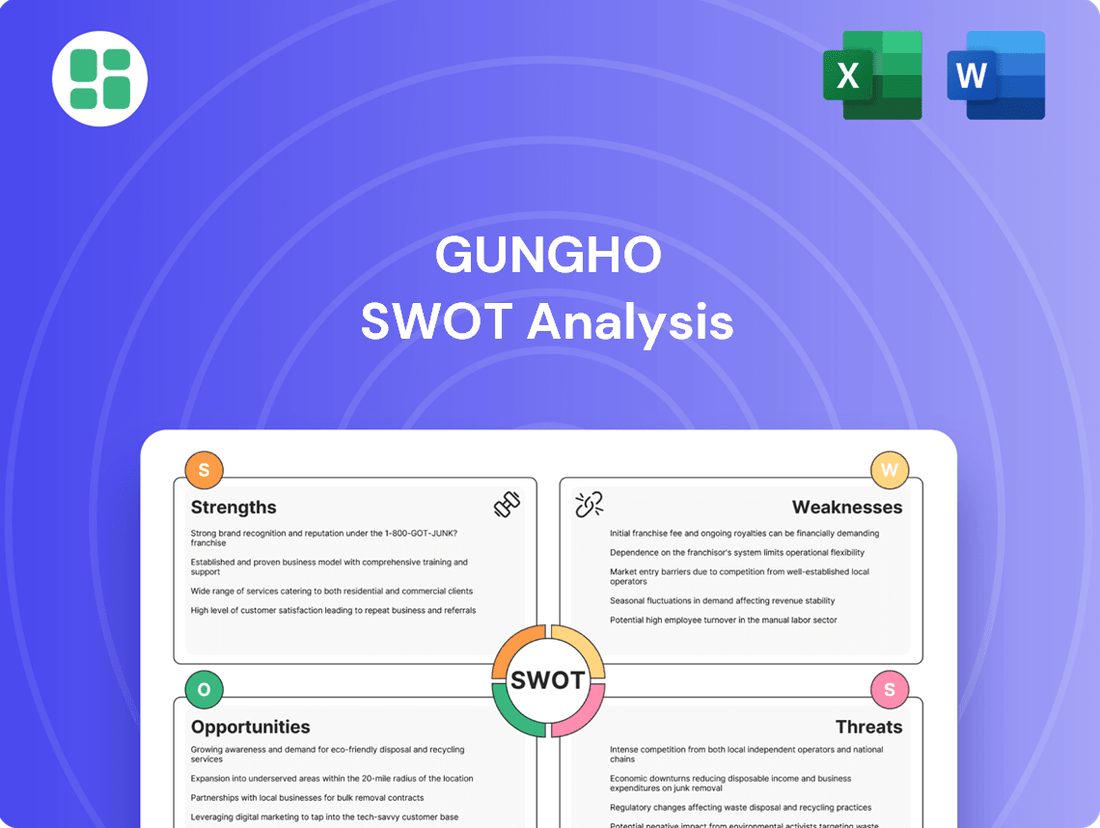

GungHo SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GungHo Bundle

GungHo's unique position in the mobile gaming market, driven by its strong IP and dedicated player base, presents significant opportunities for continued growth. However, understanding the competitive landscape and potential regulatory shifts is crucial for navigating future challenges.

Want the full story behind GungHo's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

GungHo's dominant flagship title, Puzzle & Dragons, continues to be a powerhouse, having amassed over $6 billion in revenue since its debut. Its enduring popularity in Japan, evident in 2025, showcases GungHo's strength in creating and maintaining deeply engaging intellectual property with a loyal player base.

The ongoing commitment to refreshing Puzzle & Dragons, exemplified by the May 2025 launch of Puzzle & Dragons 0, is a testament to GungHo's strategy for player retention and re-engagement. This sustained effort solidifies the game's strong market presence and its role as a core revenue driver.

GungHo excels in the live service and free-to-play (F2P) gaming model, a strategy that has proven incredibly lucrative in the mobile sector. This approach allows for sustained revenue generation through in-app purchases and ongoing content updates for titles like Puzzle & Dragons.

This expertise is particularly advantageous given the Japanese mobile gaming market's strong reliance on F2P mechanics and in-app spending, aligning perfectly with GungHo's core competencies. In 2023, the Japanese mobile gaming market was valued at approximately $19.8 billion, with F2P and in-app purchases forming a significant portion of this revenue.

