Guerbet Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Guerbet Bundle

Guerbet's competitive landscape is shaped by potent forces, from the bargaining power of its buyers to the constant threat of new market entrants. Understanding these dynamics is crucial for any strategic assessment of the company.

The complete report reveals the real forces shaping Guerbet’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Supplier concentration is a key factor in Guerbet's bargaining power of suppliers. The medical imaging contrast agent market depends heavily on specialized raw materials like iodine and gadolinium. These critical components are sourced from a small number of highly specialized chemical suppliers, granting them significant leverage, especially when alternative sources are scarce.

Guerbet's operational continuity and profitability are directly tied to its ability to secure these essential inputs reliably and at competitive prices. For instance, in 2024, the global iodine market saw price fluctuations driven by supply chain disruptions, highlighting the impact of supplier concentration on companies like Guerbet.

Switching suppliers for critical raw materials in pharmaceutical manufacturing can be incredibly costly for Guerbet. This involves extensive re-validation procedures, obtaining new regulatory approvals, and the significant risk of disrupting established production processes. These hurdles inherently limit Guerbet's flexibility.

The substantial costs associated with changing suppliers give existing, qualified suppliers considerable leverage. They can more easily exert pricing pressure on Guerbet, knowing that the alternatives are not readily or cheaply available. This dynamic directly impacts Guerbet's cost control efforts.

While Guerbet strives for efficient cost management, past price increases for key raw materials, such as iodine, have presented challenges. Although the rate of such increases is anticipated to decelerate, the underlying switching costs remain a factor influencing supplier power.

The specialized nature of contrast agent components means that certain inputs may be proprietary or require specific manufacturing processes, limiting Guerbet's options for alternative suppliers. This uniqueness enhances the bargaining power of those suppliers providing patented or highly specialized chemicals.

Guerbet's continuous innovation and R&D investment, amounting to 9% of its sales in 2023, might also involve unique partnerships with specialized material providers, further solidifying supplier leverage.

Threat of Forward Integration

The threat of forward integration by raw material suppliers in the contrast agent market, while theoretically present, is generally considered low for Guerbet. This is due to the substantial capital investment, complex regulatory hurdles, and established distribution channels needed to enter pharmaceutical manufacturing. For instance, launching a new contrast agent typically requires billions in R&D and regulatory approvals, a barrier few raw material suppliers can overcome.

Guerbet's strong global footprint and decades of experience in the highly regulated pharmaceutical industry significantly mitigate this risk. Their established relationships and market penetration make it difficult for a supplier to effectively replicate their operations and compete directly. In 2024, Guerbet continued to strengthen its market position, underscoring the challenges any potential entrant would face.

Consider the following points regarding this threat:

- High Barriers to Entry: The pharmaceutical sector demands extensive regulatory compliance, clinical trials, and manufacturing expertise, making forward integration by suppliers a costly and lengthy endeavor.

- Guerbet's Market Strength: Guerbet's established global sales force and distribution network, built over many years, provide a significant competitive advantage that is difficult for a raw material supplier to replicate.

- Specialized Knowledge: Contrast agent manufacturing requires highly specialized technical knowledge and quality control processes, which are core competencies for established players like Guerbet, not typically found in raw material suppliers.

Supplier's Importance to Guerbet's Cost Structure

The cost of raw materials, particularly active pharmaceutical ingredients (APIs) and excipients, forms a substantial part of Guerbet's manufacturing expenses. Any increase in these input prices that Guerbet cannot transfer to its customers directly squeezes profit margins. This highlights the critical need for effective supplier cost management.

Guerbet's financial projections for 2025 anticipate sustained profit growth, largely driven by stringent cost control measures. This forward-looking strategy underscores the company's commitment to actively managing its supplier relationships and associated costs to achieve its profitability targets.

- Significant Cost Component: Raw materials, including APIs, can constitute a large percentage of Guerbet's total production costs.

- Profitability Impact: Unabsorbed increases in input prices directly reduce Guerbet's profitability.

- 2025 Forecast: Guerbet expects profitability growth in 2025, supported by ongoing cost management, which includes supplier cost control.

