Zhejiang Haers Vacuum Containers Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Zhejiang Haers Vacuum Containers Bundle

Zhejiang Haers Vacuum Containers operates in a market characterized by moderate buyer power and intense rivalry, with the threat of substitutes posing a significant challenge. Understanding these dynamics is crucial for navigating the competitive landscape.

The complete report reveals the real forces shaping Zhejiang Haers Vacuum Containers’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers for Zhejiang Haers is significantly shaped by the concentration of providers for essential raw materials like high-grade stainless steel and specialized vacuum insulation components. When a limited number of suppliers control these critical inputs, their leverage grows, potentially driving up manufacturing expenses. For instance, stainless steel prices experienced notable volatility throughout 2024, directly impacting Haers' cost of goods sold.

The availability of substitute inputs significantly influences the bargaining power of suppliers for Zhejiang Haers Vacuum Containers. While stainless steel is a primary material, the existence of alternative grades or even different insulation technologies, though potentially less efficient, could offer Haers some leverage.

However, Haers' commitment to high-quality vacuum insulation, a key differentiator, means that the practical alternatives are limited. For instance, while some plastics could be used for outer casings, the core vacuum insulation technology relies heavily on specific material properties and manufacturing processes, potentially concentrating power among a few specialized suppliers.

Switching suppliers for critical components like specialized stainless steel or vacuum technology involves potential costs for Zhejiang Haers Vacuum Containers. These can include retooling machinery, adjusting quality control processes, and rigorous testing, all of which can increase the bargaining power of existing suppliers. For instance, in 2024, the global stainless steel market saw price volatility, making the cost of supplier change a significant consideration.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into the production of vacuum containers can significantly bolster their bargaining power over companies like Zhejiang Haers. If suppliers possess the necessary capabilities and the motivation to manufacture vacuum containers themselves, they can exert greater pressure on Haers regarding pricing and terms.

However, the insulated drinkware industry, particularly for established players like Haers, often involves complex manufacturing techniques and strong brand loyalty. These factors tend to make forward integration by raw material suppliers a less frequent occurrence, as the barriers to entry in terms of specialized knowledge and market penetration are substantial.

- Supplier Forward Integration Risk: If suppliers can produce vacuum containers, their leverage over Haers increases.

- Industry Barriers: Specialized manufacturing and brand recognition in the vacuum container market limit supplier forward integration.

Importance of Haers to Suppliers

The significance of Zhejiang Haers Vacuum Containers as a customer directly influences its bargaining power with suppliers. When Haers places large-volume orders, it becomes a crucial revenue stream for its suppliers, thereby diminishing the suppliers' leverage. For instance, if Haers accounts for a substantial percentage of a supplier's output, that supplier is more inclined to offer favorable terms to retain Haers' business.

Conversely, if Haers' orders represent a minor fraction of a supplier's overall sales, the supplier is less dependent on Haers and can therefore exert more influence. This imbalance of power can manifest in price negotiations or supply guarantees. The specific raw materials or components involved also play a role; for essential inputs where Haers has few alternative suppliers, supplier power naturally increases.

- Customer Dependence: Zhejiang Haers' substantial order volumes can make it a key client, reducing supplier leverage.

- Supplier Reliance: If Haers' orders are a small part of a supplier's business, that supplier gains more bargaining power.

- Input Specificity: The bargaining power dynamic shifts based on the criticality and availability of specific raw materials or components.

The bargaining power of suppliers for Zhejiang Haers Vacuum Containers is influenced by the concentration of suppliers for critical inputs like high-grade stainless steel and specialized vacuum insulation components. Limited suppliers mean greater leverage, potentially increasing manufacturing costs, as seen with stainless steel price volatility in 2024.

The availability of substitute materials is limited for Haers due to its focus on high-quality vacuum insulation. While some alternatives exist for outer casings, core insulation technology relies on specific materials and processes, concentrating power among a few specialized suppliers.

