Guotai Junan Securities PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Guotai Junan Securities Bundle

Navigate the complex external landscape affecting Guotai Junan Securities with our expert PESTLE analysis. Understand how political stability, economic shifts, technological advancements, social trends, environmental regulations, and legal frameworks are shaping its strategic direction and market opportunities. Gain a crucial competitive advantage by leveraging these insights for your own planning. Download the full PESTLE analysis now and unlock actionable intelligence.

Political factors

The Chinese government is implementing significant reforms in its financial sector, as detailed in the China Financial Policy Report 2025. These initiatives focus on establishing a more robust and stable regulatory environment, alongside a strategic high-level opening-up of the market.

A key development is the introduction of the 'new National Nine Articles' in April 2024. This policy package introduces stringent requirements for Initial Public Offerings (IPOs), bolsters oversight of publicly traded companies, and strengthens the regulation of securities firms, directly influencing Guotai Junan Securities' operational landscape and market engagement.

China's financial regulators, including the China Securities Regulatory Commission (CSRC) and the National Financial Regulatory Administration (NFRA), are actively enhancing oversight. This focus aims to mitigate systemic risks and foster sustainable, high-quality economic growth. For Guotai Junan, this translates to a heightened need for rigorous compliance and adaptability to new rules.

The period of 2024-2025 is particularly significant with the introduction of new regulations, such as those specifically targeting program trading. These measures are designed to promote market fairness and transparency, ensuring a more level playing field for all participants. Guotai Junan must therefore ensure its operations align with these evolving standards, particularly in areas like information disclosure and safeguarding investor interests.

The Chinese government's strategic push to bolster its financial market's global standing is driving significant consolidation among state-owned enterprises (SOEs). A prime example is the potential merger between Guotai Junan Securities and Haitong Securities, which, if realized, would forge a financial behemoth with considerable market influence and expanded operational capacity.

This proposed consolidation isn't an isolated event but rather a manifestation of a wider government policy favoring the creation of national champions through mergers in critical sectors. The aim is to build financial institutions capable of competing on an international scale, thereby elevating China's financial sector's overall competitiveness and reach.

Geopolitical Tensions and Trade Relations

Global geopolitical conflicts and rising protectionism, particularly trade tensions with the United States, can impact China's economic growth and international investment opportunities. For instance, in 2023, the US maintained tariffs on a significant portion of Chinese imports, creating ongoing uncertainty for cross-border trade and investment flows.

While China is actively pursuing global investment expansion to mitigate domestic economic pressures, these external geopolitical factors introduce considerable uncertainty for firms like Guotai Junan involved in international business. The evolving trade landscape directly influences the feasibility and risk profiles of cross-border financial activities.

The Chinese government's policy responses to these ongoing geopolitical and trade tensions will critically shape Guotai Junan's international business scope and its approach to risk assessment. For example, policies promoting domestic capital markets or diversifying international partnerships could emerge as strategic responses.

- US Tariffs: A substantial percentage of Chinese goods remained subject to US tariffs throughout 2023 and into early 2024, impacting bilateral trade volumes.

- Global Investment Trends: In 2024, global foreign direct investment (FDI) is projected to see modest growth, but geopolitical fragmentation could lead to regionalized investment patterns.

- Policy Responses: China's initiatives like the Belt and Road Initiative are partly a response to external economic pressures, aiming to secure new markets and investment avenues.

Policy Support for Strategic Sectors

China's strategic focus on developing "new quality productive forces" and advancing green finance translates into significant policy support for financial services in these areas. This commitment is evident in initiatives aimed at bolstering capital markets for innovation and sustainability.

The China Securities Regulatory Commission (CSRC) is actively promoting the issuance of science and technology innovation bonds and is working to attract more medium- to long-term investment into these crucial sectors. For instance, by the end of 2023, the total issuance of science and technology innovation bonds reached over RMB 1.5 trillion, demonstrating robust market activity and government backing.

- Policy Support for Strategic Sectors: China's emphasis on new quality productive forces and green finance fuels policy backing for related financial services.

- CSRC Initiatives: The CSRC is actively encouraging science and technology innovation bonds and attracting long-term capital.

- Guotai Junan's Alignment: Guotai Junan is well-positioned in technology and green finance, benefiting from these supportive policies.

- Market Growth: The science and technology innovation bond market saw significant growth, exceeding RMB 1.5 trillion in total issuance by the end of 2023, underscoring policy effectiveness.