The bargaining power of suppliers for Guerbet is significantly influenced by the concentration of specialized raw material providers, particularly for iodine and gadolinium. These suppliers hold considerable sway due to the limited number of producers and the high switching costs associated with re-validation and regulatory hurdles for Guerbet. This leverage allows suppliers to exert pricing pressure, impacting Guerbet's cost management and profitability, as seen with iodine price fluctuations in 2024.

| Factor | Impact on Guerbet | 2024/2023 Data Point |

| Supplier Concentration | High leverage for few specialized suppliers | Iodine price fluctuations in 2024 |

| Switching Costs | Significant barriers (regulatory, production) | N/A (inherent cost) |

| Proprietary Inputs | Limited alternatives, increased supplier power | N/A (inherent characteristic) |

| R&D Partnerships | Potential for unique supplier relationships | 9% of sales in R&D (2023) |

What is included in the product

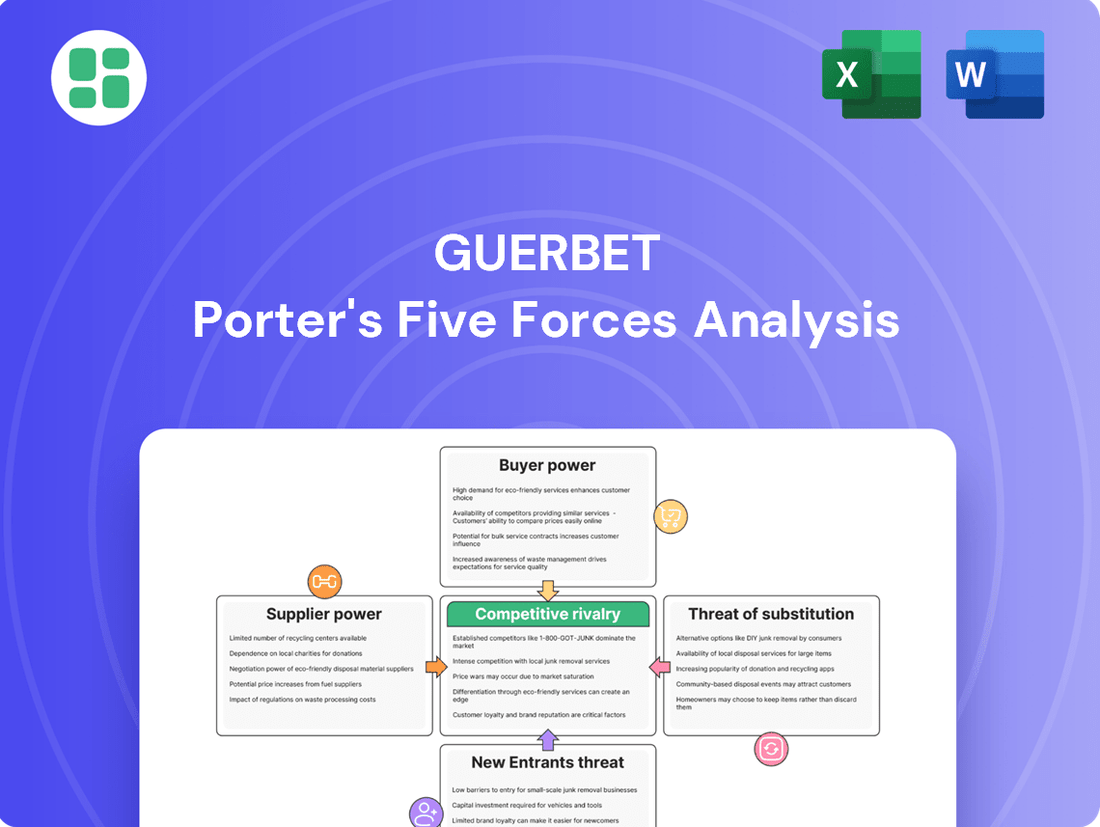

A Guerbet-focused Porter's Five Forces analysis dissects the competitive intensity within its specific market, examining threats from new entrants, the power of buyers and suppliers, and the impact of substitutes and existing rivals.

