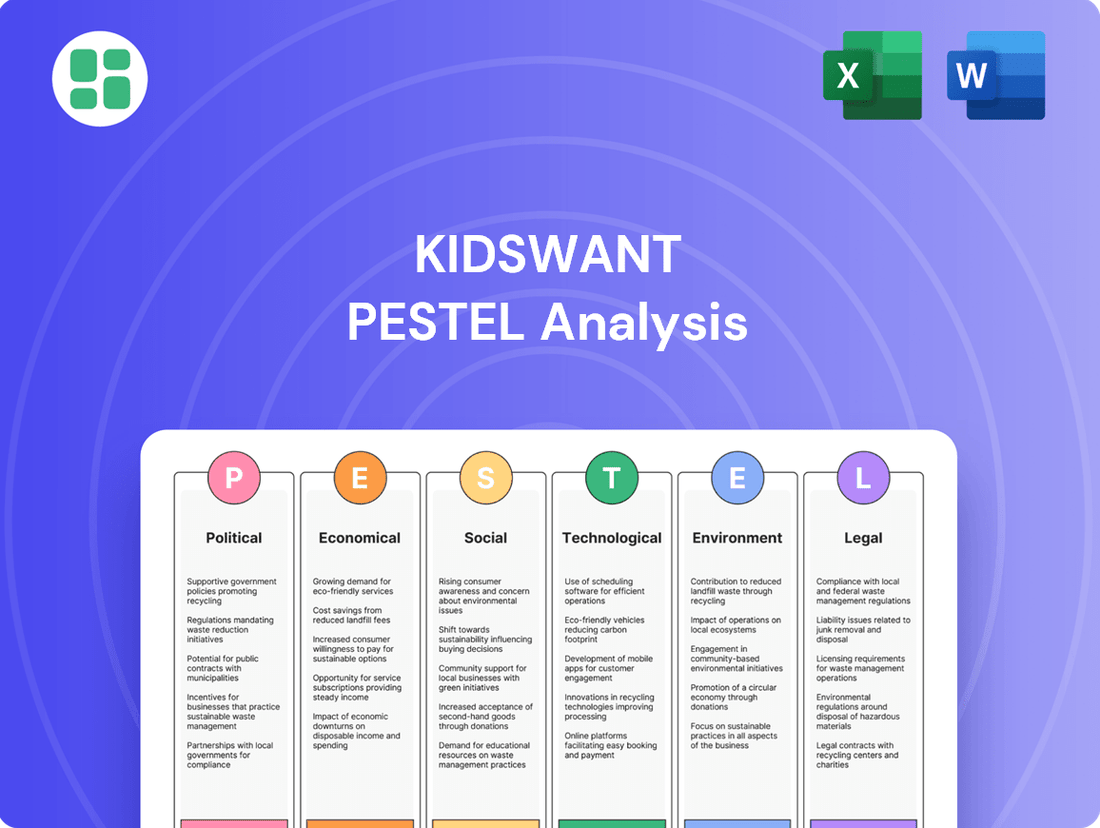

Kidswant PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kidswant Bundle

Navigate the dynamic landscape of the children's retail market with our comprehensive PESTEL Analysis of Kidswant. Understand the political, economic, social, technological, environmental, and legal factors that are shaping its trajectory and uncover actionable insights to inform your own strategic decisions. Download the full analysis now to gain a competitive edge.

Political factors

The Chinese government's introduction of nationwide childcare subsidies, providing 3,600 yuan annually per child under three years old starting January 1, 2025, is a pivotal development. This policy directly addresses the financial strain on families, aiming to boost birth rates. For Kidswant, this translates into a potentially larger customer base and increased spending power among its target demographic for infant and children's products and services.

China's birth policies are evolving, with a notable short-term rebound in newborns observed in 2024. 9.54 million births were recorded that year, a rise from 2023's figures. This demographic shift, supported by government initiatives aimed at encouraging family growth, suggests a potential long-term positive impact on markets serving young families, like Kidswant.

Governments globally, including in key markets for children's products, enforce rigorous consumer protection and product safety regulations. For instance, in 2024, the U.S. Consumer Product Safety Commission (CPSC) continued its focus on recalls, with thousands of children's products identified as hazardous, underscoring the critical need for retailers like Kidswant to maintain impeccable safety standards.

Kidswant's adherence to these evolving safety mandates, such as those related to chemical content in toys or flammability in apparel, is paramount. Non-compliance can lead to substantial fines, product seizures, and significant damage to brand reputation, impacting consumer trust and sales, especially in a market where parents prioritize safety above all else.

