Haleon Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Haleon Bundle

Haleon navigates a complex consumer health landscape, facing intense rivalry and significant buyer power from discerning consumers. Understanding the threat of substitutes and the influence of powerful suppliers is crucial for any stakeholder.

This snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Haleon’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Haleon's reliance on specialized raw materials, such as active pharmaceutical ingredients and unique packaging components, means that suppliers of these niche inputs can hold considerable bargaining power. This is particularly true if only a few companies can provide these essential, high-quality materials, as is often the case with science-backed consumer healthcare products. For instance, in 2024, the pharmaceutical ingredient market saw price increases for certain specialized compounds due to supply chain disruptions and increased demand, directly impacting the cost of goods for companies like Haleon.

Switching suppliers for critical components or ingredients can be a costly endeavor for Haleon. These costs often include re-validation of materials, obtaining new regulatory approvals, and the potential for significant disruption to ongoing production lines. For instance, if a key ingredient for a flagship product like Sensodyne requires extensive testing and certification with new suppliers, it could delay market availability and impact sales.

These switching costs naturally bolster the bargaining power of Haleon's suppliers. This is particularly true in instances where Haleon has established long-standing relationships with suppliers, leading to highly integrated processes and specialized dependencies. A supplier of a unique active pharmaceutical ingredient, for example, might leverage this integration to negotiate favorable terms.

Haleon's commitment to initiatives like its Sustainable Supply Chain Pledge, launched in recent years, suggests a strategic focus on its supplier relationships. While this pledge aims to foster collaboration and drive shared sustainability goals, it can also deepen existing ties. This can present opportunities for joint efforts to improve cost efficiencies and meet evolving environmental standards, but it also means that suppliers with strong alignment might wield greater influence.

Suppliers might threaten Haleon by integrating forward into the manufacturing or distribution of consumer healthcare products, effectively becoming competitors. This is more plausible for large manufacturers of key pharmaceutical ingredients or specialized chemicals if market conditions allow for it.

While a direct threat, the likelihood for many raw material providers is limited. However, for significant ingredient suppliers, the potential exists if the profitability of entering Haleon's market outweighs the risks. For instance, a major producer of active pharmaceutical ingredients (APIs) could theoretically leverage their expertise to produce finished goods.

Haleon's robust brand portfolio, including well-recognized names like Sensodyne and Advil, along with its extensive global distribution network, presents a substantial hurdle for any supplier contemplating forward integration. These established market positions and logistical capabilities make it difficult for new entrants, even those with strong supply chain control, to compete effectively.

Importance of Supplier Inputs to Product Quality

Haleon's commitment to science-backed health products means the quality of its supplier inputs is non-negotiable. Compromising on raw materials or active ingredients could lead to product efficacy issues, regulatory scrutiny, and a significant blow to its trusted brand image. For instance, the pharmaceutical and consumer health sectors often face strict regulations regarding ingredient sourcing and purity, making reliable suppliers crucial.

This critical dependence empowers suppliers who consistently deliver high-quality, compliant materials. Haleon, like many in its industry, is unlikely to switch suppliers for minor cost advantages if it means risking product integrity or facing potential recalls. In 2023, the global pharmaceutical excipients market, a key input category, was valued at approximately $10.5 billion, highlighting the scale and importance of these supply chains.

- Critical Reliance on Input Quality: Haleon's reputation hinges on the efficacy and safety of its health products, directly linking supplier input quality to consumer trust and well-being.

- Regulatory Imperative: Stringent regulations within the health sector necessitate suppliers who adhere to rigorous quality and safety standards, reducing Haleon's flexibility in sourcing.

- Supplier Power Leverage: Suppliers consistently meeting Haleon's high standards possess significant bargaining power, as the company prioritizes product integrity over marginal cost savings.

- Market Context: The substantial value of related input markets, such as the global pharmaceutical excipients market (around $10.5 billion in 2023), underscores the critical role and potential leverage of key suppliers.

Supplier Industry Concentration

The concentration within Haleon's supplier industries plays a crucial role in determining supplier bargaining power. A market with many small suppliers typically grants less leverage to any single entity, whereas a few dominant suppliers for essential components can dictate terms and pricing more effectively. For instance, if a small number of companies control the supply of a key active pharmaceutical ingredient, they hold significant sway over Haleon.

