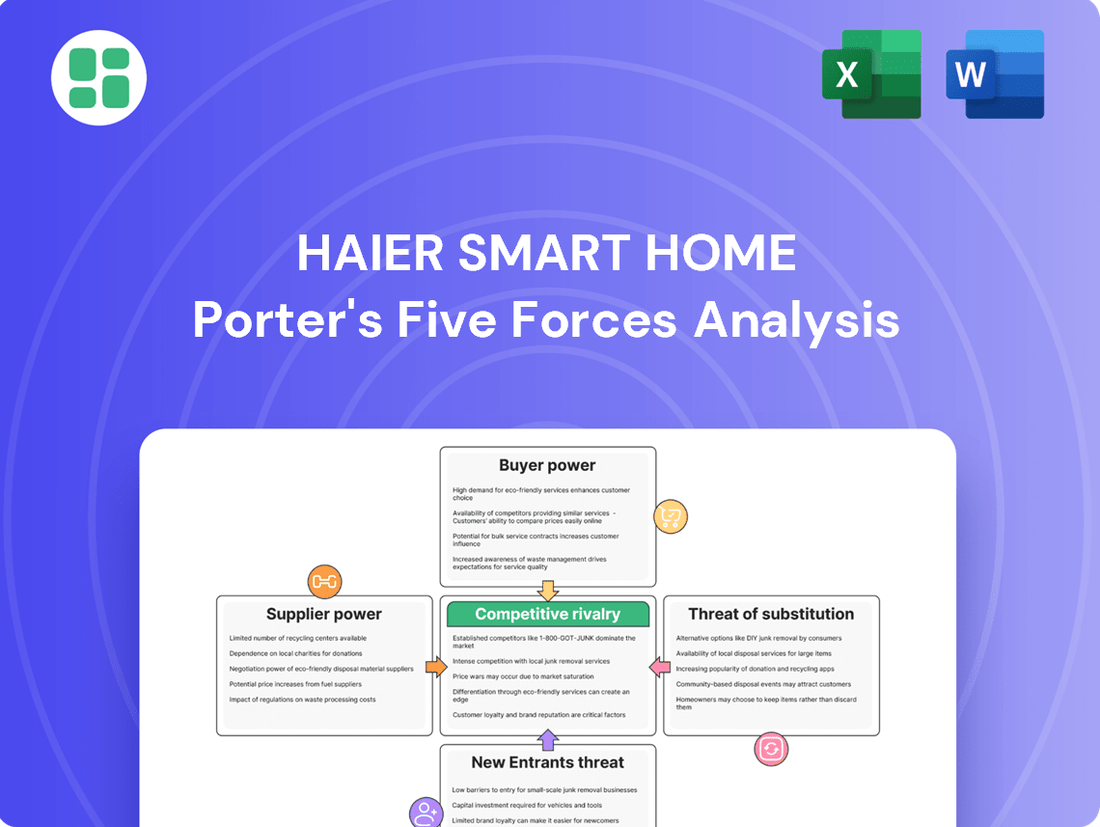

Haier Smart Home Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Haier Smart Home Bundle

Haier Smart Home faces a dynamic competitive landscape, with moderate bargaining power from buyers and suppliers, and a significant threat from new entrants in the rapidly evolving smart home market. The intensity of rivalry among existing players is high, while the threat of substitutes, though growing, is currently manageable.

The complete report reveals the real forces shaping Haier Smart Home’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Haier Smart Home manages a vast global supplier network, encompassing 4,677 entities. In 2024, around 70% of their product procurement relied on local suppliers, a strategy that typically dilutes the bargaining power of any single supplier.

However, the landscape shifts for specialized components or cutting-edge technologies essential for smart home functionalities. For these critical inputs, suppliers with unique expertise or limited alternatives can exert considerable influence.

To mitigate this, Haier Smart Home actively cultivates robust relationships with its key suppliers. This includes strategic investments and even mergers, aimed at securing supply chain stability and managing potential supplier leverage.

