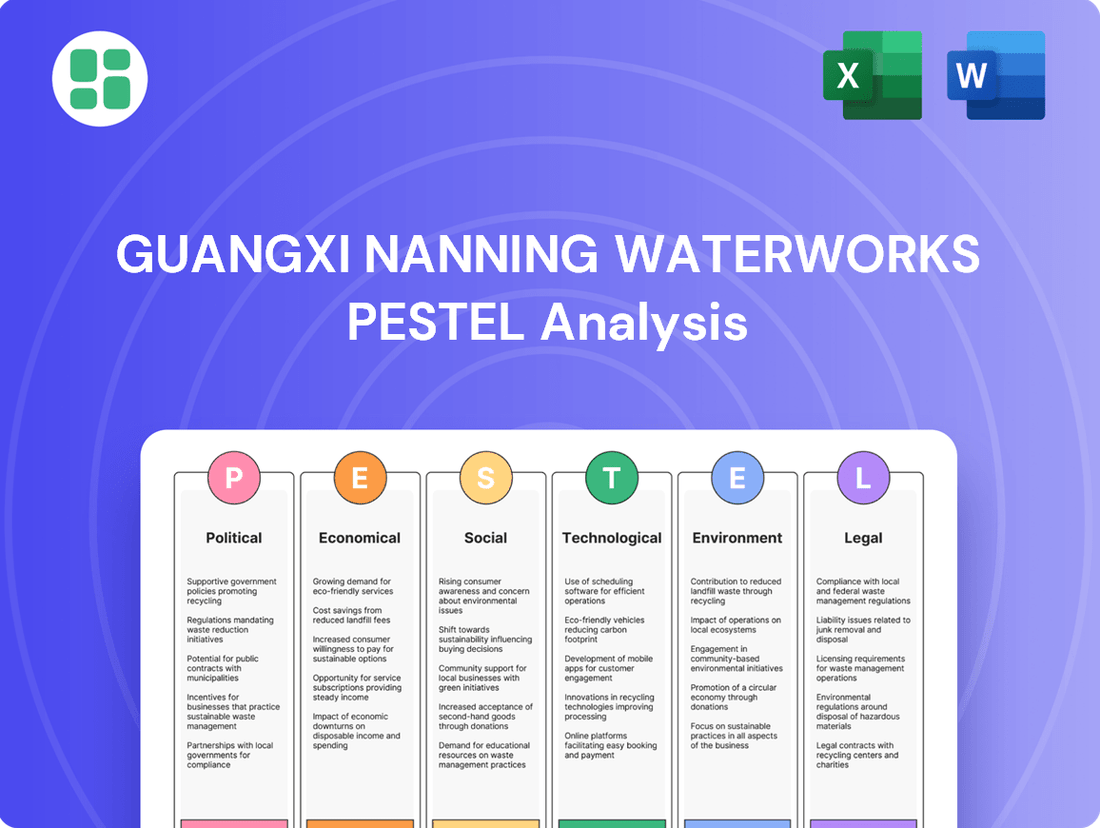

Guangxi Nanning Waterworks PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Guangxi Nanning Waterworks Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Guangxi Nanning Waterworks's future. This comprehensive PESTLE analysis provides actionable insights for strategic planning and risk mitigation. Don't get left behind; download the full version now to gain a competitive edge.

Political factors

The Chinese government, through bodies like the National Development and Reform Commission (NDRC) and the Ministry of Water Resources, actively shapes the water sector. They've set ambitious targets for water conservation, quality improvement, and pollution reduction, impacting companies like Guangxi Nanning Waterworks.

Recent policy shifts include the implementation of mandatory water usage limits and a transition from water resource fees to a unified national water tax. Stricter pollutant discharge standards are also a key focus, directly influencing operational compliance and capital expenditure decisions for water utilities.

China's national strategic initiatives, such as the 'Beautiful China' campaign and the 14th Five-Year Plan (2021-2025), place a strong emphasis on environmental protection and enhancing water quality. These directives are fueling substantial investments in water infrastructure and sustainable water management practices nationwide.

These national priorities translate into tangible opportunities for companies like Guangxi Nanning Waterworks, as they encourage significant capital allocation towards wastewater reuse and ecological restoration projects. For instance, the government has pledged substantial funding for water pollution control and water resource management throughout the 14th Five-Year Plan period, creating a favorable investment climate.

The alignment of Guangxi Nanning Waterworks' operations with these overarching national goals provides a robust framework for its growth and potential expansion. The initiatives offer both a supportive policy environment and direct avenues for securing funding, bolstering the company's development prospects in the water sector.