Haleon's scale as a major consumer of raw materials and packaging is a key factor in its ability to negotiate. By leveraging its substantial purchasing volume, Haleon can often secure more favorable pricing and terms, even from concentrated supplier markets. This strategy helps to offset the inherent power of dominant suppliers.

- Supplier Concentration Impact: A concentrated supplier market, where a few firms dominate, increases their collective bargaining power over buyers like Haleon.

- Fragmented Market Advantage: Conversely, a fragmented supplier base with many small players dilutes individual supplier power, benefiting Haleon.

- Haleon's Mitigation Strategy: Haleon's global procurement operations aim to leverage its purchasing scale to negotiate better terms, even in concentrated supplier environments.

- Example: The market for specific excipients or active ingredients, if dominated by a few manufacturers, presents a higher bargaining power scenario for those suppliers.

Haleon faces significant supplier bargaining power due to its reliance on specialized raw materials and the high switching costs associated with changing suppliers for critical components. For example, the pharmaceutical ingredient market experienced price increases for certain compounds in 2024, directly impacting Haleon's cost of goods. This power is amplified when suppliers can threaten forward integration, though Haleon's strong brand portfolio and distribution network mitigate this risk.

The concentration of suppliers in certain input markets, such as for active pharmaceutical ingredients, allows dominant players to dictate terms. While Haleon leverages its purchasing scale to negotiate, the critical need for high-quality, compliant materials, as seen in the $10.5 billion global pharmaceutical excipients market in 2023, means suppliers consistently meeting these standards wield considerable influence. This is particularly true given the strict regulatory environment in the health sector.

| Factor | Impact on Haleon | Supporting Data/Example |

|---|---|---|

| Reliance on Specialized Inputs | High Supplier Power | Specialized active pharmaceutical ingredients and unique packaging components. |

| Switching Costs | High Supplier Power | Re-validation, regulatory approvals, production disruption for flagship products. |

| Supplier Concentration | High Supplier Power (if concentrated) | Few dominant suppliers for key active pharmaceutical ingredients. |

| Haleon's Purchasing Scale | Mitigates Supplier Power | Leverages substantial volume to negotiate favorable terms. |

| Input Quality & Regulatory Needs | High Supplier Power | Non-negotiable quality for efficacy, safety, and brand trust; strict regulations. |

What is included in the product

This analysis unpacks the competitive landscape for Haleon, examining the power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the consumer healthcare market.

Easily assess competitive intensity and identify areas for strategic advantage across the consumer healthcare landscape.

Customers Bargaining Power

Haleon operates in a market with a vast, fragmented global consumer base. This means that the power of any single customer to influence pricing or terms is minimal, as millions of individuals purchase their products. For instance, in 2023, Haleon reported net sales of £11,314 million, underscoring the sheer volume and dispersion of its customer transactions.

For many everyday healthcare items, it's quite simple for consumers to switch from one brand to another. Think about common over-the-counter pain relievers or toothpaste; if a competitor offers a similar product at a better price or with a more appealing promotion, consumers might easily make the change. This low barrier to switching gives customers more leverage.

While Haleon has well-established, science-backed brands such as Sensodyne and Advil, many consumers can readily find products from other companies that perform a similar function. For instance, in 2023, the global toothpaste market, where Sensodyne is a major player, was valued at over $40 billion, indicating substantial competition with many accessible alternatives.

This ease of brand hopping becomes particularly powerful for customers when there are noticeable differences in price or perceived value. If a competitor's product is significantly cheaper or offers a perceived benefit that resonates more strongly, consumers are more likely to switch their purchasing habits, thereby increasing their bargaining power against Haleon.

Customer price sensitivity is a key factor influencing Haleon's bargaining power of customers. For essential or highly differentiated products, Haleon can often maintain premium pricing. However, for more commoditized offerings, price pressure is more significant.

