Guotai Junan Securities Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Guotai Junan Securities Bundle

Guotai Junan Securities operates within a dynamic financial landscape, influenced by intense rivalry and the ever-present threat of substitutes. Understanding these forces is crucial for navigating its competitive terrain.

The complete report reveals the real forces shaping Guotai Junan Securities’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of specialized talent, particularly highly skilled financial professionals and experienced management, is a significant factor for Guotai Junan Securities. These individuals are the backbone of its core operations, including investment banking, asset management, and research. Their expertise is difficult to replicate, giving them considerable leverage.

In 2023, Guotai Junan Securities reported a substantial investment in its workforce, reflecting the high cost and importance of acquiring and retaining top talent. The firm's ability to attract and keep these key personnel directly impacts its service quality and competitive edge in the financial markets.

Technology and data providers, such as those offering advanced trading platforms, analytics tools, and market information, exert moderate bargaining power over Guotai Junan Securities. The specialized nature of these critical systems, essential for operational efficiency and competitive edge, can lead to significant switching costs for the firm, thereby granting these suppliers a degree of leverage.

Regulatory and compliance services, though not typical suppliers, hold considerable sway over Guotai Junan Securities. The dynamic regulatory landscape in China necessitates significant investment in compliance expertise and technology, effectively making these services a critical, non-negotiable input. For instance, the China Securities Regulatory Commission (CSRC) frequently updates its guidelines, impacting everything from capital requirements to client onboarding processes, giving them de facto control over operational frameworks.

Financial Market Infrastructure Providers

Financial market infrastructure providers, including exchanges, clearinghouses, and payment systems, wield significant bargaining power over securities firms like Guotai Junan. These entities offer critical services for trade execution, settlement, and capital management, and firms like Guotai Junan have few viable alternatives to these foundational functions.

This dependence means Guotai Junan must accept the pricing and terms set by these infrastructure providers, directly impacting operational costs. For instance, exchange listing fees and transaction processing charges are often non-negotiable, representing a substantial overhead for any securities firm.

- Exchanges: Provide platforms for trading securities, setting listing and trading fees.

- Clearinghouses: Mitigate counterparty risk and facilitate the settlement of trades, charging fees for these services.

- Payment Systems: Enable the movement of funds, essential for client transactions and capital management.

Office Space and IT Infrastructure

The bargaining power of suppliers for essential office space and basic IT infrastructure for Guotai Junan Securities is generally low. This is due to the commoditized nature of these inputs, meaning there are many providers available. For instance, in 2024, the commercial real estate market in major Chinese financial hubs like Shanghai and Shenzhen offered a wide array of office spaces, giving tenants like Guotai Junan leverage in negotiations. Similarly, providers of standard IT hardware and utility services are numerous, allowing for easy vendor switching and favorable contract terms.

Guotai Junan can effectively negotiate favorable terms for these foundational operational needs. The availability of multiple vendors for office leases and basic IT equipment means that no single supplier holds significant sway. This contrasts sharply with specialized financial technology platforms or highly sought-after financial talent, where supplier power is considerably higher. The ability to easily switch providers for utilities and standard IT infrastructure further diminishes supplier leverage, ensuring cost-effectiveness for Guotai Junan.

- Low Bargaining Power: Suppliers of office space and basic IT infrastructure have limited power due to market saturation.

- Commoditized Inputs: Standard IT hardware, utilities, and generic office spaces are widely available from numerous providers.

- Negotiation Leverage: Guotai Junan can secure favorable terms and pricing for these services.

- Vendor Flexibility: The ease of switching providers for these commoditized inputs reduces supplier dependence.

Guotai Junan Securities faces limited bargaining power from suppliers of commoditized inputs like basic IT infrastructure and office space. In 2024, the availability of numerous providers in major Chinese cities meant Guotai Junan could negotiate favorable terms, as switching costs for these services are low. This situation contrasts with specialized talent or financial market infrastructure, where supplier power is significantly higher.