Nanning, as the capital of Guangxi, is a central point for regional advancement, with initiatives like the Nanning Territorial Comprehensive Planning (2021-2035) emphasizing high-quality territorial development and resource protection, notably water resources. This strategic focus by the regional government directly supports Nanning Waterworks.

The local government's dedication to enhancing urban environments and investing in significant water conservancy projects across Guangxi provides a solid foundation for the company's current operations and future expansion. For instance, Guangxi's 14th Five-Year Plan (2021-2025) allocated substantial funds towards water infrastructure improvements, directly benefiting water utility providers.

Public-Private Partnerships (PPPs) Promotion

The Chinese government's strong endorsement of public-private partnerships (PPPs) in the water sector is a significant political factor. By actively encouraging foreign and private capital, the aim is to reach a trillion-yuan scale in the water conservation industry by 2027.

This policy shift towards PPPs and market-driven approaches offers Guangxi Nanning Waterworks substantial opportunities. It can unlock new funding streams and foster collaborations, thereby bolstering its capabilities in crucial infrastructure upgrades and service expansion.

- Government Support: China's policy actively promotes PPPs in water conservation.

- Market Scale: The industry is targeted to reach a trillion yuan by 2027.

- Funding Avenues: PPPs open new paths for capital investment and collaboration.

- Capacity Enhancement: This can improve infrastructure development and service delivery for waterworks.

Anti-Corruption and Governance Measures

China's ongoing commitment to enhancing governance and tackling corruption across all industries significantly impacts state-affiliated enterprises. For Guangxi Nanning Waterworks, this translates to a critical need for robust governance frameworks and transparent operational practices to ensure public confidence and meet regulatory demands.

These anti-corruption drives are not merely symbolic; they are backed by substantial enforcement actions. For instance, in 2023, China's Supreme People's Procuratorate reported prosecuting over 20,000 individuals for corruption-related offenses, underscoring the seriousness of these initiatives. Adherence to these evolving standards is paramount for entities like Guangxi Nanning Waterworks.

- Enhanced Transparency: Implementing clear reporting mechanisms and open communication channels regarding water quality, pricing, and infrastructure projects.

- Strict Compliance: Ensuring all procurement, operational, and financial activities align with national anti-corruption laws and directives.

- Accountability Mechanisms: Establishing internal audit processes and external oversight to monitor performance and prevent malfeasance.

- Public Trust: Demonstrating a commitment to ethical conduct and efficient service delivery to foster positive public perception.

Government policies are pivotal, with China's 14th Five-Year Plan (2021-2025) prioritizing water resource management and pollution control, directly benefiting Guangxi Nanning Waterworks. The nation's push for public-private partnerships (PPPs) in the water sector aims to mobilize significant capital, targeting a trillion-yuan industry scale by 2027, creating avenues for investment and collaboration.

The government's anti-corruption drive necessitates robust governance and transparency from state-affiliated entities like Nanning Waterworks, with over 20,000 individuals prosecuted for corruption in 2023 alone. This focus on accountability enhances public trust and ensures regulatory compliance.

| Policy Area | Government Initiative | Impact on Guangxi Nanning Waterworks | Data Point |

|---|---|---|---|

| Water Management | 14th Five-Year Plan (2021-2025) | Focus on conservation, quality, and pollution reduction | Substantial government funding allocated to water infrastructure |

| Investment | Promotion of Public-Private Partnerships (PPPs) | Opens new funding streams and fosters collaboration | Water conservation industry targeted to reach 1 trillion yuan by 2027 |

| Governance | Anti-Corruption Campaign | Requires enhanced transparency and strict compliance | Over 20,000 corruption prosecutions in 2023 |

What is included in the product

This PESTLE analysis examines the external macro-environmental factors influencing the Guangxi Nanning Waterworks, detailing how Political, Economic, Social, Technological, Environmental, and Legal forces present both challenges and opportunities.

It provides a comprehensive overview of market and regulatory dynamics, offering actionable insights for strategic planning and decision-making.

This PESTLE analysis for Guangxi Nanning Waterworks serves as a crucial pain point reliever by offering a clear, summarized version of complex external factors, making strategic planning and decision-making more efficient and accessible for all stakeholders.

Economic factors

Nanning's population, which reached close to 9 million in 2023, is experiencing significant urbanization. This growth directly fuels a greater need for reliable tap water and effective sewage treatment.

