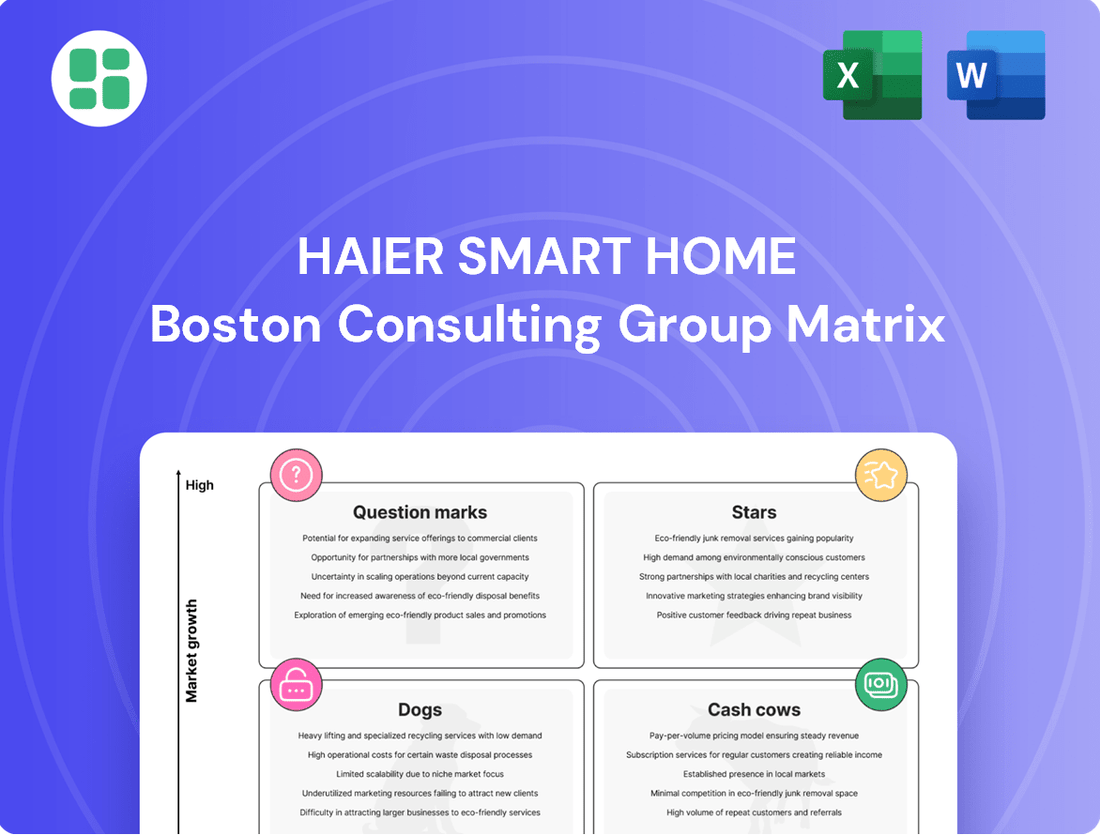

Haier Smart Home Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Haier Smart Home Bundle

Curious about Haier Smart Home's product portfolio performance? This glimpse into their BCG Matrix highlights key areas of opportunity and potential challenges, but imagine the strategic advantage of knowing precisely which products are Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and actionable insights to drive your smart home strategy.

Stars

Haier's Premium Smart Home Ecosystem, powered by the hOn app and AI Vision technology, is a significant growth area. Consumer interest in connected living is surging, driving strong adoption of these integrated solutions. This segment shows high market growth potential as Haier pushes innovation in AI-driven home automation.

Casarte, Haier's luxury appliance brand, shines as a Star in the BCG Matrix, driven by robust growth in China's premium market. Its high-end refrigerators and kitchen appliances, like the Casarte Ultra-realm range hood, have captured significant market share.

In 2024 and early 2025, Casarte experienced substantial volume increases, reflecting strong consumer appetite for its premium offerings. This upward trend in a high-value segment positions Casarte for continued success and investment.