The firm's ability to secure cost-effective deals for office leases and standard IT hardware is a direct result of market saturation. This allows Guotai Junan to maintain operational efficiency without being overly reliant on any single provider for these essential, yet non-specialized, resources.

| Supplier Type | Bargaining Power | Reasoning | Example for Guotai Junan |

|---|---|---|---|

| Basic IT Hardware | Low | Numerous providers, commoditized products | Procurement of standard servers and workstations |

| Office Space | Low | Abundant commercial real estate options | Leasing office floors in Shanghai financial district |

| Utilities | Low | Multiple service providers, essential services | Securing electricity and internet services |

What is included in the product

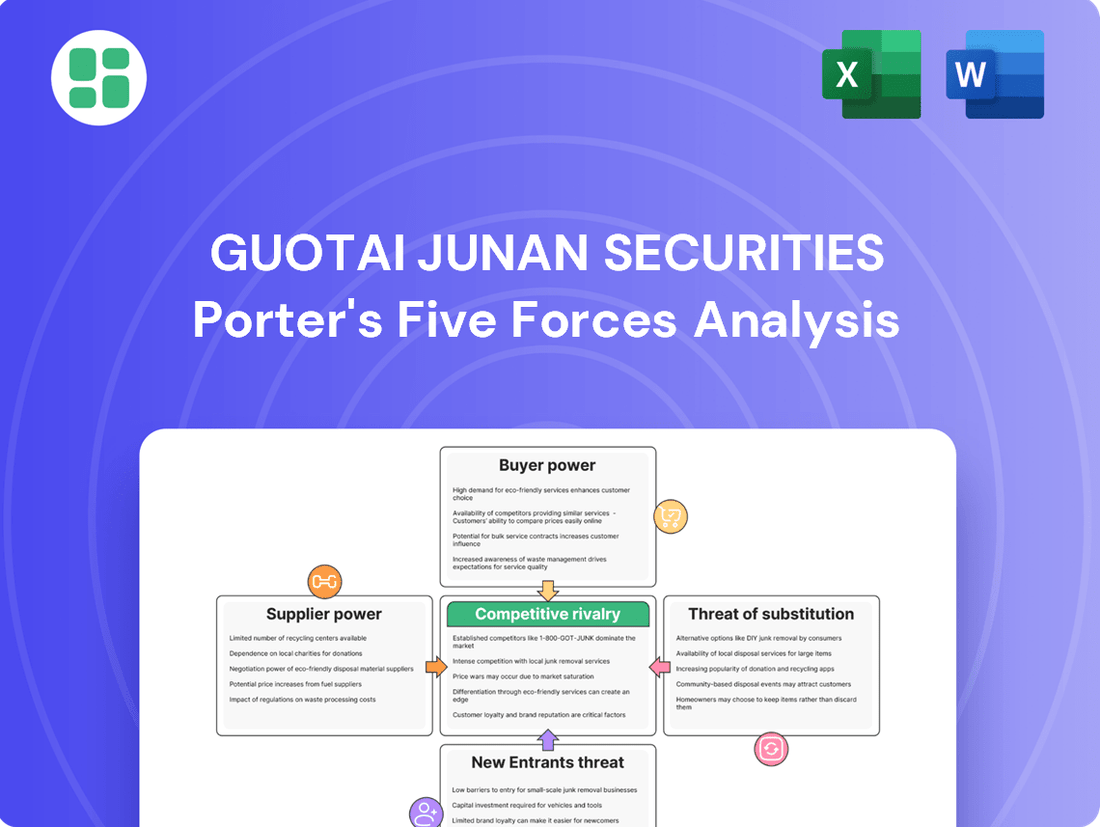

This analysis meticulously examines the competitive landscape for Guotai Junan Securities, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Guotai Junan Securities' Porter's Five Forces analysis offers a streamlined, visual representation of competitive pressures, allowing for rapid identification of strategic vulnerabilities and opportunities.

Customers Bargaining Power

Large institutional clients, including mutual funds and pension funds, wield considerable bargaining power in the financial services sector. Their substantial transaction volumes mean they can negotiate for more favorable fee structures and specialized services. For instance, in 2024, major institutional investors often represent a significant portion of a brokerage's revenue, giving them leverage.

These clients can easily shift their business to competitors if their demands for customized solutions or cost efficiencies are not met. This ability to switch providers, coupled with their large asset bases, forces firms like Guotai Junan Securities to offer competitive pricing and tailored offerings to retain their business.

