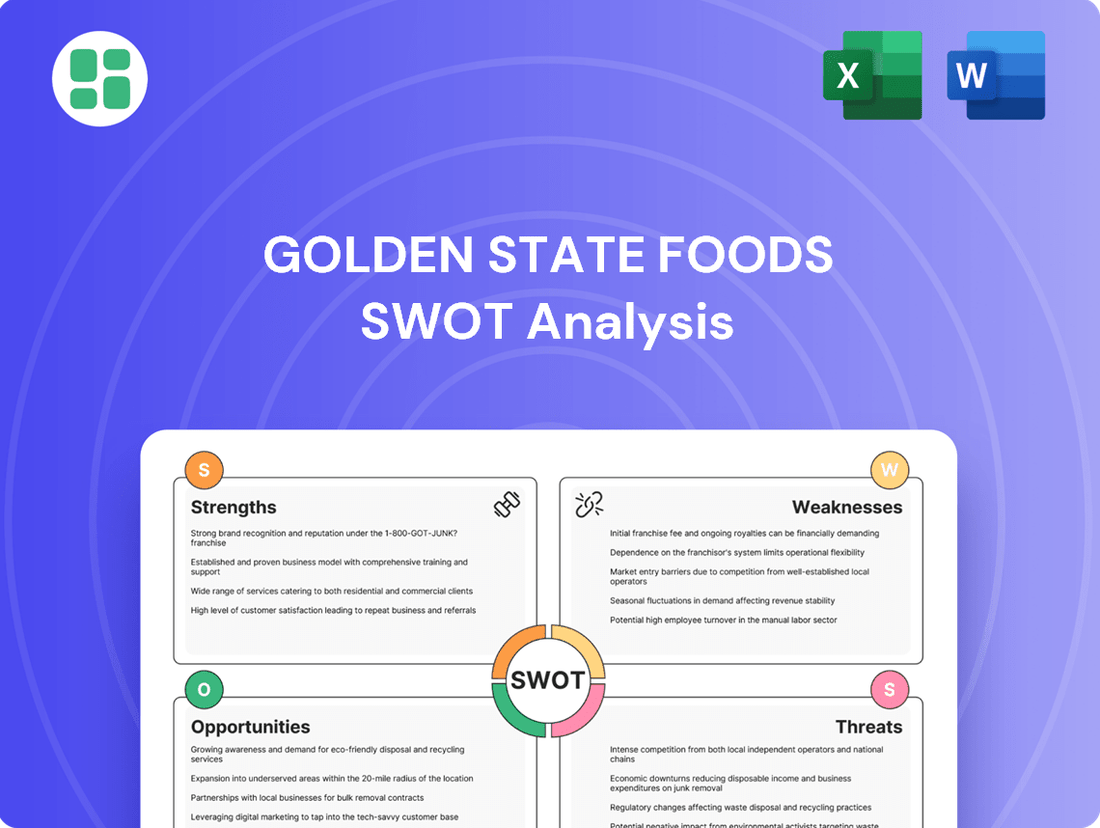

Golden State Foods SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Golden State Foods Bundle

Golden State Foods leverages its strong supplier relationships and operational efficiency as key strengths, but faces challenges in adapting to evolving consumer preferences for healthier options. Discover the complete picture behind the company’s market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

Golden State Foods (GSF) boasts a highly diversified product portfolio, encompassing liquid products such as sauces and condiments, dairy items, fresh produce, and a variety of protein solutions. This broad offering acts as a significant strength, reducing the company's dependence on any single product category and enhancing its stability against fluctuating market trends. For instance, in 2024, GSF's ability to supply a wide range of essential ingredients positioned it as a crucial partner for major quick-service restaurant chains.

Golden State Foods leverages its impressive global reach, operating from 50 locations across five continents. This expansive network supports approximately 125,000 restaurants worldwide, showcasing its substantial scale and ability to cater to a diverse international clientele.

Golden State Foods' integrated supply chain is a significant strength, offering end-to-end services from manufacturing to final delivery. This comprehensive approach, covering distribution, logistics, and quality management, allows for meticulous oversight at every stage. For instance, in 2024, GSF's streamlined logistics network contributed to a 98% on-time delivery rate for key QSR partners, a testament to their operational efficiency.

This integrated model is a key differentiator in the marketplace, enabling GSF to provide highly customized solutions that precisely meet client requirements. By controlling the entire supply chain, they ensure unparalleled quality control and operational efficiency, which is crucial for maintaining strong relationships with demanding clients in the food service industry.