Haier Smart Home's supplier bargaining power is influenced by switching costs. While Haier aims for long-term partnerships, such as its 30-year collaboration with Haitian Group for smart manufacturing, significant investments in custom tooling or integrated digital systems with a specific supplier can create high switching costs. This deep integration makes it more expensive and complex for Haier to change suppliers for those particular components or services.

While the threat of suppliers integrating forward into manufacturing their own smart home products is generally low for Haier, a key supplier of specialized components or software could theoretically develop their own branded appliances. This scenario is less likely given the significant capital and expertise required for appliance manufacturing and brand building, areas where Haier excels.

The complexity of producing a diverse range of home appliances, from refrigerators to washing machines, and establishing a strong consumer brand presents a substantial barrier for most suppliers. Haier's established manufacturing capabilities and extensive distribution network make it challenging for a component supplier to replicate their full product offering and market reach.

Furthermore, Haier's strategy of building a comprehensive smart home ecosystem, encompassing a wide variety of interconnected appliances and services, further dilutes the threat. A single supplier would struggle to compete across Haier's broad product portfolio and established ecosystem, making direct forward integration a less viable competitive strategy.

Importance of Haier to Suppliers

Haier Smart Home's status as a global leader, holding the top spot in major home appliance retail volume for 16 consecutive years, makes it an exceptionally important customer for many suppliers. This immense purchasing power translates into significant leverage for Haier, as the loss of its business would severely impact many suppliers' revenue streams.

This substantial market presence and consistent demand from Haier generally diminish the bargaining power of its suppliers. Suppliers are often incentivized to offer competitive pricing and favorable terms to maintain their relationship with such a dominant player.

- Significant Customer: Haier's 16 consecutive years as the global leader in home appliance retail volume (as of 2023 data) highlights its massive scale.

- Supplier Dependence: Many component manufacturers and raw material providers rely heavily on Haier's orders, reducing their ability to dictate terms.

- Price Negotiation: Haier's purchasing volume allows it to negotiate aggressively on price, squeezing supplier margins and limiting their bargaining power.

Availability of Substitute Inputs

The availability of substitute inputs significantly influences the bargaining power of suppliers for Haier Smart Home. When alternative raw materials, components, or technologies are readily available, suppliers have less leverage. For instance, standard electronic components often have many manufacturers, which keeps their pricing power in check.

However, the landscape shifts for specialized inputs crucial for advanced smart home functionalities. For cutting-edge AI chips, sophisticated IoT modules, or unique materials needed for next-generation smart appliances, the pool of qualified suppliers can be quite limited. This scarcity grants these specialized suppliers greater bargaining power. In 2024, Haier's strategic emphasis on localized procurement aimed to broaden its supplier base, thereby increasing access to alternative inputs and potentially mitigating the power of any single supplier.

- Limited Substitutes for Advanced Tech: For specialized components like AI processors or advanced IoT modules, fewer suppliers exist, increasing their leverage.

- Numerous Suppliers for Standard Parts: Standard components have many providers, diminishing supplier bargaining power.

- Haier's 2024 Strategy: Localized procurement helps diversify Haier's supply chain, increasing access to alternative inputs.

- Impact on Costs: The availability of substitutes directly affects Haier's component costs and, consequently, its product pricing and margins.

Haier Smart Home's bargaining power with suppliers is generally strong due to its immense scale and market leadership, holding the top spot in major home appliance retail volume for 16 consecutive years. This dominance means many suppliers depend heavily on Haier's orders, limiting their ability to dictate terms and allowing Haier to negotiate aggressively on price.

However, for highly specialized components critical to smart home technology, such as advanced AI chips or unique IoT modules, the bargaining power shifts to the suppliers. The limited availability of these niche inputs means suppliers with unique expertise can exert considerable influence, a factor Haier mitigates through strategic investments and cultivating strong supplier relationships.