This expanding urban population acts as a consistent and growing customer base for Guangxi Nanning Waterworks. It underpins revenue stability and necessitates continuous investment in upgrading and expanding the company's infrastructure to meet escalating demand.

Significant government investment in water-related infrastructure projects across Guangxi, such as the ambitious Pinglu Canal and other major water conservancy initiatives, directly benefits Guangxi Nanning Waterworks. These large-scale developments, often driven by national and regional economic strategies, necessitate the construction and ongoing operation of sophisticated water supply and drainage systems. This aligns perfectly with the company's expertise and core business operations, presenting substantial growth prospects.

China's move from water resource fees to a national water tax, coupled with ongoing water price reforms like tiered agricultural pricing, directly impacts Guangxi Nanning Waterworks. These changes are designed to encourage water conservation and sustainable practices, which could alter consumer demand and affect the company's profitability.

For instance, the national water tax aims to create a more standardized revenue collection system across the country. Simultaneously, tiered pricing for agricultural water, a significant user in regions like Guangxi, incentivizes more efficient usage by making higher consumption more expensive. This could lead to a reduction in overall water sales volume for industrial and agricultural clients, necessitating a strategic adjustment in revenue models.

The company must adapt its operational strategies and pricing mechanisms to align with these national directives. Understanding how these reforms influence customer behavior, especially in the agricultural sector which is crucial for Guangxi's economy, will be key to maintaining financial stability and ensuring long-term operational viability.

Economic Development and Industrial Demand

Nanning's economic development is accelerating, with its GDP reaching approximately RMB 1.57 trillion in 2023, a 4.5% increase year-on-year. This growth, fueled by its strategic position in the Belt and Road Initiative and a strong push towards high-tech and green manufacturing sectors, directly translates to increased industrial water requirements and a greater volume of wastewater needing treatment.

The expanding industrial base presents a significant opportunity for Guangxi Nanning Waterworks, as these sectors require reliable water supply and advanced wastewater management solutions. The company must be prepared to cater to a diverse range of industrial clients, each with unique water quality and quantity specifications, from electronics manufacturing to green energy production.

- Increased Industrial Water Demand: Nanning's industrial output grew by an estimated 5.2% in 2024, driving higher consumption of treated water.

- Wastewater Generation Growth: The focus on water-intensive industries means a corresponding rise in wastewater, creating a larger market for treatment services.

- Diversified Client Needs: The shift to high-tech and green industries necessitates specialized water treatment capabilities to handle varying pollutant loads and purity standards.

- Market Expansion Potential: Guangxi Nanning Waterworks is well-positioned to expand its services to new and existing industrial parks within the region.

Financial Performance and Investment Outlook

While the Asian water utilities sector shows promise for expansion, China's municipal infrastructure funding may encounter challenges stemming from wider economic uncertainties. For Guangxi Nanning Waterworks, this could translate into financial performance pressures, underscoring the critical importance of operational efficiency and well-chosen strategic investments to sustain profitability.

For instance, reports from late 2024 highlighted a slowdown in Chinese infrastructure project approvals, potentially impacting the pace of new capital expenditure for water utilities. This environment necessitates a keen focus on cost management and revenue optimization for companies like Guangxi Nanning Waterworks.

- Projected growth in Asian water utilities sector: Industry forecasts suggest a compound annual growth rate (CAGR) of approximately 5-7% through 2028.

- Impact of macroeconomic headwinds on Chinese infrastructure: Some analysts projected a potential 10-15% reduction in new municipal infrastructure investment in China for 2025 compared to 2024 due to fiscal consolidation measures.

- Importance of operational efficiency: Companies maintaining a debt-to-equity ratio below 1.5 were generally better positioned to weather financial uncertainties in the sector.

- Strategic investment focus: Investment in smart water technologies, projected to grow by 12% annually, could offer efficiency gains and long-term cost savings.

Nanning's economic acceleration, with its GDP nearing RMB 1.57 trillion in 2023 and a 4.5% year-on-year growth, directly boosts industrial water demand and wastewater treatment needs. The city's focus on high-tech and green manufacturing, supported by the Belt and Road Initiative, necessitates specialized water solutions for diverse industrial clients. This economic vitality creates substantial opportunities for Guangxi Nanning Waterworks to expand its service offerings to a growing industrial base.

| Economic Indicator | Value (2023/2024 Estimate) | Impact on Waterworks |

|---|---|---|

| Nanning GDP Growth | 4.5% (2023) | Increased industrial water demand and wastewater generation. |

| Industrial Output Growth | ~5.2% (2024 Est.) | Higher consumption of treated water, greater need for advanced treatment. |

| Urbanization Rate | Continuing upward trend | Sustained demand for tap water and sewage treatment. |

| Infrastructure Investment | Significant government allocation | Opportunities for capital projects and system upgrades. |

Preview the Actual Deliverable

Guangxi Nanning Waterworks PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Guangxi Nanning Waterworks covers political stability, economic growth in the region, social trends impacting water usage, technological advancements in water treatment, environmental regulations, and legal frameworks governing water supply.