Strong, Long-Standing Customer Relationships

Golden State Foods (GSF) boasts incredibly strong, long-standing customer relationships, serving more than 200 prominent brands. Many of these partnerships, particularly with major Quick-Service Restaurant (QSR) giants like McDonald's, Starbucks, Chick-fil-A, KFC, and Taco Bell, have endured for decades. This stability is a testament to GSF's consistent delivery of quality and reliability, forming a solid revenue base.

These deep-rooted connections are more than just contracts; they represent a profound understanding of each client's specific needs and evolving demands. This intimate knowledge fosters exceptional customer loyalty and facilitates a collaborative approach to growth, ensuring GSF remains a preferred supplier.

- Over 200 leading brands served.

- Decades-long partnerships with major QSRs.

- Stable revenue foundation due to enduring relationships.

- Deep understanding of key customer requirements drives loyalty.

Proven Track Record and Values-Based Culture

Golden State Foods (GSF) boasts a proven track record, having successfully created value for over 75 years since its establishment in 1947. This longevity is a testament to its consistent superior performance, unwavering commitment to safety and quality, and a culture of innovation.

The company's deep-rooted, values-based culture, emphasizing integrity and exceptional customer service, underpins its enduring success. This foundational strength cultivates significant trust and reliability, resonating with both its customer base and its workforce.

- Established 1947: Over 75 years of continuous operation and value creation.

- Core Values: Integrity, customer service, safety, quality, and innovation are central to GSF's operations.

- Reputation: Recognized for superior performance, fostering strong trust and reliability.

Golden State Foods' diversified product range, including sauces, dairy, produce, and proteins, provides significant market resilience. Their global footprint, serving approximately 125,000 restaurants across five continents from 50 locations, highlights their extensive operational capacity. The company’s integrated supply chain ensures quality and efficiency, evidenced by a 98% on-time delivery rate for key QSR partners in 2024.

GSF's strength lies in its deep, decades-long relationships with over 200 brands, including major QSR players. This stability, built on consistent quality and reliability, forms a robust revenue base. Their 75+ year history since 1947, driven by core values of integrity, safety, and innovation, underscores a proven track record of performance and trust.

What is included in the product

Delivers a strategic overview of Golden State Foods’s internal and external business factors, highlighting its strong supply chain and brand recognition alongside potential labor shortages and evolving consumer preferences.

Offers a clear, actionable framework for identifying and addressing Golden State Foods' strategic challenges and opportunities.

Weaknesses

Golden State Foods (GSF) exhibits a significant reliance on the quick-service restaurant (QSR) sector, which forms the bedrock of its operations. While the company has broadened its product offerings, its core business remains supplying major QSR chains.

This concentrated focus inherently links GSF's financial health directly to the performance and evolving trends within the QSR industry. For instance, a substantial portion of GSF's revenue, often exceeding 70% in recent years, is derived from its QSR clientele, highlighting this dependency.

Consequently, any adverse developments, such as a slowdown in consumer spending at fast-food establishments or a significant shift in dietary preferences away from traditional QSR fare, could have a disproportionately negative effect on GSF's revenue streams and overall financial stability.

As a privately held entity, Golden State Foods maintains a veil over its detailed financial performance. This means specific revenue figures, profit margins, and investment data aren't readily available to the public. For instance, unlike publicly traded competitors who must file quarterly reports with the SEC, Golden State Foods is not bound by these disclosure requirements.

This limited public financial transparency presents a hurdle for external parties like potential investors or market analysts seeking to perform a comprehensive valuation or assess the company's financial health. Without access to granular data, understanding the precise scale of their operations or the efficiency of their capital allocation becomes more speculative.

Golden State Foods faces significant operational hurdles due to its extensive and diverse product range, which spans liquid condiments, fresh produce, and protein items. Managing this variety across a global distribution network inherently complicates manufacturing, logistics, and quality control processes.

Coordinating these multifaceted operations across numerous international locations and varied product lines demands robust management systems and substantial resource allocation. For instance, ensuring consistent quality for perishable goods like fresh produce alongside shelf-stable items requires distinct supply chain strategies, increasing the potential for inefficiencies if not meticulously overseen.

