GungHo Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GungHo Bundle

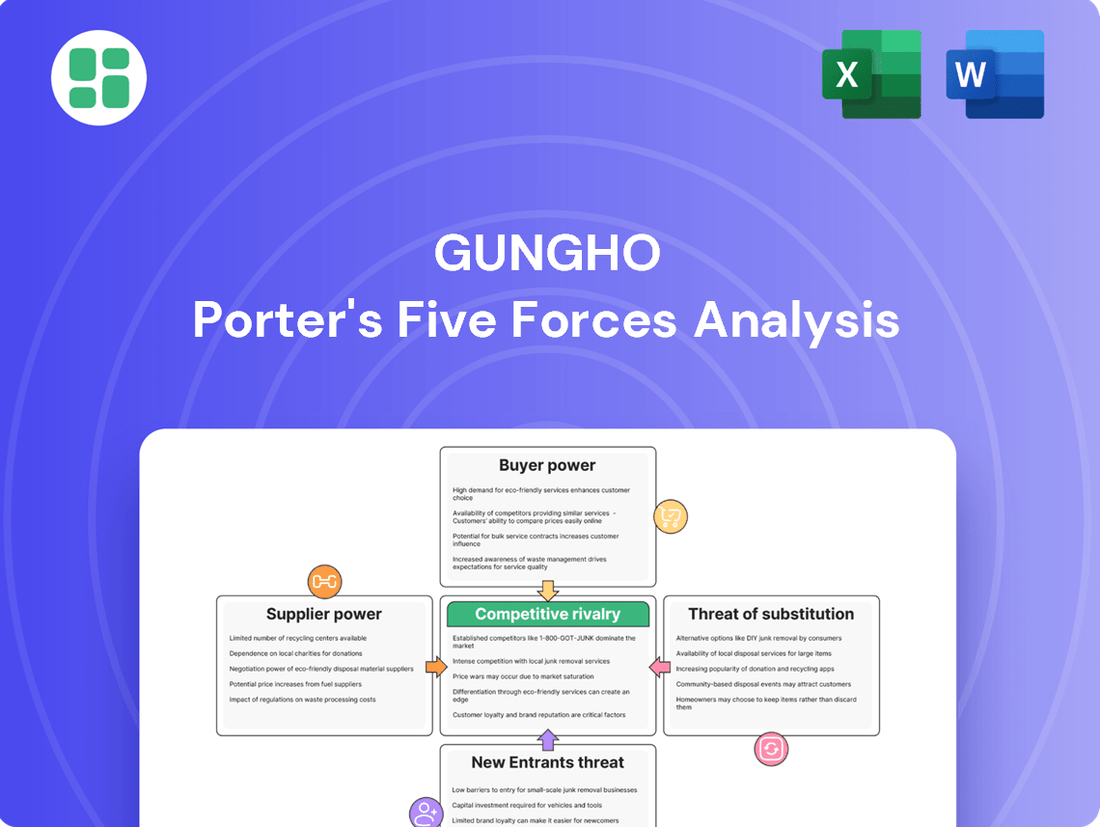

GungHo's competitive landscape is shaped by the interplay of powerful forces, from the bargaining power of their suppliers to the ever-present threat of new entrants. Understanding these dynamics is crucial for any strategic decision.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore GungHo’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Platform holders like Apple and Google wield considerable power over GungHo. They control the essential channels for distributing mobile games, setting the rules for content and how games are found. This means GungHo, like many developers, has to accept terms such as a 15-30% revenue share from sales on their platforms.

GungHo's dependence on the App Store and Google Play for its popular titles, such as Puzzle & Dragons, significantly limits its ability to negotiate these critical business terms. The sheer volume of users on these platforms makes them indispensable for reaching a wide audience, thereby strengthening the platform holders' bargaining position.

GungHo Online Entertainment's reliance on third-party game engines, such as their recent switch to Unreal Engine for GungHo America's future projects, grants these engine providers moderate bargaining power. This influence is shaped by the degree of customization GungHo requires and the availability of comparable alternative engines in the market.

