Guess' SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Guess' Bundle

Guess faces challenges with its brand perception and reliance on wholesale channels, but leverages its strong brand recognition and global presence. Want to understand how these factors shape its future?

Discover the complete picture behind Guess's market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

Guess? Inc. boasts significant global brand recognition, a key strength cultivated since its inception in 1981. This widespread awareness spans roughly 100 countries, underscoring its established presence in the fashion industry, particularly in premium denim and apparel.

The company's brand value was estimated at $1.2 billion in 2023, a testament to its enduring appeal and market penetration. This strong recognition allows Guess to effectively differentiate itself from competitors and maintain a loyal customer base worldwide.

Guess boasts a robust and diversified product portfolio that spans apparel, handbags, watches, footwear, and eyewear for men, women, and children. This broad offering, notably enhanced by the luxury Marciano line and the strategic acquisition of rag & bone, allows the company to appeal to a wide array of consumer tastes and price points.

Guess? leverages a strong multi-channel distribution strategy, combining direct retail, wholesale partnerships, and global licensing. This diversified approach ensures broad market penetration and accessibility for its brands.

As of May 3, 2025, Guess? directly managed 1,074 retail stores, complemented by 527 additional locations operated by partners and distributors worldwide. This extensive physical footprint is further enhanced by a growing e-commerce presence, significantly expanding its customer reach.

Commitment to Sustainability (ESG)

Guess's commitment to Environmental, Social, and Governance (ESG) principles, particularly through its ACTION GUESS strategy, is a significant strength. This focus on responsible sourcing, reducing emissions, community involvement, and utilizing eco-friendly materials appeals to a growing segment of consumers who prioritize sustainability, thereby bolstering brand image.

The company's ambitious target to source 75% of its denim sustainably by 2025, as detailed in its FY2024–2025 ESG Report, underscores this dedication. Such initiatives not only align with global environmental goals but also position Guess favorably in a market increasingly sensitive to ethical and sustainable practices.

- ACTION GUESS ESG Strategy: A comprehensive framework for sustainable business practices.

- Responsible Sourcing and Materials: Focus on ethical supply chains and smarter material usage.

- Emissions Reduction and Community Engagement: Efforts to minimize environmental impact and support local communities.

- Sustainable Denim Target: Aiming for 75% sustainable denim sourcing by 2025.

Strategic Acquisitions and Partnerships

Guess?'s strategic acquisitions and partnerships are a significant strength, notably the April 2024 acquisition of rag & bone in collaboration with WHP Global. This move is designed to bolster Guess?'s footprint in the premium segment and diversify its brand offerings.

This partnership is expected to unlock operational efficiencies through supply chain enhancements and broaden market access, ultimately driving revenue and solidifying Guess?'s competitive edge. The company also actively engages in collaborations with key influencers and designers to enhance brand appeal.

- Acquisition of rag & bone (April 2024): Expands Guess?'s reach into the luxury market.

- Partnership with WHP Global: Leverages synergies for supply chain and market expansion.

- Brand Diversification: Strengthens overall brand portfolio and market resilience.

- Collaborations: Enhances brand visibility and appeal through influencer and designer partnerships.

Guess? possesses strong global brand recognition, estimated at $1.2 billion in 2023, which aids in market differentiation and customer loyalty across approximately 100 countries. Its diverse product range, including apparel, accessories, and the premium Marciano line, caters to a broad consumer base. The company effectively utilizes a multi-channel distribution network, with 1,074 directly managed stores and 527 partner locations as of May 3, 2025, alongside a growing e-commerce presence.

