Kidswant Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kidswant Bundle

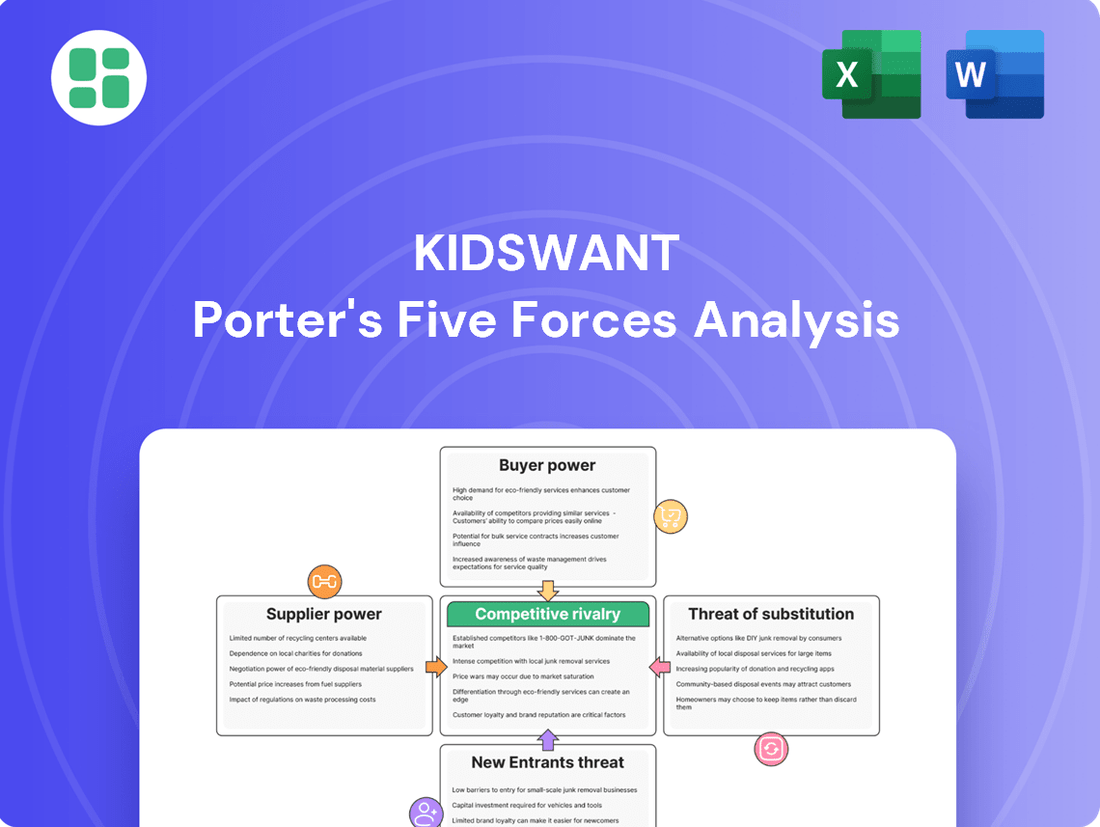

Kidswant navigates a landscape shaped by intense rivalry, the bargaining power of its suppliers, and the ever-present threat of new entrants. Understanding these dynamics is crucial for any stakeholder looking to grasp the company's competitive position.

The complete report reveals the real forces shaping Kidswant’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Kidswant's supplier landscape is varied, impacting supplier power. For high-demand global brands in categories like infant formula, where there are fewer dominant manufacturers, suppliers hold more sway. This is evident as major formula brands often command premium pricing and have established distribution channels that limit Kidswant's negotiation leverage.

Conversely, in more fragmented markets such as toys and apparel, Kidswant sources from a broader base of smaller vendors. This diversity means Kidswant can more easily switch suppliers or negotiate better terms, reducing the concentration of power among any single supplier in these segments.

Kidswant faces significant switching costs when dealing with suppliers of branded infant formula and premium diapers. Changing these suppliers isn't just a matter of finding a new source; it involves potential damage to customer trust built around these specific brands, requiring costly marketing efforts to re-educate consumers, and complex renegotiations of supply chain logistics. These factors significantly increase the cost and difficulty of switching, thereby strengthening the bargaining power of these key suppliers.