Haier's 2024 strategy of increasing localized procurement aims to broaden its supplier base, thereby enhancing access to alternative inputs and reducing reliance on any single supplier, which further dilutes supplier bargaining power for standard components.

| Factor | Haier Smart Home Impact | Supplier Bargaining Power |

| Customer Size & Market Share | Global leader for 16 consecutive years (as of 2023 data) | Low |

| Supplier Dependence | Many suppliers rely heavily on Haier's orders | Low |

| Availability of Substitutes (Standard Components) | Numerous manufacturers for common parts | Low |

| Availability of Substitutes (Specialized Components) | Limited suppliers for advanced tech (e.g., AI chips) | High |

| Switching Costs | High for custom tooling or integrated digital systems | Can be High (for specific relationships) |

What is included in the product

This analysis of Haier Smart Home's competitive landscape reveals the intensity of rivalry, the bargaining power of buyers and suppliers, and the threat of new entrants and substitutes.

Effortlessly assess competitive pressures from rivals and new entrants, allowing Haier to proactively adjust its smart home strategy.

Gain immediate insight into buyer and supplier power, enabling Haier to negotiate favorable terms and mitigate risks in the smart home ecosystem.

Customers Bargaining Power

Customer price sensitivity in the smart home sector remains a significant factor. While consumers appreciate advanced features, the upfront cost of smart appliances can be a deterrent, particularly in price-conscious markets. For instance, a 2024 survey indicated that over 60% of potential smart home buyers cited cost as a primary concern.

Haier Smart Home must navigate this by offering a range of products that cater to different budget levels. The growing demand in emerging economies for energy-efficient and affordable smart appliances underscores this need. This dynamic directly enhances customer bargaining power, pushing Haier to ensure its pricing strategies are competitive and its value propositions are clear and compelling.

Customers in the smart home market face a wealth of alternatives. They can opt for devices from Haier's direct smart home competitors, or they can mix and match traditional appliances with smart devices from entirely different ecosystems. This broad availability of choices significantly amplifies customer bargaining power.

The sheer variety of smart home products means consumers aren't locked into a single brand's ecosystem. They can readily substitute components or entire systems if Haier's offerings don't meet their price or feature expectations. For instance, a customer might find a smart thermostat from Brand X to be more appealing than Haier's, directly impacting Haier's ability to command premium pricing.

Haier's strategic imperative is to build an integrated smart home experience so seamless and valuable that it discourages customers from assembling a patchwork of solutions from various providers. The market for smart home devices is projected to reach over $150 billion globally by 2025, highlighting the vast competitive landscape Haier navigates.

Customers today are incredibly well-informed, thanks to the internet. They can easily access online reviews, compare prices across various brands, and scrutinize detailed product specifications. This wealth of information means they know exactly what they're getting and what a fair price should be, giving them significant leverage.

This transparency directly empowers customers. They can confidently negotiate for better prices or readily switch to a competitor if they feel they aren't getting good value. For instance, in 2024, consumer spending on electronics, a key market for Haier, continued to be influenced by detailed online comparisons and user feedback.

Haier's own digital transformation efforts, including robust digital marketing campaigns, are designed to tap into this empowered customer base. By providing clear product information and engaging directly with consumers online, Haier aims to influence purchasing decisions and build loyalty in a market where customer knowledge is a powerful bargaining tool.

Low Switching Costs for Customers

For many smart home appliances, the cost for a consumer to switch brands is relatively low, particularly for individual, standalone products. This ease of transition directly enhances the bargaining power of customers.

While Haier strives to build a cohesive smart home ecosystem, fragmentation and compatibility challenges between different brands and platforms can hinder a complete system adoption. However, this also means that switching out individual devices remains a straightforward process for consumers, further tipping the scales in their favor.

- Low Switching Costs: For many smart home devices, consumers can easily switch between brands without incurring significant costs or hassle.