Guess's commitment to ESG principles, particularly its ACTION GUESS strategy and the target of sourcing 75% of its denim sustainably by 2025, enhances its brand image among environmentally conscious consumers. Strategic acquisitions, such as rag & bone in April 2024, further strengthen its market position and brand portfolio.

| Strength | Description | Data/Fact |

|---|---|---|

| Brand Recognition | Global awareness and established market presence. | Estimated brand value of $1.2 billion in 2023; operates in ~100 countries. |

| Product Diversification | Wide range of apparel and accessories for various demographics. | Includes apparel, handbags, watches, footwear, eyewear; features Marciano line. |

| Distribution Network | Extensive physical and online retail presence. | 1,074 directly managed stores; 527 partner locations (as of May 3, 2025); growing e-commerce. |

| ESG Commitment | Focus on sustainability and ethical practices. | ACTION GUESS strategy; target of 75% sustainable denim sourcing by 2025. |

| Strategic Acquisitions | Expansion into premium segments and brand portfolio enhancement. | Acquisition of rag & bone (April 2024) in partnership with WHP Global. |

What is included in the product

Delivers a strategic overview of Guess's internal and external business factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a structured framework to identify and address Guess' competitive weaknesses and external threats, enabling proactive strategy development.

Weaknesses

Guess? has faced headwinds in its retail comparable sales, particularly in the Americas and Asia. In the second quarter of fiscal year 2025, the Americas region saw a 10% decrease in retail comparable sales, which includes their e-commerce channel. This indicates a slowdown in consumer purchasing behavior and potentially less foot traffic in their physical stores.

The Asian market also presented challenges, with retail comparable sales in that segment declining by 14% during the same Q2 FY2025 period. These figures highlight a struggle to maintain customer engagement and drive sales through their direct-to-consumer channels in these important geographical areas, possibly due to broader economic uncertainties impacting discretionary spending.

Guess? has experienced considerable pressure on its operating margins. For fiscal year 2025, the adjusted operating margin saw a decrease when compared to fiscal year 2024.

This margin compression stems from several factors, notably increased operational costs like marketing expenditures and higher store-related expenses. Furthermore, the integration of recently acquired businesses has also presented challenges, negatively impacting profitability.

Shifts in the company's business mix have also played a role. A greater proportion of wholesale sales and a reduction in royalty income contributed to a contraction in gross margins, further squeezing operating profitability.

Guess? operates in a fiercely competitive fashion landscape where consumer tastes can shift almost overnight. This makes the brand particularly susceptible to changes in fashion trends, a challenge amplified by the rise of agile fast-fashion competitors and established global brands. For instance, in the first quarter of fiscal year 2025, Guess? reported a 1.7% decrease in total revenue compared to the previous year, highlighting the ongoing pressure to align with rapidly evolving consumer demands.

Challenges in Specific Geographic Markets

Guess? is encountering significant headwinds in specific geographic markets, with the Greater China region presenting a notable weakness. This underperformance has necessitated a strategic review, including plans for operational restructuring and the anticipation of associated losses. The company is actively exploring options such as transferring its direct operations in China to a local partner, a move that underscores the depth of the challenges faced in this key market. This regional struggle directly impacts Guess?'s overall revenue streams and profitability, compelling a focused recalibration of its international strategy.

The difficulties in Greater China are not isolated incidents but represent a critical drag on Guess?'s global financial performance. For instance, during the fiscal year ending February 3, 2024, Guess? reported a net loss of $47.5 million, a figure significantly influenced by the underperformance in certain international segments, including China. The company's financial reports often highlight the impact of currency fluctuations and localized market conditions, which are particularly pronounced in emerging economies.

- Regional Underperformance: The Greater China market has been identified as a significant area of weakness, impacting overall revenue and profitability.

- Operational Restructuring: Guess? is planning operational restructuring in China, indicating a need for substantial adjustments to its business model in the region.

- Partnership Considerations: The company is considering handing over direct operations in China to a local partner, reflecting a strategic shift away from direct control due to market challenges.

- Financial Impact: This regional underperformance directly affects Guess?'s consolidated financial results, necessitating strategic recalibration to mitigate losses and improve global performance.

Impact of Currency Fluctuations

Guess? faces significant headwinds from currency fluctuations, which have negatively impacted its reported financial results. These shifts can erode the gains seen in constant currency revenue, directly affecting metrics like adjusted diluted earnings per share (EPS) and operating margins. For instance, during the fiscal year 2024, a strengthening U.S. dollar presented a headwind, impacting Guess?'s reported profitability.

