Harbor Freight Tools SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Harbor Freight Tools Bundle

Harbor Freight Tools leverages its strong brand recognition and extensive store network as key strengths, while facing potential threats from increased competition and evolving consumer preferences. Understanding these dynamics is crucial for anyone looking to capitalize on the DIY market.

Want the full story behind Harbor Freight Tools' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Harbor Freight's aggressive price competitiveness is a cornerstone of its success, driven by a business model focused on direct sourcing from overseas manufacturers. This approach allows them to bypass traditional distribution channels, translating into substantial cost savings that are passed directly to consumers.

This strategy is particularly effective in attracting DIYers and professional tradespeople who prioritize affordability. With estimated annual sales around $8 billion in 2024, their value proposition is clearly resonating with a broad customer base seeking high-quality tools at accessible price points.

Harbor Freight Tools is a powerhouse in retail expansion, consistently opening an impressive two to three new stores weekly across the nation. This rapid growth saw them celebrate their 1500th store opening in April 2024, a testament to their aggressive market penetration strategy.

The company has ambitious plans, targeting 2,000 stores by the close of 2025, which will further solidify its widespread accessibility for customers. This expansion isn't just about more stores; it includes significant investments in infrastructure like a new research and development center in South Carolina, supporting their ongoing operational growth.

Harbor Freight Tools boasts a diverse and ever-expanding product lineup, consistently introducing between 500 and 600 new stock-keeping units (SKUs) each year. This commitment to variety ensures they cater to a wide array of customer needs.

The company strategically employs a 'Good, Better, Best' approach, notably developing and launching premium proprietary brands such as Icon and Hercules. This initiative aims to attract a more discerning customer segment, including professional tradespeople, by offering higher quality options.

Their dedication to innovation was evident at SEMA 2024, where Harbor Freight unveiled a slate of new products scheduled for release in 2025. This forward-looking strategy underscores their drive to maintain market relevance and meet evolving customer demands.

Robust E-commerce Platform

Harbor Freight's e-commerce platform, harborfreight.com, is a significant contributor to its financial success, reporting $414 million in revenue for 2024, with further growth anticipated in 2025. This digital channel effectively broadens customer reach and supports evolving shopping preferences, working in tandem with their vast physical store footprint. The online presence enhances accessibility, allowing customers to browse and purchase a wide array of tools and equipment conveniently, thereby boosting overall sales and customer engagement.

Strong Brand Recognition and Positive Workplace Culture

Harbor Freight Tools enjoys significant brand recognition, especially with customers who value affordable tools. This strong presence is reinforced by consistent positive feedback, including being certified as a Great Place to Work for multiple years and named one of America's Best Large Employers by Forbes. In 2024, USA Today also recognized them as a Customer Service Champion, underscoring favorable public perception.

Harbor Freight's aggressive pricing strategy, fueled by direct overseas sourcing, allows them to offer highly competitive prices, appealing to a wide customer base. Their rapid retail expansion, with plans to reach 2,000 stores by the end of 2025, ensures broad market accessibility. The company also excels in product diversification, introducing hundreds of new items annually and developing premium in-house brands to cater to professionals.

Their robust e-commerce presence, generating substantial revenue and anticipated growth, complements their physical store network. Furthermore, strong brand recognition, bolstered by positive customer service accolades and employer certifications, solidifies their market position.

| Strength | Description | Supporting Data |

|---|---|---|

| Price Competitiveness | Direct sourcing and efficient operations lead to significantly lower prices. | Estimated annual sales ~ $8 billion (2024). |

| Aggressive Retail Expansion | Rapid store openings and ambitious growth targets increase accessibility. | 1500th store opened April 2024; targeting 2000 stores by end of 2025. |

| Product Diversification & Innovation | Continuous introduction of new products and development of premium brands. | 500-600 new SKUs annually; new product releases planned for 2025. |

| Strong E-commerce Presence | Online sales contribute significantly to revenue and customer reach. | $414 million in e-commerce revenue (2024). |

| Brand Recognition & Reputation | Positive customer perception and employer accolades enhance brand loyalty. | Certified Great Place to Work; Forbes Best Large Employers; USA Today Customer Service Champion (2024). |

What is included in the product

Delivers a strategic overview of Harbor Freight Tools’s internal and external business factors, highlighting its value proposition and market position.