Individual and retail investors, though a vast group, possess moderate bargaining power. The sheer number of these investors means that collectively they represent a significant client base for securities firms like Guotai Junan. However, their individual impact is limited.

The increasing accessibility of online brokerage platforms and the downward pressure on trading fees have significantly amplified the bargaining power of retail investors. For instance, by mid-2024, the average commission for online stock trades had fallen to fractions of a cent per share, making it easier for investors to switch providers based on cost and service. This ease of switching, coupled with readily available financial data, makes price and service quality key differentiators for brokers, forcing firms to compete more aggressively for this segment.

The proliferation of readily accessible, often free, financial data and research online significantly enhances the bargaining power of Guotai Junan Securities' customers. This widespread transparency enables clients to readily compare service offerings and pricing structures from various financial institutions.

This ease of comparison directly pressures Guotai Junan to articulate and demonstrate its unique value proposition, moving beyond the exclusivity of proprietary information to justify its fee structures. For instance, as of early 2024, numerous financial news aggregators and data platforms offer extensive market analysis and company valuations at minimal or no cost to the end-user.

Low Switching Costs for Standard Services

For standardized services like equity trading, the switching costs for customers are often quite low. This means if another brokerage offers a better deal, perhaps lower fees or a slicker trading platform, clients can easily move their business. In 2023, the average retail investor in China might have considered switching if fees were even a few basis points higher, especially given the competitive landscape. This forces companies like Guotai Junan to stay sharp on pricing and service to keep their customers.

The ease with which customers can switch providers directly impacts Guotai Junan's bargaining power. When switching costs are minimal, customers have more leverage. For instance, if a competitor launches a new promotional offer, such as zero commission on certain trades, it can quickly attract a segment of Guotai Junan's client base. This pressure necessitates continuous innovation and cost management to retain market share.

- Low Switching Costs: Customers can easily move their accounts for services like equity trading.

- Competitive Pressure: Attractive commission structures or user-friendly platforms from rivals can lure clients away.

- Impact on Guotai Junan: The company must maintain competitive pricing and high service quality to retain customers.

- Customer Leverage: Minimal switching costs empower customers, giving them greater bargaining power in the market.

Demand for Integrated Solutions

Customers are increasingly looking for financial firms that can offer a complete package of services, from stock trading to wealth management. This demand for integrated solutions means clients who need a broad range of financial products might stick with a provider that can deliver them all efficiently. For instance, in 2024, many high-net-worth individuals expressed a preference for wealth management platforms that also offer direct access to investment banking deals and sophisticated trading tools.

This trend gives customers more leverage. If Guotai Junan Securities can successfully bundle and cross-sell its diverse offerings, it can foster greater client loyalty. However, these same clients, by virtue of needing multiple services, can also dictate the terms, demanding a smooth, interconnected experience across all aspects of their financial dealings with the firm.

- Integrated Solutions Demand: Clients seek a one-stop shop for brokerage, investment banking, and asset management.

- Cross-Selling Power: Firms that bundle services can enhance customer loyalty.

- Customer Leverage: Demand for seamless integration empowers clients to negotiate better terms and service levels.

The bargaining power of customers for Guotai Junan Securities is significantly influenced by the availability of information and the ease of switching providers. As of early 2024, numerous financial data platforms offer extensive market analysis and company valuations at little to no cost, empowering clients to compare offerings and pricing structures across institutions. This transparency forces Guotai Junan to clearly articulate its unique value proposition beyond proprietary information to justify its fees.

For standardized services like equity trading, switching costs remain low, allowing customers to easily move their business if a competitor offers better pricing or a superior trading platform. In 2023, even minor fee differences could prompt retail investors in China to consider switching, highlighting the competitive pressure on firms like Guotai Junan to maintain aggressive pricing and service quality.