Support for Domestic Consumption

The Chinese government is actively promoting domestic consumption as a primary engine for economic growth. This strategic shift is supported by policies designed to encourage consumer spending, such as nationwide trade-in programs and various initiatives aimed at expanding internal demand. For instance, in 2023, retail sales of consumer goods in China grew by 7.1% year-on-year, reaching 47.15 trillion yuan, demonstrating the effectiveness of these measures and the growing importance of the domestic market.

This increasing reliance on internal consumption creates a more robust and favorable market environment for companies like Kidswant. By focusing on strategies that align with government objectives to boost domestic spending, Kidswant can better tap into the expanding consumer base and enhance its market penetration and sales performance within China.

Key government initiatives supporting domestic consumption include:

- Trade-in programs: Encouraging consumers to upgrade existing products, stimulating demand for new goods.

- Expansion of domestic demand initiatives: Policies aimed at increasing purchasing power and consumer confidence.

- Focus on rural revitalization: Efforts to boost incomes and consumption in less developed areas.

- Support for the digital economy: Facilitating online retail and e-commerce growth, making goods more accessible.

Urbanization and Regional Development Policies

China's ongoing urbanization drive, with policies encouraging rural populations to move into cities, is a significant political factor. This trend is expected to boost investment and consumer spending, directly benefiting companies like Kidswant that cater to urban families. For instance, by 2023, China's urbanization rate reached approximately 65.2%, with projections indicating continued growth. This expanding urban demographic presents a larger potential customer base and opens avenues for Kidswant to establish new stores in developing urban centers.

These policies are designed to foster economic growth in urban areas, which can translate into increased disposable income for families. As more people settle in cities, demand for goods and services, including children's products, is likely to rise. The government's focus on developing new urban zones and improving infrastructure further supports this expansion.

- Urbanization Rate: China's urbanization rate stood at around 65.2% in 2023, a key indicator of growing urban populations.

- Investment Stimulus: Urbanization policies aim to attract investment into infrastructure and services, creating a more favorable business environment.

- Consumer Demand Growth: The influx of people into cities is projected to increase overall consumer demand, benefiting sectors like retail.

- Market Expansion: Developing urban areas offer strategic locations for Kidswant to expand its retail footprint and reach a wider customer base.

Government policies directly influence consumer behavior and market opportunities. China's proactive measures, such as the 3,600 yuan annual childcare subsidy per child under three, effective January 2025, aim to boost birth rates and increase family spending power.

The observed rebound in births in 2024, with 9.54 million newborns, signifies a positive demographic trend supported by government incentives, potentially expanding the market for children's products and services. Stringent product safety regulations, like those enforced by the U.S. CPSC in 2024, necessitate strict adherence from companies like Kidswant to avoid penalties and maintain brand trust.

China's strategic push for domestic consumption, evidenced by a 7.1% year-on-year retail sales growth in 2023 reaching 47.15 trillion yuan, creates a favorable environment for businesses aligned with national economic objectives. Furthermore, the ongoing urbanization drive, with China's rate reaching approximately 65.2% in 2023, fuels demand in urban centers, offering Kidswant strategic expansion opportunities.

What is included in the product

The Kidswant PESTLE analysis comprehensively examines external macro-environmental forces impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Kidswant's PESTLE analysis provides a clear, summarized version of the full analysis for easy referencing during meetings or presentations, simplifying complex external factors into actionable insights.

Economic factors

China's per capita disposable income reached RMB 41,314 in 2024, marking a significant 5.1 percent real increase. This upward trend is projected to continue into 2025, directly boosting consumer spending power.

This growing disposable income translates to families having more funds available for discretionary purchases, including higher-quality goods and services for their children. It signifies an increased capacity for parents to invest in premium offerings, which aligns well with Kidswant's product and service portfolio.

Consumer spending in the mother and baby product sector has demonstrated notable resilience, with growth observed even amidst broader economic caution. For instance, in early 2024, spending on baby care items saw a steady increase, indicating a consistent demand for essential goods.

Despite a general trend of more rational purchasing, consumer confidence has shown signs of stabilization. This suggests that while shoppers are more discerning, they remain willing to invest in products perceived as high-quality and offering good value, directly impacting purchasing decisions for brands like Kidswant.