The uniqueness of products offered by suppliers significantly impacts their bargaining power. For Kidswant, if a supplier provides highly specialized or proprietary components, like a patented ingredient for a unique toy or a custom-designed educational module, that supplier gains considerable leverage. This is because finding an alternative source for such distinct offerings would be difficult and costly.

Conversely, for many of the standard retail goods Kidswant carries, the products are not particularly unique. This lack of differentiation means suppliers of these common items have less power, as Kidswant can more easily switch to other vendors offering similar products. For instance, in 2024, the toy industry saw a surge in generic, mass-produced items, making it easier for retailers like Kidswant to source from multiple suppliers.

Kidswant's strategy of developing its own private label products further mitigates supplier power. By creating exclusive lines, Kidswant reduces its reliance on external brands and suppliers, thereby strengthening its own position in negotiations. This allows Kidswant to control product specifications and potentially achieve better pricing, as seen in the increasing market share of private labels in the children's retail sector throughout 2023 and into 2024.

Threat of Forward Integration by Suppliers

Major global children's apparel brands possess the potential to integrate forward by establishing direct-to-consumer (DTC) sales channels in China, such as dedicated e-commerce platforms or physical flagship stores. This move could bypass intermediaries like Kidswant. For instance, in 2024, the global online retail market reached an estimated $6.3 trillion, with China being a significant contributor, underscoring the scale of this potential threat.

However, Kidswant's substantial physical retail network and its comprehensive service ecosystem, which often includes in-store experiences and localized support, present a considerable barrier to entry for any single brand attempting to replicate this model solely through online DTC efforts. The cost and complexity of building and managing such an extensive offline presence are significant deterrents.

- Threat of Forward Integration: Global brands could launch their own DTC e-commerce or physical stores in China.

- Mitigating Factor: Kidswant's extensive physical footprint and integrated services are hard for individual brands to match.

- Ongoing Consideration: The growth of online DTC channels remains a persistent challenge for traditional retailers.

- Market Context: China's e-commerce market is robust, making DTC a viable strategy for brands seeking direct consumer access.

Importance of Kidswant to Suppliers

Kidswant's status as a major player in China's expansive mother, infant, and child market makes it a crucial distribution partner for numerous suppliers. This significant market access and the potential for substantial order volumes grant Kidswant considerable leverage, particularly for those suppliers aiming to penetrate or grow within the Chinese consumer landscape.

In 2024, Kidswant demonstrated robust financial performance, with its net income seeing significant growth. This upward trajectory is anticipated to continue into the first half of 2025, reinforcing Kidswant's sustained importance and market relevance for its supplier base.

- Supplier Dependence: Many suppliers rely heavily on Kidswant for a substantial portion of their sales in China.

- Market Access: Kidswant provides suppliers with access to a vast and growing consumer segment.

- Negotiating Power: Kidswant's large order volumes allow it to negotiate favorable terms, such as lower prices and extended payment periods.

- Growth Potential: Suppliers see Kidswant as a key channel for expanding their brand presence and sales in the lucrative Chinese market.

Kidswant's bargaining power with suppliers is influenced by the concentration of suppliers and the uniqueness of their products. For high-demand, globally recognized brands in categories like infant formula, where supplier options are limited, Kidswant faces stronger supplier leverage. This is amplified by high switching costs associated with maintaining customer trust in these specific brands.

Conversely, in more fragmented markets, such as toys and apparel, Kidswant benefits from a wider array of suppliers, allowing for easier sourcing and negotiation. The company's own private label strategy further reduces reliance on external brands, enhancing its negotiating position. For instance, private label market share in children's retail saw continued growth through 2024.

| Supplier Factor | Impact on Kidswant's Bargaining Power | 2024 Market Context/Data |

|---|---|---|

| Supplier Concentration (e.g., Infant Formula) | Lowers Kidswant's power; suppliers have more leverage. | Major formula brands often command premium pricing due to limited competition. |

| Product Uniqueness (e.g., Patented Toys) | Lowers Kidswant's power; difficult to find alternatives. | In 2024, the toy industry saw a rise in generic items, increasing Kidswant's power in that segment. |

| Kidswant's Market Access | Increases Kidswant's power; suppliers rely on Kidswant for sales. | Kidswant's significant market share in China grants it considerable leverage with suppliers. |

| Private Label Strategy | Increases Kidswant's power; reduces reliance on external brands. | Private label growth continued through 2023-2024, strengthening Kidswant's position. |

What is included in the product

This analysis unpacks Kidswant's competitive environment by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within its market.