Offers a clear, actionable SWOT analysis of Harbor Freight Tools, highlighting how their value proposition addresses customer price sensitivity and their operational efficiencies mitigate market competition.

Weaknesses

Despite introducing premium lines, Harbor Freight still battles a perception of variable quality. Historically known for budget tools, their 'Good, Better, Best' approach aims to shift this, but the lingering stigma can deter customers seeking only top-tier equipment.

This historical perception may limit their appeal to consumers prioritizing brand-name reliability, even as they invest in better product offerings. For instance, while specific sales figures for their premium lines aren't publicly broken out, the company's overall revenue growth, reaching over $8 billion in 2023, suggests a growing customer base, though the quality perception remains a hurdle for some.

Harbor Freight's extensive reliance on overseas manufacturing, particularly from China, presents a notable weakness. In 2023, it was estimated that over 80% of their product offerings were manufactured abroad. This significant offshore production makes them susceptible to geopolitical tensions and trade policy shifts, such as potential tariffs, which could escalate costs.

The company's global supply chain is also vulnerable to disruptions, as seen during recent global events that impacted shipping and production. These disruptions can lead to delays in product availability and increased logistics expenses, potentially affecting their competitive pricing strategy and customer fulfillment.

Harbor Freight operates in a crowded tool and equipment market, facing formidable competition from giants like Home Depot and Lowe's, alongside numerous specialized retailers. These established players often boast wider product ranges and more robust customer loyalty initiatives.

While Harbor Freight's value proposition is strong, competitors frequently provide a more extensive selection of premium brands and a broader suite of services, creating a persistent hurdle for market share growth.

Vulnerability to Supply Chain Disruptions

Harbor Freight's reliance on a global sourcing strategy makes it particularly vulnerable to disruptions. For instance, 2024 saw continued volatility in international shipping, with freight costs fluctuating significantly, impacting companies like Harbor Freight that depend on overseas manufacturing. These disruptions can lead to stockouts and extended lead times, directly affecting product availability for their price-sensitive customer base.

The complexities of global trade, including geopolitical tensions and trade policy shifts observed throughout 2024 and into early 2025, pose a constant risk. Such events can create unforeseen delays and increase the cost of goods. This vulnerability can erode Harbor Freight's core competitive advantage of offering low prices, as increased operational expenses may necessitate price adjustments.

- Global Sourcing Risk: Harbor Freight's extensive use of international suppliers exposes it to risks like port congestion and shipping delays, which were prominent issues in 2024.

- Rising Freight Costs: Fluctuations in global shipping rates, a trend continuing into 2025, directly impact Harbor Freight's cost of goods sold.

- Inventory Management Challenges: Supply chain disruptions can lead to stockouts, affecting customer satisfaction and sales.

- Competitive Price Erosion: Increased operational costs due to supply chain issues may force price increases, potentially undermining their value proposition.

Limited Appeal to Niche Professional Segments

Harbor Freight's brand perception as a discount provider might still present a hurdle for widespread adoption among certain professional segments, particularly those prioritizing premium branding or specialized features. While the company is making strides to attract professionals, some may still gravitate towards established, high-end tool manufacturers with decades of proven performance in niche applications. This could mean that Harbor Freight misses out on capturing a share of the market for specialized, high-margin tools used in very specific trades.

For instance, while Harbor Freight's extensive product line covers many general contractor needs, its offerings in highly specialized areas like precision machining or advanced automotive diagnostics might not yet match the depth or technological sophistication found in brands catering exclusively to those demanding professions. This gap could limit their appeal to professionals who require tools with very specific tolerances, advanced digital interfaces, or specialized material capabilities. In 2024, many such professionals continue to rely on brands with established reputations for these specific attributes, potentially leaving Harbor Freight with a smaller segment of the professional market.

