Guerbet PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Guerbet Bundle

Navigate the complex external forces impacting Guerbet's strategic landscape. Our PESTLE analysis provides a deep dive into the political, economic, social, technological, legal, and environmental factors shaping the company's future. Gain a critical understanding of market dynamics and competitive pressures to inform your investment decisions. Download the full, expertly crafted PESTLE analysis now and secure your strategic advantage.

Political factors

Government healthcare policies, particularly concerning spending and drug pricing, are critical for Guerbet. For instance, in 2024, many European countries are grappling with rising healthcare costs, potentially leading to tighter controls on reimbursement for medical imaging. This directly influences Guerbet's revenue streams for its contrast agents and imaging solutions.

Shifts towards value-based care models, where providers are reimbursed based on patient outcomes rather than services rendered, could also impact Guerbet. If imaging procedures are deemed less critical to overall patient value, or if alternative diagnostic methods gain favor, demand for Guerbet's products might see a slowdown. For example, some health systems are exploring bundled payments for diagnostic pathways, which could alter how Guerbet's products are factored into overall costs.

Austerity measures implemented by governments, especially in response to economic challenges, can further constrain healthcare budgets. This means Guerbet needs to remain agile, adapting its commercial strategies to navigate potential reductions in healthcare spending and ensuring its products remain competitive and accessible within evolving reimbursement landscapes.

The political landscape significantly shapes Guerbet's operational environment through regulatory frameworks. The efficiency and responsiveness of agencies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) directly impact the time and expense associated with launching new contrast agents and medical imaging devices. For instance, a faster review process can accelerate market entry, while heightened scrutiny, perhaps driven by political concerns over drug pricing or safety, can introduce delays and increase R&D costs.

Political will plays a crucial role in determining the pace of approvals. In 2024, for example, many health authorities are focusing on expediting the review of innovative therapies, which could benefit Guerbet if its pipeline includes such advancements. Conversely, political pressure to control healthcare spending might lead to more stringent cost-effectiveness evaluations for new products, potentially affecting Guerbet's pricing strategies and market access.

Global trade policies, including tariffs and trade agreements, significantly influence Guerbet's operational landscape. For instance, the ongoing evolution of trade relations between major economic blocs, such as the European Union and the United States, can directly impact the cost of importing raw materials or exporting finished pharmaceutical products.

Geopolitical tensions and protectionist policies can disrupt Guerbet's supply chain, potentially increasing manufacturing costs. For example, if new tariffs are imposed on key chemical intermediates used in contrast media production, Guerbet might face higher input expenses, directly affecting its profit margins in affected markets.

Navigating these complex international political landscapes is crucial for Guerbet's global operations. The company must remain adaptable to changes in trade regulations and geopolitical stability to ensure continued market access and maintain competitive pricing for its specialized diagnostic imaging agents worldwide.

Political Stability and Geopolitical Risks

Political instability in regions where Guerbet sources raw materials or has significant manufacturing operations, such as parts of Asia or Eastern Europe, could disrupt its supply chain. For instance, recent geopolitical tensions in Eastern Europe have led to increased shipping costs and potential delays for various industries, a factor Guerbet monitors closely.

Geopolitical events, like the ongoing conflicts or increased trade protectionism, can impact market demand for elective medical procedures that utilize Guerbet's contrast agents. The World Health Organization has noted that global health spending can be indirectly affected by such events, potentially influencing the uptake of advanced diagnostic imaging.

- Supply Chain Vulnerability: Political instability in key manufacturing hubs can lead to disruptions in the availability of essential components for contrast media production.

- Market Access & Demand: Geopolitical tensions can affect market access and reduce demand for non-essential medical procedures, impacting Guerbet's sales in affected regions.

- Operational Risk: Personnel safety and infrastructure integrity in regions experiencing civil unrest or conflict are significant concerns for Guerbet's global operations.

- Regulatory Environment: Changes in government policies and trade agreements stemming from political shifts can impact Guerbet's ability to operate and sell its products internationally.

Public Health Initiatives and Pandemic Preparedness

Government initiatives focused on public health, such as enhanced pandemic preparedness and widespread disease screening, directly impact the medical imaging sector. For instance, the US Department of Health and Human Services' ongoing investment in public health infrastructure, including diagnostic capabilities, signals a growing demand for advanced imaging technologies and associated contrast agents. Guerbet's strategic alignment with these national health priorities, by offering solutions that support early diagnosis and readiness for health crises, positions the company to capitalize on this trend.

The emphasis on early detection of conditions like cancer and cardiovascular disease, often facilitated by medical imaging, is a key driver. In 2024, global spending on diagnostic imaging is projected to reach over $45 billion, with contrast media representing a significant portion of this market. Guerbet, as a leader in contrast media, is well-positioned to benefit from increased government funding and healthcare system investments aimed at improving patient outcomes through timely and accurate diagnoses.

- Government funding for pandemic preparedness: Initiatives like the Biomedical Advanced Research and Development Authority (BARDA) funding for medical countermeasures directly influence the market for diagnostic tools.

- Focus on early disease detection: National screening programs for conditions such as breast cancer and lung cancer are increasing the utilization of imaging modalities and contrast agents.

- Investment in healthcare infrastructure: Governments worldwide are upgrading hospitals and diagnostic centers, creating opportunities for suppliers of advanced medical imaging equipment and consumables.

- Guerbet's role in public health: The company's contrast agents are crucial for a wide range of diagnostic procedures, supporting public health goals for disease management and prevention.