Switching costs, including retooling and testing, can increase supplier bargaining power. The global stainless steel market's 2024 price fluctuations highlighted the financial implications of changing suppliers.

The threat of supplier forward integration is mitigated by high industry barriers, including specialized manufacturing and brand loyalty, making it a less frequent occurrence for raw material providers.

Zhejiang Haers' significant order volumes can reduce supplier leverage, making it a key client. Conversely, if Haers represents a small portion of a supplier's sales, the supplier gains more influence, especially for critical inputs with few alternatives.

| Factor | Impact on Haers | Data Point/Example |

|---|---|---|

| Supplier Concentration | Increases supplier power, potentially raising costs. | Stainless steel price volatility in 2024 impacted cost of goods sold. |

| Availability of Substitutes | Limited for high-quality vacuum insulation, strengthening supplier position. | Core insulation technology requires specific materials and processes. |

| Switching Costs | Can deter Haers from changing suppliers, enhancing existing supplier leverage. | Retooling and testing are significant considerations for input changes. |

| Customer Dependence | Haers' large orders can decrease supplier leverage. | If Haers is a major client, suppliers are more likely to offer favorable terms. |

What is included in the product

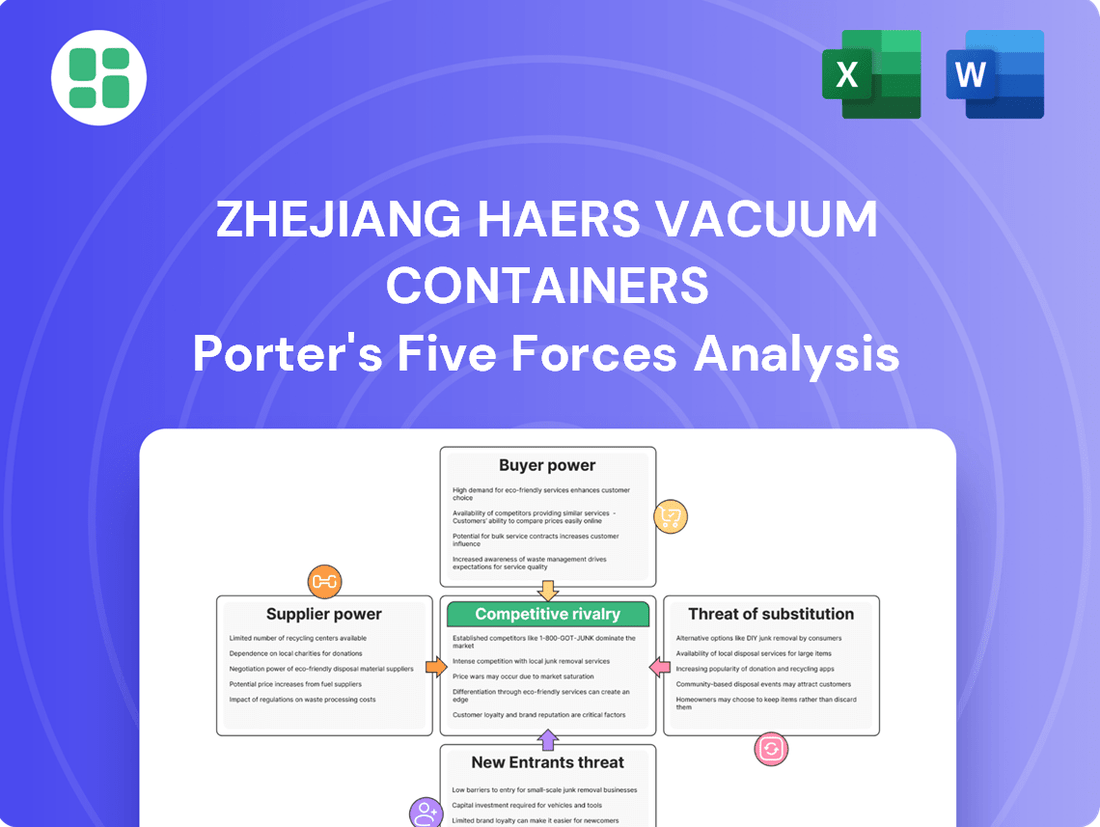

This Porter's Five Forces analysis for Zhejiang Haers Vacuum Containers dissects the competitive intensity within the vacuum container market, examining supplier and buyer power, the threat of new entrants and substitutes, and the rivalry among existing players.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each Porter's Five Forces for Zhejiang Haers Vacuum Containers.

