Harbor Freight Tools Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Harbor Freight Tools Bundle

Harbor Freight Tools navigates a landscape shaped by intense rivalry and the constant threat of new entrants, while also managing the bargaining power of its suppliers. Understanding these pressures is crucial for any competitor or investor in the retail tool market.

The complete report reveals the real forces shaping Harbor Freight Tools’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The tool retail industry features a relatively concentrated manufacturing base. This means Harbor Freight, like its competitors, relies on a finite number of major suppliers for its product lines. For instance, in 2024, the global power tools market, a key segment for Harbor Freight, saw significant consolidation, with a few large players holding substantial market share, potentially increasing supplier leverage.

Harbor Freight's direct sourcing model significantly reduces supplier bargaining power. By going straight to factories, often in Asia, they cut out distributors and agents, which typically adds 10-30% to costs. This allows Harbor Freight to negotiate better prices and maintain control over their supply chain.

Harbor Freight Tools has built strong, long-term relationships with its suppliers. This stability gives them an advantage when negotiating prices and ensuring a steady flow of goods, which is vital for their everyday low-price model.

Impact of Geopolitical Factors and Tariffs

Harbor Freight's significant reliance on overseas manufacturing, especially from China, exposes it to the bargaining power of suppliers influenced by geopolitical tensions and tariffs. For instance, the U.S.-China trade war, which saw tariffs imposed on various goods, directly impacted import costs for companies like Harbor Freight. In 2023, the U.S. continued to maintain tariffs on many Chinese goods, creating ongoing cost pressures for importers.

These external factors can directly translate into higher costs for Harbor Freight, potentially forcing adjustments to its competitive pricing strategy. Increased import duties could erode profit margins or necessitate price hikes, affecting customer affordability and the company's value proposition. Suppliers, aware of these potential cost increases, may leverage the situation to negotiate more favorable terms.

- Tariff Impact: Tariffs on goods imported from China, a key manufacturing hub for Harbor Freight, can increase the cost of goods sold.

- Geopolitical Volatility: Shifts in international relations or trade policies can disrupt supply chains and lead to unpredictable cost fluctuations.

- Supplier Leverage: Overseas suppliers, facing their own cost pressures due to tariffs or geopolitical events, may pass these increases onto Harbor Freight, strengthening their bargaining power.

- Pricing Strategy Challenges: Increased input costs can strain Harbor Freight's ability to maintain its low-price, high-value model, potentially impacting customer loyalty.

Supplier Switching Costs for Harbor Freight

Harbor Freight's relationships with its suppliers, while established, do present some switching costs. These can include the expense and time involved in re-establishing quality control protocols, reconfiguring logistics and supply chain operations, and building new trust with alternative manufacturers. These factors can grant existing suppliers a degree of bargaining power.

However, Harbor Freight's business model, which relies on a constant stream of new and diverse products, coupled with its direct sourcing approach, indicates a capacity to navigate these challenges. The company's ability to adapt and manage its supplier base effectively can mitigate the impact of these switching costs.

- Supplier Dependence: While Harbor Freight sources globally, a significant portion of its private label products are manufactured by a select group of overseas factories.

- Quality Control Investment: Harbor Freight reportedly invests heavily in its own quality control teams stationed at manufacturing facilities, reducing reliance on supplier-provided quality assurance and thus lowering switching costs.

- Volume Purchasing Power: As a major retailer with substantial order volumes, Harbor Freight likely possesses considerable leverage in negotiations, which can offset supplier bargaining power even with moderate switching costs.

The bargaining power of suppliers for Harbor Freight Tools is moderate, influenced by the concentrated nature of some manufacturing sectors and geopolitical factors affecting overseas production. While Harbor Freight's direct sourcing and strong supplier relationships help mitigate this power, reliance on specific overseas manufacturers and potential tariff impacts in 2024 and beyond introduce complexities.

The global power tools market, a key area for Harbor Freight, saw continued consolidation in 2024, with a few major players dominating. This concentration can amplify supplier leverage. For instance, if a significant portion of Harbor Freight's product lines comes from a limited number of large factories, those suppliers gain more power to dictate terms.

