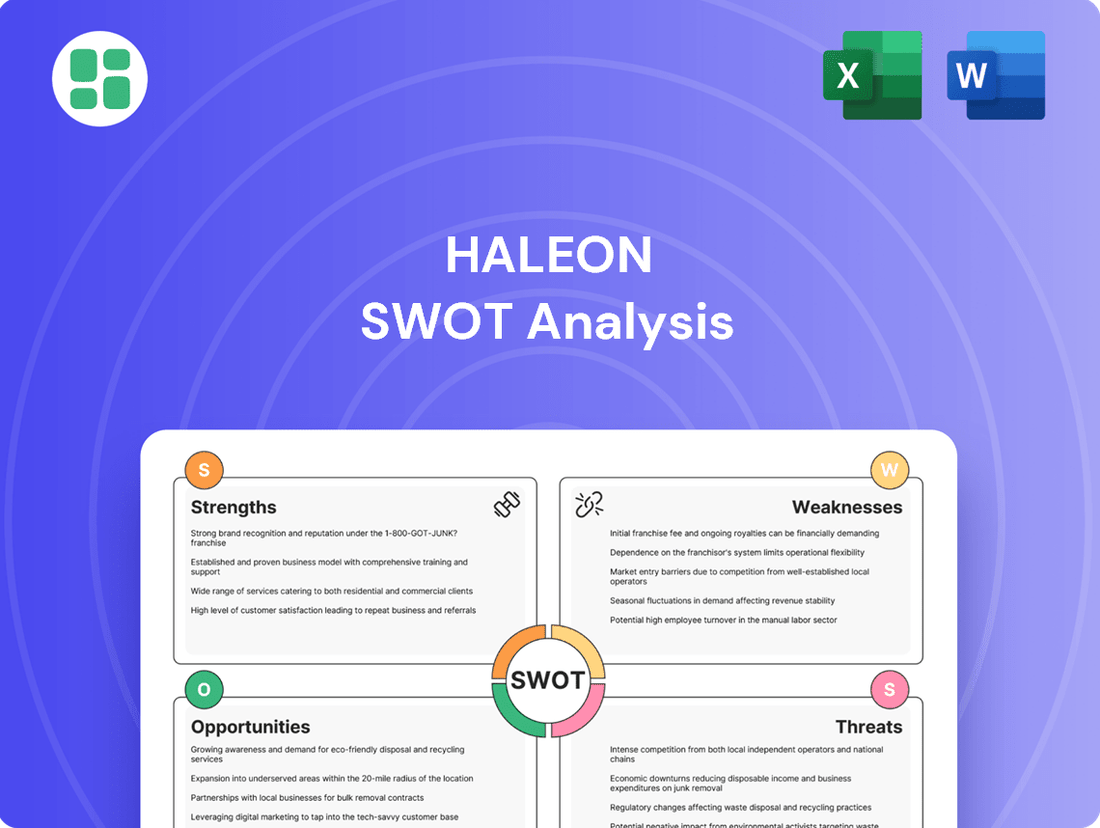

Haleon SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Haleon Bundle

Haleon, a prominent player in consumer health, leverages strong brand recognition and a diverse product portfolio as key strengths. However, the company faces challenges from intense competition and evolving regulatory landscapes, impacting its market opportunities and potential threats.

Want the full story behind Haleon's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Haleon commands a formidable global leadership position in consumer healthcare, underpinned by its impressive portfolio of nine 'Power Brands.' These brands, including trusted names like Sensodyne, Panadol, Advil, and Centrum, are not only widely recognized but also backed by scientific credibility, fostering strong consumer loyalty across the globe. This robust brand equity translates directly into significant pricing power and sustained consumer preference, a crucial advantage in a competitive market.