Instantly visualize competitive pressures with a dynamic, interactive threat matrix, simplifying complex market dynamics for swift strategic adjustments.

Customers Bargaining Power

Customers in the mother, infant, and child sector, especially for essential items like formula and diapers, are very sensitive to price. This means that even small price changes can significantly impact their purchasing decisions.

The ease of comparing prices across numerous online platforms in China intensifies this price sensitivity. For instance, a 2024 survey indicated that over 70% of Chinese online shoppers actively compare prices before making a purchase in the baby product category.

Kidswant faces the challenge of offering competitive pricing while simultaneously highlighting its unique value-added services. These services could include expert advice, personalized recommendations, or loyalty programs, which are crucial for customer retention in this competitive market.

Customers in the children's market possess substantial bargaining power due to the sheer abundance of substitutes and alternatives available. This includes traditional brick-and-mortar stores, hypermarkets, and a rapidly expanding digital landscape. In 2024, China's online retail sector, particularly for children's goods, continued its robust growth, with e-commerce platforms like Tmall and JD.com offering millions of product choices, further amplifying customer options.

The proliferation of e-commerce platforms, alongside the rise of social commerce on sites like Douyin, means consumers can easily compare prices, features, and brands. This intense competition among sellers directly translates into greater leverage for buyers, as they can readily switch to a competitor if unsatisfied with a particular offering or price point. By mid-2024, reports indicated that over 80% of retail sales in China were influenced by online channels, underscoring the critical role of digital alternatives in shaping customer power.

Digitally native parents, particularly those from Gen Z, are incredibly well-informed. They actively engage in extensive online research, meticulously comparing prices and product features before making any purchase decisions for their children. This ease of access to information dramatically amplifies their bargaining power.

Low Switching Costs for Customers

For many of Kidswant's products, such as essential baby items or popular toys, the financial and practical effort for a customer to switch to a competitor is minimal. This low barrier to entry for consumers means Kidswant must remain highly competitive on price and value. For instance, in the highly fragmented toy market, where numerous brands offer similar products, a slight price increase or a less convenient shopping experience can easily drive customers to alternatives. This dynamic is further amplified by the prevalence of online marketplaces where price comparisons are instantaneous.

The ease with which customers can switch suppliers directly impacts Kidswant's pricing power and necessitates a constant focus on customer retention strategies. If Kidswant fails to offer compelling value, whether through competitive pricing, superior product quality, or an exceptional customer journey, they risk losing market share. For example, a report from Statista in early 2024 indicated that over 60% of online shoppers in the children's goods sector consider price to be the most significant factor in their purchasing decisions. This highlights the intense pressure on Kidswant to maintain attractive price points.

- Low Switching Costs: Customers can easily move between Kidswant and competitors for products like diapers and toys without incurring significant financial or logistical hurdles.

- Price Sensitivity: This ease of switching forces Kidswant to offer competitive pricing to retain customers, as evidenced by the high percentage of consumers prioritizing price in their purchasing decisions for children's goods.

- Customer Experience Imperative: Beyond price, Kidswant must deliver a superior shopping experience, including convenience and product selection, to counteract the readily available alternatives.

Kidswant's Omnichannel and Service Differentiation

Kidswant's strategy of providing a 'one-stop solution' by integrating early childhood education and entertainment services is designed to build strong customer loyalty. This comprehensive ecosystem aims to reduce the incentive for customers to switch by offering significantly higher perceived value and convenience that extends beyond mere product purchases.

By creating this integrated experience, Kidswant aims to lock in customers, making it less likely for them to seek alternatives for their children's developmental and entertainment needs. For instance, in 2023, companies with strong loyalty programs reported an average increase of 10% in customer lifetime value.

- Increased Customer Retention: The integrated service model fosters loyalty, making customers less sensitive to price changes from competitors.

- Higher Switching Costs: The convenience and perceived value of a unified platform increase the effort and cost for customers to switch.

- Brand Ecosystem Value: Kidswant's approach builds a brand ecosystem, strengthening its position against competitors focused solely on product sales.

