Guess' Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Guess' Bundle

Guess navigates a fashion landscape rife with intense rivalry and the constant threat of new entrants, while buyers wield significant power through online channels and brand loyalty shifts.

The full analysis reveals the strength and intensity of each market force affecting Guess', complete with visuals and summaries for fast, clear interpretation.

Ready to move beyond the basics? Get a full strategic breakdown of Guess's market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

The bargaining power of suppliers for Guess? can be considered moderate. While the global apparel market offers a wide array of suppliers for standard components, the leverage shifts when specialized materials, unique finishes, or proprietary manufacturing processes are involved. For instance, if a key supplier provides Guess? with a highly distinctive fabric or a patented production method, the cost and complexity of switching to an alternative supplier would rise, thereby increasing that supplier's influence.

The cost and complexity of switching suppliers significantly impact Guess?'s bargaining power. If Guess? has made substantial investments in supplier relationships, specialized tooling, or intricate quality control protocols, the financial and operational disruption of changing suppliers can be considerable.

This creates a strong incentive for Guess? to maintain existing supplier relationships, thereby enhancing the bargaining power of those suppliers. For instance, if a key supplier provides unique fabrics or manufacturing techniques that are integral to Guess?'s product lines, the expense and time required to find and onboard a new supplier with comparable capabilities would be substantial.

Suppliers in the branded fashion retail sector, like Guess?, typically face a low threat of forward integration. This is because moving into retail requires significant investment in brand development, marketing campaigns, and establishing robust distribution channels, which are distinct from their core manufacturing operations. For instance, while some large textile manufacturers might explore direct-to-consumer sales, this is generally not a primary strategic focus that threatens established fashion brands.

Importance of Supplier to Guess?

Guess?'s substantial scale and extensive global operations position it as a significant customer for a wide array of suppliers. This considerable purchasing volume inherently grants Guess? leverage, often limiting the bargaining power of individual suppliers who rely on the company's business. For instance, in 2024, Guess? continued to source a diverse range of apparel, accessories, and manufacturing services worldwide, meaning many suppliers would hesitate to alienate such a large client by demanding unfavorable terms.

However, the power dynamic can shift if a particular supplier provides a unique, high-demand product or a critical component essential for a specific Guess? collection. In such scenarios, that supplier's importance to Guess? escalates, potentially enabling them to negotiate better pricing or more favorable contract conditions. This is particularly relevant for specialized fabrics, unique embellishments, or components for limited-edition lines where alternative sourcing might be difficult or costly for Guess?.

The bargaining power of suppliers for Guess? can be understood through these key considerations:

- Customer Scale: Guess?'s large order volumes generally reduce supplier leverage.

- Product Criticality: Suppliers of unique or essential components for popular product lines gain increased power.

- Supplier Concentration: If only a few suppliers can meet specific quality or design requirements, their power is amplified.

- Switching Costs: High costs for Guess? to switch suppliers for critical inputs can empower those suppliers.

Raw Material and Labor Costs

Fluctuations in the cost of raw materials like cotton and synthetic fibers, along with labor expenses in manufacturing hubs, directly influence supplier profitability and their ability to set prices. For instance, the average cost of cotton, a key input for Guess?, saw considerable volatility through 2024.

Global economic shifts and supply chain disruptions, a recurring theme in 2024 and projected into 2025, tend to inflate these input costs. This pressure often compels suppliers to pass on these increased expenses, leading them to demand higher prices from brands such as Guess?.

- Cotton Price Volatility: Global cotton prices experienced significant fluctuations in 2024, with futures contracts for December 2024 delivery trading within a range that impacted manufacturing costs.

- Labor Cost Increases: Minimum wage adjustments in key apparel manufacturing countries in Southeast Asia during 2024 contributed to an upward trend in labor costs for garment production.

- Supply Chain Bottlenecks: Persistent logistical challenges in 2024, including port congestion and shipping container shortages, added an estimated 5-10% to the cost of imported goods for many retailers.