The strength of Haleon's brand power is evident in its market performance, with a remarkable 71% of its business gaining or maintaining market share in 2024. This demonstrates the enduring appeal and competitive resilience of its product offerings, driven by consistent consumer trust and the perceived value of its science-backed innovations. Such market dominance solidifies Haleon's standing as a key player in the global health and wellness sector.

Haleon showcased impressive financial resilience in 2024, posting a 5.0% organic revenue growth. This growth was complemented by a strong 9.8% increase in organic operating profit, underscoring the company's operational efficiency.

The company's robust financial health is further evidenced by its substantial free cash flow generation, which amounted to £1.9 billion in 2024. This strong cash flow underpins Haleon's ability to manage its debt effectively.

Haleon's financial discipline translates into significant shareholder returns, with a £500 million share buyback program slated for 2025. This, along with consistent dividend payouts, highlights a commitment to rewarding investors.

Haleon’s commitment to innovation is a significant strength, evidenced by its substantial investment in research and development. In 2024 alone, the company launched 127 new products, a clear indication of its focus on addressing evolving consumer needs and driving growth through premium offerings.

This dedication to innovation is further highlighted by successful product launches such as Sensodyne Clinical White and Advil Targeted Relief. These products showcase Haleon's capability in developing science-backed solutions that offer tangible benefits to consumers, reinforcing its market position.

The opening of Haleon’s £130 million Innovation Center in 2024 solidifies its strategic intent to prioritize R&D. This investment is designed to accelerate the development pipeline and ensure the company maintains a robust competitive advantage in the dynamic consumer healthcare market.

Diversified Product Portfolio

Haleon's strength lies in its highly diversified product portfolio, spanning five key global categories: Oral Health, Pain Relief, Vitamins, Minerals and Supplements (VMS), Respiratory Health, and Digestive Health. This broad operational base significantly reduces the company's dependence on any single product segment, offering a robust shield against sector-specific downturns and market volatility.

This strategic diversification not only provides resilience but also ensures broad market appeal, as Haleon strategically targets large and expanding categories where it already commands significant global or local leadership positions. For instance, in 2023, Haleon reported strong performance in its Oral Health segment, driven by brands like Sensodyne and Aquafresh, contributing to its overall revenue stability.

- Oral Health: Strong brand recognition with products like Sensodyne.

- Pain Relief: Established brands such as Advil and Panadol.

- VMS: Growing segment with brands like Centrum and Caltrate.

- Respiratory Health: Presence in a category with consistent demand.

- Digestive Health: Offering solutions for common ailments.

Strong Execution and Operational Efficiency

Haleon has demonstrated robust execution of its 'Win as One' strategy, a key strength that has driven increased household penetration and significant supply chain optimization. This strategic focus is a major contributor to its operational efficiency.

The company's commitment to enhancing productivity savings is substantial, with a target of unlocking £800 million by 2026. These savings are instrumental in bolstering margin expansion and fortifying operational resilience, ensuring Haleon can navigate market fluctuations effectively.

Haleon's operational management is particularly noteworthy for its ability to sustain high service levels while simultaneously reducing inventory days. This balancing act underscores a sophisticated approach to inventory control and logistical efficiency.

- Strong 'Win as One' Strategy Execution: Focused on increasing household penetration and supply chain optimization.

- Significant Productivity Savings: Projected to unlock £800 million by 2026, bolstering margins and resilience.

- High Service Levels with Reduced Inventory: Demonstrates effective operational and inventory management.

Haleon's strength lies in its portfolio of nine 'Power Brands,' including Sensodyne and Centrum, which hold significant global leadership positions and strong consumer loyalty. This brand equity allows for pricing power and sustained preference, as evidenced by 71% of its business gaining or maintaining market share in 2024.

The company achieved 5.0% organic revenue growth and a 9.8% increase in organic operating profit in 2024, demonstrating operational efficiency and financial resilience. Furthermore, Haleon generated £1.9 billion in free cash flow in 2024, supporting its debt management and a £500 million share buyback program planned for 2025.