The bargaining power of game engine providers is further influenced by industry trends; a widespread adoption of a particular engine can consolidate its market position and amplify its leverage over developers like GungHo. Conversely, GungHo's investment in proprietary engine technology or the development of robust in-house alternatives could significantly diminish the external suppliers' sway.

GungHo's reliance on hardware manufacturers for console and PC game development, including crucial development kits and technical specifications, positions these suppliers with low to moderate bargaining power. This is largely due to the standardized nature of PC components, which allows for easy sourcing from various vendors.

The console market, while more controlled, also exhibits relative stability. In 2024, major console manufacturers like Sony and Microsoft continued to dominate, but the existence of established development pipelines and the ability for companies like GungHo to adapt to evolving hardware standards limit the leverage of individual hardware component suppliers.

Moderate Power of Payment Processors and Cloud Services

GungHo's reliance on its live service model, particularly for revenue generation through in-app purchases in titles like Puzzle & Dragons, makes payment processors and cloud services critical. The availability of numerous providers for these essential functions might suggest lower supplier power. However, the integration complexity and the potential disruption to ongoing operations mean that switching providers isn't always a simple or cost-free exercise for a mature game.

The moderate switching costs, especially for a deeply embedded service like Puzzle & Dragons which has accumulated years of user data and transaction history, grant payment processors and cloud service providers a degree of leverage. Established providers often offer a perceived higher level of stability and security, which can be a significant factor for GungHo, as downtime or data breaches directly impact revenue and customer trust. For instance, in 2023, the global cloud computing market reached approximately $600 billion, highlighting the scale and importance of these services, with major players like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud holding substantial market share.

- Payment Processing Integration: GungHo's live service model requires seamless integration with payment gateways for in-app purchases.

- Cloud Hosting Dependency: Cloud services are vital for hosting game servers, managing user data, and ensuring game stability.

- Switching Costs: Migrating extensive user data and re-integrating payment systems can incur significant costs and operational risks for established titles.

- Provider Stability: The reliability and security offered by major cloud and payment providers can give them leverage in negotiations.

Moderate Power of Specialized Talent

The gaming industry, especially in Japan, relies heavily on exceptionally skilled developers, artists, and designers. While GungHo is a significant player, the intense competition for top-tier talent, particularly in specialized areas like AR/VR development which GungHo is investigating, grants these individuals moderate leverage concerning compensation and benefits.

- Specialized Skills Demand: The creation of sophisticated games, especially those incorporating emerging technologies like augmented reality (AR) and virtual reality (VR), necessitates a workforce with highly specific and often rare skill sets.

- Talent Scarcity: In 2024, the global demand for experienced game developers, particularly those proficient in advanced programming languages and engine technologies, continued to outstrip supply, leading to increased competition among studios.

- Negotiating Leverage: When a company like GungHo seeks to hire individuals with proven expertise in niche genres or cutting-edge technologies, these professionals can command higher salaries and more attractive benefit packages due to their unique value.

- Industry Trends: The ongoing exploration of AR/VR by companies like GungHo means that developers with experience in these fields are in particularly high demand, further strengthening their bargaining position.

The bargaining power of suppliers for GungHo is primarily concentrated with platform holders like Apple and Google, who dictate distribution terms and revenue shares, often around 15-30%. This leverage is amplified by GungHo's dependence on these platforms for its major titles, such as Puzzle & Dragons, to reach a vast user base.

Game engine providers also hold moderate power, influenced by GungHo's need for customization and the availability of alternatives. While GungHo's investment in proprietary technology can reduce this, the industry's trend towards specific engines can consolidate supplier influence.