Gain immediate clarity on the bargaining power of suppliers and buyers, enabling proactive strategies to protect profit margins.

Customers Bargaining Power

Customer price sensitivity for Zhejiang Haers varies significantly. Large OEM/ODM clients, accounting for a substantial portion of sales, often leverage bulk orders for aggressive price negotiations. For instance, in 2024, industry reports indicated that large B2B clients in the consumer electronics sector, a related market, were seeing average price reductions of 3-5% on high-volume orders due to competitive pressures.

Conversely, end-consumers purchasing insulated drinkware are swayed by factors beyond just price. Brand loyalty, innovative design, and the perceived quality or value of products like those from Zhejiang Haers play a crucial role. While the insulated drinkware market continues its upward trajectory, projected to grow at a CAGR of approximately 4.5% through 2028, intense competition among numerous players ensures that price remains a relevant, though not exclusive, consideration for these buyers.

The sheer volume of insulated drinkware and alternative hydration options means customers have plenty of choices, significantly boosting their negotiating strength. For instance, the global insulated drinkware market was valued at approximately USD 10.5 billion in 2023 and is projected to grow, indicating a highly competitive landscape with numerous players.

Consumers can readily shift their allegiance to brands like Hydro Flask, Yeti, or even simpler, non-insulated bottles if Zhejiang Haers Vacuum Containers' pricing or product features aren't appealing. This ease of switching means Haers must remain competitive to retain its customer base.

The internet and e-commerce platforms have dramatically increased customer information accessibility. This allows consumers to easily compare product details, read reviews, and check prices across various brands, significantly boosting their bargaining power. For instance, in 2024, online price comparison tools are ubiquitous, making it simple for buyers to identify the best deals, compelling manufacturers like Zhejiang Haers Vacuum Containers to maintain competitive pricing and superior product quality to attract and retain customers.

Low Switching Costs for Customers

For most consumers, the financial and practical effort involved in switching from one brand of insulated drinkware to another is minimal. This generally translates to simply purchasing a new item, which directly empowers customers.

This low barrier to switching means that if customers are unhappy with Zhejiang Haers Vacuum Containers' products or find a competitor offering better value, they can easily opt for an alternative. This flexibility is a key driver of their bargaining power.

- Low Switching Costs: The cost to change brands for insulated drinkware is typically just the price of a new product.

- Customer Choice: Consumers can readily switch if dissatisfied or if better deals are available elsewhere.

- Market Impact: In 2024, the global insulated drinkware market saw numerous new entrants, intensifying competition and further empowering consumers with more choices and potentially lower prices.

Concentration of Haers' Customers

Zhejiang Haers Vacuum Containers operates in both domestic and international arenas, notably providing OEM/ODM services. This dual market presence means their customer base is diverse, ranging from end consumers to large corporate clients. The concentration of Haers' customers, particularly within its OEM/ODM segment, is a key factor in assessing customer bargaining power.

If a substantial portion of Haers' revenue is generated from a limited number of large OEM/ODM partners or major retail distributors, these powerful buyers can leverage their volume to negotiate more favorable terms. For instance, if a few key clients account for over 30% of Haers' sales, their ability to dictate pricing or demand specific product modifications increases significantly. This concentration means that losing even one major client could have a considerable impact on Haers' profitability and market position.

- Customer Concentration: A significant portion of sales may depend on a few large OEM/ODM clients or major retail chains.