- Ecosystem Challenges: While Haier aims for an integrated ecosystem, compatibility issues can make a full switch difficult, but it also simplifies switching individual components.

- Increased Bargaining Power: The ability to easily swap out devices gives customers more leverage when negotiating prices or demanding better features from manufacturers like Haier.

Customer Volume and Concentration

Haier Smart Home reaches an enormous global user base, estimated at over 1 billion families. While individual consumers typically wield little bargaining power, substantial influence can come from large entities like major retailers, distributors, or significant real estate developers. For instance, Haier's 2024 collaboration to integrate smart water heaters into new housing projects in India highlights how bulk purchases by developers can concentrate purchasing power. Haier's strategy of utilizing a wide array of distribution channels helps to dilute the impact of any single large buyer's demands.

Customers today are highly informed, easily comparing prices and product details online, which significantly boosts their bargaining power. This transparency allows them to readily switch to competitors if they perceive better value, a trend evident in 2024 consumer electronics spending where online comparisons heavily influenced decisions.

The low cost of switching individual smart home devices means customers have considerable leverage. Even with Haier's ecosystem efforts, compatibility issues can make replacing single components easy, further empowering consumers to demand competitive pricing and features.

While individual consumers have limited power, large buyers like major retailers or property developers can exert significant influence. For example, bulk purchases for new housing projects in India in 2024 demonstrated this concentrated buying power, though Haier's diverse distribution channels help mitigate the impact of any single large buyer.

| Factor | Impact on Haier | Customer Leverage |

|---|---|---|

| Price Sensitivity | Requires competitive pricing strategies. | High, due to upfront costs of smart tech. |

| Availability of Alternatives | Intensifies competition. | High, due to numerous brands and mixed ecosystems. |

| Customer Information & Transparency | Demands clear value propositions. | High, due to easy access to reviews and price comparisons. |

| Switching Costs | Encourages ecosystem lock-in, but individual device switching is easy. | High, for individual component replacement. |

| Bargaining Power of Large Buyers | Can influence bulk deals. | Significant, through large-scale purchases. |

What You See Is What You Get

Haier Smart Home Porter's Five Forces Analysis

This preview shows the exact Haier Smart Home Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. It delves into the competitive landscape by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry within the smart home industry. This comprehensive document is ready for your immediate use and strategic planning.

Rivalry Among Competitors

The smart home appliance market is intensely competitive and quite fragmented, featuring a broad array of global and regional manufacturers. Haier Smart Home faces formidable competition from major international corporations such as Midea Group, Samsung, LG, Whirlpool, Bosch, and Hisense, alongside specialized smart home technology firms.

This diverse competitive environment, encompassing both established appliance giants and agile tech innovators, significantly heightens the rivalry within the sector. For instance, in 2023, Midea Group reported revenues of approximately $53.5 billion, underscoring the scale of its operations and competitive presence.

The global smart home market is on a strong upward trajectory, with projections indicating it will reach USD 97,066.3 million by 2035, growing at a compound annual growth rate of 8.2% from 2025. This robust expansion, while creating ample room for participants, simultaneously fuels intense competition.

The allure of a rapidly expanding market naturally draws in new players, intensifying the competitive landscape. Existing companies are compelled to ramp up their innovation efforts and aggressively pursue market share, knowing that standing still means falling behind in this dynamic sector.

Haier Smart Home distinguishes itself with a broad smart home ecosystem, integrating IoT and AI solutions like HomeGPT and AI Vision. This focus on connected platforms and personalized living aims to create a unique market position.

However, the competitive landscape is intense, with rivals like Samsung aggressively pursuing AI-driven appliances. This necessitates Haier's ongoing commitment to innovation to sustain its product differentiation and market edge.

Brand Identity and Loyalty

Haier's competitive advantage is significantly bolstered by its robust brand identity and the resulting customer loyalty. The company has consistently been recognized as the No. 1 Major Appliances Brand worldwide for 16 consecutive years, according to Euromonitor. This sustained market leadership underscores a deep-seated trust and preference among consumers.