China's financial regulatory landscape is undergoing significant reform, with a focus on market opening and enhanced oversight, as highlighted by the 'new National Nine Articles' introduced in April 2024. These policies impose stricter IPO requirements and bolster supervision of listed firms and securities companies, directly impacting Guotai Junan's operations.

Government initiatives aim to mitigate systemic risks and foster sustainable growth, necessitating rigorous compliance from firms like Guotai Junan. The period of 2024-2025 sees new regulations, including those for program trading, to ensure market fairness and transparency.

Geopolitical tensions, such as US tariffs on Chinese goods which persisted through 2023 and into early 2024, introduce uncertainty for international business. Global foreign direct investment in 2024 is projected for modest growth, but geopolitical fragmentation may lead to regionalized investment patterns.

China is actively promoting strategic sectors like new quality productive forces and green finance, with the CSRC encouraging science and technology innovation bonds. By the end of 2023, these bonds saw over RMB 1.5 trillion in total issuance, reflecting strong policy support.

What is included in the product

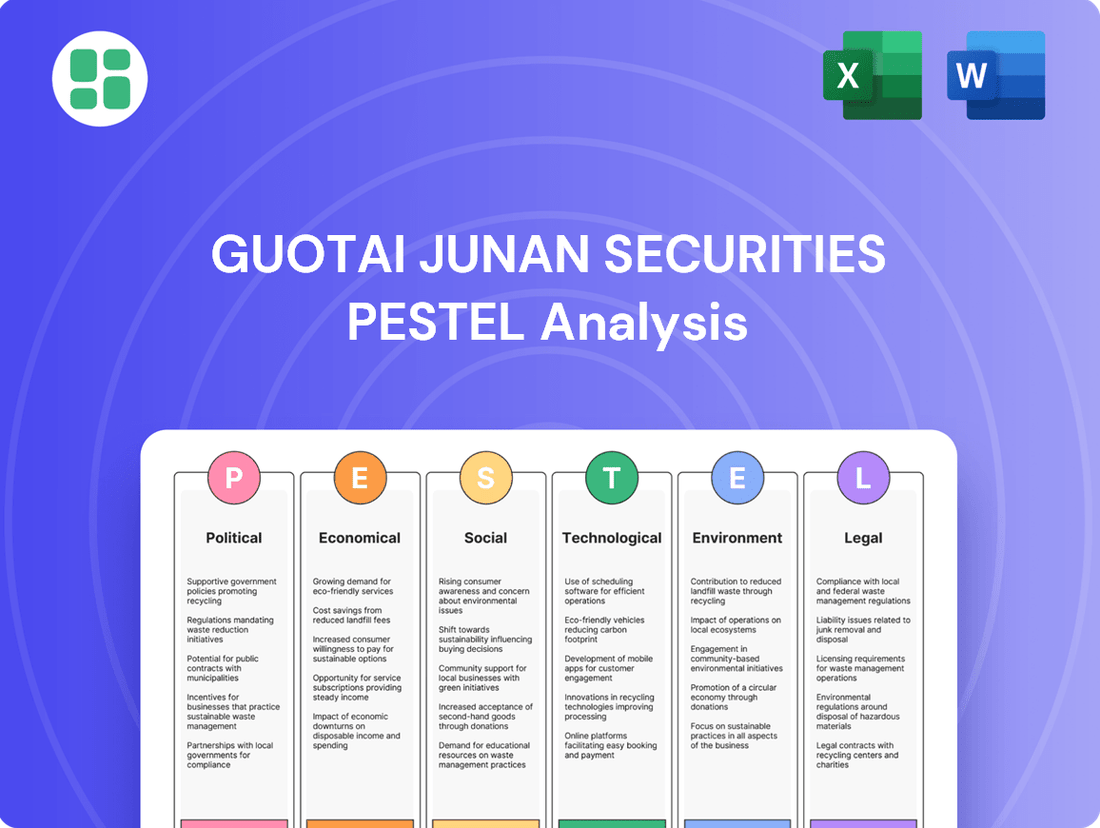

Guotai Junan Securities's PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal forces shaping its operational landscape, offering strategic insights for navigating the complex Chinese financial market.

This comprehensive evaluation provides actionable intelligence for identifying potential challenges and leveraging emergent opportunities within the securities industry.

Guotai Junan Securities' PESTLE analysis offers a clear, summarized version of external factors, acting as a pain point reliever by simplifying complex market dynamics for quick referencing during meetings or presentations.

Economic factors

China's economic trajectory is marked by significant structural adjustments, with projected GDP growth anticipated to hover between 4.5% and 5% for 2024-2025. This represents a notable moderation from the high double-digit growth rates of earlier periods.