In 2024, consumers in challenging economic conditions, especially in North America, are showing increased price sensitivity for discretionary items. This is evident in Haleon's nicotine replacement therapy segment, where consumers might switch to more affordable options. This trend highlights the direct impact of economic headwinds on purchasing decisions for non-essential health products.

Despite this, Haleon's robust portfolio of 'Power Brands,' such as Sensodyne and Advil, benefits from strong brand loyalty. This loyalty can act as a buffer against extreme price sensitivity, allowing these brands to command a degree of pricing power even in a price-conscious market.

Availability of Substitutes and Alternatives

The bargaining power of Haleon's customers is significantly influenced by the wide array of substitute products available. This includes everything from private label brands to generic options and direct competitor offerings, all of which give consumers considerable choice.

Haleon operates in markets where substitutes are plentiful. For instance, in pain relief, consumers can choose from numerous brands beyond Haleon's Sensodyne or Advil, and the vitamin and supplement aisles are similarly crowded with diverse options. This abundance of alternatives inherently strengthens the customer's position.

To counter this, Haleon focuses on innovation and premium product development. By consistently introducing new formulations or enhanced benefits, the company aims to make its products stand out, thereby reducing the ease with which customers can switch to alternatives and diminishing their bargaining power.

- Customer Choice: The presence of private label, generic, and competitor products grants customers significant leverage.

- Market Landscape: Haleon's key categories, like pain relief and vitamins, are characterized by a high degree of substitutability.

- Haleon's Strategy: Continuous innovation and premiumization are employed to differentiate products and reduce perceived substitutability.

Customer Information and Awareness

Customers today have unprecedented access to information. Digital channels provide a wealth of product details, user reviews, and side-by-side price comparisons. This readily available knowledge significantly boosts their bargaining power, allowing them to make more informed decisions and scrutinize company pricing and product claims.

Haleon, recognizing this shift, invests heavily in building trust through science-backed brands and robust advertising campaigns. The company aims to cultivate brand loyalty and influence consumer perception, even when faced with a highly informed customer base. For instance, in 2023, Haleon reported strong growth in its oral health segment, partly driven by consumer trust in brands like Sensodyne, which emphasizes scientific innovation.

- Digital Information Access: Consumers can easily compare products and prices online, increasing their leverage.

- Informed Decision-Making: Well-informed customers pressure companies to justify value propositions.

- Haleon's Strategy: The company focuses on science-backed brands and advertising to build trust and loyalty.

- Brand Equity: Strong brands like Sensodyne help mitigate customer bargaining power by fostering loyalty.

The bargaining power of Haleon's customers is moderate, primarily due to the availability of numerous substitutes and the increasing price sensitivity observed in certain market segments. While Haleon's strong brand portfolio provides some resilience, the ease with which consumers can switch between similar products, especially in less differentiated categories, grants them considerable leverage.

The global consumer healthcare market, where Haleon operates, is vast and highly competitive. In 2023, Haleon achieved net sales of £11,314 million, indicating a broad customer base, but also highlighting the sheer volume of transactions that can be influenced by collective consumer behavior. For instance, the toothpaste market alone, a key area for Haleon with brands like Sensodyne, exceeded $40 billion in 2023, showcasing a landscape rich with alternatives from both major competitors and private labels.

Customer price sensitivity is a growing concern, particularly in the current economic climate. In 2024, consumers, especially in North America, are more inclined to seek out more affordable options for non-essential health products, impacting segments like nicotine replacement therapy. This heightened awareness of price, coupled with easy access to online comparisons and reviews, empowers consumers to demand greater value, thereby increasing their bargaining power.

| Factor | Impact on Haleon | Supporting Data (2023/2024) |

|---|---|---|

| Availability of Substitutes | High | Toothpaste market > $40 billion (2023) |

| Price Sensitivity | Moderate to High | Increased consumer focus on affordability in 2024 |

| Brand Loyalty | Moderate | Strong performance of Power Brands like Sensodyne |

| Information Access | High | Digital channels enable easy price and product comparisons |

