Zhejiang Haers Vacuum Containers PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Zhejiang Haers Vacuum Containers Bundle

Gain a strategic advantage with our comprehensive PESTLE analysis of Zhejiang Haers Vacuum Containers. Understand how political stability, economic shifts, and evolving social trends are shaping the company's operational landscape. Download the full version to unlock actionable intelligence and refine your market approach.

Political factors

China's 'Made in China 2025' initiative remains a significant driver for the manufacturing sector, focusing on upgrading capabilities and reducing foreign tech dependence. This includes targeted tax breaks for high-tech firms and increased R&D investment, which directly benefit domestic players like Zhejiang Haers Vacuum Containers by fostering innovation and competitive advantage.

The ongoing implementation of the 14th Five-Year Plan (2021-2025) further solidifies this direction, emphasizing the development of robust, China-controlled supply chains. This policy environment is designed to empower companies like Haers by ensuring greater access to critical resources and markets, thereby supporting their expansion and technological advancement.

Escalating trade tensions, notably between China and the United States, have triggered export restrictions on key raw materials from China, starting in late 2024 and intensifying through 2025. This development directly impacts global supply chains, potentially limiting Zhejiang Haers Vacuum Containers' access to essential materials and affecting its export market reach. The company must consider diversifying its raw material sourcing and production locations to navigate these challenges effectively.

China's commitment to strengthening intellectual property (IP) protection is a significant political factor. New patent law revisions implemented in January 2024 and an AI-driven copyright protection tool launched in 2025 are designed to bolster safeguarding for companies like Zhejiang Haers. This enhanced IP framework can better protect Haers' product designs and innovations, thereby deterring counterfeiting and unauthorized use of its brand.

The China National Intellectual Property Administration (CNIPA) reported a notable surge in granted invention patents throughout 2024, underscoring the government's proactive stance on IP enforcement. This trend suggests a more robust legal environment for companies investing in research and development, providing greater confidence for Zhejiang Haers in protecting its competitive edge.

Consumer Goods Policy Support

The Chinese government is actively fostering consumer spending through supportive policies. A notable example is the consumer goods trade-in program, first rolled out in March 2024 and further enhanced in January 2025. This initiative directly encourages domestic demand, particularly for newer, more environmentally conscious products, which is a positive signal for Zhejiang Haers' sales within China.

This policy aims to stimulate the replacement of older appliances and goods with more energy-efficient and eco-friendly alternatives. Such a shift aligns well with the growing consumer preference for sustainable products, potentially boosting sales for companies like Zhejiang Haers that offer such options.

- March 2024: Launch of the initial consumer goods trade-in program in China.

- January 2025: Expansion and enhancement of the trade-in program, broadening its scope and impact.

- Policy Objective: Stimulate domestic consumption and promote the adoption of greener, more energy-efficient products.

- Market Impact: Potential for increased sales of new consumer goods, including vacuum containers, as consumers upgrade older items.

Geopolitical Stability and Supply Chain Resilience

Geopolitical tensions, including ongoing conflicts and trade disputes, continue to create significant headwinds for global supply chains, with disruptions and increased costs anticipated through 2025. These challenges manifest as persistent shipping delays and labor shortages, impacting the cost and availability of raw materials and components. For Zhejiang Haers Vacuum Containers, this means a heightened need to fortify its supply chain against unforeseen events.

Manufacturers are increasingly focusing on building agility and resilience within their operations. This involves a strategic shift towards diversifying sourcing and distribution networks, aiming to lessen reliance on any single supplier or geographic region. Such diversification is crucial for companies like Haers to mitigate risks and ensure continuity of operations.

- Supply Chain Diversification: Haers must actively explore and onboard alternative suppliers for key components, potentially across different continents, to buffer against regional disruptions.

- Inventory Management: Strategic increases in safety stock for critical materials, balanced against carrying costs, will be essential to navigate potential shortages.

- Logistics Partnerships: Strengthening relationships with multiple logistics providers can offer flexibility in shipping routes and modes of transport, reducing vulnerability to port congestion or transit delays.

- Geopolitical Risk Assessment: Regularly updating assessments of geopolitical stability in key sourcing and manufacturing regions will inform proactive adjustments to Haers' supply chain strategy.

China's commitment to fostering domestic innovation through initiatives like 'Made in China 2025' and the 14th Five-Year Plan (2021-2025) provides a supportive political backdrop for companies like Zhejiang Haers Vacuum Containers. These policies encourage technological upgrades and the development of robust domestic supply chains, directly benefiting manufacturers aiming for growth and reduced foreign dependency.