Despite efforts to diversify, Harbor Freight's substantial reliance on Asian manufacturing, particularly China, exposes it to supply chain risks. In 2023, U.S. tariffs on Chinese goods remained a factor, increasing import costs and giving suppliers leverage to pass on these expenses, potentially impacting Harbor Freight's low-price strategy.

| Factor | Impact on Harbor Freight | Mitigation Strategies |

|---|---|---|

| Supplier Concentration | Moderate to High (in specific product categories) | Diversification of suppliers, long-term relationships |

| Geopolitical/Trade Policies (e.g., Tariffs) | Cost Increases, Supply Chain Disruptions | Sourcing from alternative regions, absorbing some costs |

| Switching Costs | Moderate (due to quality control and logistics) | Investment in own QC, strong supplier partnerships |

What is included in the product

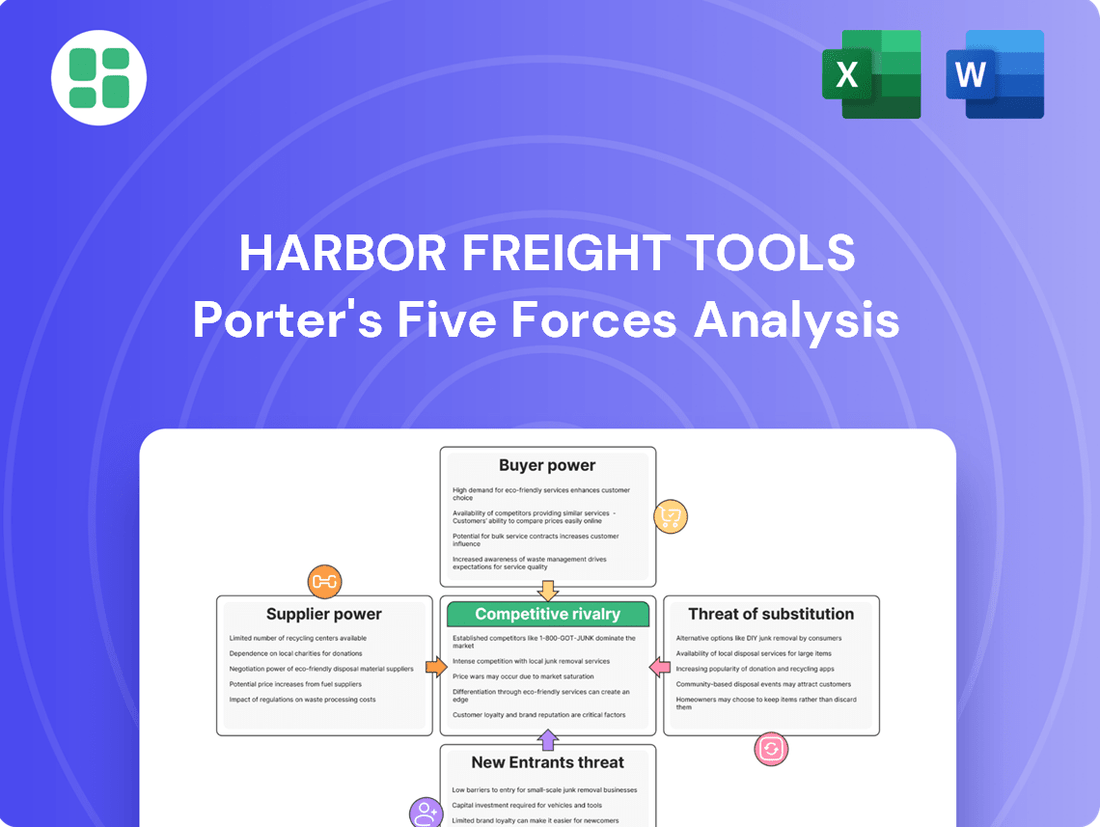

A Porter's Five Forces analysis for Harbor Freight Tools examines the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants, and the risk of substitutes within the discount tool and equipment market.

Instantly visualize competitive pressures—from supplier power to substitute threats—to inform strategic pricing and product development.

Simplify complex competitive landscapes into actionable insights, enabling Harbor Freight to proactively address market challenges.