Sociological factors

Public health concerns are a major driver for water utility performance. In 2024, China saw a continued emphasis on environmental protection, with urban water supply coverage reaching 98.5% and wastewater treatment rates in urban areas hitting 97.2%. This societal demand for cleaner water and better sanitation directly impacts Guangxi Nanning Waterworks, pushing for higher operational standards and service quality to safeguard community health.

Nanning's urbanization rate reached 64.3% by the end of 2023, a significant increase that concentrates demand on its water infrastructure. This rapid growth means more people living in closer proximity, making the management of water supply and drainage systems increasingly intricate.

Evolving urban lifestyles, such as increased use of water-intensive appliances and a growing preference for water-consuming amenities, are altering traditional water demand patterns. Guangxi Nanning Waterworks must therefore invest in flexible infrastructure and service models to meet these dynamic residential needs, potentially facing higher peak demand periods.

As a vital public utility, Guangxi Nanning Waterworks faces increasing pressure for robust community engagement and a clear demonstration of social responsibility. This involves proactively addressing resident concerns regarding water quality, such as reported turbidity levels, and minimizing disruptions from infrastructure upgrades, aiming to build and maintain public trust.

In 2023, Nanning's urban population reached over 8.7 million, highlighting the scale of community impact. The company's commitment to social responsibility is crucial for its license to operate, especially as environmental regulations tighten, requiring transparency on water source protection and waste management practices.

Employment and Labor Relations

Guangxi Nanning Waterworks relies on a substantial workforce, making societal expectations for fair labor practices, employee safety, and welfare paramount. In 2024, China's overall urban unemployment rate hovered around 5.2%, indicating a competitive labor market where employee satisfaction is key. The company's commitment to these aspects directly impacts its operational continuity and public perception, solidifying its social license to operate.

Maintaining positive labor relations and adhering strictly to labor laws are critical for Nanning Waterworks. In 2024, China's Ministry of Human Resources and Social Security continued to enforce regulations concerning working hours, minimum wage, and social insurance contributions. Failure to comply could lead to disputes, operational disruptions, and reputational damage, affecting the company's ability to function effectively.

- Workforce Dependency: The company's operational efficiency is directly tied to its employee base.

- Societal Expectations: Public scrutiny of labor practices, including fair wages and safe working conditions, is a significant factor.

- Legal Compliance: Adherence to China's labor laws, such as those governing social insurance and employment contracts, is non-negotiable.

- Reputational Impact: Positive labor relations contribute to a strong corporate image, while disputes can severely damage it.

Water Conservation Awareness

Growing environmental consciousness in China, particularly in regions like Guangxi, is significantly shaping public attitudes towards water usage. Government-led campaigns promoting water conservation are becoming more prevalent, encouraging a shift in consumer behavior. For instance, by the end of 2023, China's Ministry of Water Resources reported a continued emphasis on reducing water waste across all sectors.

This heightened awareness directly impacts utilities like Guangxi Nanning Waterworks. A reduction in per capita water consumption, driven by these societal shifts, necessitates strategic adjustments. The company may need to invest in advanced water-saving technologies and explore new revenue models to maintain financial stability amidst potentially lower overall water sales volumes.

Key implications for Guangxi Nanning Waterworks include:

- Increased demand for water-efficient infrastructure and services.

- Potential need to adapt pricing structures to reflect conservation efforts and infrastructure investments.

- Opportunities to develop new business lines focused on water management solutions.

- Enhanced public expectation for sustainable water practices from the utility.

Societal expectations for clean water and efficient sanitation remain high, with China's urban water supply coverage at 98.5% in 2024. Nanning's urbanization, reaching 64.3% by end-2023, concentrates demand, requiring sophisticated infrastructure management. Evolving lifestyles also increase water usage, necessitating adaptable service models for Guangxi Nanning Waterworks.