Government healthcare policies, especially those dictating drug pricing and reimbursement, directly influence Guerbet's revenue. For instance, in 2024, many nations are tightening healthcare budgets, which could lead to stricter controls on the reimbursement of medical imaging contrast agents. This policy environment necessitates Guerbet's adaptation to evolving reimbursement landscapes and competitive pricing strategies.

Political will also shapes the pace of product approvals. In 2024, a focus on expediting innovative therapies could benefit Guerbet if its pipeline aligns. Conversely, political pressure to curb healthcare spending may result in more rigorous cost-effectiveness evaluations for new products, impacting Guerbet's market access and pricing.

Global trade policies and geopolitical stability are critical for Guerbet's supply chain and market access. For example, trade tensions can increase the cost of raw materials, while regional instability might disrupt operations or reduce demand for elective procedures. Guerbet must remain agile to navigate these international political dynamics.

Government initiatives supporting public health, such as investments in pandemic preparedness and disease screening, directly boost the medical imaging sector. For 2024, global spending on diagnostic imaging is projected to exceed $45 billion, with contrast media being a substantial part. Guerbet's alignment with these public health goals, by providing essential diagnostic agents, positions it to benefit from increased healthcare system investments.

What is included in the product

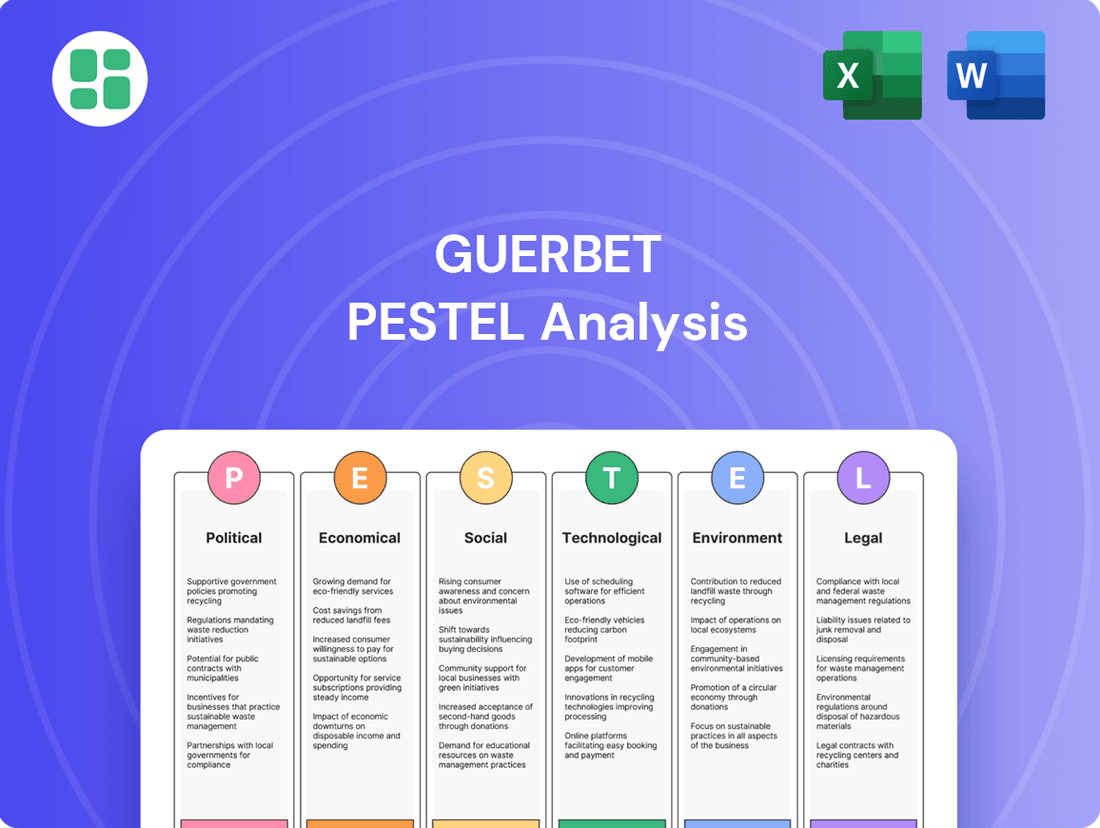

This Guerbet PESTLE analysis examines the impact of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic positioning.

The Guerbet PESTLE Analysis offers a structured framework to identify and address external factors, transforming potential market disruptions into manageable opportunities and alleviating the stress of uncertainty.

Economic factors

Global healthcare spending is a significant driver for markets like medical imaging, which Guerbet serves. In 2023, global healthcare spending was estimated to reach $10 trillion, a figure expected to continue its upward trajectory. This overall economic health directly influences how much is invested in healthcare infrastructure and advanced diagnostic tools.

Economic downturns, however, can present challenges. For instance, if major economies experience a slowdown, as seen with some regions in late 2023 and early 2024, hospitals might face tighter budgets. This can lead to delays in purchasing new imaging equipment or reduced demand for contrast agents, impacting Guerbet's sales volumes.

Conversely, periods of robust economic growth, like the projected 2.7% global GDP growth for 2024 according to the IMF, typically translate into increased healthcare investments. This often means more funding for hospital upgrades, expansion of diagnostic services, and greater adoption of innovative medical imaging technologies, creating favorable conditions for companies like Guerbet.