GungHo's strength lies in its robust multi-platform development and publishing capabilities, allowing it to reach a wide audience. This versatility is evident in its releases across mobile, consoles, and PC. For instance, the upcoming Lunar Remastered Collection is slated for multiple consoles and Steam in Spring 2025, showcasing their commitment to diverse platforms.

This broad market penetration is crucial for revenue diversification. By simultaneously developing for and publishing on various gaming ecosystems, GungHo can tap into different player bases and mitigate risks associated with over-reliance on a single platform. The planned Fall 2025 release of Trails in the Sky 1st Chapter for Nintendo Switch, PlayStation 5, and Steam further underscores this strategic multi-platform approach.

Strong Financial Base and Asset Position

GungHo maintains a robust financial standing, evidenced by its total assets of 175,464 million yen as of December 31, 2024. This figure represents a healthy increase from the prior fiscal year, underscoring a solid asset base. A significant portion of these assets is held in readily available cash and deposits, providing substantial liquidity.

Despite a year-on-year decrease in net sales and profits for FY2024 and the first quarter of 2025, GungHo's substantial financial foundation remains a key strength. This financial resilience is crucial for funding future endeavors.

The company's strong financial position equips it with the necessary resources to invest in:

- New game development projects.

- Aggressive marketing campaigns to boost existing titles.

- Potential strategic acquisitions or partnerships.

Proven Track Record in the Japanese Market

GungHo boasts a proven track record in the Japanese market, a crucial strength given Japan's standing as the world's third-largest gaming market by revenue. Their flagship title, Puzzle & Dragons, achieved immense popularity, becoming a cultural touchstone and demonstrating a deep understanding of local player preferences. This localized success is particularly valuable in a market where mobile gamers exhibit high spending habits, with average annual spending per user significantly exceeding global averages.

Key data points supporting this strength include:

- Japan's Gaming Market Size: Estimated to be worth over $20 billion annually in recent years, highlighting the significant revenue potential.

- Puzzle & Dragons' Impact: The game has consistently ranked among the top-grossing mobile titles in Japan since its 2012 launch, generating billions in revenue.

- High Mobile Gamer Spending: Reports from 2023 and early 2024 indicate Japanese mobile gamers spend an average of over $100 per year, a substantial figure compared to other major markets.

- Cultural Resonance: GungHo's ability to create games that resonate deeply with Japanese culture and player behavior provides a sustained competitive edge.

GungHo's core strength lies in its enduringly popular flagship title, Puzzle & Dragons, which has generated over $6 billion in revenue since its 2012 debut. The game's continued success in Japan, reinforced by updates like Puzzle & Dragons 0 in May 2025, demonstrates GungHo's skill in creating and sustaining deeply engaging intellectual property with a loyal player base.

The company's mastery of the live service and free-to-play (F2P) model is another significant advantage, perfectly aligning with the lucrative Japanese mobile gaming market, which was valued at approximately $19.8 billion in 2023. This expertise allows for consistent revenue generation through in-app purchases and ongoing content updates, a strategy exemplified by Puzzle & Dragons.

GungHo's robust financial health, with total assets of 175,464 million yen as of December 31, 2024, provides the liquidity and stability needed to invest in new projects, marketing, and potential acquisitions, ensuring future growth and resilience despite recent dips in net sales.

The company's proven success in the Japanese market, the world's third-largest gaming market, is a key strength. Puzzle & Dragons' cultural resonance and the high spending habits of Japanese mobile gamers, who spent over $100 annually on average in 2023-2024, underscore GungHo's deep understanding of local player preferences and its ability to capitalize on this lucrative market.

| Metric | Value (as of latest available data) | Significance |

|---|---|---|

| Puzzle & Dragons Revenue | >$6 billion (cumulative) | Demonstrates long-term IP value and player engagement. |

| Japanese Mobile Gaming Market Value | ~$19.8 billion (2023) | Highlights the significant revenue potential within GungHo's primary market. |

| GungHo Total Assets | 175,464 million yen (Dec 31, 2024) | Indicates strong financial stability and capacity for investment. |

| Avg. Annual Mobile Gamer Spending (Japan) | >$100 (2023-2024) | Confirms high monetization potential in the Japanese market. |

What is included in the product

Delivers a strategic overview of GungHo’s internal and external business factors, highlighting its strengths in mobile gaming and potential threats from market competition.