China's inflation has been remarkably low, with the Consumer Price Index (CPI) showing a modest increase of only 0.2% in 2024. This subdued inflation environment is generally beneficial for consumer purchasing power, as it helps maintain the affordability of goods and services.

For Kidswant, this presents an opportunity to leverage stable pricing. However, the company must remain vigilant about its own internal cost management. Any unexpected shifts in global commodity prices or supply chain disruptions could introduce inflationary pressures that might impact production costs and, consequently, product pricing and overall profitability.

E-commerce Growth and Offline Resilience

China's retail landscape is a dynamic blend of booming e-commerce and enduring offline presence. In 2024, online retail sales in China are projected to continue their strong growth trajectory, capturing an increasing share of the overall market. This digital expansion is a significant trend, but it does not negate the importance of physical retail, particularly within specialized sectors.

For categories like maternal and infant products, brick-and-mortar stores continue to be a vital touchpoint for consumers. Parents often seek tactile experiences and immediate availability for these essential items. Kidswant's strategic approach recognizes this duality, actively integrating its physical store network with its online sales channels. This omnichannel strategy is crucial for capturing a broad customer base and adapting to diverse shopping preferences.

By offering a seamless experience across both online and offline platforms, Kidswant can cater to consumers who prefer browsing in-store as well as those who prioritize the convenience of online purchasing. This integrated model is key to navigating the evolving consumer journey in the Chinese market. For instance, in 2023, while e-commerce accounted for a significant portion of retail sales, physical stores still represented a substantial share, highlighting the continued relevance of offline channels.

- E-commerce Dominance: Online retail sales in China are expected to grow by over 10% in 2024, further solidifying their lead over offline channels.

- Offline Resilience: Despite e-commerce growth, physical stores remain critical, especially for high-trust categories like baby products, where consumers value in-person interaction and product inspection.

- Omnichannel Advantage: Kidswant's strategy of integrating online and offline operations allows it to capture sales across both channels, offering flexibility to consumers and enhancing brand reach.

- Consumer Behavior: A significant percentage of Chinese consumers still prefer to see and touch products before purchasing, particularly for high-value or sensitive items, underscoring the ongoing importance of physical retail.

Investment in 'New Productive Forces'

China's strategic push towards 'new quality productive forces' by 2025 signals a significant economic shift. This vision prioritizes high-tech innovation and the modernization of existing industries, creating a dynamic environment for businesses like Kidswant.

This national economic strategy could translate into tangible benefits for Kidswant. For instance, advancements in retail technology, such as AI-powered inventory management or personalized online shopping experiences, are likely to emerge from this focus. Furthermore, improved supply chain logistics, driven by technological upgrades, could enhance Kidswant's operational efficiency and reduce costs.

The emphasis on new productive forces might also spur the development of novel product categories within the children's market. Think educational technology toys or sustainable, eco-friendly children's apparel, areas where innovation is directly encouraged by the government's economic blueprint.

- Retail Technology: Expect increased investment in AI and data analytics for personalized customer experiences in the retail sector.

- Supply Chain Efficiency: Government initiatives may drive the adoption of advanced logistics and automation, improving delivery times and reducing waste.

- Emerging Product Categories: The focus on innovation could lead to new types of educational toys and smart devices for children.

- Digital Infrastructure: Enhanced digital infrastructure will support online retail growth and the integration of new technologies.

China's economic landscape in 2024 and 2025 is characterized by a steady increase in disposable income, with per capita disposable income reaching RMB 41,314 in 2024, a 5.1% real increase, which is expected to continue into 2025. This directly fuels consumer spending, particularly in sectors like mother and baby products, which have shown resilience. Despite a trend towards more rational purchasing, consumer confidence is stabilizing, indicating a willingness to invest in quality and value, benefiting brands like Kidswant.

Low inflation, with the CPI showing a modest 0.2% increase in 2024, helps maintain purchasing power. However, Kidswant must manage its own costs to avoid passing on potential price hikes. The retail sector is dominated by e-commerce, projected for over 10% growth in 2024, but offline channels remain crucial for high-trust categories like baby products, where Kidswant's omnichannel approach provides a distinct advantage.