What You See Is What You Get

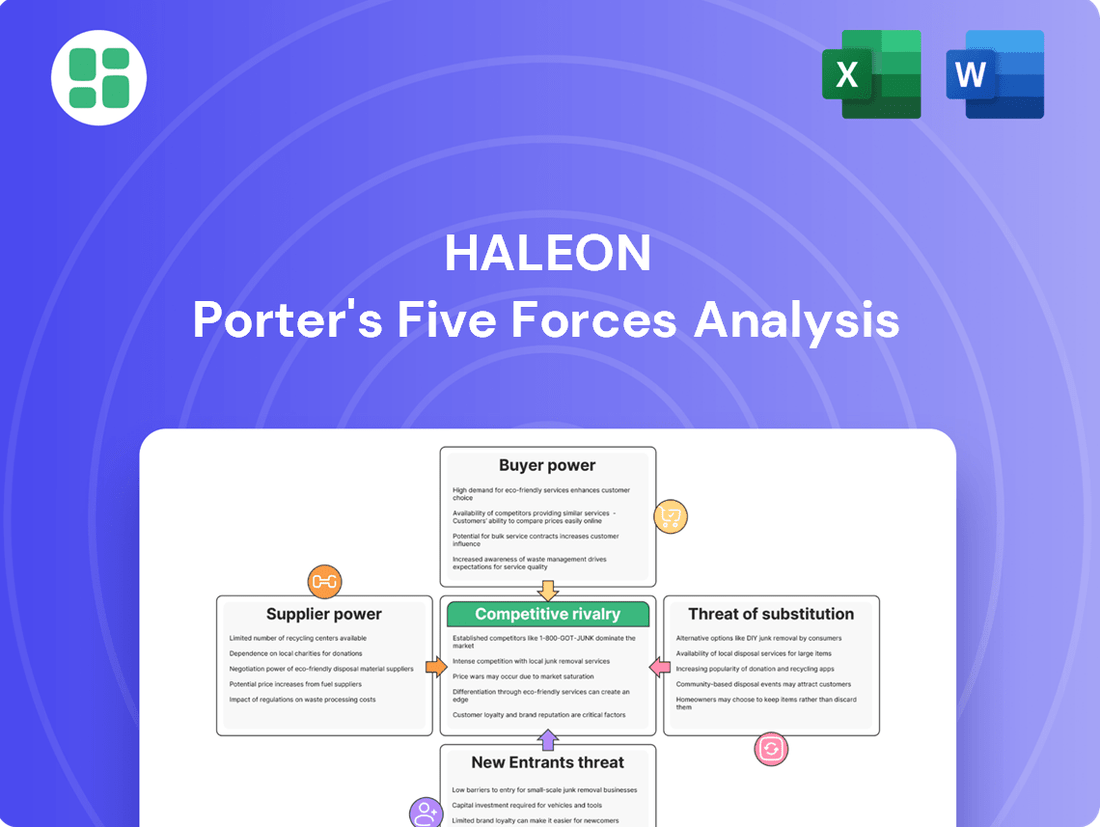

Haleon Porter's Five Forces Analysis

This preview shows the exact, comprehensive Haleon Porter's Five Forces Analysis you'll receive immediately after purchase, detailing the competitive landscape and strategic implications for the consumer healthcare giant. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. This is the complete, ready-to-use analysis file, ensuring you get precisely what you need to understand Haleon's market position.

Rivalry Among Competitors

The consumer healthcare market is characterized by significant concentration, with a handful of global giants, including Haleon, holding substantial sway. Competitors such as Kenvue, Procter & Gamble Hygiene and Health Care, Unilever, and Reckitt are formidable forces, actively contesting market share across diverse health segments. This intense rivalry is particularly acute in categories where Haleon enjoys leading positions, such as oral care and pain management.

Haleon's strategy hinges on differentiating its products through science-backed innovation and robust brand equity, exemplified by its Power Brands such as Sensodyne, Advil, and Centrum. This approach effectively reduces direct competition based on price.

However, rivals are also making significant investments in research and development, alongside aggressive marketing campaigns, to cultivate their own strong brands. This creates an ongoing struggle for consumer loyalty and market share.

For instance, in 2024, Haleon reported that its Power Brands, which represent over 70% of its revenue, saw organic growth driven by innovation and marketing support, underscoring the importance of this differentiation strategy in a competitive landscape.