- Brand Perception: Core identity as a discount retailer may limit appeal to professionals seeking premium brands.

- Niche Specialization: Certain high-end trades may prefer tools with advanced technology or specialized features not yet fully represented.

- Market Penetration: Difficulty fully penetrating segments where established premium brands hold strong loyalty and perceived superiority.

- Revenue Opportunity: Potential loss of high-margin sales from professionals in niche markets who opt for competitors.

Harbor Freight's historical reputation for budget-friendly tools, while a strength in some areas, can also be a weakness by creating a perception of variable quality. Despite efforts to introduce premium lines, this lingering stigma may deter customers who prioritize established brands for critical tasks. This perception could limit their ability to capture a larger share of the professional market, even as their overall revenue continues to grow, exceeding $8 billion in 2023.

Same Document Delivered

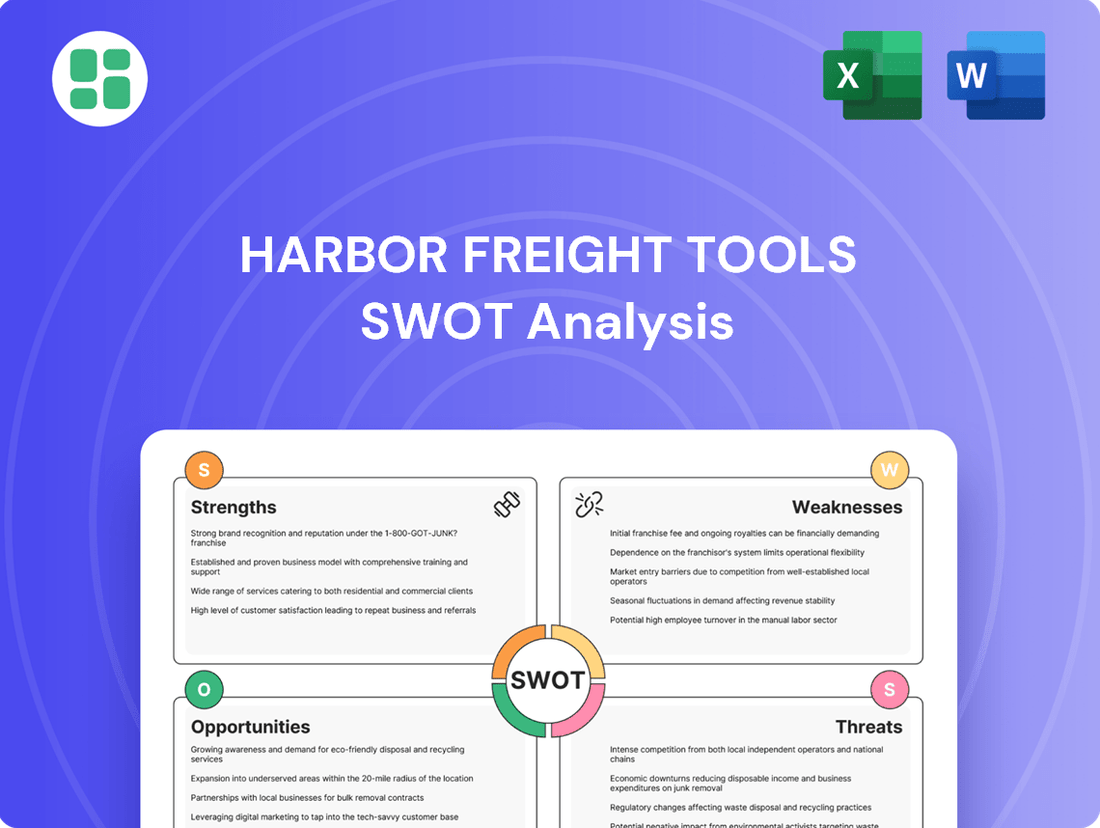

Harbor Freight Tools SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of Harbor Freight Tools' Strengths, Weaknesses, Opportunities, and Threats, offering actionable insights.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing key strategic considerations for Harbor Freight Tools.