The company employs a strategic multi-brand approach, encompassing names like Haier, Casarte, GE Appliances, and Fisher & Paykel. This allows Haier to effectively target diverse market segments and cater to a wide array of consumer preferences and price points. For instance, Casarte is positioned as a premium brand, cultivating strong loyalty among affluent customers who value high-end features and design.

- Global Brand Recognition: Haier's status as the top major appliances brand globally for 16 years (Euromonitor) highlights its strong market presence.

- Multi-Brand Strategy: Brands like Haier, Casarte, GE Appliances, and Fisher & Paykel allow for broad market coverage and appeal to various consumer needs.

- Customer Loyalty: Particularly with premium offerings like Casarte, Haier benefits from high customer retention, which mitigates the intensity of competitive rivalry.

Exit Barriers

The home appliance sector, where Haier operates, presents considerable exit barriers due to significant investments in fixed assets, intricate supply chains, and ongoing research and development. These factors make it difficult for companies to simply withdraw from the market.

Consequently, even during periods of economic slowdown, competition remains intense as established players are disinclined to exit. This commitment means companies like Haier are likely to see continued aggressive competition for market share and profitability.

- High Capital Intensity: The home appliance industry requires substantial upfront capital for manufacturing facilities and technology, estimated to be in the billions for global players. For instance, Haier's significant investments in smart manufacturing and R&D underscore this.

- Specialized Assets: Production lines and supply chain networks are often highly specialized for appliance manufacturing, making them difficult and costly to repurpose or sell if a company decides to exit.

- Brand Reputation and Market Share: Companies invest heavily in building brand loyalty and market presence. Abandoning these assets represents a significant loss, discouraging exit. In 2023, Haier maintained a leading position in global major appliance sales, highlighting the value of its established market presence.

Competitive rivalry in the smart home appliance market is fierce, driven by a large number of global and regional players. Haier Smart Home contends with giants like Samsung and LG, as well as specialized tech firms, all vying for market share in a rapidly expanding sector. This intense competition necessitates continuous innovation and strategic differentiation to maintain a competitive edge.

The market's robust growth, projected to reach USD 97,066.3 million by 2035 at an 8.2% CAGR, attracts new entrants and intensifies existing rivalries. Companies must innovate aggressively to capture market share, as stagnation leads to decline. Haier's multi-brand strategy, including Casarte and GE Appliances, allows it to target diverse consumer segments and build loyalty, mitigating some of the competitive pressures.

Haier's consistent recognition as the No. 1 Major Appliances Brand globally for 16 consecutive years (Euromonitor) demonstrates significant customer loyalty and brand strength. However, competitors like Samsung are also heavily investing in AI-driven appliances, ensuring that Haier must maintain its innovation momentum to sustain its market position.

| Competitor | 2023 Revenue (Approx.) | Key Smart Home Focus |

|---|---|---|

| Midea Group | $53.5 billion | Integrated smart home solutions, AI-powered appliances |

| Samsung | $200 billion+ (Group Revenue) | SmartThings ecosystem, AI-driven appliances, connectivity |

| LG | $65 billion+ (Group Revenue) | ThinQ AI platform, connected appliances, smart home integration |

| Haier Smart Home | $32.4 billion (2023) | HomeGPT, AI Vision, broad smart home ecosystem, multi-brand strategy |

SSubstitutes Threaten

Traditional non-smart appliances represent a significant threat of substitution for Haier's smart home offerings. These older, unconnected devices often come with a lower upfront cost, appealing to budget-conscious consumers. For instance, a basic refrigerator might cost significantly less than a smart refrigerator, making it an attractive alternative for those not prioritizing advanced features.

