% due to limited availability of certain hardwoods.

This concentration means fewer alternatives for Haverty, potentially leading to higher prices and less flexibility in delivery schedules. If suppliers are highly concentrated, they can dictate terms, impacting Haverty's cost of goods sold and overall profitability. A fragmented supplier landscape, however, would empower Haverty by providing more choices and competitive pricing.

The uniqueness of inputs significantly impacts supplier bargaining power. If Haverty Furniture relies on suppliers providing proprietary designs or specialized materials that are difficult to find elsewhere, those suppliers gain considerable leverage. This is because switching to an alternative supplier would involve substantial costs.

These switching costs can be quite high for furniture retailers like Haverty. They might include expenses related to retooling manufacturing processes, redesigning furniture lines to accommodate different materials, or establishing entirely new supply chain and logistical networks. For instance, in 2024, the furniture industry continued to see consolidation among key component suppliers, particularly for specialized wood treatments and high-performance fabrics, which could increase dependence on a limited number of providers.

Suppliers' potential to move into furniture retailing, effectively bypassing Haverty, significantly boosts their bargaining clout. If a manufacturer can sell directly to consumers, they no longer rely solely on retailers like Haverty, giving them more leverage in pricing and terms.

This threat is more pronounced for manufacturers possessing strong brand recognition or existing direct-to-consumer (DTC) sales channels. For instance, in 2024, the DTC furniture market continued its growth trajectory, with many brands investing in online platforms and showrooms, making forward integration a more viable strategy.

Importance of Haverty to Suppliers

Haverty's significance as a customer directly impacts its bargaining power with suppliers. When Haverty represents a substantial portion of a supplier's revenue, that supplier is more likely to offer competitive pricing and favorable terms to secure continued business. For instance, if a supplier's sales to Haverty constitute a significant percentage of their overall sales, they have a stronger incentive to maintain that relationship through negotiation.

Conversely, if Haverty is a minor client for a large supplier, its negotiating leverage is considerably reduced. In such scenarios, the supplier may be less inclined to concede on pricing or terms, as the loss of Haverty's business would have a minimal impact on their operations. This disparity highlights how the revenue concentration plays a crucial role in supplier negotiations.

Haverty's Furniture reported total revenue of approximately $1.04 billion for the fiscal year 2023. The proportion of this revenue that flows to any single supplier would determine that supplier's dependence on Haverty and, consequently, their willingness to negotiate.

- Supplier Dependence: The percentage of a supplier's total sales attributed to Haverty is a key determinant of Haverty's bargaining power.

- Revenue Concentration: If Haverty is a major revenue source for a supplier, they are more amenable to favorable terms.

- Negotiating Leverage: Haverty's ability to influence supplier pricing and terms is directly linked to its importance as a customer.

Availability of Substitute Inputs

The ease with which Haverty Furniture can source alternative inputs significantly impacts supplier bargaining power. If many suppliers can offer similar quality and style furniture or components, Haverty's reliance on any single supplier diminishes.

A robust domestic and international manufacturing base for furniture components means Haverty has choices. This availability of substitutes weakens a supplier's ability to dictate terms, as Haverty can readily switch if prices become unfavorable or quality falters.

- Reduced Supplier Leverage: When numerous suppliers can provide comparable materials or finished goods, the bargaining power of individual suppliers is inherently lowered.

- Cost Control: Haverty can leverage the availability of substitutes to negotiate better pricing and more favorable contract terms, directly impacting its cost of goods sold.

- Supply Chain Resilience: A diverse supplier base with readily available alternatives enhances Haverty's supply chain resilience, mitigating risks associated with disruptions from any single source.