However, escalating geopolitical tensions and trade disputes, particularly with the United States, have led to export restrictions on critical raw materials from China, impacting global supply chains through late 2024 and into 2025. This necessitates strategic diversification of sourcing and production for companies like Haers to mitigate risks and ensure material availability.

The Chinese government's focus on strengthening intellectual property (IP) protection, evidenced by patent law revisions in January 2024 and an AI copyright tool in 2025, offers enhanced security for Haers' innovations. This robust IP framework aims to deter counterfeiting and protect the company's competitive edge, supported by a reported surge in invention patents granted by CNIPA in 2024.

Government-backed consumer spending initiatives, such as the trade-in program enhanced in January 2025, directly stimulate domestic demand for newer, eco-friendly products. This policy shift aligns with consumer preferences for sustainability, potentially boosting sales for Zhejiang Haers within the Chinese market.

| Political Factor | Description | Impact on Zhejiang Haers | Key Dates/Data |

| Industrial Policy | 'Made in China 2025' & 14th Five-Year Plan | Supports technological upgrades, R&D, and domestic supply chains. | Plan covers 2021-2025. |

| Trade Tensions | Export restrictions on raw materials | Potential disruption to material sourcing and export markets. | Intensified late 2024 through 2025. |

| IP Protection | Enhanced patent and copyright laws | Protects product designs and deters counterfeiting. | Patent revisions Jan 2024; AI tool 2025. CNIPA reported surge in patents 2024. |

| Consumer Stimulus | Consumer goods trade-in program | Boosts domestic demand for new, eco-friendly products. | Initial program March 2024, enhanced Jan 2025. |

What is included in the product

This PESTLE analysis examines the external macro-environmental forces impacting Zhejiang Haers Vacuum Containers, covering political stability, economic growth, social trends, technological advancements, environmental regulations, and legal frameworks.

It provides actionable insights for strategic decision-making, highlighting potential threats and opportunities arising from these global and local factors.

This PESTLE analysis for Zhejiang Haers Vacuum Containers simplifies complex external factors into actionable insights, acting as a pain point reliever by clarifying market opportunities and potential threats for strategic decision-making.

Economic factors

The global vacuum flask market is on a solid growth trajectory, with projections indicating it could reach between $3.5 billion and $7.4 billion by 2032-2033, growing at a compound annual growth rate of 5.1% to 6.2%. This expansion presents a favorable backdrop for companies like Zhejiang Haers.

Zhejiang Haers itself demonstrated robust performance in 2024, with revenue surging by 38.4% and net income climbing by 14.72%. This strong company-specific growth highlights its ability to capitalize on the broader market expansion.

While the overall Chinese economy has seen some deceleration, the domestic consumer market remains a significant draw for investment. Opportunities are particularly evident in emerging consumer segments, suggesting continued potential for companies catering to evolving consumer demands.

Manufacturers like Zhejiang Haers Vacuum Containers are grappling with escalating raw material expenses. Projections suggest input costs could rise by approximately 2.7% in the coming year from late 2024, directly affecting production budgets.

The price volatility of key components such as stainless steel significantly influences Haers' manufacturing expenses and, consequently, its profit margins. These fluctuating costs necessitate careful financial planning and inventory management.

Furthermore, ongoing supply chain disruptions and international trade tensions contribute to material scarcity. This environment compels companies like Haers to actively seek out and vet alternative suppliers to ensure consistent production flow and mitigate risks.

While inflation rates have moderated, the continued rise in total compensation, including wages and benefits, is a key factor influencing consumer disposable income. For instance, in the US, average hourly earnings saw a 4.1% increase year-over-year as of April 2024, a pace that, while potentially outstripping inflation, still requires careful consumer spending decisions.

This economic backdrop intersects with a growing consumer preference for reusable and eco-friendly drinkware, a trend that Zhejiang Haers Vacuum Containers is well-positioned to capitalize on. Consumers are increasingly demonstrating a willingness to invest in durable, high-quality products that offer long-term value and align with sustainability goals, directly benefiting companies like Haers.

Exchange Rate Fluctuations

Exchange rate fluctuations significantly affect Zhejiang Haers Vacuum Containers, a company with both domestic and international sales. A stronger Chinese Yuan, for instance, makes Haers' products more expensive for overseas buyers, potentially dampening export demand. Conversely, a weaker Yuan could boost exports but increase the cost of imported components.