The company's financial performance is therefore inherently susceptible to global economic volatility and unpredictable exchange rate movements. This makes it challenging to forecast earnings accurately and can lead to a disconnect between operational success and reported financial outcomes.

- Erosion of Reported Earnings: Currency headwinds, particularly from a strong U.S. dollar, can diminish the value of international earnings when translated back into dollars, negatively impacting reported EPS.

- Impact on Operating Margins: Fluctuations in exchange rates can squeeze operating margins as the cost of goods sold or operating expenses in foreign currencies change relative to the company's reporting currency.

- Forecasting Challenges: The inherent volatility of currency markets creates uncertainty, making it more difficult for Guess? to provide reliable financial guidance and for investors to accurately predict future performance.

- Sensitivity to Global Economic Conditions: Guess?'s reliance on international markets means its financial health is closely tied to the economic stability and currency performance of various global regions.

Guess? faces intense competition from both fast-fashion retailers and established brands, making it difficult to keep pace with rapidly changing consumer preferences. This is evidenced by a 1.7% decrease in total revenue in Q1 FY2025 compared to the prior year, highlighting the ongoing challenge of aligning with evolving fashion trends.

The company's operating margins are under pressure due to rising operational costs, including increased marketing spend and higher store expenses. Furthermore, the integration of recent acquisitions has presented integration challenges, further impacting profitability. A shift towards a greater proportion of wholesale sales and a decline in royalty income have also contributed to margin compression.

Guess? is experiencing significant underperformance in key international markets, particularly in Greater China. This has led to plans for operational restructuring and the potential transfer of direct operations to a local partner, reflecting the severity of challenges in this region.

Currency fluctuations, especially a strengthening U.S. dollar, have negatively impacted Guess?'s reported financial results, eroding gains in constant currency revenue and affecting metrics like adjusted diluted earnings per share (EPS) and operating margins.

| Metric | Q2 FY2025 (vs. Q2 FY2024) | Impact |

|---|---|---|

| Americas Retail Comp Sales | -10% | Slowdown in consumer spending, reduced foot traffic |

| Asia Retail Comp Sales | -14% | Struggles with customer engagement, reduced discretionary spending |

| Total Revenue | -1.7% (Q1 FY2025 vs. Q1 FY2024) | Pressure from fast fashion and evolving trends |

| Operating Margin | Decreased (FY2025 vs. FY2024) | Increased operational costs, integration challenges, business mix shifts |