The bargaining power of suppliers for Haverty Furniture is influenced by several key factors. When suppliers are concentrated, inputs are unique, or they have the potential for forward integration, their leverage increases, potentially driving up costs for Haverty. Conversely, Haverty's own significance as a customer and the availability of alternative suppliers can diminish this power.

| Factor | Impact on Haverty's Bargaining Power | 2024/2025 Relevance |

|---|---|---|

| Supplier Concentration | High concentration increases supplier power. | Some raw material costs rose 15% in 2024 due to limited availability. |

| Uniqueness of Inputs | Proprietary or specialized inputs grant suppliers leverage. | Consolidation among suppliers of specialized wood treatments and high-performance fabrics continues. |

| Threat of Forward Integration | Suppliers selling directly to consumers gain power. | The DTC furniture market grew in 2024, making this a more viable strategy for manufacturers. |

| Haverty's Customer Significance | Haverty's revenue share with a supplier impacts its leverage. | Haverty's 2023 revenue was $1.04 billion; its impact on individual suppliers varies. |

| Availability of Substitutes | Many alternatives weaken supplier power. | A robust domestic and international manufacturing base offers choices, reducing reliance on single suppliers. |

What is included in the product

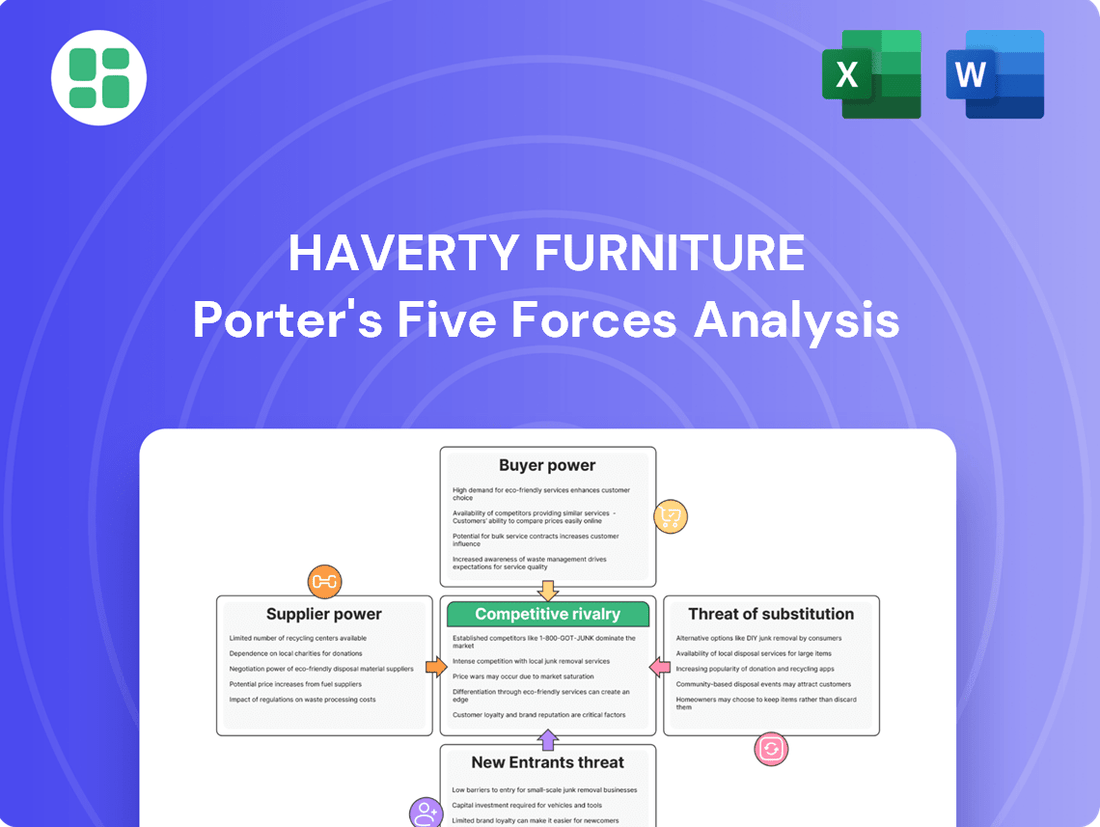

This analysis of Haverty Furniture's competitive landscape identifies the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitutes on the furniture retail market.

Instantly understand strategic pressure with a powerful spider/radar chart, visualizing Haverty's competitive landscape to pinpoint key threats and opportunities.