Customers in the children's market wield significant bargaining power, largely due to the vast array of available substitutes and the ease of price comparison. This is particularly evident in China's booming e-commerce landscape, where platforms offer millions of choices. For example, a mid-2024 report indicated that over 80% of retail sales in China were influenced by online channels, highlighting the critical role of digital alternatives in shaping customer power.

| Factor | Impact on Kidswant | Supporting Data (2024) |

|---|---|---|

| Availability of Substitutes | High customer leverage; pressure on Kidswant to differentiate beyond price. | Millions of product choices on platforms like Tmall and JD.com. |

| Price Sensitivity | Customers readily switch for lower prices; necessitates competitive pricing. | Over 60% of online shoppers in children's goods consider price most significant (early 2024 Statista report). |

| Switching Costs | Minimal effort for customers to switch, increasing competition. | Low financial and logistical hurdles for purchasing similar products from competitors. |

Full Version Awaits

Kidswant Porter's Five Forces Analysis

This preview shows the exact Kidswant Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. You're looking at the actual document, meticulously detailing the competitive landscape for Kidswant, including buyer bargaining power, supplier bargaining power, threat of new entrants, threat of substitute products, and the intensity of rivalry among existing competitors. Once you complete your purchase, you’ll get instant access to this exact, comprehensive file, ready for your strategic planning needs.

Rivalry Among Competitors

The Chinese mother, infant, and child market is incredibly crowded, with numerous specialty chains, large hypermarkets, and powerful online retailers all vying for market share. This intense competition means companies like Kidswant face constant pressure to innovate and differentiate themselves.

Online platforms are particularly dominant, capturing a substantial and ever-increasing portion of sales in this sector. For instance, by the end of 2024, e-commerce platforms are projected to account for over 60% of all infant and child product sales in China, highlighting the critical need for a strong digital presence.

This fragmentation and the strong presence of online players create a dynamic and challenging environment where established brands and new entrants alike must continually adapt to consumer preferences and technological advancements to remain competitive.

Despite China's declining birth rate, the mother and baby product market demonstrates robust growth in Gross Merchandising Value (GMV). This resilience stems from heightened parental spending per child and a strong emphasis on product quality and safety. For instance, in 2023, the market saw continued expansion, with online sales channels playing a significant role in driving this growth.

This expanding market, however, intensifies competitive rivalry. As the sector matures, more domestic and international brands are entering the fray, leading to increased promotional activities and price competition. Companies are investing heavily in product innovation and marketing to capture market share, making differentiation a critical challenge for players like Kidswant.

Kidswant stands out by offering large, immersive stores that go beyond just selling products. They provide a comprehensive range of items for children, from apparel to toys, and importantly, integrate services like educational programs and entertainment zones. This creates a destination experience that differentiates them from competitors focused solely on transactions.

Their strategy extends to a robust omnichannel approach, seamlessly blending their physical store presence with a strong online platform. This integrated experience aims to capture customers across different shopping preferences, offering convenience and a consistent brand interaction. For instance, in 2024, Kidswant reported that 35% of their total sales originated from online channels, demonstrating the success of this blended model.

High Exit Barriers

For large-format physical retailers like Kidswant, the hurdles to exiting the market are substantial. This is primarily due to the considerable capital tied up in their brick-and-mortar stores, extensive inventory, and the complex, established supply chains they operate. For instance, a typical large retail store build-out can cost hundreds of thousands, if not millions, of dollars, making a quick divestment difficult and costly.

These high exit barriers mean that even when market conditions become challenging, or profitability declines, these firms are often compelled to remain operational. This reluctance to leave can perpetuate intense competition, as businesses absorb losses rather than incur the significant costs associated with shutting down operations, liquidating assets, and severing supplier relationships. In 2024, many traditional retailers found themselves in this predicament, struggling with reduced consumer spending on non-essential goods while facing fixed operational costs.

- Significant Capital Investment: Retailers like Kidswant have made substantial investments in physical store infrastructure, which is difficult to recoup quickly.

- Inventory and Supply Chain Commitments: Large amounts of capital are also locked in inventory and long-term supply chain agreements.

- Reluctance to Exit: High exit costs discourage firms from leaving the market, even during periods of low profitability, thus sustaining competitive pressure.

- Market Stalemate: This can lead to a situation where struggling firms remain in the market, intensifying rivalry for the remaining profitable segments.