China's focus on 'new quality productive forces' by 2025 will drive innovation in retail technology and supply chain efficiency, potentially creating new product categories like educational tech toys. This strategic emphasis on modernization and high-tech advancement offers Kidswant opportunities for operational improvements and product development.

| Economic Factor | 2024 Data/Projection | 2025 Projection | Impact on Kidswant |

|---|---|---|---|

| Disposable Income Growth | RMB 41,314 (5.1% real increase) | Continued growth | Increased consumer spending power for premium products |

| Inflation Rate (CPI) | 0.2% | Expected to remain subdued | Stable pricing environment, but requires internal cost management |

| E-commerce Growth | Over 10% | Continued strong growth | Reinforces need for robust online presence and integration |

| Offline Retail Importance | Significant share for high-trust categories | Continued relevance | Supports Kidswant's omnichannel strategy |

Full Version Awaits

Kidswant PESTLE Analysis

The preview shown here is the exact Kidswant PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll get a comprehensive breakdown of Political, Economic, Social, Technological, Legal, and Environmental factors impacting Kidswant.

The content and structure shown in the preview is the same Kidswant PESTLE Analysis document you’ll download after payment, providing actionable insights for strategic planning.

Sociological factors

The rise of digitally savvy mothers, especially Gen Z, is reshaping consumer behavior in the children's product market. These mothers are highly active online, prioritizing thorough research, price comparisons, and seeking recommendations through social channels before making purchasing decisions. Their focus is firmly on quality, health, and safety, reflecting a growing demand for 'quality parenting' and specifically functional products.

China's birth rate, which had been on a downward trend for a decade, experienced an unexpected uptick in 2024, with preliminary reports suggesting a modest increase. This demographic shift, while still representing a smaller cohort than in previous years, indicates a potential new consumption cycle for the mother-and-baby sector.

For Kidswant, this means a strategic pivot is necessary. The focus must shift from sheer volume to attracting a more affluent and quality-conscious consumer base. This smaller, but potentially higher-spending, demographic will demand premium products and services, necessitating an emphasis on brand value and innovation.

Parents are prioritizing more than just basic needs for their children, actively seeking out services that foster holistic development. This includes a growing demand for early childhood education, engaging entertainment options, and family-oriented activities that create enriching experiences. For instance, the global early childhood education market was valued at approximately $245 billion in 2023 and is projected to reach over $400 billion by 2030, highlighting this significant trend.

Kidswant's approach of providing a comprehensive, all-in-one solution directly addresses this societal shift. By integrating educational programs, entertainment, and family engagement opportunities, the company positions itself as a valuable partner for parents invested in their children's overall growth and well-being, aligning with the increasing consumer willingness to spend on such integrated services.

Influence of Social Media and Content E-commerce

Social media and content e-commerce are transforming how parents in China buy baby products. Platforms like Douyin (TikTok) and Kuaishou are becoming key sales channels. In 2023, live streaming e-commerce in China reached an estimated 2.9 trillion yuan, with maternal and baby products being a significant category.

Kidswant can tap into this trend by using live streaming to connect with parents. This allows for direct interaction, product demonstrations, and real-time Q&A sessions. By offering engaging and educational content, Kidswant can foster trust and encourage purchases.

The influence of social commerce is undeniable. For example, user-generated content and influencer marketing on platforms like Xiaohongshu (Little Red Book) heavily impact purchasing decisions for baby care items. A significant portion of Chinese consumers, particularly millennials and Gen Z, rely on social recommendations before buying.

- Live streaming e-commerce in China is projected to grow substantially, with maternal and baby products being a strong segment.

- Platforms like Douyin and Kuaishou offer direct engagement opportunities for brands like Kidswant.

- Influencer marketing and user-generated content on social platforms significantly sway purchasing decisions for parents in China.

Shifting Perceptions of Sustainability and Health

Chinese consumers are increasingly prioritizing sustainability and health, often linking these attributes to higher quality and safety, especially for children. This trend is evident in market research, with a significant portion of urban Chinese consumers willing to pay a premium for eco-friendly and health-conscious baby products. For instance, a 2024 survey indicated that over 60% of parents in major Chinese cities consider product safety and environmental impact as key purchasing factors for baby formula and diapers.

Kidswant can capitalize on this by expanding its range of eco-friendly and non-toxic offerings. This aligns with a growing demand for transparency in product ingredients and manufacturing processes. By highlighting certifications related to environmental standards and health safety, Kidswant can build trust and appeal to parents actively seeking responsible brands for their families.

Key opportunities for Kidswant include:

- Developing and marketing organic or sustainably sourced baby food and formula.

- Introducing biodegradable or recyclable diaper options.

- Emphasizing non-toxic materials and chemical-free production in all product lines.

- Communicating sustainability efforts clearly on packaging and through marketing campaigns to resonate with health-conscious parents.