Hardware manufacturers for consoles and PCs generally have low to moderate bargaining power due to the standardization of PC components. However, specialized talent in areas like AR/VR development, which GungHo is exploring, grants individuals significant leverage due to high demand and scarcity in 2024.

| Supplier Category | GungHo's Dependence | Supplier Bargaining Power | Key Factors |

|---|---|---|---|

| Platform Holders (Apple, Google) | High (Distribution, User Access) | High | Platform fees (15-30%), User base size |

| Game Engine Providers | Moderate (Development Tools) | Moderate | Customization needs, Availability of alternatives |

| Hardware Manufacturers (Consoles/PCs) | Low to Moderate (Development Kits) | Low to Moderate | Component standardization (PCs), Established console pipelines |

| Skilled Talent (Developers, Artists) | High (Specialized Skills) | Moderate to High | Demand for niche/AR/VR skills, Talent scarcity |

What is included in the product

This analysis examines the competitive landscape for GungHo, detailing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes.

Instantly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces, allowing for targeted strategic adjustments.

Customers Bargaining Power

In the free-to-play mobile gaming sector, players can easily switch between games with minimal effort or cost. This means GungHo, known for titles like Puzzle & Dragons, faces significant pressure to keep its existing players engaged. For instance, in 2023, the global mobile gaming market generated over $90 billion, highlighting the intense competition and the constant influx of new titles vying for player attention.

In GungHo's free-to-play model, customers wield significant bargaining power due to their price sensitivity. While the initial game download costs nothing, the company's revenue hinges on in-app purchases, making players acutely aware of the value they receive for virtual goods and how they are monetized.

If players perceive GungHo's monetization tactics as overly aggressive or unfair, they have the immediate option to cease spending or even abandon the game altogether. This direct action directly impacts the company's core revenue streams, underscoring the substantial leverage customers possess.

GungHo's games thrive on vibrant player communities, particularly online. These communities act as powerful feedback loops, directly influencing game updates and future development. For instance, player sentiment expressed on platforms like Reddit or Discord can quickly shape developer priorities.

This collective voice significantly amplifies customer bargaining power. Negative feedback can go viral, impacting a game's reputation and deterring potential new players. Consider the impact of widespread player dissatisfaction with a new monetization strategy; this can lead to boycotts or a significant drop in player engagement, forcing GungHo to reconsider its approach.

Dependence on Flagship Title

GungHo's considerable dependence on its flagship title, Puzzle & Dragons, significantly amplifies the bargaining power of its customers. A substantial portion of the company's revenue is tied to this single game, meaning any dip in its popularity or player engagement would empower its loyal player base. This concentration risk grants these dedicated players more leverage in influencing the game's ongoing development and event planning.

For instance, in the fiscal year ending December 31, 2023, GungHo Online Entertainment reported net sales of ¥95.6 billion (approximately $640 million USD at current exchange rates). While specific revenue breakdowns for individual titles are not always publicly detailed, industry analysis consistently points to Puzzle & Dragons as the primary revenue driver for the company. This reliance means that the game's community holds considerable sway.

- Revenue Concentration: Puzzle & Dragons remains a critical revenue generator for GungHo, giving its player base significant influence.

- Player Engagement: Declines in player engagement for the flagship title would directly increase customer bargaining power.

- Influence on Development: Loyal players can leverage their importance to impact future game updates and monetization strategies.

Access to Abundant Alternatives

Customers in the gaming industry, including those who might engage with GungHo's products, benefit from an incredibly diverse marketplace. The sheer volume of mobile, console, and PC online games available from developers worldwide means players have a wealth of alternatives at their fingertips. This abundance directly translates into increased bargaining power for consumers.

This broad access to substitutes is a critical factor. If a customer finds GungHo's games or pricing unsatisfactory, they can readily switch to a competitor's offering that provides a similar or even a more appealing experience. For instance, the free-to-play segment alone offers countless titles across all platforms, many of which are highly polished and engaging.

- Market Saturation: The global games market is projected to reach $272 billion in 2024, with mobile gaming representing a significant portion. This vastness means more choices for consumers.