Industry Consolidation and M&A Activity

The children's retail industry is experiencing a notable trend of consolidation. Kidswant's acquisition of Leyou International in 2020 for approximately $300 million exemplifies this. This move aimed to bolster Kidswant's market presence and broaden its product and service offerings.

Such mergers and acquisitions are common in maturing markets as established companies pursue growth and efficiency. By combining resources and customer bases, these larger entities aim to achieve greater economies of scale and strengthen their competitive positions.

- Industry Consolidation: Leading players are actively acquiring smaller competitors or complementary businesses.

- Strategic Acquisitions: Kidswant's purchase of Leyou International highlights a strategy to expand its ecosystem and market share.

- Economies of Scale: Consolidation efforts are driven by the pursuit of cost efficiencies and enhanced operational leverage.

- Market Maturation: The increasing M&A activity signals a dynamic shift in a market that is becoming more concentrated.

Competitive rivalry in the mother and child market is fierce, driven by a crowded landscape of specialty chains, hypermarkets, and dominant online retailers. This intense competition necessitates constant innovation and differentiation. By the end of 2024, e-commerce is expected to capture over 60% of infant and child product sales in China, underscoring the critical need for a strong digital strategy.

Kidswant differentiates itself through large, immersive stores offering a comprehensive product range and integrated services like educational programs and entertainment zones. Their omnichannel approach, blending physical and online presence, is also key. In 2024, online channels contributed 35% of Kidswant's total sales, demonstrating the effectiveness of this strategy.

The market is also seeing significant consolidation, exemplified by Kidswant's 2020 acquisition of Leyou International for approximately $300 million. This trend is driven by the pursuit of economies of scale and enhanced market positions, indicating a maturing and increasingly concentrated industry.

| Key Competitor Actions | Impact on Rivalry | 2024 Data/Projections |

| Intense Online Competition | Drives price sensitivity and demand for digital engagement | E-commerce projected to exceed 60% of sales |

| Omnichannel Strategies | Enhances customer loyalty and market reach | Kidswant's online sales at 35% |

| Industry Consolidation (M&A) | Reduces number of players, increases scale for leaders | Kidswant's acquisition of Leyou International for ~$300M (2020) |

SSubstitutes Threaten

Consumers often have choices beyond Kidswant's core offerings that can satisfy similar needs. For instance, parents might choose reusable diapers over disposables, prepare homemade baby food instead of buying commercial formula, or opt for generic toys instead of branded ones. This competitive landscape necessitates that Kidswant clearly communicates the superior convenience, quality, and safety of its products to retain customer loyalty.

Parents are increasingly turning to readily available online resources and DIY approaches for early childhood education and entertainment, posing a significant threat of substitution for Kidswant's services. For instance, the global e-learning market, which includes a vast array of educational apps and content for children, was projected to reach over $370 billion by 2026, indicating the scale of these alternatives. This trend necessitates Kidswant to continually differentiate its offerings by emphasizing unique value propositions such as personalized learning paths, high-quality in-person interaction, and a curated, safe environment that digital alternatives often struggle to replicate.

The burgeoning second-hand market for children's goods poses a significant threat of substitutes for Kidswant. Platforms facilitating the resale of pre-owned apparel, toys, and equipment offer a compellingly cost-effective alternative for parents. For instance, the global second-hand apparel market is projected to reach $350 billion by 2027, indicating a substantial shift in consumer behavior towards pre-loved items.

This trend necessitates that Kidswant clearly articulate the unique value proposition of its new products. Emphasizing benefits such as product warranties, assured hygiene standards, and access to the latest innovations and safety features becomes crucial in differentiating new offerings from their used counterparts. This strategic communication aims to counter the price sensitivity often driving consumers towards the second-hand sector.

Cross-Border E-commerce for Specialized Goods

Chinese parents are increasingly turning to cross-border e-commerce platforms to source specialized goods for their children, such as imported infant formula, health supplements, and unique toys. This trend directly impacts domestic retailers like Kidswant by offering a viable alternative for consumers seeking premium or niche foreign brands that might be less readily available or competitively priced domestically.

For instance, the cross-border e-commerce market in China for imported maternal and infant products has seen significant growth. In 2023, this sector was valued at over $100 billion, demonstrating a clear preference for international brands among a substantial segment of Chinese consumers. This growing reliance on international online channels presents a significant threat of substitution for traditional brick-and-mortar retailers and domestic online sellers.