Haleon's commitment to innovation is a key strength, with £130 million invested in its new Innovation Center in 2024 and 127 new products launched that year. This focus on science-backed solutions, like Sensodyne Clinical White, reinforces its competitive edge.

The company's diversified product portfolio across Oral Health, Pain Relief, VMS, Respiratory, and Digestive Health provides resilience against sector-specific downturns. Strong performance in Oral Health in 2023, driven by brands like Sensodyne, highlights this stability.

What is included in the product

Delivers a strategic overview of Haleon’s internal and external business factors, highlighting its strong brand portfolio and market position alongside potential challenges in innovation and competition.

Offers a clear, actionable framework to identify and leverage Haleon's strengths while mitigating weaknesses, supporting strategic pain point relief.

Weaknesses

Following its spin-off from GSK, Haleon inherited a substantial debt load, resulting in a highly leveraged financial position. While the company has been actively working to reduce this debt, with net debt standing at £7.91 billion by the close of 2024, the initial high leverage may constrain its ability to pursue aggressive expansion strategies funded by additional borrowing.

Haleon has encountered significant headwinds in the North American market, specifically within the United States and Canada. This slowdown stems from a weaker consumer spending climate and ongoing efforts by retailers to reduce existing inventory levels, a phenomenon known as destocking.

North America represents a substantial portion of Haleon's business, contributing around 36% of its total revenue. However, the region’s performance in the first half of 2025 was disappointing, with only 1% organic growth recorded. This sluggishness directly affected the company's overall revenue projections.

The challenges are further highlighted by the underperformance of some of Haleon's flagship brands in this critical market. Brands such as Centrum and Advil have experienced notable difficulties, contributing to the broader regional sales slump.

Haleon faces significant challenges from foreign exchange rate fluctuations. For fiscal year 2025, the company anticipates a headwind of around 2% on net revenue and approximately 3% on adjusted operating profit due to these currency movements.

These translational foreign exchange headwinds have already negatively impacted Haleon's reported revenue and adjusted operating profit in previous periods. Such currency volatility can make it difficult to discern the company's true operational performance and injects a level of unpredictability into its financial outcomes.

Intense Competitive Pressure

Haleon operates in a fiercely competitive consumer healthcare landscape. The market is crowded with established giants and agile new entrants, including a growing presence of generic and private label alternatives. This intense rivalry can significantly impact pricing strategies and market share, especially if Haleon's product portfolio lacks distinct advantages or if consumers become more price-conscious.

For instance, in 2023, the global consumer health market was valued at approximately $300 billion, with significant growth projected. However, this growth is contested. Haleon faces pressure from companies like Procter & Gamble and Johnson & Johnson, as well as the increasing market penetration of store brands which often offer lower price points.

To navigate this, Haleon must consistently invest in product innovation and robust marketing campaigns.

- Intense Rivalry: Competitors like P&G and J&J vie for market share across Haleon's key categories.

- Price Sensitivity: The rise of private label brands and economic pressures can drive consumers towards lower-cost options.

- Innovation Imperative: Sustained investment in R&D and marketing is crucial to maintain brand loyalty and differentiation.

Dependence on Seasonality and Consumer Trends

Haleon's performance is notably susceptible to seasonal fluctuations, particularly in categories like Respiratory Health, where demand spikes during colder months. For instance, the 2024 cold and flu season's severity directly impacts sales volumes.

Consumer trends also present a significant challenge. A rapid shift in preferences, such as a move away from certain supplement formats or a growing demand for plant-based alternatives, requires swift product development and marketing adjustments. Failure to anticipate these shifts can lead to inventory imbalances and missed revenue opportunities.

- Seasonal Impact: Sales in Respiratory Health and Pain Relief can see significant swings based on seasonal illness patterns, affecting revenue predictability.

- Trend Responsiveness: The company must continually innovate to align with evolving consumer health priorities, such as the growing demand for wellness and preventative care products.