- Volume Purchasing Power: Large clients can use their substantial order volumes to negotiate better prices and terms.

- Demand Specificity: Concentrated customers may impose specific product requirements or delivery schedules, limiting Haers' flexibility.

- Switching Costs: If Haers' clients face high costs in switching suppliers, their bargaining power might be somewhat mitigated, but this depends on the overall market competitiveness.

Customers possess significant bargaining power due to a wide array of choices in the insulated drinkware market. The global market, valued at approximately USD 10.5 billion in 2023, is highly competitive, with numerous brands offering similar products. This abundance of options, coupled with low switching costs for consumers, allows them to easily shift to competitors if unsatisfied with pricing or features. In 2024, the proliferation of online price comparison tools further amplifies this power, enabling consumers to readily find the best deals.

Large business clients, particularly OEM/ODM partners, wield considerable influence through their substantial order volumes. These clients can negotiate more favorable pricing and terms, with industry reports in 2024 suggesting average price reductions of 3-5% for high-volume orders in related consumer electronics markets. If a few key clients represent a large percentage of Zhejiang Haers Vacuum Containers' sales, their ability to dictate terms increases, potentially impacting the company's flexibility and profitability.

| Factor | Impact on Haers | Data/Observation |

|---|---|---|

| Customer Choice | High | Global insulated drinkware market valued at ~USD 10.5 billion (2023) with many competitors. |

| Switching Costs | Low | Minimal financial or practical effort for consumers to change brands. |

| Information Accessibility | High | Ubiquitous online price comparison tools in 2024 empower informed consumer decisions. |

| Customer Concentration (OEM/ODM) | Potentially High | Large clients can leverage volume for price negotiations; losing key clients impacts revenue. |

Preview the Actual Deliverable

Zhejiang Haers Vacuum Containers Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The Zhejiang Haers Vacuum Containers Porter's Five Forces analysis meticulously examines the competitive landscape, detailing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. This comprehensive assessment provides actionable insights for strategic decision-making.

Rivalry Among Competitors

The insulated drinkware market is intensely competitive, with established global brands like Thermos, Yeti, and Hydro Flask alongside a multitude of regional and local manufacturers, including many in China. This broad spectrum of competitors, from market leaders to smaller niche players, significantly fuels competitive rivalry within the industry.

In 2024, the insulated drinkware market continued to see robust activity. For instance, Yeti Holdings reported net sales of $1.47 billion for fiscal year 2023, demonstrating the significant market size these major players operate within. The presence of numerous smaller, agile companies, often with lower overheads, further intensifies this rivalry by offering diverse price points and product variations.

The global insulated drinkware market is booming, with projections showing substantial growth from 2024 through 2034. This expansion offers a bit of breathing room, potentially softening the impact of fierce price wars as there's more room for everyone to grow.

However, the market's impressive compound annual growth rate (CAGR) of over 30% signals a highly dynamic landscape. This rapid expansion means companies will remain intensely focused on capturing market share and pursuing aggressive growth strategies.

While many insulated drinkware products offer similar basic functions, companies like Haers actively pursue differentiation. This is achieved through unique designs, superior material quality such as premium stainless steel, and incorporating technological advancements like enhanced vacuum insulation.

Building strong brand loyalty is a key strategy. Haers, for instance, aims to cultivate this by consistently delivering quality and innovation. This can effectively lessen competitive rivalry. However, maintaining this advantage necessitates continuous investment in research and development to stay ahead of the curve.

Exit Barriers

Zhejiang Haers Vacuum Containers faces significant competitive rivalry, partly due to high exit barriers. The substantial investments in manufacturing facilities, ongoing research and development, and the intricate web of established supply chains create a situation where exiting the market is financially punishing for many players. This forces even less profitable competitors to stay operational, leading to intensified competition within the industry.