The bargaining power of suppliers for Guess? is generally moderate, influenced by factors like customer scale and product criticality. While Guess?'s substantial purchasing volume in 2024 provided leverage over many suppliers, those providing unique materials or manufacturing processes held more sway. For instance, the volatility in cotton prices throughout 2024, with December 2024 futures showing significant price swings, directly impacted raw material costs for suppliers, potentially increasing their pricing power.

High switching costs for Guess? regarding specialized inputs can empower certain suppliers. For example, if a supplier offers a proprietary fabric or a unique finishing technique integral to a popular Guess? product line, the expense and time to find and onboard a replacement would be considerable, strengthening that supplier's negotiating position. This dynamic was evident in 2024 as supply chain disruptions added an estimated 5-10% to the cost of imported goods, making supplier stability more valuable.

Labor cost increases in key manufacturing regions, such as adjustments to minimum wages in Southeast Asia during 2024, also played a role. These rising operational costs for suppliers could translate into higher prices demanded from Guess?, thus amplifying supplier bargaining power, especially when combined with other cost pressures.

| Factor | Impact on Supplier Bargaining Power | 2024 Relevance |

| Guess?'s Scale | Decreases Power | Significant purchasing volume limits supplier leverage. |

| Product Uniqueness | Increases Power | Suppliers of proprietary fabrics or techniques gain leverage. |

| Switching Costs | Increases Power | High costs for Guess? to change suppliers for critical inputs. |

| Raw Material Costs | Increases Power | Volatility in cotton prices (e.g., Dec 2024 futures) pressured supplier margins. |

| Labor Costs | Increases Power | Wage increases in manufacturing hubs raised supplier operational expenses. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Guess', evaluating supplier and buyer power, and identifying threats from substitutes and new entrants.

Effortlessly identify and mitigate competitive threats with a visual breakdown of Porter's Five Forces, empowering you to anticipate and respond to market shifts.

Customers Bargaining Power

Guess?'s customer base, encompassing both individual shoppers and wholesale clients, shows a spectrum of price sensitivity. This means some customers are more inclined to seek out deals and discounts than others.

In early 2025, the apparel and luxury sectors experienced a noticeable slowdown in consumer spending. This economic climate has made customers more watchful of their budgets, prioritizing value when making purchasing decisions.

This increased price sensitivity among consumers puts pressure on Guess? to keep its prices competitive. When customers are more likely to shop around for the best price, their bargaining power grows, potentially impacting Guess?'s profit margins.

The fashion industry is incredibly crowded, with countless brands and retailers offering very similar clothing and accessories. This means customers have a vast array of choices, from budget-friendly fast fashion to more established lifestyle brands.

Because there are so many alternatives, customers can easily move to a competitor if they aren't happy with Guess?'s prices, the quality of their products, or their fashion sense. For instance, in 2023, the global apparel market was valued at over $1.5 trillion, highlighting the sheer volume of competition Guess faces.

This abundance of options significantly strengthens the bargaining power of customers. They can readily find comparable items elsewhere, forcing Guess to remain competitive in its offerings and pricing to retain its customer base.

The proliferation of e-commerce platforms and social media has dramatically increased customer access to product details, user reviews, and cross-brand price comparisons. This heightened transparency significantly levels the playing field, empowering consumers to make more educated choices and strengthening their position when considering purchases or seeking better deals.

For instance, in 2024, a significant portion of online shoppers, estimated to be over 80%, actively utilize comparison websites and customer reviews before making a purchase, according to industry reports. This readily available information diminishes the information advantage previously held by sellers, giving customers greater leverage.

Brand Loyalty and Differentiation

Guess? benefits from a degree of brand loyalty, a key factor in moderating customer bargaining power. This loyalty is cultivated through distinctive designs and effective marketing campaigns, making consumers less inclined to seek alternatives. For instance, Guess reported a net sales increase of 11% to $2.4 billion in the fiscal year ending February 2024, indicating sustained customer engagement.