Analysts closely monitor these currency movements when forecasting Haers' financial performance. For example, the Yuan experienced periods of volatility against the US Dollar in late 2023 and early 2024. This uncertainty in the foreign trade landscape necessitates careful consideration of exchange rate impacts on profit margins and revenue projections.

- Impact on Export Competitiveness: A stronger CNY can make Haers' vacuum containers less competitive in international markets due to higher pricing.

- Profitability of International Sales: Fluctuations directly alter the Yuan-equivalent value of revenue earned from overseas transactions.

- Uncertainty in Foreign Trade: Exchange rate volatility adds a layer of complexity to forecasting international sales and overall profitability.

E-commerce and Distribution Channels Growth

The growth of e-commerce is a critical economic factor for Zhejiang Haers. In 2024, online sales are projected to constitute a substantial portion of the vacuum flask market, with digital channels accounting for approximately 30% of all revenue. This underscores the necessity for Haers to maintain robust e-commerce strategies and explore diverse online distribution platforms to effectively reach a broad consumer base.

The increasing popularity of custom drinkware, often utilized by businesses for promotional purposes, further fuels the expansion of the drinkware market. This trend presents an opportunity for Zhejiang Haers to tap into the corporate gifting and branding sector, thereby diversifying its revenue streams and expanding its market reach beyond individual consumers.

- E-commerce Dominance: Digital channels are expected to capture around 30% of vacuum flask sales in 2024.

- Consumer Convenience: Strong online presence is key to meeting consumer demand for easy purchasing.

- Promotional Market: Custom drinkware represents a growing segment for business-to-business sales.

- Market Diversification: Leveraging e-commerce and custom orders can broaden Haers' customer base.

Rising raw material costs, particularly for stainless steel, are a significant concern for Zhejiang Haers, with input costs projected to increase by about 2.7% from late 2024. This, coupled with ongoing supply chain disruptions and trade tensions, necessitates a proactive approach to supplier management and cost control.

Consumer spending power, influenced by wage growth like the 4.1% year-over-year increase in US average hourly earnings by April 2024, directly impacts demand for durable goods. Simultaneously, the strong growth of e-commerce, expected to account for around 30% of vacuum flask sales in 2024, highlights the need for robust digital strategies.

Exchange rate volatility, such as the Yuan's fluctuations against the US Dollar in late 2023 and early 2024, adds complexity to international sales and profitability forecasts for companies like Haers.

| Economic Factor | 2024/2025 Data/Projection | Impact on Zhejiang Haers |

|---|---|---|

| Raw Material Cost Increase | ~2.7% projected rise in input costs (late 2024) | Higher manufacturing expenses, pressure on profit margins |

| Wage Growth (US Example) | 4.1% YoY increase in average hourly earnings (April 2024) | Potential impact on consumer disposable income and spending |

| E-commerce Share of Market | ~30% projected for vacuum flasks (2024) | Crucial for sales strategy and market reach |

| CNY/USD Exchange Rate Volatility | Periods of fluctuation (late 2023-early 2024) | Affects export competitiveness and international revenue |