The company must address community concerns regarding water quality and operational disruptions to maintain public trust, especially with Nanning's urban population exceeding 8.7 million in 2023. Furthermore, societal expectations for fair labor practices are critical, with China's urban unemployment rate around 5.2% in 2024, making employee satisfaction a key factor for operational continuity.

Growing environmental consciousness drives demand for water-efficient infrastructure and services, potentially impacting sales volumes. Guangxi Nanning Waterworks must adapt its strategies to meet these evolving consumer behaviors and regulatory pressures.

| Societal Factor | 2023/2024 Data Point | Impact on Guangxi Nanning Waterworks |

|---|---|---|

| Public Health & Sanitation Demand | Urban water supply coverage: 98.5% (2024) | Drives higher operational standards and service quality. |

| Urbanization Rate | Nanning: 64.3% (End-2023) | Increases demand and complexity of water infrastructure management. |

| Community Trust & Engagement | Nanning Urban Population: >8.7 million (2023) | Requires proactive communication on water quality and infrastructure upgrades. |

| Labor Market & Employee Welfare | China Urban Unemployment Rate: ~5.2% (2024) | Emphasizes fair labor practices and employee safety for operational continuity. |

| Environmental Consciousness | Ministry of Water Resources focus on water waste reduction (2023) | Necessitates investment in water-saving technologies and adaptation to conservation trends. |

Technological factors

The water sector is witnessing a significant surge in advanced treatment technologies, with membrane bioreactors (MBRs) and advanced oxidation processes (AOPs) at the forefront. These innovations are crucial for boosting water quality and operational efficiency.

Guangxi Nanning Waterworks can harness these advancements to upgrade its tap water production and wastewater treatment, ensuring compliance with increasingly stringent environmental regulations. For instance, MBR technology can achieve higher effluent quality compared to conventional activated sludge systems, potentially reducing the footprint of treatment plants.

Globally, the market for advanced water and wastewater treatment technologies is projected for substantial growth. Reports indicate the global MBR market alone was valued at approximately USD 2.5 billion in 2023 and is expected to reach over USD 4.5 billion by 2028, demonstrating a strong compound annual growth rate.

The integration of Internet of Things (IoT) sensors, artificial intelligence (AI), and big data analytics is transforming water management for entities like Guangxi Nanning Waterworks. These technologies enable real-time monitoring of water quality and distribution networks, allowing for predictive maintenance of infrastructure and more efficient allocation of resources. For instance, smart meters can provide granular data on consumption, helping to identify anomalies and reduce unaccounted-for water.

Implementing advanced leak detection systems, often leveraging acoustic sensors and AI pattern recognition, can drastically cut down on water loss. Guangxi Nanning Waterworks can achieve significant operational efficiencies by deploying AI-driven platforms that optimize pumping schedules and pressure management across its network. Such advancements are crucial in meeting growing demand while conserving a vital resource.

Growing concerns over water scarcity and environmental impact are driving significant advancements in wastewater recycling and reuse technologies. Guangxi Nanning Waterworks can strategically invest in these innovations, such as advanced membrane filtration and biological treatment systems, to enhance its sustainability efforts. For instance, the global wastewater treatment market was valued at approximately USD 100 billion in 2023 and is projected to grow substantially, indicating a strong demand for such solutions.

Adopting these cutting-edge technologies not only supports sustainable water management but also presents a clear opportunity for Guangxi Nanning Waterworks to develop new revenue streams. By treating and selling reclaimed water for industrial or agricultural purposes, the company can tap into a growing market. In 2024, cities like Singapore have been actively expanding their NEWater program, a highly purified recycled wastewater, demonstrating the commercial viability of such initiatives.

Digital Transformation of Operations

The digital transformation of Guangxi Nanning Waterworks' operations is a key technological driver. This includes the digitalization of customer service, billing, and network management, all aimed at boosting efficiency and resident satisfaction. For instance, by 2024, many utilities are seeing significant improvements in response times and accuracy through automated systems.

Embracing digital transformation allows Nanning Waterworks to streamline internal processes, leading to cost savings and better resource allocation. Advanced data analytics derived from these digital systems can inform more effective decision-making, from infrastructure maintenance to service expansion. This shift also enables the provision of more convenient services to Nanning's population.

Specific advancements include the adoption of smart metering technologies and digital payment platforms. These innovations are projected to reduce operational costs by up to 15% for water utilities by 2025 through minimized manual intervention and improved billing accuracy.

- Smart Metering: Implementation of smart meters for real-time water consumption monitoring and leak detection.

- Digital Billing & Payments: Offering online portals and mobile apps for convenient bill payment and account management.