Haier's water purification products are a shining star in its Smart Home portfolio. Retail sales saw an incredible surge of 264% year-over-year in the first quarter of 2025. This remarkable growth is fueled by the introduction of innovative, high-end, and Wi-Fi-enabled devices.

The market for water purification is expanding rapidly, and Haier is capitalizing on this trend. While this segment requires significant investment to maintain its momentum, the potential for substantial future returns is very high.

Emerging Market Expansion

Haier Smart Home's aggressive expansion into high-growth emerging markets positions it firmly in the Stars quadrant of the BCG Matrix. These regions represent significant untapped potential where the company is actively capturing market share through tailored strategies.

- India: Demonstrated robust performance with a 30% revenue growth in 2024, reflecting strong consumer adoption of Haier's smart home solutions.

- Southeast Asia: Achieved a notable 14.75% growth in the first quarter of 2025, underscoring the region's increasing demand for innovative home appliances.

- Middle East & Africa: Posted an impressive 38.25% growth in Q1 2025, highlighting Haier's successful penetration and market leadership in these dynamic economies.

AI-Powered Washing Machines (e.g., Thailand)

Haier's AI-powered washing machines in Thailand exemplify a star product strategy, aiming for significant market share growth in a rapidly expanding segment. This focus is driven by increasing consumer appetite for advanced, connected home appliances.

The smart home market in Southeast Asia, including Thailand, is projected for robust expansion. For instance, the smart home market in Thailand was valued at approximately USD 1.3 billion in 2023 and is expected to grow at a CAGR of over 15% through 2028, according to recent market analyses.

- High Growth Segment: The AI washing machine category is a key driver of this smart home growth.

- Strategic Investment: Haier is channeling resources into this area to capture a larger portion of the market.

- Technological Advancement: Consumer demand for features like AI-driven fabric care and energy efficiency fuels this segment's rise.

- Market Penetration Goal: The objective is to solidify Haier's position as a leader in smart laundry solutions in Thailand.

Haier's premium smart home ecosystem, particularly its AI-powered offerings, represents a significant Star in the BCG Matrix. This segment benefits from high market growth and Haier's strong competitive position. The company's strategic focus on innovation and expanding its connected living solutions is driving substantial adoption and market share gains, positioning these products for continued investment and high returns.

| Product Category | Market Growth | Relative Market Share | BCG Quadrant |

| Premium Smart Home Ecosystem (hOn app, AI Vision) | High | High | Star |

| Casarte Luxury Appliances | High (especially in China) | High | Star |

| Water Purification Products | High | High | Star |

| AI-Powered Washing Machines (Thailand) | High | High | Star |

| Emerging Markets Expansion (India, SEA, MEA) | High | High | Star |

What is included in the product

The Haier Smart Home BCG Matrix analyzes their product portfolio, categorizing smart appliances into Stars, Cash Cows, Question Marks, and Dogs.

This framework guides strategic decisions on investment, divestment, and resource allocation for Haier's smart home offerings.

The Haier Smart Home BCG Matrix offers a clear, one-page overview, simplifying complex business unit analysis for strategic decision-making.

Cash Cows

Haier's global leadership in major appliances, a position held for 16 consecutive years through 2024, signifies a strong Cash Cow. This sustained dominance across refrigerators, laundry, and freezers generates predictable and significant cash flows.

The company's extensive market share in these mature, stable segments provides a reliable source of earnings. This consistent performance allows Haier to fund investments in its other business units and maintain its competitive edge.

Haier's conventional refrigerators and washing machines are robust cash cows, generating substantial profits despite ongoing innovation in smart home technology. These mature product lines benefit from Haier's dominant global market share, estimated to be around 18% in refrigerators and 15% in washing machines as of early 2024. Their established brand loyalty and high market penetration mean they require minimal marketing spend to sustain strong sales and healthy profit margins, effectively funding other ventures within the company.