Inflationary pressures in 2024 and 2025 are directly impacting Guerbet's operational costs. For instance, the Producer Price Index (PPI) for chemicals in the US saw a notable increase, contributing to higher raw material expenses. This rise in input costs, coupled with elevated energy prices, squeezes profit margins for pharmaceutical companies like Guerbet, especially if they cannot fully pass these on to consumers.

Guerbet's reliance on specific chemical precursors means that disruptions or price spikes in these markets, often linked to global energy dynamics, pose a significant risk. Managing these volatile costs through robust supply chain strategies and efficient manufacturing processes is paramount for maintaining profitability in the 2024-2025 period.

Guerbet, operating globally, is significantly exposed to currency exchange rate fluctuations. For example, if the Euro strengthens against currencies like the US Dollar or Japanese Yen, Guerbet's products become pricier for customers in those regions. This can also decrease the value of revenue earned in foreign currencies when converted back into Euros. In 2024, the Euro experienced periods of volatility against major currencies, impacting the cost competitiveness of European-based manufacturers.

To mitigate these risks, Guerbet employs currency hedging strategies, which involve financial instruments to lock in exchange rates for future transactions. Furthermore, maintaining a diversified market presence across various currency zones helps to naturally offset some of the negative impacts of a strong Euro. This diversification ensures that a downturn in one currency market may be balanced by favorable movements in others, contributing to overall economic stability for the company.

Research and Development Investment Capacity

Guerbet's ability to fund its crucial research and development (R&D) for new contrast agents and imaging technologies is directly tied to the prevailing economic conditions. When economies are robust, companies like Guerbet are generally more inclined and able to allocate significant capital towards long-term innovation.

However, the economic landscape of 2024 and into 2025 presents challenges. For instance, the European Central Bank's key interest rates remained at elevated levels through much of 2024, impacting the cost of borrowing for R&D initiatives. If interest rates continue to be high or credit markets tighten, Guerbet might face increased expenses for financing its innovation pipeline, potentially moderating the pace of new product development. Conversely, sustained economic stability would provide a more predictable environment for consistent R&D investment, which is absolutely essential for Guerbet's future growth and competitive edge in the medical imaging sector.

- Economic Stability: A stable economic climate in key markets supports consistent R&D funding for Guerbet.

- Interest Rates: High interest rates, such as those maintained by the ECB in 2024, can increase the cost of borrowing for R&D.

- Credit Markets: Tight credit conditions can further restrict access to capital for innovation projects.

- Innovation Pace: Economic headwinds may slow Guerbet's capacity to invest in and develop new contrast agents and imaging solutions.

Competition and Pricing Pressures

The medical imaging and contrast agent market faces significant pricing pressures, largely fueled by economic considerations. Guerbet, like its peers, navigates a landscape where healthcare providers are increasingly focused on cost containment, directly impacting product pricing strategies.

The rise of generic competition for established contrast agents, particularly as patents expire, intensifies this pressure. For instance, the market for iodinated contrast media, a core area for Guerbet, has seen increased generic penetration, forcing a re-evaluation of pricing models for branded products. This economic reality necessitates a keen focus on operational efficiency and cost management to maintain profitability.

Guerbet's ability to differentiate its offerings through continuous innovation, such as developing new formulations or delivery systems, is paramount. This innovation allows for a stronger value proposition, potentially justifying premium pricing even amidst broader market pressures. For example, advancements in MRI contrast agents that offer improved safety profiles or enhanced diagnostic capabilities can command higher price points.

- Generic Erosion: The increasing availability of generic contrast agents can reduce the average selling price of established products.

- Hospital Cost-Saving Initiatives: Economic pressures on healthcare systems worldwide drive demand for lower-cost alternatives.

- Innovation as a Differentiator: Guerbet's investment in R&D for novel contrast agents and imaging solutions is key to commanding premium pricing.

- Market Share Dynamics: Competitors' pricing strategies directly influence Guerbet's market share and margin potential.

Global economic health significantly influences Guerbet's market. In 2024, projected global GDP growth of around 2.7% by the IMF suggests a supportive environment for healthcare investment. However, persistent inflation, with producer price indexes for chemicals showing increases in 2024, directly impacts Guerbet's raw material and operational costs, potentially squeezing profit margins if these costs cannot be passed on.

Currency fluctuations also pose a risk, as seen with Euro volatility in 2024. A stronger Euro can make Guerbet's products more expensive for international buyers, affecting sales volumes. Furthermore, elevated interest rates, such as those maintained by the ECB through 2024, increase the cost of borrowing for crucial R&D investments, potentially slowing innovation.

The medical imaging market faces pricing pressures due to hospital cost-saving initiatives and the increasing prevalence of generic contrast agents. For instance, the market for iodinated contrast media has seen greater generic penetration, forcing Guerbet to focus on differentiation through innovation to maintain premium pricing and market share.

| Economic Factor | 2024/2025 Impact | Guerbet Relevance |

| Global GDP Growth | Projected ~2.7% (IMF) | Supports healthcare investment and demand for imaging agents. |

| Inflation (Chemicals PPI) | Notable increases in 2024 | Raises raw material and operational costs, impacting profit margins. |

| Interest Rates (ECB) | Elevated through 2024 | Increases cost of borrowing for R&D, potentially slowing innovation. |

| Currency Exchange Rates | Euro volatility in 2024 | Affects international pricing competitiveness and revenue conversion. |

| Generic Competition | Increasing in contrast media | Drives pricing pressure; necessitates innovation for differentiation. |

Preview Before You Purchase

Guerbet PESTLE Analysis

The preview shown here is the exact Guerbet PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This Guerbet PESTLE Analysis is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises.