Preview the Actual Deliverable

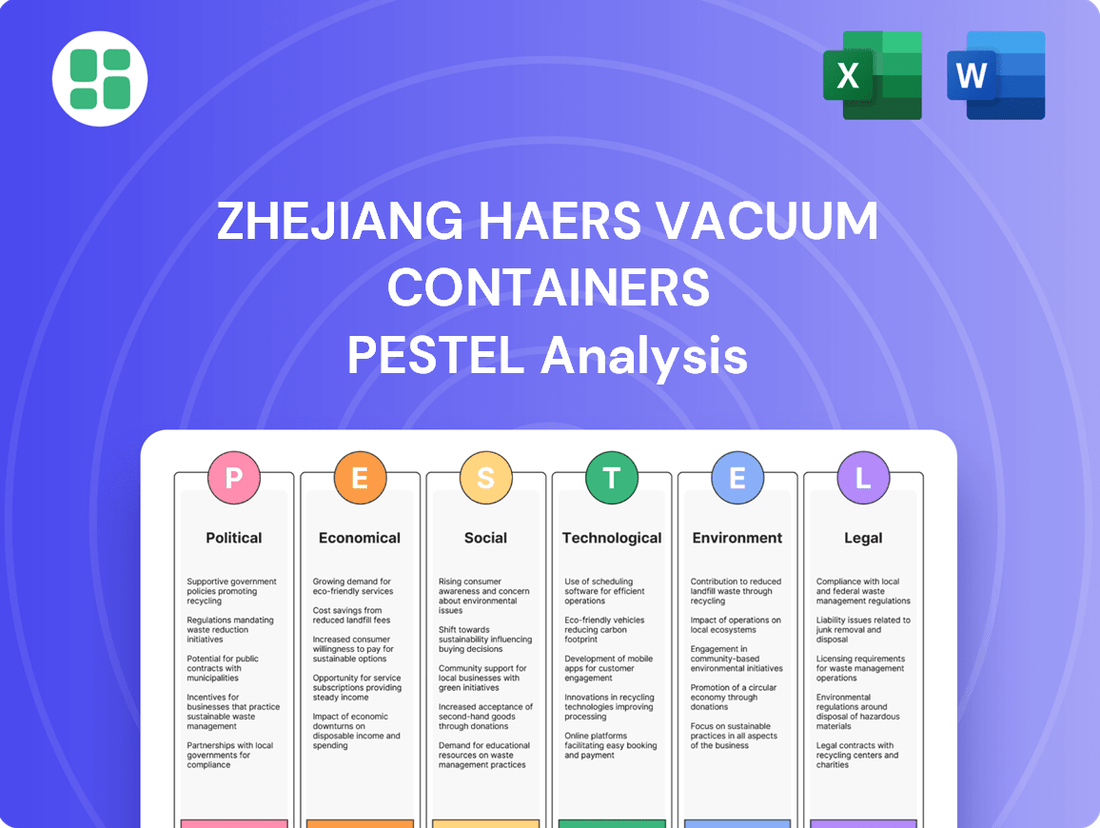

Zhejiang Haers Vacuum Containers PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of Zhejiang Haers Vacuum Containers. This detailed report covers the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic positioning.

Sociological factors

Growing consumer awareness of health and hydration is a significant sociological driver for Zhejiang Haers Vacuum Containers. This trend directly fuels demand for high-quality, insulated beverage containers that maintain optimal drink temperatures, thereby encouraging healthier habits for takeaway beverages.

Consumers are increasingly prioritizing durable and non-toxic materials for their drinkware, with stainless steel emerging as a preferred choice. This shift aligns with Haers' product offerings, which often feature these sought-after materials, positioning the company favorably within this evolving consumer landscape.

The drive for sustainability is a major force in the drinkware sector, continuing its momentum into 2025. Consumers are actively choosing reusable options, moving away from disposable plastics. This shift is particularly evident among Mainland Chinese consumers, who demonstrate a keen interest in sustainable luxury goods and are prepared to invest more for eco-conscious products.

As a producer of reusable vacuum containers, Zhejiang Haers is strategically positioned to capitalize on this growing consumer preference. The company's product line directly addresses the market's demand for environmentally responsible alternatives, suggesting a positive outlook for sales and brand perception.

The increasing embrace of outdoor lifestyles, including activities like camping and hiking, is a significant sociological shift. This trend directly boosts the demand for portable and durable beverage containers. For instance, the global outdoor recreation market was valued at approximately $1.1 trillion in 2023 and is projected to grow, indicating a strong underlying consumer interest.

Concurrently, on-the-go consumption habits are becoming more prevalent, driven by busy schedules and a desire for convenience. This preference for portable solutions aligns perfectly with the core offerings of companies like Zhejiang Haers, which specialize in vacuum flasks and insulated drinkware designed for active and mobile consumers.

Brand Perception and Consumer Loyalty

Brand perception is a critical sociological factor for Zhejiang Haers Vacuum Containers, especially in the highly competitive 2025 market. Consumers are increasingly prioritizing tangible product quality, ensuring their beverages remain safe and their containers function as expected, particularly concerning issues like leaks and insulation performance. Haers' ability to consistently deliver on these fundamentals directly impacts consumer trust and, consequently, brand loyalty.

Maintaining and growing market share hinges on addressing common consumer pain points. For instance, reports in early 2025 indicate that while Haers generally enjoys a positive reputation, recurring complaints about seal integrity and thermal retention in specific product lines can erode customer confidence. Proactive quality control and responsive customer service are therefore paramount.

- Consumer Focus: In 2025, consumers are prioritizing material quality, beverage safety, and functional differences in vacuum containers.