Preview the Actual Deliverable

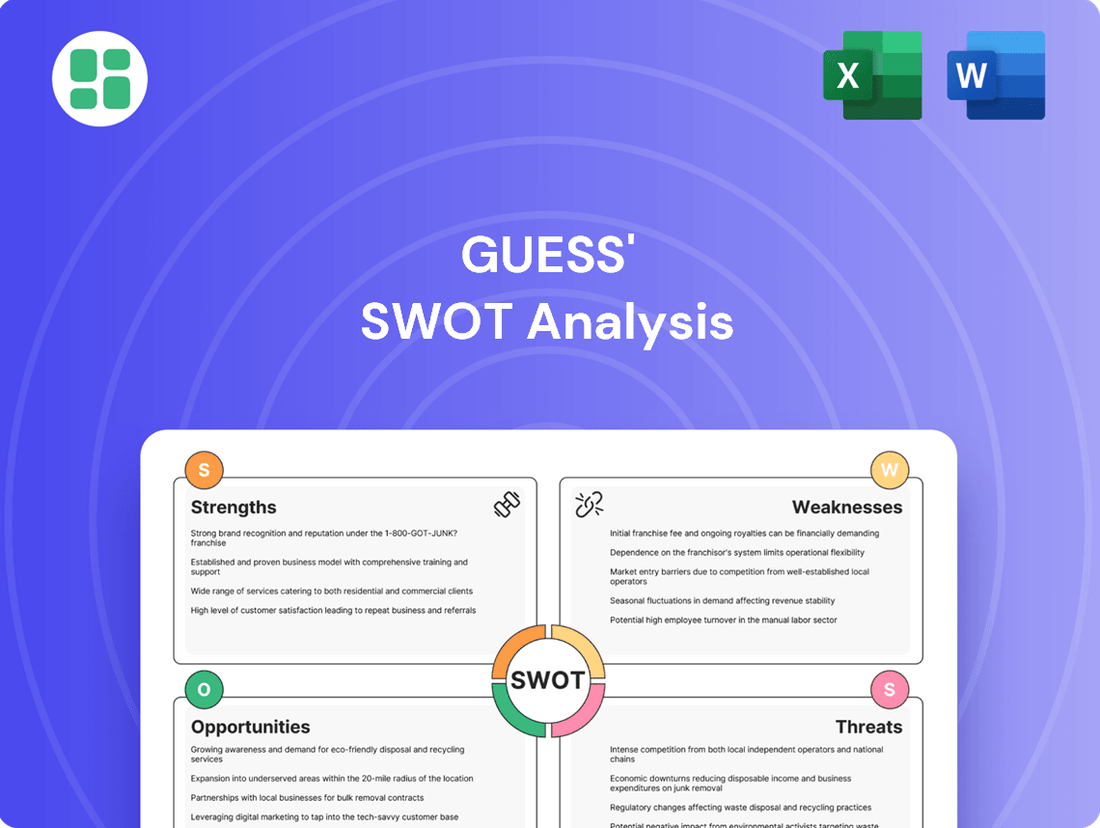

Guess' SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality, detailing Guess' Strengths, Weaknesses, Opportunities, and Threats.

The preview below is taken directly from the full SWOT report you'll get, offering a clear glimpse into the comprehensive analysis of Guess' strategic position.

Purchase unlocks the entire in-depth version, ensuring you have all the insights needed to understand Guess' competitive landscape.

Opportunities

Guess? has a significant opportunity to grow by entering and expanding in emerging international markets. Regions like Asia-Pacific and Latin America are particularly attractive, showing strong revenue growth potential. For instance, Guess? reported that its international segment, which includes these emerging markets, saw a revenue increase in recent fiscal periods, demonstrating the viability of this strategy.

Expanding into these dynamic economies allows Guess? to diversify its income sources, lessening its dependence on more established, possibly slower-growing markets in North America and Europe. This geographical diversification can also help buffer the company against regional economic downturns.

The company's existing global infrastructure, including supply chains and brand recognition, provides a solid base for successfully launching and scaling operations in these new territories. This established presence can significantly reduce the costs and risks associated with international market entry.

The ongoing surge in online shopping offers a significant chance for Guess? to bolster its digital footprint and refine its e-commerce operations. By prioritizing digital transformation, enhancing the online customer journey, and utilizing data insights, Guess? can stimulate e-commerce sales and connect with a wider audience, counteracting any dips in physical store visits.

Guess? reported that its global e-commerce business saw a notable increase in momentum during the first quarter of fiscal year 2024, with digital sales contributing 19% to total revenue, up from 17% in the prior year period. This growth trajectory highlights the potential for further expansion in the digital space.

Guess? can leverage its sustainability initiatives, like the 'ACTION GUESS' ESG strategy, to attract environmentally aware shoppers. This focus on responsible sourcing and eco-friendly materials can set the brand apart in a crowded fashion landscape, fostering loyalty and potentially creating new income opportunities.

Strategic Collaborations and Brand Innovation

Strategic collaborations offer a powerful avenue for Guess to expand its reach and appeal. By partnering with influencers, designers, or complementary brands, Guess can tap into new demographics and generate significant buzz. For instance, the acquisition of rag & bone in 2023, valued at approximately $270 million, signals a strategic move to diversify its brand portfolio and capture a more premium market segment. This, coupled with the ongoing innovation in its Guess Jeans line, which saw a 5% increase in sales in the first half of 2024, demonstrates a commitment to keeping the brand fresh and relevant.