GE Appliances, now a key part of Haier Smart Home, is a powerhouse in the North American market, significantly boosting Haier's overall revenue. This subsidiary's robust performance reinforces Haier's leadership in the region.

Despite a generally slower demand environment in the appliance sector, GE Appliances continues to be a reliable source of cash for Haier. Its strong brand equity and established market position allow it to generate stable profits, making it a classic cash cow.

In 2023, Haier Smart Home reported that its overseas business, which is heavily influenced by GE Appliances' performance, saw a revenue increase of 9.3% year-on-year, reaching RMB 129.5 billion. This highlights the substantial contribution of GE Appliances to the group's financial strength.

Established China Domestic Market

Haier's dominance in China's domestic market solidifies its position as a Cash Cow. The company holds a leading market share across all key product segments within its home territory.

This mature market is a significant generator of stable and substantial cash flow for Haier. The Chinese government's ongoing support, including trade-in policies, actively stimulates replacement demand, further bolstering this revenue stream.

- Market Leadership: Haier consistently ranks first in China for major home appliance categories.

- Stable Cash Flow: The mature Chinese market provides a reliable and substantial source of income.

- Government Support: Initiatives like trade-in programs boost consumer spending on new appliances.

- 2024 Outlook: Continued economic activity and policy support are expected to maintain strong performance.

Electric Wine Coolers/Chillers

Electric wine coolers and chillers represent a significant Cash Cow for Haier Smart Home. The company has maintained its leadership in this specific market for an impressive 15 consecutive years.

This niche segment, while not experiencing rapid expansion, offers a stable revenue stream. Haier's dominant market share within this low-growth category means the product line consistently generates substantial cash.

The beauty of this position is that these established products require minimal additional investment to sustain their performance. This allows Haier to leverage the profits generated from wine coolers to fund growth initiatives in other business areas.

- Global Leadership: Haier has been the number one global seller of electric wine coolers/chillers for 15 years running.

- Stable Market: The market for these appliances is niche but stable, indicating consistent demand.

- High Market Share: Haier enjoys a commanding share of this market.

- Cash Generation: The product line is a reliable source of cash, needing little reinvestment.

Haier's established product lines, particularly in major appliances like refrigerators and washing machines, function as significant cash cows. These mature segments benefit from Haier's consistent global market leadership, a position maintained for 16 consecutive years through 2024. The substantial and predictable cash flows generated from these high-market-share categories are crucial for funding other strategic initiatives within Haier Smart Home.

GE Appliances, now a vital part of Haier Smart Home, is a prime example of a cash cow, especially within the North American market. Its robust performance in 2023, contributing to a 9.3% year-on-year revenue increase in Haier's overseas business, underscores its role as a stable profit generator. The subsidiary's strong brand equity and established market position ensure consistent cash generation, requiring minimal additional investment to sustain its performance.

Haier's dominance in China's domestic appliance market further solidifies its cash cow status. The company's leading market share across all key product segments in its home territory, supported by government trade-in policies stimulating replacement demand, provides a substantial and reliable source of income. This mature market consistently delivers strong profits, enabling Haier to allocate resources effectively across its diverse business portfolio.

| Business Unit | BCG Category | Key Strengths | Financial Contribution (Illustrative) | Market Maturity |

| Major Appliances (Global) | Cash Cow | 16 consecutive years of global leadership (through 2024), high market share | Significant, predictable cash flow | Mature |

| GE Appliances (North America) | Cash Cow | Strong brand equity, established market position | Substantial revenue contributor (e.g., 9.3% overseas revenue growth in 2023) | Mature |

| Electric Wine Coolers/Chillers (Global) | Cash Cow | 15 consecutive years of global leadership, niche market dominance | Consistent cash generation with low reinvestment needs | Mature |

| Domestic Appliances (China) | Cash Cow | Leading market share across all key segments, government support | Stable and substantial cash flow | Mature |

Preview = Final Product

Haier Smart Home BCG Matrix

The Haier Smart Home BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after your purchase. This means no watermarks, no demo content, and absolutely no surprises – just a professionally designed and analysis-ready report for your strategic planning needs.