These elevated exit barriers can manifest in aggressive market behaviors. For instance, to sustain production volumes and cover fixed costs, companies might engage in price wars, eroding profit margins across the board. Alternatively, they may resort to more aggressive marketing campaigns to capture market share, further fueling the rivalry and making it challenging for any single competitor to gain a decisive advantage.

- High Capital Investment: The vacuum container industry requires significant upfront capital for specialized machinery and production lines, making it costly to shut down operations.

- Specialized Workforce: Retaining or retraining a skilled workforce accustomed to vacuum technology adds to the cost of exiting.

- Brand Reputation and Customer Loyalty: Established brands have invested heavily in building trust and loyalty, making it difficult for new entrants to displace them and for existing players to abandon their market position.

- Contractual Obligations: Long-term supply agreements and distribution contracts can also impose penalties for early termination, acting as another layer of exit barrier.

Strategic Stakes and Aggressiveness of Competitors

Competitive rivalry in the insulated drinkware sector is intense, with companies actively vying for market share. This aggressive stance is evident in their pursuit of innovation, forming strategic alliances, and prioritizing sustainability. For instance, in 2024, many brands rolled out new products incorporating smart technologies and eco-friendly materials, underscoring significant strategic investments aimed at capturing a larger piece of the market.

The stakes are undeniably high, pushing competitors to continually differentiate themselves. This often translates into substantial marketing budgets and R&D expenditures. Companies are not just competing on product features but also on brand image and ethical sourcing, reflecting a broader industry trend towards conscious consumerism.

- Product Innovation: Launch of smart-enabled bottles and vacuum-insulated tumblers with advanced temperature control features.

- Strategic Partnerships: Collaborations with lifestyle brands and sports teams to enhance market visibility.

- Sustainability Initiatives: Increased use of recycled materials and commitment to reducing carbon footprints in manufacturing.

- Market Share Aggression: Aggressive pricing strategies and promotional campaigns to attract and retain customers in a saturated market.

Competitive rivalry within the insulated drinkware market is fierce, driven by a crowded field of global and local players. Companies like Yeti Holdings, which reported $1.47 billion in net sales for fiscal year 2023, demonstrate the significant scale of competition. The market's substantial growth, with a projected CAGR exceeding 30% from 2024, fuels aggressive strategies for market share capture.

Companies actively differentiate through product innovation, strategic partnerships, and sustainability efforts, as seen in 2024 product launches featuring smart technology and eco-friendly materials. High exit barriers, including substantial capital investments in specialized machinery and brand reputation, compel existing players to remain competitive, often leading to price wars and intense marketing efforts.

This environment necessitates continuous investment in R&D and brand building to maintain an edge. For example, the pursuit of advanced vacuum insulation and unique designs is crucial for companies like Haers to stand out. The pressure to maintain production volumes and cover fixed costs further intensifies rivalry, making it challenging for any single competitor to achieve a dominant, lasting advantage.

| Key Competitor Metric | 2023 Data Point | Significance for Rivalry |

|---|---|---|

| Yeti Holdings Net Sales | $1.47 billion | Indicates large market size and significant resources of major players. |

| Market CAGR (Projected) | Over 30% (2024 onwards) | Drives aggressive growth strategies and competition for market share. |

| Exit Barriers | High (Capital Investment, Brand Loyalty) | Keeps competitors in the market, intensifying rivalry and potentially leading to price wars. |

| Product Differentiation Focus | Smart technology, eco-friendly materials | Companies invest heavily in R&D and marketing to stand out. |

SSubstitutes Threaten

The threat of substitutes for Zhejiang Haers Vacuum Containers' insulated products is present, primarily from non-insulated reusable bottles made of plastic or glass, as well as disposable plastic bottles and traditional cups. These alternatives often come with a lower upfront cost, making them attractive to budget-conscious consumers.

However, the core value proposition of Haers' containers lies in their superior temperature retention capabilities, a feature largely absent in these substitutes. This fundamental difference in performance often outweighs the initial price advantage of non-insulated options, allowing Haers to command a premium.