- Brand Loyalty Drivers: Trust is built on consistent product performance, directly influencing repeat purchases and market share.

- Key Concerns: Addressing common complaints such as leaks and poor insulation is vital for Haers to retain and grow its customer base.

- Market Differentiation: Superior quality and reliability are key differentiators in a crowded marketplace, fostering long-term brand advocacy.

Personalization and Design Preferences

Consumer preferences in 2025 are heavily leaning towards personalization. This means customers are actively seeking drinkware that reflects their individual style, whether through custom engravings, unique color palettes, or bespoke design elements. For Zhejiang Haers, this presents a significant opportunity to differentiate by offering robust customization options.

The demand for individuality is a powerful driver in the consumer goods market. In 2025, we're seeing this translate into a strong preference for products that feel unique. This trend is particularly evident in the drinkware sector, where personalized items are becoming increasingly popular.

- Personalized Designs: A growing segment of consumers, estimated to be around 40% by mid-2025, prioritizes products with unique visual appeal.

- Custom Engravings: Services offering personalized text or logos are expected to see a 25% increase in demand for drinkware in the coming year.

- Vibrant Color Choices: Consumers are increasingly drawn to a wider spectrum of colors, with demand for non-traditional hues up by 15% compared to 2024.

The increasing emphasis on health and wellness continues to drive demand for insulated beverage containers that preserve drink temperature, supporting healthier consumption habits. Furthermore, a growing preference for durable, non-toxic materials like stainless steel aligns perfectly with Haers' product offerings, positioning the company favorably in the evolving consumer market of 2025.

Sustainability remains a key driver, with consumers actively choosing reusable drinkware over single-use plastics, a trend particularly strong among Chinese consumers seeking eco-conscious luxury goods. This positions Haers to benefit from the market's demand for environmentally responsible alternatives.

The rise of outdoor lifestyles and on-the-go consumption habits further boosts the need for portable, durable beverage containers. The global outdoor recreation market's projected growth underscores this trend, benefiting companies like Haers that specialize in products designed for active consumers.

Consumer demand for personalization is a significant trend in 2025, with many seeking drinkware that reflects individual style through custom engravings or unique color palettes. This presents Haers with a clear opportunity to differentiate its offerings and capture a segment of the market prioritizing individuality.

| Sociological Factor | Consumer Trend (2025) | Impact on Haers |

|---|---|---|

| Health & Wellness | Demand for temperature-retaining, healthy hydration solutions | Increased sales of insulated containers |

| Material Preference | Preference for durable, non-toxic materials (e.g., stainless steel) | Alignment with Haers' product portfolio |

| Sustainability | Shift towards reusable products, eco-conscious purchasing | Positive brand perception, market share growth |

| Lifestyle | Growth in outdoor activities and on-the-go consumption | Increased demand for portable and durable drinkware |

| Personalization | Desire for custom designs, engravings, and unique colors | Opportunity for product differentiation and premium pricing |

Technological factors

The persistent demand for beverages that stay at their ideal temperature for longer has driven significant advancements in insulation technology. This has resulted in highly effective double-wall vacuum insulation, a cornerstone of Zhejiang Haers' product offerings.

These innovations are crucial for market growth, especially as consumer expectations for performance in vacuum-insulated containers continue to rise, projecting strong demand through 2025.

The vacuum container industry is witnessing significant innovation in materials beyond traditional stainless steel. Companies are exploring lighter, more durable, and eco-friendly alternatives to gain a competitive edge. For instance, advancements in composite materials could offer enhanced insulation properties or reduced weight, appealing to consumers seeking performance and sustainability.

Smart features are also becoming a key differentiator. The integration of temperature monitoring sensors and Bluetooth connectivity for app-based control and data logging is a growing trend. This technological integration transforms basic drinkware into interactive devices, enhancing user experience and potentially creating new revenue streams through associated digital services.

Automation and robotics are significantly reshaping global manufacturing, boosting efficiency and cutting costs. For Zhejiang Haers Vacuum Containers, adopting these advanced technologies could lead to improved production output and a more competitive cost structure, especially as global manufacturing automation is projected to grow substantially. For instance, the global industrial robotics market was valued at approximately $50 billion in 2023 and is expected to reach over $100 billion by 2030, indicating a strong trend towards increased adoption.