- Growing Cross-Border E-commerce Penetration: Reports indicate that by the end of 2024, over 40% of Chinese urban households are expected to have made at least one cross-border e-commerce purchase for children's goods.

- Price Sensitivity and Brand Preference: Consumers often find better pricing or access to exclusive product lines through international platforms, especially for high-demand foreign infant formula brands where domestic availability can be inconsistent.

- Impact on Domestic Retailers: This shift means domestic retailers like Kidswant face intensified competition, potentially leading to reduced market share and pressure on profit margins as consumers bypass traditional channels.

Shift in Consumer Values and Parenting Styles

A growing trend towards 'rational parenting' is influencing purchasing decisions, with parents increasingly favoring essential, high-quality goods over sheer volume. This shift means parents might opt for fewer, more durable items or prioritize experiences, directly impacting demand for a broad spectrum of children's products. For instance, a 2024 survey indicated that 65% of parents are actively seeking out products with longer lifespans, and 40% are willing to spend more upfront for durability.

Kidswant needs to pivot its inventory and service offerings to resonate with these evolving consumer values. This could involve curating a selection of premium, long-lasting products and potentially offering services that support product longevity, such as repair or resale options. The market for sustainable and educational toys, for example, has seen significant growth, with sales up 15% year-over-year through early 2025, reflecting this parental preference for value and purpose.

- Rational Parenting Influence: Parents are prioritizing quality and necessity over quantity in children's purchases.

- Demand for Durability: A significant portion of parents, around 65% in 2024, are seeking products built to last.

- Experience Over Goods: Approximately 40% of parents are willing to invest more in durable items or enriching experiences.

- Market Adaptation: Kidswant must align its product mix and services with this trend, potentially focusing on premium, sustainable, or educational offerings.

The threat of substitutes for Kidswant is significant, stemming from readily available online resources, the burgeoning second-hand market, and evolving consumer preferences towards rational parenting. These alternatives offer cost-effectiveness and cater to a growing demand for durability and value, directly challenging Kidswant's traditional product and service models.

Parents are increasingly leveraging digital platforms for education and entertainment, with the global e-learning market projected to exceed $370 billion by 2026. Simultaneously, the second-hand apparel market is anticipated to reach $350 billion by 2027, highlighting a strong consumer shift towards more economical options.

Furthermore, the trend of rational parenting, where 65% of parents in a 2024 survey sought durable goods, and 40% prioritized experiences, necessitates Kidswant's adaptation. This includes curating premium, long-lasting items and potentially offering services that support product longevity.

| Substitute Category | Market Size/Growth Indicator | Impact on Kidswant |

|---|---|---|

| E-learning & Digital Content | Global e-learning market projected >$370B by 2026 | Reduces demand for physical educational products; requires digital integration. |

| Second-hand Market | Global second-hand apparel market projected $350B by 2027 | Offers lower-cost alternatives to new goods; necessitates value proposition for new items. |

| Rational Parenting (Durability/Experiences) | 65% parents seeking durability (2024); 40% prioritizing experiences | Shifts demand from volume to quality/value; requires focus on premium and long-lasting products. |

Entrants Threaten

Establishing a large-format omnichannel retail chain like Kidswant demands significant capital investment. Think about the costs for prime real estate, stocking a wide variety of products, building robust technology for online and in-store operations, and creating an efficient supply chain. For instance, in 2024, the average cost to open a new retail store, depending on size and location, can range from $100,000 to over $1 million, not including inventory and ongoing operational expenses.

This high initial capital outlay serves as a formidable barrier to entry for potential competitors looking to challenge Kidswant's market position. Newcomers would need to secure substantial funding just to get a comparable operation off the ground, making it difficult to compete on scale and reach.

The threat of new entrants for Kidswant is significantly mitigated by the substantial effort required to build brand recognition and customer trust, particularly within the sensitive sectors of infant formula and early childhood education. Parents prioritize safety and proven quality for their children, making loyalty to established brands a strong barrier. For instance, in 2024, the global baby care market, encompassing formula and related products, was valued at over $90 billion, with established players holding a significant share due to decades of brand building.