The content and structure of this Guerbet PESTLE Analysis shown in the preview is the same document you’ll download after payment.

Sociological factors

The world's population is getting older, with projections showing that by 2050, nearly 1 in 6 people globally will be 65 years or older. This demographic shift is directly linked to a rise in chronic diseases like cardiovascular conditions and cancer, which often necessitate advanced medical imaging techniques for diagnosis and ongoing management. For instance, the prevalence of Alzheimer's disease, a major age-related chronic condition, is expected to nearly double by 2050 in the United States alone.

This sustained increase in the elderly population and the associated chronic disease burden translates into a consistently growing demand for diagnostic imaging procedures, and consequently, for the contrast agents that Guerbet specializes in. The market for medical imaging contrast media was valued at approximately $5.1 billion in 2023 and is projected to reach over $7.5 billion by 2030, demonstrating a clear upward trend driven by these demographic realities.

Effectively catering to this demographic requires a nuanced understanding of their specific imaging needs and potential health challenges. Guerbet's product development and market strategies must therefore be closely aligned with the evolving healthcare requirements of an aging global population, ensuring their contrast agents and related solutions remain relevant and impactful.

Growing public understanding of health issues and the advantages of early detection is fueling a greater demand for medical imaging services. This societal shift towards preventative health and proactive wellness encourages more frequent use of diagnostic imaging, directly benefiting companies like Guerbet that supply essential contrast media for these procedures. For instance, the global medical imaging market was valued at approximately USD 35 billion in 2023 and is projected to grow significantly, with contrast media being a key driver.

The increasing prevalence of lifestyle diseases like obesity, diabetes, and cardiovascular conditions is significantly boosting the demand for advanced medical imaging. These chronic illnesses necessitate detailed scans to pinpoint issues and monitor their development, driving the need for sophisticated diagnostic tools.

For instance, the World Health Organization reported in 2024 that non-communicable diseases, largely driven by lifestyle factors, accounted for 74% of all deaths globally. This trend directly translates to a greater reliance on imaging technologies, including MRI and CT scans, to detect and manage conditions such as atherosclerosis and diabetic neuropathy.

Guerbet's strategic focus on developing and supplying high-performance contrast agents and medical devices positions it well to meet these evolving imaging needs. Their product pipeline is designed to support accurate visualization for a wide range of lifestyle-related pathologies, ensuring better patient outcomes.

Patient Expectations and Experience

Societal expectations are increasingly prioritizing patient comfort, safety, and minimally invasive diagnostic procedures. This shift directly influences how medical imaging services are designed and delivered, pushing for advancements that reduce patient discomfort and recovery times. For Guerbet, this means a continued focus on developing contrast agents that offer improved safety profiles and enhanced imaging capabilities to meet these evolving patient demands.

Patients are actively seeking diagnostic options that are less painful, faster to administer, and yield more accurate results. This patient-centric approach is a significant driver in the healthcare market. Guerbet's strategic direction in contrast media development must align with these preferences, aiming for agents that minimize side effects and maximize diagnostic precision.

In 2024, the global medical imaging market was valued at approximately USD 105.2 billion, with a projected compound annual growth rate (CAGR) of 5.8% through 2030. This growth is partly fueled by the increasing demand for advanced diagnostic techniques and patient-friendly solutions.

- Patient-Centric Innovation: Guerbet's R&D investments in contrast agents are increasingly focused on reducing adverse reactions and improving patient tolerability, aligning with a growing preference for less invasive and more comfortable diagnostic experiences.

- Demand for Speed and Accuracy: Patients expect faster turnaround times for diagnoses and more precise imaging results, driving demand for contrast agents that facilitate quicker scans and clearer visualization of anatomical structures.

- Safety Profile Emphasis: A heightened awareness of contrast agent safety, particularly among vulnerable patient populations, necessitates ongoing development of agents with superior safety profiles, a key factor in patient and physician choice.

Healthcare Accessibility and Equity

Societal concerns about equitable access to healthcare, particularly in diagnostic imaging, directly shape government policies. For instance, in 2024, many developed nations continued to focus on reducing wait times and expanding access to advanced imaging technologies in rural and underserved areas, a trend likely to persist through 2025. This push for greater equity can translate into increased demand for Guerbet's contrast agents and related services as infrastructure is upgraded.

Conversely, a growing public demand for lower healthcare expenditures could pressure companies like Guerbet to adjust pricing strategies. In 2024, discussions around drug pricing reform remained prominent in several key markets, potentially influencing reimbursement rates for contrast media. This could impact Guerbet's profit margins and necessitate a focus on cost-effective solutions and demonstrating clear value propositions.

- Healthcare Accessibility Initiatives: Many governments are investing in expanding diagnostic imaging services to underserved populations, aiming to improve health outcomes and reduce disparities.

- Cost Containment Pressures: Public and political pressure to control rising healthcare costs may lead to stricter price negotiations for medical products, including contrast agents.

- Focus on Value-Based Care: The shift towards value-based healthcare models encourages the adoption of technologies and treatments that demonstrate superior clinical outcomes relative to their cost.

- Demographic Shifts: Aging populations in many developed countries increase the demand for diagnostic imaging, but also place greater strain on healthcare budgets, creating a complex market dynamic.