- Product Lifecycle Management: Effectively managing the introduction of new products and the phasing out of less popular ones is crucial to avoid obsolescence and maintain market relevance.

Haleon's substantial debt load from its GSK spin-off, with net debt at £7.91 billion by the end of 2024, could limit aggressive expansion through borrowing. The company also faces significant headwinds in North America, its largest market (36% of revenue), which saw only 1% organic growth in H1 2025, impacting overall projections due to weaker consumer spending and retailer destocking, particularly affecting brands like Centrum and Advil.

Full Version Awaits

Haleon SWOT Analysis

This is the actual Haleon SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get, offering a glimpse into its comprehensive insights.

Purchase unlocks the entire in-depth version, providing a complete strategic overview of Haleon's market position.

Opportunities

The increasing global focus on self-care and preventive health, fueled by aging demographics and heightened consumer health consciousness, presents a significant opportunity for Haleon. This macro trend allows Haleon to broaden its market presence and launch innovative products that enable individuals to take charge of their well-being, directly supporting its core mission.

In 2024, the global wellness market was valued at an estimated $5.6 trillion, with preventive health and self-care segments showing robust growth. This expansion is expected to continue, with projections indicating further market penetration for consumer health products that support proactive health management.

Emerging markets present a significant growth avenue for Haleon, especially within lower-income demographics. The company's strategic focus on these regions is yielding positive results, with notable performance in India. For instance, in 2023, Haleon's India business saw robust growth, driven by its expanding portfolio and targeted marketing efforts.

Haleon is actively working to broaden its footprint in these developing economies. This includes tailoring product offerings to suit local needs and affordability. The development of products like Centrum Recharge in India exemplifies this strategy, aiming to capture new consumer segments previously underserved.

Acquisitions and strategic partnerships are also key to Haleon's expansion. The company's increased stake in its China Joint Venture underscores its commitment to leveraging opportunities in major emerging markets. This move is expected to enhance its market penetration and product distribution in the region.

The accelerating shift towards digital healthcare solutions and the robust expansion of e-commerce present a prime opportunity for Haleon to deepen its direct-to-consumer relationships and expand its product reach. By strategically investing in digital capabilities and online marketing, Haleon can make its diverse portfolio of trusted brands more accessible to a wider audience.

Haleon can capitalize on the growing consumer preference for online purchasing, which saw significant acceleration in 2024. For instance, global e-commerce sales in health and personal care categories continued to show strong year-over-year growth, indicating a clear consumer trend towards digital channels for these essential goods, further solidifying the opportunity for Haleon to enhance its digital engagement and sales strategies.

Strategic Acquisitions and Partnerships

Haleon continues to explore strategic tuck-in acquisitions, even while prioritizing deleveraging. These acquisitions aim to enhance its existing product lines or expand its reach into important therapeutic categories and geographic markets. For instance, the company recently increased its stake in its China joint venture by an additional 33%, a move designed to capitalize on higher growth prospects and solidify its market standing in a crucial region.

This targeted approach to M&A allows Haleon to strategically strengthen its portfolio and market presence. The company's focus remains on acquiring assets that offer clear synergies or access to attractive growth avenues. By selectively adding to its brand stable, Haleon can further diversify its revenue streams and competitive positioning.

- Strategic Focus: Haleon targets 'tuck-in' acquisitions to bolster its product portfolio and expand into key therapeutic areas or geographies.

- China JV Investment: An example of this strategy is the acquisition of an additional 33% stake in its China JV, enhancing growth capture and market position.

- Portfolio Enhancement: These acquisitions are designed to complement existing brands and provide access to new or growing market segments.

- Deleveraging Balance: The company balances its acquisition strategy with a commitment to deleveraging its balance sheet.