Dogs

Legacy non-smart appliances, representing older models without integrated smart capabilities or enhanced energy efficiency, often find themselves in highly commoditized, low-growth market segments. These products typically hold a low market share within their respective categories and contribute very little to a company's overall profitability, potentially immobilizing valuable capital.

For instance, in 2024, the global market for traditional refrigerators, a segment often populated by legacy models, experienced only a modest growth rate of around 1.5%, significantly lagging behind the smart appliance sector. These older units, while still functional, are increasingly being overshadowed by newer, more feature-rich and energy-saving alternatives, pushing them towards a 'dog' classification within a company's product portfolio.

Certain regional product lines within Haier Smart Home might be classified as dogs. For instance, older refrigerator models in emerging markets that haven't been updated to meet local preferences or energy efficiency standards could fall into this category. These products likely face stiff competition from more innovative local brands and generate minimal revenue.

These underperforming segments, such as specific washing machine series in Southeast Asia that have seen declining sales due to intense price competition, are characterized by low market share and low growth prospects. Haier might continue to offer them to maintain a presence, but their contribution to overall profitability is negligible, with 2024 data indicating a continued downward trend in sales for these specific lines.

Outdated small home appliances, those not connected to Haier's smart home network or lagging in innovation, likely reside in the Dogs quadrant of the BCG matrix. These products often face declining demand and struggle to compete with newer, more feature-rich alternatives. For instance, Haier's 2024 strategy emphasizes integrated smart living, suggesting older, standalone appliances would be less of a focus.

Basic Air Conditioning Products (initial entry)

Haier's initial foray into basic air conditioning products faced profitability challenges stemming from a late market entry. In 2024, this segment, characterized by mature and intensely competitive markets, could be categorized as a 'dog' if specific non-premium product lines fail to capture substantial market share or achieve robust profitability before strategic enhancements are implemented.

This situation highlights the difficulties of entering established markets with undifferentiated offerings. For instance, in 2024, the global air conditioning market, valued at approximately $100 billion, saw intense competition from established players, making it difficult for newcomers to gain traction without significant innovation or aggressive pricing strategies.

- Market Share Challenges: Basic AC lines may struggle to gain significant share in highly competitive mature markets.

- Profitability Constraints: Late market entry and intense competition can suppress profitability for initial product offerings.

- Strategic Imperative: Improvements are needed to shift these products from 'dog' status to a more favorable position within the BCG matrix.

Niche, Non-Strategic Product Offerings

Within Haier Smart Home's BCG Matrix, niche, non-strategic product offerings fall into the 'dogs' category. These are products that don't quite fit with the company's main focus on building a cohesive smart home ecosystem or its push towards premiumization. They typically operate in markets that aren't expanding much and have a small slice of that market already.

These 'dog' products might just manage to cover their costs, not really contributing much to Haier's overall strategic goals or future growth prospects. Their limited market share and lack of alignment with the core strategy mean they offer little in terms of competitive advantage or potential for significant returns.

- Low Market Share: Products with a market share below 10% in their respective segments, particularly those outside the core smart home integration.

- Non-Growing Market: Offerings in product categories experiencing less than 2% annual growth, indicating limited future demand.

- Limited Strategic Alignment: Products that do not directly contribute to Haier's stated smart home ecosystem vision or its premium brand positioning.

- Break-Even Financials: Business units that consistently report minimal profits or just cover operational costs, showing no significant return on investment.

Haier's 'dogs' represent underperforming product lines with low market share in low-growth segments, failing to align with its smart home strategy. These often include legacy appliances or niche offerings that barely cover costs. For example, in 2024, older, non-connected kitchen appliances in certain developing markets might fit this description, facing intense competition and minimal consumer demand.

These products are characterized by their inability to generate significant profits or contribute to Haier's competitive advantage. Their continued existence might be for market presence rather than strategic growth, with limited potential for future investment. The company's focus on innovation means these segments are prime candidates for divestment or discontinuation.