Customers Bargaining Power

Harbor Freight's customer base, a mix of DIYers, homeowners, and tradespeople, is notably price-sensitive. This means they actively hunt for deals and are willing to switch brands if a better price is available, giving them substantial leverage.

The company's strategy of offering deeply discounted tools directly appeals to this price-conscious demographic. For instance, in 2023, Harbor Freight reported over 25 million customers, highlighting the sheer volume of individuals prioritizing affordability in their tool purchases.

Customers at Harbor Freight Tools face a market brimming with alternatives, significantly boosting their bargaining power. They can easily compare prices and features across major home improvement stores like Home Depot and Lowe's, as well as numerous online retailers and other discount tool brands.

This abundance of choice means customers can readily switch suppliers if they find better deals or perceive greater value elsewhere. For instance, in 2024, the U.S. home improvement retail market was valued at over $450 billion, indicating intense competition and a strong customer position.

Customers generally face low switching costs when choosing between Harbor Freight and its competitors for many standard tools and equipment. This ease of transition is a significant factor in their bargaining power.

The ability to readily purchase comparable products from other retailers, often at competitive prices, further strengthens the customer's position. For instance, in 2024, the average price for a basic cordless drill across major retailers remained relatively stable, indicating a commoditized market where brand loyalty may be less impactful than price and convenience.

Frequent sales and promotions across the broader retail landscape also empower buyers, giving them ample opportunities to find favorable deals. This constant availability of discounts means customers can easily shift their spending to whichever retailer offers the best current value, directly impacting Harbor Freight's pricing strategies.

Access to Product Information and Reviews

Customers today are incredibly informed, thanks to the vast amount of product information and reviews readily available online. This accessibility allows them to thoroughly research product quality, how well it performs, and what it costs from various brands and stores before making a purchase. This transparency significantly boosts their power to negotiate and secure the best value.

For a retailer like Harbor Freight Tools, this means customers can easily compare pricing and features of similar tools from competitors. For example, a quick search can reveal average prices for a cordless drill, allowing customers to gauge if Harbor Freight's offerings are competitive. This readily available data empowers them to seek better deals or even demand price matching, directly impacting Harbor Freight's pricing strategies and profit margins.

- Informed Purchasing Decisions: Consumers can access detailed product specifications, user manuals, and how-to guides online, enabling them to understand product capabilities and limitations.

- Peer Reviews and Ratings: Platforms like Amazon, Google Reviews, and specialized tool forums provide a wealth of customer feedback, including ratings and detailed experiences, influencing purchasing choices.

- Price Comparison Tools: Websites and browser extensions allow shoppers to instantly compare prices across multiple retailers, ensuring they find the lowest available price for a given product.

- Brand Reputation Scrutiny: Customers can research a brand's history, customer service reputation, and warranty policies, using this information to their advantage when choosing where to shop.

Diverse Product Needs and Quality Tiers

Harbor Freight's ability to serve a wide range of customer needs, from DIY enthusiasts to tradespeople, directly impacts their bargaining power. By offering diverse product lines and quality tiers, such as their 'Good, Better, Best' approach, customers can find solutions that align with their specific budget and performance expectations. This flexibility means customers are less likely to be locked into a single, high-cost option.

For instance, a homeowner needing a basic drill for occasional use will have different expectations and price sensitivity than a contractor requiring a heavy-duty hammer drill for daily construction work. Harbor Freight's tiered product strategy allows them to capture both segments. In 2024, Harbor Freight reported continued strong sales growth, indicating that this strategy resonates with a broad customer base.

- Diverse Product Needs: Harbor Freight offers tools for homeowners, hobbyists, and professional trades.

- Quality Tiers: Products are often categorized into 'Good, Better, Best' to meet varying customer budgets and quality demands.

- Customer Empowerment: This tiered approach allows customers to select products based on their specific requirements, increasing their bargaining power by providing choice.

The bargaining power of Harbor Freight's customers is substantial due to the highly competitive retail landscape and the availability of numerous alternatives. Customers can easily cross-shop between Harbor Freight, big-box home improvement stores like Home Depot and Lowe's, and a plethora of online retailers, all offering comparable tools. This ease of comparison, coupled with readily available online reviews and price comparison tools, empowers buyers to seek the best value, directly influencing Harbor Freight's pricing and promotional strategies.