The demand for integrated financial services, encompassing everything from stock trading to wealth management, also shapes customer leverage. Clients seeking a comprehensive suite of products may remain loyal to a provider that efficiently delivers them, but they can also dictate terms for a seamless, interconnected experience. For instance, in 2024, high-net-worth individuals often preferred wealth management platforms offering direct access to investment banking deals and advanced trading tools.

| Factor | Impact on Customer Bargaining Power | Example for Guotai Junan Securities (2023-2024) |

|---|---|---|

| Information Accessibility | High. Customers can easily compare prices and services. | Free financial data aggregators and research platforms are widely available. |

| Switching Costs (Standard Services) | High. Low costs enable easy account transfers. | Retail investors might switch for a few basis points lower commission fees. |

| Demand for Integrated Services | Moderate to High. Clients seeking multiple services can negotiate terms. | High-net-worth individuals prefer one-stop shops for trading, wealth management, and investment banking. |

Preview the Actual Deliverable

Guotai Junan Securities Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis of Guotai Junan Securities, presenting the exact, professionally formatted document you will receive immediately after purchase. You'll gain immediate access to this in-depth analysis, covering the competitive landscape, bargaining power of buyers and suppliers, threat of new entrants and substitutes, and the intensity of rivalry within the securities industry. What you see here is precisely what you'll be able to download and utilize, ensuring no surprises or placeholder content.

Rivalry Among Competitors

Guotai Junan Securities operates within a fiercely competitive Chinese financial services landscape, populated by numerous large domestic players. This intense rivalry stems from the presence of many established state-owned and privately-owned securities firms, all vying for the same customer base and market share.

Key competitors such as CITIC Securities, China Merchants Securities, and Huatai Securities actively compete across a similar spectrum of services. For instance, in 2023, CITIC Securities reported total operating revenue of approximately RMB 193.8 billion, demonstrating its significant market presence and competitive capacity against Guotai Junan.

The core financial services offered by firms like Guotai Junan Securities, such as basic securities brokerage, have largely become commoditized. This means that many providers offer very similar services, leading to intense competition primarily focused on price. For instance, in 2023, the average commission rate for stock trading in China continued to be a key battleground for brokerage firms.

This commoditization forces companies to engage in price wars, which inevitably squeezes profit margins. As a result, Guotai Junan and its competitors must increasingly focus on efficiency and leveraging technological advancements to remain competitive. Differentiation through value-added services, beyond just basic transaction execution, becomes crucial for survival and growth in this environment.

The Chinese capital market's rapid expansion, coupled with evolving regulations, fuels intense competition among securities firms like Guotai Junan. For instance, the China Securities Regulatory Commission (CSRC) has been actively refining rules around areas like wealth management and IPO processes. These changes, while creating new avenues for growth, also necessitate significant investment in compliance and talent, intensifying the battle for market share as firms scramble to adapt and leverage emerging opportunities.

Expansion into New Business Areas

Securities firms are actively diversifying beyond core brokerage services into asset management, investment banking, and wealth management. This strategic shift intensifies competition as firms enter previously distinct market segments.

For instance, in 2024, many leading Chinese securities firms reported significant revenue growth from their asset management divisions, often exceeding traditional brokerage income. This expansion means companies like CITIC Securities and Haitong Securities are now directly competing with specialized asset managers, creating a more crowded and dynamic market.

- Diversification Strategy: Firms are moving into asset management, investment banking, and wealth management.

- Intensified Rivalry: This expansion leads to increased competition across formerly separate business areas.

- Market Landscape: The competitive environment is becoming broader and more complex as firms encroach on each other's traditional strengths.

Technological Advancements and Digitalization

The financial services industry is experiencing a significant surge in competitive rivalry driven by rapid technological advancements and widespread digitalization. Firms are actively investing in cutting-edge technologies like artificial intelligence (AI), big data analytics, and blockchain to gain a competitive edge. These investments are aimed at improving trading efficiency, personalizing customer experiences, and bolstering risk management capabilities. This creates an ongoing technology arms race, where a firm's competitive advantage can be short-lived as rivals quickly adopt and surpass existing innovations.

For instance, in 2024, global investment in FinTech was projected to exceed $300 billion, reflecting the intense focus on technological integration. Companies like Guotai Junan Securities are actively engaged in this race, deploying AI for algorithmic trading and utilizing big data to understand market trends and client behavior. This technological push intensifies rivalry as firms that fail to keep pace risk falling behind in service quality and operational efficiency.