Many consumers still prefer traditional appliances due to their perceived simplicity and reliability, especially if they are hesitant about adopting new technology or concerned about data privacy. A 2024 survey indicated that over 40% of consumers cited ease of use as a primary factor in appliance purchasing decisions, with smart features being a secondary consideration for many.

To counter this threat, Haier needs to effectively communicate the value proposition of its smart home ecosystem. Highlighting tangible benefits like energy efficiency, which can lead to long-term cost savings, and enhanced convenience through remote control and automation, is crucial. For example, smart thermostats can reduce energy consumption by up to 10% annually, a benefit that can offset the initial price difference over time.

Consumers increasingly opt for DIY smart home setups, piecing together devices from different brands. This flexibility allows them to integrate various components, often at a lower cost than a fully branded ecosystem. For instance, by 2024, the global smart home market saw a significant portion of growth driven by individual device sales, allowing users to build personalized systems.

For many of the functions offered by smart home devices, manual or low-tech alternatives persist. For instance, manual cleaning methods can substitute for robotic vacuums, and traditional alarm systems can serve as an alternative to integrated smart security solutions. These simpler options often appeal to consumers prioritizing cost savings and ease of use over advanced features.

Alternative Service Providers

The threat of substitutes for Haier Smart Home’s offerings is present, particularly from independent service providers. Services like energy management or home security, which are integrated into smart home appliances, can be replicated by specialized companies. For example, a dedicated energy auditing firm or a traditional security system installer can provide similar benefits without requiring consumers to invest in smart home technology.

These alternative service providers can pose a challenge by offering focused expertise and potentially lower upfront costs for specific functions. For instance, a standalone smart thermostat company might compete with Haier's integrated climate control features. In 2023, the global smart home market was valued at approximately $100 billion, with a significant portion of this value derived from the convenience and integration of various services.

Haier aims to mitigate this threat through its hOn app and strategic ecosystem partnerships. By integrating a wide array of services and creating a seamless user experience, Haier makes its smart home ecosystem more compelling and harder to replicate with piecemeal solutions. This strategy focuses on providing a holistic value proposition that extends beyond individual appliance functions.

- Alternative Service Providers: Traditional energy auditors and third-party security companies offer services similar to those provided by smart home appliances, but without requiring smart device integration.

- Competitive Landscape: Standalone smart device manufacturers, such as Nest (Google) for thermostats or Ring (Amazon) for security, represent direct substitutes for specific functionalities within Haier's smart home ecosystem.

- Haier's Mitigation Strategy: The hOn app and partnerships are designed to create a comprehensive and integrated smart home experience, thereby increasing customer loyalty and reducing the appeal of substitute services.

- Market Context: The growing smart home market, projected to reach over $200 billion by 2028, highlights the increasing demand for integrated home services, making the threat of substitutes a critical consideration for market share.

Shifting Consumer Priorities

Consumer priorities can indeed shift away from sophisticated smart features towards attributes like extreme durability, ease of repair, or even a return to minimalist, non-connected designs. This shift could diminish the perceived value of Haier's advanced smart home products.

For instance, a growing segment of consumers in 2024 is expressing concerns about the longevity and potential obsolescence of smart technology, favoring appliances built to last and be easily maintained. This trend makes traditional, non-smart appliances more appealing.

- Durability Focus: Consumers increasingly seek appliances with longer lifespans, prioritizing robust build quality over integrated smart functionalities.

- Repairability Trend: The "right to repair" movement is gaining traction, making appliances that are easier and cheaper to fix more attractive than complex smart devices.

- Economic Sensitivity: In periods of economic uncertainty, such as potential slowdowns anticipated in late 2024 and early 2025, consumers often revert to prioritizing essential functionality and lower upfront costs, making basic appliances a more viable substitute.

- Minimalist Appeal: A segment of the market is actively choosing simpler, less connected home environments, viewing smart technology as unnecessary complexity.