Offers a clear, actionable framework to identify and address internal weaknesses and external threats, thereby mitigating potential business disruptions.

Weaknesses

GungHo's primary weakness lies in its substantial reliance on a single game. In the fiscal year ending December 31, 2024, the Puzzle & Dragons series alone contributed a significant 41.2% to the company's net sales.

This high dependency creates a considerable vulnerability. A downturn in Puzzle & Dragons' popularity or revenue could disproportionately affect GungHo's overall financial health and stability.

While GungHo has explored other titles, the majority of its income remains tied to this established franchise, highlighting a persistent challenge in diversifying its revenue streams effectively.

GungHo Online Entertainment experienced a significant downturn in its financial performance for the fiscal year ending December 31, 2024. Net sales saw a considerable drop of 17.3%, while operating profit declined by a steeper 37.3% compared to the prior year.

This negative momentum persisted into the first quarter of 2025. All key profitability metrics, including net sales, operating profit, ordinary profit, and net profit, registered substantial decreases when measured against the corresponding period in the previous year.

These figures highlight GungHo's ongoing struggles to sustain revenue generation and maintain profitability amidst a highly competitive market landscape.

GungHo has faced significant hurdles in replicating the massive success of its flagship title, Puzzle & Dragons, with its newer intellectual properties. Despite releasing several new games and updates, none have managed to capture the same level of market dominance or revenue generation. This struggle to consistently create new 'killer content' directly impacts the company's ability to diversify its revenue streams beyond its established hit.

The reliance on Puzzle & Dragons, which continues to be a primary revenue driver, presents a notable weakness. While GungHo reported net sales of ¥77.9 billion for the fiscal year ending December 31, 2023, a significant portion is still attributed to its established titles. The lack of new, equally successful IPs limits GungHo's long-term growth potential and exposes it to greater business risk should its current main revenue source falter.

Intense Competition in the Global Gaming Market

GungHo operates within a fiercely competitive global gaming landscape, a market characterized by an overwhelming number of developers and publishers vying for player attention. This saturation extends to the Japanese mobile gaming sector, a significant market that also faces intense pressure from both established domestic games and a constant influx of international competitors. Acquiring new users and retaining market share, particularly for titles that are not flagship offerings, becomes an increasingly difficult endeavor due to this intense rivalry.

The global games market is projected to generate over $200 billion in revenue in 2024, highlighting the scale of the opportunity but also the intensity of the competition. Furthermore, the mobile gaming segment, which GungHo heavily relies on, is expected to account for a substantial portion of this, with forecasts suggesting it will surpass $100 billion in 2024. This means that while the market is large, the battle for dominance is exceptionally fierce, with established players and agile newcomers constantly innovating to capture player engagement.

- Market Saturation: The global gaming market is oversaturated with developers and publishers.

- Intense Mobile Competition: The Japanese mobile gaming market is particularly crowded with domestic and international titles.

- User Acquisition Challenges: High competition makes it difficult and costly to attract new players and maintain existing ones.

- Non-Flagship Performance: Titles not considered flagship products face even greater hurdles in gaining traction and market share.

Vulnerability to Market Currency Fluctuations

The weakening Japanese Yen presents a significant vulnerability for GungHo Online Entertainment. As of early 2024, the Yen has experienced considerable depreciation against major currencies like the US Dollar. This currency fluctuation directly impacts the reported revenue of Japanese companies with substantial international sales, even if their underlying transactions are in local currency. For GungHo, while its financial statements are denominated in JPY, a portion of its international revenue and potentially some operational costs are exposed to exchange rate volatility.

This exposure can distort the perceived financial performance when viewed from a global perspective. For instance, if GungHo generates a significant portion of its revenue from the US market in USD, a weaker Yen means that those USD earnings translate into fewer Yen when repatriated. This can negatively affect GungHo's consolidated profitability and its valuation by international investors who often assess companies based on global financial metrics. The trend of Yen weakness, observed throughout 2023 and continuing into early 2024, highlights this ongoing risk for the company's international earnings.

- Revenue Translation Impact: A weaker Yen means that revenue earned in foreign currencies, such as USD from its popular titles like Puzzle & Dragons, translates into fewer Japanese Yen, potentially dampening reported revenue growth.