Exposure to Commodity Price Volatility

Golden State Foods' significant reliance on agricultural commodities, such as beef, poultry, and grains, exposes it to considerable price volatility. For instance, the U.S. Department of Agriculture (USDA) reported that average steer prices, a key input for beef processing, saw fluctuations throughout 2024, impacting costs for companies in the sector. These unpredictable swings in raw material costs can directly compress profit margins if not effectively managed through hedging or agile pricing adjustments.

The company's extensive supply chain, involving the processing and distribution of a broad range of food products, amplifies this vulnerability. A sudden spike in the cost of a major ingredient, like wheat for baked goods or corn for animal feed, can significantly increase overall production expenses. For example, global grain markets experienced notable price increases in late 2024 due to supply chain disruptions and weather patterns, directly affecting food manufacturers.

- Exposure to fluctuating commodity prices for key inputs like beef and poultry.

- Potential for squeezed profit margins due to unexpected increases in raw material costs.

- Need for robust risk management strategies, including hedging and dynamic pricing.

- Impact of global supply chain disruptions and weather events on ingredient availability and cost.

Intense Competition in Food Service Supply

The foodservice and retail supply industry is intensely competitive, featuring many large national and international companies alongside smaller, specialized regional distributors. This crowded market means Golden State Foods must constantly innovate and focus on cost-effectiveness and excellent customer service to hold its ground.

For instance, in 2024, the U.S. foodservice distribution market alone was valued at over $200 billion, with major players like Sysco and US Foods capturing significant market share. Golden State Foods operates within this dynamic environment, facing pressure to differentiate itself.

- Market Saturation: Numerous competitors vie for the same customer base, making market penetration and expansion challenging.

- Price Sensitivity: Customers often prioritize cost, forcing suppliers to operate on thin margins and making price wars a constant threat.

- Innovation Demands: Competitors are continually introducing new products, services, and technologies, requiring Golden State Foods to invest heavily in R&D and operational upgrades to stay relevant.

Golden State Foods' significant reliance on the quick-service restaurant (QSR) sector, often accounting for over 70% of its revenue, makes it highly susceptible to industry downturns or shifts in consumer preferences. This concentration means any slowdown in fast-food spending or a move towards healthier eating could disproportionately impact GSF's financial stability.

The company's private status limits public financial transparency, making it difficult for external parties to conduct thorough valuations or assess its financial health. Without access to granular data, understanding the precise scale of operations or capital allocation efficiency remains speculative.

Managing a diverse product range across a global network presents complex operational challenges, affecting manufacturing, logistics, and quality control. The need for distinct supply chain strategies for perishable versus shelf-stable goods increases the potential for inefficiencies.

GSF's vulnerability to fluctuating commodity prices, such as beef and poultry, can compress profit margins, especially given events like the 2024 steer price volatility reported by the USDA. Global supply chain disruptions and weather patterns, as seen in late 2024 grain markets, further impact ingredient availability and cost.

The foodservice supply industry is highly competitive, with major players like Sysco and US Foods dominating the over $200 billion U.S. market in 2024. This saturation forces GSF to constantly innovate and focus on cost-effectiveness to maintain its position against competitors introducing new technologies and services.

What You See Is What You Get

Golden State Foods SWOT Analysis

The preview you see is the same document the customer will receive after purchasing. This Golden State Foods SWOT analysis offers a comprehensive look at the company's strategic position. You can trust that the insights provided here are representative of the full, detailed report you'll access.

Opportunities

Golden State Foods is strategically poised to capitalize on the burgeoning foodservice sectors in emerging markets, a key component of its 2024-2025 growth agenda. For instance, Asia-Pacific foodservice revenues are projected to reach $1.7 trillion by 2027, presenting a significant opportunity for expansion. This geographic diversification can mitigate risks associated with market saturation in more developed regions.

Furthermore, the company can enhance its competitive edge by venturing into new product categories that align with evolving consumer preferences. The global plant-based food market, valued at an estimated $37.4 billion in 2023, is a prime example of a segment ripe for innovation and market penetration. This diversification into areas like plant-based alternatives or health-conscious options promises to unlock substantial new revenue streams.

Golden State Foods (GSF) has a prime opportunity to significantly boost its supply chain performance by embracing cutting-edge technologies. Integrating AI for smarter inventory management, for instance, could drastically cut down on overstocking and stockouts, which are persistent challenges in the food service industry. In 2024, the global supply chain management market was valued at over $25 billion, indicating a strong trend towards tech adoption.