Societal trends highlight an increasing demand for patient comfort and minimally invasive procedures in medical diagnostics. This directly influences Guerbet's product development, pushing for contrast agents with improved safety profiles and enhanced imaging capabilities. Patients are actively seeking quicker, less painful diagnostic options with more accurate results, aligning with Guerbet's strategic focus on patient-centric innovation.

Growing awareness of preventative healthcare and early disease detection fuels greater demand for medical imaging services. This societal shift encourages more frequent diagnostic imaging, directly benefiting companies like Guerbet that supply essential contrast media. The global medical imaging market, valued at approximately USD 35 billion in 2023, with contrast media as a key driver, underscores this trend.

Equitable access to healthcare is a growing societal concern, impacting government policies on diagnostic imaging. Initiatives to reduce wait times and expand access in underserved areas, ongoing in 2024 and projected for 2025, can increase demand for Guerbet's products as infrastructure improves. Conversely, pressure for lower healthcare expenditures may necessitate pricing adjustments and a focus on cost-effectiveness.

| Societal Factor | Impact on Guerbet | Supporting Data (2023-2025 Projections) |

| Patient-Centricity & Comfort | Demand for safer, less invasive contrast agents; focus on patient tolerability. | Global medical imaging market growth driven by patient-friendly solutions. |

| Preventative Healthcare Awareness | Increased use of diagnostic imaging leads to higher demand for contrast media. | Medical imaging market projected to grow, with contrast media as a key segment. |

| Healthcare Accessibility & Cost | Opportunities from expanded access initiatives; pressure from cost containment efforts. | Government focus on reducing wait times and controlling healthcare spending. |

Technological factors

Continuous advancements in imaging technologies like MRI, CT, and X-ray are crucial for Guerbet. For instance, the development of higher field strength MRI scanners, reaching 7 Tesla and beyond, necessitates contrast agents that perform optimally at these higher magnetic field strengths, potentially improving image clarity and diagnostic accuracy.

Guerbet's contrast agents must be compatible with and optimized for these evolving imaging platforms. This includes ensuring agents can be effectively utilized with faster scan times and improved resolution offered by new equipment, which directly influences the utility and demand for their products.

Early collaboration with leading imaging equipment manufacturers, such as Siemens Healthineers, GE Healthcare, and Philips, is vital. This partnership allows Guerbet to align its contrast agent development with upcoming technological trends, ensuring their product portfolio remains relevant and competitive in the rapidly advancing medical imaging landscape.

The increasing integration of Artificial Intelligence (AI) into medical imaging offers significant opportunities for Guerbet to enhance the diagnostic value of its contrast agents. AI algorithms can improve the analysis of contrast-enhanced images, leading to more precise diagnostics and streamlined workflows for healthcare professionals. For instance, AI-powered tools are being developed to automate lesion detection and characterization in radiology, potentially boosting the utility of Guerbet's products.

However, this technological shift also presents challenges. Guerbet must ensure its contrast media products are compatible with evolving AI platforms and diagnostic software, which may require investment in new digital solutions and data management capabilities. The global AI in healthcare market was valued at approximately $15.4 billion in 2023 and is projected to grow substantially, indicating a strong demand for AI-enabled medical technologies.

Furthermore, the rise of digital health platforms and telemedicine directly impacts how imaging data and related products are managed and accessed. Guerbet needs to consider how its offerings can be integrated into these digital ecosystems, potentially enabling remote consultations and data sharing. This digital transformation necessitates a strategic approach to product development and service provision to remain competitive in the evolving healthcare landscape.

Guerbet's technological landscape is significantly shaped by the ongoing development of novel contrast agent chemistries. This includes research into targeted agents that can specifically bind to certain tissues or disease markers, as well as multimodal agents offering enhanced diagnostic capabilities. The exploration of alternatives to current formulations is also a key area, aiming for improved safety and efficacy.

Guerbet's competitive advantage hinges on its capacity for innovation in bringing advanced contrast agents to market. These next-generation products are expected to offer better safety profiles, superior diagnostic performance, or entirely new applications in medical imaging. For instance, advancements in gadolinium-free agents or agents utilizing novel chelating agents are actively pursued to address concerns around gadolinium retention.

This pursuit of cutting-edge contrast agents necessitates substantial investment in research and development (R&D) and specialized expertise. Guerbet's commitment to R&D is evident in its strategic partnerships and internal development programs. In 2023, the company allocated approximately 10% of its revenue to R&D, a significant portion dedicated to pipeline expansion and the development of these advanced chemistries.

Biotechnology and Personalized Medicine Trends

Biotechnology advancements are fueling a significant shift towards personalized medicine, enabling the creation of highly specific diagnostic agents. Guerbet must investigate how its contrast agents can integrate into this personalized model, potentially through theranostics or targeted imaging, which necessitates a deep understanding of molecular biology.

The global personalized medicine market was valued at approximately $580 billion in 2023 and is projected to reach over $1.1 trillion by 2030, growing at a CAGR of around 10%. This trend presents opportunities for Guerbet to develop contrast agents that are tailored to individual patient genetic profiles or specific disease biomarkers.

- Biotechnology Integration: Guerbet can leverage advancements in genetic sequencing and molecular diagnostics to design contrast agents that precisely target disease markers.

- Theranostics Potential: Exploring the combination of diagnostic imaging with therapeutic delivery mechanisms for contrast agents could offer new treatment pathways.

- Market Growth: The increasing adoption of precision diagnostics and targeted therapies in oncology, rare diseases, and infectious diseases underscores the market's potential.