In 2024, the U.S. home improvement market, exceeding $450 billion, underscores the intense competition customers face, further amplifying their leverage. With low switching costs for many standard tool purchases, customers can readily shift their allegiance to competitors offering better prices or perceived value. This dynamic environment means Harbor Freight must continually offer competitive pricing and promotions to retain its significant customer base, which surpassed 25 million in 2023.

| Factor | Impact on Harbor Freight | Supporting Data (2024 unless stated) |

| Price Sensitivity | High | Customers actively seek deals; over 25 million customers in 2023 indicates a broad, value-conscious base. |

| Availability of Alternatives | High | U.S. home improvement market valued at over $450 billion, featuring numerous competitors. |

| Switching Costs | Low | Easy to purchase comparable tools from other retailers without significant cost or effort. |

| Information Accessibility | High | Online reviews and price comparison tools empower customers to make informed decisions and negotiate value. |

What You See Is What You Get

Harbor Freight Tools Porter's Five Forces Analysis

This preview showcases the complete Harbor Freight Tools Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape. The document you see here is the exact, professionally formatted analysis you will receive instantly upon purchase, ensuring no discrepancies or missing information. You're looking at the final, ready-to-use report, providing immediate value for your strategic planning.

Rivalry Among Competitors

Harbor Freight Tools operates in a highly competitive landscape, particularly against major retail giants like Home Depot and Lowe's. These established players command significant market share, brand loyalty, and extensive product assortments, making it challenging for any competitor to gain substantial ground. For instance, in 2023, Home Depot reported over $152 billion in revenue, showcasing its immense scale and market penetration.

Harbor Freight Tools fuels intense competitive rivalry through its relentless expansion. The company plans to operate 2,000 stores by 2025, opening an average of two to three new locations each week. This aggressive physical growth strategy directly places them in closer proximity to existing competitors, escalating competition within local markets.

The growth of e-commerce, exemplified by giants like Amazon and specialized online tool sellers such as Northern Tool and Vevor, intensifies competition for Harbor Freight Tools. These digital marketplaces offer extensive product ranges and aggressive pricing, compelling all retailers to establish a robust online presence to remain competitive.

Product Diversification and Quality Improvement

Harbor Freight is aggressively expanding its product range and enhancing the quality of its private-label brands like Hercules, Bauer, and Icon. This strategy directly challenges established, pricier competitors and aims to draw in a wider audience, including professional tradespeople, thereby intensifying competition.

- Product Line Expansion: Harbor Freight's commitment to product diversification, evident in its continuous introduction of new tool categories and accessories, directly confronts rivals by offering a more comprehensive solution for customers.

- Quality Enhancements: Significant investments in improving the durability and performance of its house brands are crucial. For instance, the Bauer line has seen notable upgrades, positioning it as a viable alternative to premium brands, a trend that has accelerated through 2024.

- Targeting Professionals: By improving quality and expanding offerings, Harbor Freight is increasingly appealing to professional users who previously might have exclusively purchased from higher-end competitors, a shift observed throughout the past year.

Price Wars and Promotional Activities

Harbor Freight Tools operates in a highly competitive retail environment where price wars and aggressive promotional activities are commonplace. The market for tools and equipment is notably price-sensitive, compelling retailers to frequently engage in discounts and special offers to capture customer attention and loyalty. This intense pricing competition can put significant pressure on profit margins for all players involved.

Retailers like Harbor Freight often use promotions as a key strategy to drive sales volume. For instance, in 2023, many home improvement and tool retailers heavily promoted seasonal sales, such as Memorial Day, Fourth of July, and Black Friday events, offering discounts that sometimes reached 50% or more on select items. This ongoing promotional cycle means that consumers often expect and wait for these deals, further intensifying the rivalry.

- Price Sensitivity: The market for tools and equipment is highly sensitive to price, leading to frequent promotional activities.

- Promotional Strategies: Retailers commonly employ discounts, coupons, and bundled offers to attract and retain customers.

- Margin Erosion: Constant price wars can significantly impact industry-wide profit margins as companies compete on price.