The increasing emphasis on holistic child development is a significant sociological trend. Parents are actively seeking products and services that support cognitive, emotional, and physical growth, moving beyond basic needs to invest in enrichment activities. This is reflected in the global early childhood education market, valued at approximately $245 billion in 2023 and projected to exceed $400 billion by 2030.

Digitally native parents, particularly Gen Z mothers, are highly influential, prioritizing research, online recommendations, and brand transparency. Their purchasing decisions are heavily swayed by social media content and influencer marketing, with platforms like Douyin and Xiaohongshu becoming crucial for product discovery and sales. Live streaming e-commerce in China, a major market for baby products, reached an estimated 2.9 trillion yuan in 2023, underscoring the power of these new sales channels.

A growing societal concern for sustainability and health is also shaping consumer preferences. Parents are increasingly willing to pay a premium for eco-friendly, non-toxic, and safely manufactured baby products, with a 2024 survey showing over 60% of parents in major Chinese cities prioritizing these factors for items like formula and diapers.

| Sociological Factor | Impact on Kidswant | Supporting Data/Trend |

|---|---|---|

| Holistic Child Development | Demand for integrated educational and entertainment services. | Global early childhood education market projected to reach over $400 billion by 2030. |

| Digital Savvy Parents (Gen Z) | Need for strong online presence, social media engagement, and influencer collaborations. | Live streaming e-commerce in China reached 2.9 trillion yuan in 2023. |

| Sustainability & Health Consciousness | Opportunity to expand eco-friendly and non-toxic product lines; emphasis on transparency. | Over 60% of parents in major Chinese cities prioritize safety and environmental impact (2024 survey). |

Technological factors

The Chinese retail landscape is increasingly defined by the rise of e-commerce, with online sales accounting for a significant portion of total retail turnover. In 2023, China's online retail sales of physical goods reached approximately 11.49 trillion yuan, a 6.2% increase year-on-year, highlighting the continued digital shift.

Kidswant's strategy of integrating its physical stores with online channels is vital in this environment. This omnichannel approach allows for greater customer convenience, enabling shoppers to browse online and pick up in-store, or vice versa, fostering loyalty and expanding market reach. By the end of 2024, it's projected that over 70% of retail sales will involve some form of digital interaction, underscoring the necessity of this integrated model.

Artificial intelligence is fundamentally reshaping the Chinese retail landscape. By 2024, AI-powered recommendation engines are expected to drive a significant portion of online sales, with China leading global adoption in areas like automated warehousing and personalized customer journeys. This technological shift presents a substantial opportunity for companies like Kidswant.

Kidswant can strategically deploy AI to refine its operations and customer interactions. Implementing AI for personalized marketing campaigns, for instance, can boost engagement by tailoring product suggestions to individual preferences, a strategy that has shown to increase conversion rates by up to 15% in similar retail environments. Furthermore, AI can optimize inventory management, reducing stockouts and overstock situations, a critical factor in the fast-paced children's apparel market.

Advanced data analytics are transforming retail by enabling a deeper understanding of consumer behavior. This allows companies like Kidswant to move towards a more user-centered approach, automating responses and personalizing the shopping experience. For instance, by 2024, retail analytics are projected to grow significantly, with companies increasingly investing in platforms that can process vast amounts of customer data to drive smarter decisions.

Kidswant can harness big data to create highly detailed user profiles. This granular insight allows for precise tailoring of product designs to meet specific demographic needs and preferences. Furthermore, offering customized recommendations based on past purchases and browsing history can significantly boost engagement and sales, effectively aligning supply with fluctuating consumer demand, a strategy that saw personalized marketing campaigns achieve up to a 20% increase in conversion rates in 2023.

Smart Parenting Solutions and IoT

The rise of smart parenting solutions, particularly in China, presents a significant technological opportunity. Chinese consumers are increasingly adopting AI-powered baby monitors, smart cribs, and other connected devices. This trend indicates a strong demand for innovative products that offer convenience and advanced features for parents.

Kidswant can capitalize on this by integrating or offering such smart parenting products. For instance, the global smart baby monitor market was valued at approximately $2.1 billion in 2023 and is projected to grow significantly. By embracing these technologies, Kidswant can enhance its appeal to a growing segment of tech-savvy parents.

Consider these specific technological integrations for Kidswant:

- AI-Powered Baby Monitors: Offering devices with features like sleep pattern analysis, cry detection, and remote interaction capabilities.