Easily visualize competitive intensity and identify strategic vulnerabilities with a dynamic, interactive five forces chart.

Customers Bargaining Power

Guerbet's main clients are healthcare facilities like hospitals and radiology centers. These entities often buy contrast agents in bulk, frequently through centralized purchasing departments or larger buying groups. This concentration of purchasing power means these customers can significantly influence pricing and contract conditions.

Major purchasers, especially within national healthcare frameworks, hold substantial leverage. For example, France's supply chain and reimbursement system reforms in 2023 led to disruptions and negatively affected Guerbet's sales, demonstrating the considerable impact customers can have on the company's performance in specific markets.

While switching contrast agent brands might involve some administrative and training adjustments for healthcare professionals, these costs are generally not prohibitively high if a comparable product offers better pricing or service. The relative ease of switching among approved contrast agents directly enhances customer bargaining power.

Guerbet's strategic emphasis on product differentiation, exemplified by its innovative Elucirem™ (Gadopiclenol) for MRI, is a key tactic to cultivate customer loyalty and mitigate the impact of switching costs. This focus aims to create a stickier customer base.

Healthcare providers, facing significant cost pressures and tight budgets, exhibit high price sensitivity when acquiring medical supplies such as contrast agents. This sensitivity is further heightened by existing reimbursement structures and the presence of comparable generic options in the market.

In 2024, the global contrast media market experienced growth, but price remains a critical factor for many purchasers. For instance, hospitals are continually seeking ways to optimize their spending, making the cost-effectiveness of products a primary consideration in their procurement decisions.

Guerbet addresses this by focusing on strategies like promoting multi-use contrast agents, which can reduce overall consumption and associated costs for healthcare facilities. Additionally, the company invests in automating its industrial processes to improve efficiency and strengthen its profit margins, enabling more competitive pricing.

Customer Information Availability

Customers in the medical imaging sector, encompassing procurement departments and clinicians, are typically well-versed in product specifications, pricing, and the landscape of competing products. This awareness, fueled by readily available market data and comparative research, significantly strengthens their negotiating position.

Guerbet actively participates in key industry events, such as the European Congress of Radiology (ECR) in 2024, to disseminate information and shape customer perceptions. This strategic engagement underscores the company's commitment to transparency and customer education.

- Informed Procurement: Hospitals and clinics often have dedicated procurement teams who meticulously research and compare contrast media based on efficacy, safety profiles, and cost-effectiveness.

- Clinician Influence: Clinicians, particularly radiologists, have a strong say in product selection due to their direct experience with product performance and patient outcomes.

- Data Accessibility: The availability of clinical trial data, peer-reviewed studies, and market intelligence reports empowers customers to make informed decisions and demand competitive pricing.

- Price Sensitivity: While efficacy is paramount, budget constraints in healthcare systems make price a significant factor, increasing customer bargaining power, especially for established product categories.

Threat of Backward Integration by Customers

The threat of backward integration by customers, such as large hospital networks, developing their own contrast agents is exceptionally low. This is primarily due to the substantial capital required for manufacturing facilities, the complex and ongoing investment in specialized research and development, and the rigorous regulatory hurdles inherent in the pharmaceutical industry. For instance, bringing a new contrast agent to market typically involves years of clinical trials and significant financial outlay, often in the hundreds of millions of dollars.

Guerbet's extensive 98-year history in contrast media development highlights the deep-seated expertise and established infrastructure necessary to compete, creating formidable barriers to entry for potential customer-led integration. The specialized nature of producing sterile, high-purity injectable pharmaceuticals means that even well-funded healthcare systems would face immense challenges in replicating Guerbet's capabilities and regulatory compliance.

- High Capital Investment: Establishing contrast agent manufacturing requires billions in infrastructure and equipment.

- Specialized R&D Needs: Continuous innovation and formulation expertise are critical, demanding dedicated scientific teams.

- Stringent Regulatory Approval: Navigating FDA or EMA approvals is a lengthy and costly process, often taking over a decade.

- Guerbet's Experience: Nearly a century of focused development provides a significant competitive moat.