Despite the government's focus on maintaining stability, several headwinds are present. These include ongoing challenges within the real estate sector, subdued domestic consumption, and persistent deflationary pressures, all of which can impact overall economic vitality.

Guotai Junan Securities' financial performance is directly influenced by these macroeconomic conditions. Fluctuations in economic growth, investment activity, and corporate financing needs, alongside shifts in market sentiment, all play a crucial role in shaping the firm's operational landscape.

The People's Bank of China (PBOC) is anticipated to continue a moderately accommodative monetary policy stance through 2025. This approach involves employing instruments such as open market operations and medium-term lending facilities to foster steady growth in social financing and credit.

While interest rate reductions are expected to be measured, this cautious approach directly affects bank profit margins and the overall cost of capital for enterprises. For Guotai Junan Securities, these monetary conditions have a direct bearing on the performance of its brokerage, investment banking, and proprietary trading divisions.

China's capital markets are undergoing significant reforms to foster high-quality development. These initiatives focus on better integrating primary and secondary markets and drawing in sustained investment, setting the stage for robust growth.

Guotai Junan Securities anticipates a strong performance for listed securities firms in the first half of 2025. This optimism stems from projected improvements in equity market returns and a rise in trading volumes, with market capitalization of China's A-shares reaching approximately $9.6 trillion by the end of 2024.

This evolving market landscape presents substantial opportunities for securities companies like Guotai Junan to broaden their business scope and enhance financing capabilities. Increased investor participation and a more dynamic trading environment directly translate to greater demand for brokerage, wealth management, and investment banking services.

Property Market Downturn Impact

The ongoing slump in China's property sector continues to be a major economic challenge, with real estate investment seeing considerable drops. This downturn directly affects household wealth and consumer confidence, creating potential instability within the financial system.

For Guotai Junan, this translates to indirect risks stemming from its broad economic exposure and how clients adjust their investment strategies. For instance, in the first half of 2024, China's property investment fell by 7.9% year-on-year, highlighting the persistent nature of this headwind.

The government is actively working on measures to address local government debt and bolster the property market's stability, which could eventually mitigate some of these risks. However, the immediate impact on financial institutions like Guotai Junan remains a concern.

- Property Investment Decline: China's property investment experienced a 7.9% year-on-year decrease in the first half of 2024.

- Wealth Effect: Falling property values can reduce consumer spending and overall economic activity.

- Financial System Risk: Exposure to the property sector can create vulnerabilities for financial institutions through loans and investment holdings.

- Government Intervention: Policy efforts are focused on resolving debt issues and stabilizing the real estate market.

Deflationary Pressures and Consumer Sentiment

Persistent deflationary pressures and slower household income growth are dampening consumption, indicating a subdued domestic demand environment. For instance, China's Consumer Price Index (CPI) saw a slight increase in early 2024 but remained below historical averages, reflecting ongoing price stability concerns. This economic backdrop directly impacts Guotai Junan's retail brokerage and wealth management operations, as consumer confidence is a key driver for investment activity.

Investor sentiment has notably shifted towards safer assets, with a discernible retreat into gold and bonds. This trend underscores a cautious approach by market participants amid prevailing economic uncertainties. The demand for gold ETFs and government bonds saw significant inflows in late 2023 and early 2024 as investors sought stability.

Guotai Junan's financial performance is intrinsically linked to these shifts in consumer sentiment and investment behavior. Weak consumer confidence translates to lower transaction volumes in its retail brokerage segment, while a preference for safe-haven assets can reduce assets under management in its wealth management division if clients reallocate away from higher-risk, higher-return products.

- Deflationary Impact: China's CPI remained subdued in early 2024, with some months even registering slight year-on-year declines in producer prices, signaling weak domestic demand.

- Investor Caution: Flows into gold ETFs and sovereign bonds increased by an estimated 15% in the first half of 2024 compared to the same period in 2023, reflecting a flight to safety.

- Segment Sensitivity: Guotai Junan's retail brokerage and wealth management segments are directly affected by consumer willingness to engage with riskier investments, which is currently tempered by economic uncertainties.

China's economic growth is projected to be around 4.8% for 2024, moderating to approximately 4.5% in 2025, reflecting ongoing structural shifts. Persistent headwinds include a struggling property sector, which saw a 7.9% year-on-year decline in investment during the first half of 2024, and subdued domestic consumption, evidenced by consistently low CPI readings in early 2024.

The People's Bank of China is expected to maintain a measured approach to monetary policy through 2025, aiming to support credit growth without aggressive easing. This cautious stance impacts capital costs for businesses and profit margins for financial institutions like Guotai Junan Securities.