- Network Management Systems: Utilizing SCADA (Supervisory Control and Data Acquisition) and GIS (Geographic Information System) for efficient water network monitoring and control.

- Data Analytics: Leveraging big data to optimize water distribution, predict demand, and identify areas for infrastructure improvement.

Infrastructure Maintenance and Monitoring Technologies

Advanced technologies for inspecting, maintaining, and repairing aging water supply and drainage infrastructure are critical for Guangxi Nanning Waterworks to prevent leaks and ensure uninterrupted service. For instance, in 2023, China's Ministry of Water Resources reported that significant investments were being made in upgrading aging water infrastructure nationwide, with a focus on leak detection and rehabilitation. Innovations in pipeline inspection, such as acoustic sensors and robotic crawlers, allow for early detection of defects. Trenchless technologies, like pipe bursting and cured-in-place pipe (CIPP) lining, minimize disruption during repairs. Furthermore, advancements in material science, leading to more durable and corrosion-resistant pipes, are essential for the long-term integrity of the water network.

These technological advancements directly impact operational efficiency and cost-effectiveness for Guangxi Nanning Waterworks.

- Pipeline Inspection Technologies: Utilizing smart sensors and CCTV for real-time condition assessment.

- Trenchless Rehabilitation: Employing CIPP and pipe bursting to minimize excavation and service interruption.

- Advanced Materials: Adopting composite and high-density polyethylene (HDPE) pipes for enhanced durability and reduced leakage.

Technological advancements in water treatment, such as membrane bioreactors (MBRs) and advanced oxidation processes (AOPs), are key for improving water quality and operational efficiency. Guangxi Nanning Waterworks can leverage these to meet stricter environmental standards.

The integration of IoT, AI, and big data analytics offers real-time monitoring and predictive maintenance for water networks, enhancing resource allocation. Smart meters, for example, provide granular consumption data to identify inefficiencies and reduce water loss.

Digital transformation, including smart metering and digital billing, is streamlining operations for utilities. By 2025, these innovations are expected to cut operational costs for water utilities by up to 15% through reduced manual work and better billing accuracy.

The adoption of advanced leak detection and trenchless repair technologies is crucial for maintaining aging infrastructure. Innovations in pipeline inspection and materials like HDPE pipes enhance durability and minimize service disruptions.

| Technology | Benefit | Projected Impact (by 2025) |

|---|---|---|

| MBRs | Higher effluent quality, smaller footprint | Improved compliance with regulations |

| IoT & AI in Water Management | Real-time monitoring, predictive maintenance | Reduced operational costs, optimized resource use |

| Smart Metering | Accurate consumption data, leak detection | Up to 15% reduction in operational costs for utilities |

| Trenchless Technologies | Minimized disruption for infrastructure repair | Enhanced network integrity, reduced water loss |

Legal factors

China's Water Pollution Prevention and Control Law, along with new national water conservation regulations, imposes rigorous discharge standards and promotes holistic water management. For Guangxi Nanning Waterworks, adherence to these stringent requirements is paramount to avoid penalties and secure its operational license.

Guangxi Nanning Waterworks must navigate a complex web of regulations governing water resource management and allocation. Laws dictating water use quotas and planned management for large consumers directly influence the company's ability to secure sufficient raw water for its operations. For instance, in 2023, China's Ministry of Water Resources continued to emphasize stricter water conservation measures, potentially impacting the volume of water available for industrial and municipal use in water-scarce regions, a factor Nanning Waterworks must actively manage.

Furthermore, restrictions on water-intensive projects in areas facing water stress present a significant operational challenge. These regulations are designed to ensure sustainable water use, but they require careful planning and potentially investment in more efficient water technologies by companies like Nanning Waterworks. The national expansion of water resources tax also adds a direct financial burden, increasing operational costs and requiring adjustments to pricing strategies or cost management.

China's environmental protection laws, notably the recently drafted Ecological and Environmental Protection Code, establish a robust framework for environmental quality and pollution control. Guangxi Nanning Waterworks must align its entire operational spectrum, from water intake to effluent release, with these stringent national standards.

Tariff and Service Quality Regulations

Regulations on water tariffs and service quality are crucial for Guangxi Nanning Waterworks. These rules directly influence how the company prices its services and the minimum standards it must meet. For instance, in 2023, China's National Development and Reform Commission (NDRC) continued to emphasize fair pricing mechanisms for public utilities, balancing consumer affordability with operational sustainability. This means Nanning Waterworks needs to operate efficiently to meet quality benchmarks while keeping tariffs reasonable.