Customers, primarily hospitals and radiology centers, wield considerable bargaining power due to bulk purchasing and price sensitivity. Their ability to switch between brands, though requiring some adjustment, is facilitated by the availability of comparable products and a focus on cost-effectiveness, particularly in light of healthcare budget constraints. In 2024, the global contrast media market saw continued price competition, with purchasers actively seeking value.

Guerbet's efforts to counter this include developing differentiated products like Elucirem™ and improving operational efficiency to offer competitive pricing. The low threat of backward integration by customers, due to high capital, R&D, and regulatory barriers, also plays a role in the power dynamic.

| Factor | Impact on Guerbet | Customer Action |

|---|---|---|

| Bulk Purchasing | Increased price pressure | Negotiating volume discounts |

| Price Sensitivity | Need for competitive pricing | Comparing costs across suppliers |

| Switching Costs | Moderate, but manageable | Evaluating alternatives for better value |

| Customer Knowledge | Empowers negotiation | Leveraging market data and clinical outcomes |

Preview the Actual Deliverable

Guerbet Porter's Five Forces Analysis

This preview showcases the complete Guerbet Porter's Five Forces analysis, offering a detailed examination of the competitive landscape within the pharmaceutical industry. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, providing actionable insights for strategic decision-making without any placeholders or surprises.

Rivalry Among Competitors

The medical imaging contrast media market is quite competitive, featuring several major global companies. Guerbet competes directly with giants like GE Healthcare, Bayer, and Bracco Imaging, forming an oligopoly. Guerbet itself acknowledges at least 10 active competitors in the space.

This mix of large, established players and smaller, more specialized firms creates a dynamic rivalry. Companies of varying sizes and with different geographic strengths all compete for market share, making the landscape challenging.

The contrast media market is expected to see consistent growth, with projections for a compound annual growth rate (CAGR) between 2.59% and 8.1% from 2024 through 2031 or 2032. This expansion is fueled by a rise in diagnostic imaging procedures and the increasing prevalence of chronic diseases.

While this growth presents opportunities, the competitive landscape remains intense, potentially capping individual company advancements. For instance, Guerbet, a key player, reported robust growth of 9.0% in 2024, measured at constant exchange rates and on a like-for-like basis, indicating strong performance amidst this dynamic market.

While contrast agents share core functions, companies like Guerbet differentiate by focusing on improved safety, better imaging, and patient ease. Guerbet's Elucirem™ (Gadopiclenol) is a prime example, allowing for reduced gadolinium usage. This pursuit of differentiation demands significant investment in research and development.

Despite these efforts, the market faces pressure from generic alternatives, which can cap pricing power. For instance, the market for older gadolinium-based contrast agents has seen increased generic penetration, impacting the pricing flexibility of established brands.

Exit Barriers

High fixed costs in manufacturing, research and development, and regulatory adherence act as significant exit barriers in the contrast media sector. These substantial investments, often running into hundreds of millions of dollars for state-of-the-art facilities and continuous innovation, make it economically challenging for companies to simply walk away from the market, even when facing reduced profitability. For instance, a typical pharmaceutical manufacturing plant for contrast agents can cost upwards of $200 million to build and equip, with ongoing R&D budgets often representing 10-15% of annual revenue.

These entrenched costs compel firms to maintain operations and compete fiercely, rather than incur massive losses by shutting down. Guerbet, a key player, exemplifies this with its extensive global infrastructure and consistent, significant R&D spending, which totaled €116.9 million in 2023, underscoring the deep commitment required to stay in this specialized field.

- High Capital Investment: Pharmaceutical contrast media production requires specialized, high-volume manufacturing facilities with stringent quality control, representing a significant upfront capital outlay.

- R&D Intensity: Continuous innovation and the development of new contrast agents with improved safety profiles and diagnostic capabilities necessitate substantial and ongoing investment in research and development.

- Regulatory Hurdles: Navigating complex and evolving regulatory approval processes across different global markets is time-consuming and expensive, creating a deterrent to exiting the industry.

- Brand and Distribution Networks: Established relationships with healthcare providers and robust distribution channels are valuable assets that are difficult and costly to replicate, further increasing the cost of exit.