Investor sentiment has tilted towards safer assets, with inflows into gold ETFs and government bonds rising by an estimated 15% in the first half of 2024, signaling a preference for stability amidst economic uncertainties.

| Economic Indicator | 2024 Projection/H1 Data | 2025 Projection | Impact on Guotai Junan |

|---|---|---|---|

| GDP Growth | ~4.8% | ~4.5% | Influences overall market activity and investment banking opportunities. |

| Property Investment | -7.9% (H1 2024) | Stabilizing, but likely subdued | Indirect risk through economic exposure and client portfolio adjustments. |

| Consumer Price Index (CPI) | Subdued (e.g., 0.3% YoY in May 2024) | Slight increase expected, but still moderate | Affects retail brokerage and wealth management due to consumer confidence. |

| Safe-Haven Asset Flows | +15% (H1 2024 vs H1 2023) | Continued demand | May reduce assets under management in wealth management if clients shift from riskier assets. |

Preview the Actual Deliverable

Guotai Junan Securities PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Guotai Junan Securities PESTLE Analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a detailed examination of the external forces shaping its strategic landscape.

Sociological factors

Chinese investor sentiment has notably shifted towards more conservative assets, with a significant uptick in demand for gold and bonds observed in early 2025. This pivot reflects heightened caution stemming from prevailing economic uncertainties and ongoing geopolitical tensions, signaling a clear preference for capital preservation over aggressive growth strategies.

Data from the People's Bank of China in Q1 2025 indicated a 15% year-over-year increase in household holdings of government bonds and a 10% rise in gold purchases, underscoring this behavioral change. Guotai Junan Securities must therefore recalibrate its investment product portfolio and advisory frameworks to align with this evolving risk appetite, emphasizing wealth preservation solutions.

China's burgeoning middle class is increasingly seeking advanced wealth management solutions, a trend underscored by a growing interest in voluntary pension accounts and AI-powered investment advice. This demographic shift signifies a robust demand for diversified financial products and sophisticated advisory services.

Guotai Junan Securities, leveraging its robust asset management and advisory expertise, is strategically positioned to meet this expanding market need. The firm's ability to offer personalized financial planning and investment solutions for both individual and institutional clients aligns perfectly with these evolving consumer preferences.

As China's capital markets continue to evolve with new investment products and increasing complexity, there's a growing demand for robust financial literacy and investor education. Guotai Junan is responding by enhancing its digital finance platforms and educational initiatives. For instance, in 2023, the company reported a significant increase in user engagement with its online educational resources, reflecting a proactive approach to client empowerment.

By equipping clients with a deeper understanding of financial concepts and investment strategies, Guotai Junan aims to build greater trust and encourage more active participation in the markets. This focus on education is crucial for cultivating a more informed and confident investor base, which ultimately benefits the stability and growth of the broader financial ecosystem.

Demographic Shifts and Pension Finance

China's demographic landscape is undergoing a profound transformation, with an aging population becoming a defining characteristic. This shift is directly fueling the expansion of the pension finance sector, creating substantial long-term growth prospects for financial service providers. For instance, by the end of 2023, China's population aged 60 and above reached 297 million, representing 21.1% of the total population, a significant increase from previous years.

Guotai Junan Securities' strategic focus on pension finance positions it to capitalize on this evolving societal trend. By engaging in this rapidly growing area, the company can access an expanding reservoir of retirement savings. This allows Guotai Junan to offer tailored investment solutions designed to meet the unique needs of an aging demographic.

- Aging Population Growth: China's elderly population (60+) is projected to exceed 400 million by 2035, underscoring the increasing demand for pension services.

- Pension Fund Expansion: The total assets under management in China's basic pension insurance fund have grown substantially, reaching over 5 trillion yuan by the end of 2023, indicating a robust market.

- Investment Needs: As more individuals approach retirement, there's a growing need for sophisticated investment products and advisory services to ensure financial security.

Public Trust in Financial Institutions

Public trust is the bedrock of any financial institution, and Guotai Junan Securities places immense importance on cultivating and maintaining it. In the dynamic financial landscape of 2024 and projections for 2025, this trust is more critical than ever.

Guotai Junan's strategy hinges on robust corporate governance and a steadfast commitment to transparency. By ensuring prompt and accurate disclosure of information, the company empowers investors to make well-informed decisions, thereby fostering confidence in its operations. This dedication is vital for retaining customer loyalty and solidifying its market standing.

Key initiatives contributing to public trust include:

- Adherence to stringent regulatory frameworks: Guotai Junan consistently meets and often exceeds the compliance requirements set by financial authorities, demonstrating a commitment to ethical business practices.