For instance, while a basic reusable plastic bottle might cost under $5, a comparable insulated stainless steel bottle from a reputable brand can range from $20 to $50 or more, reflecting the added technology and performance. This price-performance trade-off is a key factor influencing consumer decisions.

In 2024, the market for reusable water bottles, which includes both insulated and non-insulated types, continued to show robust growth, driven by environmental awareness and a desire for convenience. Despite the availability of cheaper non-insulated options, the demand for high-performance insulated containers remained strong, indicating that consumers are willing to pay for the added benefits Haers provides.

Switching from a vacuum-insulated container to a non-insulated alternative like a simple plastic bottle or metal can presents minimal direct financial cost to the buyer. This ease of switching, in purely monetary terms, amplifies the threat of substitutes. For instance, a basic plastic water bottle might cost less than $1, a stark contrast to a premium insulated tumbler that could range from $20 to $50.

However, the perceived value and functional performance of insulated containers create a significant, albeit non-monetary, switching cost for many consumers. The ability to maintain beverage temperature for extended periods, whether hot coffee or cold water, is a key differentiator. Data from market research in early 2024 indicates that over 70% of consumers purchasing reusable beverage containers prioritize thermal insulation, suggesting a strong preference that outweighs the low financial barrier to entry for non-insulated options.

The market is flooded with alternatives that can perform the basic function of holding beverages. Consumers can easily opt for simple plastic bottles, glass tumblers, or even basic metal cans to carry their drinks, bypassing the need for vacuum insulation altogether. These readily available substitutes directly challenge Haers Vacuum Containers' core value proposition.

Furthermore, a growing trend towards environmental consciousness is fueling demand for reusable, non-insulated options. For instance, the global reusable water bottle market, excluding insulated ones, is projected to grow significantly, with some estimates suggesting a compound annual growth rate of over 7% through 2028. This shift in consumer preference away from specialized insulation features presents a tangible threat to insulated container manufacturers like Haers.

Buyer Propensity to Substitute

Consumer willingness to switch to alternatives for Zhejiang Haers Vacuum Containers products hinges on several factors. Environmental consciousness is a significant driver, pushing consumers towards reusable options, even if they lack insulation. Cost sensitivity also plays a role, with budget-minded shoppers more likely to consider cheaper, non-vacuum-sealed alternatives for less demanding use cases.

The increasing popularity of sustainable and eco-friendly goods broadly benefits the substitute market. For instance, reports in 2024 indicate a 15% year-over-year growth in the reusable water bottle market, directly impacting demand for traditional single-use plastic bottles and, by extension, potentially influencing choices away from premium vacuum-insulated ones for simpler hydration needs.

- Environmental Awareness: Rising consumer concern for sustainability encourages the adoption of reusable beverage containers, including non-insulated options.

- Cost Sensitivity: Price remains a key consideration, making lower-cost, less specialized containers attractive alternatives for consumers prioritizing budget.

- Use Case Specificity: The need for long-term temperature retention versus short-term hydration dictates the necessity of vacuum insulation, influencing substitute choices.

- Market Trends: Growth in the reusable product sector, with a notable 15% increase in the reusable water bottle market in 2024, signals a broader shift that can impact demand for vacuum-insulated products.

Innovations in Substitute Products

Innovations in substitute products, like advanced fiber-based coolers, are emerging that offer some temperature-retaining capabilities with enhanced environmental appeal. These alternatives, potentially more sustainable than traditional insulated containers, could attract environmentally conscious consumers. For instance, the global market for sustainable packaging is projected to reach over $400 billion by 2027, indicating a growing consumer preference for eco-friendly options.

The continuous evolution of packaging alternatives, such as new biodegradable or compostable materials, presents a persistent threat to Zhejiang Haers Vacuum Containers. As these substitutes improve their performance in areas like insulation and durability, they become more viable competitors. The demand for sustainable products is a significant trend, with reports indicating that over 70% of consumers are willing to pay more for sustainable goods in 2024.