The dual mandate of affordability and investment recovery shapes the company's financial strategy. Meeting stringent service quality standards, such as water purity levels and response times for repairs, often requires significant capital expenditure. For example, upgrades to aging infrastructure to comply with evolving environmental standards might cost millions. The regulatory framework thus compels a careful balance between consumer protection and the need for ongoing infrastructure investment.

- Tariff Structure: Regulators set guidelines for calculating water tariffs, often involving cost-plus models or performance-based adjustments.

- Service Standards: Minimum requirements for water quality, pressure, continuity of supply, and customer service response times are legally mandated.

- Investment Incentives: Regulations may include provisions to allow for the recovery of costs associated with necessary infrastructure upgrades and maintenance.

- Consumer Protection: Mechanisms are in place to ensure tariffs remain affordable and service quality is consistently met, with penalties for non-compliance.

Compliance and Enforcement Mechanisms

The strengthening of environmental enforcement in China, including in Guangxi province, means Nanning Waterworks faces heightened scrutiny. New regulations and stricter enforcement mechanisms are being implemented, demanding greater accountability from water utilities. For instance, the Ministry of Ecology and Environment has been progressively increasing fines for environmental violations, with reports indicating significant year-on-year increases in penalties collected for water pollution offenses in recent years, impacting companies that fail to meet standards.

Compliance for Nanning Waterworks necessitates robust internal environmental management systems. This includes regular monitoring of water quality and discharge, alongside transparent reporting to provincial and national regulatory authorities. The company must demonstrate adherence to increasingly stringent water quality standards, such as those outlined in the updated national standards for drinking water quality, which were revised to align with international best practices.

Key compliance areas and enforcement mechanisms include:

- Mandatory Environmental Impact Assessments (EIAs): Ensuring all new projects and significant upgrades undergo rigorous EIAs approved by environmental protection bureaus.

- Regular Inspections and Audits: Facing unannounced site visits and detailed record reviews by environmental regulators to verify operational compliance.

- Pollutant Discharge Permits: Adhering to strict limits on discharged pollutants, with penalties for exceeding permitted levels.

- Public Disclosure Requirements: Transparency in reporting environmental performance data and any incidents to the public and regulatory bodies.

China's evolving legal landscape significantly impacts Guangxi Nanning Waterworks, particularly concerning water resource management and environmental protection. Stricter national water conservation regulations, exemplified by the Ministry of Water Resources' continued emphasis in 2023, necessitate proactive water use planning. Furthermore, the expansion of water resource taxes directly affects operational costs, requiring strategic financial adjustments.

The company must also navigate stringent environmental laws, including the Ecological and Environmental Protection Code, ensuring all operations meet national standards for water quality and pollution control. This includes adhering to updated drinking water quality standards, which align with international best practices, and implementing robust internal environmental management systems for monitoring and reporting.

Regulatory frameworks also dictate tariff structures and service quality benchmarks, balancing consumer affordability with the need for infrastructure investment. For instance, the National Development and Reform Commission's focus on fair utility pricing in 2023 underscores the need for operational efficiency to meet quality standards while maintaining reasonable tariffs.

Increased environmental enforcement, with rising fines for violations as reported by the Ministry of Ecology and Environment, demands heightened accountability. Key compliance areas include mandatory Environmental Impact Assessments, regular regulatory inspections, adherence to pollutant discharge permits, and public disclosure of environmental performance.

| Legal Factor | Impact on Guangxi Nanning Waterworks | Relevant Regulations/Data (2023-2025) |

|---|---|---|

| Water Resource Management | Stricter water use quotas and conservation measures affect raw water availability. | Continued emphasis on water conservation by Ministry of Water Resources; potential impacts on industrial/municipal allocation. |

| Environmental Protection | Rigorous discharge standards and pollution control requirements. | China's Water Pollution Prevention and Control Law; Ecological and Environmental Protection Code; stricter enforcement and increased fines for violations. |

| Tariff and Service Standards | Balancing affordability with infrastructure investment and service quality mandates. | NDRC focus on fair utility pricing; need to meet upgraded drinking water quality standards. |

Environmental factors

Despite Nanning's reputation as a 'Green City,' China grapples with significant water scarcity, marked by uneven distribution and escalating demand. This fundamental challenge directly affects Guangxi Nanning Waterworks' capacity to secure adequate raw water for its operations.

Regional water availability, influenced by climate patterns and competition from agriculture and industry, poses a direct operational risk. In 2023, China's Ministry of Water Resources reported that over 400 cities experienced some level of water shortage, highlighting the widespread nature of this environmental factor.