Further opportunities lie in implementing real-time tracking systems, offering unparalleled visibility from farm to fork. This not only improves delivery accuracy but also enhances food safety and traceability, crucial for GSF's customer base. Automation in warehouses and logistics can also streamline operations, reducing labor costs and speeding up order fulfillment, potentially leading to millions in annual savings.

By investing in these technological advancements, GSF can achieve substantial cost savings and solidify its competitive advantage. For example, companies that have adopted advanced analytics in their supply chains have reported an average of 5-10% reduction in operational costs. This strategic move positions GSF for greater efficiency and reliability in a dynamic market.

The recent acquisition of a controlling interest in Golden State Foods (GSF) by private equity firm Lindsay Goldberg in late 2023 injects significant financial backing and strategic expertise, poised to unlock new growth avenues. This partnership is expected to fuel GSF's expansion through strategic alliances, joint ventures, or targeted acquisitions, potentially enhancing market share and product diversification.

This infusion of capital and strategic guidance from Lindsay Goldberg creates a fertile ground for GSF to explore opportunities that leverage new technologies and expand its operational footprint. For instance, GSF could pursue acquisitions in the plant-based protein sector, a market projected to reach $165 billion globally by 2032, aligning with evolving consumer preferences.

Growing Demand for Sustainable and Ethical Sourcing

The increasing consumer and regulatory focus on environmental, social, and governance (ESG) factors presents a significant opportunity for Golden State Foods (GSF). This growing demand for sustainable and ethical sourcing aligns with GSF's existing commitments, such as their goal to achieve net-zero emissions by 2050.

GSF's proactive sustainability initiatives can bolster its brand image, attracting a segment of the market increasingly prioritizing ethical practices. This can translate into stronger customer loyalty and a competitive edge. Furthermore, these efforts can unlock operational efficiencies by encouraging reduced resource consumption, potentially lowering costs.

- Enhanced Brand Reputation: Demonstrating a commitment to sustainability can significantly improve GSF's public image.

- Attracting Conscious Consumers: A growing consumer base actively seeks out ethically sourced and environmentally responsible products.

- Operational Efficiencies: Initiatives like reducing energy and water usage can lead to cost savings.

- Meeting Regulatory Expectations: Proactive sustainability measures help GSF stay ahead of evolving environmental regulations.

Catering to Evolving Consumer Preferences in QSR

The quick-service restaurant (QSR) sector is seeing significant changes, with consumers increasingly seeking personalized meals, healthier choices, and plant-based options. Golden State Foods has a prime opportunity to align with these shifts. For instance, a 2024 report indicated that 60% of consumers are actively looking for healthier fast-food choices, and plant-based sales in the food service industry have seen consistent double-digit growth year-over-year.

Golden State Foods can leverage these trends by focusing on innovation in its product offerings and providing flexible solutions to its QSR partners. This includes developing new menu items that cater to dietary preferences and supporting partners in enhancing their digital platforms for a smoother customer experience. The company's ability to adapt its supply chain and product development to meet these evolving demands will be crucial for continued success in the dynamic QSR market.

- Product Innovation: Developing and supplying customized meal components and healthier alternatives.

- Plant-Based Expansion: Offering a wider range of plant-based ingredients and finished products.

- Digital Integration: Supporting QSR partners in enhancing online ordering and delivery capabilities.

- Health-Conscious Options: Expanding the availability of low-calorie, low-fat, and allergen-friendly ingredients.

Golden State Foods can capitalize on the growing demand for personalized and healthier options within the quick-service restaurant (QSR) sector. With 60% of consumers actively seeking healthier fast-food choices in 2024, GSF's ability to innovate its product offerings and support QSR partners in digital integration presents a significant growth opportunity. This includes developing new menu items and enhancing online ordering capabilities.

Threats

The foodservice sector, including Golden State Foods (GSF), is still grappling with significant supply chain issues. These include ongoing port delays, the impact of severe weather, and a persistent shortage of truck drivers, all of which are driving up transportation expenses and causing delivery delays.

These persistent disruptions directly affect GSF's ability to operate smoothly and reliably supply its customers. For instance, the American Trucking Associations reported in late 2023 that the driver shortage could reach 175,000 by 2024, a figure that continues to strain logistics.

Economic uncertainties, including elevated inflation and climbing interest rates, present a considerable threat to Golden State Foods. These conditions can dampen consumer spending on dining out, directly impacting traffic at quick-service restaurants (QSRs) and thus reducing demand for GSF's offerings. For instance, the U.S. inflation rate remained elevated throughout much of 2023 and into early 2024, impacting household budgets.