Consider the following points regarding innovations in substitute products:

- Emerging Eco-Friendly Alternatives: New materials like advanced paper pulp or plant-based composites are being developed to mimic the insulating properties of traditional vacuum containers, offering a greener choice for consumers.

- Improving Performance of Substitutes: Ongoing research is enhancing the thermal efficiency and structural integrity of these biodegradable options, making them increasingly competitive in retaining temperature for shorter durations.

- Consumer Demand for Sustainability: A significant portion of consumers, particularly younger demographics, are actively seeking out products with a lower environmental footprint, driving demand for innovative substitute packaging.

- Potential Market Share Erosion: As substitute products become more cost-effective and performant, they could capture market share from traditional vacuum container manufacturers, especially for applications where extreme long-term insulation is not the primary requirement.

The threat of substitutes for Zhejiang Haers Vacuum Containers is amplified by the low switching costs associated with basic beverage containers. Consumers can easily opt for cheaper alternatives like plastic bottles, glass tumblers, or metal cans, which perform the fundamental task of holding liquids. For instance, a basic reusable plastic bottle might cost under $1, a stark contrast to a premium insulated tumbler that could range from $20 to $50.

While the financial cost to switch is minimal, the perceived value of vacuum insulation creates a non-monetary switching barrier. Market data from early 2024 indicated that over 70% of consumers buying reusable containers prioritized thermal insulation, highlighting a preference that can offset the low cost of substitutes. This suggests that for consumers valuing long-term temperature retention, the threat of simple, non-insulated alternatives is less pronounced.

However, the growing demand for sustainable products presents a nuanced threat. The reusable water bottle market saw a 15% year-over-year increase in 2024, encompassing both insulated and non-insulated options. This trend indicates a broader shift towards reusability, which could draw consumers away from specialized insulated products towards more environmentally friendly, albeit less insulating, alternatives for everyday use.

| Substitute Type | Typical Price Range (USD) | Key Differentiator vs. Haers | Consumer Trend Impact (2024) |

|---|---|---|---|

| Basic Reusable Plastic Bottle | $1 - $5 | Low upfront cost, lightweight | Growing environmental consciousness favors reusability |

| Glass Tumbler | $5 - $15 | Perceived purity, aesthetic | Steady demand for home/office use |

| Basic Metal Can (Non-insulated) | $2 - $10 | Durability, recyclability | Increasing interest in sustainable materials |

| Innovative Eco-Friendly Coolers | Varies (Emerging) | Environmental appeal, some insulation | Growing market for sustainable packaging |

Entrants Threaten

Entering the stainless steel vacuum container manufacturing sector demands substantial capital. Companies need to invest heavily in specialized machinery for metal forming and vacuum sealing, alongside building suitable factory infrastructure. For instance, setting up a production line capable of competing with established players like Zhejiang Haers could easily require tens of millions of dollars in initial investment.

Existing giants in the vacuum container market, such as Zhejiang Haers, already leverage significant economies of scale. This advantage translates into lower per-unit production costs, more favorable raw material pricing due to bulk purchasing of stainless steel, and efficient distribution networks. For instance, Haers' substantial production volume in 2023 allowed them to absorb fixed costs across a larger output, a feat difficult for newcomers.

New entrants face a steep uphill battle in matching these cost efficiencies. Without the same production volume, they cannot negotiate the same bulk discounts on materials or spread their overheads as thinly. This means any new company entering the market would likely have to accept higher initial costs, making it challenging to compete on price against established players like Haers, potentially leading to substantial early losses.

Established brands like Haers have cultivated strong brand recognition and customer loyalty through years of delivering consistent quality, appealing designs, and effective marketing. For instance, Haers reported a revenue of ¥3.5 billion in 2023, showcasing its significant market presence.