Customers Bargaining Power

Customer price sensitivity is a significant factor in Haverty's furniture market. In 2024, with inflation impacting discretionary spending, consumers are likely scrutinizing furniture purchases more closely, potentially increasing their sensitivity to price fluctuations. This heightened awareness means Haverty must remain competitive to attract and retain buyers.

The ease with which customers can purchase furniture from a wide array of retailers, including online giants like Wayfair and Amazon, as well as brick-and-mortar competitors such as Ashley Furniture HomeStore and IKEA, significantly bolsters their bargaining power. This abundance of choice means customers can readily compare prices, styles, and quality, putting pressure on Haverty to remain competitive.

Low switching costs are a critical factor here. For instance, a customer looking for a sofa can easily visit multiple stores or browse numerous websites without incurring substantial time or financial penalties. This flexibility allows them to walk away from a Haverty purchase if they find a better deal elsewhere, directly enhancing their leverage in price negotiations or product selection.

In 2024, the furniture retail landscape continues to be highly fragmented. Online furniture sales, for example, represented a significant portion of the market, with some estimates suggesting it could reach over 20% of total furniture sales in the US. This digital accessibility further empowers consumers by broadening their immediate options beyond local brick-and-mortar stores.

Customers today have unprecedented access to information. Online channels provide detailed product specifications, user reviews, and readily available price comparisons, significantly boosting their knowledge. This transparency directly impacts their bargaining power, as they can easily assess value and identify the best deals available in the market.

This heightened transparency allows consumers to directly compare Haverty Furniture’s products and pricing with those of its competitors. For instance, a quick search can reveal similar sofa styles at different price points from various retailers. This makes customers more discerning and less likely to accept higher prices without justification, thereby increasing pressure on Haverty to offer competitive pricing and compelling value propositions.

Importance of Purchase to Customer

For many consumers, acquiring new furniture is a substantial financial commitment, often representing a significant portion of their discretionary spending. For instance, the average household spent approximately $1,200 on furniture and home furnishings in 2023, according to the U.S. Bureau of Labor Statistics. This considerable outlay encourages buyers to thoroughly research options, compare prices, and scrutinize product quality and durability.

This heightened customer engagement directly translates into increased bargaining power for consumers. They are more inclined to seek out the best value, demanding superior quality, extended warranties, and exceptional customer service. Consequently, furniture retailers like Haverty must offer compelling propositions to attract and retain these informed buyers, as customers are less likely to compromise on their expectations for such important purchases.

- Significant Investment: Furniture purchases are often major expenditures for households.

- Extensive Research: Consumers dedicate time to comparing prices, quality, and styles.

- Demand for Value: Customers expect high quality, durability, and good service for their money.

- Reduced Price Sensitivity: While price is a factor, customers prioritize overall value and longevity.

Customer Concentration

Haverty Furniture generally benefits from a broad and dispersed customer base. This wide appeal means that individual customers typically have limited bargaining power. For instance, in 2023, Haverty reported serving millions of households across its operating regions, a scale that prevents any single customer or small group from dictating terms or prices effectively.

The company's reliance on a large number of individual consumers, rather than a few large institutional buyers, significantly dilutes the bargaining leverage any one customer can exert. This diversity spreads risk and reduces Haverty's dependence on any particular customer segment, reinforcing its pricing flexibility.

- Customer Dispersion: Haverty's business model relies on a vast number of individual consumers, not a few major clients.

- Limited Individual Leverage: No single customer possesses substantial power to negotiate lower prices or demand customized terms.

- Risk Mitigation: A broad customer base reduces the impact of losing any single buyer.

- 2023 Customer Reach: Millions of households interacted with Haverty's products, underscoring the scale of its customer base.