- Free-to-Play Dominance: Many successful games operate on a free-to-play model, lowering the barrier to entry and providing readily available alternatives to paid titles.

- Cross-Platform Availability: Games are increasingly available across multiple platforms, further expanding the pool of substitutes for any given player.

- Indie Developer Growth: The rise of independent game developers has also contributed to a richer and more varied game library, offering niche experiences that can attract players away from larger publishers.

GungHo's customers, particularly those in its free-to-play mobile games, possess significant bargaining power. Their ability to easily switch between titles with minimal cost means GungHo must constantly offer value to retain them. In 2023, the global mobile gaming market exceeded $90 billion, underscoring the intense competition for player attention and spending.

The company's reliance on in-app purchases makes players highly sensitive to pricing and perceived value, directly impacting revenue. If players deem monetization unfair, they can cease spending or abandon the game, a potent form of leverage.

Furthermore, player communities significantly influence game development and monetization strategies. Negative sentiment, amplified through social platforms, can force GungHo to reconsider its approaches, especially given the concentration of revenue from titles like Puzzle & Dragons.

The vast and diverse gaming market, with its abundance of free-to-play alternatives, further empowers GungHo's customers. The projected $272 billion global games market in 2024 means players have readily available substitutes if they find GungHo's offerings unsatisfactory.

| Factor | Impact on GungHo | Supporting Data (2023/2024 Estimates) |

|---|---|---|

| Ease of Switching | High customer leverage; pressure to maintain engagement | Global mobile gaming market > $90 billion (2023) |

| Price Sensitivity (In-App Purchases) | Direct impact on revenue; customers can withhold spending | - |

| Community Influence | Ability to shape game development and monetization | - |

| Availability of Substitutes | Customers can easily move to competing games | Global games market projected $272 billion (2024) |

Same Document Delivered

GungHo Porter's Five Forces Analysis

The document you see here is the complete, professionally researched GungHo Porter's Five Forces Analysis, ready for immediate download and use. What you're previewing is precisely the same comprehensive analysis, detailing the competitive landscape and strategic implications for GungHo, that you'll receive instantly after purchase. This ensures you get the full, unedited report without any placeholders or sample sections, allowing you to leverage its insights right away.

Rivalry Among Competitors

The global online gaming market, especially mobile gaming, is incredibly crowded. In 2024, it's estimated that there are tens of thousands of game developers and publishers actively releasing titles. This saturation means GungHo faces a constant battle for player engagement and spending against a vast array of competitors, from industry giants like Sony and Microsoft to countless smaller, agile indie studios.

Japan's gaming landscape, GungHo's home turf, is also intensely fragmented. Thousands of companies vie for a share of the market, which is projected to reach over $25 billion in 2024. This intense rivalry forces GungHo to continually innovate and differentiate its offerings to stand out amidst the noise and capture player attention.

Developing games demands substantial upfront investment in creation, promotion, and maintaining the game's infrastructure. For instance, major AAA game development can easily cost hundreds of millions of dollars, with some titles in 2024 reportedly exceeding $200 million.

However, once a game is developed, the cost to distribute it digitally to additional players, known as marginal cost, is remarkably low, often just pennies for server bandwidth. This stark contrast between high fixed and low marginal costs creates a powerful incentive for intense competition within the gaming industry.

Companies are driven to spend aggressively on marketing and continuously release new content and updates to attract and keep players engaged. This strategy aims to maximize the return on their initial investment by achieving a large player base, as seen with the ongoing live service model of many popular online games in 2024.

The online gaming industry, where GungHo operates, is fiercely competitive, demanding constant innovation and unique product offerings to capture player attention. Success is directly tied to a company's ability to differentiate its games and consistently introduce new, engaging content. This pressure means GungHo must continually invest in research and development to create exciting new titles and enhance existing ones with features like augmented or virtual reality to stay ahead.