These initiatives are crucial for attracting younger consumers and adapting to rapidly changing fashion trends. Guess's recent efforts to integrate sustainable materials into its denim lines, with a target of 30% recycled content by 2025, also positions it favorably with environmentally conscious shoppers. Such strategic alliances and product innovations are key to maintaining brand momentum and driving future growth.

- Brand Diversification: The acquisition of rag & bone in 2023 allows Guess to access a different customer base and expand its offerings beyond its core denim and apparel.

- Product Innovation: The continued development and marketing of the Guess Jeans line, which reported a 5% sales increase in H1 2024, highlights the brand's focus on refreshing its core products.

- Market Relevance: Collaborations and innovative product lines are essential for staying competitive and appealing to evolving consumer tastes, particularly among younger demographics.

- Sustainability Focus: Guess's commitment to increasing recycled content in its denim to 30% by 2025 aligns with growing consumer demand for sustainable fashion.

Optimizing Retail Footprint and Portfolio

Guess? is actively optimizing its retail footprint to boost profitability. This includes closing underperforming stores, particularly in North America, and exploring a transition of its China operations to local partners. These strategic adjustments are designed to streamline operations and concentrate resources on more successful locations and sales channels.

The company anticipates these portfolio optimizations will significantly enhance its financial health. By FY27, Guess? expects these measures to contribute to a notable increase in overall profit. This focus on efficiency aims to improve the company's bottom line and strengthen its market position.

- Store Closures: Targeting underperforming North American locations.

- China Strategy: Potential transition of operations to local partners.

- Resource Allocation: Focusing on high-performing stores and channels.

- Profit Impact: Expected profit boost by FY27.

Guess? has a significant opportunity to grow by entering and expanding in emerging international markets, with regions like Asia-Pacific and Latin America showing strong revenue growth potential. The company's global infrastructure supports this expansion, reducing entry costs and risks.

Bolstering its digital footprint and e-commerce operations presents another key opportunity, as evidenced by the notable increase in digital sales momentum during Q1 FY24. Guess? can leverage its sustainability initiatives, like the ACTION GUESS ESG strategy, to attract environmentally conscious shoppers and differentiate itself.

Strategic collaborations and product innovation are vital for staying competitive and appealing to evolving consumer tastes. The acquisition of rag & bone in 2023 and the 5% sales increase in Guess Jeans in H1 2024 highlight the brand's focus on diversification and refreshing core products, with a target of 30% recycled content in denim by 2025.

Optimizing its retail footprint by closing underperforming stores and potentially transitioning China operations to local partners is expected to significantly enhance profitability, with a notable profit increase anticipated by FY27.

| Opportunity Area | Key Actions | Supporting Data/Targets |

|---|---|---|

| International Market Expansion | Enter and grow in Asia-Pacific and Latin America | Strong revenue growth potential in these regions |

| Digital Transformation | Enhance e-commerce operations and online customer journey | Digital sales contributed 19% to total revenue in Q1 FY24 (up from 17% YoY) |

| Sustainability Initiatives | Leverage eco-friendly materials and responsible sourcing | Target of 30% recycled content in denim by 2025 |

| Strategic Collaborations & Innovation | Acquire brands, partner with influencers/designers, innovate product lines | Acquisition of rag & bone in 2023; Guess Jeans sales up 5% in H1 2024 |

| Retail Footprint Optimization | Close underperforming stores, explore local partnerships for China | Expected profit boost by FY27 from these measures |

Threats

The fashion world is incredibly crowded, with Guess? up against a multitude of global manufacturers, distributors, and famous designers. This fragmented market means Guess? is constantly vying for attention against everyone from giants like Levi's and Ralph Lauren to nimble online startups and fast fashion brands, all competing for consumer dollars and brand loyalty.

This fierce rivalry often forces price adjustments, potentially squeezing profit margins and making it harder for Guess? to stand out. In 2023, the global apparel market was valued at approximately $1.7 trillion, a figure expected to grow, underscoring the sheer scale of competition Guess? navigates.