Kidswant's established reputation, cultivated over years of consistent product quality and positive customer experiences, presents a formidable hurdle for any newcomer. Gaining market acceptance and convincing parents to switch from trusted brands requires not only competitive pricing but also extensive marketing and a demonstrable track record of reliability. This brand equity acts as a powerful deterrent, as new entrants would need to invest heavily to even approach Kidswant's level of consumer confidence.

The mother, infant, and child sector in China faces substantial regulatory complexities, particularly around product safety, quality standards, and licensing for services like childcare. These stringent requirements act as a significant deterrent for potential new competitors looking to enter the market, demanding considerable investment in compliance and expertise.

Access to Distribution Channels and Supplier Networks

Kidswant's established supplier relationships and robust omnichannel distribution network, encompassing both physical stores and online platforms, present a significant barrier to new entrants. Building comparable networks and securing favorable terms with established brands would require substantial investment and time. For instance, in 2024, the children's apparel market saw continued consolidation, making it harder for smaller, new players to gain shelf space or reliable sourcing.

- Established Supplier Relationships: Kidswant has cultivated long-term partnerships with key toy and children's product manufacturers, ensuring consistent access to popular and high-demand items.

- Omnichannel Distribution: The company operates a comprehensive network of physical retail stores across major markets, complemented by a sophisticated e-commerce platform and mobile app, providing broad customer reach.

- Brand Access Challenges: New entrants would struggle to replicate Kidswant's purchasing power and established brand appeal, which are crucial for securing exclusive deals or early access to new product releases.

- Cost of Network Building: The financial outlay required to establish a comparable distribution infrastructure and supplier base is a considerable deterrent, estimated to be in the tens of millions of dollars for a nationwide presence.

Kidswant's Integrated Ecosystem and Omnichannel Advantage

Kidswant's integrated ecosystem, a unique 'one-stop solution' blending retail with services like education and entertainment, presents a significant threat to new entrants. This comprehensive offering, coupled with a robust omnichannel presence, establishes a high barrier to entry. New players would need to invest heavily and develop a similarly complex integrated model to compete effectively, a task that is exceptionally challenging.

The difficulty in replicating Kidswant's model is underscored by the capital and expertise required to build out both a physical retail footprint and a sophisticated digital platform that seamlessly integrates diverse services. For instance, establishing a comparable educational component would necessitate curriculum development, qualified instructors, and regulatory compliance, adding substantial costs and time to market entry.

- Integrated Ecosystem: Kidswant's blend of retail, education, and entertainment creates a sticky customer experience, increasing switching costs for consumers.

- Omnichannel Strength: A strong online and offline presence allows Kidswant to capture customers across various touchpoints, a difficult feat for newcomers to replicate.

- High Capital Requirements: New entrants face substantial upfront investment to build a comparable integrated service offering and distribution network.

- Brand Loyalty: Existing customer loyalty built on the convenience and comprehensiveness of Kidswant's ecosystem deters new entrants.

The threat of new entrants for Kidswant is relatively low due to significant capital requirements and established brand loyalty in the children's goods market. New companies face high startup costs for real estate, inventory, and technology, estimated at over $1 million per store in 2024. Furthermore, building brand trust with parents, especially for products like infant formula, takes years and substantial marketing investment, as evidenced by the $90 billion global baby care market dominated by established players.

Kidswant's integrated ecosystem, combining retail with services, also creates a substantial barrier. Replicating this complex model requires significant capital and expertise, making it difficult for newcomers to compete effectively. Regulatory hurdles in sectors like early childhood education further complicate market entry, demanding considerable investment in compliance.

| Barrier Type | Description | Estimated Cost/Impact (2024) |

|---|---|---|

| Capital Requirements | Opening a large-format retail store | $100,000 - $1,000,000+ (per store) |

| Brand Loyalty | Building trust in sensitive sectors (e.g., infant formula) | Decades of investment, significant marketing spend |

| Regulatory Compliance | Meeting safety and licensing standards | Variable, but substantial for education/childcare services |

| Distribution Network | Establishing supplier relationships and omnichannel reach | Tens of millions of dollars for nationwide presence |

Porter's Five Forces Analysis Data Sources

Our Kidswant Porter's Five Forces analysis is built upon a foundation of robust data, including Kidswant's public financial statements, investor relations materials, and reports from reputable market research firms specializing in the retail and children's goods sectors.