Data Management and Cybersecurity in Medical Imaging

The sheer volume of digital medical images is exploding, requiring sophisticated systems for managing, storing, and safeguarding this data. By 2024, the global medical imaging market was valued at approximately USD 35.5 billion, with a significant portion attributed to the digital transformation of imaging processes. This escalating data flow places immense pressure on cybersecurity measures.

As medical imaging systems become increasingly networked, protecting patient information from breaches and ensuring data integrity is critical. A 2024 report indicated that healthcare data breaches cost an average of USD 10.93 million, highlighting the financial and reputational risks involved. Guerbet, as a key player in imaging solutions, must prioritize these aspects.

Guerbet's product development and service offerings need to account for robust data security and privacy. This could involve integrating advanced encryption, access controls, and secure data handling protocols directly into their imaging technologies and associated platforms. By offering secure data management features, Guerbet can differentiate itself and meet stringent regulatory requirements.

- Data Growth: Medical imaging data is projected to grow at a compound annual growth rate (CAGR) of over 15% through 2027, driven by AI adoption and higher resolution imaging.

- Cybersecurity Investment: Healthcare organizations are expected to increase cybersecurity spending by 10-15% in 2024-2025 to combat rising threats.

- Regulatory Compliance: Stricter data protection laws like GDPR and HIPAA mandate robust security for patient data, influencing technology choices.

- Guerbet's Role: Developing solutions that ensure data integrity and privacy can be a significant competitive advantage for Guerbet in the evolving medical imaging landscape.

Technological advancements continue to drive Guerbet's product development, particularly in imaging hardware and software. For instance, the increasing adoption of AI in medical imaging, with the global AI in healthcare market valued at around $15.4 billion in 2023, presents opportunities for enhanced diagnostic value of contrast agents. Guerbet must ensure its products are compatible with these evolving AI platforms and diagnostic software.

Guerbet's R&D investment, approximately 10% of its revenue in 2023, is crucial for developing novel contrast agent chemistries and next-generation products. This includes research into targeted and multimodal agents, as well as gadolinium-free alternatives, aiming for improved safety and efficacy in a market that saw the global personalized medicine market valued at approximately $580 billion in 2023.

The exponential growth of digital medical images, with the global medical imaging market valued at approximately USD 35.5 billion in 2024, necessitates robust cybersecurity measures. Guerbet must prioritize data security and privacy, integrating advanced encryption and access controls into its offerings to comply with stricter data protection laws and mitigate risks, as healthcare data breaches cost an average of USD 10.93 million in 2024.

Legal factors

Guerbet navigates a complex web of global pharmaceutical and medical device regulations, including the EU Medical Device Regulation (MDR) and U.S. Food and Drug Administration (FDA) mandates. These regulations cover everything from initial product design and manufacturing processes to how products are labeled and monitored after they reach the market. For instance, the EU MDR, fully applicable since May 2021, has significantly increased the scrutiny and data requirements for medical devices, impacting timelines and costs for market access.

Adhering to these rigorous legal standards is not just a requirement but a significant operational cost for Guerbet. The company must invest heavily in quality management systems, clinical data generation, and regulatory affairs expertise to ensure ongoing compliance. Failure to meet these exacting legal benchmarks can result in substantial financial penalties, forced product recalls from key markets, and severe damage to Guerbet's brand reputation, directly affecting its ability to operate and generate revenue.

Protecting its intellectual property, particularly patents for its innovative contrast agents and manufacturing processes, is fundamental to Guerbet's sustained competitive edge and financial success. For instance, in 2023, Guerbet continued to invest in R&D, a key driver for patentable innovations, with a significant portion of its revenue allocated to this area, though specific figures for IP protection investments are not publicly itemized.

Legal hurdles, such as challenges to existing patents or the natural expiration of crucial patent protections, pose a direct threat by potentially opening the market to generic competitors, which could erode Guerbet's market share and pricing power.

To counter these risks, Guerbet actively manages its extensive patent portfolio, which includes numerous filings across key markets, and is prepared to engage in rigorous legal defense to protect its innovations from infringement.

Data privacy laws, such as the General Data Protection Regulation (GDPR) in Europe and the Health Insurance Portability and Accountability Act (HIPAA) in the United States, impose stringent requirements on how sensitive patient health information is handled. Guerbet, operating within the medical imaging sector, must meticulously adhere to these regulations for its products and digital services. Failure to comply can lead to substantial financial penalties; for instance, GDPR fines can reach up to 4% of annual global turnover or €20 million, whichever is higher, while HIPAA violations can incur fines up to $1.5 million per violation category annually.

Product Liability and Safety Regulations

Guerbet operates under strict product liability laws, meaning the company can be held accountable for any harm stemming from its diagnostic imaging agents if they are found to be defective or inadequately labeled. This necessitates rigorous adherence to safety testing protocols and quality control measures throughout the product lifecycle. For instance, in 2023, the pharmaceutical industry globally saw a significant number of product recall incidents, underscoring the constant vigilance required in this sector.

Compliance with evolving safety regulations and thorough adverse event reporting frameworks is not merely a legal obligation but a critical operational imperative for Guerbet. Failure to meet these standards can lead to substantial financial penalties and severe reputational damage. The European Medicines Agency (EMA) and the U.S. Food and Drug Administration (FDA) consistently update their guidelines, requiring ongoing investment in compliance infrastructure. For example, the total fines levied against pharmaceutical companies for regulatory non-compliance in 2024 are projected to exceed previous years, reflecting increased enforcement.