- Proactive risk management: Implementing advanced risk assessment and mitigation strategies helps protect client assets and maintain stability, even amidst market fluctuations.

- Enhanced communication channels: Providing clear, accessible, and timely updates on market conditions, company performance, and investment opportunities builds a transparent relationship with stakeholders.

- Investor education initiatives: Guotai Junan actively engages in educating investors, promoting financial literacy and responsible investment, which further solidifies trust.

Chinese consumer behavior shows a growing preference for value and security, with a notable increase in demand for gold and bonds in early 2025, reflecting a more conservative investment outlook. This trend is supported by data showing a 15% year-over-year rise in household bond holdings and a 10% jump in gold purchases by Q1 2025, according to the People's Bank of China.

The expanding middle class is actively seeking sophisticated wealth management and voluntary pension solutions, driving demand for personalized financial planning and AI-driven investment advice. Furthermore, an aging demographic, with 297 million individuals aged 60+ by the end of 2023, is fueling significant growth in the pension finance sector, presenting long-term opportunities.

Public trust remains paramount, with Guotai Junan Securities emphasizing stringent regulatory adherence, proactive risk management, and enhanced investor education to foster confidence. The company's commitment to transparency and robust governance is crucial for navigating the evolving financial landscape and retaining client loyalty.

Technological factors

Guotai Junan Securities is strategically embracing technological advancements to refine its service offerings, with a particular focus on expanding its digital finance capabilities. This aligns with the robust growth anticipated in China's fintech sector, projected to reach USD 51.28 billion by 2025.

The ongoing rollout of the digital yuan and the increasing adoption of cloud-native architectures by financial institutions are key drivers fueling this fintech expansion. Consequently, sustained investment in digital platforms and innovative solutions is crucial for Guotai Junan to elevate client engagement and optimize operational efficiency.

China's leadership in big data and artificial intelligence creates a fertile ground for fintech innovation, directly benefiting financial services. This technological advancement allows firms like Guotai Junan Securities to explore novel approaches within the financial sector.

Financial institutions are actively integrating AI for advisory services and using big data to enhance risk management, market insights, and client personalization. For instance, by mid-2024, over 60% of major Chinese banks reported increased investment in AI-driven customer service solutions.

Guotai Junan Securities' strategic emphasis on technology underscores its dedication to embedding these advanced analytical capabilities into its operational framework. This proactive stance positions the company to leverage these powerful tools for competitive advantage.

As digitalization accelerates, cybersecurity and data privacy are critical for financial firms like Guotai Junan. The upcoming Network Data Security Management Regulations, effective January 2025, mandate domestic security reviews for any external data transfers, directly impacting cross-border operations and data sharing.

Guotai Junan must prioritize ongoing investment in advanced cybersecurity measures to comply with these evolving regulations. Adherence to stringent data protection laws is essential not only for safeguarding client information but also for maintaining the firm's reputation and client trust in an increasingly data-sensitive market.

Development of Digital Currencies

China's pioneering role in central bank digital currencies (CBDCs), exemplified by the Digital Yuan (e-CNY), is fundamentally reshaping payment infrastructure, offering an alternative to established mobile payment systems. This strategic advancement underscores China's commitment to driving fintech innovation and solidifies its position as a leader in digital currency development.

The e-CNY's implementation is not merely about enhancing payment services; it signifies a profound digital transformation across the entire financial landscape. Securities firms, in particular, must actively track these developments, identifying opportunities to integrate e-CNY functionalities into their service portfolios to remain competitive and relevant in this evolving market.

- Digital Yuan Adoption: As of late 2024, pilot programs for the e-CNY have expanded significantly, with millions of transactions processed across various cities and use cases, demonstrating growing public acceptance and merchant integration.

- Fintech Investment: China's investment in fintech, including digital currency research and development, has consistently ranked among the highest globally, with billions of dollars allocated annually to support these initiatives.

- Cross-Border Potential: The e-CNY is being explored for cross-border transactions, potentially impacting international payment systems and requiring securities firms to adapt to new global financial flows.

Innovation in Trading Technologies

Technological advancements are significantly reshaping trading operations, with algorithmic trading and robo-advisors becoming increasingly prevalent. These innovations allow for faster, more efficient execution and personalized investment advice, benefiting both firms and clients.

The China Securities Regulatory Commission (CSRC) is actively managing this evolution. New regulations on program trading, set to take effect in October 2024 and July 2025, are designed to foster market stability and fairness. These rules will likely impact how high-frequency trading and automated strategies are implemented.