New competitors entering the vacuum container market must overcome the substantial hurdle of building a comparable brand identity and earning consumer trust amidst a highly competitive landscape. This requires significant investment in marketing and product development to even approach the established reputation of companies like Haers.

Access to Distribution Channels

Newcomers often struggle to gain access to established distribution networks, a significant barrier to entry in the vacuum container market. Zhejiang Haers likely benefits from pre-existing, strong relationships with a wide array of retailers, both domestically and internationally, facilitating broad market reach. Furthermore, their established online presence provides a direct-to-consumer channel that new entrants would find challenging and costly to replicate quickly.

Consider the following points regarding distribution channel access:

- Established Retailer Partnerships: Zhejiang Haers has cultivated long-standing relationships with major retail chains, securing prime shelf space and consistent sales volume.

- Robust Online Presence: The company likely operates a well-developed e-commerce platform, offering direct sales and bypassing traditional retail gatekeepers.

- Logistical Infrastructure: Building a comparable distribution and logistics network to handle mass-market or specialized retail demands requires substantial upfront investment and time.

Proprietary Technology and Patents

Zhejiang Haers Vacuum Containers' proprietary technology and patents present a significant barrier to new entrants. The intricate vacuum insulation processes and unique product designs are often protected, making it difficult for newcomers to match the performance and quality of established players. For instance, while basic vacuum technology is accessible, advanced methods for achieving superior thermal retention, a key selling point for Haers, can be patented, requiring substantial R&D investment for replication.

The threat of new entrants is therefore moderated by the intellectual property landscape. Companies without similar patented technologies or the capital to invest in developing them would struggle to compete effectively. This technological moat helps maintain Haers' market position.

- Proprietary Vacuum Insulation: Advanced techniques for creating and maintaining vacuum levels are often patented.

- Unique Product Features: Novel designs that enhance durability or performance can also be protected.

- R&D Investment Barrier: New entrants need significant investment to develop or license comparable technologies.

- Market Entry Hurdles: Without protected technology, competitors face challenges in replicating Haers' product quality and efficiency.

The threat of new entrants into the vacuum container market, particularly for companies like Zhejiang Haers, is significantly constrained by high capital requirements for specialized machinery and infrastructure. Furthermore, established players benefit from substantial economies of scale, leading to lower production costs and preferential raw material pricing, as evidenced by Haers' ¥3.5 billion revenue in 2023.

New competitors face challenges in matching brand loyalty and distribution network access. Haers' strong market presence, built over years, means newcomers must invest heavily in marketing and establishing relationships with retailers and online platforms. Proprietary technologies and patents further erect barriers, demanding considerable R&D investment from potential entrants to replicate Haers' product quality and efficiency.

| Barrier Type | Description | Impact on New Entrants | Example (Zhejiang Haers) |

| Capital Requirements | High investment in specialized manufacturing equipment and facilities. | Significant upfront cost, limiting the number of potential entrants. | Setting up a competitive production line could cost tens of millions of dollars. |

| Economies of Scale | Lower per-unit costs due to high production volume and bulk purchasing. | New entrants face higher initial costs and struggle to compete on price. | Haers' 2023 production volume allowed for efficient cost absorption. |

| Brand Loyalty & Recognition | Established reputation and customer trust built over time. | New entrants need substantial marketing investment to gain market share. | Haers' significant market presence is reflected in its 2023 revenue. |

| Distribution Channels | Pre-existing relationships with retailers and robust online presence. | Difficult and costly for new players to replicate broad market reach. | Haers likely benefits from extensive retail partnerships and a developed e-commerce platform. |

| Intellectual Property | Patented technologies for vacuum insulation and product design. | Requires significant R&D or licensing fees for new entrants to match quality. | Advanced thermal retention methods used by Haers may be protected by patents. |

Porter's Five Forces Analysis Data Sources

Our analysis of Zhejiang Haers Vacuum Containers' competitive landscape is built upon a foundation of publicly available financial reports, industry-specific market research from reputable firms, and news releases from key players in the vacuum container sector.