Haverty Furniture's customers possess moderate bargaining power, influenced by the significant cost of furniture purchases and the availability of information. In 2024, with economic uncertainties, consumers are more price-conscious, actively comparing options. However, Haverty's broad customer base, serving millions of households, limits the power of any single buyer to dictate terms, thus moderating overall customer leverage.

| Factor | Impact on Haverty | 2024 Context |

|---|---|---|

| Customer Price Sensitivity | Moderate to High | Inflationary pressures increase scrutiny of discretionary spending. |

| Availability of Substitutes | High | Numerous online and brick-and-mortar competitors offer wide selection. |

| Switching Costs | Low | Easy to compare and purchase from alternative retailers. |

| Customer Information Access | High | Online reviews and price comparison tools empower informed decisions. |

| Customer Base Concentration | Low | Millions of individual customers dilute the power of any single buyer. |

What You See Is What You Get

Haverty Furniture Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Haverty Furniture's Porter's Five Forces Analysis, providing a comprehensive overview of competitive forces impacting the company, including supplier power, buyer power, threat of new entrants, threat of substitutes, and industry rivalry. This professionally formatted analysis is ready for your immediate use.

Rivalry Among Competitors

The furniture retail landscape is densely populated with a wide array of competitors. This includes major national retailers such as Ashley HomeStore and Rooms To Go, alongside prominent online retailers like Wayfair and Overstock. The market also features numerous smaller, local specialty shops, creating a highly fragmented environment.

This extensive diversity in competitor types intensifies rivalry. Each business, regardless of size or business model, actively competes for customer attention and market share. This dynamic forces companies like Haverty Furniture to constantly innovate and differentiate their offerings to stand out.

For instance, in 2024, the U.S. furniture and home furnishings stores sector generated an estimated $116.6 billion in revenue, showcasing the significant market size and the fierce competition for these sales. This vast market attracts a broad spectrum of players, from mass-market providers to niche luxury brands.

The overall growth rate of the residential furniture market directly impacts competitive rivalry. In 2023, the U.S. furniture and bedding stores sector saw a modest sales increase, but the pace of growth is crucial for understanding competitive intensity. A slower-than-expected growth trajectory can compel companies like Haverty to engage in more aggressive tactics to capture market share, potentially leading to price competition.

Haverty Furniture's ability to stand out through unique styles, exclusive brands, or enhanced interior design services significantly influences competitive rivalry. Strong differentiation builds customer loyalty, lessening the pressure from price-focused competition.

In 2024, the furniture market remains highly competitive, with many players offering similar products. Haverty's focus on quality and design, evident in their private label brands and design services, aims to carve out a distinct market position, thereby mitigating direct comparisons with mass-market retailers.

High Fixed Costs and Exit Barriers

Haverty Furniture, like many in the furniture retail sector, faces significant competitive rivalry stemming from high fixed costs. These costs are driven by substantial investments in physical showrooms, extensive inventory management, and the complex logistics required to deliver furniture. For instance, maintaining a network of large retail spaces and managing a diverse stock of goods represents a considerable ongoing expense.

These high fixed costs, coupled with considerable exit barriers, intensify the competitive landscape. Companies are often locked into long-term lease agreements for their retail locations, and the specialized nature of furniture inventory can make it difficult and costly to liquidate if a business decides to scale back or close. This situation pressures existing players to maintain robust sales volumes to cover their overhead, leading to aggressive pricing and promotional activities.

- High Fixed Costs: Furniture retailers typically incur significant expenses for showroom leases, inventory storage, and transportation networks.

- Exit Barriers: Long-term leases and the challenge of selling specialized inventory create hurdles for companies looking to exit the market.

- Sales Volume Pressure: The need to cover high fixed costs compels companies to prioritize sales volume, fueling intense competition.

- Impact on Rivalry: These factors collectively drive aggressive competition as firms strive to maintain market share and profitability amidst substantial operational commitments.

Brand Identity and Customer Loyalty

Haverty Furniture's brand identity and its success in cultivating customer loyalty play a significant role in softening the intensity of competitive rivalry. A well-defined brand, resonating with consumers, can create a buffer against aggressive pricing strategies employed by competitors.

This loyalty translates into repeat business, reducing the need for constant promotional efforts to attract new customers. For instance, in 2024, companies with strong brand recognition often see higher customer retention rates, lessening their dependence on price wars.

- Brand Strength: Haverty's established presence and recognized style contribute to brand equity, making customers less susceptible to competitor offers.