Reliance on Flagship Title and Diversification Efforts

GungHo Online Entertainment's competitive rivalry is significantly shaped by its heavy reliance on its flagship title, Puzzle & Dragons. This dependence presents a clear vulnerability; a downturn in Puzzle & Dragons' performance could disproportionately affect GungHo's overall financial health. For instance, while Puzzle & Dragons has historically been a massive revenue driver, reporting billions in lifetime gross revenue, its growth trajectory can fluctuate.

To counter this, GungHo is actively engaged in diversification efforts. This strategy involves launching new games across different platforms and genres, aiming to broaden its revenue streams and reduce its dependence on any single title. The success of these new ventures, such as titles released in 2024, will be a critical determinant of GungHo's ability to maintain and enhance its competitive position in the dynamic gaming market.

- Flagship Dependence: Puzzle & Dragons remains a core revenue generator, creating a risk if its popularity wanes.

- Diversification Strategy: GungHo is investing in new game development to spread risk and capture new markets.

- 2024 Initiatives: The performance of games launched in 2024 will be key indicators of the success of GungHo's diversification strategy.

Aggressive Marketing and User Acquisition

The mobile gaming industry is characterized by intense competition, with companies pouring significant resources into attracting new players. This aggressive marketing and user acquisition strategy directly impacts companies like GungHo, forcing them to allocate substantial budgets to stay competitive, especially when launching new titles.

In 2024, the cost to acquire a new mobile game user continued to be a major consideration. For instance, some reports indicated that the average cost per install (CPI) for hypercasual games could range from $0.50 to $2.00, while more complex genres might see CPIs exceeding $5.00 or even $10.00 in highly competitive markets.

- Aggressive Marketing Spend: Competitors frequently employ broad-reaching advertising campaigns across various platforms, including social media, influencer marketing, and in-app advertising, to capture user attention.

- Rising User Acquisition Costs: The constant battle for visibility drives up the cost for each new player acquired, making efficient marketing spend crucial.

- Budgetary Demands: GungHo must maintain significant marketing budgets to ensure its games are discovered amidst the noise, impacting profitability and requiring careful financial planning.

- Impact on New Launches: Successfully introducing a new game hinges on breaking through the clutter, necessitating even greater marketing investment during the critical launch phase.

The competitive rivalry in the online gaming sector, where GungHo operates, is exceptionally fierce. With a global market valued at over $200 billion in 2024, the sheer number of developers and publishers means intense pressure to capture and retain player attention. This necessitates continuous innovation and differentiation, as GungHo faces off against both established giants and agile indie studios constantly vying for market share.

GungHo's reliance on its flagship title, Puzzle & Dragons, highlights a key aspect of its competitive landscape. While this game has generated substantial revenue, its performance directly impacts the company's overall standing. To mitigate this, GungHo is actively pursuing diversification, launching new titles in 2024 across various genres and platforms to broaden its revenue base and reduce single-title dependency.

The cost of user acquisition in the mobile gaming market remains a significant challenge, with average costs per install (CPI) in 2024 ranging from $0.50 to over $10.00 depending on game complexity and market. This intense competition drives aggressive marketing spend by all players, forcing GungHo to allocate substantial budgets to ensure its games are discovered and to compete effectively during launch phases.

| Key Competitive Factors | Description | Impact on GungHo |

|---|---|---|

| Market Saturation | Tens of thousands of game developers and publishers globally in 2024. | Requires constant innovation and differentiation to stand out. |

| Flagship Dependence | Heavy reliance on Puzzle & Dragons for revenue. | Creates vulnerability to performance fluctuations of a single title. |

| User Acquisition Costs | Rising costs to acquire new players, with CPIs varying widely in 2024. | Necessitates significant marketing budgets for visibility and growth. |

| Diversification Efforts | Launching new games to spread risk and capture new markets. | Success of 2024 launches is crucial for long-term competitive positioning. |

SSubstitutes Threaten

The most significant substitutes for GungHo's online games are other forms of digital entertainment. Think about video streaming services like Netflix and YouTube, or even social media platforms. These all vie for consumers' precious leisure time and their spending money, offering a wide array of experiences at different costs.