- Cost of Goods Sold and Operations: While GungHo's core development is in Japan, any imported goods, services, or even talent acquisition costs denominated in foreign currencies become more expensive as the Yen weakens.

- Investor Perception: International investors may view the company's earnings with caution due to currency headwinds, potentially impacting its stock valuation and access to foreign capital markets.

- Competitive Landscape: Competitors based in countries with stronger currencies might see their Yen-denominated revenues become relatively more attractive, potentially shifting market dynamics.

GungHo's significant dependence on Puzzle & Dragons remains a core weakness. In the fiscal year ending December 31, 2024, this single title accounted for 41.2% of net sales, underscoring a lack of revenue diversification. This concentration makes the company highly susceptible to fluctuations in the popularity and revenue generation of this one game, posing a substantial risk to its overall financial stability.

Same Document Delivered

GungHo SWOT Analysis

The preview you see is the same GungHo SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

This is a real excerpt from the complete GungHo SWOT analysis. Once purchased, you’ll receive the full, editable version.

The file shown below is not a sample—it’s the real GungHo SWOT analysis you'll download post-purchase, in full detail.

Opportunities

GungHo Online Entertainment has a clear objective to grow its global footprint, with a particular focus on North America and Europe. This strategic push offers a significant chance to tap into new player communities and broaden revenue sources, moving beyond its established base in Japan.

By entering these key markets, either through direct operations or strategic alliances, GungHo can mitigate risks associated with over-reliance on a single region. This diversification is crucial for long-term stability and growth.

The company's commitment to international expansion is evident in its multi-language game releases. For instance, the launch of Disney Pixel RPG in 18 countries underscores this ambition, demonstrating a proactive approach to reaching a global audience and capturing market share in diverse territories.

The gaming industry's rapid evolution presents significant opportunities for GungHo, particularly in cloud gaming and the increasing power of mobile devices. These advancements, coupled with the widespread availability of 4G and 5G networks, create fertile ground for innovative gameplay experiences.

GungHo's strategic focus on financial stability and an efficient development pipeline directly supports its ability to embrace these technological shifts. This preparedness allows the company to effectively integrate emerging technologies, such as AI in game creation and ongoing live services, thereby enhancing player engagement and operational efficiency.

Strategic partnerships and acquisitions offer GungHo significant opportunities to expand its global reach and enhance its game development capabilities. Collaborations with international partners can unlock new distribution channels, bringing GungHo's titles to a wider audience and potentially tapping into markets where it has less presence. For instance, a partnership in 2024 with a major Southeast Asian publisher could grant access to millions of new players.

Acquiring studios with specialized expertise or established intellectual properties (IPs) can accelerate GungHo's entry into new genres or solidify its position in existing ones. This strategy allows GungHo to leverage external talent and proven concepts, thereby reducing internal development risks and costs. By integrating new IPs, GungHo can diversify its revenue streams and appeal to a broader player base, a move seen in the industry as crucial for sustained growth in the competitive gaming landscape.

Furthermore, strategic alliances can be instrumental in mitigating the high costs and inherent market risks associated with developing and launching new games. By sharing these burdens, GungHo can pursue more ambitious projects and explore innovative gameplay mechanics. This approach is particularly relevant in 2024 and 2025, as game development budgets continue to rise, making shared investment models increasingly attractive for market penetration and portfolio diversification.

Growth in the Mobile Gaming and Free-to-Play Market

The global free-to-play (F2P) gaming market is experiencing robust expansion, with projections indicating a rise from an estimated USD 63.98 billion in 2025 to USD 141.50 billion by 2030, representing a compound annual growth rate of 17.23%. This significant upward trend presents a prime opportunity for GungHo Online Entertainment. Japan's mobile gaming sector, a key market for GungHo, is also set for substantial growth, anticipated to reach USD 19.6 billion by 2033, with a projected growth rate of 10.3% between 2025 and 2033.

GungHo's established proficiency in developing and managing successful F2P titles positions it favorably to leverage this market momentum. By continuing to innovate within the F2P model, the company can attract a wider player base and deepen existing user engagement, thereby capitalizing on the increasing demand for accessible and engaging mobile gaming experiences.

- Projected Global F2P Market Growth: Expected to grow from USD 63.98 billion in 2025 to USD 141.50 billion by 2030, at a CAGR of 17.23%.