Strategic Commitments of Competitors

Major players in the contrast media market are deeply committed to ongoing product innovation, aggressive expansion into burgeoning emerging markets, and the formation of strategic alliances. This sustained investment and competitive drive inherently intensify the rivalry amongst these key participants.

Guerbet, a significant entity in this space, is particularly focused on bolstering profitability within its established X-ray division while simultaneously aiming to capture greater market share in the rapidly growing MRI segment. These clear strategic commitments underscore a proactive approach to market positioning and growth.

The company actively pursues strategic partnerships to enhance its capabilities and reach. For instance, its collaboration with NUCLIDIUM highlights a commitment to advancing the field of radiopharmaceuticals, a key area for future development and competitive advantage.

- Product Innovation: Competitors are investing heavily in R&D to develop next-generation contrast agents with improved efficacy and safety profiles.

- Market Expansion: Significant efforts are directed towards penetrating emerging economies, where demand for advanced medical imaging is on the rise.

- Strategic Partnerships: Companies are forming alliances for co-development, distribution, and access to new technologies, such as Guerbet's partnership with NUCLIDIUM in radiopharmaceuticals.

- Focus on Profitability and Market Share: Guerbet's strategic aims to strengthen its X-ray division's profitability and increase its MRI market share exemplify the intense focus on financial performance and competitive positioning.

Competitive rivalry in the medical imaging contrast media market is intense, driven by a few large global players and numerous smaller firms. Guerbet, for example, faces competition from giants like GE Healthcare and Bayer, operating within an oligopolistic structure. The market's projected growth, estimated between 2.59% and 8.1% CAGR from 2024 to 2031, fuels this competition as companies vie for increasing demand.

Differentiation through innovation, such as Guerbet's Elucirem™ (Gadopiclenol) for reduced gadolinium use, is a key strategy, but it requires substantial R&D investment. Despite these efforts, pricing power is challenged by generic alternatives, particularly for older contrast agents. Guerbet's own 2024 performance, with 9.0% growth at constant exchange rates, highlights its active participation in this dynamic and competitive environment.

SSubstitutes Threaten

The threat of substitutes for Guerbet's contrast agents is significant, primarily stemming from diagnostic methods that bypass the need for such agents altogether. For instance, advancements in non-contrast MRI techniques, often augmented by artificial intelligence, are increasingly capable of providing detailed anatomical and pathological information, potentially reducing reliance on contrast-enhanced imaging.

While these emerging technologies present a growing alternative, contrast agents like those produced by Guerbet remain indispensable for achieving specific levels of visualization and diagnostic certainty in many clinical scenarios. The ability of contrast media to highlight subtle abnormalities or differentiate between tissue types continues to be a critical factor in their sustained use.

The price-performance of substitute diagnostic methods significantly impacts Guerbet. If alternative imaging techniques or contrast agents offer comparable diagnostic accuracy at a lower price point or with a superior safety profile, they represent a substantial threat.

For instance, Lantheus Medical Imaging's manganese-based MRI contrast agent is being developed as a potential substitute for gadolinium-based agents, specifically targeting concerns around renal impairment and environmental impact. This innovation highlights a trend towards improved safety and efficacy in diagnostic tools, directly challenging existing market offerings.

Healthcare professionals and patients are increasingly prioritizing safety and efficacy, which naturally pushes demand towards higher-quality products that also minimize side effects. This focus on patient well-being directly impacts the appeal of alternatives.

Concerns regarding gadolinium retention and the potential for nephrogenic systemic fibrosis (NSF) are significant drivers that could boost the adoption of substitute products or non-contrast imaging alternatives, provided these options are readily available and demonstrate proven effectiveness. For instance, studies continue to investigate the long-term implications of gadolinium-based contrast agents, influencing prescriber behavior.

Guerbet's commitment to eco-friendly packaging, a move directly addressing growing sustainability requirements within hospitals, also signals a responsiveness to evolving customer preferences. This initiative acknowledges that environmental impact is becoming a factor in product selection, potentially influencing the choice between Guerbet's offerings and those of competitors or substitute solutions.