However, the fashion industry's dynamic nature, marked by rapid trend shifts and growing consumer emphasis on sustainability, presents a challenge to maintaining this loyalty. Companies like Guess must continuously innovate and adapt to evolving consumer preferences to retain their customer base and mitigate the risk of customers switching to competitors offering more contemporary or ethically produced goods.

- Brand Loyalty: Guess?'s established brand identity and loyal customer base help reduce the impact of customer bargaining power.

- Differentiation: Unique designs and marketing efforts contribute to customer stickiness, making them less sensitive to price changes.

- Market Dynamics: Evolving fashion trends and increasing demand for sustainable products necessitate ongoing innovation to maintain customer loyalty.

Wholesale Buyer Power

For Guess?, the bargaining power of wholesale buyers, particularly large department stores and specialty retailers, is a significant factor. These entities often represent substantial portions of Guess?'s sales volume. Their ability to consolidate purchasing power allows them to negotiate terms that can directly affect Guess?'s profitability.

These major buyers can leverage their market presence and influence over consumer purchasing decisions. This influence translates into their capacity to demand concessions from Guess?, such as lower wholesale prices, extended payment terms, or increased marketing and promotional support. For instance, a large retailer threatening to reduce shelf space or shift to competitor brands can exert considerable pressure.

- High Purchasing Volume: Major retailers like Macy's or Nordstrom, which are significant buyers of Guess? apparel, can command better pricing due to the sheer quantity they purchase.

- Alternative Suppliers: The availability of numerous other apparel brands provides these wholesale buyers with options, reducing their reliance on Guess? and increasing their leverage.

- Influence on Consumer Choice: Retailers' merchandising strategies and placement of Guess? products within their stores can impact sales velocity, giving them a say in promotional activities and pricing.

- Information Asymmetry: While Guess? has sales data, large buyers often possess more granular point-of-sale information for their specific channels, which they can use in negotiations.

The bargaining power of customers for Guess? is influenced by several factors, including the availability of substitutes and the price sensitivity of consumers. In early 2025, a general slowdown in apparel spending made consumers more value-conscious, increasing their leverage.

The fashion market is highly competitive, with numerous brands offering similar products, allowing customers to easily switch if unsatisfied with Guess?'s offerings or pricing. For example, the global apparel market exceeding $1.5 trillion in 2023 underscores the vast array of choices available.

Online platforms and social media further empower customers by providing easy access to price comparisons and reviews. In 2024, over 80% of online shoppers used comparison tools, diminishing seller information advantages and strengthening buyer negotiation power.

Guess? mitigates some of this power through brand loyalty, cultivated by distinctive designs and marketing, as evidenced by its net sales of $2.4 billion in fiscal year 2024. However, rapid trend shifts and a growing demand for sustainable fashion require continuous innovation to maintain this loyalty.

| Factor | Impact on Guess? | Supporting Data/Example |

|---|---|---|

| Price Sensitivity | Increased pressure on pricing and margins. | Consumers more budget-conscious in early 2025. |

| Availability of Substitutes | Weakens brand loyalty, increases switching. | Global apparel market value over $1.5 trillion (2023). |

| Information Transparency | Empowers customers with price/quality comparisons. | Over 80% of online shoppers use comparison tools (2024). |

| Brand Loyalty | Moderates customer bargaining power. | Guess? net sales $2.4 billion (FY ending Feb 2024). |