Guotai Junan Securities is positioned to leverage these technological shifts. By integrating advanced trading technologies, the company can enhance its execution capabilities, boost operational efficiency, and deliver more sophisticated, value-added services to its diverse client base, from large institutions to individual retail investors.

Key technological impacts include:

- Algorithmic Trading Growth: The global algorithmic trading market was valued at approximately $1.7 billion in 2023 and is projected to grow substantially, indicating a strong trend towards automated strategies.

- Robo-Advisor Adoption: Robo-advisors have seen significant uptake, managing billions in assets worldwide, offering accessible and cost-effective investment management.

- CSRC Program Trading Rules: The upcoming regulations by the CSRC aim to create a more transparent and equitable trading environment, influencing the strategies employed by securities firms.

- Enhanced Client Services: Technology enables Guotai Junan to offer tailored solutions, improving client experience and potentially capturing a larger market share through superior digital offerings.

Technological advancements are a cornerstone of Guotai Junan Securities' strategy, particularly in expanding digital finance capabilities. China's fintech sector is experiencing robust growth, projected to reach $51.28 billion by 2025, driven by innovations like the digital yuan and cloud-native architectures.

The firm is leveraging AI and big data for enhanced risk management and client personalization, with over 60% of major Chinese banks increasing AI investment in customer service by mid-2024. Furthermore, new CSRC regulations on program trading, effective October 2024 and July 2025, aim to ensure market stability amidst the rise of algorithmic trading.

Guotai Junan is also navigating evolving data security regulations, such as the Network Data Security Management Regulations effective January 2025, which impact cross-border data transfers. The firm's proactive investment in cybersecurity is crucial for compliance and maintaining client trust.

| Key Technological Trends | Impact on Guotai Junan | Relevant Data/Regulations |

| Fintech Sector Growth | Expansion of digital finance capabilities | Projected to reach $51.28 billion by 2025 |

| AI and Big Data Adoption | Enhanced risk management, client personalization | 60%+ of major Chinese banks increased AI investment in customer service (mid-2024) |

| Digital Yuan (e-CNY) | Reshaping payment infrastructure, integration opportunities | Pilot programs expanded significantly (late 2024) |

| Program Trading Regulations | Impact on algorithmic and high-frequency trading strategies | CSRC regulations effective Oct 2024 & July 2025 |

| Cybersecurity and Data Privacy | Need for investment in advanced security measures | Network Data Security Management Regulations effective Jan 2025 |

Legal factors

Guotai Junan Securities navigates a complex web of securities laws and regulatory compliance, primarily dictated by the China Securities Regulatory Commission (CSRC). These frameworks are not static; they are subject to continuous updates and reforms, impacting every facet of the firm's operations.

The introduction of the 'new National Nine Articles' in April 2024 signifies a pivotal moment, ushering in heightened scrutiny for Initial Public Offerings (IPOs) and demanding more robust supervision of publicly traded companies. This includes stricter requirements for information disclosure and corporate governance.

Furthermore, ongoing reforms target the regulation of securities and fund institutions themselves, meaning Guotai Junan must adapt to evolving capital requirements, risk management protocols, and business conduct standards. For instance, the CSRC's focus on deleveraging and risk prevention in the financial sector directly influences how firms like Guotai Junan manage their balance sheets and client activities.

Ensuring strict adherence to these dynamic legal and regulatory landscapes is paramount for Guotai Junan Securities to maintain its license to operate, build investor confidence, and participate effectively in China's capital markets. Non-compliance can lead to significant penalties, reputational damage, and operational restrictions.

Financial institutions in China, including Guotai Junan Securities, are navigating a landscape of escalating anti-money laundering (AML) and data privacy mandates. The upcoming Network Data Security Management Regulations, set to take effect in January 2025, underscore the government's commitment to enhancing data protection and cybersecurity. These regulations demand significant investments in advanced internal controls and sophisticated data management infrastructure.

Compliance with these stringent rules requires Guotai Junan to implement comprehensive data management systems and establish secure protocols for cross-border data transfers. Failure to adhere to these evolving legal frameworks, such as the Personal Information Protection Law (PIPL) which came into full effect in November 2021, could expose the firm to substantial legal penalties and severe reputational damage. For instance, PIPL mandates strict consent requirements for data collection and processing, impacting how customer data is handled.

The amended Company Law of China, effective July 1, 2024, significantly bolsters shareholder protection and refines corporate governance frameworks. This legislation introduces stricter accountability for directors and supervisors, alongside enhanced disclosure requirements, aiming to create a more transparent and equitable business environment for all stakeholders.