- Customer Loyalty: Repeat purchases and positive word-of-mouth, driven by satisfaction, provide a stable revenue stream.

- Reduced Price Sensitivity: Loyal customers are often willing to pay a premium for the perceived quality and service associated with a trusted brand.

- Competitive Insulation: A strong brand identity and loyal customer base allow Haverty to compete on factors beyond just price, such as design, quality, and customer experience.

The furniture retail sector is exceptionally competitive, featuring a wide range of players from national giants like Ashley HomeStore to online disruptors such as Wayfair. This crowded market, estimated to generate $116.6 billion in U.S. revenue for furniture and home furnishings stores in 2024, forces companies like Haverty Furniture to constantly differentiate themselves. High fixed costs, including showroom leases and inventory management, coupled with significant exit barriers, intensify this rivalry, pushing firms to prioritize sales volume and often engage in aggressive pricing.

Haverty's brand strength and cultivated customer loyalty serve as a crucial buffer against this intense competition. In 2024, companies with strong brand recognition tend to experience higher customer retention, reducing their reliance on price wars. This allows Haverty to compete on factors like design and customer experience, rather than solely on price, insulating them from the most aggressive competitive pressures.

| Competitor Type | Examples | Impact on Rivalry |

|---|---|---|

| National Retailers | Ashley HomeStore, Rooms To Go | High market share, significant marketing budgets |

| Online Retailers | Wayfair, Overstock | Price transparency, broad reach |

| Specialty/Local Shops | Independent furniture stores | Niche market focus, personalized service |

SSubstitutes Threaten

The threat of substitutes for Haverty Furniture customers comes from various alternative ways to furnish a home. These include renting furniture for short-term needs, which can be appealing for those relocating or needing temporary solutions. In 2023, the furniture rental market saw continued growth, with companies reporting increased demand for flexible furnishing options.

Another significant substitute is the burgeoning market for pre-owned furniture. Platforms like Facebook Marketplace and dedicated vintage furniture stores offer a wide range of used items, often at considerably lower price points than new furniture. This segment is particularly attractive to budget-conscious consumers and those seeking unique or antique pieces.

Furthermore, the rise of DIY and upcycling trends presents a substitute. Many consumers are now investing time in refurbishing existing furniture or creating their own decor items. This do-it-yourself approach allows for personalization and cost savings, directly competing with the purchase of new, ready-made furniture from retailers like Haverty.

The appeal of substitute furniture options hinges on their price-performance ratio when stacked against new Haverty pieces. For consumers prioritizing affordability, pre-owned furniture, rental services, or even do-it-yourself projects present attractive alternatives, often at a fraction of the cost. In 2024, the used furniture market saw continued growth, with platforms like Facebook Marketplace and OfferUp facilitating millions of transactions, highlighting consumer interest in budget-friendly options.

Haverty, therefore, faces the challenge of articulating a clear value proposition that justifies its premium pricing. This means emphasizing superior quality materials, distinctive design aesthetics, and the overall customer experience, from showroom interaction to delivery and assembly. A recent industry report indicated that while price remains a significant factor, consumers are increasingly willing to pay more for durability and unique styles, a trend Haverty can leverage.

Shifting consumer lifestyles, like a greater emphasis on mobility and smaller living spaces, can boost the attractiveness of alternative solutions to traditional furniture. For instance, those who relocate often might opt for furniture rental services or adaptable, portable pieces instead of substantial, fixed items, thereby lowering the need for conventional furniture purchases.

Technological Advancements in Substitutes

Technological advancements are increasingly making substitutes for traditional furniture more appealing and accessible. For instance, the rise of online marketplaces for pre-owned furniture, often facilitated by user-friendly apps, allows consumers to find affordable alternatives to new pieces. In 2023, the global secondhand apparel market alone was valued at over $100 billion, indicating a strong consumer appetite for used goods across categories, which could extend to furniture.