Preview the Actual Deliverable

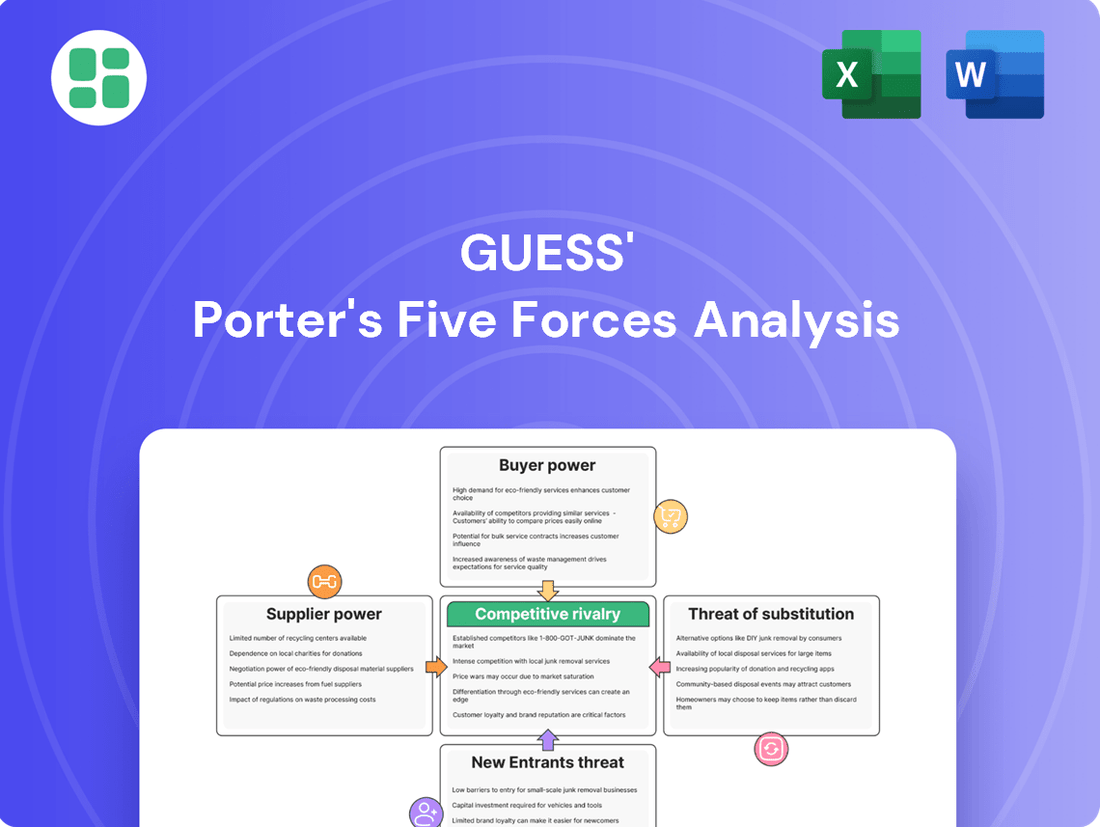

Guess' Porter's Five Forces Analysis

This preview offers a comprehensive Porter's Five Forces analysis of Guess, detailing the competitive landscape, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products, and the intensity of rivalry among existing competitors. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. You can confidently expect to receive this exact, professionally formatted analysis immediately after your purchase, providing you with actionable insights into Guess's strategic position.

Rivalry Among Competitors

Guess? operates in a highly fragmented and intensely competitive apparel and accessories market. The landscape is populated by a vast array of players, from established global fashion behemoths and prestigious luxury houses to nimble fast fashion chains and rapidly growing online-only brands.

This intense rivalry spans across Guess?'s diverse product offerings and its various distribution channels. For instance, in 2024, the global apparel market is projected to reach over $1.7 trillion, showcasing the sheer scale and the multitude of participants vying for market share.

The fashion industry anticipates a period of subdued growth, with revenue expected to expand at a modest rate in the low single digits for 2024 and 2025. This sluggish growth environment naturally fuels more intense competition among players vying for market share.

When the overall market isn't expanding rapidly, companies must aggressively compete to capture a larger slice of the existing pie. This often translates to a direct struggle for customers and market dominance, intensifying rivalry as firms seek to outperform their peers in a less dynamic economic landscape.

Guess? aims to stand out through its distinctive design and lifestyle branding, but the fashion market is crowded with similar offerings. Competitors can quickly mimic popular styles, making it challenging for Guess? to maintain a unique edge. This imitation can force the company into price wars, impacting profitability.