- FinTech Investment Surge: Global FinTech investment was anticipated to surpass $300 billion in 2024.

- Key Technologies: AI, big data, and blockchain are central to competitive strategies.

- Impact on Rivalry: These technologies drive an arms race, making advantages transient.

- Strategic Focus: Enhanced trading, customer experience, and risk management are primary goals.

The competitive rivalry within China's securities sector is exceptionally high, characterized by a large number of established players. This intensity is further amplified by the commoditization of core brokerage services, leading to fierce price competition and shrinking profit margins for firms like Guotai Junan Securities.

Companies are actively diversifying into areas like asset management and investment banking, blurring industry lines and intensifying competition across a wider range of financial services. For example, in 2024, many Chinese securities firms saw substantial growth in their asset management divisions, directly challenging specialized asset managers.

A significant driver of this rivalry is the ongoing technological arms race, with firms investing heavily in AI, big data, and blockchain to enhance efficiency and customer offerings. Global FinTech investment was projected to exceed $300 billion in 2024, underscoring the critical role of technology in maintaining a competitive edge.

| Competitor | 2023 Revenue (Approx. RMB Billion) | Key Business Areas |

|---|---|---|

| CITIC Securities | 193.8 | Brokerage, Asset Management, Investment Banking |

| China Merchants Securities | N/A (Data not readily available for direct comparison in this format) | Brokerage, Wealth Management, Investment Banking |

| Huatai Securities | N/A (Data not readily available for direct comparison in this format) | Brokerage, Asset Management, Insurance |

SSubstitutes Threaten

Individual and institutional investors are increasingly bypassing traditional securities firms by accessing direct investment channels. For instance, in 2024, the growth of online brokerage platforms has made direct participation in IPOs more accessible than ever, with many retail investors no longer solely relying on their brokers for these opportunities.

This trend extends to private equity and bond markets, where technology now allows for more direct engagement, diminishing the necessity of intermediaries like Guotai Junan Securities for certain investment activities.

For corporate clients, alternative financing methods are increasingly presenting a viable substitute for traditional investment banking services. Platforms offering peer-to-peer (P2P) lending, crowdfunding, and supply chain finance provide diverse structures and potentially more competitive pricing compared to conventional equity or debt issuance through securities firms.

These alternative avenues empower companies with choices, bypassing some of the established channels that Guotai Junan Securities might typically engage with. For instance, the global P2P lending market was projected to reach over $300 billion by 2025, indicating a significant shift in corporate funding strategies.

The proliferation of fintech platforms and robo-advisors represents a considerable threat of substitutes for traditional brokerage and wealth management services like those offered by Guotai Junan Securities. These digital alternatives, such as Wealthfront and Betterment, provide automated investment management and financial planning at a fraction of the cost. For instance, by mid-2024, the assets under management for major robo-advisors had surpassed $2 trillion globally, indicating a significant shift in investor preferences towards lower-cost, accessible digital solutions.

Real Estate and Commodities as Investment Alternatives

Investors often consider real estate and commodities as viable alternatives to traditional securities. These asset classes can attract significant capital, potentially diverting funds that might otherwise flow into the stock and bond markets Guotai Junan operates within. For instance, global real estate investment trusts (REITs) saw substantial inflows in early 2024, indicating a strong investor appetite for property-related assets.

Physical commodities, such as gold and oil, also present a compelling investment case, particularly during periods of economic uncertainty or inflation. In 2024, gold prices reached new highs, driven by geopolitical tensions and central bank buying, demonstrating their appeal as a safe-haven asset. This competition for investor capital means that Guotai Junan must consider how these alternative investments influence the demand for its core securities offerings.

- Real Estate Diversification: Investors may allocate capital to real estate, including commercial properties and residential markets, as a hedge against stock market volatility.

- Commodity Appeal: Physical commodities like gold, silver, and oil attract investors seeking inflation protection or exposure to global supply and demand dynamics.

- Cryptocurrency as an Alternative: Emerging digital assets, while volatile, are increasingly viewed by some investors as a potential store of value or speculative opportunity, diverting funds from traditional markets.

- Impact on Capital Markets: The attractiveness of these substitutes directly influences the pool of capital available for securities, impacting trading volumes and investment banking activities for firms like Guotai Junan.