Persistent inflation also directly increases Golden State Foods' operational expenses, from raw material sourcing to transportation and labor. This cost pressure can significantly squeeze profit margins if not effectively managed through pricing strategies or efficiency improvements. The Federal Reserve's monetary policy, aimed at curbing inflation through higher interest rates, further exacerbates these cost pressures and can slow overall economic growth.

Golden State Foods faces growing threats from increasingly strict regulations in the food and beverage sector. These include tougher food safety protocols, evolving labor laws, and new environmental mandates like food waste diversion, which became more prominent in 2024. Compliance with these complex and often costly requirements necessitates significant investment in updated infrastructure and ongoing monitoring to prevent fines and protect brand reputation.

Shifting Consumer Preferences Away from Traditional QSR

A significant threat for Golden State Foods (GSF) lies in the potential for consumer preferences to move away from traditional Quick Service Restaurants (QSR). While GSF has a robust QSR client portfolio, a sustained shift towards home cooking, meal kit services, or other novel dining experiences could shrink the overall market for QSR suppliers. For instance, the meal kit delivery market alone was valued at over $15 billion globally in 2023 and is projected to grow substantially in the coming years, indicating a tangible alternative for consumers.

This evolving consumer behavior necessitates that GSF remains highly adaptable. Failure to anticipate and respond to these broader market shifts could lead to a gradual erosion of demand for their products and services. The company's ability to innovate and potentially diversify its offerings beyond the traditional QSR model will be crucial in navigating this long-term challenge.

- Market Diversification Need: Consumer interest in health-conscious options and plant-based diets is rising, impacting traditional QSR menus and, by extension, their suppliers.

- Competitive Landscape: Alternative food solutions, like direct-to-consumer prepared meals, are gaining traction, offering consumers more choices outside of the QSR channel.

- Demand Erosion Risk: A significant decline in QSR traffic due to changing consumer habits directly translates to reduced order volumes for GSF.

Cybersecurity Risks and Data Breaches

Golden State Foods, with its extensive global reach and reliance on interconnected digital systems for logistics and operations, faces significant cybersecurity risks. The increasing sophistication of cyber threats means a successful attack could halt vital supply chain functions, leading to substantial financial losses and delivery disruptions.

The potential for data breaches is a major concern, as compromised sensitive information, whether proprietary company data or customer details, could result in severe reputational damage and regulatory penalties. For instance, the average cost of a data breach in 2024 reached $4.73 million globally, a figure that underscores the financial implications for companies like Golden State Foods.

- Operational Disruption: Cyberattacks can cripple logistics and processing, impacting delivery schedules and product availability.

- Data Breach Impact: Compromised customer or company data can lead to significant financial penalties and loss of trust.

- Reputational Damage: A major security incident can severely tarnish brand image, affecting customer loyalty and business partnerships.

- Increased Investment Needs: Continuous investment in advanced cybersecurity infrastructure and training is essential to stay ahead of evolving threats.

Golden State Foods faces significant threats from evolving consumer preferences, with a notable shift away from traditional quick-service restaurants (QSRs) towards home cooking and meal kit services. This trend, evidenced by the meal kit market's valuation exceeding $15 billion globally in 2023, directly impacts GSF's core business. Furthermore, rising inflation and interest rates, as seen with elevated U.S. inflation rates throughout 2023 and into early 2024, increase operational costs and can dampen consumer spending on dining out, squeezing profit margins.

Supply chain disruptions, including port delays and driver shortages, continue to plague the foodservice sector, driving up transportation costs and causing delivery delays. The American Trucking Associations projected a driver shortage of 175,000 by 2024, a critical factor straining logistics for companies like GSF. Additionally, increasingly stringent food safety, labor, and environmental regulations necessitate ongoing investment in compliance, adding further operational complexity and cost.

Cybersecurity risks present a substantial threat, with the average cost of a data breach reaching $4.73 million globally in 2024. A successful cyberattack could halt vital supply chain functions and compromise sensitive data, leading to significant financial losses and reputational damage.

SWOT Analysis Data Sources

This Golden State Foods SWOT analysis is built upon a foundation of robust data, including publicly available financial statements, comprehensive market research reports, and expert industry analysis to provide a well-rounded strategic perspective.