Further Supply Chain Optimization and Sustainability Initiatives

Haleon's commitment to enhancing its supply chain and embedding sustainability offers a significant avenue for further cost reductions and bolstering its brand image. By continuing to push for initiatives such as minimizing virgin plastic consumption, aiming for zero-waste manufacturing sites, and prioritizing sustainable sourcing practices, the company can unlock greater operational efficiencies.

These efforts not only streamline processes but also resonate strongly with a growing segment of consumers who prioritize environmental responsibility. This alignment can translate into improved market access, particularly within the burgeoning 'green markets' where eco-conscious products command a premium and attract dedicated customer bases.

For instance, Haleon's 2023 sustainability report highlighted a 15% reduction in Scope 1 and 2 greenhouse gas emissions compared to their 2019 baseline, demonstrating tangible progress. Further expanding these programs, such as investing in renewable energy for manufacturing plants or developing more circular packaging solutions, could yield even greater financial and reputational benefits in the 2024-2025 period.

- Continued reduction in virgin plastic use: Aiming for a 50% reduction by 2030, as stated in their sustainability goals, offers significant material cost savings.

- Zero-waste to landfill targets: Achieving this across all major operational sites by 2025 can reduce waste disposal fees and improve resource utilization.

- Sustainable sourcing expansion: Increasing the percentage of sustainably sourced key ingredients, like palm oil or mica, appeals to ethical consumers and mitigates supply chain risks.

- Investment in green logistics: Optimizing transportation routes and exploring lower-emission delivery methods can cut fuel costs and carbon footprint.

The increasing global focus on self-care and preventive health, fueled by aging demographics and heightened consumer health consciousness, presents a significant opportunity for Haleon. This macro trend allows Haleon to broaden its market presence and launch innovative products that enable individuals to take charge of their well-being, directly supporting its core mission.

In 2024, the global wellness market was valued at an estimated $5.6 trillion, with preventive health and self-care segments showing robust growth. This expansion is expected to continue, with projections indicating further market penetration for consumer health products that support proactive health management.

Emerging markets present a significant growth avenue for Haleon, especially within lower-income demographics. The company's strategic focus on these regions is yielding positive results, with notable performance in India. For instance, in 2023, Haleon's India business saw robust growth, driven by its expanding portfolio and targeted marketing efforts.

Haleon is actively working to broaden its footprint in these developing economies. This includes tailoring product offerings to suit local needs and affordability. The development of products like Centrum Recharge in India exemplifies this strategy, aiming to capture new consumer segments previously underserved.

Acquisitions and strategic partnerships are also key to Haleon's expansion. The company's increased stake in its China Joint Venture underscores its commitment to leveraging opportunities in major emerging markets. This move is expected to enhance its market penetration and product distribution in the region.

The accelerating shift towards digital healthcare solutions and the robust expansion of e-commerce present a prime opportunity for Haleon to deepen its direct-to-consumer relationships and expand its product reach. By strategically investing in digital capabilities and online marketing, Haleon can make its diverse portfolio of trusted brands more accessible to a wider audience.

Haleon can capitalize on the growing consumer preference for online purchasing, which saw significant acceleration in 2024. For instance, global e-commerce sales in health and personal care categories continued to show strong year-over-year growth, indicating a clear consumer trend towards digital channels for these essential goods, further solidifying the opportunity for Haleon to enhance its digital engagement and sales strategies.

Haleon continues to explore strategic tuck-in acquisitions, even while prioritizing deleveraging. These acquisitions aim to enhance its existing product lines or expand its reach into important therapeutic categories and geographic markets. For instance, the company recently increased its stake in its China joint venture by an additional 33%, a move designed to capitalize on higher growth prospects and solidify its market standing in a crucial region.

This targeted approach to M&A allows Haleon to strategically strengthen its portfolio and market presence. The company's focus remains on acquiring assets that offer clear synergies or access to attractive growth avenues. By selectively adding to its brand stable, Haleon can further diversify its revenue streams and competitive positioning.

- Strategic Focus: Haleon targets 'tuck-in' acquisitions to bolster its product portfolio and expand into key therapeutic areas or geographies.