In 2024, the global digital entertainment market is massive, with video streaming alone projected to reach over $200 billion. This sheer size highlights the intense competition GungHo faces not just from other game developers, but from any service that captures a user's attention and wallet.

The threat of substitutes for GungHo's games is significant, extending beyond direct mobile and online competitors. Players can easily shift their attention and spending to console gaming, with titles like those on PlayStation 5 and Xbox Series X/S offering immersive experiences. In 2024, the global console gaming market is projected to reach over $70 billion, highlighting a substantial alternative for entertainment.

Furthermore, PC gaming, encompassing both online multiplayer and offline single-player titles, presents another strong substitute. The PC gaming market is expected to grow robustly, with revenue anticipated to surpass $40 billion in 2024. This broad ecosystem includes a vast array of genres and experiences that can divert player engagement from GungHo's portfolio.

The rise of cloud gaming services, such as Xbox Cloud Gaming and PlayStation Plus Premium, further broadens the substitution landscape. These platforms allow access to a wide library of games across various devices, reducing the need for specific hardware and offering a more flexible gaming experience. This accessibility makes it easier for consumers to explore different gaming avenues, potentially impacting GungHo's user retention and acquisition efforts.

Consumer preferences in entertainment are constantly evolving, with rapid shifts towards new trends, technologies, and content formats. GungHo must actively monitor and adapt to these changes, such as the growing interest in virtual and augmented reality gaming or emerging social media trends. Failure to do so could lead players to substitute GungHo's games with these novel experiences.

Low Switching Costs to Non-Gaming Activities

The threat of substitutes for GungHo's games is amplified by the extremely low switching costs to non-gaming leisure activities. For many casual players, the decision to engage in activities like reading, pursuing outdoor sports, or participating in social gatherings involves minimal financial outlay or effort, making these alternatives readily accessible and highly competitive.

This ease of substitution significantly broadens the competitive landscape beyond just other video games. In 2023, global spending on all forms of entertainment, including streaming services, live events, and hobbies, reached trillions of dollars, indicating the vast array of choices consumers have for their discretionary time and money.

- Low Switching Costs: Transitioning from GungHo's games to other leisure pursuits requires little to no financial investment or learning curve for casual users.

- Broad Competitive Set: The competition isn't limited to other game developers but extends to all forms of entertainment and leisure activities.

- Consumer Time Allocation: In 2024, the average consumer dedicates a significant portion of their disposable income and free time to a wide range of entertainment options, not solely gaming.

- Accessibility of Alternatives: Activities like reading, outdoor recreation, and social events are widely available and often free or low-cost, presenting a constant alternative to gaming.

Emergence of New Monetization Models

The threat of substitutes for GungHo's current free-to-play (F2P) model is growing. While GungHo relies heavily on in-app purchases, the broader entertainment landscape is seeing shifts. For instance, subscription services like Xbox Game Pass, which offered over 100 games in 2024, provide a different value proposition by giving players access to a large library for a recurring fee, potentially diverting consumer spending from individual F2P titles.

Furthermore, the rise of blockchain-based play-to-earn (P2E) games presents another avenue for substitution. These models allow players to earn cryptocurrency or NFTs through gameplay, appealing to a segment of the market looking for direct financial incentives. While the P2E market experienced volatility in 2023 and early 2024, its continued development could offer a compelling alternative for players seeking ownership and potential returns on their gaming time.

These evolving monetization strategies challenge the dominance of the F2P model by offering distinct player experiences and value. GungHo must consider how these substitutes might attract and retain players who are increasingly open to diverse gaming and payment structures.

- Subscription Services: Access to a broad game catalog for a fixed monthly fee, such as Xbox Game Pass.

- Play-to-Earn (P2E) Games: Models integrating blockchain technology for player rewards and asset ownership.