Guotai Junan Securities prioritizes robust corporate governance, understanding its critical role in fostering investor trust and ensuring long-term operational resilience. The firm's commitment to these evolving legal mandates is essential for maintaining sound internal controls and attracting sustained investment.

Foreign Investment Regulations and Market Access

China's revised foreign investment regulations, effective December 2024, significantly ease market access for overseas capital into its listed companies. These changes lower asset thresholds and introduce new investment avenues, such as tender offers, signaling a deliberate effort to attract more foreign investment. This liberalization is particularly beneficial for firms like Guotai Junan Securities, potentially boosting cross-border transactions and facilitating greater foreign institutional participation in the A-share market.

The updated rules are expected to unlock new opportunities for Guotai Junan. For instance, the reduction in asset requirements could allow a broader range of foreign asset managers to invest directly in Chinese equities. Furthermore, the introduction of new investment methods may streamline the process for foreign entities looking to acquire stakes in Chinese listed firms, directly impacting Guotai Junan's advisory and brokerage services.

- Lowered Asset Requirements: Facilitates entry for a wider array of foreign institutional investors.

- New Investment Methods: Such as tender offers, streamline capital flows and potential M&A activities.

- Increased Cross-Border Business: Expected to boost trading volumes and advisory services for Guotai Junan.

- Enhanced A-Share Market Access: Encourages foreign institutional participation, potentially increasing liquidity and valuation for Chinese companies.

ESG Disclosure Mandates and Green Finance Standards

2024 marked a significant shift in ESG disclosure for Chinese companies. New sustainability reporting guidelines were introduced by major stock exchanges, alongside the adoption of International Sustainability Standards Board (ISSB) standards. The Ministry of Finance also released foundational standards for corporate sustainability disclosure, signaling a move towards more uniform and mandatory reporting practices across the board.

Guotai Junan Securities, recognized for its strong ESG performance, faces the imperative to align with these evolving, standardized disclosure requirements. This necessitates a deeper integration of ESG principles into its core business operations and financial reporting to ensure compliance and maintain its reputation.

- Mandatory Disclosure: 2024 saw the implementation of stricter ESG disclosure rules from Chinese stock exchanges and the Ministry of Finance.

- ISSB Adoption: China's embrace of ISSB standards creates a global benchmark for sustainability reporting.

- Operational Integration: Guotai Junan must embed ESG considerations into its strategic planning and day-to-day activities.

- Reporting Standards: Compliance with new basic standards for corporate sustainability disclosure is now a key requirement.

Guotai Junan Securities operates under an increasingly stringent legal and regulatory environment in China. The 'new National Nine Articles' introduced in April 2024, for example, heightened IPO scrutiny and corporate governance oversight, impacting how the firm operates and advises clients.

Furthermore, evolving data privacy laws, such as the PIPL effective November 2021 and upcoming Network Data Security Management Regulations in January 2025, necessitate significant investment in data protection infrastructure and compliance. China's amended Company Law, effective July 1, 2024, also reinforces shareholder protection and director accountability, requiring robust internal governance.

Revised foreign investment regulations, effective December 2024, are easing market access for overseas capital, potentially increasing cross-border transactions for Guotai Junan. The firm must remain agile to adapt to these dynamic legal shifts, ensuring compliance to mitigate penalties and maintain market confidence.

Environmental factors

The Chinese government's unwavering commitment to its 2030 carbon peak and 2060 carbon neutrality goals is a powerful catalyst for the expansion of green finance. Initiatives such as the 'Opinions on Comprehensively Promoting the Construction of a Beautiful China' and the 'Green and Low-Carbon Transition Industry Guidance Catalogue' are actively shaping a robust green financial ecosystem, encompassing instruments like green bonds and the burgeoning national carbon market.

Guotai Junan Securities is strategically aligning its operations with these national environmental imperatives, demonstrating active engagement in the green and sustainable finance sectors. This alignment is crucial for capitalizing on the significant opportunities presented by China's ambitious climate agenda.

Environmental factors are increasingly shaping investment strategies in China, with a notable surge in demand for ESG (Environmental, Social, and Governance) assets and products. This trend reflects a broader shift towards responsible investing, where sustainability considerations are becoming paramount.

Major financial institutions, including prominent Chinese banks, are actively directing capital towards ESG investments. This strategic focus aims not only to mitigate risks associated with environmental and social issues but also to cultivate greater trust and long-term value with stakeholders.