The global consumer healthcare market is experiencing robust growth, driven by demographic shifts like an aging population and a heightened emphasis on personal well-being. This expanding market generally softens competitive pressures by creating ample opportunities for all participants.

However, Haleon itself aims for above-market expansion, targeting 4-6% organic revenue growth through 2025. This ambition means the company is actively competing for a larger slice of the market, potentially intensifying rivalry as players vie for incremental share and customer loyalty.

High Exit Barriers

The consumer healthcare sector, including companies like Haleon, typically faces substantial exit barriers. These are often rooted in the massive capital poured into specialized manufacturing plants and the intricate web of distribution channels built over years. Furthermore, deeply ingrained brand loyalty and extensive marketing investments create significant hurdles for any company considering a departure from established product categories.

These high exit barriers mean that even when market conditions become less favorable or profitability dips, companies are often compelled to remain, leading to persistent and often intense competition. This dynamic can trap capital and resources, as exiting the market would mean abandoning substantial, often illiquid, assets. For instance, Haleon's significant investment in its diverse product lines, from Sensodyne to Advil, represents a considerable commitment that makes complete withdrawal from key segments economically challenging.

While exiting entire markets is difficult, companies may engage in portfolio optimization. Haleon, for example, has been strategically divesting non-core brands. This approach allows them to shed underperforming assets or those that no longer align with their strategic focus, rather than exiting established, profitable segments altogether. This is a common tactic to improve overall business health without succumbing to the high costs of a full market exit.

- High Capital Investment: Significant funds are tied up in manufacturing facilities and R&D for consumer healthcare products.

- Established Distribution Networks: Building and maintaining widespread access to retail and pharmacy channels is costly and time-consuming to replicate.

- Brand Equity and Loyalty: Decades of marketing and product development create strong consumer recognition and preference, making it hard for new entrants and difficult for exiting firms to recover brand-related investments.

- Regulatory Hurdles: Exiting certain product lines may involve complex regulatory processes and potential write-downs of specialized assets.

Marketing and Innovation Intensity

Competitive rivalry in consumer healthcare, particularly for companies like Haleon, is fierce due to high marketing and innovation intensity. This means companies are constantly vying for consumer attention through advertising and by launching new or improved products. Haleon itself recognized this by increasing its advertising and promotional spend by over 10% in 2024. This strategic move aims to solidify its market position and capture a larger share.

This aggressive marketing and innovation cycle forces competitors to respond in kind. To stay relevant and competitive, other players in the consumer healthcare market must also invest heavily in R&D and marketing efforts. This creates a dynamic and demanding environment where continuous product development and effective communication of value are essential for survival and growth.

- Marketing and Innovation as Key Drivers: The consumer healthcare sector is characterized by aggressive marketing campaigns and a relentless pursuit of product innovation.

- Haleon's Investment Strategy: Haleon boosted its advertising and promotional spending by over 10% in 2024 to maintain and grow its market share.

- Competitive Response: Competitors are compelled to match or exceed these marketing and innovation efforts to remain competitive.

- Dynamic Market Environment: This creates a fast-paced landscape where consistent product improvement and strong brand communication are critical for success.

Competitive rivalry within the consumer healthcare sector is intense, driven by significant investments in marketing and innovation. Haleon, for instance, increased its advertising and promotional spending by over 10% in 2024 to bolster its market position. This necessitates that competitors also allocate substantial resources to R&D and marketing to maintain relevance and capture market share, creating a dynamic environment where continuous product advancement and effective brand messaging are paramount for success.

| Key Competitor | 2024 Revenue (Approx. USD Billions) | Key Product Categories |

|---|---|---|

| Kenvue | ~15.5 | Skin Health, Baby Care, Oral Care |

| Procter & Gamble (Hygiene & Health Care) | ~20.0 (Hygiene & Health Care Segment) | Oral Care, Personal Health Care |

| Unilever | ~10.0 (Beauty & Wellbeing Segment - incl. Health) | Oral Care, Personal Care |

| Reckitt | ~17.0 | Hygiene, Health, Nutrition |

SSubstitutes Threaten

Consumers have a broad spectrum of alternatives to Haleon's packaged health and wellness products. These include adopting healthier lifestyles, modifying diets, exploring traditional or herbal remedies, or even choosing to manage minor health issues without intervention. For instance, the global wellness market was valued at approximately $5.6 trillion in 2023, highlighting the significant consumer interest in non-product-based health solutions.