- Customer Expectations: Consumers often anticipate and delay purchases to take advantage of promotional periods, creating a cyclical demand pattern.

The competitive rivalry within the tools and equipment sector is fierce, with Harbor Freight Tools facing off against a broad spectrum of competitors. This includes large home improvement chains like Home Depot and Lowe's, which boast substantial revenue, with Home Depot reporting over $152 billion in 2023. Additionally, the rise of e-commerce platforms and specialized online retailers intensifies this rivalry, forcing all players to maintain competitive pricing and robust online offerings.

Harbor Freight's aggressive expansion, with plans for 2,000 stores by 2025, directly increases its competitive footprint. Furthermore, the company's focus on enhancing its private-label brands, such as Bauer and Hercules, aims to capture market share from higher-priced competitors by offering improved quality at accessible price points. This strategy, coupled with frequent promotional activities and price sensitivity in the market, creates a dynamic and challenging competitive landscape.

| Competitor Type | Key Characteristics | Impact on Harbor Freight |

| Large Home Improvement Retailers (e.g., Home Depot, Lowe's) | Massive scale, brand loyalty, extensive product assortments, significant market share. | Direct competition for customer spending, pressure on pricing and product breadth. |

| E-commerce Giants (e.g., Amazon) | Vast selection, aggressive pricing, convenient delivery, broad customer reach. | Forces Harbor Freight to maintain a strong online presence and competitive digital pricing. |

| Specialty Online Tool Retailers (e.g., Northern Tool, Vevor) | Niche product focus, often competitive pricing, direct-to-consumer models. | Captures specific customer segments, requires Harbor Freight to differentiate through product and value. |

| Discount Retailers (e.g., Walmart, Target) | Broad product categories including tools, focus on everyday low prices. | Compete for general consumer spending, can influence price expectations. |

SSubstitutes Threaten

The expanding tool and equipment rental market poses a substantial threat of substitution for Harbor Freight Tools. For consumers and professionals needing specialized or infrequently used tools, renting provides a much more economical option than outright purchase. This is particularly true for high-cost items where ownership is not justified by usage frequency.

The equipment rental industry in the US generated approximately $47 billion in revenue in 2023, highlighting its significant market presence and the availability of diverse rental options. This robust market means customers have readily accessible alternatives for many tools that Harbor Freight sells, directly impacting potential sales volume.

The threat of substitutes for Harbor Freight Tools is amplified by the rise of multi-purpose tools and DIY solutions. Consumers, especially casual DIYers, may choose to use a single versatile tool instead of buying multiple specialized ones, or even improvise with items already around their home. This trend can significantly reduce the demand for specific products, impacting sales volume.

The availability of used tools through online marketplaces like eBay, Facebook Marketplace, and Craigslist, along with traditional avenues like pawn shops, presents a significant substitute. Budget-conscious consumers often find these options appealing as they can acquire necessary tools at a fraction of the new price, directly impacting demand for Harbor Freight's new offerings.

Furthermore, the informal practice of borrowing tools from friends, family, or neighbors further erodes the need for outright purchase, especially for infrequent or specialized tasks. This accessibility to pre-owned or borrowed equipment directly challenges the value proposition of buying new, particularly for DIY enthusiasts or those with limited tool collections.

Professional Services

For intricate projects, some consumers and businesses opt for professional contractors instead of buying tools and doing the work themselves. This choice hinges on the perceived value proposition of DIY versus hiring a pro.

The decision often boils down to a cost-benefit analysis. For instance, a homeowner needing a complex electrical rewiring might find it more economical and safer to hire a licensed electrician, even with the cost of tools, rather than risking damage or injury. In 2023, the average cost for an electrician to perform a full home rewiring could range from $3,000 to $8,000, a significant expense that might make DIY tool purchases seem less appealing for a one-off job.

- DIY vs. Professional Cost Calculation: Individuals weigh the upfront cost of tools and materials against the total cost of hiring a professional, factoring in time and potential errors.

- Complexity and Skill Level: Highly specialized tasks requiring specific expertise or certifications, such as major plumbing or HVAC work, significantly increase the threat of substitutes.

- Time Constraints: Busy individuals or businesses may prioritize time savings by outsourcing tasks, making professional services a more attractive alternative than investing in tools and learning new skills.