- Product Liability: Guerbet must ensure its contrast agents meet all safety and efficacy standards to mitigate risks of lawsuits arising from patient harm.

- Regulatory Compliance: Continuous investment in quality assurance and pharmacovigilance systems is essential to meet global regulatory body requirements.

- Adverse Event Reporting: Prompt and accurate reporting of any side effects or safety concerns is legally mandated and crucial for maintaining market access.

- Legal Challenges: Potential litigation over product defects or labeling errors poses a significant financial and reputational threat, impacting market trust and investor confidence.

Anti-Trust and Competition Law

Guerbet, as a major force in the medical imaging sector, navigates a landscape shaped by stringent anti-trust and competition laws. These regulations are designed to prevent any single company from dominating the market or engaging in practices that stifle fair competition. Regulatory bodies actively monitor Guerbet's strategic moves, including mergers, acquisitions, and significant commercial partnerships, to ensure they don't negatively impact the competitive environment. For instance, the European Commission has historically investigated and imposed penalties on companies for anti-competitive behavior in the pharmaceutical and medical device sectors, with fines sometimes reaching millions of euros, underscoring the financial risks involved.

The consequences of non-compliance can be severe. Violations of anti-trust laws can result in substantial financial penalties, potentially impacting Guerbet's profitability. Beyond fines, regulatory authorities can mandate divestitures, forcing the company to sell off certain assets or business units to restore competitive balance. In 2023, the French Competition Authority fined a pharmaceutical company €10 million for abuse of dominant position, illustrating the ongoing enforcement in related industries.

- Regulatory Scrutiny: Guerbet's market activities, from product launches to strategic alliances, are subject to oversight by competition authorities globally.

- Merger & Acquisition Review: Any proposed mergers or acquisitions by Guerbet undergo rigorous review to assess their impact on market competition.

- Potential Penalties: Non-compliance can lead to significant fines, operational restrictions, and forced divestitures, as seen in past cases within the healthcare industry.

- Market Integrity: Adherence to these laws is crucial for maintaining a fair and competitive market, ensuring patient access to innovative medical imaging solutions.

Guerbet operates under a stringent legal framework governing pharmaceuticals and medical devices, including the EU MDR and FDA mandates, demanding rigorous compliance for product design, manufacturing, and post-market surveillance. The increasing complexity and data requirements of regulations like the EU MDR, fully applicable since May 2021, directly influence market access timelines and associated costs for Guerbet.

The company must invest significantly in quality management, clinical data, and regulatory expertise to meet these evolving legal standards. Non-compliance can result in substantial financial penalties, product recalls, and severe reputational damage, impacting Guerbet's operational capacity and revenue streams.

Protecting its intellectual property is paramount for Guerbet's competitive advantage. While specific IP protection investment figures are not detailed, R&D spending in 2023, a key driver for patentable innovations, remained a significant allocation of revenue. Legal challenges, such as patent expirations or infringement disputes, pose a direct threat to market share and pricing power.

Guerbet actively manages its patent portfolio and is prepared for legal defense to safeguard its innovations. Data privacy laws like GDPR and HIPAA impose strict requirements on handling patient health information, with potential fines reaching up to 4% of global turnover for GDPR and $1.5 million per violation category annually for HIPAA. Product liability laws hold Guerbet accountable for any harm from defective products, necessitating robust safety testing and quality control.

Adherence to evolving safety regulations and adverse event reporting is critical, with projected increases in regulatory fines for non-compliance in 2024 across the pharmaceutical industry. Guerbet also faces scrutiny under anti-trust and competition laws, with potential penalties including hefty fines and forced divestitures for anti-competitive behavior, as exemplified by a €10 million fine levied against a pharmaceutical company in 2023 for abuse of dominant position.

Environmental factors

Guerbet is increasingly scrutinized for its environmental impact, pushing for sustainable manufacturing and supply chain practices to reduce its footprint. This involves actively minimizing waste, enhancing energy efficiency in production, and ensuring responsible sourcing of raw materials. For example, in 2023, the pharmaceutical industry, including companies like Guerbet, faced growing demands for transparency in their carbon emissions, with many setting net-zero targets by 2040 or 2050.

Adherence to evolving environmental regulations, such as those concerning chemical waste disposal and emissions, is critical. Stakeholder expectations for corporate social responsibility, particularly around sustainability, are also rising, making these practices a key business imperative. By 2025, it's anticipated that over 70% of major global companies will have publicly disclosed their Scope 3 emissions, a significant increase from previous years, highlighting the industry-wide focus on supply chain sustainability.

The disposal of medical waste, including residual contrast agents, is heavily regulated to protect the environment. Guerbet must navigate these stringent rules, which vary by region, impacting how their products are handled post-use. For instance, in the European Union, the Waste Framework Directive sets overarching principles for waste management, emphasizing prevention, reuse, and recycling.

Guerbet's environmental responsibility extends across its product lifecycle. This means considering the impact of manufacturing processes and the ultimate fate of contrast agents after they are administered to patients. Reports from industry bodies in 2024 highlighted increasing scrutiny on the biodegradability of pharmaceutical products, a factor Guerbet is likely evaluating.

Developing greener contrast agent formulations or championing improved disposal infrastructure presents a significant strategic opportunity. By innovating in this area, Guerbet could gain a competitive edge and enhance its corporate social responsibility profile. The company's sustainability reports often detail ongoing research into more eco-friendly product designs and waste reduction initiatives.