The rise of generic and private-label brands presents a substantial threat of substitution for Haleon's products, particularly in the over-the-counter (OTC) medicine and supplement categories. These alternatives frequently feature comparable active ingredients but are offered at considerably lower prices, attracting consumers who prioritize cost savings. For instance, in the pain relief segment, store-brand ibuprofen or acetaminophen can be found for a fraction of the cost of branded equivalents.

Haleon actively addresses this substitution threat by focusing on the inherent value and trust associated with its established 'Power Brands.' The company highlights its commitment to scientific backing, rigorous quality control, and the long-standing reputation of its brands to differentiate itself from lower-cost alternatives. This strategy aims to justify the premium pricing of its products by emphasizing efficacy, reliability, and consumer confidence, a crucial factor when dealing with health-related purchases.

For certain health concerns, consumers might choose prescription medications over Haleon's over-the-counter (OTC) offerings, particularly if their symptoms are severe or ongoing. This presents a potential threat, as pharmaceutical companies offering prescription alternatives can capture market share. For instance, while Haleon excels in everyday health solutions, conditions requiring more potent treatment may drive consumers towards prescription drugs, blurring the lines of substitution.

Digital Health Solutions and Telemedicine

The burgeoning digital health sector presents a significant threat of substitutes for traditional consumer healthcare products. The increasing uptake of telemedicine, digital health apps, and online consultations offers consumers alternative pathways for managing their health and seeking advice. For instance, by mid-2024, the global telemedicine market was projected to reach over $200 billion, indicating a substantial shift in how healthcare is accessed.

These digital solutions can steer consumers away from purchasing certain over-the-counter medications or in-person health services. They can also guide users towards different health management strategies, potentially impacting demand for Haleon's established product lines. For example, a consumer might opt for a digital symptom checker and personalized wellness plan instead of purchasing a specific remedy.

- Growing Telehealth Adoption: Telemedicine usage surged, with some estimates showing a more than 60-fold increase in early 2024 compared to pre-pandemic levels in certain regions.

- Digital Health App Market: The digital health app market alone was valued at over $60 billion in 2023 and is expected to grow substantially.

- Consumer Behavior Shift: Consumers are increasingly comfortable with digital platforms for health advice, potentially reducing reliance on traditional product-based solutions for minor ailments.

- Haleon's Strategic Response: Haleon could counter this threat by integrating digital tools for consumer engagement, offering personalized health insights, and potentially developing its own digital health offerings to complement its product portfolio.

Emerging Natural and Holistic Remedies

The increasing consumer demand for natural and holistic health solutions poses a significant threat of substitution for traditional over-the-counter (OTC) products. Many individuals are actively seeking alternatives to conventional pharmaceuticals, often driven by a perception of greater safety or a desire for remedies that align with their personal wellness philosophies. This trend is evident in the expanding market for supplements and plant-based medicines, which saw global sales reach an estimated $175 billion in 2023, with continued growth projected.

Haleon can navigate this substitution threat by strategically integrating natural ingredients into its product development pipeline or by emphasizing the robust scientific backing and proven safety profiles of its existing brands. For instance, a 2024 survey indicated that 65% of consumers are more likely to purchase health products with clearly labeled natural ingredients. Haleon's extensive research and development capabilities can be leveraged to create innovative products that bridge the gap between conventional efficacy and natural appeal.

To counter this, Haleon could consider:

- Expanding its portfolio with products featuring scientifically-validated natural ingredients.

- Launching marketing campaigns that highlight the safety and efficacy of its established brands, drawing parallels to natural benefits.

- Acquiring or partnering with companies specializing in natural or holistic health products to broaden market reach.

Consumers have a wide array of substitutes for Haleon's products, ranging from lifestyle changes like improved diet and exercise to traditional remedies and even opting for no treatment. The global wellness market, valued at approximately $5.6 trillion in 2023, underscores the significant consumer interest in non-product health solutions.