- Japanese Mobile Gaming Expansion: The Japanese market is forecast to reach USD 19.6 billion by 2033, growing at 10.3% from 2025-2033.

- GungHo's Strategic Advantage: Expertise in the F2P model allows for capturing new users and enhancing player retention in a growing market.

Revitalization of Older or Niche IPs through Remasters/Remakes

GungHo can capitalize on the growing trend of revitalizing older or niche intellectual properties (IPs) through remasters and remakes. The success of collections like the Lunar Remastered Collection and the Trails in the Sky 1st Chapter on modern platforms demonstrates a clear market appetite for these re-releases. This strategy offers a pathway to re-engage a dedicated, nostalgic player base while simultaneously introducing beloved classic titles to a new generation of gamers.

Leveraging existing brand recognition, particularly within genres like JRPGs where GungHo has a strong presence, can significantly reduce the perceived development risk associated with creating entirely new IPs. This approach can unlock additional revenue streams with a potentially more predictable return on investment. For instance, the global market for remasters and remakes has seen steady growth, with many titles achieving significant sales figures upon their modern platform debut, indicating a strong consumer willingness to repurchase or discover classic gaming experiences.

Consider these specific opportunities:

- Targeted Remasters: Identify GungHo's own catalog of well-regarded but perhaps dated titles, especially within the JRPG space, for high-definition remasters.

- Niche IP Revival: Explore opportunities to remake or remaster niche IPs that have a cult following but may have been limited by the technology of their original release.

- Cross-Platform Releases: Ensure remasters and remakes are released across multiple modern platforms (PC, PlayStation, Xbox, Nintendo Switch) to maximize reach and potential sales.

- Bundled Content: Offer remastered collections that include bonus content, such as developer interviews, concept art, or even previously unreleased material, to enhance value and appeal to dedicated fans.

GungHo's expansion into North America and Europe presents a significant opportunity to broaden its player base and revenue streams. The company's proactive approach to multi-language releases, exemplified by the launch of Disney Pixel RPG in 18 countries, highlights its commitment to global reach.

The gaming industry's technological advancements, particularly in cloud gaming and mobile capabilities, coupled with widespread 4G and 5G network availability, create fertile ground for GungHo to innovate and enhance player experiences. The company's financial stability and efficient development pipeline further bolster its ability to integrate emerging technologies like AI.

Strategic partnerships and acquisitions offer GungHo avenues to expand its global footprint and development capabilities. Collaborations can unlock new distribution channels, while acquiring studios with specialized expertise or established IPs can accelerate entry into new genres and reduce development risks, a strategy crucial for sustained growth in the competitive gaming market.

The burgeoning global free-to-play (F2P) market, projected to reach USD 141.50 billion by 2030, and the steady growth of Japan's mobile gaming sector, expected to hit USD 19.6 billion by 2033, represent prime opportunities for GungHo, given its expertise in the F2P model.

Revitalizing existing intellectual properties (IPs) through remasters and remakes taps into a clear market appetite for classic titles, offering a way to re-engage nostalgic players and attract new ones. This strategy leverages brand recognition, particularly in JRPGs, potentially leading to more predictable returns on investment.

| Opportunity Area | Key Data Point (2024/2025 Focus) | GungHo's Advantage |

| Global Market Expansion | North America and Europe are key growth regions for gaming. | Leveraging existing multi-language release strategies. |

| Technological Advancements | Cloud gaming and 5G adoption are accelerating. | Financial stability and efficient development pipeline for tech integration. |

| Strategic Alliances | Partnerships can mitigate high development costs and market risks. | Access to new distribution channels and player bases. |

| F2P Market Growth | Global F2P market to reach USD 63.98 billion in 2025. | Proven expertise in developing and managing successful F2P titles. |

| IP Revitalization | Strong consumer willingness to repurchase classic gaming experiences. | Established presence in genres like JRPGs for remaster potential. |

Threats

The global gaming market is incredibly crowded, with an estimated 3 billion players worldwide in 2024, making it harder for any single company to stand out. This intense competition, particularly in Japan, means GungHo faces constant pressure to innovate and attract new players, especially beyond its popular titles like Puzzle & Dragons. Competitors are aggressively pursuing user acquisition, directly impacting GungHo's ability to maintain and grow its market share.