Traditional, non-smart appliances remain a significant substitute for Haier Smart Home products, especially for consumers prioritizing lower upfront costs and perceived simplicity. For example, a basic washing machine can be purchased for a fraction of the price of a smart-enabled model, directly appealing to budget-conscious buyers. Many consumers also value the straightforward operation and perceived reliability of older technologies, particularly if they are wary of complex interfaces or data privacy concerns. In 2024, a substantial portion of consumers still cited ease of use as a primary purchasing driver, with smart features often being a secondary consideration.

Furthermore, the rise of DIY smart home solutions and specialized service providers presents another layer of substitution. Consumers can build personalized smart home systems by integrating devices from various brands, often at a more competitive price point than a fully branded ecosystem. This trend was evident in 2024, with significant market growth attributed to individual smart device sales, allowing users to create bespoke setups. For instance, independent companies offering energy management or home security services can provide functionalities similar to those integrated into smart appliances, but without the need for consumers to adopt a full smart home ecosystem.

| Substitute Type | Key Appeal | Example for Haier | Consumer Behavior (2024 Data) | Haier's Counter Strategy |

|---|---|---|---|---|

| Non-Smart Appliances | Lower upfront cost, simplicity | Basic refrigerator vs. Smart refrigerator | 40% prioritize ease of use | Highlight energy savings, convenience |

| DIY Smart Devices | Flexibility, cost-effectiveness | Mixing brands for smart lighting | Growth in individual device sales | Integrated ecosystem via hOn app |

| Specialized Service Providers | Focused expertise, specific function | Independent security installers | Market value of integrated services | Partnerships, holistic value proposition |

Entrants Threaten

Entering the competitive home appliance and smart home market demands significant upfront capital. This includes substantial investment in research and development for innovative products, establishing state-of-the-art manufacturing facilities, building robust global supply chains, and creating widespread distribution and service networks. For instance, setting up a single advanced manufacturing plant for smart appliances can cost hundreds of millions of dollars.

Haier Smart Home, as a leading player, has already made these massive investments, creating a formidable barrier to entry. Their established global production bases and extensive distribution channels, reaching millions of households worldwide, are assets that new competitors would struggle to replicate quickly or affordably. This high capital requirement significantly deters potential new entrants, particularly those lacking substantial financial backing and a long-term strategic vision.

Haier Smart Home benefits from substantial brand loyalty, a result of its four decades of operation and a robust portfolio including Haier, Casarte, and GE Appliances. This established reputation and customer trust present a significant barrier for newcomers aiming to quickly gain market traction.

The smart home sector thrives on sophisticated technologies such as the Internet of Things (IoT), artificial intelligence (AI), and integrated platforms. This technological foundation creates a high barrier to entry for newcomers.

Haier has made substantial investments in research and development, resulting in proprietary advancements like HomeGPT and AI Vision. The company's substantial patent portfolio further solidifies its technological leadership.

Aspiring competitors would need to surmount the considerable hurdle of developing comparable cutting-edge technologies or securing essential intellectual property rights, making it difficult to challenge Haier's established position.

Access to Distribution Channels and Supply Chains

New entrants face significant hurdles in accessing established distribution channels and robust supply chains, a critical barrier for companies like Haier Smart Home. Haier's extensive global presence, bolstered by a vast network of experience stores and franchised outlets, provides unparalleled market reach. This deep penetration makes it incredibly difficult for newcomers to establish a comparable footprint and gain consumer access.

The complexity and scale of Haier Smart Home's supply chain, which involves thousands of suppliers worldwide, present another formidable challenge. Replicating this intricate web of reliable and cost-effective sourcing, especially for the diverse range of smart home products, requires immense capital investment and years of operational experience. Without this established infrastructure, new entrants would likely face higher production costs and potential supply disruptions.

- Established Global Reach: Haier Smart Home operates a vast network of over 10,000 experience stores and franchised outlets globally, providing immediate access to consumers.