Self-Directed Investment and Financial Literacy

The rise of self-directed investing, fueled by increasing financial literacy, presents a significant threat of substitutes to traditional brokerage and advisory services. As individuals become more comfortable managing their own finances, they are less reliant on external guidance.

By mid-2024, reports indicated a substantial uptick in retail investors actively managing their portfolios. For instance, a significant percentage of new brokerage accounts opened in 2023 were by individuals with no prior investment experience, leveraging user-friendly digital platforms.

This shift is driven by several factors:

- Accessibility of Information: Online resources, educational platforms, and readily available market data empower individuals to make informed decisions.

- Lower Costs: Robo-advisors and commission-free trading platforms offer cost-effective alternatives to traditional, higher-fee advisory services.

- Technological Advancements: Sophisticated trading apps and analytical tools are now accessible to the average investor, democratizing sophisticated investment strategies.

Consequently, firms that previously relied on comprehensive advisory models may see a decline in demand as more clients opt for DIY approaches, particularly for simpler investment needs.

The threat of substitutes for Guotai Junan Securities is significant, with alternative investments like real estate and commodities drawing capital away from traditional securities. For example, in early 2024, substantial inflows into global real estate investment trusts (REITs) highlighted investor interest in property as a hedge against market volatility. Similarly, gold prices reached new highs in 2024 due to geopolitical factors and central bank purchases, underscoring its appeal as a safe-haven asset and a substitute for financial instruments.

Fintech platforms and robo-advisors pose another major substitute threat, offering lower-cost, automated investment management. By mid-2024, global assets under management for robo-advisors exceeded $2 trillion, reflecting a clear investor preference for these accessible digital solutions. This trend directly impacts demand for traditional brokerage and wealth management services.

Direct investment channels and alternative financing methods also substitute traditional securities firm offerings. In 2024, online brokerage platforms increasingly facilitated direct IPO participation, reducing reliance on intermediaries. Furthermore, P2P lending and crowdfunding platforms provide corporate clients with alternative funding avenues, with the global P2P lending market projected to exceed $300 billion by 2025.

The increasing accessibility of information, lower costs associated with digital platforms, and advancements in trading technology empower individuals to manage their own investments. By mid-2024, a notable increase in self-directed investing was observed, with many new brokerage accounts opened by novice investors leveraging user-friendly digital tools.

| Substitute Category | Examples | 2024 Trend/Data Point | Impact on Guotai Junan |

| Alternative Investments | Real Estate (REITs), Commodities (Gold, Oil) | Substantial inflows into REITs; Gold prices hit record highs due to geopolitical tensions. | Diversion of capital from traditional securities markets. |

| Digital Wealth Management | Robo-advisors (e.g., Wealthfront, Betterment) | Global AUM for robo-advisors surpassed $2 trillion by mid-2024. | Reduced demand for traditional brokerage and advisory services due to lower costs and automation. |

| Direct Investment Channels | Online Brokerages, P2P Lending, Crowdfunding | Increased direct retail investor participation in IPOs; P2P lending market projected to exceed $300 billion by 2025. | Disintermediation of traditional securities firm services for certain investment and financing activities. |

| Self-Directed Investing | DIY Portfolio Management | Significant uptick in retail investors actively managing portfolios; new accounts opened by novice investors. | Decreased reliance on external financial advice and management for individual investors. |

Entrants Threaten

The financial services sector, especially for a comprehensive firm like Guotai Junan Securities, demands immense capital. This includes significant spending on robust infrastructure, cutting-edge technology, and meeting stringent regulatory requirements. For instance, in 2024, the capital adequacy ratios for major securities firms in China, like Guotai Junan, often exceeded 15%, showcasing the substantial financial foundation required.

Newcomers entering this arena confront formidable obstacles due to these high initial capital needs. Established companies, benefiting from years of operation, typically achieve significant economies of scale, which allows them to operate more cost-effectively. This cost advantage makes it difficult for new entrants to compete on price and profitability from the outset.

The Chinese financial market imposes rigorous licensing and compliance standards for securities brokerage, investment banking, and asset management. New entrants face lengthy and complex approval procedures, creating a significant barrier that benefits established firms with existing regulatory connections.