- Risk Aversion: For tasks with high stakes or potential for significant damage if done incorrectly, the perceived reliability and insurance offered by professionals can outweigh the cost savings of DIY.

Advancements in Tool Technology and Versatility

The threat of substitutes for tools, particularly for a retailer like Harbor Freight, is significantly influenced by advancements in tool technology. New innovations are creating tools that are more versatile, often combining multiple functions into a single device. This directly reduces the need for consumers to purchase a broad range of specialized tools, thereby acting as a substitute for individual tool purchases.

Harbor Freight itself is a prime example of this trend, actively launching new products that embody this increased versatility. For instance, their recent introductions include multi-functional power tools that can perform tasks previously requiring several separate attachments or machines. This strategic product development means that a single, advanced tool from Harbor Freight might replace the demand for multiple, less sophisticated tools that customers would otherwise buy.

- Technological Convergence: Innovations like cordless multi-tools and advanced diagnostic equipment can replace the need for a toolbox filled with single-purpose instruments.

- DIY Market Impact: As of 2024, the DIY and home improvement market continues to grow, with consumers seeking cost-effective and space-saving solutions, making versatile tools highly attractive substitutes.

- Harbor Freight's Response: Harbor Freight has seen success with its U.S. General and Hercules lines, which often feature tools designed for broader application, directly addressing this substitution threat by offering versatile options.

The availability of used tools, accessible through platforms like eBay and Facebook Marketplace, presents a significant substitute for new purchases. Budget-conscious consumers can acquire necessary tools at a fraction of the original cost, directly impacting demand for Harbor Freight's new offerings.

The threat of substitutes is also heightened by the growing popularity of tool rental services. For infrequently used or specialized equipment, renting offers a more economical alternative than purchasing, especially for high-cost items where ownership is not justified by usage frequency. The U.S. equipment rental market generated approximately $47 billion in revenue in 2023, underscoring the accessibility and breadth of rental options available to consumers.

Additionally, the rise of multi-purpose tools and DIY solutions means consumers may opt for versatile items that can perform multiple tasks, reducing the need to buy a variety of specialized tools. This trend, coupled with the informal practice of borrowing tools from friends or neighbors, further diminishes the necessity of outright purchase.

Entrants Threaten

The significant capital outlay needed to establish a physical retail footprint comparable to Harbor Freight's, which boasts over 1,600 stores, acts as a formidable barrier to entry. This includes substantial costs for acquiring or leasing prime retail locations, stocking diverse inventory, and building out store infrastructure.

Harbor Freight's direct sourcing strategy, heavily reliant on overseas manufacturers, creates a formidable barrier to entry. Developing a comparable global supply chain, encompassing logistics, quality assurance, and international partnerships, is an immensely complex and capital-intensive undertaking for any new competitor. This intricate network, honed over years, represents a significant hurdle that newcomers must overcome to compete effectively.

Harbor Freight Tools has cultivated significant brand recognition over many years, largely due to its consistent messaging of offering quality tools at the lowest prices. This long-standing reputation, coupled with a dedicated customer base, presents a substantial hurdle for any new competitor aiming to establish a foothold and earn consumer trust in the discount tool market.

Economies of Scale in Purchasing and Distribution

Harbor Freight Tools leverages substantial economies of scale in purchasing, allowing it to negotiate lower prices from suppliers due to its massive order volumes. This cost advantage is further amplified by its efficient, large-scale distribution network, which reduces per-unit logistics expenses. For instance, in 2023, Harbor Freight reported over 1,500 stores across the United States, each requiring significant inventory replenishment, a scale that smaller new entrants cannot easily replicate.

The threat of new entrants is significantly mitigated by these purchasing and distribution economies of scale. A new competitor would find it exceedingly difficult to achieve comparable cost efficiencies, making it challenging to compete with Harbor Freight on price, a key differentiator for the company. This barrier effectively deters many potential market entrants who cannot absorb the higher initial operating costs.

- Economies of Scale in Purchasing: Harbor Freight's vast store count and high sales volume (estimated to be in the billions of dollars annually) grant it immense bargaining power with suppliers, securing favorable pricing on a wide array of tools and equipment.