- Shifting Player Preferences: Growing player interest in alternative value propositions beyond traditional F2P mechanics.

- Market Diversification: The entertainment industry's continuous innovation in how content is monetized.

The threat of substitutes for GungHo's games is substantial, encompassing a wide array of digital and non-digital entertainment options. Consumers have numerous choices for their leisure time and discretionary spending, making it easy to switch away from GungHo's offerings. In 2024, the global digital entertainment market is projected to exceed $300 billion, underscoring the vast competitive landscape.

Key substitutes include video streaming services, social media, and even physical activities, all competing for consumer attention. The ease with which players can shift to these alternatives, often with minimal switching costs, presents a significant challenge. For instance, in 2023, global spending on all entertainment, including hobbies and live events, reached trillions of dollars, illustrating the breadth of competition.

| Substitute Category | Examples | 2024 Market Projection (USD) | Impact on GungHo |

|---|---|---|---|

| Digital Entertainment | Video Streaming (Netflix, YouTube), Social Media | > $300 Billion (Global Digital Entertainment) | Diverts leisure time and spending. |

| Console Gaming | PlayStation 5, Xbox Series X/S titles | > $70 Billion (Global Console Gaming) | Offers immersive, high-fidelity experiences. |

| PC Gaming | Online multiplayer, single-player titles | > $40 Billion (PC Gaming Market) | Provides diverse genres and deep engagement. |

| Cloud Gaming | Xbox Cloud Gaming, PlayStation Plus Premium | N/A (Integrated Service) | Reduces hardware dependency, increases accessibility. |

| Non-Gaming Leisure | Reading, Outdoor Sports, Social Gatherings | Trillions (Global Entertainment Spending 2023) | Low switching costs, readily available alternatives. |

Entrants Threaten

Developing high-quality, competitive online games, particularly for consoles and PCs, demands significant capital. This includes substantial investments in game development, extensive marketing campaigns, and robust infrastructure.

GungHo's own reported increase in average development costs for new titles, reaching approximately ¥5 billion (around $32 million USD) in recent fiscal years, underscores this reality. This escalating cost makes it exceedingly difficult for new companies lacking substantial funding to enter the market and compete effectively at a significant scale.

GungHo's established brand recognition, particularly with flagship titles like Puzzle & Dragons, acts as a formidable barrier to new entrants. This brand equity translates into lower customer acquisition costs, as players are already familiar with and trust GungHo's offerings.

New competitors often find it challenging to replicate this level of brand loyalty. They typically resort to acquiring popular intellectual property (IP) or undertaking substantial marketing campaigns, which can be prohibitively expensive, to carve out a market share.

For instance, in 2024, the mobile gaming market continued to see high marketing spend, with top-grossing games often investing millions in user acquisition to compete with established players. This highlights the significant financial hurdle new entrants face when trying to build brand awareness against giants like GungHo.

While digital storefronts like the Apple App Store and Google Play have democratized app distribution, securing meaningful visibility remains a significant hurdle for newcomers. New entrants often struggle to break through the noise of millions of applications, making it difficult to reach potential players.

GungHo Online Entertainment, with its established brand recognition and substantial marketing resources, possesses a distinct advantage in negotiating for prominent placement and featuring within these digital marketplaces. This preferential treatment can significantly boost a new game's discoverability, a benefit less accessible to smaller, unproven entities.

Talent Acquisition and Retention

The video game industry, including companies like GungHo, faces a significant challenge in acquiring and retaining top talent. There's a global demand for skilled developers, designers, and operational staff, making it a competitive landscape. New companies entering the market often find it difficult to match the compensation, benefits, and job security offered by established players.

For instance, in 2024, the average salary for a senior game developer in major tech hubs often exceeded $150,000 annually, with comprehensive benefits packages. Established firms like GungHo can leverage their financial stability and brand recognition to attract these professionals. This creates a substantial barrier for new entrants who may not have the capital to offer comparable packages or the established reputation to draw in experienced individuals.