- Smart Cribs: Products that can monitor a baby's movement, temperature, and even gently rock the baby to sleep.

- Connected Wearables for Infants: Devices that track vital signs, location, and activity levels, providing parents with real-time data.

Logistics and Supply Chain Automation

Technological advancements are significantly reshaping logistics and supply chain operations in China, particularly in areas like cold-chain management and the deployment of unmanned vehicles and drones. These innovations are key to enhancing efficiency and reducing costs within complex distribution networks.

For Kidswant, embracing these technological shifts offers a substantial opportunity to streamline its operations. By integrating advanced automation, the company can achieve more precise inventory management, leading to reduced waste and improved product availability. Furthermore, the adoption of unmanned delivery systems promises to cut down on transportation expenses and ensure that products reach consumers and retail points more reliably and swiftly across Kidswant's wide reach.

- Cold-Chain Advancements: Investments in smart cold-chain solutions are crucial for maintaining product integrity, especially for sensitive items.

- Unmanned Vehicle Deployment: The increasing use of autonomous trucks and delivery robots can lower labor costs and increase delivery speeds.

- Drone Delivery Expansion: Drones offer a novel solution for last-mile delivery in geographically challenging areas, improving accessibility and speed.

- Impact on Kidswant: These technologies can directly translate to optimized inventory, reduced operational overhead, and enhanced customer satisfaction through timely deliveries.

Technological advancements are a dominant force in China's retail sector, with e-commerce sales of physical goods reaching an estimated 11.49 trillion yuan in 2023, a 6.2% increase year-on-year. Kidswant's integration of online and offline channels, an omnichannel strategy, is essential as over 70% of retail sales are projected to involve digital interaction by the end of 2024. AI is also playing a transformative role, with China leading in automated warehousing and personalized customer experiences, expected to drive a significant portion of online sales in 2024.

Legal factors

China's commitment to food safety, especially for infant products, is exceptionally high, with strict regulations governing everything from ingredient sourcing to final product testing. For companies like Kidswant, this means rigorous adherence to standards like GB 7718 for general food labeling and GB 10765 for infant formula, demanding comprehensive registration and transparent quality control processes. Failing to meet these evolving national standards, which often see updates to ensure the highest safety levels, can lead to severe penalties, including product recalls and significant damage to brand reputation, impacting consumer trust which is paramount in the baby products sector.

China's E-Commerce Law, enacted in 2019, mandates strict adherence to consumer rights protection, fair competition, and intellectual property safeguards for online businesses. Kidswant's digital storefronts must navigate these regulations, emphasizing robust data privacy, advanced cybersecurity protocols, and the prevention of misleading advertising to maintain a compliant and trustworthy online presence.

Compliance with these legal frameworks is crucial, as evidenced by the growing number of consumer complaints related to online transactions. In 2023, China's State Administration for Market Regulation reported a significant increase in e-commerce related disputes, highlighting the importance of transparent practices and adherence to consumer protection laws for companies like Kidswant.

Advertising and marketing laws in China are particularly stringent for infant formula and children's products. These regulations often limit specific claims about product benefits or prohibit endorsements from certain individuals, impacting how Kidswant can promote its offerings. For instance, the Advertising Law of the People's Republic of China, revised in 2021, emphasizes truthfulness and prohibits misleading advertisements, a key consideration for any brand targeting young families.

Data Privacy and Cybersecurity Laws (PIPL)

China's Personal Information Protection Law (PIPL), effective since November 1, 2021, imposes stringent regulations on how companies collect, process, and store personal data. Kidswant, operating within this framework, must prioritize obtaining explicit consent for all data handling activities. This includes customer information gathered through its e-commerce sites, physical stores, and loyalty programs. Failure to comply can result in significant penalties, with fines potentially reaching up to 5% of the previous year's annual turnover or RMB 50 million, whichever is higher.

To navigate these legal requirements, Kidswant needs to invest in and maintain advanced data protection and cybersecurity infrastructure. This is crucial for securing customer data across its entire omnichannel presence, from online transactions to in-store interactions. The company must ensure its systems are resilient against breaches and that data handling practices align with PIPL's mandates on data minimization, purpose limitation, and user rights like access and deletion. For instance, in 2023, China saw a notable increase in data privacy-related enforcement actions, underscoring the importance of proactive compliance.

- PIPL Compliance: Kidswant must adhere to PIPL's strict consent requirements for data collection and usage.

- Cybersecurity Investment: Robust data protection measures are essential to safeguard customer information across all platforms.