Generic and private-label brands offer a strong substitution threat, particularly in OTC medicines and supplements, by providing similar active ingredients at lower prices. For instance, store-brand pain relievers are often considerably cheaper than their branded counterparts.

Haleon counters this by emphasizing the trust, scientific backing, and quality of its established 'Power Brands,' aiming to justify premium pricing through efficacy and consumer confidence.

Prescription medications also substitute for Haleon's OTC offerings when symptoms are severe or persistent, allowing pharmaceutical companies to capture market share for more potent treatments.

The growing digital health sector, including telemedicine and health apps, presents a significant substitution threat by offering alternative health management and advice channels. The global telemedicine market was projected to exceed $200 billion by mid-2024.

These digital solutions can divert consumers from purchasing traditional OTC products or seeking in-person services, potentially impacting demand for Haleon's established lines as consumers opt for digital symptom checkers or personalized wellness plans.

The increasing demand for natural and holistic health solutions is another substitution threat, with consumers seeking alternatives to conventional pharmaceuticals. The market for supplements and plant-based medicines reached an estimated $175 billion in global sales in 2023.

Haleon can address this by incorporating scientifically validated natural ingredients, highlighting the safety and efficacy of existing brands, or through strategic partnerships in the natural health sector.

| Substitution Type | Examples for Haleon | Market Value/Growth (2023-2024 Estimates) | Haleon's Counter-Strategy |

|---|---|---|---|

| Lifestyle & Self-Care | Healthy diet, exercise, stress management | Global Wellness Market: ~$5.6 trillion (2023) | Promote holistic health benefits alongside products |

| Private Label & Generics | Store-brand pain relievers, vitamins | Significant price differential in OTC categories | Emphasize brand trust, scientific backing, quality control |

| Prescription Medications | Stronger treatments for chronic or severe conditions | N/A (Specific to condition) | Focus on OTC solutions for everyday health needs |

| Digital Health Solutions | Telemedicine, health apps, online diagnostics | Telemedicine Market: >$200 billion (projected mid-2024) | Integrate digital engagement, explore own digital offerings |

| Natural & Holistic Remedies | Herbal supplements, traditional medicines | Supplements & Plant-Based Medicines: ~$175 billion (2023) | Develop products with natural ingredients, highlight safety |

Entrants Threaten

Entering the consumer healthcare sector, particularly to rival a company like Haleon, necessitates immense financial resources. Significant investments are needed for cutting-edge research and development, state-of-the-art manufacturing plants, extensive marketing campaigns, and building robust distribution networks.

These substantial upfront costs create a formidable barrier. For instance, launching a new over-the-counter medication often involves millions in clinical trials and regulatory approvals alone, making it exceptionally difficult for smaller firms or startups to enter on a competitive scale.

The sheer financial muscle required deters many potential new players. Companies must be prepared to commit billions to establish a foothold, a level of investment that naturally limits the number of viable new entrants challenging established giants like Haleon.

The consumer healthcare sector faces substantial regulatory hurdles, demanding extensive product testing and approvals. For instance, the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) impose stringent requirements on efficacy and safety, which can take years and millions of dollars to satisfy. These rigorous processes, including Good Manufacturing Practices (GMP) compliance, represent a significant capital and time investment, deterring many potential new entrants.

Navigating these complex regulatory landscapes across various international markets adds another layer of difficulty and expense. Companies must adhere to differing regulations for product labeling, advertising, and distribution in each region. This global compliance burden can cost millions annually, creating a formidable barrier for new players who lack the established infrastructure and expertise to manage such complexities efficiently, unlike established firms such as Haleon.

Haleon enjoys substantial brand loyalty, a significant barrier for new competitors. Brands like Sensodyne, Advil, and Centrum are household names, fostering trust and repeat purchases, particularly in the health and wellness sector where consumers prioritize familiarity. This established trust means new entrants must invest heavily in marketing to even begin challenging Haleon's market position.