Exit Barriers

High fixed costs in the fashion industry, such as those for manufacturing plants, unsold inventory, and long-term retail leases, make it difficult for companies to leave the market. These substantial investments act as significant exit barriers.

These barriers often force fashion companies to continue operating and competing even when profits are low, directly intensifying the competitive rivalry among existing players. For instance, many apparel retailers in 2024 are still managing the residual costs of physical store footprints established in prior years, impacting their ability to pivot or exit unprofitable segments without incurring substantial losses.

- High Fixed Costs: Manufacturing, inventory, and leases represent significant capital tied up, making withdrawal costly.

- Forced Competition: Companies must often continue competing to recoup investments, even in unfavorable market conditions.

- Intensified Rivalry: The inability to easily exit leads to more aggressive competition for market share and survival.

Marketing and Advertising Intensity

The fashion industry, including brands like Guess?, operates with exceptionally high marketing and advertising intensity. Companies consistently invest significant sums to capture consumer attention and cultivate brand loyalty amidst a crowded marketplace. Guess? must allocate substantial resources towards integrated campaigns, a robust social media presence, and strategic influencer partnerships to ensure its visibility and competitive standing against rivals possessing considerable marketing war chests.

In 2024, the global fashion advertising market was projected to reach approximately $70 billion, highlighting the immense competitive pressure. Brands are increasingly leveraging digital channels, with social media marketing and influencer collaborations becoming crucial for reaching younger demographics. For instance, a successful influencer campaign can drive significant brand awareness and sales, but it requires ongoing investment and careful selection of partners to maintain authenticity and impact.

- High Industry Spend: The fashion sector's advertising expenditure is a major factor, with global spending in the tens of billions annually.

- Digital Dominance: Social media and influencer marketing are critical components of modern fashion advertising strategies.

- Brand Visibility Imperative: Continuous investment is necessary for brands like Guess? to remain top-of-mind for consumers.

- Competitive Landscape: Rivals with larger marketing budgets can exert significant pressure, necessitating strategic allocation of resources by Guess?.

Guess? faces intense competition due to the sheer number of players in the apparel market, from global giants to online startups. This rivalry is amplified by the industry's projected low single-digit revenue growth in 2024 and 2025, forcing companies to fight harder for market share.

The ease with which competitors can imitate designs and the high marketing spend required to stand out further intensify this rivalry. Guess? must continually invest in branding and digital presence to maintain its position against well-funded competitors, especially as the global fashion advertising market nears $70 billion in 2024.

| Competitive Factor | Description | Impact on Guess? |

|---|---|---|

| Market Fragmentation | Numerous global and niche players compete. | Requires differentiation and efficient operations. |

| Imitation of Styles | Competitors quickly replicate popular designs. | Pressures pricing and necessitates rapid product cycles. |

| High Marketing Intensity | Significant spending on advertising and promotion. | Demands substantial marketing budgets for brand visibility. |

| Low Market Growth | Projected low single-digit growth for 2024-2025. | Intensifies competition for existing market share. |

SSubstitutes Threaten

The second-hand fashion market is booming, with projections indicating it could reach substantial valuations between 2029 and 2034. This surge is fueled by a growing consumer focus on sustainability and affordability, especially among younger demographics like Gen Z and Millennials. These pre-owned options present a compelling alternative to buying new apparel, directly impacting brands like Guess by potentially siphoning off sales.

The rise of online clothing rental services presents a significant threat of substitutes for traditional apparel retailers. These platforms cater to a growing consumer base prioritizing sustainability and a desire for fashion variety without the commitment of ownership. For instance, Rent the Runway, a prominent player, reported a substantial increase in its subscriber base in recent years, reflecting this shift in consumer behavior.

These rental services offer a compelling alternative, especially for consumers seeking designer outfits for specific occasions or those who prefer to experiment with trends without the long-term investment. This accessibility to high-fashion and diverse wardrobes directly competes with the need to purchase new clothing, thereby impacting sales volumes for many brands.