- China JV Investment: An example of this strategy is the acquisition of an additional 33% stake in its China JV, enhancing growth capture and market position.

- Portfolio Enhancement: These acquisitions are designed to complement existing brands and provide access to new or growing market segments.

- Deleveraging Balance: The company balances its acquisition strategy with a commitment to deleveraging its balance sheet.

Haleon's commitment to enhancing its supply chain and embedding sustainability offers a significant avenue for further cost reductions and bolstering its brand image. By continuing to push for initiatives such as minimizing virgin plastic consumption, aiming for zero-waste manufacturing sites, and prioritizing sustainable sourcing practices, the company can unlock greater operational efficiencies.

These efforts not only streamline processes but also resonate strongly with a growing segment of consumers who prioritize environmental responsibility. This alignment can translate into improved market access, particularly within the burgeoning 'green markets' where eco-conscious products command a premium and attract dedicated customer bases.

For instance, Haleon's 2023 sustainability report highlighted a 15% reduction in Scope 1 and 2 greenhouse gas emissions compared to their 2019 baseline, demonstrating tangible progress. Further expanding these programs, such as investing in renewable energy for manufacturing plants or developing more circular packaging solutions, could yield even greater financial and reputational benefits in the 2024-2025 period.

- Continued reduction in virgin plastic use: Aiming for a 50% reduction by 2030, as stated in their sustainability goals, offers significant material cost savings.

- Zero-waste to landfill targets: Achieving this across all major operational sites by 2025 can reduce waste disposal fees and improve resource utilization.

- Sustainable sourcing expansion: Increasing the percentage of sustainably sourced key ingredients, like palm oil or mica, appeals to ethical consumers and mitigates supply chain risks.

- Investment in green logistics: Optimizing transportation routes and exploring lower-emission delivery methods can cut fuel costs and carbon footprint.

Haleon can leverage the growing demand for personalized health solutions, driven by advancements in data analytics and biotechnology. By offering tailored product recommendations and solutions, the company can enhance customer loyalty and capture market share in a rapidly evolving health landscape.

The company's strong brand portfolio, including Sensodyne and Advil, provides a solid foundation for innovation in personalized health. In 2024, consumer interest in genetic testing and microbiome analysis for health insights surged, creating an opening for Haleon to integrate these technologies into its offerings.

Furthermore, strategic collaborations with health tech companies and research institutions can accelerate Haleon's ability to develop and deliver these personalized solutions. This approach allows for efficient scaling of new offerings and access to cutting-edge scientific advancements.

Haleon's expansion into emerging markets, particularly in Asia and Africa, presents substantial growth opportunities. In 2024, these regions continued to show increasing disposable incomes and a rising awareness of health and wellness, driving demand for consumer healthcare products.

The company's strategy to adapt its product portfolio to local needs and price points, as seen with its Centrum Recharge launch in India, is crucial for capturing market share in these diverse economies.

By focusing on accessible innovation and strategic distribution channels, Haleon can effectively penetrate these markets and build a strong, long-term presence.

Threats

The consumer healthcare landscape is incredibly crowded, featuring a mix of established pharmaceutical giants, major consumer goods companies, and an increasing number of private label brands. This fierce competition directly translates into significant pricing pressures, forcing companies like Haleon to invest heavily in marketing and promotions, which can impact profitability.

For instance, in 2023, the global consumer health market was valued at approximately $315 billion, with growth driven by wellness trends but also intensified by the proliferation of private label offerings. This dynamic means Haleon must continually innovate and differentiate its products to avoid being squeezed by aggressive pricing strategies from competitors and the growing consumer preference for more affordable private label alternatives, especially during economic downturns.

Macroeconomic headwinds, including persistent high inflation and the potential for economic downturns, pose a significant threat to Haleon. These conditions can erode consumer purchasing power, leading to reduced discretionary spending on health and wellness products, particularly in established markets like North America. For instance, a continued slowdown in consumer spending could directly impact Haleon's volume growth and profitability.