Furthermore, innovations in DIY tools and materials empower consumers to create or customize their own furniture, bypassing traditional retailers altogether. The home improvement sector saw significant growth, with U.S. DIY home improvement sales reaching an estimated $470 billion in 2023. This trend suggests that consumers are increasingly willing to invest time and effort into personalized solutions, posing a threat to standardized furniture offerings.

Virtual reality and augmented reality technologies also present novel forms of substitution. These tools can enable virtual home staging or allow consumers to visualize furniture in their own spaces without ever visiting a showroom, potentially reducing the perceived need for physical furniture purchases. As these technologies mature, they could fundamentally alter how consumers approach furnishing their homes.

- Online marketplaces for used furniture are gaining traction.

- DIY home improvement sales highlight a growing trend in personalized solutions.

- Virtual and augmented reality offer new ways to visualize and potentially replace physical furniture.

Customer Propensity to Substitute

Customer willingness to switch to alternatives significantly impacts the threat of substitutes for furniture retailers like Haverty. If consumers are readily open to different ways of furnishing their homes, the threat increases. For instance, a growing trend in furniture rental services, which saw significant uptake in the early 2020s, presents a direct substitute for outright purchase.

Haverty must monitor consumer behavior shifts, such as the increasing popularity of second-hand furniture markets or the rise of subscription-based home goods. In 2023, the resale market for home goods continued its robust growth, with platforms like Chairish reporting substantial increases in transaction volume, indicating a segment of consumers actively seeking alternatives to new furniture.

- High Customer Propensity to Substitute: Consumers are increasingly exploring rental, resale, or DIY furniture options as viable alternatives to traditional purchasing.

- Impact of Digital Platforms: Online marketplaces and rental services make it easier than ever for customers to discover and adopt substitute solutions.

- Haverty's Response: The company needs to emphasize the long-term value, quality, and unique design propositions of its new furniture to counter this growing threat.

The threat of substitutes for Haverty Furniture is significant, driven by the increasing accessibility and appeal of alternative furnishing solutions. Consumers can opt for furniture rental services for short-term needs, a market that experienced continued growth in 2023 due to demand for flexible options. Pre-owned furniture, readily available through online platforms and vintage stores, offers a budget-friendly and unique alternative, with the used furniture market seeing sustained growth in 2024, facilitating millions of transactions.

The DIY and upcycling movement also poses a threat, with consumers investing time in refurbishing or creating their own decor, appealing to those seeking personalization and cost savings. This trend is supported by robust growth in the home improvement sector, with U.S. DIY home improvement sales estimated at $470 billion in 2023. Furthermore, emerging technologies like virtual and augmented reality allow for virtual home staging, potentially reducing the perceived need for physical furniture purchases.

Haverty must therefore highlight its value proposition, focusing on superior quality, design, and customer experience to justify its pricing against these alternatives. The company needs to monitor shifts in consumer behavior, like the growing popularity of second-hand markets, as indicated by platforms like Chairish reporting substantial increases in transaction volume in 2023.

| Substitute Type | Key Appeal | 2023/2024 Data Point |

|---|---|---|

| Furniture Rental | Flexibility, short-term needs | Continued growth in demand for flexible furnishing options (2023) |

| Pre-owned Furniture | Affordability, uniqueness | Millions of transactions facilitated on platforms like Facebook Marketplace (2024) |

| DIY/Upcycling | Personalization, cost savings | U.S. DIY home improvement sales: $470 billion (2023) |

Entrants Threaten

The furniture retail industry demands substantial upfront capital, creating a significant hurdle for newcomers. Establishing prime showroom locations, stocking a diverse inventory, and building efficient supply chains require millions of dollars. For instance, a new furniture store might need upwards of $5 million to $10 million just for initial setup and inventory, a figure that can easily deter many aspiring entrepreneurs.

Established furniture retailers like Haverty Furniture often enjoy significant advantages from economies of scale. This means they can buy materials and manufacture goods in larger quantities, leading to lower per-unit costs. For instance, in 2024, large furniture retailers can negotiate bulk discounts on lumber, fabric, and hardware that smaller, newer companies simply cannot access, giving them a substantial price edge.