Opportunities

Harbor Freight has a prime opportunity to capture more of the professional tool market by highlighting its premium lines like Icon and Hercules. These brands are designed to compete directly with established, higher-priced competitors, offering tradespeople a compelling value proposition.

By focusing on performance and durability, Harbor Freight can appeal to a segment of professionals who are actively looking for cost-effective solutions without sacrificing quality. This move aligns with a broader trend observed in the 2024 market where value-conscious professionals are increasingly open to exploring alternative brands that meet their demanding needs.

Harbor Freight's opportunity lies in significantly boosting its e-commerce and digital strategy. By further investing in their online platform, they can create a smoother shopping experience and broaden their digital marketing reach. This focus is crucial for attracting new customers and increasing online sales, building upon their existing e-commerce revenue streams.

Enhancing the integration between their online presence and physical stores offers another avenue for growth. A seamless omnichannel experience can significantly improve customer convenience and loyalty. For instance, initiatives like click-and-collect services or improved online inventory visibility can drive traffic both online and in-store.

In 2024, e-commerce sales are projected to continue their upward trend across the retail sector. Harbor Freight can capitalize on this by refining its digital marketing, potentially leveraging data analytics to personalize offers and improve customer engagement, thereby driving higher conversion rates and overall digital revenue.

Harbor Freight has a significant opportunity to diversify its global sourcing beyond current primary locations, such as China. By exploring manufacturing partnerships in regions like Mexico or Canada, the company can proactively reduce its exposure to geopolitical risks and potential trade disputes. This move could also lead to more stable and predictable supply chain costs, especially given the ongoing volatility in international trade relations. For instance, nearshoring initiatives have seen increased traction, with companies looking to shorten lead times and improve responsiveness to market shifts.

Expansion into New Product Categories and Technologies

Harbor Freight Tools has a significant opportunity to broaden its product lines by venturing into categories that resonate with current market demands. This could include sustainable tools, smart home technology, or specialized equipment tailored for rapidly expanding sectors. Their commitment to innovation is underscored by their investment in a new R&D facility in South Carolina, which is crucial for developing and launching these novel offerings.

This strategic expansion will ensure Harbor Freight's product assortment remains current and appealing to a wider customer base, adapting to evolving consumer preferences and technological advancements. For instance, the growing consumer interest in eco-friendly products presents a clear avenue for sustainable tool lines.

- Expand into sustainable tool lines to meet growing environmental consciousness.

- Introduce smart home devices leveraging the increasing adoption of connected living.

- Develop specialized equipment for high-growth industries like renewable energy installation or advanced manufacturing.

- Utilize R&D investment to ensure product innovation and market relevance.

Leveraging Data Analytics for Personalized Marketing

Harbor Freight can significantly boost its marketing effectiveness by diving deep into customer purchasing data and online behavior. This allows for tailored campaigns and product suggestions, making each customer feel uniquely understood. For instance, by analyzing past purchases, Harbor Freight could identify customers who frequently buy power tools and offer them early access to new tool releases or specialized maintenance kits.

This data-driven strategy directly translates to better customer engagement and higher conversion rates. Imagine a customer who recently bought a drill; personalized follow-up emails could suggest compatible drill bits or safety glasses, increasing the likelihood of an additional sale. In 2024, companies leveraging personalized marketing saw an average increase of 15% in customer retention compared to those using generic approaches.

Furthermore, a granular understanding of customer preferences enables more impactful promotions and smarter inventory management. If data shows a surge in demand for specific gardening tools during spring, Harbor Freight can ensure adequate stock levels and run targeted promotions. This proactive approach minimizes stockouts and reduces the risk of overstocking less popular items, directly impacting profitability.

- Personalized Recommendations: Offering specific product bundles based on past purchases, like a welding kit with accompanying safety gear.

- Targeted Promotions: Running flash sales on DIY project essentials during weekends when data indicates higher customer activity.