Increasing global and national regulations, like the European Union's Fit for 55 package aiming for a 55% net greenhouse gas emission reduction by 2030, directly influence Guerbet's operational strategies. These mandates require the company to rigorously assess and actively reduce its carbon footprint across manufacturing sites and supply chains.

Guerbet's commitment to sustainability involves evaluating its energy consumption and emissions. For instance, in 2023, the company reported a reduction in its Scope 1 and 2 greenhouse gas emissions by 11.5% compared to 2019, demonstrating progress in managing its environmental impact.

Investing in energy-efficient technologies and exploring renewable energy sources for its facilities presents a strategic opportunity for Guerbet. This not only helps in complying with evolving regulations but also enhances corporate responsibility and potentially lowers long-term operational costs.

Resource Scarcity and Water Management

Resource scarcity, especially concerning water, presents a significant environmental challenge for pharmaceutical manufacturers like Guerbet. The company must prioritize responsible water usage throughout its production cycles. This includes implementing water-efficient technologies and exploring water recycling initiatives to minimize its footprint.

Assessing and mitigating risks associated with water scarcity in its operational regions is crucial for Guerbet's long-term resilience. For instance, regions in Southern Europe, where Guerbet has manufacturing sites, have faced increasing water stress. In 2023, Spain experienced its driest year on record, impacting water availability for industrial use.

- Water Stress: Guerbet operates in regions facing varying levels of water stress, requiring proactive management strategies.

- Sustainable Practices: Implementing water-efficient technologies and recycling programs are key to responsible resource utilization.

- Operational Resilience: Securing reliable water sources is vital for uninterrupted pharmaceutical production and supply chains.

- Regulatory Compliance: Adhering to evolving water usage regulations and environmental standards is a continuous requirement.

Environmental Impact Assessments and Reporting

Guerbet, like many companies, faces increasing pressure to conduct thorough environmental impact assessments for its operations and new developments. This involves evaluating the potential effects of its activities on ecosystems and natural resources. For instance, in 2023, the company continued its efforts to minimize waste and emissions, aligning with evolving regulatory landscapes that mandate detailed environmental reporting.

Compliance with these reporting standards is crucial for Guerbet. The company must transparently communicate its environmental initiatives and progress to a range of stakeholders, including investors, regulators, and the public. This includes detailing efforts in areas like water management and carbon footprint reduction, as seen in their ongoing sustainability reporting practices.

A robust Environmental, Social, and Governance (ESG) performance is becoming a significant differentiator. Guerbet's commitment to strong ESG principles can significantly enhance its reputation and attract a growing segment of responsible investors. For example, companies with strong ESG scores, often exceeding industry averages, have shown a tendency to outperform their peers financially, a trend anticipated to continue through 2024 and beyond.

Key environmental focus areas for Guerbet include:

- Waste Reduction: Implementing strategies to minimize hazardous and non-hazardous waste generation across manufacturing and research facilities.

- Energy Efficiency: Investing in technologies and processes to reduce energy consumption and lower greenhouse gas emissions.

- Water Stewardship: Managing water resources responsibly, focusing on conservation and responsible wastewater treatment.

- Sustainable Sourcing: Evaluating and selecting suppliers based on their environmental performance and commitment to sustainability.

Guerbet faces increasing regulatory and stakeholder pressure regarding its environmental impact, particularly concerning waste management and emissions. The company is actively working on reducing its carbon footprint, with a stated goal of improving its environmental performance across its operations. For instance, in 2023, Guerbet reported a 11.5% reduction in its Scope 1 and 2 greenhouse gas emissions compared to 2019, demonstrating tangible progress.

Water scarcity is a growing concern, especially in regions where Guerbet has manufacturing sites, such as Southern Europe. The company must implement water-efficient technologies and responsible water usage practices to ensure operational resilience and comply with evolving regulations. Spain's record dry year in 2023 highlighted the increasing water stress faced by industries in the region.

The pharmaceutical industry, including Guerbet, is seeing a significant trend towards greater transparency in environmental reporting. By 2025, it is projected that over 70% of major global companies will disclose their Scope 3 emissions, underscoring the importance of supply chain sustainability. Guerbet's commitment to ESG principles is crucial for its reputation and attracting responsible investors, with studies in 2024 indicating that strong ESG performance often correlates with financial outperformance.

| Environmental Factor | Guerbet's Focus/Action | Relevant Data/Trend (2023-2025) |

|---|---|---|

| Greenhouse Gas Emissions | Reducing Scope 1, 2, and 3 emissions; investing in energy efficiency. | 11.5% reduction in Scope 1 & 2 emissions (vs. 2019) reported in 2023. Industry trend: Many companies setting net-zero targets by 2040/2050. |

| Water Management | Responsible water usage, conservation, and wastewater treatment. | Operating in regions facing water stress (e.g., Spain's driest year in 2023). |

| Waste Management | Minimizing hazardous and non-hazardous waste generation. | Ongoing evaluation of biodegradability of products; stringent regulations on medical waste disposal. |

| Supply Chain Sustainability | Evaluating supplier environmental performance. | Anticipated 70%+ of major companies disclosing Scope 3 emissions by 2025. |

PESTLE Analysis Data Sources

Our Guerbet PESTLE Analysis draws from a robust blend of data, including official government publications, reports from international organizations like the WHO and OECD, and leading market research firms specializing in the pharmaceutical and chemical industries. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting Guerbet's operations.