- Omnichannel Data Handling: Consistent application of privacy policies is required for both online and offline customer touchpoints.

- Enforcement Trends: Increased regulatory scrutiny in China highlights the financial and reputational risks of non-compliance.

Intellectual Property Rights Protection

Kidswant, as a significant player in the retail sector, particularly in China, must rigorously adhere to the country's intellectual property (IP) laws. This is paramount for protecting its brand names, logos, and any proprietary product designs from infringement. China's IP landscape has seen significant strengthening, with recent reforms aimed at enhancing enforcement and protecting both domestic and foreign rights holders. For instance, in 2023, China's Supreme People's Court reported a notable increase in IP-related cases, underscoring the active legal environment.

Navigating these regulations effectively is not just about avoiding legal disputes; it's a strategic imperative for Kidswant to foster innovation and maintain its competitive edge. The company's ability to secure and defend its trademarks and patents directly impacts its brand value and consumer trust. Failure to adequately protect its IP could lead to significant financial losses and reputational damage.

Key aspects of IP protection relevant to Kidswant include:

- Trademark Registration and Enforcement: Ensuring all Kidswant brands and product lines are properly registered in China and actively monitoring for and pursuing any unauthorized use.

- Copyright Protection: Safeguarding original content, including marketing materials, website designs, and any in-house developed product designs.

- Patent Law Compliance: If Kidswant develops unique product technologies or manufacturing processes, understanding and complying with patent laws is essential.

- Anti-Counterfeiting Measures: Implementing robust strategies to combat the sale of counterfeit goods that could dilute Kidswant's brand and mislead consumers.

China's legal environment for businesses, especially those in the infant product sector, is characterized by stringent food safety regulations and evolving e-commerce laws. Kidswant must navigate these, ensuring compliance with standards like GB 7718 and GB 10765, which demand meticulous ingredient sourcing and transparent quality control.

The Personal Information Protection Law (PIPL) mandates strict data handling, requiring explicit consent for all data collection and processing, with potential fines up to 5% of annual turnover for non-compliance. Furthermore, advertising and marketing laws, particularly for infant formula, prohibit misleading claims and necessitate truthfulness, as reinforced by the 2021 Advertising Law revision.

Intellectual property (IP) protection is also critical, with China's strengthening IP landscape demanding robust trademark registration, copyright safeguarding, and anti-counterfeiting measures. In 2023, IP-related cases saw a notable increase, highlighting the active legal environment and the importance of proactive protection for brands like Kidswant.

Environmental factors

Chinese consumers are showing a strong preference for eco-friendly, non-toxic, and sustainably sourced goods, with a notable willingness to pay more for these attributes, largely due to concerns for personal and family health. This shift is significant, with reports indicating that over 60% of Chinese consumers actively seek out sustainable brands.

Kidswant can leverage this growing demand by increasing its range of green products across various segments, including toys, clothing, and everyday essentials. For instance, introducing organic cotton apparel or toys made from recycled materials aligns directly with these consumer values and could capture a larger market share.

China's evolving environmental landscape presents a significant challenge and opportunity for Kidswant. New regulations are pushing for reduced packaging waste, a move that aligns with global sustainability trends. For instance, by the end of 2024, many Chinese cities are expected to implement stricter rules on single-use plastics, impacting product presentation and shipping materials.

Kidswant must proactively adapt its packaging strategies to meet these mandates. This involves a shift towards more sustainable materials, such as recycled paper or biodegradable plastics, and optimizing packaging design to minimize material usage. Companies that embrace these changes, like those participating in pilot programs for circular economy packaging in Shanghai, are likely to see improved brand perception and operational efficiency.

China's push for a circular economy, focusing on minimizing virgin material use and boosting recycling, presents a significant environmental factor. The government's emphasis on eco-design and stringent collection mandates impacts product lifecycle management.

Kidswant can capitalize on these trends by investigating product-as-a-service models, which could reduce waste and offer new revenue streams. Furthermore, implementing robust take-back programs and increasing the use of recycled content in their private label offerings directly aligns with these national environmental goals.

ESG Disclosure Requirements

China's stock exchanges, including the Shanghai Stock Exchange and Shenzhen Stock Exchange, have been progressively implementing ESG disclosure guidelines. For instance, the Shanghai Stock Exchange released its ESG reporting framework in 2022, encouraging listed companies to enhance their transparency in environmental, social, and governance practices. Kidswant, as a publicly traded entity, must align with these evolving requirements, which will necessitate a robust system for collecting and reporting ESG data to meet investor expectations and regulatory mandates.