- Improved Inventory: Adjusting stock based on seasonal buying patterns identified through sales data, ensuring popular items are always available.

- Enhanced Loyalty: Rewarding repeat customers with exclusive discounts or early access to new product lines, fostering a stronger connection.

Harbor Freight can leverage its growing reputation for quality in premium tool lines like Icon and Hercules to attract professionals seeking value. By emphasizing durability and performance, the company can appeal to tradespeople who are increasingly budget-conscious but unwilling to compromise on tool capability, a trend that gained momentum in 2024.

Investing further in its digital infrastructure presents a significant opportunity for Harbor Freight to enhance its e-commerce platform and expand its online marketing reach. This focus is critical for attracting new customers and driving online sales, building on existing digital revenue streams. In 2024, e-commerce sales continued their upward trajectory across retail, with companies utilizing data analytics for personalized offers seeing improved customer engagement.

Expanding product lines into emerging categories such as sustainable tools or smart home devices aligns with evolving consumer preferences and technological advancements. Harbor Freight's investment in R&D, including a new facility in South Carolina, supports this innovation, ensuring product relevance and appeal to a broader customer base. The growing consumer interest in eco-friendly products, for example, offers a clear path for developing new sustainable tool lines.

By analyzing customer purchasing data, Harbor Freight can refine its marketing strategies to deliver personalized campaigns and product recommendations, leading to increased customer engagement and conversion rates. In 2024, personalized marketing approaches yielded an average 15% increase in customer retention compared to generic strategies, highlighting the effectiveness of data-driven customer understanding.

| Opportunity Area | Description | Potential Impact |

|---|---|---|

| Professional Tool Market Penetration | Highlighting premium brands (Icon, Hercules) to compete with higher-priced alternatives. | Capture market share from value-conscious professionals seeking quality at a better price point. |

| Digital & E-commerce Enhancement | Investing in online platform improvements and digital marketing. | Increase online sales, customer acquisition, and overall digital revenue in a growing e-commerce landscape. |

| Product Line Diversification | Introducing sustainable tools, smart home devices, and specialized equipment. | Adapt to evolving consumer demands and technological trends, broadening appeal. |

| Data-Driven Marketing Personalization | Leveraging customer data for tailored campaigns and recommendations. | Boost customer engagement, conversion rates, and retention, leading to higher profitability. |

Threats

A significant economic downturn or prolonged inflation could severely impact Harbor Freight's sales by reducing consumer spending on discretionary items like tools. For instance, if inflation continues to hover around 3-4% as projected for late 2024 into 2025, consumers may prioritize essential goods over tool purchases.

Furthermore, rising costs for raw materials, manufacturing, and transportation, exacerbated by inflationary pressures, directly threaten Harbor Freight's ability to maintain its value proposition. If input costs increase by, say, 5-7% as seen in some sectors during 2024, it becomes challenging to absorb these without affecting their low-price strategy.

This economic instability poses a direct threat to Harbor Freight's affordability model, as consumers become more price-sensitive during economic contractions, potentially shifting to cheaper alternatives or delaying purchases altogether.

Harbor Freight's reliance on sourcing from countries like China makes it vulnerable to potential tariff increases. For example, in 2023, the U.S. maintained tariffs on a wide range of Chinese goods, impacting many industries. Any further escalation or changes in these policies could directly increase Harbor Freight's cost of goods sold.

Fluctuations in international trade policies and the introduction of new import regulations pose a significant threat. These changes could necessitate absorbing higher costs, which would challenge Harbor Freight's core value proposition of offering low prices. Alternatively, passing these costs to consumers might diminish their price competitiveness in the market.

The tool and equipment sector is fiercely competitive, with giants like Home Depot and Lowe's, alongside burgeoning online sellers, posing a significant threat to Harbor Freight. These established players are known for their aggressive pricing and extensive loyalty programs, which could erode Harbor Freight's market position.