Building a strong brand reputation and earning client trust in the financial industry is a marathon, not a sprint. Guotai Junan, as a prominent player, has cultivated this over years, fostering deep-seated credibility and enduring client relationships. This established trust acts as a significant barrier, making it exceedingly challenging for newcomers to swiftly gain substantial market traction without a demonstrable history of reliability and performance.

Access to Distribution Channels and Talent Pool

Established financial institutions like Guotai Junan Securities benefit from deeply entrenched distribution networks, including a vast physical branch presence and sophisticated proprietary digital platforms. These existing channels are crucial for client acquisition and retention, making it difficult for newcomers to gain comparable market penetration. For instance, in 2023, Guotai Junan reported operating over 400 securities branches across China, providing a significant advantage in reaching diverse customer segments.

Furthermore, attracting and retaining top-tier talent is a considerable hurdle for new entrants. Experienced financial professionals are often drawn to the stability, resources, and established client bases offered by major players. This talent gap can limit a new firm's ability to innovate, manage risk effectively, and provide the comprehensive services expected by sophisticated investors.

- Established Distribution: Guotai Junan leverages its extensive network of over 400 securities branches as of 2023.

- Digital Infrastructure: Proprietary digital platforms enhance client acquisition and service delivery.

- Talent Acquisition Challenges: New entrants face difficulties attracting skilled professionals compared to established firms.

- Resource Disparity: Major players offer greater stability and resources, making them more attractive employers.

Disruptive Fintech Startups in Niche Segments

The threat of new entrants for Guotai Junan Securities is amplified by disruptive fintech startups. While establishing a full-service brokerage is challenging, these nimble companies often target niche segments, such as robo-advisory or specialized digital trading platforms. They can chip away at market share by offering tailored, often lower-cost, solutions in specific areas, even if they don't replicate the entire service offering of traditional firms.

These fintech innovators are not necessarily aiming to become comprehensive financial supermarkets overnight. Instead, their strategy often involves carving out profitable niches. For instance, a startup focusing solely on low-fee ETF trading or a platform connecting small businesses with P2P lenders can gain traction without the extensive regulatory hurdles and capital requirements of a full-service broker. This specialized approach lowers the barrier to entry and allows them to compete effectively in their chosen domains.

- Niche Focus: Fintech startups often concentrate on specific services like robo-advisory or P2P lending, rather than broad-spectrum financial services.

- Lower Barriers: Specialization reduces the capital, regulatory, and operational complexities associated with entering the financial services market.

- Market Erosion: These entrants can erode market share in particular segments, impacting revenue streams for established players like Guotai Junan Securities.

- 2024 Trend: The first half of 2024 saw continued growth in digital-first investment platforms, with user acquisition rates often exceeding 20% year-over-year in key fintech segments.

The threat of new entrants for Guotai Junan Securities remains moderate, primarily due to substantial capital requirements, stringent regulatory hurdles, and the established brand loyalty of incumbents. While fintech innovations are creating new avenues for competition, the sheer scale and integrated service offerings of firms like Guotai Junan present significant barriers.

New entrants face immense capital demands for infrastructure and technology, often exceeding billions of yuan for comprehensive operations. Regulatory approvals are lengthy, and building trust takes years. For instance, in 2024, China's financial regulators continued to emphasize capital strength and compliance, making it harder for undercapitalized firms to gain a foothold.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | High investment needed for technology, compliance, and operations. | Significant financial hurdle, limiting the number of well-funded entrants. |

| Regulatory Compliance | Complex licensing and ongoing adherence to strict financial regulations. | Lengthy approval processes and substantial compliance costs deter many. |

| Brand Reputation & Trust | Established firms have years of client relationships and proven reliability. | New entrants struggle to attract clients without a track record, impacting market penetration. |

| Economies of Scale | Incumbents benefit from lower per-unit costs due to large operational volumes. | New firms face higher initial costs, making price competition difficult. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Guotai Junan Securities is built upon a foundation of publicly available financial statements, annual reports, and investor presentations. We supplement this with data from reputable financial data providers and industry-specific research reports to ensure a comprehensive view of the competitive landscape.