- High Demand for Specialized Skills: The need for experienced programmers, artists, and game designers remains consistently high across the industry.

- Competitive Compensation and Benefits: Established companies can offer attractive salary ranges, health insurance, retirement plans, and stock options, which are difficult for startups to replicate.

- Brand Reputation and Project Stability: GungHo's established presence and history of successful titles provide a sense of stability and prestige, appealing to professionals seeking long-term career growth.

- Talent Wars and Acquisition Costs: The intense competition for talent drives up recruitment costs and can lead to high employee turnover if retention strategies are not robust.

Network Effects and User Base

The threat of new entrants into the mobile gaming market, particularly for games like those developed by GungHo Online Entertainment, is significantly mitigated by powerful network effects. Existing games, such as GungHo's flagship title 'Puzzle & Dragons,' have cultivated massive and highly engaged player communities. This established user base is a critical asset; the more players a game has, the more valuable it becomes to each individual player through social interaction, competition, and shared experiences. For instance, 'Puzzle & Dragons' boasts millions of daily active users, creating a vibrant ecosystem that is difficult for newcomers to replicate.

Attracting players away from these deeply entrenched communities presents a formidable challenge for potential new entrants. New games must not only offer compelling gameplay but also overcome the inertia of existing player loyalty and the established social connections within popular titles. This barrier is amplified by the content and economic ecosystems that surround successful games, which often include regular updates, special events, and in-game economies that further solidify player engagement. In 2024, the mobile gaming landscape continues to see this trend, with established titles maintaining dominance due to their strong network effects and loyal player bases.

- Network Effects: Value of a game increases with the number of players.

- GungHo's User Base: 'Puzzle & Dragons' has millions of daily active users.

- Barrier to Entry: Difficult for new games to attract players from established communities.

- Content Ecosystems: Regular updates and events further lock in existing players.

The threat of new entrants for GungHo Online Entertainment is considerably low due to extremely high capital requirements. Developing and marketing competitive online games, especially for PC and consoles, demands massive investment in development, marketing, and infrastructure. GungHo’s own reported average development costs for new titles reaching around ¥5 billion (approximately $32 million USD) in recent years clearly illustrate this significant financial barrier.

Brand loyalty and established recognition, exemplified by GungHo's flagship title Puzzle & Dragons, present another substantial hurdle. Newcomers must invest heavily in marketing or acquire popular intellectual property to build comparable brand awareness and trust. In 2024, the mobile gaming market saw top-grossing games spending millions on user acquisition, underscoring the cost of competing with established players.

Talent acquisition is also a major challenge, with a global shortage of skilled game developers. In 2024, senior game developers in tech hubs often earned over $150,000 annually plus benefits, a level difficult for new entrants to match compared to established firms like GungHo.

Network effects, driven by large and engaged communities like Puzzle & Dragons’ millions of daily active users, further deter new entrants. These established player bases create a social and experiential value that is incredibly difficult for new games to replicate, especially given the ongoing trend of player loyalty to established titles in 2024.

| Barrier | Description | Impact on New Entrants | Supporting Data (Approximate) |

|---|---|---|---|

| Capital Requirements | High costs for development, marketing, and infrastructure. | Very High | GungHo's average new title dev costs: ~¥5 billion ($32M USD) |

| Brand Recognition & Loyalty | Established trust and familiarity with titles like Puzzle & Dragons. | High | Millions of daily active users for flagship titles. |

| Talent Acquisition | Competition for skilled developers, designers, and staff. | High | Senior game dev salaries: >$150K USD/year (2024) |

| Network Effects | Increased game value with more players, fostering strong communities. | Very High | Established player bases are difficult to attract away. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for GungHo Online Entertainment is built upon a foundation of publicly available financial reports, investor presentations, and official company statements. We supplement this with insights from reputable industry analysis firms and gaming-specific market research to capture the nuances of the competitive landscape.