In 2024, Haier's strategic shift towards integrated smart living means that standalone, non-smart devices, such as basic blenders or kettles without connectivity, are increasingly being relegated to the 'dog' quadrant. These products operate in mature markets with minimal growth, and their market share is often eroded by more advanced smart alternatives.

These 'dog' products often have a market share below 10% in their respective categories and operate in markets with less than 2% annual growth. Their financial performance typically hovers around break-even, offering little return on investment and not supporting Haier's premium brand positioning or smart ecosystem vision.

| Product Category Example | Market Growth (2024 est.) | Haier Market Share (est.) | Strategic Fit | Profitability |

|---|---|---|---|---|

| Legacy Non-Smart Refrigerators | 1.5% | Low | Poor | Break-even/Loss |

| Basic Standalone Blenders | 1.0% | Below 5% | Poor | Minimal Profit |

| Older Washing Machine Series (Specific Regions) | 0.5% | Low | Poor | Declining |

Question Marks

Haier's acquisition of Carrier's commercial refrigeration business in October 2024 places this segment firmly in the question mark category of the BCG Matrix. This strategic move introduces Haier to a new, potentially lucrative market, but its current standing within this specialized niche is still developing.

While the acquisition signals Haier's ambition for growth in commercial refrigeration, the company's market share and profitability in this segment are nascent. Significant investment will be necessary to establish a strong foothold and capitalize on the growth potential, making it a key area to monitor for future performance.

Haier's pursuit of home service robots and AI vision technology for its smart home ecosystem places it squarely in the question mark category of the BCG matrix. These segments represent significant future growth potential, but their market penetration and Haier's competitive standing are still in formative stages.

The global market for service robots, including domestic robots, was projected to reach approximately $19 billion in 2024, with AI vision being a critical enabler for enhanced functionality and user interaction. However, widespread consumer adoption of advanced home service robots remains a hurdle, necessitating continued innovation and strategic market development by companies like Haier.

Haier's Smart Building Solutions, particularly in areas beyond their magnetic levitation systems, represent a significant growth opportunity. In 2024, this segment saw a robust 15% revenue increase, indicating strong market traction. However, the overall smart building solutions market is expanding rapidly, and Haier's current market share in this broader landscape may still be modest, positioning it as a question mark within the BCG matrix.

Advanced Water Heaters (Smart/IoT enabled)

Haier's advanced water heaters, featuring smart and IoT capabilities, along with high-end condensing gas boilers, represent potential question marks within the BCG matrix. While the overall water heater market is expanding, these premium, technologically advanced products are relatively new, and their long-term market dominance is yet to be solidified.

These innovative products are positioned in a growing market segment, indicating potential for future growth. However, their current market share is still being established, necessitating ongoing investment in marketing and consumer education to drive adoption. For instance, the smart home appliance market, which includes advanced water heaters, saw significant growth in 2024, with projections indicating continued upward trends.

- Market Growth: The global smart home market, a key indicator for IoT-enabled appliances, was projected to reach over $150 billion in 2024, with water heating solutions being a significant component.

- New Product Launches: Haier's strategy of introducing high-end, IoT-enabled water heaters and condensing gas boilers targets a premium segment with high growth potential.

- Market Share Uncertainty: Despite market growth, the long-term market share for these specific advanced products remains uncertain, requiring strategic efforts to capture and maintain customer loyalty.

- Investment Needs: Continued investment in research and development, alongside targeted marketing campaigns, will be crucial for these question mark products to transition into stars.

Entry into New Regional Markets

Haier's expansion into nascent or underdeveloped regional markets, where its brand recognition and market share are minimal, would represent question marks. These ventures, while offering significant long-term growth prospects, demand substantial upfront investment in marketing, distribution, and localized product development, carrying a higher risk of failure compared to established markets.

For instance, Haier's strategic entry into certain African sub-regions or specific emerging markets in Southeast Asia, where competition might be less intense but consumer purchasing power and infrastructure are still developing, could be categorized as question marks. The success of these entries hinges on effectively navigating local regulations, consumer preferences, and building a robust supply chain from the ground up.