Competitors are increasingly introducing their own value-oriented product lines, directly challenging Harbor Freight's core offering. For instance, Home Depot's Husky brand and Lowe's Kobalt brand offer a wide range of tools at competitive price points, directly impacting Harbor Freight's customer base.

The market is becoming saturated, meaning it's harder to gain new customers and retain existing ones. This intensified competition could limit Harbor Freight's ability to achieve its projected growth targets for 2024 and 2025, especially as consumer spending patterns shift.

Global Supply Chain Instability

Global supply chain disruptions remain a significant threat. Geopolitical events, like the ongoing tensions in Eastern Europe and the Red Sea shipping crisis, continue to impact shipping routes and costs, affecting companies like Harbor Freight. For instance, the Suez Canal disruptions in early 2024 led to rerouting of vessels, increasing transit times and fuel expenses for many global retailers.

These instabilities directly translate to unpredictable shipping delays and higher transportation costs for Harbor Freight. This can make it challenging to maintain the consistent inventory levels that customers expect, especially for popular items.

The consequence of such disruptions for Harbor Freight could be lost sales opportunities and a potential erosion of customer trust if products are frequently out of stock. For example, in 2023, many retailers reported stockouts of key goods due to port congestion and container shortages, impacting their revenue.

- Geopolitical Conflicts: Ongoing conflicts can disrupt key shipping lanes and manufacturing hubs.

- Increased Shipping Costs: Rerouting and higher fuel prices directly inflate operational expenses.

- Inventory Management Challenges: Unpredictable lead times make it difficult to forecast and maintain adequate stock.

- Impact on Customer Availability: Product shortages can lead to lost sales and damage brand reputation.

Shifting Consumer Preferences Towards Premium or Sustainable Products

A significant threat to Harbor Freight's business model is the increasing consumer demand for premium or sustainable products. As shoppers become more discerning, they may gravitate towards tools that offer greater durability, enhanced performance, or a reduced environmental impact. This shift could challenge Harbor Freight's core strategy of providing deeply discounted, value-oriented tools.

For instance, a growing segment of the market, particularly younger demographics, is showing a preference for products with transparent sourcing and eco-friendly manufacturing processes. A 2024 survey indicated that over 60% of consumers are willing to pay more for sustainable goods. If this trend intensifies, Harbor Freight might face pressure to adapt its product lines and supply chain to meet these evolving expectations, potentially impacting its cost structure and competitive pricing.

This evolving consumer sentiment necessitates a strategic re-evaluation for Harbor Freight. The company may need to consider:

- Expanding its range of higher-quality, professional-grade tools to cater to users who prioritize longevity and performance.

- Investing in research and development for more sustainable product options and transparent sourcing practices.

- Communicating the value proposition of its existing products more effectively to a broader consumer base, highlighting durability and affordability.

Failure to address this trend could lead to a gradual erosion of market share as consumers seek out alternatives that better align with their increasing focus on quality and environmental responsibility.

Increased competition from both established retailers and online sellers poses a significant threat, as they increasingly offer comparable value propositions. For example, major players like Home Depot and Lowe's are enhancing their private-label tool brands, directly challenging Harbor Freight's market share. This intensified competition could limit Harbor Freight's customer acquisition and retention efforts through 2025.

Supply chain disruptions, including geopolitical instability and shipping cost volatility, remain a critical concern. Events like the Red Sea shipping crisis in early 2024, which rerouted vessels and increased transit times, directly impact Harbor Freight's ability to maintain consistent inventory and pricing. This can lead to stockouts and potentially alienate customers who expect reliable product availability.

Evolving consumer preferences towards premium and sustainable products present another challenge. A growing segment of shoppers, particularly younger demographics, are prioritizing durability and eco-friendly manufacturing. A 2024 survey indicated over 60% of consumers are willing to pay more for sustainable goods, which could pressure Harbor Freight to adapt its offerings and potentially increase costs, impacting its core value proposition.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of credible data, including Harbor Freight's financial reports, extensive market research on the tools and home improvement sectors, and insights from industry experts and consumer reviews.