The experience curve also plays a crucial role. As companies like Haverty have been operating for years, they’ve refined their production processes, supply chain management, and marketing strategies. This accumulated knowledge allows them to operate more efficiently and effectively. New entrants would need considerable time and investment to reach a comparable level of operational expertise, making it difficult to compete on cost or quality initially.

Haverty Furniture benefits from decades of brand building, creating strong customer loyalty that acts as a significant barrier to new entrants. This established trust and recognition, cultivated over years of operation, makes it difficult for newcomers to quickly gain market share. For instance, in 2024, Haverty continued to emphasize its customer-centric approach, investing in personalized service and loyalty programs designed to retain its existing clientele.

Access to Distribution Channels and Suppliers

Haverty Furniture, like other retailers, must secure prime retail locations and establish efficient warehousing and delivery systems. Newcomers often find it challenging to access these crucial distribution channels, and may also struggle to negotiate favorable terms with established furniture manufacturers, impacting their ability to compete on cost and availability.

In 2024, the retail furniture market continues to see consolidation, making it harder for new entrants to secure prime real estate. For instance, major players often control a significant portion of desirable mall and high-street locations, leaving limited options for emerging brands. Furthermore, established suppliers may prioritize existing relationships, potentially offering better pricing and faster lead times to long-term partners like Haverty, creating a barrier for new businesses seeking reliable inventory.

- Limited prime retail space availability: Major retailers often dominate sought-after locations.

- Supplier relationship leverage: Established manufacturers may offer preferential terms to existing partners.

- Logistical infrastructure costs: Building efficient warehousing and delivery networks is capital-intensive for new entrants.

- Brand recognition and trust: New brands need time and investment to build the same level of trust as established players like Haverty.

Regulatory and Legal Barriers

New furniture retailers face significant hurdles due to stringent regulatory and legal frameworks. Zoning laws dictate where physical stores can operate, while building codes ensure safety and accessibility, both adding to initial setup costs and complexity for aspiring businesses. In 2024, obtaining the necessary business licenses and permits across various jurisdictions can be a time-consuming and expensive process, especially for smaller operations aiming to establish a physical presence.

Navigating international trade regulations presents another formidable barrier, particularly for companies relying on imported furniture. Tariffs, customs duties, and compliance with product safety standards for imported goods can substantially increase the cost of goods sold and require specialized expertise. For instance, in 2024, the evolving landscape of international trade agreements and potential tariffs on furniture imports from key manufacturing regions like Asia could significantly impact the profitability and market entry strategy of new entrants.

- Zoning Laws: Restrict where retail furniture stores can be established.

- Building Codes: Mandate safety and accessibility standards for physical locations.

- Business Licenses: Require multiple permits and approvals to operate legally.

- International Trade Regulations: Impose complex rules, tariffs, and compliance requirements on imported furniture.

The threat of new entrants in the furniture retail sector, impacting companies like Haverty Furniture, is generally considered moderate to low. This is primarily due to the substantial capital investment required for inventory, prime retail locations, and establishing efficient supply chains. For example, launching a new mid-sized furniture store in 2024 could easily demand an initial outlay of $5 million to $10 million.

Established players benefit from economies of scale, allowing them to negotiate better prices on materials and logistics, a distinct advantage over newcomers who lack this purchasing power. Furthermore, strong brand loyalty and established customer relationships, cultivated over years of operation, create a significant barrier. In 2024, Haverty continued to invest in customer retention programs, reinforcing this loyalty.

| Barrier to Entry | Impact on New Entrants | Example Data (2024) |

|---|---|---|

| Capital Requirements | High | Initial setup and inventory costs can range from $5M-$10M. |

| Economies of Scale | Significant | Large retailers secure bulk discounts on materials, reducing per-unit costs. |

| Brand Loyalty | High | Established brands like Haverty benefit from decades of trust and repeat business. |

| Distribution Channels | Challenging | Securing prime retail space and efficient logistics is difficult for new players. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Haverty Furniture is built upon a foundation of verified data, including annual reports, industry-specific market research from firms like IBISWorld, and public financial disclosures. This ensures a comprehensive understanding of competitive dynamics.