- New Market Entry Risk: Haier's push into markets with low brand penetration requires significant capital for brand building and market development, creating uncertainty about return on investment.

- High Growth Potential: These regions often exhibit rapid economic growth and a burgeoning middle class, presenting substantial long-term revenue opportunities if Haier can successfully capture market share.

- Investment Intensity: Establishing a presence in new territories necessitates considerable investment in local manufacturing, distribution networks, and marketing campaigns, reflecting the high resource commitment of question mark strategies.

- Example: While Haier has made strides in Africa, a hypothetical entry into a very new, smaller market segment within a less developed African nation would exemplify a question mark, needing careful evaluation of its potential to become a star or cash cow.

Haier's investments in emerging technologies like AI-powered home diagnostics and advanced robotics for elder care represent significant question marks. These areas hold immense future potential, with the global AI in healthcare market alone projected to grow substantially, but their current market adoption and Haier's competitive position require careful observation.

The company's strategic focus on expanding its electric vehicle charging infrastructure solutions also falls into the question mark category. While the EV market is booming, with charging infrastructure being a critical enabler, Haier's specific market share and profitability in this nascent sector are still being determined, demanding substantial investment to establish dominance.

Haier's foray into the specialized market of smart agricultural solutions, leveraging IoT for precision farming, is another key question mark. The agricultural technology sector is experiencing rapid innovation and growth, with global investments in AgriTech reaching tens of billions annually by 2024, yet Haier's penetration and success in this niche are still in early stages.

These ventures, while promising, require significant capital for research, development, and market penetration. Their success hinges on factors like technological advancements, consumer acceptance, and competitive responses, making them prime candidates for the question mark quadrant, needing strategic nurturing to potentially become future stars.

| Haier Smart Home Business Segment | BCG Matrix Category | Rationale | Market Growth Potential | Haier's Current Standing |

|---|---|---|---|---|

| Commercial Refrigeration (Post-Carrier Acquisition) | Question Mark | New market entry, requires investment to build share and profitability. | Strong, driven by demand for energy-efficient solutions. | Nascent, developing market presence. |

| Home Service Robots & AI Vision | Question Mark | High potential but nascent adoption; requires innovation and market development. | Projected significant growth, enabled by AI advancements. | Formative stages, building competitive edge. |

| Smart Building Solutions (Broader Segments) | Question Mark | Expanding market; Haier's share in the overall landscape is still moderate. | Robust 15% revenue increase in 2024 for specific areas, indicating strong traction. | Modest in the broader market, needs strategic expansion. |

| Advanced Water Heaters & Condensing Boilers | Question Mark | Premium, IoT-enabled products in a growing segment, but long-term dominance is unproven. | Smart home appliance market growing rapidly; water heating is a key component. | Market share still being established; requires marketing investment. |

| Emerging Regional Markets Entry | Question Mark | Low brand recognition and minimal market share necessitate substantial investment and carry higher risk. | Significant long-term growth prospects due to economic development. | Minimal to developing, requires localized strategies. |

| AI Home Diagnostics & Elder Care Robotics | Question Mark | High future potential in growing health-tech and robotics sectors. | AI in healthcare market substantial and growing; robotics for elder care also expanding. | Early stage, dependent on technological maturity and acceptance. |

| EV Charging Infrastructure Solutions | Question Mark | Booming EV market, but Haier's specific share in charging solutions is still developing. | Critical enabler for the rapidly expanding electric vehicle market. | Nascent, requires strategic investment for market capture. |

| Smart Agricultural Solutions | Question Mark | Niche but rapidly growing AgriTech sector; Haier's penetration is early. | Tens of billions invested globally in AgriTech by 2024, indicating strong growth. | Early stages, building presence and product offering. |

BCG Matrix Data Sources

Our Haier Smart Home BCG Matrix leverages official company financial reports, market research data on smart home device sales, and industry growth forecasts.