Technological Advancements in Non-Contrast Imaging

Continuous advancements in medical imaging technologies, like higher resolution MRI and CT scans, coupled with AI integration in image analysis, could lessen the reliance on contrast agents for certain diagnostics. For instance, AI-enhanced CT post-processing is already driving demand for scans used in plaque characterization, and research is exploring AI's role in detecting prostate cancer and liver lesions.

These technological leaps represent a potential substitute threat because they might offer comparable or superior diagnostic information without requiring contrast media. This could impact the market share for contrast agents if these non-contrast methods become widely adopted and clinically validated.

- AI in Medical Imaging: AI is projected to significantly impact the healthcare market, with some estimates suggesting the AI in imaging market could reach over $4 billion by 2026.

- Improved Resolution: Advances in MRI technology, such as higher field strengths (e.g., 7T MRI), are providing greater detail, potentially reducing the need for contrast in specific applications.

- Non-Contrast Techniques: The development of novel non-contrast MRI sequences for specific conditions, like neuroimaging, offers an alternative that bypasses the need for gadolinium-based contrast agents.

Regulatory and Safety Scrutiny on Contrast Agents

Increased regulatory scrutiny and patient safety concerns, especially surrounding gadolinium-based contrast agents, are a significant threat of substitutes for Guerbet. For instance, new regulations implemented in 2024 have tightened safety standards, potentially pushing demand towards alternative diagnostic methods or less scrutinized agents.

This pressure from regulatory bodies and heightened patient safety awareness encourages the development and adoption of safer, low-toxicity contrast agents. It also fuels innovation in alternative diagnostic pathways that may bypass the need for traditional contrast agents altogether.

Guerbet is actively responding to this threat by investing in its next-generation products, such as Elucirem™, which aims to offer improved safety profiles. This strategic move positions the company to mitigate the impact of evolving regulatory landscapes and patient expectations.

- Regulatory Impact: New safety regulations for contrast agents in 2024 are driving a search for alternatives.

- Patient Safety Focus: Growing concerns about existing agents, particularly gadolinium-based ones, are a key motivator for substitution.

- Innovation Response: Guerbet is developing safer products like Elucirem™ to address this evolving market demand.

- Market Shift: The threat encourages a move towards lower-toxicity agents and alternative diagnostic imaging techniques.

The threat of substitutes for Guerbet's contrast agents is substantial, driven by advancements in non-contrast imaging and the development of alternative contrast agents with improved safety profiles. For instance, the increasing sophistication of AI in medical imaging, with the AI in imaging market projected to exceed $4 billion by 2026, offers a pathway to enhanced diagnostic detail without contrast. Furthermore, higher resolution MRI technologies, like 7T MRI, are reducing the need for contrast in certain applications, directly challenging the market for traditional agents.

| Substitute Type | Key Characteristic | Impact on Guerbet |

|---|---|---|

| Non-Contrast Imaging (AI-enhanced) | Improved diagnostic detail without contrast agents. | Reduces demand for contrast media in specific procedures. |

| Alternative Contrast Agents (e.g., Manganese-based) | Potentially improved safety profiles, addressing concerns like gadolinium retention. | Direct competition, especially if offering superior efficacy or lower risk. |

| Advanced Imaging Techniques (e.g., High-field MRI) | Greater anatomical visualization, potentially negating the need for contrast. | Limits the market for contrast agents in applications where these techniques suffice. |

Entrants Threaten

The medical imaging contrast agent sector demands significant upfront capital. Companies need substantial funds for cutting-edge research and development, rigorous clinical trials, state-of-the-art manufacturing plants, and establishing widespread global distribution channels. For example, Guerbet, a key player, allocates 9% of its revenue to research and development, highlighting the ongoing investment needed to stay competitive.

The pharmaceutical sector, especially for specialized products like contrast agents, faces significant regulatory challenges. For instance, obtaining approval from bodies like the U.S. Food and Drug Administration (FDA) or the European Medicines Agency (EMA) involves lengthy and expensive clinical trials and documentation. This demanding process, often taking years and costing millions, acts as a substantial barrier, deterring potential new entrants who may lack the necessary capital and specialized knowledge.