Shifting consumer preferences, particularly the sustained move towards online shopping and increasingly cautious spending due to persistent inflation and economic uncertainties, present a considerable threat. For instance, a recent report from the U.S. Bureau of Labor Statistics in early 2024 indicated that consumer spending on apparel and services saw a noticeable slowdown compared to the previous year, directly linked to rising costs of essentials.

Economic downturns inherently reduce discretionary spending on non-essential items like fashion, directly impacting sales volumes and overall profitability. Many retailers, including those in the fashion sector, experienced a decline in their profit margins throughout 2023 as they navigated these challenging economic conditions. The company itself has acknowledged observing a softer consumer environment and a notable decrease in physical store foot traffic during its latest earnings call.

Guess? faces significant headwinds from ongoing global supply chain disruptions. These issues, coupled with rising labor costs, particularly in key manufacturing and logistics hubs, directly inflate operational expenses. For instance, the cost of shipping containers saw a dramatic surge in late 2023 and early 2024, impacting Guess?'s cost of goods sold.

These escalating manpower and transportation costs can squeeze Guess?'s profit margins. The company may struggle to pass these increased expenses onto consumers without impacting demand, potentially leading to reduced profitability and slower inventory turnover. This dynamic was evident in Guess?'s Q4 2023 earnings, where higher freight costs were cited as a drag on margins.

Brand Perception and Reputation Risks

In the fashion world, how people see Guess? is incredibly important. Negative press, like concerns about how workers are treated or the environmental footprint, can really hurt the brand's image and make customers lose faith. For instance, in 2023, fashion industry sustainability reports highlighted increasing consumer scrutiny on supply chains, impacting brands that don't adapt.

Guess? faces risks if it doesn't keep up with changing social expectations. Failing to show commitment to ethical sourcing or environmental responsibility can lead to backlash. A 2024 survey indicated that over 60% of Gen Z consumers consider a brand's ethical stance when making purchasing decisions.

- Reputational Damage: Negative publicity regarding labor practices or environmental impact can erode consumer trust.

- Consumer Boycotts: Ethical concerns can trigger boycotts, directly impacting sales and market share.

- Loss of Brand Loyalty: Failure to align with evolving social values can alienate core customer segments.

Intellectual Property Infringement and Counterfeiting

Guess faces a significant threat from intellectual property infringement and counterfeiting. As a global lifestyle brand recognized for its distinct designs, the company is a prime target for counterfeiters seeking to capitalize on its brand equity. The widespread availability of fake Guess products can significantly damage its brand image and erode consumer confidence, leading to direct revenue losses.

The challenge is amplified by the ease of online distribution, making it harder to police and remove infringing items. For instance, reports from organizations like the International Anti-Counterfeiting Coalition highlight the ongoing struggle for fashion brands to combat this issue, with billions lost annually. Guess's efforts to protect its trademarks and designs are therefore critical for maintaining its market standing and financial performance.

- Brand Dilution: Counterfeit goods can confuse consumers and diminish the perceived value of authentic Guess products.

- Lost Sales: Consumers purchasing fakes are not spending money on genuine Guess items, impacting top-line revenue.

- Erosion of Trust: A proliferation of poor-quality counterfeits can damage the brand's reputation for quality and authenticity.

- Legal Costs: Guess incurs significant expenses in pursuing legal action against infringers and protecting its intellectual property.

Guess? operates in an intensely competitive global apparel market, valued at approximately $1.7 trillion in 2023, facing pressure from established brands and emerging online retailers. This intense rivalry can force price reductions, impacting profit margins. Furthermore, shifts towards online shopping and cautious consumer spending due to inflation, as indicated by a slowdown in apparel spending reported by the U.S. Bureau of Labor Statistics in early 2024, pose significant challenges. Economic downturns directly reduce discretionary spending, affecting sales volumes and profitability, a trend reflected in the profit margin declines observed across many fashion retailers in 2023.

SWOT Analysis Data Sources

This SWOT analysis is built on a foundation of comprehensive data, including Guess's official financial reports, detailed market research from reputable firms, and expert industry analysis to provide a well-rounded perspective.