Consumers increasingly turn to unbranded or generic apparel, readily available at lower price points from discount retailers and online marketplaces. While lacking the brand cachet of Guess?, these alternatives fulfill the fundamental need for clothing, particularly attracting price-conscious shoppers. For instance, the fast fashion market, dominated by generic offerings, saw continued growth in 2024, with online sales channels expanding significantly, directly impacting the demand for branded apparel.

Do-It-Yourself (DIY) and Customization

The growing popularity of Do-It-Yourself (DIY) fashion and the increasing availability of customization options serve as a significant threat of substitutes. Consumers can alter existing garments or create entirely new ones, bypassing traditional fashion retailers. This trend is fueled by a desire for unique, personalized items and a greater emphasis on sustainability, as extending the life of clothing through alterations aligns with eco-conscious values.

Data from 2024 indicates a strong consumer interest in personalization. For instance, a significant portion of Gen Z and Millennial shoppers expressed a willingness to pay more for customized apparel. This DIY movement is further empowered by readily available online tutorials, affordable crafting supplies, and the rise of platforms that facilitate custom design and production, directly challenging off-the-rack offerings.

The threat is amplified by:

- Increased accessibility of sewing machines and crafting tools: Prices for basic sewing equipment have remained stable or decreased, making it easier for individuals to engage in garment creation and alteration.

- Online tutorials and communities: Platforms like YouTube and TikTok saw a surge in DIY fashion content in 2023 and 2024, providing free, accessible instruction for complex techniques.

- Rise of upcycling and sustainable fashion movements: Consumers are increasingly looking for ways to reduce textile waste, and DIY customization offers a direct solution by giving old clothes new life.

Shifts in Consumer Spending Priorities

Broader shifts in consumer spending priorities can act as a significant threat of substitutes for the fashion industry. For instance, a growing preference for spending on experiences like travel or digital entertainment, rather than physical goods, means less discretionary income is available for apparel and accessories.

This reallocation of consumer budgets directly impacts the fashion market. In 2024, the global travel and tourism sector continued its strong recovery, with spending expected to reach trillions, potentially drawing funds away from other discretionary purchases like fashion.

- Experiences Over Goods: A noticeable trend in 2024 saw consumers, particularly younger demographics, prioritizing spending on travel, dining, and digital subscriptions over material possessions.

- Technological Advancements: Increased investment in personal technology, from upgraded smartphones to immersive gaming setups, also competes for discretionary income that might otherwise be spent on fashion items.

- Reduced Market Size: When consumers allocate more of their disposable income to these alternative categories, the overall market size for fashion and apparel naturally shrinks, intensifying competitive pressures.

The threat of substitutes for Guess? is substantial, encompassing a range of alternatives that fulfill the basic need for clothing and fashion. These substitutes range from the rapidly growing second-hand market and clothing rental services to unbranded apparel and even DIY fashion. Furthermore, a broader economic trend of consumers prioritizing experiences over goods, such as travel and digital entertainment, directly diverts discretionary spending away from fashion purchases.

| Substitute Category | Key Drivers | Impact on Guess? |

|---|---|---|

| Second-hand Market | Sustainability, Affordability, Trend Adoption | Reduced demand for new items, potential brand dilution |

| Clothing Rental Services | Occasional wear, Variety, Sustainability | Direct competition for specific purchase occasions |

| Unbranded/Generic Apparel | Price Sensitivity, Basic Needs Fulfillment | Loss of price-conscious customers |

| DIY/Upcycling | Personalization, Sustainability, Cost Savings | Reduced reliance on mass-produced fashion |

| Experiences (Travel, Digital) | Shifting Consumer Priorities, Discretionary Spending | Decreased overall market size for fashion |

Entrants Threaten

Guess’ established brand recognition and deep customer loyalty present a formidable barrier to new entrants. Building this level of trust and appeal requires immense investment in marketing campaigns, ensuring consistent product quality, and a sustained market presence over many years. For instance, in 2024, Guess continued its global marketing efforts, investing significantly to maintain its brand visibility and connection with its core demographic.