The volatility in consumer confidence directly influences spending patterns. When consumers feel uncertain about the future, they tend to cut back on non-essential purchases, which can include many of Haleon's product categories. This can also prompt retailers to reduce their inventory levels, a phenomenon known as destocking, which directly squeezes Haleon's sales and revenue streams.

These macroeconomic pressures have already led Haleon to adjust its financial outlook. The company has revised its 2025 revenue guidance downwards, reflecting the anticipated impact of these challenging economic conditions on its sales performance. This recalibration highlights the tangible effect of these threats on Haleon's operational and financial planning.

Haleon faces significant threats from escalating regulatory scrutiny across its diverse product portfolio. For instance, in 2024, the U.S. Food and Drug Administration (FDA) continued its focus on over-the-counter (OTC) drug labeling accuracy, potentially impacting Haleon's consumer health brands. Failure to adapt to evolving compliance standards in key markets like Europe and Asia could result in substantial fines and product market withdrawals.

Product liability risks represent another major concern, especially given the nature of healthcare products. A significant product recall, such as those seen in the consumer goods sector impacting competitors in late 2023 and early 2024, could severely damage Haleon's brand reputation and lead to considerable legal costs. The company's commitment to science-backed claims means any misstep in product efficacy or safety reporting could trigger intense scrutiny and litigation.

Supply Chain Vulnerabilities and Raw Material Costs

Global supply chain disruptions and geopolitical tensions continue to present significant threats to Haleon's operations. Volatility in raw material prices, such as those for active pharmaceutical ingredients and packaging, can directly impact manufacturing costs. For instance, the global chemical industry experienced price surges in early 2024, affecting many components used in consumer healthcare products.

Haleon's reliance on specific sourcing locations or key materials could lead to production bottlenecks or increased costs if these are disrupted. While the company is actively diversifying its supplier base, the potential for unforeseen events to impact production efficiency and product availability remains a concern. This could affect profit margins and the ability to meet market demand consistently.

- Supply Chain Risk: Continued global logistics challenges and trade policy shifts pose a risk to timely and cost-effective product delivery.

- Raw Material Price Volatility: Fluctuations in the cost of key ingredients, like ibuprofen or paracetamol, can squeeze profit margins if not effectively managed through pricing strategies or hedging.

- Geopolitical Impact: Regional conflicts or trade disputes can disrupt the flow of goods and raw materials, impacting Haleon's access to essential production inputs.

Changing Consumer Preferences and Health Paradigms

Haleon faces the threat of rapidly changing consumer preferences, influenced by emerging scientific findings and social media trends. For instance, a growing consumer demand for natural ingredients and sustainable packaging, as highlighted by a 2023 NielsenIQ report indicating a 20% increase in consumers seeking eco-friendly options, could challenge Haleon's existing product lines if not addressed.

Failure to adapt its product portfolio swiftly through innovation or to effectively communicate the science-backed benefits of its brands in this dynamic market poses a significant risk. This could result in a decline in market share, especially as competitors might be quicker to capitalize on new health paradigms.

- Consumer preference shifts: Rapid changes driven by science, social media, and evolving health views.

- Product relevance: Existing products may become less appealing due to these shifts.

- Market share risk: Slow adaptation or ineffective communication of brand benefits can lead to lost market share.

Intense competition, particularly from private labels, forces significant marketing spend and creates pricing pressure, impacting Haleon's profitability. Macroeconomic headwinds like inflation and potential downturns erode consumer spending power, directly affecting sales volumes and revenue. Regulatory scrutiny and product liability risks also pose substantial threats, with non-compliance or product recalls potentially leading to hefty fines and reputational damage.

SWOT Analysis Data Sources

This analysis is built upon a foundation of robust data, including Haleon's official financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded strategic perspective.