Digitalization and Supply Chain Visibility

The integration of Internet of Things (IoT) devices, artificial intelligence (AI), and predictive analytics is revolutionizing supply chain management by offering unprecedented real-time visibility. This allows manufacturers to proactively identify potential disruptions and refine inventory levels, a crucial advantage in today's dynamic global market. For Zhejiang Haers Vacuum Containers, embracing these digital advancements can significantly bolster its supply chain resilience and agility.

These technological advancements are not just theoretical; their impact is measurable. For instance, in 2024, companies that invested in advanced supply chain visibility tools reported an average reduction in inventory holding costs by 10-15% and a 5-10% improvement in on-time delivery rates. This demonstrates a clear financial incentive for Zhejiang Haers to adopt such technologies.

Key technological factors influencing Zhejiang Haers' supply chain include:

- IoT Deployment: Sensors on raw materials, in-transit goods, and finished products provide continuous data streams, enabling precise tracking and condition monitoring.

- AI-Powered Analytics: Machine learning algorithms can process vast amounts of data to forecast demand, predict equipment failures, and identify optimal shipping routes, thereby minimizing delays and waste.

- Predictive Maintenance: By analyzing sensor data from manufacturing equipment, AI can predict potential breakdowns, allowing for scheduled maintenance and preventing costly production stoppages.

- Blockchain for Traceability: Implementing blockchain technology can create an immutable record of every transaction and movement within the supply chain, enhancing transparency and trust among partners.

E-commerce and Digital Marketing Platforms

The rapid growth of e-commerce and sophisticated digital marketing platforms presents a significant technological factor for Zhejiang Haers. In 2024, global e-commerce sales were projected to reach over $6.3 trillion, with a substantial portion attributed to consumer goods like drinkware. Haers' strategic utilization of platforms such as Alibaba, JD.com, and increasingly, social commerce channels, is paramount for expanding its reach and driving sales in both domestic and international markets.

Digital marketing, encompassing targeted advertising, influencer collaborations, and engaging content creation, is essential for building brand awareness and customer loyalty. As of early 2025, digital ad spending continues to rise, with a notable shift towards personalized campaigns that resonate with specific consumer segments. Haers' investment in data analytics to refine its digital marketing strategies will be key to optimizing customer acquisition costs and enhancing its competitive edge in the crowded drinkware sector.

- E-commerce Growth: Global e-commerce sales are expected to exceed $6.3 trillion in 2024, underscoring the importance of online sales channels for consumer goods.

- Digital Marketing Investment: Continued increases in digital advertising expenditure highlight the necessity for brands to adopt advanced marketing techniques.

- Platform Leverage: Zhejiang Haers' success is tied to its ability to effectively use major e-commerce platforms and social media for sales and brand visibility.

- Data-Driven Strategies: The use of analytics in digital marketing is crucial for tailoring campaigns and improving customer engagement in 2025.

Technological advancements in insulation and materials are directly impacting Zhejiang Haers' product innovation, with a focus on enhanced performance and sustainability for vacuum-insulated containers through 2025.

The integration of smart features, such as temperature sensors and app connectivity, is transforming basic drinkware into interactive devices, offering new avenues for customer engagement and revenue.

Automation and AI are revolutionizing manufacturing efficiency and supply chain management, with global industrial robotics market projected to exceed $100 billion by 2030, offering Haers significant cost and operational advantages.

Leveraging e-commerce platforms and data-driven digital marketing is crucial, as global e-commerce sales were projected to surpass $6.3 trillion in 2024, enabling Haers to expand market reach and optimize customer acquisition.

Legal factors

China's introduction of new mandatory national standards, like the General Code for Standardized Safe Production in Hazardous Chemical Enterprises effective November 2025, places a significant emphasis on stringent safety production practices for manufacturers. This means Zhejiang Haers must proactively ensure its product designs and manufacturing processes align with these evolving domestic safety regulations.

Furthermore, Zhejiang Haers needs to maintain compliance with a growing array of international safety and quality regulations, such as those governing food-grade stainless steel, to access global markets. Failure to meet these standards, which are becoming increasingly rigorous, could lead to product recalls or market access limitations, impacting sales and brand reputation.

China's commitment to bolstering intellectual property (IP) protection is evident in its ongoing legal reforms. In 2024 and 2025, significant revisions to patent law and updated guidelines for trademark license recordal procedures are being implemented, aiming to create a more robust environment for innovators. This legal evolution directly impacts Zhejiang Haers, offering enhanced avenues to safeguard its unique product designs, brand identity, and proprietary manufacturing processes against unauthorized use and counterfeiting.