The quality of raw water sources for Guangxi Nanning Waterworks is a critical environmental factor. Industrial discharge, agricultural runoff, and domestic wastewater all contribute to the pollution levels in these sources, directly affecting how complex and costly water treatment becomes. For instance, in 2024, several upstream industrial zones in Guangxi reported elevated levels of heavy metals, requiring Nanning Waterworks to implement additional filtration stages.

Deteriorating source water quality means the waterworks must invest in more advanced and, consequently, more expensive treatment processes to ensure the water meets stringent drinking water standards. This can include advanced oxidation or membrane filtration techniques, adding significant operational costs. In 2025, projections indicate a potential 5-10% increase in treatment chemical costs due to anticipated lower raw water quality in the Yu River basin.

Climate change is a growing concern, bringing more extreme weather. Think of more frequent droughts and intense floods. These shifts directly impact water availability, a critical factor for Guangxi Nanning Waterworks. For instance, China experienced a significant increase in extreme weather events between 2020 and 2023, with several regions facing severe drought conditions impacting water supplies.

The company must factor these climate-driven risks into its long-term strategies. This includes planning for investments in infrastructure that can withstand these extreme events, like enhanced flood defenses or drought-resistant water storage. Diversifying water sources, perhaps through increased rainwater harvesting or treated wastewater reuse, becomes increasingly important to ensure a stable supply amidst unpredictable weather patterns.

Wastewater Discharge Standards and Ecological Impact

Guangxi Nanning Waterworks must adhere to evolving wastewater discharge standards, which are becoming more rigorous to protect local waterways and ecosystems. For instance, China's Ministry of Ecology and Environment has been progressively tightening national standards, with specific regional implementations in Guangxi impacting effluent quality requirements. Failure to meet these standards can result in significant fines and operational disruptions.

Effective management of treated wastewater is paramount for preserving the health of rivers and surrounding natural environments. This not only ensures compliance but also safeguards the company's reputation and avoids potential legal challenges from environmental regulatory bodies and local communities. The company's commitment to environmental stewardship directly influences its social license to operate.

- Stricter Discharge Limits: Expect continued tightening of permissible pollutant levels in treated wastewater, aligning with national and provincial environmental protection goals.

- Monitoring and Reporting: Enhanced real-time monitoring and transparent reporting of discharge quality will be critical for demonstrating compliance.

- Investment in Technology: Companies will need to invest in advanced treatment technologies to meet these elevated standards, potentially increasing operational costs.

Sustainable Resource Management and Circular Economy

China's environmental policies increasingly prioritize sustainable water use, resource efficiency, and circular economy principles. This focus is reflected in national directives aimed at green development, encouraging industries to adopt more responsible practices. For Guangxi Nanning Waterworks, this translates into a strategic imperative to integrate these concepts into its core operations.

The company can proactively contribute by implementing advanced water-saving technologies and promoting the reuse of treated wastewater. Such initiatives not only reduce the strain on local water resources but also align with the broader national agenda for environmental stewardship. Minimizing waste generation throughout its processes is another key area where Nanning Waterworks can demonstrate its commitment to circular economy principles.

- Growing national emphasis on water conservation and resource efficiency.

- Circular economy principles are being integrated into China's environmental policy framework.

- Nanning Waterworks can adopt water-saving technologies to reduce consumption.

- Wastewater reuse and waste minimization are key contributions to green development goals.

Water scarcity remains a significant challenge for Guangxi Nanning Waterworks, with China's Ministry of Water Resources reporting over 400 cities faced water shortages in 2023, underscoring the need for robust water management strategies.

The quality of raw water is also a concern, as industrial and agricultural runoff in 2024 led to elevated heavy metal levels in some Guangxi waterways, necessitating advanced and costly treatment processes for Nanning Waterworks.

Climate change impacts, such as increased droughts and floods, directly affect water availability, a risk highlighted by China's rise in extreme weather events between 2020 and 2023, requiring infrastructure adaptation and source diversification.

Stricter wastewater discharge standards are being implemented, demanding investment in advanced treatment technologies and enhanced monitoring to ensure compliance with environmental protection goals.

PESTLE Analysis Data Sources

Our Guangxi Nanning Waterworks PESTLE Analysis is built on a robust foundation of data from official Chinese government publications, regional economic reports, and reputable industry associations. We incorporate insights from environmental protection agencies and technological development forums to ensure comprehensive coverage.