Access to Distribution Channels

Established consumer healthcare companies like Haleon possess deeply entrenched relationships with a vast network of retailers, pharmacies, and online marketplaces worldwide. For new players, securing access to these vital distribution channels presents a significant challenge. Limited shelf space and retailer preferences for established, reliable suppliers create a formidable barrier to entry.

Haleon's impressive global footprint, serving consumers in approximately 170 countries, underscores the scale of this advantage. New entrants often struggle to replicate this extensive reach, making it difficult to get their products in front of a broad customer base.

- Established Relationships: Haleon benefits from long-standing partnerships with key distributors and retailers, ensuring prominent placement for its products.

- Limited Shelf Space: Retailers have finite shelf capacity, making it challenging for new brands to secure visibility against established players.

- Global Reach: Haleon's presence in around 170 markets highlights the difficulty for newcomers to achieve comparable distribution leverage.

Economies of Scale in Production and Marketing

Haleon benefits significantly from substantial economies of scale across its production, procurement, and marketing operations. This scale allows the company to spread its fixed costs over a larger output, resulting in lower per-unit production costs. For instance, in 2023, Haleon reported a revenue of £11.3 billion, demonstrating the sheer volume of its operations.

New entrants would find it extremely challenging to replicate Haleon's cost efficiencies. Achieving comparable purchasing power for raw materials and securing favorable terms with contract manufacturers requires a similar scale of operations, which is a significant barrier. This cost disadvantage would make it difficult for newcomers to compete on price against established players.

Haleon's optimized supply chain further solidifies its cost leadership. By efficiently managing its global network of suppliers and distributors, the company minimizes logistics expenses and ensures timely product availability. This operational excellence contributes directly to its competitive pricing strategy.

- Economies of Scale: Haleon's vast operational size translates into lower per-unit costs in production and marketing.

- Procurement Power: The company leverages its scale to negotiate better prices for raw materials and components.

- Supply Chain Efficiency: Haleon's optimized logistics network reduces costs and enhances delivery speed.

- Competitive Disadvantage for Newcomers: Start-ups would struggle to match Haleon's cost structure, hindering their ability to offer competitive pricing.

The threat of new entrants into the consumer healthcare market, specifically challenging a company like Haleon, is significantly mitigated by several high barriers. These include the immense capital required for research, development, manufacturing, and marketing, alongside stringent regulatory approvals that demand substantial investment in time and money. Furthermore, Haleon's strong brand recognition and established distribution networks create considerable hurdles for newcomers seeking market access and consumer trust.

Economies of scale are also a major deterrent. Haleon's vast operational size, evidenced by its £11.3 billion in revenue in 2023, allows for lower per-unit costs in production, procurement, and marketing. This cost advantage, coupled with an efficient global supply chain, makes it exceedingly difficult for new entrants to compete on price and achieve similar operational efficiencies without comparable scale.

| Barrier Type | Description | Impact on New Entrants | Haleon's Advantage |

|---|---|---|---|

| Capital Requirements | High costs for R&D, manufacturing, marketing, and distribution. | Deters smaller firms; requires significant upfront investment. | Established financial resources and infrastructure. |

| Regulatory Hurdles | Strict product testing, safety approvals (e.g., FDA, EMA), and GMP compliance. | Time-consuming and expensive; requires expertise in global compliance. | Experience and infrastructure to navigate complex regulations. |

| Brand Loyalty & Trust | Established consumer trust in brands like Sensodyne, Advil. | Requires substantial marketing investment to build awareness and trust. | Strong brand equity and consumer recognition. |

| Distribution Networks | Entrenched relationships with retailers, pharmacies, and online platforms. | Limited shelf space and difficulty securing access to key channels. | Extensive global reach and established retail partnerships. |

| Economies of Scale | Lower per-unit costs due to high production and procurement volumes. | Cost disadvantage; difficulty matching pricing of established players. | Cost leadership through operational efficiency and purchasing power. |

Porter's Five Forces Analysis Data Sources

Our Haleon Porter's Five Forces analysis is built upon a robust foundation of data, including Haleon's official annual reports and investor presentations, alongside market research from reputable firms like Statista and Euromonitor International. We also incorporate insights from industry-specific trade publications and regulatory filings to capture the full competitive landscape.