- Supply Chain Dependencies: The company partners with thousands of suppliers, ensuring a diverse and resilient supply chain for its wide product portfolio.

- Barriers to Entry: New entrants would need substantial investment to build a comparable distribution network and secure reliable, cost-effective supply chains, a process that typically takes years.

Regulatory Hurdles and Standards

The home appliance and smart home sector is heavily regulated, with stringent rules on safety, energy efficiency, and data privacy varying significantly by country. For instance, in 2024, the European Union continued to enforce its Ecodesign Directive, impacting appliance energy consumption, while the US Cybersecurity and Infrastructure Security Agency (CISA) emphasized data security for connected devices. New companies must invest heavily in compliance and possess specialized knowledge to navigate these diverse requirements, making entry challenging.

These regulatory complexities act as a substantial barrier to entry. New entrants often lack the established infrastructure and expertise to manage compliance across multiple jurisdictions. This can translate into significant upfront costs for product testing, certification, and ongoing legal counsel. For example, achieving UL certification in the United States or CE marking in Europe involves rigorous processes that can delay market entry and drain capital for startups.

- Safety Standards: Compliance with standards like IEC 60335 for household appliances is mandatory.

- Energy Efficiency: Regulations such as Energy Star in the US and EU energy labels require products to meet specific performance benchmarks.

- Data Privacy: Adherence to frameworks like GDPR in Europe and CCPA in California is critical for smart home devices handling personal data.

- Cybersecurity: Growing concerns in 2024 have led to increased scrutiny of device security protocols, demanding robust protection against breaches.

The threat of new entrants for Haier Smart Home is moderate, primarily due to the substantial capital required for R&D, manufacturing, and global distribution. For instance, establishing advanced smart appliance manufacturing can cost hundreds of millions of dollars.

Haier's established brand loyalty, built over four decades, and its portfolio including Haier, Casarte, and GE Appliances, create a significant hurdle for newcomers seeking market traction. Furthermore, the need to develop and integrate sophisticated IoT and AI technologies, as demonstrated by Haier's HomeGPT and AI Vision, presents a high technological barrier.

Accessing Haier's extensive global distribution network, comprising over 10,000 experience stores and franchised outlets, is another major challenge for potential entrants. Replicating Haier's complex supply chain, which involves thousands of suppliers, demands immense capital and years of operational experience.

Navigating diverse and stringent global regulations concerning safety, energy efficiency (e.g., Energy Star, EU Ecodesign), and data privacy (e.g., GDPR, CCPA) further increases the cost and complexity for new companies entering the smart home market.

| Barrier Category | Description | Impact on New Entrants | Example for Haier Smart Home |

|---|---|---|---|

| Capital Requirements | High investment needed for R&D, manufacturing, and distribution. | Deters new entrants without significant financial backing. | Setting up advanced smart appliance manufacturing can cost hundreds of millions of dollars. |

| Brand Loyalty & Reputation | Established trust and recognition from decades of operation. | Makes it difficult for new brands to gain immediate consumer acceptance. | Haier's portfolio includes well-recognized brands like GE Appliances. |

| Technology & Intellectual Property | Need for advanced IoT, AI integration, and proprietary technologies. | Requires substantial R&D investment and patent acquisition. | Haier's investments in HomeGPT and AI Vision, along with a significant patent portfolio. |

| Distribution & Supply Chain | Extensive global networks and complex supplier relationships. | Challenging and costly for new entrants to replicate market reach and sourcing. | Over 10,000 global experience stores and partnerships with thousands of suppliers. |

| Regulatory Compliance | Adherence to varying international safety, efficiency, and data privacy laws. | Adds significant costs and time delays for market entry. | Compliance with EU Ecodesign Directive and US cybersecurity standards for connected devices. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Haier Smart Home leverages data from company annual reports, investor presentations, and industry-specific market research reports. We also incorporate insights from technology trend analyses and consumer electronics market data to provide a comprehensive view of the competitive landscape.