Guess, like many established fashion brands, faces a significant barrier to entry due to substantial capital requirements. Launching a new fashion brand on a global scale necessitates considerable investment in design, sourcing, manufacturing, and building a robust supply chain. For instance, in 2024, the average cost to launch a new apparel brand with a moderate retail presence could easily range from $500,000 to over $2 million, covering initial product development, inventory, marketing campaigns, and setting up e-commerce platforms.

Furthermore, establishing a physical retail footprint, a key component of brand visibility and customer engagement in the fashion sector, adds another layer of significant capital expenditure. Opening even a few flagship stores in prime locations can cost millions. This high upfront investment in infrastructure, inventory management, and brand building effectively deters many aspiring entrepreneurs from entering the competitive fashion landscape against established players like Guess.

Securing prime shelf space in department stores, building widespread retail networks, and developing strong global e-commerce and logistics are essential hurdles. Newcomers often find it challenging to break into these established distribution channels, which are typically controlled by existing market leaders.

Economies of Scale

Guess? benefits significantly from economies of scale, a major barrier to new entrants. Established players leverage their size for lower per-unit costs in sourcing materials, manufacturing apparel, and executing large-scale marketing campaigns. For instance, in 2023, Guess? reported net revenue of $2.6 billion, indicating a substantial operational footprint that allows for cost efficiencies unavailable to startups.

Newcomers entering the fashion retail market struggle to replicate Guess?'s cost advantages. Without the same purchasing power or production volume, their per-unit costs for manufacturing and marketing are inherently higher. This cost disadvantage makes it difficult for new entrants to compete on price and achieve profitability against an established brand like Guess?.

The threat of new entrants is therefore moderated by Guess?'s ability to achieve and maintain economies of scale. This allows Guess? to offer competitive pricing while still maintaining healthy profit margins, a feat challenging for smaller, less established competitors.

- Lower Sourcing Costs: Guess? can negotiate better prices for raw materials due to bulk purchasing.

- Efficient Manufacturing: High production volumes reduce per-unit manufacturing expenses.

- Marketing Reach: Larger marketing budgets allow for broader and more cost-effective brand awareness campaigns.

- Distribution Network: Established logistics reduce shipping and handling costs per item.

Regulatory Hurdles and Intellectual Property

Newcomers often face significant challenges due to complex international trade regulations, labor laws, and intellectual property rights, such as design patents and trademarks. For instance, in 2024, the average cost to file a single international trademark application through the Madrid System can range from several hundred to over a thousand dollars, depending on the number of classes and designated countries. This financial and administrative burden acts as a strong deterrent.

Protecting designs and brand identity in a global marketplace demands substantial legal expertise and financial resources. Smaller, emerging companies may find it difficult to compete with established players who already possess robust IP portfolios and the means to enforce them. This disparity in legal and financial capacity creates an uneven playing field, limiting the threat of new entrants.

- Regulatory Complexity: Navigating diverse international trade and labor laws requires specialized knowledge and significant investment, often exceeding the capabilities of new entrants.

- Intellectual Property Costs: Protecting design patents and trademarks globally can incur substantial legal fees, with international filings potentially costing thousands of dollars per application in 2024.

- Enforcement Challenges: Established firms have existing legal frameworks and resources to defend their IP, making it difficult for new companies to operate without infringing or facing costly legal battles.

- Brand Recognition Barrier: The cost and effort to build and protect a strong brand identity in a global market are considerable, favoring incumbents with established reputations.

The threat of new entrants for Guess is significantly mitigated by high capital requirements and established brand loyalty. Guess's substantial investment in marketing and its long-standing customer relationships create a formidable barrier. For instance, in 2024, the cost to launch a comparable apparel brand with a notable retail presence could easily exceed $2 million, encompassing product development, inventory, and marketing.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of publicly available information, including company annual reports, industry-specific market research, and relevant government data. This ensures a comprehensive understanding of the competitive landscape.