Established players like Guerbet have cultivated deep, long-standing relationships with healthcare providers, distributors, and group purchasing organizations across the globe. These established networks are crucial for market access and are difficult and costly for newcomers to replicate. For instance, Guerbet's global reach in serving healthcare professionals and patients underscores the significant barrier to entry presented by exclusive or preferential distribution agreements.

Economies of Scale and Experience Curve

Existing players in the contrast media market, like Guerbet, leverage significant economies of scale in their operations. This includes bulk purchasing of raw materials, optimized manufacturing processes, and extensive distribution networks, all contributing to a lower cost per unit. For instance, in 2023, Guerbet reported a revenue of €730 million, indicating a substantial operational scale that new entrants would struggle to match immediately.

Guerbet's nearly a century of experience, dating back to its founding in 1926, has allowed it to develop a deep understanding of the industry and refine its production techniques, creating an experience curve advantage. This accumulated knowledge translates into greater efficiency and cost-effectiveness, making it challenging for newcomers to compete on price. Their established R&D capabilities, focused on innovation in diagnostic and interventional imaging, further solidify this advantage.

- Economies of Scale: Large-scale production allows existing companies to spread fixed costs over a greater output, reducing the average cost per unit.

- Experience Curve: Accumulated knowledge and process improvements over time lead to increased efficiency and lower production costs for established firms.

- Guerbet's Scale: With €730 million in revenue in 2023, Guerbet demonstrates a significant operational footprint that creates cost advantages.

- Competitive Barrier: The combined effect of scale and experience makes it difficult for new entrants to achieve comparable cost structures and compete effectively on price.

Product Differentiation and Brand Loyalty

Developing highly differentiated contrast agents with proven efficacy and safety, coupled with building strong brand loyalty among medical professionals, demands substantial investment in research and development, along with significant marketing expenditures. This high barrier to entry makes it challenging for new players to establish a foothold.

Guerbet's established product portfolio, which includes well-regarded contrast agents such as Dotarem® and Lipiodol®, contributes to its brand recognition. Furthermore, the company's strategic focus on developing and launching innovative products, exemplified by its pipeline including Elucirem™, reinforces its market position and creates a formidable challenge for potential new entrants seeking to capture market share.

- Significant R&D and Marketing Investment: High upfront costs associated with developing and promoting novel contrast agents deter new market entrants.

- Established Product Portfolio: Guerbet's existing range of trusted contrast agents like Dotarem® and Lipiodol® fosters strong brand loyalty.

- Innovation Pipeline: The company's commitment to new product development, such as Elucirem™, further solidifies its competitive advantage.

- Barriers to Traction: These factors collectively create substantial hurdles for new companies aiming to gain traction in the contrast agent market.

The threat of new entrants in the medical imaging contrast agent market, where Guerbet operates, is significantly mitigated by high capital requirements for R&D, clinical trials, and manufacturing. Stringent regulatory hurdles, such as FDA and EMA approvals, demand extensive time and financial resources, acting as a major deterrent. Established players also benefit from deeply entrenched distribution networks and strong brand loyalty built over years, making it difficult for newcomers to gain market access and trust.

| Barrier Type | Description | Impact on New Entrants | Guerbet Example |

|---|---|---|---|

| Capital Requirements | High costs for R&D, clinical trials, and manufacturing facilities. | Deters companies lacking substantial funding. | 9% of revenue allocated to R&D. |

| Regulatory Hurdles | Lengthy and expensive approval processes (e.g., FDA, EMA). | Requires specialized expertise and significant investment. | Navigating complex global regulatory landscapes. |

| Distribution Networks | Established relationships with healthcare providers and distributors. | Difficult and costly for new players to replicate. | Global reach and existing partnerships. |

| Brand Loyalty & Product Differentiation | Strong brand recognition and trusted product portfolios. | Challenging for new entrants to build credibility. | Well-regarded products like Dotarem® and Lipiodol®. |

Porter's Five Forces Analysis Data Sources

Our Guerbet Porter's Five Forces analysis is built upon a foundation of robust data, incorporating annual reports, investor presentations, and regulatory filings from Guerbet and its key competitors. We also leverage industry-specific market research reports and data from financial information providers to capture the competitive landscape.