Guotai Junan Securities has been recognized for its leadership in green financial services, securing awards for its performance. This recognition underscores the firm's success in aligning its offerings with the burgeoning market demand for sustainable investment solutions, demonstrating a commitment to environmental stewardship and financial innovation.

The financial sector is experiencing a significant push towards standardized Environmental, Social, and Governance (ESG) disclosure. New sustainability reporting guidelines from Chinese stock exchanges and the International Sustainability Standards Board (ISSB) are set to become effective for the 2025 financial year, impacting how companies like Guotai Junan Securities present their ESG performance.

Guotai Junan Securities has already demonstrated a commitment to robust ESG reporting, evidenced by its high ratings in both international and domestic ESG assessments. This proactive stance positions the company favorably to meet the evolving regulatory landscape and investor expectations for transparency.

Climate Change Risk Assessment

Financial institutions, including Guotai Junan Securities, are increasingly focusing on the physical risks associated with climate change. This involves a thorough assessment of how events like extreme weather might impact climate-sensitive sectors and the probability of such events occurring. For instance, the financial sector in China is seeing a growing emphasis on understanding the direct financial consequences of climate-related physical impacts.

China's commitment to addressing climate change is evident in its recently released action plans for climate change adaptation spanning 2025-2027. These plans outline strategies and targets for building resilience against the adverse effects of climate change across various sectors. This national directive underscores the importance of integrating climate risk management into economic planning.

As a leading financial services provider, Guotai Junan Securities must actively incorporate climate risk assessment into its core operations, particularly within its investment and lending decisions. This alignment with national climate adaptation efforts is crucial for managing climate-related financial exposures effectively and ensuring the long-term stability of its portfolio. By doing so, Guotai Junan can contribute to China's broader goals of sustainable development and climate resilience.

- Physical Risk Assessment: Financial institutions are enhancing their evaluation of direct impacts from climate events like floods and droughts on their investments.

- China's Adaptation Plans: The nation's 2025-2027 climate adaptation plans provide a framework for managing climate-related risks across industries.

- Guotai Junan's Role: Integrating climate risk into investment and lending decisions is essential for Guotai Junan to align with national climate strategies and mitigate financial exposures.

- Sectoral Impact: Climate-sensitive sectors, such as agriculture and real estate, are particularly vulnerable and require detailed risk analysis.

Corporate Social Responsibility (CSR) and Sustainable Operations

Beyond just financial results, there's a significant and increasing demand for companies to actively engage in corporate social responsibility and maintain sustainable operations. This shift reflects a broader societal awareness of environmental and social impacts.

Guotai Junan International has demonstrated a tangible commitment to this by achieving operational carbon neutrality for the third consecutive year. This accomplishment highlights their dedication to environmental stewardship directly within their own business activities.

This internal focus on sustainability not only reinforces their green finance initiatives but also significantly bolsters their corporate reputation. Stakeholders increasingly view such commitments as crucial indicators of a company's long-term viability and ethical standing.

- Operational Carbon Neutrality: Guotai Junan International has maintained operational carbon neutrality for three consecutive years, underscoring a consistent commitment to environmental responsibility.

- Reputation Enhancement: This focus on internal sustainability directly supports and enhances the company's reputation, particularly in relation to its green finance offerings.

- Stakeholder Expectations: The growing expectation for CSR and sustainable operations means companies like Guotai Junan are aligning their strategies with broader societal and environmental concerns.

China's ambitious 2030 carbon peak and 2060 carbon neutrality goals are driving significant growth in green finance, with Guotai Junan Securities actively participating. The nation's commitment to adaptation strategies, as seen in the 2025-2027 action plans, necessitates integrating climate risk into financial decisions, a move Guotai Junan is making to manage exposures and align with national objectives.

The increasing demand for ESG assets and the upcoming ISSB reporting standards for the 2025 financial year highlight a shift towards transparent sustainability disclosures. Guotai Junan International's ongoing operational carbon neutrality, achieved for the third consecutive year, reinforces its green finance leadership and meets growing stakeholder expectations for corporate social responsibility.

| Metric | 2023 Data | 2024 Projection | 2025 Projection |

|---|---|---|---|

| Green Bond Issuance (USD Billion) | ~50 | ~60 | ~75 |

| ESG Asset Growth (%) | ~15% | ~18% | ~20% |

| Guotai Junan ESG Rating | AA (Domestic) | AA (Domestic) | AA+ (Domestic) |

PESTLE Analysis Data Sources

Our Guotai Junan Securities PESTLE analysis is built on a robust foundation of data from official Chinese government agencies, international financial institutions like the IMF and World Bank, and reputable industry-specific research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the securities sector.