- Distribution Network Efficiency: The company operates a sophisticated and extensive network of distribution centers, enabling cost-effective delivery to its numerous retail locations, a logistical feat that requires substantial upfront investment.

- Barrier to Entry: New entrants would need massive capital investment to build a comparable purchasing leverage and distribution infrastructure, creating a significant hurdle to market entry and price competitiveness.

Regulatory and Compliance Hurdles

Navigating the intricate web of regulations and compliance is a significant barrier for new entrants in the tools and equipment market. Harbor Freight Tools, like others, must adhere to numerous safety standards, import/export laws, and product-specific certifications. For instance, in 2024, the Consumer Product Safety Commission (CPSC) continued to enforce stringent safety regulations on a wide array of consumer products, including power tools and machinery. Failure to comply can result in hefty fines and product recalls, adding substantial costs and operational complexity for newcomers.

The sourcing of tools, particularly from international markets, introduces further layers of regulatory challenges. New companies must understand and comply with customs regulations, tariffs, and quality control standards in multiple jurisdictions. This can be particularly daunting when dealing with a diverse product catalog like Harbor Freight's, which spans thousands of SKUs. In 2024, global supply chain disruptions and evolving trade policies further complicated these international compliance efforts, demanding significant investment in expertise and infrastructure for any aspiring competitor.

These regulatory and compliance hurdles translate into tangible financial and operational barriers. New entrants face considerable upfront costs for legal counsel, product testing, and establishing robust compliance protocols.

- Product Safety Certifications: Obtaining certifications from bodies like UL or ETL can cost thousands of dollars per product line.

- Import Duties and Tariffs: Tariffs on goods imported from certain countries can significantly increase the cost of goods sold. In 2024, tariffs on specific manufactured goods remained a consideration for importers.

- Environmental Regulations: Compliance with regulations related to materials, manufacturing processes, and disposal of certain products adds another layer of complexity and cost.

The threat of new entrants for Harbor Freight Tools is considerably low due to several robust barriers. The sheer scale of its operations, including over 1,600 stores as of 2023, necessitates massive capital for real estate, inventory, and infrastructure, which is a significant deterrent.

Harbor Freight's established global sourcing and distribution network, built over decades, is complex and capital-intensive for newcomers to replicate. Furthermore, its strong brand recognition, built on a consistent value proposition of low prices, creates a loyalty hurdle for new players in the discount tool market.

Economies of scale in purchasing and distribution provide Harbor Freight with substantial cost advantages, making it difficult for new entrants to compete on price. For example, their massive order volumes in 2023 allowed for favorable supplier pricing, a scale that smaller competitors cannot easily match.

Navigating regulatory compliance, including product safety certifications and international trade laws, presents another significant barrier. In 2024, stringent CPSC regulations and evolving trade policies added complexity and cost, requiring substantial investment in expertise for any new market participant.

| Barrier Type | Description | Impact on New Entrants | Example Data (2023-2024) |

| Capital Requirements | Establishing a retail footprint and supply chain comparable to Harbor Freight's extensive network. | High initial investment needed for store build-out, inventory, and logistics. | Harbor Freight's 2023 store count exceeding 1,600 units. |

| Supply Chain & Sourcing | Developing direct sourcing relationships and managing international logistics. | Requires significant expertise, capital, and time to build comparable global supply chains. | Complexity of managing thousands of SKUs sourced internationally. |

| Brand Loyalty & Reputation | Building consumer trust and recognition in a competitive market. | New entrants face a challenge in differentiating and attracting customers away from established brands. | Harbor Freight's long-standing reputation for value. |

| Economies of Scale | Achieving cost efficiencies through high-volume purchasing and distribution. | New entrants struggle to match Harbor Freight's per-unit cost advantages. | Billions in annual sales enabling significant supplier negotiation power. |

| Regulatory Compliance | Adhering to product safety, import, and environmental regulations. | Adds substantial costs for legal, testing, and compliance infrastructure. | CPSC safety standards and potential tariff implications in 2024. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Harbor Freight Tools leverages data from industry-specific market research reports, financial statements of key competitors, and consumer spending trend databases to understand the competitive landscape.