GungHo's significant reliance on its flagship title, Puzzle & Dragons, presents a substantial threat. While the game continues to perform, any downturn in user engagement or revenue directly translates to a severe impact on the company's overall financial health. Investor concerns have previously flagged this over-dependence, labeling GungHo as a 'one-hit wonder,' a risk that remains pertinent given the inherent unpredictability of game lifecycles.

Player tastes in gaming evolve at a breakneck pace, directly affecting game viability and how companies make money. For instance, while free-to-play with in-app purchases is currently king, a significant pivot towards subscription services or entirely new game genres could catch GungHo off guard if they aren't agile enough to respond.

The gaming industry's landscape is inherently unpredictable, marked by frequent, short-term shifts. This novelty means GungHo must constantly monitor player sentiment and be prepared to pivot its monetization strategies, such as adjusting the balance of in-app purchases versus potential subscription offerings, to remain competitive.

Regulatory and Legal Risks

The gaming industry, especially free-to-play games with mechanics like gacha, is under increasing scrutiny for consumer protection and potential gambling parallels. GungHo, like its peers, must navigate evolving regulations concerning in-app purchases and player welfare.

Changes in intellectual property laws, data privacy mandates, or monetization rules could necessitate significant adjustments to GungHo's operations, leading to increased compliance costs or legal battles. For instance, as of March 2025, GungHo acknowledges intellectual property infringement as a notable risk in its disclosures.

- Consumer Protection Laws: Heightened focus on fairness in free-to-play monetization models, particularly gacha, could lead to new restrictions.

- Intellectual Property: Risks of infringement claims, as highlighted by GungHo in early 2025, can disrupt game development and distribution.

- Data Privacy Regulations: Evolving global standards like GDPR or similar frameworks require continuous adaptation of data handling practices, impacting user acquisition and personalization strategies.

Macroeconomic Factors and Currency Volatility

Macroeconomic shifts, particularly the weakening Japanese Yen, significantly impacted GungHo's reported revenue in USD during 2024. This currency depreciation directly lowered the dollar value of Yen-denominated earnings from the Japanese mobile gaming market. Continued currency fluctuations or a wider economic slowdown could further dampen consumer discretionary spending on entertainment, thereby affecting GungHo's sales performance and overall profitability.

The global games market is expected to see very little growth in 2025, especially when adjusted for inflation. This projected stagnation presents a significant challenge for GungHo, as it suggests a tougher competitive environment and limited opportunities for organic revenue expansion.

- Currency Headwinds: The Japanese Yen's performance directly influences GungHo's translated revenues.

- Consumer Spending Sensitivity: Economic downturns can lead to reduced spending on non-essential goods like video games.

- Market Growth Stagnation: The global games market's flat growth projection for 2025 limits expansion potential.

GungHo faces significant threats from evolving player preferences and the rapid pace of technological change in the gaming industry. The industry's inherent unpredictability means that a constant need to adapt monetization strategies and game content is paramount for survival. Furthermore, increasing regulatory scrutiny around in-game purchases, particularly gacha mechanics, poses a compliance risk that could impact revenue streams.

The company's reliance on Puzzle & Dragons remains a critical vulnerability, as any decline in its performance directly impacts GungHo's financial stability. The broader gaming market's projected stagnation for 2025, coupled with currency headwinds from a weakening Yen, further exacerbates these challenges, limiting opportunities for growth and impacting reported earnings.

| Threat Category | Specific Threat | Impact on GungHo | Timeline/Data Point |

|---|---|---|---|

| Market Competition | Crowded global gaming market | Difficulty in user acquisition and market share retention | 3 billion players worldwide (2024 estimate) |

| Product Dependence | Over-reliance on Puzzle & Dragons | Significant financial risk if flagship title underperforms | Investor concerns flagged as 'one-hit wonder' risk |

| Regulatory Environment | Consumer protection scrutiny (gacha) | Potential for new restrictions on monetization models | Ongoing regulatory discussions globally |

| Economic Factors | Weakening Japanese Yen | Reduced translated revenue in USD | Impacted 2024 reported revenue |

| Market Growth | Projected market stagnation | Limited organic revenue expansion opportunities | Very little growth expected in global games market for 2025 (adjusted for inflation) |

SWOT Analysis Data Sources

This GungHo SWOT analysis is built upon a robust foundation of data, including official financial reports, comprehensive market research, and expert industry analysis to provide a well-rounded strategic perspective.