This push for greater ESG disclosure is driven by a global trend towards sustainable investing. In 2023, global sustainable investment assets reached an estimated $37.4 trillion, indicating a significant investor appetite for companies demonstrating strong ESG performance. Kidswant's ability to effectively communicate its environmental initiatives, social impact, and governance structures will be crucial for attracting this capital and maintaining a competitive edge in the market.

To comply and thrive, Kidswant should focus on key areas:

- Environmental Impact: Quantifying and reporting on carbon emissions, waste management, and resource utilization.

- Social Responsibility: Disclosing labor practices, supply chain management, and community engagement efforts.

- Governance Quality: Detailing board diversity, executive compensation, and ethical business conduct.

- Data Verification: Ensuring the accuracy and reliability of reported ESG data through third-party assurance.

Climate Change and Carbon Footprint Management

China's push for product carbon footprint management and its burgeoning carbon trading system are significant environmental factors for Kidswant. By 2025, it's anticipated that more stringent regulations will necessitate detailed carbon footprint reporting for goods sold within China, potentially impacting Kidswant's supply chain transparency.

Kidswant could face future mandates to measure and disclose the carbon footprint of its products and entire operations. This will likely spur investments in areas like energy-efficient manufacturing processes and the adoption of more sustainable logistics solutions to mitigate its environmental impact and comply with evolving standards.

The development of China's national carbon trading system, which saw its emissions allowances trade between ¥60-¥80 per tonne of CO2 in early 2024, presents both a challenge and an opportunity. Kidswant may need to account for carbon costs associated with its production and distribution, while also exploring opportunities to generate credits through emissions reductions.

Key considerations for Kidswant include:

- Regulatory Compliance: Proactively understanding and preparing for potential carbon disclosure mandates in China.

- Operational Efficiency: Investing in energy-saving technologies and optimizing logistics to reduce the company's carbon intensity.

- Supply Chain Integration: Collaborating with suppliers to ensure a transparent and lower-carbon supply chain.

- Market Positioning: Leveraging sustainability efforts to enhance brand reputation and appeal to environmentally conscious consumers.

Chinese consumers are increasingly prioritizing eco-friendly and sustainable products, with over 60% actively seeking out such brands and showing a willingness to pay a premium. This trend is driven by health concerns and a growing awareness of environmental issues.

Kidswant can capitalize on this by expanding its range of green products, such as organic cotton apparel or toys made from recycled materials, directly aligning with consumer values and potentially capturing a larger market share.

China's evolving environmental regulations, including stricter rules on single-use plastics by the end of 2024, necessitate Kidswant's adaptation of packaging strategies towards sustainable materials and optimized design to minimize waste.

The nation's focus on a circular economy and eco-design impacts product lifecycle management, encouraging Kidswant to explore product-as-a-service models and robust take-back programs to reduce waste and align with government goals.

| Environmental Factor | Description | Impact on Kidswant | Opportunity/Challenge | Relevant Data (2024/2025) |

|---|---|---|---|---|

| Consumer Demand for Sustainability | Growing preference for eco-friendly, non-toxic, sustainable goods. | Increased demand for green product lines. | Opportunity to capture market share and build brand loyalty. | Over 60% of Chinese consumers actively seek sustainable brands. |

| Packaging Regulations | Stricter rules on single-use plastics and waste reduction. | Need to adapt packaging to sustainable materials and designs. | Challenge to redesign packaging; opportunity for innovation. | Many Chinese cities expected to implement stricter rules by end of 2024. |

| Circular Economy Initiatives | Emphasis on minimizing virgin material use and boosting recycling. | Potential for product-as-a-service models and take-back programs. | Opportunity for new revenue streams and waste reduction. | Government emphasis on eco-design and collection mandates. |

| Carbon Trading System & Footprint Management | Development of a national carbon trading system and product carbon footprint reporting. | Potential need to measure and disclose product carbon footprints. | Challenge to manage carbon costs; opportunity to invest in efficiency. | Carbon allowances traded between ¥60-¥80 per tonne of CO2 in early 2024. |

PESTLE Analysis Data Sources

Our Kidswant PESTLE Analysis is built on a comprehensive review of data from government reports, market research firms, and industry publications. We synthesize information on economic indicators, social trends, technological advancements, and regulatory changes to provide a holistic view of the operating environment.