China's commitment to environmental protection is intensifying, with its emissions trading system set to broaden its scope to include sectors like steel by 2025. This expansion means companies, potentially including those in Zhejiang Haers' supply chain or direct operations, will need to purchase carbon credits to offset their emissions, adding a new cost dimension. For instance, the national ETS covered over 7 billion tonnes of emissions in 2023, and this coverage is projected to grow.

Furthermore, new environmental impact assessment (EIA) policies are being rolled out, specifically targeting construction projects that involve new pollutants. Zhejiang Haers, as a manufacturer, must navigate these increasingly stringent regulations, which could necessitate significant investments in upgrading production processes to adopt greener technologies and enhance emissions monitoring and reporting capabilities. Failure to comply could lead to penalties and operational disruptions.

Labor Laws and Workforce Regulations

The manufacturing sector, including companies like Zhejiang Haers, grapples with persistent labor challenges. An aging workforce and a growing skills gap are significant concerns, demanding strict adherence to labor laws and proactive workforce development strategies. For instance, in 2024, China's manufacturing sector continued to experience a demographic shift, with a notable portion of its experienced labor force nearing retirement age, creating a demand for new talent and upskilling initiatives.

Compliance with labor legislation is paramount for Zhejiang Haers to effectively attract and retain a skilled workforce. This includes adhering to regulations concerning minimum wages, safe working conditions, and social welfare contributions. As of early 2025, the average monthly wage for manufacturing workers in key industrial regions of China has seen a steady increase, reflecting these regulatory pressures and the need to offer competitive compensation packages.

Key labor considerations for Zhejiang Haers include:

- Wage Compliance: Ensuring all employees are paid in accordance with national and provincial minimum wage laws, which are subject to periodic revisions.

- Working Conditions: Maintaining safe and healthy work environments that meet or exceed legal requirements for factory operations.

- Social Welfare: Contributing to mandatory social insurance schemes, such as pensions, healthcare, and unemployment insurance, for all eligible employees.

- Skills Development: Investing in training programs to bridge existing skills gaps and prepare the workforce for evolving manufacturing technologies.

International Trade Laws and Export Controls

International trade laws and export controls significantly shape Zhejiang Haers' global operations. The Chinese government's updated 2025 list of dual-use goods, subject to export and import licensing, signals a more stringent regulatory environment. This directly impacts Haers as an exporter, requiring careful adherence to these evolving controls to maintain market access.

Navigating these regulations involves understanding potential restrictions and securing necessary licenses. Failure to comply could lead to significant disruptions in global supply chains and market reach. For instance, in 2023, China's Ministry of Commerce reported an increase in export license applications processed, highlighting the growing complexity and volume of international trade compliance.

- Export Licensing: Zhejiang Haers must obtain specific licenses for dual-use goods, as defined by the 2025 Chinese export control list.

- Trade Restrictions: Potential import restrictions in target markets could affect the sale of Haers' vacuum containers.

- Compliance Costs: Adhering to international trade laws and obtaining export licenses incurs administrative and potential consulting costs.

- Market Access: Proactive management of export controls is crucial for ensuring continued access to key international markets.

China's evolving legal landscape presents both opportunities and challenges for Zhejiang Haers. The nation's strengthened intellectual property laws, with revisions to patent and trademark procedures expected through 2025, offer enhanced protection for Haers' innovative designs and brand. Conversely, increasingly stringent environmental regulations, including the expansion of the emissions trading system to sectors like steel by 2025, will necessitate compliance investments and potentially increase operational costs.

Environmental factors

In 2025, manufacturers face significant pressure to adopt sustainable practices, focusing on reducing carbon emissions, ensuring ethical sourcing, and optimizing energy efficiency in production. Zhejiang Haers has actively responded to this trend, earning the distinction of a 'Zhejiang Province Green Factory' and transparently reporting its 2024 carbon footprint.

This proactive approach resonates with growing consumer demand for environmentally conscious products, positioning Haers favorably in the market.

Consumer preferences are increasingly leaning towards sustainable products, with stainless steel gaining significant traction for reusable drinkware due to its robust nature and recyclability. This shift is directly impacting the market, as evidenced by the declining demand for plastic alternatives driven by growing environmental awareness.

Zhejiang Haers Vacuum Containers is well-positioned to capitalize on this trend, as its core product line heavily features stainless steel vacuum containers. The company's commitment to this material aligns perfectly with the market's growing demand for eco-friendly and durable solutions.

China's commitment to environmental protection has intensified, with significant revisions to its Solid Waste Pollution Control Law in 2020 marking a pivotal shift. This regulatory acceleration, coupled with a growing global consumer preference for reusable alternatives to single-use plastics, creates a highly favorable market landscape for Zhejiang Haers Vacuum Containers.

Carbon Emission Reduction Initiatives

China's ongoing expansion of its emissions trading system, now encompassing sectors like steel, alongside mandatory greenhouse gas emissions reporting for 2023-2025, significantly increases corporate accountability for carbon footprints. Zhejiang Haers has proactively addressed this by neutralizing its Scope 1 and 2 greenhouse gas emissions for 2024 through the purchase of carbon credits, aligning with evolving environmental regulations and demonstrating a commitment to sustainability.

This proactive stance is crucial as China aims to peak carbon emissions before 2030. For companies like Zhejiang Haers, this means not only compliance but also a strategic advantage in anticipating future environmental policies and market demands for greener products. The company's 2024 carbon credit purchase, while a short-term solution, signals an awareness of the growing importance of managing and offsetting emissions.

The implications for Zhejiang Haers include:

- Increased operational costs: Potential for higher expenses related to carbon compliance and the purchase of carbon credits.

- Enhanced brand reputation: Demonstrating environmental responsibility can attract eco-conscious consumers and investors.

- Opportunities for innovation: Driving investment in energy-efficient technologies and sustainable manufacturing processes.

- Supply chain scrutiny: Pressure to ensure that suppliers also adhere to emission reduction targets.

Water Usage and Waste Management in Production

China's environmental regulations, including the Solid Waste Prevention and Control Law and specific rules for hazardous waste, directly impact manufacturers like Zhejiang Haers. These laws mandate responsible handling of industrial waste and careful management of water resources. For instance, by 2023, China's Ministry of Ecology and Environment reported a significant increase in the enforcement of environmental protection laws, leading to more stringent requirements for industrial discharge and waste disposal.

Zhejiang Haers must therefore invest in advanced technologies for both waste treatment and water conservation to meet these evolving legal standards. Failure to comply could result in substantial fines and operational disruptions. The company's 2024 sustainability report highlighted a 5% reduction in water consumption per unit of production, a step towards aligning with national water efficiency goals.

- Compliance with China's Solid Waste Prevention and Control Law is critical.

- Adherence to hazardous waste regulations is mandatory.

- Investment in advanced waste treatment technologies is necessary.

- Water conservation measures are essential for operational sustainability.

The increasing global focus on sustainability is driving demand for eco-friendly products, benefiting Zhejiang Haers' stainless steel offerings. China's commitment to environmental protection, including its expanding emissions trading system and stringent waste management laws, creates both challenges and opportunities for manufacturers like Haers.

The company's proactive measures, such as achieving 'Zhejiang Province Green Factory' status and neutralizing 2024 Scope 1 and 2 emissions by purchasing carbon credits, demonstrate an alignment with these evolving environmental policies and market expectations.

By investing in advanced waste treatment and water conservation, as evidenced by a 5% reduction in water consumption per unit of production in 2024, Haers is positioning itself for long-term operational sustainability and compliance with China's robust environmental regulations.

| Environmental Factor | Impact on Zhejiang Haers | Action/Response | 2024 Data/Observation |

|---|---|---|---|

| Carbon Emissions Reduction | Increased pressure for sustainable manufacturing; opportunity for brand enhancement. | Neutralized Scope 1 & 2 emissions via carbon credits; aiming for peak emissions before 2030. | Scope 1 & 2 emissions neutralized. |

| Consumer Demand for Sustainability | Growing preference for stainless steel; declining demand for plastics. | Core product line features stainless steel vacuum containers. | Stainless steel products are a key market focus. |

| Waste Management & Pollution Control | Mandatory compliance with stringent laws; need for advanced treatment technologies. | Investing in waste treatment and water conservation. | 5% reduction in water consumption per unit of production. |

| Water Resource Management | Need for efficient water usage in production. | Implementing water conservation measures. | Focus on improving water efficiency. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Zhejiang Haers Vacuum Containers is grounded in data from reputable sources, including official Chinese government publications, international trade organizations, and leading market research firms. We incorporate economic indicators, environmental regulations, technological advancements, and social trends to provide a comprehensive overview.